Continuous Integration Tools Market by Deployment Mode (On-premises and Cloud), Organization Size, Vertical (BFSI, Telecommunications, Media & Entertainment, Retail & eCommerce, Healthcare, Manufacturing, Education), and Region - Global Forecast to 2023

[127 Pages Report] The continuous integration tools market size was USD 402.8 million in 2017 and is expected to reach USD 1,139.3 million by 2023, at a Compound Annual Growth Rate (CAGR) of 18.7% during the forecast period.

The base year considered for this study is 2017, and the forecast period considered is from 2018 to 2023.The market is projected to grow at a significant rate over the next 5 years. Software becoming a critical component for various functions and automation of software development process to quickly release software application are expected to boost the adoption of continuous integration tools across industries.

The objective of the study is to define, describe, and forecast the continuous integration tools market, on the basis of deployment modes (cloud and on-premises), organization size (SMEs, and large enterprises), vertical (BFSI, retail and Ecommerce, telecommunications, education, media and entertainment , healthcare, manufacturing, and Others [government, logistics and transportation, and energy and utilities]), and region. Moreover, the report aims at providing detailed information about the major factors influencing the growth of market, such as drivers, restraints, opportunities, and challenges.

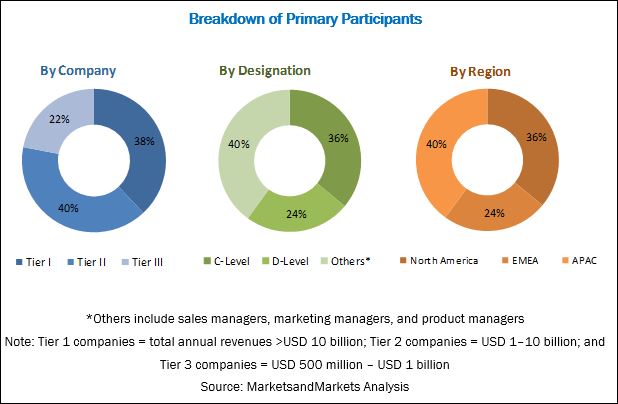

The research methodology used to estimate and forecast the global continuous integration tools market size initiated with the capturing of data on the key vendor revenues through secondary research, annual reports, Institute of Electrical and Electronic Engineers (IEEE), Factiva, Bloomberg, and press releases. Moreover, the vendor offerings were taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size from the revenues of the key market players. Post-arrival at the overall market size, the total market was split into several segments and sub-segments, which were then verified through primary research by conducting extensive interviews with the key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of the profiles of the primary participants is depicted in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

The major vendors in the global continuous integration tools market are Atlassian (Australia), IBM (US), Microsoft (US), Micro Focus (UK), CA Technologies (US), Cloudbees (US), AWS (US), Puppet (Oregon), Red Hat(US), CA Technologies (US), Oracle (US), Micro Focus (UK), SmartBear (US), Jetbrains (Czech Republic), CircleCI (US), Shippable (US), Electric Cloud (US), V-Soft Technologies (South Africa), BuildKite (Australia), TravisCI (Germany), AutoRABIT (US), AppVeyor (Canada), Drone.io (US), Rendered Text (Serbia), Bitrise (Hungary), Nevercode (UK), and PHPCI (Belgium).

Please visit 360Quadrants to see the vendor listing of Best Continuous Integration Tools Quadrant

Key Target Audience for Continuous Integration Tools Market

- Continuous integration software tools, platform, and service providers

- System integrators

- Project Managers

- CI/CD engineers

- CI/CD consultants

- SMEs

Scope of the Report:

The research report segments into the following segments:

By Deployment Mode:

- Cloud

- On-premises

Continuous Integration Tools Market by Organization Size:

- Large Enterprises

- Small and Medium Sized Enterprises (SMEs)

By Vertical:

- BFSI

- Retail and eCommerce

- Telecommunication

- Education

- Media and Entertainment

- Healthcare

- Manufacturing

- Others (Government, Logistics and Transportation, and Energy and Utilities)

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- MEA

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the APAC continuous integration tools market.

- Further breakdown of the North American market

- Further breakdown of the European market

- Further breakdown of the Latin American market

- Further breakdown of the Middle East market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The major growth driver for the market is the increasing demand for automation of software development process to quickly release software application. Continuous integration tools are becoming crucial in the application development process, as they can considerably reduce the time required to create a build, and improve developer productivity, and thereby accelerate the time-to-market.

The scope of this report covers the continuous integration tools market analysis by deployment mode, organization size, vertical, and region. Based on deployment mode, the market is segmented into on-premises and the cloud. The on-premises deployment mode gives organizations complete control over all their systems and data. However, most of the large enterprises prefer continuous integration tools deployed on-premises due to advanced security features. Cloud-based deployment, on the other hand, benefits organizations with increased scalability, speed, 24/7 service, and enhanced IT security. The demand for cloud based continuous integration tools are expected to be rapidly increasing, as it serves as a dominant Integration tools model in meeting the IT security needs.

Based on organization size, the continuous integration tools market is segmented into SMEs and large enterprises. The adoption rate of continuous integration suite among large enterprises is expected to be relatively high as compared to that among the SMEs. Due to the huge IT infrastructure budgets and high demand for advanced technologies, the large enterprises segment is expected to hold a larger market size in the market. The market in terms of organization size is important, as it has a direct impact on the adoption of DevOps tools and services worldwide.

The continuous integration tools are adopted across verticals, such as BFSI; media and entertainment; retail and ecommerce; healthcare; manufacturing; telecommunication; education; and others (government, energy and utilities, and logistics and transportation). The media and entertainment vertical is expected to hold the largest market size, as they have started adopting continuous integration tools for applications and software to meet the growing demand for automation and testing to unify the entire development process into an end-to-end process. CI/ CD tools are gaining traction across verticals to enhance the customer experience and the overall productivity of companies.

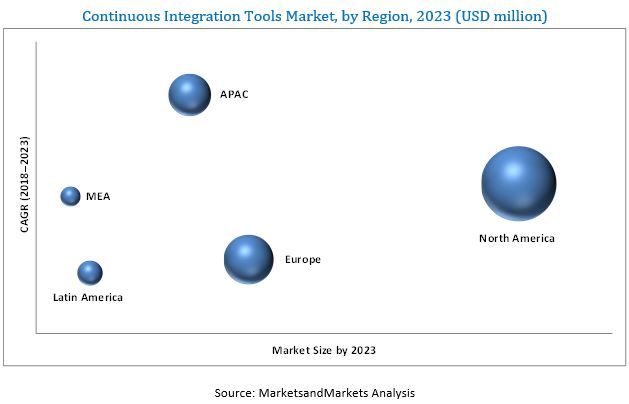

As per the geographic analysis, North America is expected to have the largest market size in the global continuous integration tools market, while APAC is expected to grow at the highest CAGR during the forecast period. The North American region has witnessed increased investments in the market. A considerable growth is expected in the region during the forecast period. In this region, the growing demand automating the build process to enhance the developer productivity are becoming crucial and achieve competitive advantage.

A major restraining factor for the growth of the market could be the availability of open source tools. Existing integration methods and lack of expertise in assembling and setting up of continuous integration system would the major challenges in the adoption of continuous integration tools.

The major vendors covered in the continuous integration tools market include Atlassian (Australia), IBM (US), Microsoft (US), Micro Focus (UK), CA Technologies (US), Cloudbees (US), AWS (US), Puppet (Oregon), Red Hat (US), CA Technologies (US), Oracle (US), Micro Focus (UK), SmartBear (US), Jetbrains (Czech Republic), CircleCI (US), Shippable (US), Electric Cloud (US), V-Soft Technologies (South Africa), BuildKite (Australia), TravisCI (Germany), AutoRABIT (US), AppVeyor (Canada), Drone.io (US), Rendered Text (Serbia), Bitrise (Hungary), Nevercode (UK), and PHPCI (Belgium). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the global market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Continuous Integration Tools Market

4.2 Market Top 4 Verticals

4.3 Market By Region

4.4 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Automation of the Software Development Process to Quickly Release Software Applications

5.2.1.2 Software Becoming A Critical Component of Various Business Functions

5.2.2 Restraints

5.2.2.1 Availability of Open Source Tools

5.2.3 Opportunities

5.2.3.1 Growing Demand for Cloud-Deployed Continuous Integration Solutions

5.2.3.2 Increasing Use of Continuous Integration Tools Across Verticals

5.2.4 Challenges

5.2.4.1 Existing Integration Methods

5.2.4.2 Lack of Expertise in Assembling and Setting Up Continuous Integration Systems

5.3 Key Acquisitions in the Continuous Integration Tools Market, 20102018

5.4 Continuous Integration Tools: Use Cases

5.4.1 Introduction

5.4.2 Use Case: Scenario 1

5.4.3 Use Case: Scenario 2

5.4.4 Use Case: Scenario 3

5.4.5 Use Case: Scenario 4

5.4.6 Use Case: Scenario 5

5.4.7 Use Case: Scenario 6

6 Continuous Integration Tools Market, By Deployment Mode (Page No. - 38)

6.1 Introduction

6.2 on Premises

6.3 Cloud

7 Market By Organization Size (Page No. - 42)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises

7.3 Large Enterprises

8 Market, By Vertical (Page No. - 46)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.3 Retail and Ecommerce

8.4 Telecommunication

8.5 Education

8.6 Media and Entertainment

8.7 Healthcare

8.8 Manufacturing

8.9 Others

9 Continuous Integration Tools Market, By Region (Page No. - 55)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.2 Canada

9.3 Europe

9.3.1 United Kingdom

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 Singapore

9.4.4 Rest of Asia Pacific

9.5 Latin America

9.5.1 Brazil

9.5.2 Mexico

9.5.3 Rest of Latin America

9.6 Middle East and Africa

9.6.1 Kingdom of Saudi Arabia

9.6.2 Qatar

9.6.3 South Africa

9.6.4 Rest of Middle East and Africa

10 Competitive Landscape (Page No. - 70)

10.1 Overview

10.2 Competitive Scenario

10.2.1 New Product/Service Launches and Enhancements

10.2.2 Partnerships, Collaborations, and Agreements

10.2.3 Mergers and Acquisitions

10.2.4 Business Expansions

11 Company Profiles (Page No. - 75)

11.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

11.2 IBM

11.3 Atlassian

11.4 Red Hat

11.5 CA Technologies

11.6 Puppet

11.7 Cloudbees

11.8 AWS

11.9 Microsoft

11.10 Oracle

11.11 Micro Focus

11.12 CircleCI

11.13 Jetbrains

11.14 Shippable

11.15 Electric Cloud

11.16 SmartBear

11.17 V-Soft Technologies

11.18 AutoRABIT

11.19 AppVeyor

11.20 Drone.Io

11.21 Rendered Text

11.22 Bitrise

11.23 Nevercode

11.24 TravisCI

11.25 PHPCI

11.26 BuildKite

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 120)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: MarketsandMarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Related Reports

12.6 Author Details

List of Tables (36 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 Global Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y %)

Table 3 Continuous Integration Tools Market Size, By Deployment Mode, 20162023 (USD Million)

Table 4 On-Premises: Market Size By Region, 20162023 (USD Million)

Table 5 Cloud: Market Size By Region, 20162023 (USD Million)

Table 6 Market Size By Organization Size, 20162023 (USD Million)

Table 7 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 8 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 9 Continuous Integration Tools Market Size, By Vertical, 20162023 (USD Million)

Table 10 Banking, Financial Services, and Insurance: Market Size By Region, 20162023 (USD Million)

Table 11 Retail and Ecommerce: Market Size By Region, 20162023 (USD Million)

Table 12 Telecommunication: Market Size By Region, 20162023 (USD Million)

Table 13 Education: Market Size By Region, 20162023 (USD Million)

Table 14 Media and Entertainment: Market Size By Region, 20162023 (USD Million)

Table 15 Healthcare: Market Size By Region, 20162023 (USD Million)

Table 16 Manufacturing: Market Size By Region, 20162023 (USD Million)

Table 17 Others: Market Size By Region, 20162023 (USD Million)

Table 18 Continuous Integration Tools Market Size, By Region, 20162023 (USD Million)

Table 19 North America: Market Size By Deployment Mode, 20162023 (USD Million)

Table 20 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 21 North America: Market Size By Vertical, 20162023 (USD Million)

Table 22 Europe: Market Size By Deployment Mode, 20162023 (USD Million)

Table 23 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 24 Europe: Market Size By Vertical, 20162023 (USD Million)

Table 25 Asia Pacific: Continuous Integration Tools Market Size, By Deployment Mode, 20162023 (USD Million)

Table 26 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 27 Asia Pacific: Market Size By Vertical, 20162023 (USD Million)

Table 28 Latin America: Market Size By Deployment Mode, 20162023 (USD Million)

Table 29 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 30 Latin America: Market Size By Vertical, 20162023 (USD Million)

Table 31 Middle East and Africa: Market Size By Deployment Mode, 20162023 (USD Million)

Table 32 Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 33 Middle East and Africa: Continuous Integration Tools Market Size, By Vertical, 20162023 (USD Million)

Table 34 New Product/Service Launches and Enhancements, 20162017

Table 35 Partnerships, Collaborations, and Agreement, 20152018

Table 36 Mergers and Acquisitions, 20152018

List of Figures (38 Figures)

Figure 1 Global Continuous Integration Tools Market Segmentation

Figure 2 Global Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market: Assumptions

Figure 8 Market Snapshot By Deployment Mode (2018 vs. 2023)

Figure 9 Market Snapshot By Organization Size

Figure 10 Market Snapshot By Vertical, (2018 vs. 2023)

Figure 11 Market Regional Snapshot

Figure 12 Automation of the Software Development Process to Quickly Release Software Applications is Expected to Drive the Market Growth During the Forecast Period

Figure 13 Media and Entertainment Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 15 Asia Pacific is Expected to Emerge as the Favorable Region for Investments During the Forecast Period

Figure 16 Continuous Integration Tools Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Cloud Deployment Mode is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 18 Small and Medium-Sized Enterprises Segment is Expected to Register A Higher CAGR During the Forecast Period

Figure 19 Media and Entertainment Vertical is Expected to Register the Highest CAGR During the Forecast Period

Figure 20 North America is Expected to Account for the Largest Market Size During the Forecast Period

Figure 21 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 22 North America: Market Snapshot

Figure 23 Asia Pacific: Market Snapshot

Figure 24 Key Developments By the Leading Players in the Continuous Integration Tools Market During 20152018

Figure 25 IBM: Company Snapshot

Figure 26 IBM: SWOT Analysis

Figure 27 Atlassian: Company Snapshot

Figure 28 Atlassian: SWOT Analysis

Figure 29 Red Hat: Company Snapshot

Figure 30 Red Hat: SWOT Analysis

Figure 31 CA Technologies: Company Snapshot

Figure 32 CA Technologies: SWOT Analysis

Figure 33 Puppet: SWOT Analysis

Figure 34 Cloudbees: SWOT Analysis

Figure 35 AWS: Company Snapshot

Figure 36 Microsoft: Company Snapshot

Figure 37 Oracle: Company Snapshot

Figure 38 Micro Focus: Company Snapshot

Growth opportunities and latent adjacency in Continuous Integration Tools Market

Gather insights into the platform of CI process and its functions and their respective market size.