Construction Repaint Market by Resin Type (Acrylic, Alkyd, Epoxy, Polyurethane, Polyester), Formulation (Solvent Borne, Waterborne), Application (Residential, Non-Residential), Region - Global Forecast to 2026

[201 Pages Report] The global Construction Repaint Market was valued at USD 47.64 Billion in 2015 and is projected to reach USD 93.72 Billion by 2026, at a CAGR of 6.5%. The base year considered for the study is 2015, while the forecast period is from 2016 to 2026.

Objectives of the report are as follows:

To define, describe, and forecast the global construction repaint market based on resin type, formulation, application, and region

- To analyze the market segmentation and project the market size, in terms of volume, and value, for key regions such as, North America, Europe, Asia-Pacific, South America, and Middle East & Africa, and the key countries within these regions

- To strategically analyze the market segments with respect to type, formulation, application, and region

- To provide detailed information regarding the major factors influencing the growth of the construction repaint market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze the key developments such as new product launches, capacity expansions, mergers & acquisitions, and partnerships in the Global market

- To analyze in detail, the short-term, mid-term, and long-term outlook of the market and the respective impact on the construction repaint market

- To identify key players and their core competencies in the market and provide their market positioning

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global market and to estimate the sizes of various other dependent submarkets in the overall construction repaint market. The research study involved the extensive use of secondary sources, directories, and databases, such as, Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the global market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the construction repaint market includes sourcing of basic raw materials, manufacturing, supplying to intermediate product manufacturers, and usage in various end-use applications. The raw materials in the construction repaint market are, solvents (conventional or green), resins, additives, extenders, and pigments. Suppliers of these raw materials include, Arkema (France), Solvay S.A. (Belgium), Nuplex Industries Limited (Australia), BASF S.E. (Germany), Covestro (Germany), DIC Corporation (Japan), DSM Coating Resins (Netherlands), Momentive Performance Materials Inc. (U.S.), Huntsman Corp. (U.S.), The Dow Chemical Company (U.S.), LyondellBasell Industries (Netherlands), and Eastman Chemical Co. (U.S.).

Key Target Audience:

- Raw Material Suppliers

- Paint Manufacturers

- Traders, Distributors, and Suppliers of Paints

- Government & Regional Agencies, Research Organizations, and Investment Research Firms

Scope of the Report:

This research report categorizes the global construction repaint market on the basis of resin type, formulation, application and region.

On the basis of Resin Type:

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Polyester

- Others

On the basis of Formulation:

- Solvent borne

- Waterborne

- Others

On the basis of Application:

- Residential

- Non-residential

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Geographic Analysis:

- Country-level analysis of the construction repaint market by resin type, formulation, and application

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

The global construction repaint market is projected to reach USD 93.72 Billion by 2026, at a CAGR of 6.5% from 2016 to 2026. Construction repaint is recognized as the paint used in homes, multi-family residential, commercial, and institutional applications such as, varnishes, emulsions, and enamels, among others, for the purpose of maintenance, repairs, and renovation work. These applications drive the market globally.

Waterborne paints are projected to be the largest segment among the formulations in the global market. Regulations on the emissions of VOCs by regulatory bodies such as, EPA (U.S.), REACH (Europe), and National Standard GB 18582-2008 (China) are driving the market for waterborne and other low-VOC and VOC-free paints.

Acrylic paints are the largest growing resin type in the construction repaint market. Acrylic paints are waterborne and are available as emulsions (latex), lacquers, enamels, and powders. Acrylic paints are inexpensive, easy to clean and have low VOC content or are VOC-free which make acrylic paints, the most preferred in the global market.

Non-residential construction is projected to be the fastest growing application in the construction repaint market. Increasing investments in the non-residential construction sector such as infrastructure, buildings, city development, urbanization, and maintenance & repair works are driving the market for construction repaint in this segment.

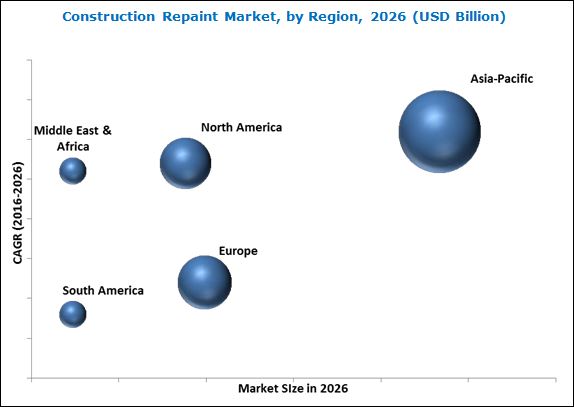

Growth in the building & construction industry has led to an increase in the demand for construction repaint. In 2015, the Asia-Pacific region accounted for the largest share of the global construction repaint market and is also projected to be the fastest-growing market till 2021. China is expected to account for the largest share of the Asia-Pacific region market till 2026, with India expected to register the fastest-growth rate during the forecast period.

Use of bio-based and hybrid paints are considered potential eco-friendly alternatives for the conventionally used solvent borne and other paints with high VOC content, which is leading to the growth of the construction repaint market. The increasing use of glass in the construction of buildings is restraining the growth of the construction repaint market. Also, the development of durable paint products increases the life of paints, restraining the repaint market.

Companies have adopted strategies such as new product developments, expansions, partnerships, mergers & acquisitions, and joint ventures to expand their market shares and distribution networks in the global market. They are engaging in intensive research & development activities to innovate and develop new products which can open new avenues of applications. For instance, PPG Industries, under its brand HOMAX, launched two new water-based aerosol ceiling textures for orange-peel and knockdown repair projects. This new product would help decrease the time taken to repair ceilings. It would also provide the company a competitive advantage over others. Strategies, including expansions, acquisitions, and new product launches have been adopted by the company between 2014 and 2016. This has resulted in enhancing the global reach, as well as the product portfolio of the company

Nippon Paint Holdings Co., Ltd. launched a new antivirus and antibacterial paint, Nippon VirusGuard Paint. The company is involved in several repaint projects and seminars in addition to the adoption of strategies such as, new product launches, expansions, and mergers & acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 By Region

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

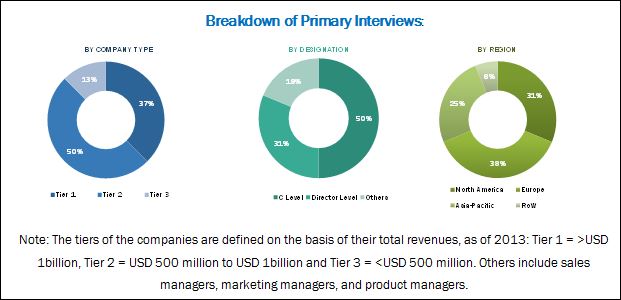

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Construction Repaint Market

4.2 Asia-Pacific Market, 2015

4.3 Waterborne Paints to Lead Global Market

4.4 Residential Constructions to Lead Construction Repaint Market

4.5 Asia-Pacific Expected to Lead The Market, During Forecast Period (2016-2021)

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Resin Type

5.2.2 By Formulation

5.2.3 By Application

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Aging Or Damage of Paints in the Existing Buildings and Infrastructures

5.3.1.2 Growing Market for Building & Construction Industry

5.3.2 Restraints

5.3.2.1 Fluctuating Crude Oil Prices Affecting the Prices of Raw Materials

5.3.2.2 Increasing Popularity of Glass Buildings

5.3.2.3 Use of Durable Products Improving the Life Cycle of Paints

5.3.3 Opportunities

5.3.3.1 Use of Bio-Based and Modified Paints

5.3.3.2 Use of Innovative Products

5.3.4 Challenges

5.3.4.1 Stringent Environmental Regulations on VOCS Emissions

5.3.4.2 Manufacturing High Performance Products Economically

5.4 Impact Analysis

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Material Manufacturers

6.2.2 Paint Manufacturers

6.2.3 End-Users

6.3 Porter’s Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Rivalry

6.4 Cost Structure Analysis

6.5 Patent Analysis

6.6 Macroeconomic Overview and Key Drivers

6.6.1 Introduction

6.7 Building & Construction Industry Trends

6.7.1 Overview of North America Building & Construction Industry

6.7.2 Overview of European Building & Construction Industry

6.7.3 Overview of Asia-Pacific Building & Construction Industry

6.7.4 Overview of Middle East & Africa Building & Construction Industry

6.7.5 Overview of Latin America Building & Construction

7 Construction Repaint Market, By Resin Type (Page No. - 58)

7.1 Introduction

7.2 Acrylic

7.3 Alkyd

7.4 Epoxy

7.5 Polyurethanes

7.6 Polyesters

7.7 Others

8 Construction Repaint Market, By Formulation (Page No. - 71)

8.1 Introduction

8.2 Waterborne Paints

8.2.1 Waterborne Paint Types

8.2.2 Resin Types for Waterborne Paints

8.2.3 Applications

8.2.4 Advantages & Disadvantages

8.3 Solventborne Paints

8.3.1 Advantages & Disadvantages

8.4 Other Formulations

8.4.1 Advantages & Disadvantages of Powder Coatings:

9 Construction Repaint Market, By Application (Page No. - 79)

9.1 Introduction

9.2 Residential Construction Repaint

9.3 Non-Residential Construction Repaint

9.3.1 Commercial

9.3.2 Industrial

10 Construction Repaint Market, By Region (Page No. - 84)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 Russia

10.3.3 U.K.

10.3.4 France

10.3.5 Italy

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 South Korea

10.4.5 Indonesia

10.4.6 Thailand

10.4.7 Malaysia

10.4.8 Rest of Asia-Pacific

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 UAE

10.5.3 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of South America

11 Competitive Landscape (Page No. - 160)

11.1 Overview

11.2 Competitive Situations and Trends

11.3 Market Share Analysis

11.3.1 PPG Industries Inc.

11.3.2 Akzonobel N.V.

11.3.3 The Sherwin-Williams Company

11.3.4 Axalta Coating Systems LLC

11.3.5 Nippon Paint Holdings Co., Ltd.

11.3.6 Asian Paints Ltd.

11.3.7 Jotun A/S

11.3.8 Kansai Paint Co., Ltd.

11.3.9 The Valspar Corporation

11.3.10 RPM International Inc.

11.3.11 New Product Launches

11.3.12 Expansions

11.3.13 Mergers & Acquisitions

11.3.14 Joint Ventures

12 Company Profiles (Page No. - 168)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 PPG Industries Inc.

12.2 Akzonobel N.V.

12.3 The Sherwin-Williams Company

12.4 RPM International Inc.

12.5 Axalta Coating Systems LLC

12.6 The Valspar Corporation

12.7 Nippon Paint Holdings Co., Ltd.

12.8 Asian Paints Ltd.

12.9 Jotun A/S

12.10 Kansai Paint Co., Ltd.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12.11 Other Key Market Players

13 Appendix (Page No. - 194)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (226 Tables)

Table 1 Market Segmentation, By Type

Table 2 Market Segmentation, By Formulation

Table 3 Market Segmentation, By Application

Table 4 Impact Analysis of Drivers

Table 5 Impact Analysis of Restraints

Table 6 Construction Repaint – Cost Structure

Table 7 Contribution of Building & Construction Industry to the GDP of North America, 2014–2021 (USD Million)

Table 8 Contribution of Building & Construction Industry to the GDP of Europe, 2014–2021 (USD Million)

Table 9 Contribution of Building & Construction Industry to the GDP of Asia-Pacific, 2014–2021 (USD Million)

Table 10 Contribution of Building & Construction Industry to the GDP of Middle East & Africa, 2014–2021 (USD Million)

Table 11 Contribution of Building & Construction Industry to the GDP of Latin America, 2014–2021 (USD Million)

Table 12 Acrylic-Based Construction Repaint Market Size, By Region, 2014–2026 (USD Million)

Table 13 Acrylic-Based Construction Repaint Market Size, By Region, 2014–2026 (Kiloton)

Table 14 Alkyd-Based Construction Repaint Market Size, By Region, 2014–2026 (USD Million)

Table 15 Alkyd-Based Construction Repaint Market Size, By Region, 2014–2026 (Kiloton)

Table 16 Epoxy-Based Construction Repaint Market Size, By Region, 2014–2026 (USD Million)

Table 17 Epoxy-Based Construction Repaint Market Size, By Region, 2014–2026 (Kiloton)

Table 18 Polyurethane-Based Construction Repaint Market Size, By Region, 2014–2026 (USD Million)

Table 19 Polyurethane-Based Construction Repaint Market Size, By Region, 2014–2026 (Kiloton)

Table 20 Polyster-Based Construction Repaint Market Size, By Region, 2014–2026 (USD Million)

Table 21 Polyester-Based Construction Repaint Market Size, By Region, 2014–2026 (Kiloton)

Table 22 Other Resins-Based Construction Repaints Market Size, By Region, 2014–2026 (USD Million)

Table 23 Other Resins-Based Construction Repaints Market Size, By Region, 2014–2026 (Kiloton)

Table 24 Market Size, By Formulation, 2014–2026 (USD Billion)

Table 25 Market Size, By Formulation, 2014–2026 (Kiloton)

Table 26 Waterborne Construction Repaint Market Size, By Region, 2014–2026 (USD Million)

Table 27 Waterborne Construction Repaint Market Size, By Region, 2014–2026 (Kiloton)

Table 28 Solventborne Construction Repaint Market Size, By Region, 2014–2026 (USD Million)

Table 29 Solventborne Construction Repaint Market Size, By Region, 2014–2026 (Kiloton)

Table 30 Other Formulations Construction Repaint Market Size, By Region, 2014–2026 (USD Million)

Table 31 Other Formulations Construction Repaint Market Size, By Region, 2014–2026 (Kiloton)

Table 32 Market By Size, By Application, 2014–2026 (USD Billion)

Table 33Market By Size, By Application, 2014–2026 (Kiloton)

Table 34 Residential Construction Repaint Market Size, By Region, 2014–2026 (USD Million)

Table 35 Residential Construction Repaint Market Size, By Region, 2014–2026 (Kiloton)

Table 36 Non-Residential Construction Repaint Market Size, By Region, 2014–2026 (USD Million)

Table 37 Non-Residential Construction Repaint Market Size, By Region, 2014–2026 (Kiloton)

Table 38 Market By Size, By Region, 2014–2026 (Kiloton)

Table 39 Market By Size, By Region, 2014–2026 (USD Billion)

Table 40 Regulations for VOCS Content in North America

Table 41 North America: Construction Repaint Market Size, By Country, 2014–2026 (Kiloton)

Table 42 North America: Market By Size, By Country, 2014–2026 (USD Million)

Table 43 North America: Market By Size, By Type, 2014–2026 (Kiloton)

Table 44 North America: Market By Size, By Type, 2014–2026 (USD Million)

Table 45 North America: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 46 North America: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 47 North America: Market By Size, By Application, 2014–2026 (Kiloton)

Table 48 North America: Market By Size, By Application, 2014–2026 (USD Million)

Table 49 U.S.: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 50 U.S.: Market By Size, By Type, 2014–2026 (USD Million)

Table 51 U.S.: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 52 U.S.: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 53 U.S.: Market By Size, By Application, 2014–2026 (Kiloton)

Table 54 U.S.: Market By Size, By Application, 2014–2026 (USD Million)

Table 55 Canada: Market By Size, By Type, 2014–2026 (Kiloton)

Table 56 Canada: Market By Size, By Type, 2014–2026 (USD Million)

Table 57 Canada: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 58 Canada: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 59 Canada: Market By Size, By Application, 2014–2026 (Kiloton)

Table 60 Canada: Market By Size, By Application, 2014–2026 (USD Million)

Table 61 Mexico: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 62 Mexico: Market By Size, By Type, 2014–2026 (USD Million)

Table 63 Mexico: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 64 Mexico: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 65 Mexico: Market By Size, By Application, 2014–2026 (Kiloton)

Table 66 Mexico: Market By Size, By Application, 2014–2026 (USD Million)

Table 67 Regulations for VOCS Content in Europe

Table 68 Europe: Construction Repaint Market Size, By Country, 2014–2026 (Kiloton)

Table 69 Europe: Market By Size, By Country, 2014–2026 (USD Million)

Table 70 Europe: Market By Size, By Type, 2014–2026 (Kiloton)

Table 71 Europe: Market By Size, By Type, 2014–2026 (USD Million)

Table 72 Europe: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 73 Europe: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 74 Europe: Market By Size, By Application, 2014–2026 (Kiloton)

Table 75 Europe: Market By Size, By Application, 2014–2026 (USD Million)

Table 76 Germany: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 77 Germany: Market By Size, By Type, 2014–2026 (USD Million)

Table 78 Germany: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 79 Germany: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 80 Germany: Market By Size, By Application, 2014–2026 (Kiloton)

Table 81 Germany: Market By Size, By Application, 2014–2026 (USD Million)

Table 82 Russia: Market By Size, By Type, 2014–2026 (Kiloton)

Table 83 Russia: Market By Size, By Type, 2014–2026 (USD Million)

Table 84 Russia: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 85 Russia: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 86 Russia: Market By Size, By Application, 2014–2026 (Kiloton)

Table 87 Russia: Market By Size, By Application, 2014–2026 (USD Million)

Table 88 U.K.: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 89 U.K.: Market By Size, By Type, 2014–2026 (USD Million)

Table 90 U.K.: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 91 U.K.: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 92 U.K.: Market By Size, By Application, 2014–2026 (Kiloton)

Table 93 U.K.: Market By Size, By Application, 2014–2026 (USD Million)

Table 94 France: Market By Size, By Type, 2014–2026 (Kiloton)

Table 95 France: Market By Size, By Type, 2014–2026 (USD Million)

Table 96 France: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 97 France: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 98 France: Market By Size, By Application, 2014–2026 (Kiloton)

Table 99 France: Market By Size, By Application, 2014–2026 (USD Million)

Table 100 Italy: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 101 Italy: Market By Size, By Type, 2014–2026 (USD Million)

Table 102 Italy: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 103 Italy: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 104 Italy: Market By Size, By Application, 2014–2026 (Kiloton)

Table 105 Italy: Market By Size, By Application, 2014–2026 (USD Million)

Table 106 Rest of Europe: Market By Size, By Type, 2014–2026 (Kiloton)

Table 107 Rest of Europe: Market By Size, By Type, 2014–2026 (USD Million)

Table 108 Rest of Europe: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 109 Rest of Europe: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 110 Rest of Europe: Market By Size, By Application, 2014–2026 (Kiloton)

Table 111 Rest of Europe: Market By Size, By Application, 2014–2026 (USD Million)

Table 112 Asia-Pacific: Construction Repaint Market Size, By Country, 2014–2026 (Kiloton)

Table 113 Asia-Pacific: Market By Size, By Country, 2014–2026 (USD Million)

Table 114 Asia-Pacific: Market By Size, By Type, 2014–2026 (Kiloton)

Table 115 Asia-Pacific: Market By Size, By Type, 2014–2026 (USD Million)

Table 116 Asia-Pacific: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 117 Asia-Pacific: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 118 Asia-Pacific: Market By Size, By Application, 2014–2026 (Kiloton)

Table 119 Asia-Pacific: Market By Size, By Application, 2014–2026 (USD Million)

Table 120 Regulations for VOCS Content in China

Table 121 China: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 122 China: Market By Size, By Type, 2014–2026 (USD Million)

Table 123 China: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 124 China: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 125 China: Market By Size, By Application, 2014–2026 (Kiloton)

Table 126 China: Market By Size, By Application, 2014–2026 (USD Million)

Table 127 Regulations for VOCS Content in India

Table 128 India: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 129 India: Market By Size, By Type, 2014–2026 (USD Million)

Table 130 India: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 131 India: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 132 India: Market By Size, By Application, 2014–2026 (Kiloton)

Table 133 India: Market By Size, By Application, 2014–2026 (USD Million)

Table 134 Japan: Market By Size, By Type, 2014–2026 (Kiloton)

Table 135 Japan: Market By Size, By Type, 2014–2026 (USD Million)

Table 136 Japan: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 137 Japan: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 138 Japan: Market By Size, By Application, 2014–2026 (Kiloton)

Table 139 Japan: Market By Size, By Application, 2014–2026 (USD Million)

Table 140 Environmental Regulations for VOCS Content in South Korea

Table 141 South Korea: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 142 South Korea: Market By Size, By Type, 2014–2026 (USD Million)

Table 143 South Korea: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 144 South Korea: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 145 South Korea: Market By Size, By Application, 2014–2026 (Kiloton)

Table 146 South Korea: Market By Size, By Application, 2014–2026 (USD Million)

Table 147 Indonesia: Market By Size, By Type, 2014–2026 (Kiloton)

Table 148 Indonesia: Market By Size, By Type, 2014–2026 (USD Million)

Table 149 Indonesia: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 150 Indonesia: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 151 Indonesia: Market By Size, By Application, 2014–2026 (Kiloton)

Table 152 Indonesia: Market By Size, By Application, 2014–2026 (USD Million)

Table 153 Thailand: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 154 Thailand: Market By Size, By Type, 2014–2026 (USD Million)

Table 155 Thailand: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 156 Thailand: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 157 Thailand: Market By Size, By Application, 2014–2026 (Kiloton)

Table 158 Thailand: Market By Size, By Application, 2014–2026 (USD Million)

Table 159 Malaysia: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 160 Malaysia: Market By Size, By Type, 2014–2026 (USD Million)

Table 161 Malaysia: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 162 Malaysia: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 163 Malaysia: Market By Size, By Application, 2014–2026 (Kiloton)

Table 164 Malaysia: Market By Size, By Application, 2014–2026 (USD Million)

Table 165 Rest of Asia-Pacific: Market By Size, By Type, 2014–2026 (Kiloton)

Table 166 Rest of Asia-Pacific: Market By Size, By Type, 2014–2026 (USD Million)

Table 167 Rest of Asia-Pacific: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 168 Rest of Asia-Pacific: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 169 Rest of Asia-Pacific: Market By Size, By Application, 2014–2026 (Kiloton)

Table 170 Rest of Asia-Pacific: Market By Size, By Application, 2014–2026 (USD Million)

Table 171 Middle East & Africa: Construction Repaint Market Size, By Country, 2014–2026 (Kiloton)

Table 172 Middle East & Africa: Market By Size, By Country, 2014–2026 (USD Million)

Table 173 Middle East & Africa: Market By Size, By Type, 2014–2026 (Kiloton)

Table 174 Middle East & Africa: Market By Size, By Type, 2014–2026 (USD Million)

Table 175 Middle East & Africa: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 176 Middle East & Africa: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 177 Middle East & Africa: Market By Size, By Application, 2014–2026 (Kiloton)

Table 178 Middle East & Africa: Market By Size, By Application, 2014–2026 (USD Million)

Table 179 Saudi Arabia: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 180 Saudi Arabia: Market By Size, By Type, 2014–2026 (USD Million)

Table 181 Saudi Arabia: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 182 Saudi Arabia: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 183 Saudi Arabia: Market By Size, By Application, 2014–2026 (Kiloton)

Table 184 Saudi Arabia: Market By Size, By Application, 2014–2026 (USD Million)

Table 185 UAE: Market By Size, By Type, 2014–2026 (Kiloton)

Table 186 UAE: Market By Size, By Type, 2014–2026 (USD Million)

Table 187 UAE: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 188 UAE: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 189 UAE: Market By Size, By Application, 2014–2026 (Kiloton)

Table 190 UAE: Market By Size, By Application, 2014–2026 (USD Million)

Table 191 Rest of Middle East & Africa: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 192 Rest of Middle East & Africa: Market By Size, By Type, 2014–2026 (USD Million)

Table 193 Rest of Middle East & Africa: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 194 Rest of Middle East & Africa: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 195 Rest of Middle East & Africa: Market By Size, By Application, 2014–2026 (Kiloton)

Table 196 Rest of Middle East & Africa: Market By Size, By Application, 2014–2026 (USD Million)

Table 197 South America: Construction Repaint Market Size, By Country, 2014–2026 (Kiloton)

Table 198 South America: Market By Size, By Country, 2014–2026 (USD Million)

Table 199 South America: Market By Size, By Type, 2014–2026 (Kiloton)

Table 200 South America: Market By Size, By Type, 2014–2026 (USD Million)

Table 201 South America: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 202 South America: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 203 South America: Market By Size, By Application, 2014–2026 (Kiloton)

Table 204 South America: Market By Size, By Application, 2014–2026 (USD Million)

Table 205 Brazil: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 206 Brazil: Market By Size, By Type, 2014–2026 (USD Million)

Table 207 Brazil: Market By Size, By Formulation, By Formulation, 2014–2026 (Kiloton)

Table 208 Brazil: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 209 Brazil: Market By Size, By Application, 2014–2026 (Kiloton)

Table 210 Brazil: Market By Size, By Application, 2014–2026 (USD Million)

Table 211 Argentina: Market By Size, By Type, 2014–2026 (Kiloton)

Table 212 Argentina: Market By Size, By Type, 2014–2026 (USD Million)

Table 213 Argentina: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 214 Argentina: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 215 Argentina: Market By Size, By Application, 2014–2026 (Kiloton)

Table 216 Argentina: Market By Size, By Application, 2014–2026 (USD Million)

Table 217 Rest of South America: Construction Repaint Market Size, By Type, 2014–2026 (Kiloton)

Table 218 Rest of South America: Market By Size, By Type, (USD Million)

Table 219 Rest of South America: Market By Size, By Formulation, 2014–2026 (Kiloton)

Table 220 Rest of South America: Market By Size, By Formulation, 2014–2026 (USD Million)

Table 221 Rest of South America: Market By Size, By Application, (Kiloton)

Table 222 Rest of South America: Market By Size, By Application, 2014–2026 (USD Million)

Table 223 New Product Launches, 2014–2016

Table 224 Expansions, 2014–2016

Table 225 Mergers & Acquisitions, 2014–2016

Table 226 Joint Ventures, 2014–2016

List of Figures (56 Figures)

Figure 1 Market Segmentation: Construction Repaint Market

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Construction Repaint Market: Data Triangulation

Figure 7 Acrylic Resin Expected to Be Largest Resin Type of Construction Repaint Between 2016 and 2021

Figure 8 Waterborne Coatings Segment is Estimated to Be Largest Formulation for Construction Repaint Industry Between 2016 and 2021 (USD Billion)

Figure 9 Residential Construction Expected to Be Largest Application for Global Market Between 2016 and 2021

Figure 10 Asia-Pacific is Largest Market for Construction Repaint Market

Figure 11 Asia-Pacific to Drive Global Demand for Market

Figure 12 Asia-Pacific Market, By Resin Type, 2015

Figure 13 Market Share, 2015, By Formulation, in Terms of Value

Figure 14 Market Share, 2015, By Application, in Terms of Value

Figure 15 Asia-Pacific Expected to Be Largest Market Between 2016 and 2021

Figure 16 Global Market Segmentation, By Region

Figure 17 Global Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Crude Oil Price Chart Between November 2014- and September 2016

Figure 19 Impact Analysis of the Global Market

Figure 20 Value Chain of the Global Market

Figure 21 Porter’s Five Forces Analysis

Figure 22 Construction Repaint – Cost Structure

Figure 23 Japanese Patents Dominated Construction Repaint Market Between 2014 and 2016

Figure 24 Japanese Patents Dominated Market Between 2014 and 2016

Figure 25 Market, By Resin Type

Figure 26 Acrylic-Based Paints to Lead Construction Repaint Market During the Forecast Period

Figure 27 Market, By Formulation

Figure 28 Waterborne Paints to Lead Market (2016-2021)

Figure 29 Market, By Application

Figure 30 Residential Construction Repaint to Dominate Construction Repaint Market (2016-2021)

Figure 31Market, By Region

Figure 32 Regional Snapshot: Rapidly-Growing Markets are Emerging as New Hotspots

Figure 33 North America Market Snapshot: U.S. to Lead the Market in North America

Figure 34 U.S. Market Snapshot: 2016 vs 2026

Figure 35 Europe Market Snapshot: Increasing Demand From Construction Sector to Drive the Market

Figure 36 Asia-Pacific Market Snapshot: Increasing Demand From Construction Activities Drives the Market

Figure 37 Asia-Pacific Market Snapshot: Country-Wise Market Share of Construction Repaint, 2015 (Kiloton)

Figure 38 Companies Adopted Expansions as the Key Growth Strategy Between 2014 and 2016

Figure 39 Market Evaluation Framework: Expansions Fueled Growth Between 2014 and 2016

Figure 40 PPG Industries Accounted for the Largest Share in 2015

Figure 41 Expansions: Most Popular Growth Strategy Between 2014 and 2016

Figure 42 PPG Industries Inc.: Company Snapshot

Figure 43 PPG Industries Inc.: SWOT Analysis

Figure 44 Akzonobel N.V.: Company Snapshot

Figure 45 Akzonobel N.V.: SWOT Analysis

Figure 46 The Sherwin-Williams Company: Company Snapshot

Figure 47 The Sherwin-Williams Company: SWOT Analysis

Figure 48 RPM International Inc.: Company Snapshot

Figure 49 RPM International Inc.: SWOT Analysis

Figure 50 Axalta Coating Systems LLC: Company Snapshot

Figure 51 Axalta Coating System LLC: SWOT Analysis

Figure 52 The Valspar Corporation: Company Snapshot

Figure 53 Nippon Paint Holdings Co., Ltd.: Company Snapshot

Figure 54 Asian Paints Ltd.: Company Snapshot

Figure 55 Jotun A/S: Company Snapshot

Figure 56 Kansai Paint Co., Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Construction Repaint Market