Continuous Delivery Market by Deployment Mode (On-premises and Cloud), Organization Size, Vertical (BFSI, Retail and eCommerce, Media and Entertainment, Telecommunication, Healthcare, Manufacturing, Education), and Region - Global Forecast to 2023

[125 Pages Report] The Continuous Delivery Market was valued at USD 1.44 Billion in 2017 and expected to reach USD 3.85 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period. The base year considered for the study is 2017 and the forecast period is 2018–2023.

Objectives of the Study

- To define, determine, and forecast the global continuous delivery market by deployment mode, organization size, vertical, and region from 2018 to 2023 and analyze the macro and microeconomic factors that affect the market’s growth

- To forecast the size of the market segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze each submarket with respect to the individual growth trends, prospects, and contribution to the total market

- To analyze the market opportunities for stakeholders by identifying high-growth segments in the continuous delivery market

- To profile the key market players; provide a comparative analysis on the basis of their business overviews; regional presence; product offerings; business strategies; key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities in the market

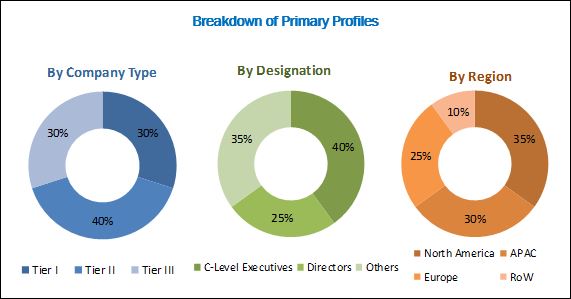

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the continuous delivery market. In addition to this, a few other market-related reports and analysis published by various consortiums, communities, and industry associations, such as Agile Alliance, Technology Services Industry Association (TSIA) and DevOps Agile Skills Association (DASA), were also considered while conducting extensive secondary research. The primary sources were mainly industry experts from the core and related industries, and preferred continuous delivery tools/solutions/software/platform providers, project managers, partners, and standards and certification organizations related to the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as assess the market’s prospects. The market has been forecasted by analyzing the driving factors, such as automation in the development and deployment of applications, the evolution of software as an essential and inseparable part of business ecosystems, the advent of the microservices architecture of applications, and the growing adoption of containers for application virtualization. The break-up of the profiles of the primary participants have been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The continuous delivery market ecosystem includes players, such as Atlassian (Australia), IBM (US), XebiaLabs (US) Electric Cloud (US), CA Technologies (US), Chef Software (US), Puppet (US), CloudBees (US), Microsoft (US), and Flexagon (US).

Please visit 360Quadrants to see the vendor listing of Best Marketplace Software Quadrant

Key Target Audience

- Project managers

- Business analysts

- Quality Assurance (QA)/test engineers

- DevOps consultants

- DevOps tools providers

- Continuous delivery tools providers

Scope of the Continuous Delivery Market Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Atlassian (Australia), IBM (US), XebiaLabs (US), CA Technologies (US), Electric Cloud (US), Puppet (US), Chef Software (US), CloudBees (US), Microsoft (US), Flexagon (US), Micro Focus (UK), Accenture (Ireland), Wipro (India), Clarive (Spain), VMware (US), appLariat (US), Red Hat (US), Shippable (US), CircleCI (US), Spirent (US), Heroku (US), JetBrains (Czech Republic), Bitrise (UK), AppVeyor (Canada), Kainos (US) |

The continuous delivery market considers the expenditure on various continuous delivery tools and services across deployment modes, verticals, organization size, and 5 major regions.

- Continuous Delivery is an approach within DevOps.

- The scope of the market includes commercialized tools and services.

- The scope of the continuous delivery market includes the tools used for continuous testing, continuous integration, and release automation phases only.

- The scope of the deployment mode includes on-premises and cloud.

- The scope of the organization size segment includes Small and Medium-sized Enterprises (SMEs) and large enterprises.

By Deployment Mode

- On-premises

- Cloud

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications

- Media and entertainment

- Retail and eCommerce

- Healthcare

- Manufacturing

- Education

- Others (government, transport and logistics, and energy and utilities)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the company’s specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country-level breakdown of the North American continuous delivery market

- Further country-level breakdown of the European market

- Further country-level breakdown of the APAC market

- Further country-level breakdown of the MEA market

- Further country-level breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The Continuous Delivery Market is expected to grow from USD 1.65 Billion in 2018 to USD 3.85 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period. The increasing need for automation in the development and deployment of applications, growing importance of software applications in business ecosystems, and rising shift toward application modernization architectures and technologies are expected to be the major factors driving the growth of the market. The increasing focus of organizations on accelerating the time-to-market is expected to drive the market.

The scope of this report covers the continuous delivery market analysis by deployment mode, organization size, vertical, and region. Continuous Delivery practice tools target phases, such as coding and building, testing and quality assurance, managing and deployment, support and maintenance, and collaboration and communication. Continuous Delivery software identified in the study targets several stages, such as continuous integration, continuous testing, and release automation. The benefits of continuous delivery practices allow businesses to accelerate their delivery cycles and reduce mean time to repair, thereby resulting in the increasing adoption of continuous delivery software.

The on-premises deployment mode is estimated to hold the larger market share in 2018, owing to better confidential information control and security from external attacks as systems are held internal to organizations. The cloud technology is steadily gaining acceptance from various enterprises across the globe, as cloud-based software and applications are cost-efficient and can be deployed even in a basic IT infrastructure. The large enterprises segment is expected to dominate the continuous delivery market. APAC is the hub for Small and Medium-sized Enterprises (SMEs), hence SMEs in this region would adopt continuous delivery tools rapidly, which in turn, is expected to boost the growth of the overall market within the next 5 years.

The media and entertainment vertical is expected to hold the largest market share in the continuous delivery market. The increase in the number of electronic gadgets, such as laptops, smartphones, home theatres, and other portable devices, is expected to be one of the major factors that is responsible for the growth of this vertical in the market. The other factors that are said to fuel the growth of the media and entertainment vertical are the advent of digital media content and digital media platforms.

As per the geographic analysis, North America is expected to hold the largest market share during the forecast period. This can be attributed to the continuous delivery software that is already penetrated in this region. North America is expected to be the most mature region for the growth of the continuous delivery market, due to the adoption of agile development, focus on faster time-to-market, and the explosion of mobile and web applications. The North American region comprises the US and Canada which are also witnessing the significant adoption of continuous delivery solutions. In fact, these countries are expected to have a major dominance in the market, due to their sustainable and well-established economies which empower them to make huge investments in R&D activities, thereby contributing to the development of new applications.

The major factor that is expected to restrain the growth of the continuous delivery market is the presence of open source tools and projects that are available in the market. These open source tools and projects are dominating commercial solutions in volumes. The major vendors covered in the market include Atlassian (Australia), IBM (US), XebiaLabs (US) Electric Cloud (US), CA Technologies (US), Chef Software (US), Puppet (US), CloudBees (US), Microsoft (US), and Flexagon (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.3.1 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Continuous Delivery Market

4.2 Continuous Delivery Market, By Deployment Mode, 2018–2023

4.3 Market By Organization Size, 2018–2023

4.4 Market By Vertical, 2018–2023

4.5 Market By Region, 2018

4.6 Market Investment Scenario, By Region, 2018–2023

5 Market Overview and Industry Trends (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Automation in Application Development and Deployment Gaining Traction Among Business Decision-Makers

5.2.1.2 Software (Commercial Off-The-Shelf and Application Programming Interface) Evolving Into an Essential and Inseparable Part of Business Ecosystem Across Verticals

5.2.1.3 Monolithic Applications Giving Way to Microservice Architecture and the Increasing Use of Containers for Virtualization

5.2.1.4 Managing Infrastructure and Configuration as A Code, Allowing Operations and Development Environments to Collaborate

5.2.2 Restraints

5.2.2.1 Open Source Tools and Projects Dominating Commercial Solutions

5.2.3 Opportunities

5.2.3.1 Increasing Use of Artificial Intelligence (AI) in Application Development and Deployment

5.2.3.2 Cloud-Based Platforms Creating an Environment for Application Development

5.2.4 Challenges

5.2.4.1 Organizational Maturity in Terms of Accepting Changes in the Existing Processes and Toolchains

5.2.4.2 Adopting End-To-End Automated and Orchestrated Practice for Achieving True Devops and Continuous Delivery

5.2.4.3 Identifying Business Value in Implementing Continuous Delivery

5.3 Industry Trends

5.3.1 Continuous Delivery Tools

5.3.1.1 Continuous Integration

5.3.1.2 Continuous Testing

5.3.1.3 Release Automation

5.3.2 Services

5.3.2.1 Professional Services

5.3.2.2 Managed Services

5.3.3 Continuous Delivery Ecosystem

6 Continuous Delivery, By Deployment Mode (Page No. - 39)

6.1 Introduction

6.2 On-Premises

6.3 Cloud

7 Continuous Delivery Market, By Organization Size (Page No. - 43)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises

7.3 Large Enterprises

8 Market By Vertical (Page No. - 47)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.3 Telecommunication

8.4 Media and Entertainment

8.5 Retail and Ecommerce

8.6 Healthcare

8.7 Manufacturing

8.8 Education

8.9 Others

9 Continuous Delivery Market, By Region (Page No. - 57)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 68)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 New Product/Service/Solution Launches

10.3.2 Business Expansions

10.3.3 Mergers and Acquisitions

10.3.4 Agreements and Partnerships

11 Company Profiles (Page No. - 73)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Atlassian

11.2 IBM

11.3 Xebialabs

11.4 CA Technologies

11.5 Electric Cloud

11.6 Puppet Enterprise

11.7 Chef Software

11.8 Cloudbees

11.9 Microsoft

11.10 Flexagon

11.11 Micro Focus

11.12 Clarive

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Key Innovators (Page No. - 101)

12.1 Accenture

12.2 Wipro

12.3 VMware

12.4 Applariat

12.5 Red Hat

12.6 Shippable

12.7 Circleci

12.8 Spirent

12.9 Heroku

12.10 Jetbrains

12.11 Bitrise

12.12 Appveyor

12.13 Infostretch

12.14 Kainos

13 Appendix (Page No. - 118)

13.1 Discussion Guide

13.2 Knowledge Store: MarketsandMarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customization

13.5 Related Reports

13.6 Author Details

List of Tables (31 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Continuous Delivery Market Size, By Deployment Mode, 2016–2023 (USD Million)

Table 3 On-Premises: Market Size, By Region, 2016–2023 (USD Million)

Table 4 Cloud: Market Size, By Region, 2016–2023 (USD Million)

Table 5 Market Size, By Organization Size, 2016–2023 (USD Million)

Table 6 Small and Medium-Sized Enterprises: Market Size, By Region, 2016–2023 (USD Million)

Table 7 Large Enterprises: Market Size, By Region, 2016–2023 (USD Million)

Table 8 Market Size, By Vertical, 2016–2023 (USD Million)

Table 9 Banking, Financial Services, and Insurance: Market Size, By Region, 2016–2023 (USD Million)

Table 10 Telecommunication: Market Size, By Region, 2016–2023 (USD Million)

Table 11 Media and Entertainment: Market Size, By Region, 2016–2023 (USD Million)

Table 12 Retail and Ecommerce: Market Size, By Region, 2016–2023 (USD Million)

Table 13 Healthcare: Market Size, By Region, 2016–2023 (USD Million)

Table 14 Manufacturing: Market Size, By Region, 2016–2023 (USD Million)

Table 15 Education: Market Size, By Region, 2016–2023 (USD Million)

Table 16 Others: Market Size, By Region, 2016–2023 (USD Million)

Table 17 North America: Continuous Delivery Market Size, By Deployment Mode, 2016–2023 (USD Million)

Table 18 North America: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 19 North America: Market Size, By Vertical, 2016–2023 (USD Million)

Table 20 Europe: Market Size, By Deployment Mode, 2016–2023 (USD Million)

Table 21 Europe: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 22 Europe: Market Size, By Vertical, 2016–2023 (USD Million)

Table 23 Asia Pacific: Market Size, By Deployment Mode, 2016–2023 (USD Million)

Table 24 Asia Pacific: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 25 Asia Pacific: Market Size, By Vertical, 2016–2023 (USD Million)

Table 26 Middle East and Africa: Continuous Delivery Market Size, By Deployment Mode, 2016–2023 (USD Million)

Table 27 Middle East and Africa: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 28 Middle East and Africa: Market Size, By Vertical, 2016–2023 (USD Million)

Table 29 Latin America: Market Size, By Deployment Mode, 2016–2023 (USD Million)

Table 30 Latin America: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 31 Latin America: Market Size, By Vertical, 2016–2023 (USD Million)

List of Figures (42 Figures)

Figure 1 Continuous Delivery Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market: Assumptions

Figure 8 Market 2016—2023

Figure 9 Market By Segmentation

Figure 10 Market By Top 3 Verticals, and Region

Figure 11 Market By Region

Figure 12 The Growing Focus on Accelerating the Time-To-Market is Expected to Drive the Growth of the Continuous Delivery Market

Figure 13 On-Premises Deployment Mode is Expected to Hold the Larger Market Share During the Forecast Period

Figure 14 Large Enterprises Segment is Expected to Hold the Larger Market Share During the Forecast Period

Figure 15 Media and Entertainment Vertical is Expected to Hold the Largest Market Share During the Forecast Period

Figure 16 North America is Estimated to Hold the Largest Market Share in 2018

Figure 17 Asia Pacific is Expected to Be the Hotspot Market to Invest in During the Forecast Period

Figure 18 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Cloud Deployment Mode is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Media and Entertainment Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Asia Pacific is Expected Grow at the Highest CAGR During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments By Leading Players in the Continuous Delivery Market During 2015–2018

Figure 26 Market Evaluation Framework

Figure 27 Atlassian: Company Snapshot

Figure 28 Atlassian: SWOT Analysis

Figure 29 IBM: Company Snapshot

Figure 30 IBM: SWOT Analysis

Figure 31 Xebialabs: SWOT Analysis

Figure 32 CA Technologies: Company Snapshot

Figure 33 CA Technologies: SWOT Analysis

Figure 34 Electric Cloud: SWOT Analysis

Figure 35 Microsoft: Company Snapshot

Figure 36 Micro Focus: Company Snapshot

Figure 37 Accenture: Company Snapshot

Figure 38 Wipro: Company Snapshot

Figure 39 VMware: Company Snapshot

Figure 40 Red Hat: Company Snapshot

Figure 41 Spirent: Company Snapshot

Figure 42 Kainos: Company Snapshot

Growth opportunities and latent adjacency in Continuous Delivery Market