Application Release Automation Market by Component (Tool and Services), Deployment Type (On-Premises and Cloud), Organization Size, Vertical (BFSI, ITEs and Telecommunications, Manufacturing), and Region - Global Forecast to 2023

[132 Pages Report] The application release automation market size is expected to grow from USD 1.78 billion in 2017 to USD 5.19 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 20.2% during the forecast period. The base year considered for this study is 2017 and the forecast period is 20182023. With the increasing penetration of IT automation and related technologies, such as big data and serverless architecture, the demand for ARA tool and services among enterprises is expected to grow significantly.

Objectives of the Study

- To describe and forecast the global application release automation market by component, deployment type, organization size, vertical, and region

- To forecast the market size of 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the markets sub segments with respect to the individual growth trends, prospects, and contribution to the total market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the major players

- To profile the key players and comprehensively analyze their core competencies and positioning

- To track and analyze the competitive developments, such as mergers and acquisitions, new product developments, and partnerships, agreements, and collaborations in the application release automation market

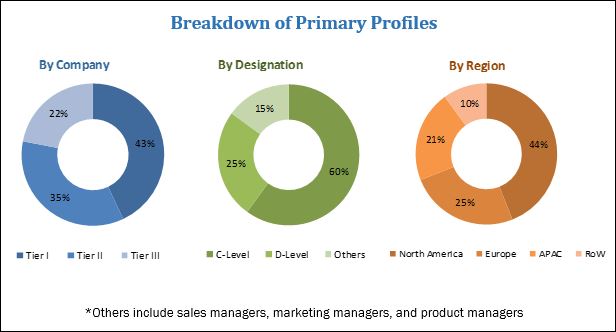

The research methodology used to estimate and forecast the application release automation market began with capturing the data on key vendors revenue through secondary research, such as Associations of Financial Professional and Information System Security Association. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub segments, which were then verified through primary research by conducting extensive interviews with the key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub segments. The breakdown of the profiles of the primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The application release automation ecosystem comprises service providers, such as BMC Software (US), CA Technologies (US), Fujitsu (Japan), IBM (US), Micro Focus (US), Microsoft (US), NIIT Technologies (India), Red Hat (US), VMware (US), Attunity (US), Arcad Software (US), Chef Software (US), Clarive (Spain), CloudBees (US), CollabNet (US), Datical (US), Electric Cloud (US), Flexagon LLC (US), Inedo (US), MidVision (UK), Octopus Deploy (Australia), Plutora (US), Puppet (US), Rocket Software (US), and XebiaLabs (US). The other stakeholders of the application release automation market include systems integrators, application designers, development service providers, and network service providers.

Key Target Audience for Application Release Automation Market

- Training and consulting service providers

- ARA vendors

- Telecom service providers

- System integrators

- Cloud service providers

- Government agencies

- Managed service providers

"The research study answers several questions for stakeholders, primarily which market segments to focus on in the next 2to 5 years for prioritizing their efforts and investments."

Scope of the Report

The research report categorizes the application release automation market to forecast the revenues and analyze the trends in each of the following submarkets:

By Component

- Tool

- Services

- Training, Consulting, and Integration

- Support and Maintenance

- Managed Services

By Deployment Type

- On-premises

- Cloud

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Vertical

- ITES And Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Retail and Consumer Goods

- Healthcare

- Media and Entertainment

- Others (government and public sector, and travel and hospitality)

By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific (APAC)

- Japan

- China

- Australia and New Zealand (ANZ)

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa (MEA)

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

Drivers

Focus on improving release processes and deployment speed

Enterprises rely on IT products and services to deliver differentiated customer experiences and to retain them. However, quick application delivery with quality is not an easy task to accomplish. Also, poorly executed software releases waste time on fixing bugs and errors, slow the time to market, and result in poor employee satisfaction due to overburden and stress. Enterprises need applications of high quality, which can be delivered quickly to enhance customer satisfaction. ARA is one of the emerging trends of software engineering that automates release processes to streamline IT delivery. It ensures continuous delivery of applications for enterprises leading to accelerated time to market. ARA also results in satisfied development teams owing to reduced operational and architectural complexities without hampering the quality of the application.

Optimized resource utilization

IT managers have a critical mandate to reduce the CAPEX and OPEX. Intense competition and global economic situations have accelerated the adoption of cost-effective measures to restructure business models. Organizations are moving from the complex process of application designing and managing hardware to the liable OPEX model. Most of the enterprises find audit and compliance boring, as it consumes time that they would rather be spending on their core job. Using ARA, enterprises can run their businesses with low operating costs and take advantage of the tool. It offers the benefits of low costs when compared to planning, managing, designing, and building enterprise applications. Hence, many organizations are considering implementing application release management across development and operations teams to utilize both monetary resources and personnel in an efficient way.

Restraints

Heavy dependence on legacy processes

Enterprises with a large number of employees have been adopting various advanced solutions to manage their software development life cycle. However, many organizations still stick to traditional methodologies that are often time consuming and tedious. Legacy processes can be problematic, as they lack the required support and do not provide a competitive edge to the company. This can be majorly attributed to budget constraints that SMEs face while implementing advanced technologies. Thus, many SMEs depend on manual and other traditional approaches to manage software development life cycle.

Opportunities

Advancements in AI and its use in application development

The pace of innovation and changing customer needs are creating challenges for companies to adapt and grow. Enterprises are working 24x7 to deliver products and services for enhancing customer experience. Furthermore, the ever-growing amount of data across applications is expected to drive the need for AI for fast application delivery. AI and Machine Learning (ML) enable enterprises to utilize resources efficiently. AI and ML algorithms enable enterprises to make data reservoir of relevant insights that may contain useful solutions in case of critical issues faced by IT operations. Companies must continue to focus on innovations, new products, and new lines of businesses, along with new capabilities of application development and deployment. Hence, information like common glitches and failures, from AI and ML can be used to improve ARA tool overtime to enhance the performance and client satisfaction level, which, in turn, would increase the adoption rates of the tool.

Challenges

Lack of understanding about ARA tasks

Many companies across the globe lack expertise and are not aware of the benefits of ARA. There is a strong need for skilled professionals who have hands-on expertise and technical knowledge. Inadequate skills result in substandard development, which may hamper the products. Companies must find both skilled programmers and IT operations specialists who can deploy the latest software development and infrastructure automation techniques. With the shortage of available skilled workers, companies nowadays have started internal training programs to enhance their own competency. Thus, continuous learning and training on ARA tool and their associated benefits can help organizations overcome this challenge.

Competitive Landscape

Partnerships, Agreements, and Collaborations

|

Date |

Company Name |

Description |

|

January 2018 |

Red Hat (US) and CoreOS (US) |

Red Hat signed a definitive agreement to acquire CoreOS. By combining both the companies' capabilities that include Kubernetes and container-based portfolio offerings, Red Hat can accelerate the adoption and development of the hybrid cloud platform for modern application workloads. This agreement enables Red Hat customers to build and deploy any application in any environment with complete flexibility due to an open source. |

|

January 2018 |

BMC Software (US) and AWS (US) |

BMC Software partnered with Amazon Web Services (AWS) for helping customers move their enterprise workloads to AWS' Cloud in a secure, low-risk, and cost-effective way. |

Source: Press Releases

New Product Launches and Product Enhancements

|

Date |

Company Name |

Description |

|

June 2018 |

CA Technologies (US) |

CA Technologies released enhancements to its CA Automic One Automation platform. The newly released enhancements enable better Operations (Ops), developer-focused automation, and eliminate automation silos. |

|

February 2018 |

Fujitsu (Japan) |

UShareSoft, a Fujitsu company, announced a new release UForge AppCenter 3.8. The new version simplifies application delivery in hybrid IT environments, and builds and deploys applications from a single console. |

Source: Press Releases

Business Expansions

|

Date |

Company Name |

Description |

|

November 2017 |

Puppet (US) |

Puppet announced the official opening of its new office in Tokyo, Japan. This office expands Puppet's global presence to 8 offices worldwide, with Tokyo being its third expansion move in the APAC region. This move comes after Puppet announced its flagship offering, Puppet, confined only for Japan - a move that helps Japanese customers accelerate the modern software deployment and better manage global infrastructures. Additionally, added investments and employees would further support the growing client base in the region. |

Source: Press Releases

Mergers and Acquisitions

|

Date |

Company Name |

Description |

|

September 2017 |

Micro Focus (UK) and HPE (US) |

Micro Focus merged with HPE's software business for becoming a pure-play enterprise software company. Due to this merger, a new and combined company was formed. This newly formed company is uniquely positioned for helping customers maximize their existing software investments and embrace innovation in the world of hybrid IT. |

|

November 2015 |

Fujitsu (Japan) and UshareSoft (France) |

Fujitsu acquired UShareSoft, a company based in France. Following this acquisition, Fujitsu strengthened its cloud business by incorporating UForge into its offering, automated systems building services. |

Source: Press Releases

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the companys specific needs.

Company Information

- Detailed analysis and profiling of the additional market players (up to 5)

The demand for application release automation offerings is expected to be driven by many factors, such as low costs, flexibility, scalability, and security. The application release automation offerings provide accelerated Time-to-Market (TTM) and speedy application release processes.

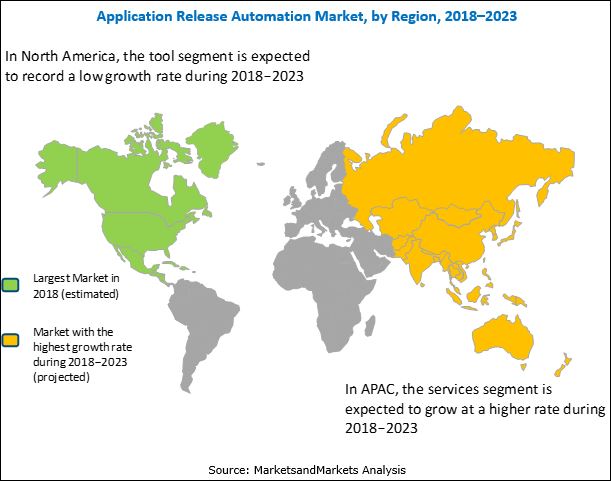

The application release automation market has been segmented on the basis of components, deployment modes, organization size, verticals, and regions. The services segment is expected to grow at a higher CAGR during the forecast period, whereas the tool segment is estimated to hold the larger market size in 2018. The application release automation tool and services have become a central part of business processes, due to their easy use and flexibility. The adoption of the application release automation tool and services is expected to grow in the coming years.

Under deployment types, the on-premises deployment type is estimated to hold the larger market size in 2018. As the application release automation market is growing, the need to deploy tools that are compatible with the on-premises infrastructure at a low cost is also becoming essential. The integration and deployment of the application release automation tool enables archiving, retention, and communication within DevOps teams and infrastructure. Organizations that deal with confidential user credentials usually prefer the on-premises deployment mode, as it can secure confidential information and prevent it from external attacks, and protect systems held on the premises of organizations.

In regions, North America is estimated to hold the largest market size in 2018, whereas Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The increasing need for speedy and low-cost DevOps processes and complete security while operating in physical, virtual, or cloud environments is expected to drive the global application release automation market.

The increasing user engagement on digital platforms, growing focus on competitive intelligence, and rising need to improve the audience experience are major factors expected to drive the growth of the market. However, complexities in analytical workflows and high initial upfront cost of analytics platforms may affect the growth of the application release automation market.

The major players in the application release automation market are BMC Software (US), CA Technologies (US), Fujitsu (Japan), IBM (US), Micro Focus (US), Microsoft (US), NIIT Technologies (India), Red Hat (US), VMware (US), Attunity (US), Arcad Software (US), Chef Software (US), Clarive (Spain), CloudBees (US), CollabNet (US), Datical (US), Electric Cloud (US), Flexagon LLC (US), Inedo (US), MidVision (UK), Octopus Deploy (Australia), Plutora (US), Puppet (US), Rocket Software (US), and XebiaLabs (US). These players have adopted various growth strategies, such as new product developments, mergers and acquisitions, collaborations, and partnerships, to expand their presence in the global market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Market

4.2 Application Release Automation Market, By Component (2018 vs 2023)

4.3 Market Shares of Top 3 Verticals and Regions, 2018

4.4 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Focus on Improving Release Processes and Deployment Speed

5.2.1.2 Numerous Applications Running in Dynamic It Environment

5.2.1.3 Optimized Resource Utilization

5.2.2 Restraints

5.2.2.1 Heavy Dependence on Legacy Processes

5.2.3 Opportunities

5.2.3.1 Cloud-Based Platforms Creating A Favorable Environment for Application Development

5.2.3.2 Advancements in AI and Its Use in Application Development

5.2.4 Challenges

5.2.4.1 Lack of Understanding About Application Release Automation Tasks

6 Market, By Component (Page No. - 35)

6.1 Introduction

6.2 Tool

6.3 Services

6.3.1 Training, Consulting, and Integration

6.3.2 Support and Maintenance

6.3.3 Managed Services

7 Market, By Deployment Type (Page No. - 41)

7.1 Introduction

7.2 On-Premises

7.3 Cloud

8 Market, By Organization Size (Page No. - 45)

8.1 Introduction

8.2 Large Enterprises

8.3 Small and Medium-Sized Enterprises

9 Market, By Vertical (Page No. - 49)

9.1 Introduction

9.2 ITES and Telecommunications

9.3 Banking, Financial Services, and Insurance

9.4 Manufacturing

9.5 Retail and Consumer Goods

9.6 Healthcare

9.7 Media and Entertainment

9.8 Others

10 Application Release Automation Market, By Region (Page No. - 57)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.2 Canada

10.3 Europe

10.3.1 United Kingdom

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 Japan

10.4.2 Australia and New Zealand

10.4.3 China

10.4.4 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 United Arab Emirates

10.5.2 Kingdom of Saudi Arabia

10.5.3 South Africa

10.5.4 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.2 Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 76)

11.1 Overview

11.2 Competitive Situations and Trends

11.2.1 Partnerships, Agreements, and Collaborations

11.2.2 New Product Launches and Product Enhancements

11.2.3 Business Expansions

11.2.4 Mergers and Acquisitions

12 Company Profiles (Page No. - 82)

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

12.1 Introduction

12.2 CA Technologies

12.3 Microsoft

12.4 IBM

12.5 Red Hat

12.6 XebiaLabs

12.7 Micro Focus

12.8 BMC Software

12.9 VMware

12.10 Fujitsu

12.11 Puppet

12.12 Chef Software

12.13 Electric Cloud

12.14 Clarive

12.15 Flexagon LLC

12.16 CloudBees

12.17 CollabNet

12.18 Arcad Software

12.19 Attunity

12.20 Datical

12.21 NIIT Technologies

12.22 Inedo

12.23 MidVision

12.24 Octopus Deploy

12.25 Plutora

12.26 Rocket Software

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 125)

13.1 Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: MarketsandMarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (55 Tables)

Table 1 Application Release Automation Market Size, By Component, 20162023 (USD Million)

Table 2 Tool: Market Size, By Region, 20162023 (USD Million)

Table 3 Services: Market Size, By Type, 20162023 (USD Million)

Table 4 Training, Consulting, and Integration Market Size, By Region, 20162023 (USD Million)

Table 5 Support and Maintenance Market Size, By Region, 20162023 (USD Million)

Table 6 Managed Services Market Size, By Region, 20162023 (USD Million)

Table 7 Market Size, By Deployment Type, 20162023 (USD Million)

Table 8 On-Premises: Market Size, By Region, 20162023 (USD Million)

Table 9 Cloud: Market Size, By Region, 20162023 (USD Million)

Table 10 Market Size, By Organization Size, 20162023 (USD Million)

Table 11 Large Enterprises: Market Size, By Region, 20162023 (USD Million)

Table 12 Small and Medium-Sized Enterprises: Market Size, By Region, 20162023 (USD Million)

Table 13 Application Release Automation Market Size, By Vertical, 20162023 (USD Million)

Table 14 ITES and Telecommunications: Market Size, By Region, 20162023 (USD Million)

Table 15 Banking, Financial Services, and Insurance: Market Size, By Region, 20162023 (USD Million)

Table 16 Manufacturing: Market Size, By Region, 20162023 (USD Million)

Table 17 Retail and Consumer Goods: Market Size, By Region, 20162023 (USD Million)

Table 18 Healthcare: Market Size, By Region, 20162023 (USD Million)

Table 19 Media and Entertainment: Market Size, By Region, 20162023 (USD Million)

Table 20 Others: Market Size, By Region, 20162023 (USD Million)

Table 21 Application Release Automation Market Size, By Region, 20162023 (USD Million)

Table 22 North America: Market Size, By Component, 20162023 (USD Million)

Table 23 North America: Market Size, By Service, 20162023 (USD Million)

Table 24 North America: Market Size, By Deployment Type, 20162023 (USD Million)

Table 25 North America: Market Size, By Organization Size, 20162023 (USD Million)

Table 26 North America: Market Size, By Vertical, 20162023 (USD Million)

Table 27 North America: Market Size, By Country, 20162023 (USD Million)

Table 28 Europe: Application Release Automation Market Size, By Component, 20162023 (USD Million)

Table 29 Europe: Market Size, By Service, 20162023 (USD Million)

Table 30 Europe: Market Size, By Deployment Type, 20162023 (USD Million)

Table 31 Europe: Market Size, By Organization Size, 20162023 (USD Million)

Table 32 Europe: Market Size, By Vertical, 20162023 (USD Million)

Table 33 Europe: Market Size, By Country, 20162023 (USD Million)

Table 34 Asia Pacific: Application Release Automation Market Size, By Component, 20162023 (USD Million)

Table 35 Asia Pacific: Market Size, By Service, 20162023 (USD Million)

Table 36 Asia Pacific: Market Size, By Deployment Type, 20162023 (USD Million)

Table 37 Asia Pacific: Market Size, By Organization Size, 20162023 (USD Million)

Table 38 Asia Pacific: Market Size, By Vertical, 20162023 (USD Million)

Table 39 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 40 Middle East and Africa: Application Release Automation Market Size, By Component, 20162023 (USD Million)

Table 41 Middle East and Africa: Market Size, By Service, 20162023 (USD Million)

Table 42 Middle East and Africa: Market Size, By Deployment Type, 20162023 (USD Million)

Table 43 Middle East and Africa: Market Size, By Organization Size, 20162023 (USD Million)

Table 44 Middle East and Africa: Market Size, By Vertical, 20162023 (USD Million)

Table 45 Middle East and Africa: Market Size, By Country, 20162023 (USD Million)

Table 46 Latin America: Application Release Automation Market Size, By Component, 20162023 (USD Million)

Table 47 Latin America: Market Size, By Service, 20162023 (USD Million)

Table 48 Latin America: Market Size, By Deployment Type, 20162023 (USD Million)

Table 49 Latin America: Market Size, By Organization Size, 20162023 (USD Million)

Table 50 Latin America: Market Size, By Vertical, 20162023 (USD Million)

Table 51 Latin America: Market Size, By Country, 20162023 (USD Million)

Table 52 Partnerships, Agreements, and Collaborations, 20172018

Table 53 New Product Launches and Product Enhancements, 20172018

Table 54 Business Expansions, 2017

Table 55 Mergers and Acquisitions, 20152018

List of Figures (40 Figures)

Figure 1 Application Release Automation Market: Market Segmentation

Figure 2 Regional Scope

Figure 3 Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Market Assumptions

Figure 9 Application Release Automation Market Size and Growth, 20162023 (USD Million, Y-O-Y %)

Figure 10 Top 3 Segments With the Largest Market Shares in the Market

Figure 11 Market: Regional Snapshot

Figure 12 Focus on Improving Release Processes and Deployment Speed is Expected to Drive the Global Market

Figure 13 Tool Segment is Estimated to Have the Larger Market Size in 2018

Figure 14 ITES and Telecommunications Vertical and North America are Expected to Have the Largest Market Shares in 2018

Figure 15 Asia Pacific is Expected to Emerge as the Best Market for Investments for the Next 5 Years

Figure 16 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Tool Segment is Estimated to Hold the Larger Market Size in 2018

Figure 18 Training, Consulting, and Integration Segment is Estimated to Hold the Largest Market Size in 2018

Figure 19 On-Premises Deployment Type is Estimated to Hold the Larger Market Size in 2018

Figure 20 Large Enterprises Segment is Estimated to Have the Larger Market Size in 2018

Figure 21 ITES and Telecommunications Vertical is Estimated to Hold the Largest Market Size in 2018

Figure 22 North America is Estimated to Hold the Largest Market Size in 2018

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments By the Leading Players in the Application Release Automation Market, 20162018

Figure 26 Market Evaluation Framework

Figure 27 CA Technologies: Company Snapshot

Figure 28 CA Technologies: SWOT Analysis

Figure 29 Microsoft: Company Snapshot

Figure 30 Microsoft: SWOT Analysis

Figure 31 IBM: Company Snapshot

Figure 32 IBM: SWOT Analysis

Figure 33 Red Hat: Company Snapshot

Figure 34 Red Hat: SWOT Analysis

Figure 35 XebiaLabs: SWOT Analysis

Figure 36 Micro Focus: Company Snapshot

Figure 37 VMware: Company Snapshot

Figure 38 Fujitsu: Company Snapshot

Figure 39 Attunity: Company Snapshot

Figure 40 NIIT Technologies: Company Snapshot

Growth opportunities and latent adjacency in Application Release Automation Market