Corrosion Protection Coatings Market by Resin Type (Epoxy, PU, Acrylic, Zinc, Chlorinated Rubber), Technology (Water, Solvent, Powder), End-use (Oil & Gas, Marine, Infrastructure, Power Generation, Water Treatment), & Region - Global Forecast to 2028

Updated on : August 22, 2025

Corrosion Protection Coatings Market

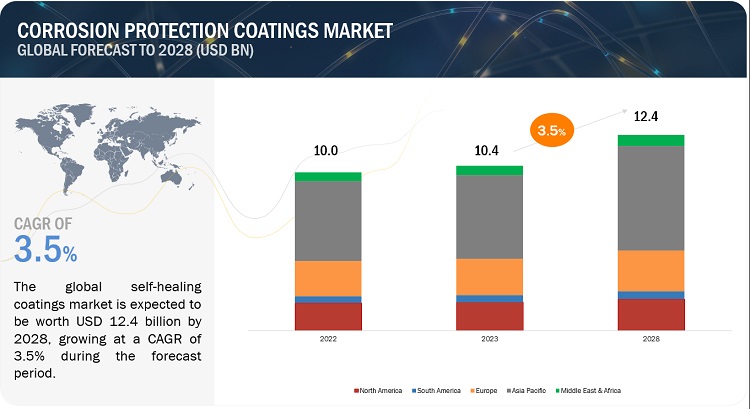

The global corrosion protection coatings market was valued at USD 10.4 billion in 2023 and is projected to reach USD 12.4 billion by 2028, growing at 3.5% cagr from 2023 to 2028. Demand for high-efficiency high performance Corrosion Protection Coatings to offer lucrative opportunities in the market.

Corrosion Protection Coatings Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Corrosion Protection Coatings Market

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Corrosion Protection Coatings Market Dynamics

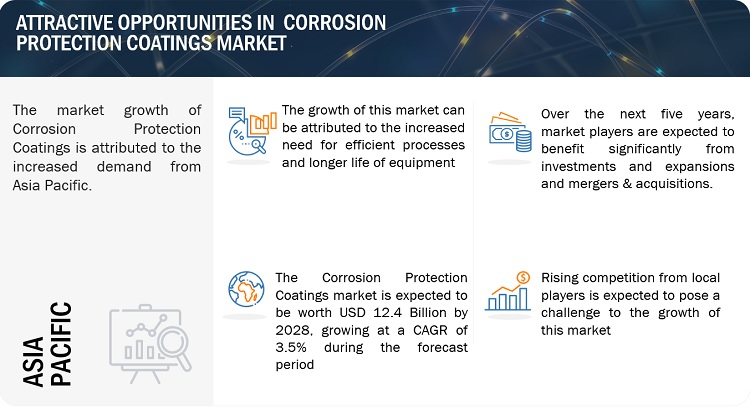

Driver: Innovations in modern structures

Countries such as China, India, and the US are investing significantly in infrastructural developments. Worldwide infrastructural spending is expected to reach USD 9 trillion by 2025, an increase from USD 4.0 trillion in 2021. This is expected, in turn, to provide momentum to the corrosion protection coatings market, as these find applications in various infrastructural activities. Many governments worldwide such as the US, China, India, and Germany have passed legislations for the modernization of their water, electrical, and transit infrastructure given the damage caused to it due to corrosion. The increased spending on corrosion protection measures in modern infrastructure is expected to be a long-term driver for the corrosion protection coatings market.

Restraint: Stringent environmental regulations

Regulations were targeted at curtailing emissions of volatile organic compounds (VOC) from coatings. REACH and LEED GreenSeal GC-03 2nd Ed., 1997 specifies the VOC content in grams per liter (g/l) for corrosion protection coatings. Such regulations have added pressure on manufacturers of coatings to comply with the required standards by reducing the VOC content while simultaneously trying to better or maintain the quality and performance of these coatings. These regulations have also impacted the prices of corrosion protection coatings as the regulations required changes in the technology used to produce coatings. These have been solvent-based coatings with moderate-to-high solid content.

Opportunities: Emerging countries offer significant growth opportunities

The emerging markets of corrosion protection coatings such as China, India, Thailand, and Brazil offer high growth opportunities for the players in the market. Currently, these countries account for the lowest per-capita consumption of coatings in the world and thus offer the potential for growth. Opportunities for market growth in these countries have further increased due to the development of their domestic industries which are consuming corrosion protection coatings significantly. Major players such as PPG Industries (US) and AkzoNobel (Netherlands) have restructured their strategies by placing high importance on penetrating and creating bases in these emerging markets.

Challenge: Increasing competition from local players

The corrosion protection coatings market is dominated by a few major global players. Companies such as PPG Industries (US), AkzoNobel (Netherlands), and Jotun A/S (Norway) lead the market in terms of revenue and product development. The market also comprises several small local players such as Diamond Vogel Paints (US) and SK Formulations India Pvt. Ltd. (India) who lack the financial or technological strength to counter the global majors. Local players are gradually gaining an edge through increased R&D initiatives and focus on limited geographic regions. They identify the needs and demands in the local market and fulfill them with application-specific products. Companies such as AnCatt (US) and Greenkote PLC (US) are emerging competitors to the current leading market players.

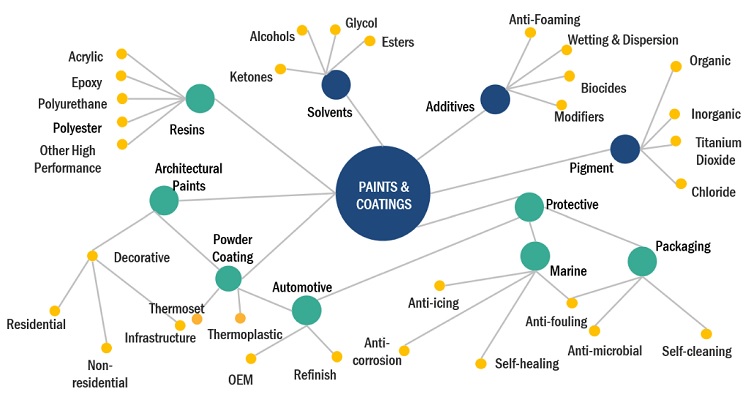

Corrosion Protection Coatings Market Ecosystem

Paints and Coatings are formed of solvent, binder, additives, hardeners, and pigments which are supplied by a number of raw material manufacturers and suppliers or distributors. These are used for their protective characteristics in different end-use industries such as marine, infrastructure, oil & gas, power generation, water treatment, and others. The paints and coatings industry is nowadays focusing on advanced, cost-effective, high-performance materials that offer permeability, thereby increasing the product’s shelf life. It is undergoing continuous technological up-gradation concerning the design and development of raw materials.

Infrastructure end-use industry is the fastest-growing segment in Corrosion Protection Coatings market between 2023 and 2028.

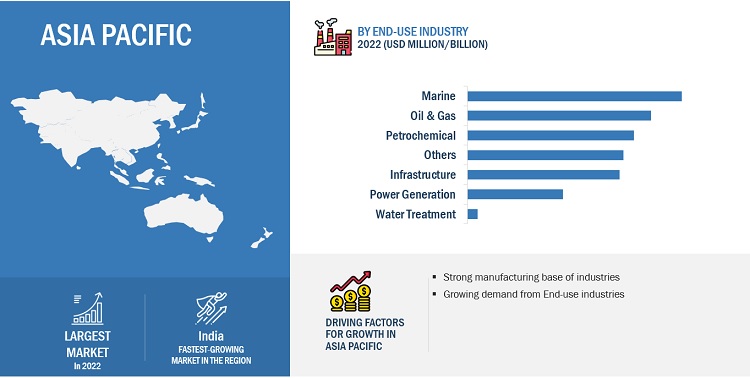

In the infrastructure sector, the Asia Pacific region accounts for the largest market growth for corrosion protection coatings. The rising investments in the infrastructure sectors in China, India, Indonesia, and the Philippines are rising demand. The need for additional infrastructure for utilities, transportation, and airports, bridges and dams, as well as commercial and manufacturing facility development plans, are the main drivers for corrosion protective coatings market growth.

Solvent-based Coating is the largest segment in the Corrosion Protection Coatings between 2023 and 2028.

Solvent-based technology refers to the use of organic solvents as the primary vehicle for delivering the active components in corrosion protection coatings. These coatings typically consist of a mixture of resin, pigments, additives, and a solvent, which helps in the application, drying, and film formation process. Solvent-based coatings can provide excellent adhesion to various substrates, including metals, concrete, or wood. They can also offer good chemical resistance, durability, and resistance to abrasion and weathering. The film formed by these coatings typically exhibits good mechanical properties.

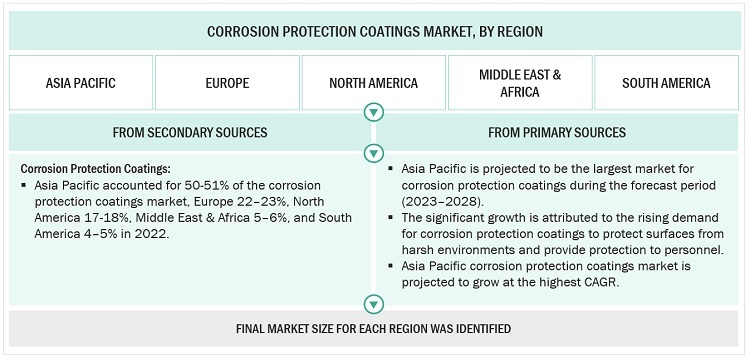

Asia Pacific is the fastest-growing Corrosion Protection Coatings market.

Asia Pacific is a centre of international investment and thriving industrial sectors, owing to low-cost labour and inexpensive land availability. The increasing industrial, infrastructure & construction, marine, and oil & gas industries are driving up demand for corrosion protective coatings. The Asia Pacific power industry is expanding, which will likely increase the market for corrosion protection coatings.

India generates the majority of its power from coal and plans to enhance solar energy generation with fresh solar projects by 2025. These factors contribute to Asia Pacific's increased need for corrosion protection coatings.

To know about the assumptions considered for the study, download the pdf brochure

Corrosion Protection Coatings Market Players

Akzo Nobel NV (Netherlands), PPG Industries, Inc. (US), Jotun A/S (Norway), The Sherwin-Williams Company (US), and Kansai Paint Co., Ltd. (Japan) are the key players in the global Corrosion Protection Coatings market.

Please visit 360Quadrants to see the vendor listing of Top paint and coating companies

Corrosion Protection Coatings Market Report Scope

|

Report Metric |

Details |

|

Years Considered for the Study |

2018-2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million) and Volume (Kiloton) |

|

Segments |

By Resin Type, Technology, End-use Industry, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies profiled |

Akzo Nobel NV (Netherlands), PPG Industries, Inc. (US), Jotun A/S (Norway), The Sherwin-Williams Company (US), and Kansai Paint Co., Ltd. (Japan). A total of 25 players have been covered. |

This research report categorizes the Corrosion protection coatings market based on resin type, technology, end-use industry, and region.

By Resin Type:

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Zinc

- Chlorinated Rubber

- Others

By Technology:

- Water-based

- Solvent-based

- Powder

- Other Technologies

By End-use Industry:

- Marine

- Oil & Gas

- Petrochemical

- Infrastructure

- Power Generation

- Water Treatment

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In April 2022, AkzoNobel completed the acquisition of Colombia-based paints and coatings company, Grupo Orbis. The transaction includes the Pintuco paints and coatings business, Andercol and Poliquim (resins, emulsions, adhesives and specialty chemicals), Mundial (paints and related product distribution services) and Centro de Servicios Mundial (shared services center).

- In June 2021, Hempel acquired a unique technology developed by Das Lack Enertherm (DLE). The company is expected to now be able to penetrate the insulation coatings market and bring new business opportunities for Hempel.

- In April 2021, The Sherwin-Williams Company acquired the business and assets of the European industrial coatings business of Sika AG which will help the company to enhance their corrosion protection coatings business.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of Corrosion Protection Coatings?

The Corrosion Protection Coatings market is driven by increasing need for efficient processes and longer life of equipment.

What are the major applications for Corrosion Protection Coatings?

The major applications of Corrosion Protection Coatings are oil & gas, marine, infrastructure, power generation, and water treatment.

Which technology is gaining popularity for Corrosion Protection Coatings?

The water based coatings are gaining popularity at the fastest rate in the Corrosion Protection Coatings market.

Who are the major manufacturers?

Akzo Nobel NV (Netherlands), PPG Industries, Inc. (US), Jotun A/S (Norway), The Sherwin-Williams Company (US), and Kansai Paint Co., Ltd. (Japan) are some of the leading players operating in the global Corrosion Protection Coatings market.

Why Corrosion Protection Coatings are gaining market share?

The growth of this market is attributed to the increase in product efficiency, customer service, and advanced technology. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 OVERVIEW OF CORROSION PROTECTION COATINGS MARKETTYPES OF CORROSION- Galvanic corrosion- Stress corrosion- General corrosion- Localized corrosion- Caustic agent corrosion

-

5.3 FACTORS CONSIDERED WHILE SELECTING CORROSION PROTECTION COATINGSTYPE OF SURFACE OR SUBSTRATE TO BE COATEDLIFE EXPECTANCYEASE OF ACCESSCOMPLIANCE WITH LEGISLATIVE AND ENVIRONMENTAL REGULATIONS

-

5.4 VALUE CHAIN OVERVIEWVALUE CHAIN ANALYSIS

-

5.5 MARKET DYNAMICSDRIVERS- Increasing losses and damage due to corrosion- Increasing need for efficient processes and longer life of equipment- Innovation in modern structures- Growth in end-use industriesRESTRAINTS- Stringent environmental regulations- High price of raw materials and energyOPPORTUNITIES- Demand for high-efficiency high-performance corrosion protection coatings- Significant growth opportunities in emerging economiesCHALLENGES- Increasing competition from local players- Rise in use of substitutes

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.8 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRYTRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.9 TECHNOLOGY OVERVIEW

-

5.10 CASE STUDYCORROSION PROTECTION COATINGS USED FOR PIPELINE IN NUCLEAR POWER PLANT

-

5.11 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY END-USE INDUSTRYAVERAGE SELLING PRICE, BY TYPEAVERAGE SELLING PRICE, BY KEY PLAYER

-

5.12 EXPORT AND IMPORT (EXIM) TRADE STATISTICSKEY COUNTRIESEXPORT TRADE DATAIMPORT TRADE DATA

-

5.13 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHGLOBAL IMPACT OF RECESSION- North America- Europe- Asia Pacific

-

5.14 ECOSYSTEM MAP

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 REGULATORY LANDSCAPE AND STANDARDS

-

5.17 TARIFFS & REGULATIONSCOATING STANDARD

- 5.18 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.19 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSINSIGHTSJURISDICTION ANALYSISTOP APPLICANTS

- 5.20 KEY CONFERENCES & EVENTS IN 2023–2024

- 6.1 INTRODUCTION

-

6.2 EPOXYSUPERIOR PROTECTIVE CHARACTERISTICS AND MODIFIABLE NATURE OF EPOXY

-

6.3 POLYURETHANEGROWING DEMAND FOR POLYURETHANE RESINS IN HIGH-PERFORMANCE APPLICATIONS

-

6.4 ACRYLICSUPERIOR WEATHERING AND OXIDATION RESISTANCE PROPERTIES

-

6.5 ALKYDLENIENT ENVIRONMENTAL REGULATIONS AND GROWTH OF END-USE INDUSTRIES IN ASIA PACIFIC

-

6.6 ZINCSTRINGENT REGULATIONS TO LIMIT USE OF ZINC-BASED COATINGS

-

6.7 CHLORINATED RUBBERSLOW GROWTH DUE TO VOC REGULATIONS IN NORTH AMERICA AND EUROPE

- 6.8 OTHER RESIN TYPES

- 7.1 INTRODUCTION

-

7.2 SOLVENT-BASED CORROSION PROTECTION COATINGSEXCELLENT PROPERTIES TO DRIVE DEMAND

-

7.3 WATER-BASED CORROSION PROTECTION COATINGSLOW TOXICITY DUE TO LOW-VOC LEVELS TO INCREASE DEMAND

-

7.4 POWDER-BASED CORROSION PROTECTION COATINGSSUPERIOR PERFORMANCE AND EXCELLENT PROPERTIES TO DRIVE DEMAND

- 7.5 OTHER TECHNOLOGIES

- 8.1 INTRODUCTION

-

8.2 MARINEDEMAND FOR LARGE VOLUMES OF COATINGS

-

8.3 OIL & GASRAPIDLY GROWING BIO-FUEL INDUSTRY

-

8.4 PETROCHEMICALINDIA AND CHINA DRIVING FORCES FOR MARKET

-

8.5 INFRASTRUCTUREASIA PACIFIC TO BE STRATEGIC INFRASTRUCTURE MARKET

-

8.6 POWER GENERATIONPOWER GENERATION AMONG FASTEST-GROWING INDUSTRIES IN ASIA PACIFIC

-

8.7 WATER TREATMENTINCREASING CONCERNS IN WATER DISPOSAL AND WATER CONSERVATION

- 8.8 OTHER END-USE INDUSTRIES

-

9.1 INTRODUCTIONGLOBAL RECESSION OVERVIEW

-

9.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Strong manufacturing industriesINDIA- Government’s focus on manufacturing sectorJAPAN- Presence of well-established industriesSOUTH KOREA- Marine industry among leading global industriesINDONESIA- Increasing investments to drive marketTHAILAND- Manufacturing industry to contribute significantly to market growthREST OF ASIA PACIFIC

-

9.3 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Presence of major manufacturersCANADA- Environmental regulations to play major roleMEXICO- Private investments, particularly in infrastructure, oil & gas, and energy sectors, to enhance economic growth

-

9.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Leading manufacturer of machinery and chemicalsUK- Sustainable and quality products to increase demandITALY- New project finance rules and investment policiesFRANCE- Adoption of innovative technologiesTURKEY- Booming and highly attractive marketREST OF EUROPE

-

9.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICASAUDI ARABIA- Increasing population and urbanizationUAE- Increasing focus on developing regulatory mechanisms and R&D capabilitiesSOUTH AFRICA- Surge in demand for coated productsREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICABRAZIL- Easy availability of raw materialsARGENTINA- Increased projects in infrastructure & construction industryCHILE- Various sectors driving market demandREST OF SOUTH AMERICA

- 10.1 OVERVIEW

-

10.2 COMPANY EVALUATION QUADRANT MATRIX, 2022STARSEMERGING LEADERSPERVASIVEPARTICIPANTS

- 10.3 STRENGTH OF PRODUCT PORTFOLIO

-

10.4 SMALL AND MEDIUM-SIZED ENTERPRISES EVALUATION QUADRANT MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 10.5 MARKET SHARE ANALYSIS

-

10.6 REVENUE ANALYSISAKZONOBEL NVPPG INDUSTRIES, INC.THE SHERWIN-WILLIAMS COMPANYJOTUN A/S

- 10.7 MARKET RANKING ANALYSIS

-

10.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 10.9 COMPETITIVE BENCHMARKING

- 10.10 STRATEGIC DEVELOPMENTS

-

11.1 KEY PLAYERSTHE SHERWIN-WILLIAMS COMPANY- Business overview- Products offered- Recent developments- MnM viewPPG INDUSTRIES INC.- Business overview- Products offered- Recent developments- MnM viewAKZONOBEL N.V.- Business overview- Products offered- Recent developments- MnM viewJOTUN A/S- Business overview- Products offered- Recent developments- MnM viewKANSAI PAINT CO., LTD.- Business overview- Products offered- Recent developments- MnM viewAXALTA COATING SYSTEMS LLC- Business overview- Products offered- Recent developmentsHEMPEL A/S- Business overview- Products offered- Recent developmentsCHUGOKU MARINE PAINTS LTD.- Business overview- Products offered- Recent developmentsNIPPON PAINT HOLDINGS CO., LTD.- Business overview- Products offered- Recent developmentsTEKNOS- Business overview- Products offered- Recent developments

-

11.2 OTHER PLAYERSNOROO PAINT & COATINGS- Products offeredDIAMOND VOGEL- Products offeredGREENKOTE PLC- Products offered- Recent developmentsRENNER HERRMANN S.A.- Products offeredNYCOTE LABORATORIES CORPORATION- Products offered- Recent developmentsO3 GROUP- Products offeredTHE MAGNI GROUP, INC.- Products offeredSECOA METAL FINISHING- Products offeredEONCOAT, LLC- Products offeredDAI NIPPON TORYO CO., LTD.- Products offeredADVANCED NANOTECH LAB- Products offeredHUISINS NEW MATERIAL TECHNOLOGY CO.- Products offeredBLUCHEM- Products offeredSK FORMULATIONS INDIA PVT. LTD.- Products offeredANCATT INC.- Products offered

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 CORROSION PROTECTION COATINGS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 2 CRITERIA FOR SELECTION OF CORROSION PROTECTION COATINGS BASED ON LIFE EXPECTANCY

- TABLE 3 SUPPLY CHAIN ECOSYSTEM

- TABLE 4 RESIN PRICES

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES (%)

- TABLE 7 KEY BUYING CRITERIA FOR CORROSION PROTECTION COATINGS

- TABLE 8 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE

- TABLE 9 INTENSITY OF TRADE, BY KEY COUNTRY

- TABLE 10 EXPORT DATA IN USD THOUSAND (2018–2022)

- TABLE 11 IMPORT DATA IN USD THOUSAND (2018–2022)

- TABLE 12 CS-1, CS-3, CS-4, SS-1, SS-2, AND SS-3 CLASSIFICATIONS FOR CORROSION PROTECTION COATINGS MARKET

- TABLE 13 STANDARDS FOR CORROSION INSPECTION PRACTICES

- TABLE 14 BASIC COATING SYSTEM REQUIREMENTS FOR DEDICATED SEAWATER BALLAST TANKS OF ALL TYPES OF SHIPS AND DOUBLE-SIDE SKIN SPACES OF BULK CARRIERS OF 150 M AND UPWARDS:

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 20 CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 21 CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 22 CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 23 CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 24 CHARACTERISTICS OF EPOXY CORROSION PROTECTION COATINGS

- TABLE 25 EPOXY CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 EPOXY CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 EPOXY CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 28 EPOXY CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 29 PROPERTIES OF POLYURETHANE CORROSION PROTECTION COATINGS

- TABLE 30 POLYURETHANE CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 POLYURETHANE CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 POLYURETHANE CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 33 POLYURETHANE CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 34 CHARACTERISTICS OF ACRYLIC CORROSION PROTECTION COATINGS

- TABLE 35 ACRYLIC CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 ACRYLIC CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 ACRYLIC CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 38 ACRYLIC CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 39 CHARACTERISTICS OF ALKYD CORROSION PROTECTION COATINGS

- TABLE 40 ALKYD CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 ALKYD CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 ALKYD CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 43 ALKYD CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 44 CHARACTERISTICS OF ZINC CORROSION PROTECTION COATINGS

- TABLE 45 ZINC CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 ZINC CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 ZINC CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 48 ZINC CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 49 CHARACTERISTICS OF CHLORINATED RUBBER CORROSION PROTECTION COATINGS

- TABLE 50 CHLORINATED RUBBER CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 CHLORINATED RUBBER CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 CHLORINATED RUBBER CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 53 CHLORINATED RUBBER CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 54 OTHER CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 OTHER CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 OTHER CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 57 OTHER CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 58 CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 59 CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 60 CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (KILOTON)

- TABLE 61 CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 62 SOLVENT-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 SOLVENT-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 SOLVENT-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 65 SOLVENT-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 66 WATER-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 WATER-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 WATER-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 69 WATER-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 70 POWDER-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 71 POWDER-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 POWDER-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 73 POWDER-BASED CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 74 OTHER TECHNOLOGIES IN CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 75 OTHER TECHNOLOGIES IN CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 OTHER TECHNOLOGIES IN CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 77 OTHER TECHNOLOGIES IN CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 78 CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 79 CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 80 CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 81 CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 82 CORROSION PROTECTION COATINGS MARKET SIZE IN MARINE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 83 CORROSION PROTECTION COATINGS MARKET SIZE IN MARINE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 CORROSION PROTECTION COATINGS MARKET SIZE IN MARINE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 85 CORROSION PROTECTION COATINGS MARKET SIZE IN MARINE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 86 CORROSION PROTECTION COATINGS MARKET SIZE IN OIL & GAS INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 87 CORROSION PROTECTION COATINGS MARKET SIZE IN OIL & GAS INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 CORROSION PROTECTION COATINGS MARKET SIZE IN OIL & GAS INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 89 CORROSION PROTECTION COATINGS MARKET SIZE IN OIL & GAS INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 90 CORROSION PROTECTION COATINGS MARKET SIZE IN PETROCHEMICAL INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 91 CORROSION PROTECTION COATINGS MARKET SIZE IN PETROCHEMICAL INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 CORROSION PROTECTION COATINGS MARKET SIZE IN PETROCHEMICAL INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 93 CORROSION PROTECTION COATINGS MARKET SIZE IN PETROCHEMICAL INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 94 CORROSION PROTECTION COATINGS MARKET SIZE IN INFRASTRUCTURE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 95 CORROSION PROTECTION COATINGS MARKET SIZE IN INFRASTRUCTURE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 CORROSION PROTECTION COATINGS MARKET SIZE IN INFRASTRUCTURE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 97 CORROSION PROTECTION COATINGS MARKET SIZE IN INFRASTRUCTURE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 98 CORROSION PROTECTION COATINGS MARKET SIZE IN POWER GENERATION INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 99 CORROSION PROTECTION COATINGS MARKET SIZE IN POWER GENERATION INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 CORROSION PROTECTION COATINGS MARKET SIZE IN POWER GENERATION INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 101 CORROSION PROTECTION COATINGS MARKET SIZE IN POWER GENERATION INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 102 CORROSION PROTECTION COATINGS MARKET SIZE IN WATER TREATMENT INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 103 CORROSION PROTECTION COATINGS MARKET SIZE IN WATER TREATMENT INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 104 CORROSION PROTECTION COATINGS MARKET SIZE IN WATER TREATMENT INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 105 CORROSION PROTECTION COATINGS MARKET SIZE IN WATER TREATMENT INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 106 CORROSION PROTECTION COATINGS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 107 CORROSION PROTECTION COATINGS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 108 CORROSION PROTECTION COATINGS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2022 (KILOTON)

- TABLE 109 CORROSION PROTECTION COATINGS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (KILOTON)

- TABLE 110 CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 111 CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 CORROSION PROTECTION COATINGS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 113 CORROSION PROTECTION COATINGS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 114 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 117 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 118 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (KILOTON)

- TABLE 121 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 122 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 125 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 126 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 129 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 130 UPCOMING MEGA PROJECTS IN CHINA

- TABLE 131 UPCOMING MEGA PROJECTS IN INDIA

- TABLE 132 UPCOMING MEGA PROJECTS IN JAPAN

- TABLE 133 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 134 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 136 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 137 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 138 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (KILOTON)

- TABLE 140 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 141 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 142 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 143 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 144 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 145 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 146 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 148 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 149 UPCOMING MEGA PROJECTS IN NORTH AMERICA

- TABLE 150 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 151 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 152 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 153 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 154 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 155 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 156 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (KILOTON)

- TABLE 157 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 158 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 159 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 160 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 161 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 162 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 163 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 164 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 165 EUROPE: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 166 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 169 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 170 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (KILOTON)

- TABLE 173 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 174 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 177 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 178 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 181 MIDDLE EAST & AFRICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 182 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 183 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 184 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 185 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 186 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 187 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 188 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2018–2022 (KILOTON)

- TABLE 189 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 190 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 191 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 192 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 193 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 194 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 195 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 196 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 197 SOUTH AMERICA: CORROSION PROTECTION COATINGS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 198 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 199 MARKET RANKING ANALYSIS, 2022

- TABLE 200 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 201 COMPANY REGION FOOTPRINT

- TABLE 202 COMPANY OVERALL FOOTPRINT

- TABLE 203 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 204 MOST FOLLOWED STRATEGIES

- TABLE 205 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 206 DETAILED LIST OF KEY MARKET PLAYERS

- TABLE 207 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 208 PRODUCT LAUNCHES, 2019–2023

- TABLE 209 DEALS, 2019–2023

- TABLE 210 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 211 THE SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

- TABLE 212 THE SHERWIN-WILLIAMS COMPANY: DEALS

- TABLE 213 PPG INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 214 PPG INDUSTRIES INC.: PRODUCT LAUNCHES

- TABLE 215 PPG INDUSTRIES INC.: DEALS

- TABLE 216 PPG INDUSTRIES INC.: OTHERS

- TABLE 217 AKZONOBEL N.V.: COMPANY OVERVIEW

- TABLE 218 AKZONOBEL N.V.: PRODUCT LAUNCHES

- TABLE 219 AKZONOBEL N.V.: DEALS

- TABLE 220 AKZONOBEL N.V.: OTHERS

- TABLE 221 JOTUN A/S: COMPANY OVERVIEW

- TABLE 222 JOTUN A/S: DEALS

- TABLE 223 JOTUN A/S: OTHERS

- TABLE 224 KANSAI PAINT CO. LTD.: COMPANY OVERVIEW

- TABLE 225 KANSAI PAINT CO., LTD.: DEALS

- TABLE 226 AXALTA COATING SYSTEMS LLC: COMPANY OVERVIEW

- TABLE 227 AXALTA COATING SYSTEMS LLC: PRODUCT LAUNCHES

- TABLE 228 AXALTA COATING SYSTEMS LLC: DEALS

- TABLE 229 HEMPEL A/S: COMPANY OVERVIEW

- TABLE 230 HEMPEL A/S: PRODUCT LAUNCHES

- TABLE 231 HEMPEL A/S: DEALS

- TABLE 232 HEMPEL A/S: OTHERS

- TABLE 233 CHUGOKU MARINE PAINTS LTD.: COMPANY OVERVIEW

- TABLE 234 CHUGOKU MARINE PAINTS LTD.: PRODUCT LAUNCHES

- TABLE 235 NIPPON PAINT HOLDINGS CO. LTD.: COMPANY OVERVIEW

- TABLE 236 NIPPON PAINT HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 237 NIPPON PAINT HOLDINGS CO., LTD.: DEALS

- TABLE 238 TEKNOS: COMPANY OVERVIEW

- TABLE 239 TEKNOS: PRODUCT LAUNCHES

- TABLE 240 NOROO PAINT & COATINGS: COMPANY OVERVIEW

- TABLE 241 DIAMOND VOGEL: COMPANY OVERVIEW

- TABLE 242 GREENKOTE PLC: COMPANY OVERVIEW

- TABLE 243 GREENKOTE PLC: PRODUCT LAUNCHES

- TABLE 244 GREENKOTE PLC: DEALS

- TABLE 245 RENNER HERRMANN S.A.: COMPANY OVERVIEW

- TABLE 246 NYCOTE LABORATORIES: COMPANY OVERVIEW

- TABLE 247 NYCOTE LABORATORIES CORPORATION: PRODUCT LAUNCHES

- TABLE 248 NYCOTE LABORATORIES CORPORATION: DEALS

- TABLE 249 O3 GROUP: COMPANY OVERVIEW

- TABLE 250 THE MAGNI GROUP, INC.: COMPANY OVERVIEW

- TABLE 251 SECOA METAL FINISHING: COMPANY OVERVIEW

- TABLE 252 EONCOAT, LLC: COMPANY OVERVIEW

- TABLE 253 DAI NIPPON TORYO CO., LTD: COMPANY OVERVIEW

- TABLE 254 ADVANCED NANOTECH LAB: COMPANY OVERVIEW

- TABLE 255 HUISINS NEW MATERIAL TECHNOLOGY CO.: COMPANY OVERVIEW

- TABLE 256 BLUCHEM: COMPANY OVERVIEW

- TABLE 257 SK FORMULATIONS INDIA PVT. LTD.: COMPANY OVERVIEW

- TABLE 258 ANCATT INC.: COMPANY OVERVIEW

- FIGURE 1 CORROSION PROTECTION COATINGS MARKET SEGMENTATION

- FIGURE 2 CORROSION PROTECTION COATINGS MARKET: GEOGRAPHIC SCOPE

- FIGURE 3 CORROSION PROTECTION COATINGS MARKET: RESEARCH DESIGN

- FIGURE 4 CORROSION PROTECTION COATINGS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 CORROSION PROTECTION COATINGS MARKET SIZE ESTIMATION: BY VALUE

- FIGURE 6 CORROSION PROTECTION COATINGS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 7 CORROSION PROTECTION COATINGS MARKET, BY RESIN TYPE

- FIGURE 8 CORROSION PROTECTION COATINGS MARKET SIZE ESTIMATION, BY TECHNOLOGY

- FIGURE 9 CORROSION PROTECTION COATINGS MARKET SIZE ESTIMATION, BOTTOM-UP APPROACH: BY END-USE INDUSTRY

- FIGURE 10 CORROSION PROTECTION COATINGS MARKET SIZE ESTIMATION, BY END-USE INDUSTRY

- FIGURE 11 CORROSION PROTECTION COATINGS MARKET: SUPPLY SIDE FORECAST

- FIGURE 12 METHODOLOGY FOR SUPPLY SIDE SIZING OF CORROSION PROTECTION COATINGS MARKET

- FIGURE 13 CORROSION PROTECTION COATINGS MARKET: DEMAND SIDE FORECAST

- FIGURE 14 FACTOR ANALYSIS OF CORROSION PROTECTION COATINGS MARKET

- FIGURE 15 CORROSION PROTECTION COATINGS MARKET: DATA TRIANGULATION

- FIGURE 16 EPOXY SEGMENT TO DOMINATE CORROSION PROTECTION COATINGS MARKET BETWEEN 2023 AND 2028

- FIGURE 17 SOLVENT-BASED SEGMENT TO LEAD CORROSION PROTECTION COATINGS MARKET BETWEEN 2023 AND 2028

- FIGURE 18 OIL & GAS TO BE LARGEST END-USE INDUSTRY OF CORROSION PROTECTION COATINGS BETWEEN 2023 AND 2028

- FIGURE 19 ASIA PACIFIC TO BE FASTEST-GROWING CORROSION PROTECTION COATINGS MARKET BETWEEN 2023 AND 2028

- FIGURE 20 CORROSION PROTECTION COATINGS MARKET TO WITNESS HIGH GROWTH IN INFRASTRUCTURE SEGMENT BETWEEN 2023 AND 2028

- FIGURE 21 EPOXY TO BE LARGEST SEGMENT BETWEEN 2023 AND 2028

- FIGURE 22 MARINE END-USE INDUSTRY SEGMENT TO LEAD CORROSION PROTECTION COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 23 CHINA TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 24 INDIA TO BE FASTEST-GROWING CORROSION PROTECTION COATINGS MARKET BETWEEN 2023 AND 2028

- FIGURE 25 ROLE OF CORROSION PROTECTION COATINGS

- FIGURE 26 CORROSION PREVENTION METHODS

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CORROSION PROTECTION COATINGS MARKET

- FIGURE 29 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 31 KEY BUYING CRITERIA FOR CORROSION PROTECTION COATINGS

- FIGURE 32 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

- FIGURE 33 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- FIGURE 34 CORROSION PROTECTION COATING TECHNOLOGY

- FIGURE 35 PRICING ANALYSIS, BY REGION, 2022

- FIGURE 36 PRICING ANALYSIS, BY END-USE INDUSTRY, 2022

- FIGURE 37 PRICING ANALYSIS, BY TYPE, 2022

- FIGURE 38 PRICING ANALYSIS OF KEY PLAYERS, BY END-USE INDUSTRY, 2022

- FIGURE 39 PAINTS & COATINGS ECOSYSTEM

- FIGURE 40 TRENDS IN END-USE INDUSTRIES IMPACTING STRATEGIES OF COATINGS MANUFACTURERS

- FIGURE 41 PUBLICATION TRENDS, 2018–2023

- FIGURE 42 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2018–2023

- FIGURE 43 NUMBER OF PATENTS, BY COMPANY, 2018–2023

- FIGURE 44 EPOXY-BASED CORROSION PROTECTION COATINGS TO LEAD MARKET BETWEEN 2023 AND 2028

- FIGURE 45 SOLVENT-BASED CORROSION PROTECTION COATINGS SEGMENT TO DOMINATE BETWEEN 2023 AND 2028

- FIGURE 46 OIL & GAS INDUSTRY TO LEAD CORROSION PROTECTION COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC COUNTRIES EMERGING AS STRATEGIC LOCATIONS FOR CORROSION PROTECTION COATINGS MARKET

- FIGURE 48 ASIA PACIFIC: CORROSION PROTECTION COATINGS MARKET SNAPSHOT

- FIGURE 49 NORTH AMERICA: CORROSION PROTECTION COATINGS MARKET SNAPSHOT

- FIGURE 50 EUROPE: CORROSION PROTECTION COATINGS MARKET SNAPSHOT

- FIGURE 51 SAUDI ARABIA TO BE LARGEST CORROSION PROTECTION COATINGS MARKET

- FIGURE 52 BRAZIL TO BE LARGEST AND FASTEST-GROWING MARKET

- FIGURE 53 COMPANY EVALUATION MATRIX, 2022

- FIGURE 54 SMALL AND MEDIUM-SIZED ENTERPRISES’ EVALUATION MATRIX, 2022

- FIGURE 55 MARKET SHARE, BY KEY PLAYERS (2022)

- FIGURE 56 REVENUE ANALYSIS OF TOP PLAYERS, 2018–2022

- FIGURE 57 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 58 PPG INDUSTRIES INC.: COMPANY SNAPSHOT

- FIGURE 59 AKZONOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 60 JOTUN A/S: COMPANY SNAPSHOT

- FIGURE 61 KANSAI PAINT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 AXALTA COATING SYSTEMS LLC: COMPANY SNAPSHOT

- FIGURE 63 HEMPEL A/S: COMPANY SNAPSHOT

- FIGURE 64 CHUGOKU MARINE PAINTS LTD.: COMPANY SNAPSHOT

- FIGURE 65 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 66 TEKNOS: COMPANY SNAPSHOT

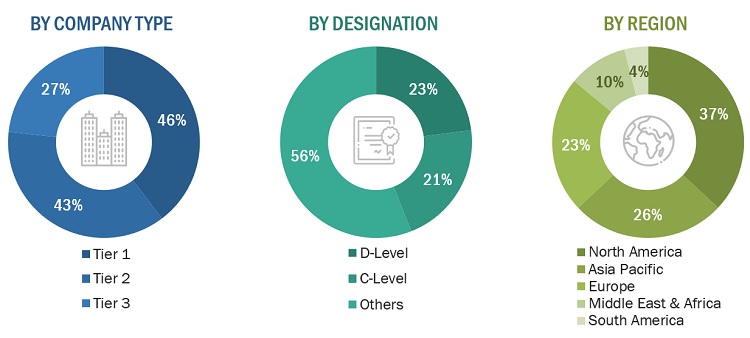

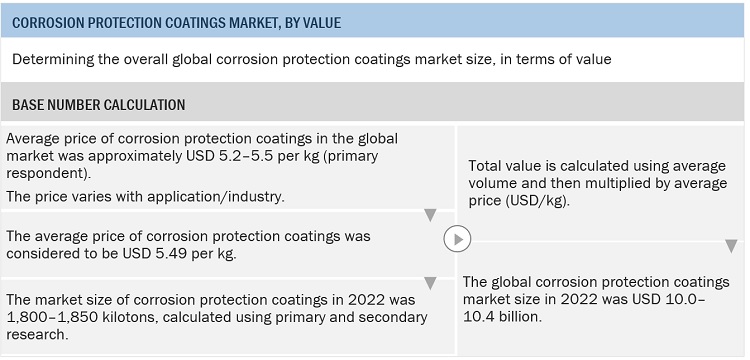

The study involves four major activities in estimating the current market size of Corrosion protection coatings. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The Corrosion protection coatings market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in end-use industries, such as oil & gas, marine, infrastructure, petrochemical, power generation, water treatment, etc. Advancements in formulations characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Corrosion protection coatings market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Corrosion protection coatings Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Corrosion protection coatings are used for protecting metal, concrete, and other components from degradation caused by moisture, oxidation, and exposure to chemicals and saltwater. In this report, corrosion protection coatings cover only heavy- to medium-duty anti-corrosion coatings.

Heavy- to medium-duty industries such as marine, oil & gas, petrochemical, water treatment, power generation, and infrastructure are specialized with high-performance anti-corrosion coatings used to protect surfaces by creating barriers between the surfaces and the corrosive agents. These corrosion protection coatings are coated or applied to substrates exposed to highly corrosive environments.

Key Stakeholders

- Manufacturers of Corrosion Protection Coatings and their raw materials

- Manufacturers of Corrosion Protection Coatings for various end-use sectors such as oil & gas, petrochemical, marine, infrastructure, power generation, water treatment, etc.

- Traders, Distributors, and Suppliers of Corrosion Protection Coatings

- Regional manufacturers’ Associations and Corrosion Protection Coatings Associations

- Government and Regional Agencies and Research Organizations

Report Objectives

- To analyze and forecast the size of the Corrosion protection coatings market in terms of value and volume

- To define, describe, and forecast the Corrosion protection coatings market by resin type, technology, end-use industry, and region

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To forecast the market size of the Corrosion protection coatings market concerning the various major regions like North America, Europe, Asia Pacific, South America, and Middle East & Africa

- To strategically analyze micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as mergers & acquisitions, new product launches, and investments & expansions, in the Corrosion protection coatings market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the Corrosion protection coatings market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Corrosion protection coatings market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Corrosion Protection Coatings Market