Biocomposites Market by Fiber Type (Wood Fiber and Non-wood Fiber), Polymer Type (Synthetic and Natural), Product (Hybrid and Green), End-use Industries (Building & Construction, Transportation, and Consumer Goods) and Region - Global Forecast to 2026

The biocomposites market is projected to reach USD 51.2 billion by 2026, at a CAGR of 16.0%. The biocomposites market is growing due to the rise in the demand from building & construction, transportation, consumer goods, and other end-use industries. However, owing to COVID-19, the sales of various industries has declined, resulting in reduced demand for biocomposites.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on global biocomposites market

COVID-19 has negatively affected the demand for biocomposites across the globe due to decrease in demand from various end-use industries. Building & construction being one of the major consumer of biocomposites has witnessed the most adverse and immediate consequences of the pandemic. The construction sector has faced the worst consequences. This has impacted badly on the demand of biocomposites.

Aspiration Global Biocomposites Market Dynamics:

Drivers: Government regulations regarding use of environmentally-friendly products

Developed countries, including Germany, the US, and Japan, are focusing on increasing the use of environmentally-friendly products instead of petroleum-based products. The European Union (EU) has been preferring the use of such products more than the US and Japanese governments. It insists on the use of bio-based materials, encouraging recyclability of vehicle components, or making the automotive manufacturers responsible for disposal at the end of the service life of the vehicles. However, the requirements in North America are not as stringent for automotive manufacturers as they are in other markets around the world. For example, the Japanese government has a target of replacing 25% of plastic consumption with renewable products, by 2030.

According to the EU Commission, every year, the European car industry consumes 80,000 tons of plant and wood fibers to reinforce composite products instead of other synthetic fibers. The European Union (EU) has also emphasized using recyclable and biodegradable parts for automotive interior components. This would boost the use of biocomposites in the transportation end-use industry during the forecast period. These regulations are expected to increase the demand for biocomposites in transportation, building & construction, electrical & electronics, among other end-use industries.

Restraints: Relatively low strength as compared to glass fibers

Natural fiber composites have a low fiber-matrix interfacial bonding that results in poor mechanical performance and relatively poor strength when compared to synthetic fibers, including glass and carbon fiber. All plant-based fibers are hydrophilic and polar. Natural fibers are composed of hemicellulose and pectins that are hydrophilic (they absorb water). Polymers, including thermoplastics and thermosets, are nonpolar and hydrophobic, and so there are compatibility issues between the fiber and the matrix. However, the mechanical strength can be increased with chemical pre-treatment of fiber. Unlike synthetic fibers, natural fibers are thermally unstable, and at about 392°F thermal degradation starts, which is not supported by certain manufacturing processes. Furthermore, poor fiber separation and dispersion are some other drawbacks of biocomposites that restrict their widespread use.

Opportunities: Possibility of price reduction with economies of scale

The energy required to produce biocomposites is much lesser than that required to produce glass fiber composites and carbon fiber composites. However, biocomposites are available at a higher cost than glass fiber composites. Owing to economies of scale and common applications, there is a possibility of the lowering of prices. These biocomposites can be produced in developing countries, such as India and China, at low cost with abundant raw materials such as flax, jute, Kenaf, and hemp. This will help to reduce the overall cost of natural fiber-based biocomposites. Moreover, in the longer term, these biocomposites are expected to become cheaper as the technology matures, and production achieves economies of scale.

Challenges: Maintaining consistency in manufacturing process and mechanical performance

Improvement in mechanical performance is a major challenge for the building & construction end-use industry; however, various natural fibers have variations in properties, such as strength, stiffness, fiber length, and cross-sectional area; depending on the plant type, area of production, maturity of plant, and weather conditions under which they are grown. In order to improve the mechanical properties of natural fibers, either the fiber or the matrix is modified; in some cases, both are modified. The matrices are modified by adding chemical coupling agents. Fibers are modified to remove undesirable fiber constituents, to make the fiber surface rough, separate individual fiber from the bundle of fibers, or reduce the hydrophilic nature of the fiber. However, the major challenge is to maintain consistency in the manufacturing process as the biocomposites highly depend on the availability and quality of the natural fibers procured.

In terms of volume, wood fiber composites has the largest market share in the global biocomposites.

Wood fiber composites dominated the market, in terms of volume. These biocomposites are produced in the form of decking, railings, balusters, fences, and others. Wood fiber composites are less expensive than non-wood fiber composites. These are used in applications, such as residential, commercial establishments, pool-side areas, observatory decks, and jetties. These are some of the factors driving the demand for wood fiber composites during the forecast period.

Synthetic polymer based composites is the major polymer segment of the market in terms of value and volume.

Synthetic polymer biocomposites dominated the biocomposites market, in terms of value, in 2020. Polymers, such as PE, PP, ABS, PET, epoxy, and PC are used in the production of biocomposites. These polymers impart various characteristics to the biocomposites, making them useful in different end-use industries. For example, PP polymer offers low density, dimensional stability, and impact resistance. PP polymer combined with natural fibers (wood fibers, cellulose, coir, and others) is, therefore, used in transportation, building & construction, marine, and other end-use industries.

Owing to the COVID-19 pandemic, the demand for synthetic polymer biocomposites had reduced in 2020. However, with the stabilization of global end-use industries by the last quarter of 2020, the demand for synthetic polymer biocomposites has surged.

Hybrid composites is the largest product segment of biocomposites in terms of value and volume.

The hybrid composites product segment accounted for the larger market share in the global biocomposites market in terms of value, and volume, backed by the strong demand for biocomposites across the globe. This high market share is attributed to their good fiber-polymer adhesion that results in low moisture absorption, high strength, and dimensional stability.

Building & construction end-use industry accounted for the largest share in terms of value and volume

The building & construction industry accounts for the largest market in the biocomposites market. Biocomposites are produced from wood fibers and natural fibers and are used in different forms in this industry. Decking, Railing, balusters, fences, windows, doors, frames, and other components are produced from biocomposites. Wood fiber composites are mainly used for the production of decking, railing, balusters, and fences. The main application of natural fiber composites is non-load bearing indoor components in civil engineering because of their susceptibility to extreme environmental conditions, such as moisture, freeze-thaw cycles, and ultraviolet radiations. They are used to make windows, doors, frames, wall panels, durable roofing elements, exterior constructions, and composites panels. Various prominent biocomposite manufacturers offer a variety of biocomposites having applications in the building & construction industry.

To know about the assumptions considered for the study, download the pdf brochure

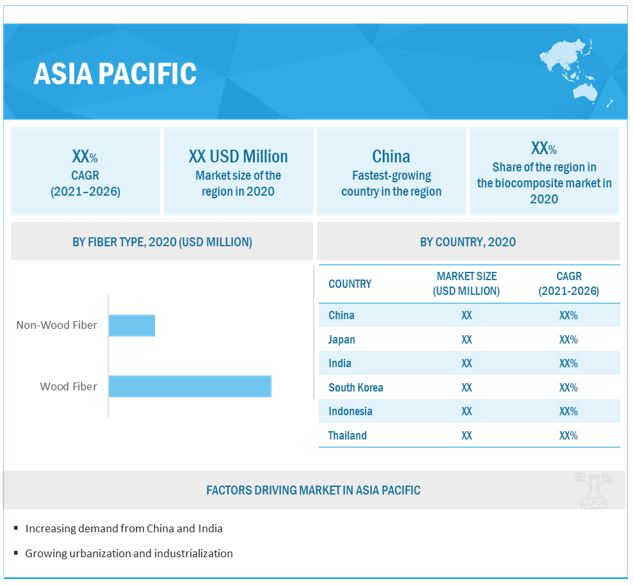

Asia Pacific held the largest market share in the biocomposites market in 2020.

The Asia Pacific region accounted for the largest biocomposites market, in terms of value, in 2020. Compared to their European and North American counterparts, the biocomposites manufacturing companies have ample opportunities in the Asia Pacific market owing to low-cost labor and raw materials. The key factor that is contributing to its growth is the increasing demand from building & construction and transportation end-use industries. High demand for biocomposites is primarily observed in countries including China, Japan, India, and South Korea. Also, the increase in foreign direct investment (FDI) in transportation and infrastructure sectors is expected to drive the demand for biocomposites during the next five years.

Key Players in Biocomposites Market

The key players in the global biocomposites market are UPM (Finland), Trex Company (US), Fiberon LLC (US), FlexForm Technologies (US), Universal Forest Products, Inc. (US), Nanjing Jufeng Advanced Materials Co., Ltd (China), Meshlin Composites ZRT (Hungary), Tecnaro GmbH (Germany). These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the biocomposites industry. The study includes an in-depth competitive analysis of these companies in the biocomposites market, with their company profiles, recent developments, and key market strategies.

Please visit 360Quadrants to see the vendor listing of Top 20 Composites Companies, Worldwide 2023

Biocomposites Market Report Scope

|

Report Metric |

Details |

| Years considered for the study | 2017–2026 |

| Base year | 2020 |

| Forecast period | 2021–2026 |

| Units considered | Value (USD Million), Volume (Kiloton) |

| Segments | Fiber Type, Polymer Type, Product, End-use Industry and Region |

| Regions | Europe, North America, Asia Pacific, Middle East & Africa, and Latin America |

| Companies | UPM (Finland), Trex Company (US), Fiberon LLC (US), FlexForm Technologies (US), Universal Forest Products, Inc. (US), Nanjing Jufeng Advanced Materials Co., Ltd (China), Meshlin Composites ZRT (Hungary), Tecnaro GmbH (Germany) |

This research report categorizes the biocomposites market based on fiber type, polymer type, product, end-use industry, and region.

By Fiber Type:

- Wood Fiber Composites

- Non-wood Fiber Composites

By Polymer Type:

- Natural Polymer Composites

- Synthetic Polymer Composites

By Product:

- Hybrid Biocomposites

- Green Biocomposites

By End-use Industries:

- Building & Construction

- Transportation

- Consumer Goods

- Others

By region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In December 2021, Deckorators, Inc., a subsidiary of Universal Forest Products, Inc., acquired Ultra Aluminum Manufacturing Inc. It is one of the prominent producers of aluminum railing, fencing, and gates.

- In November 2021, Celanese Corporation collaborated with Mitsubishi Chemical Advanced Materials to develop recycling solutions along with maintaining product quality, performance, and consistency.

- In March 2021, Fiberon LLC launched Wildwood composite cladding with excellent properties such as high durability, low maintenance, and efficient performance.

- In October 2021, Trex Company, Inc. announced plans for its third production site in the US. This expansion will provide better access to customers to Trex Residential products, enabling the company's future growth.

Frequently Asked Questions (FAQ):

What are the current size, forecast growth, and CAGR of biocomposites market?

The size of the global market for biocomposites is expected to increase from US$ 24.4 billion in 2021 to US$ 51.2 billion by 2026, with a CAGR of 16.0%.

What are the factors influencing the growth of the biocomposites tanks market?

The growing emerging applications of biocomposites in various end-use industries

Which is the fastest-growing country-level market for biocomposites?

China is the fastest-growing biocomposites market due to high demand

What are the factors contributing to the final price of biocomposites?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of biocomposites.

What are the challenges in the bio composites market?

Development of low-cost production technology is the major challenge in the biocomposites market.

Which fiber type of biocomposites holds the largest market share?

Wood fiber composites hold the largest share due to low cost and ease of manufacturing.

How is the biocomposites market aligned?

The market is growing at a significant pace. It is a potential market and many manufacturers are planning business strategies to expand their business.

Who are the major manufacturers?

UPM (Finland), Trex Company (US), Fiberon LLC (US), FlexForm Technologies (US), Universal Forest Products, Inc. (US), Nanjing Jufeng Advanced Materials Co., Ltd (China), Meshlin Composites ZRT (Hungary), and Tecnaro GmbH (Germany).

What are the polymer types for biocomposites?

Natural polymer and synthetic polymer are the major polymer types fibers used for biocomposites

What are the major end-use industries for biocomposites?

The major end-use industries for biocomposites are building & construction, transportation, consumer goods, and others.

What is the biggest restraint in the biocomposites market?

Relatively low strength as compared to glass fiber. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 BIOCOMPOSITES MARKET SEGMENTATION

1.4.1 REGIONS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 BASE NUMBER CALCULATION

2.1.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

2.1.2 APPROACH 2: DEMAND-SIDE APPROACH

2.2 FORECAST NUMBER CALCULATION

2.2.1 SUPPLY SIDE

2.2.2 DEMAND SIDE

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

2.3.2.1 Primary interviews - top biocomposite manufacturers

2.3.2.2 Breakdown of primary interviews

2.3.2.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 2 BIOCOMPOSITES MARKET: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 3 MARKET: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 4 MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 5 WOOD FIBER DOMINATED BIOCOMPOSITES MARKET

FIGURE 6 SYNTHETIC POLYMER-BASED BIOCOMPOSITES ACCOUNTED FOR LARGER MARKET SHARE

FIGURE 7 HYBRID COMPOSITES PRODUCT TYPE ACCOUNTED FOR LARGER MARKET SHARE IN 2020

FIGURE 8 BUILDING & CONSTRUCTION END-USE INDUSTRY ACCOUNTED FOR LARGEST SHARE OF BIOCOMPOSITES MARKET

FIGURE 9 ASIA PACIFIC LED BIOCOMPOSITES MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN BIOCOMPOSITES MARKET

FIGURE 10 SIGNIFICANT GROWTH EXPECTED IN BIOCOMPOSITES MARKET BETWEEN 2021 AND 2026

4.2 BIOCOMPOSITES MARKET, BY END-USE INDUSTRY AND REGION, 2020

FIGURE 11 BUILDING & CONSTRUCTION WAS LARGEST END-USE INDUSTRY IN 2020

4.3 BIOCOMPOSITES MARKET, BY FIBER TYPE, 2020

FIGURE 12 WOOD FIBER COMPOSITES SEGMENT DOMINATED BIOCOMPOSITES MARKET IN 2020

4.4 BIOCOMPOSITES MARKET, BY POLYMER TYPE, 2020

FIGURE 13 SYNTHETIC POLYMER COMPOSITES SEGMENT HELD LARGER SHARE IN MARKET

4.5 BIOCOMPOSITES MARKET, BY PRODUCT, 2020

FIGURE 14 HYBRID COMPOSITES PRODUCT TYPE DOMINATED BIOCOMPOSITES MARKET

4.6 BIOCOMPOSITES MARKET GROWTH: KEY COUNTRIES

FIGURE 15 BRAZIL TO BE FASTEST-GROWING BIOCOMPOSITES MARKET

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BIOCOMPOSITES MARKET

5.2.1 DRIVERS

5.2.1.1 Government regulations regarding use of environmentally- friendly products

5.2.1.2 Safer compared to glass fibers

5.2.1.3 Recyclability

5.2.1.4 Government stimulus packages to drive biocomposites market

5.2.2 RESTRAINTS

5.2.2.1 Relatively low strength as compared to glass fibers

TABLE 1 DIFFERENT TYPES OF FIBERS AND THEIR PROPERTIES

5.2.2.2 Fluctuating cost, availability, and quality of raw materials

5.2.2.3 Lower demand, low-capacity utilization, and liquidity crunch due to COVID-19

5.2.3 OPPORTUNITIES

5.2.3.1 Possibility of price reduction with economies of scale

5.2.3.2 Increasing market penetration in automotive interior segment driven by government regulations

5.2.3.3 Opportunities in packaging industry

5.2.4 CHALLENGES

5.2.4.1 Maintaining consistency in manufacturing process and mechanical performance

5.2.4.2 Dominance of glass fiber and carbon fiber in composites industry

5.2.4.3 Overcoming bottlenecks in supply chain due to COVID-19 pandemic

5.3 INDUSTRY TRENDS

5.3.1 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 BIOCOMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 BARGAINING POWER OF SUPPLIERS

5.3.6 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4 TECHNOLOGY ANALYSIS

TABLE 3 COMPARATIVE STUDY OF MAJOR BIOCOMPOSITE MANUFACTURING PROCESSES

5.5 ECOSYSTEM: BIOCOMPOSITES MARKET

5.6 VALUE CHAIN ANALYSIS

5.6.1 RAW MATERIALS

5.6.2 INTERMEDIATES

5.6.3 MOLDER

5.7 SUPPLY CHAIN ANALYSIS

5.8 IMPACT OF COVID-19

5.8.1 IMPACT OF COVID-19 ON AUTOMOTIVE AND TRANSPORTATION INDUSTRIES

5.8.2 SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

5.8.3 NEW OPPORTUNITIES

5.9 BIOCOMPOSITES MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 4 MARKET: CAGR (BY VALUE) IN REALISTIC, PESSIMISTIC, AND OPTIMISTIC SCENARIOS

5.9.1 OPTIMISTIC SCENARIO

5.9.2 PESSIMISTIC SCENARIO

5.9.3 REALISTIC SCENARIO

5.10 PRICING ANALYSIS

5.11 AVERAGE SELLING PRICE

TABLE 5 BIOCOMPOSITES AVERAGE SELLING PRICE, BY REGION

5.12 KEY MARKETS FOR IMPORT/EXPORT

5.13 PATENT ANALYSIS

5.13.1 INTRODUCTION

5.13.2 METHODOLOGY

5.13.3 DOCUMENT TYPE

TABLE 6 BIOCOMPOSITES MARKET: GLOBAL PATENTS

FIGURE 19 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 20 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST 10 YEARS

5.13.4 INSIGHTS

5.13.5 LEGAL STATUS OF PATENTS

FIGURE 21 BIOCOMPOSITES MARKET: LEGAL STATUS OF PATENTS

5.13.6 JURISDICTION ANALYSIS

FIGURE 22 GLOBAL JURISDICTION ANALYSIS

5.13.7 TOP APPLICANTS’ ANALYSIS

FIGURE 23 OSSIO LTD. HAS HIGHEST NUMBER OF PATENTS

5.13.8 LIST OF PATENTS, BY OSSIO LTD.

5.13.9 LIST OF PATENTS, BY CNH INDUSTRIAL CANADA

5.13.10 LIST OF PATENTS BY ECOVATIVE DESIGN LLC

5.13.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.14 CASE STUDY ANALYSIS

5.15 TARIFF AND REGULATIONS

TABLE 7 CURRENT STANDARD CODES FOR AUTOMOTIVE COMPOSITES

TABLE 8 CURRENT STANDARD CODES FOR CONSTRUCTION COMPOSITES

5.16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

6 BIOCOMPOSITES MARKET, BY FIBER TYPE (Page No. - 68)

6.1 INTRODUCTION

FIGURE 24 WOOD FIBER COMPOSITES TO DOMINATE BIOCOMPOSITES MARKET

TABLE 9 MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 10 MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 11 MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 12 MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

6.2 WOOD FIBER COMPOSITES

6.2.1 THESE COMPOSITES ARE USED MAINLY AS INDOOR AND OUTDOOR DECKING

6.2.2 HARDWOOD

6.2.3 SOFTWOOD

FIGURE 25 ASIA PACIFIC TO BE LARGEST WOOD FIBER COMPOSITES MARKET DURING FORECAST PERIOD

6.2.4 WOOD FIBER COMPOSITES, BY REGION

TABLE 13 WOOD FIBER COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 14 WOOD FIBER COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 15 WOOD FIBER COMPOSITES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 16 WOOD FIBER COMPOSITES MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.3 NON-WOOD FIBER COMPOSITES

6.3.1 PREFERABLE ALTERNATIVE TO GLASS, CARBON, AND SYNTHETIC FIBER COMPOSITES

TABLE 17 NATURAL FIBER COMPOSITES IN AUTOMOTIVE INDUSTRY BY DIFFERENT MANUFACTURERS

TABLE 18 SURFACE TREATMENT PROCESSES

6.3.2 FLAX

6.3.3 HEMP

6.3.4 JUTE

6.3.5 OTHERS

TABLE 19 PROPERTIES OF NATURAL FIBERS AND GLASS FIBERS

FIGURE 26 ASIA PACIFIC TO BE LARGEST NON-WOOD FIBER COMPOSITES MARKET

6.3.6 NON-WOOD FIBER COMPOSITES, BY REGION

TABLE 20 NON-WOOD FIBER COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 NON-WOOD FIBER COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 22 NON-WOOD FIBER COMPOSITES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 23 NON-WOOD FIBER COMPOSITES MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7 BIOCOMPOSITES MARKET, BY POLYMER TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 27 SYNTHETIC POLYMER COMPOSITES TO DOMINATE BIOCOMPOSITES MARKET

TABLE 24 MARKET SIZE, BY POLYMER TYPE, 2017–2020 (USD MILLION)

TABLE 25 MARKET SIZE, BY POLYMER TYPE, 2017–2020 (KILOTON)

TABLE 26 MARKET SIZE, BY POLYMER TYPE, 2021–2026 (USD MILLION)

TABLE 27 MARKET SIZE, BY POLYMER TYPE, 2021–2026 (KILOTON)

7.2 NATURAL POLYMER

7.2.1 INCREASING GOVERNMENT REGULATIONS ENABLING MANUFACTURERS TO ADOPT NATURAL POLYMERS FOR VARIOUS APPLICATIONS

7.2.2 POLYHYDROXYALKANOATE (PHA)

7.2.3 POLYLACTIC ACID (PLA)

7.2.4 OTHERS

TABLE 28 PROPERTIES & APPLICATIONS OF NATURAL POLYMERS

FIGURE 28 ASIA PACIFIC TO BE LARGEST NATURAL POLYMER-BASED BIOCOMPOSITES MARKET

7.2.5 NATURAL POLYMER-BASED MARKET, BY REGION

TABLE 29 NATURAL POLYMER-BASED MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 NATURAL POLYMER-BASED MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 31 NATURAL POLYMER-BASED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 32 NATURAL POLYMER-BASED MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.3 SYNTHETIC POLYMER

7.3.1 FLAME RETARDANT AND RESISTANCE TO MOISTURE PROPERTIES MAKES THEM FAVORABLE FOR DIFFERENT END-USE INDUSTRIES

7.3.2 EPOXY

7.3.3 POLYPROPYLENE (PP)

7.3.4 OTHERS

FIGURE 29 ASIA PACIFIC TO BE LARGEST SYNTHETIC POLYMER-BASED BIOCOMPOSITES MARKET

7.3.5 SYNTHETIC POLYMER-BASED MARKET, BY REGION

TABLE 33 SYNTHETIC POLYMER-BASED MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 SYNTHETIC POLYMER-BASED MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 35 SYNTHETIC POLYMER-BASED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 36 SYNTHETIC POLYMER-BASED MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

8 BIOCOMPOSITES MARKET, BY PRODUCT (Page No. - 88)

8.1 INTRODUCTION

FIGURE 30 HYBRID BIOCOMPOSITES TO DOMINATE BIOCOMPOSITES MARKET

TABLE 37 MARKET SIZE, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 38 MARKET SIZE, BY PRODUCT, 2017–2020 (KILOTON)

TABLE 39 MARKET SIZE, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 40 MARKET SIZE, BY PRODUCT, 2021–2026 (KILOTON)

8.2 HYBRID BIOCOMPOSITES

8.2.1 NEW ADDITIONS IN INDUSTRIAL MANUFACTURING DRIVING DEMAND FOR HYBRID BIOCOMPOSITES

FIGURE 31 ASIA PACIFIC TO BE LARGEST HYBRID BIOCOMPOSITES MARKET

8.2.2 HYBRID BIOCOMPOSITES MARKET, BY REGION

TABLE 41 HYBRID MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 HYBRID MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 43 HYBRID MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 44 HYBRID MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

8.3 GREEN BIOCOMPOSITES

8.3.1 GROWING ENVIRONMENTAL AWARENESS FUELLING ADOPTION OF GREEN BIOCOMPOSITES

FIGURE 32 ASIA PACIFIC TO BE LARGEST GREEN BIOCOMPOSITES MARKET

8.3.2 GREEN BIOCOMPOSITES MARKET, BY REGION

TABLE 45 GREEN BIOCOMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 GREEN BIOCOMPOSITES MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 47 GREEN BIOCOMPOSITES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 48 GREEN BIOCOMPOSITES MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

9 BIOCOMPOSITES MARKET, BY END-USE INDUSTRY (Page No. - 95)

9.1 INTRODUCTION

FIGURE 33 BUILDING & CONSTRUCTION INDUSTRY TO DOMINATE BIOCOMPOSITES MARKET

TABLE 49 MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 50 MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 51 MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 52 MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

9.2 TRANSPORTATION

9.2.1 ENVIRONMENTAL REGULATIONS REGARDING EMISSION STANDARDS DRIVING DEMAND FOR BIOCOMPOSITES

FIGURE 34 ASIA PACIFIC TO HAVE LARGEST DEMAND FOR BIOCOMPOSITES FROM TRANSPORTATION INDUSTRY

9.2.2 BIOCOMPOSITES MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION

TABLE 53 MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2017–2020 (KILOTON)

TABLE 55 MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 56 MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2021–2026 (KILOTON)

9.3 BUILDING & CONSTRUCTION

9.3.1 LARGEST END-USE INDUSTRY OF BIOCOMPOSITES MARKET

FIGURE 35 ASIA PACIFIC TO HAVE LARGEST DEMAND FROM BUILDING & CONSTRUCTION INDUSTRY

9.3.2 MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION

TABLE 57 MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2017–2020 (KILOTON)

TABLE 59 MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 60 MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2021–2026 (KILOTON)

9.4 CONSUMER GOODS

9.4.1 INCREASING ADOPTION OF BIOCOMPOSITES TO MANUFACTURE VARIOUS CONSUMER GOODS DRIVING MARKET

9.4.2 BIOCOMPOSITES MARKET SIZE IN CONSUMER GOODS END-USE INDUSTRY, BY REGION

TABLE 61 MARKET SIZE IN CONSUMER GOODS END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 MARKET SIZE IN CONSUMER GOODS END-USE INDUSTRY, BY REGION, 2017–2020 (KILOTON)

TABLE 63 MARKET SIZE IN CONSUMER GOODS END-USE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 64 MARKET SIZE IN CONSUMER GOODS END-USE INDUSTRY, BY REGION, 2021–2026 (KILOTON)

9.5 OTHERS

9.5.1 MARINE

9.5.2 SPORTS & LEISURE GOODS

9.5.3 ELECTRICAL & ELECTRONICS

9.5.4 AEROSPACE

9.5.5 BIOCOMPOSITES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION

TABLE 65 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2020 (KILOTON)

TABLE 67 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

TABLE 68 MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2026 (KILOTON)

10 BIOCOMPOSITES MARKET, BY REGION (Page No. - 109)

10.1 INTRODUCTION

FIGURE 36 CHINA TO BE FASTEST-GROWING BIOCOMPOSITES MARKET DURING FORECAST PERIOD

TABLE 69 MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 70 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 72 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: BIOCOMPOSITES MARKET SNAPSHOT

10.2.1 NORTH AMERICA: BIOCOMPOSITES MARKET, BY FIBER TYPE

TABLE 73 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.2.2 NORTH AMERICA: BIOCOMPOSITES MARKET, BY POLYMER

TABLE 77 NORTH AMERICA: MARKET SIZE, BY POLYMER, 2017–2020 (KILOTON)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY POLYMER, 2017–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY POLYMER, 2021–2026 (KILOTON)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY POLYMER, 2021–2026 (USD MILLION)

10.2.3 NORTH AMERICA: BIOCOMPOSITES MARKET, BY PRODUCT

TABLE 81 NORTH AMERICA: MARKET SIZE, BY PRODUCT, 2017–2020 (KILOTON)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY PRODUCT, 2021–2026 (KILOTON)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY PRODUCT, 2021–2026 (USD MILLION)

10.2.4 NORTH AMERICA: BIOCOMPOSITES MARKET, BY END-USE INDUSTRY

TABLE 85 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.2.5 NORTH AMERICA: BIOCOMPOSITES MARKET, BY COUNTRY

TABLE 89 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.5.1 US

TABLE 93 US: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 94 US: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 95 US: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 96 US: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.2.5.2 Canada

TABLE 97 CANADA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 98 CANADA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 99 CANADA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 100 CANADA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.3 EUROPE

FIGURE 38 EUROPE: BIOCOMPOSITES MARKET SNAPSHOT

10.3.1 EUROPE: MARKET, BY FIBER TYPE

TABLE 101 EUROPE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 102 EUROPE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 104 EUROPE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.3.2 EUROPE: BIOCOMPOSITES MARKET, BY POLYMER

TABLE 105 EUROPE: MARKET SIZE, BY POLYMER, 2017–2020 (KILOTON)

TABLE 106 EUROPE: MARKET SIZE, BY POLYMER, 2017–2020 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY POLYMER, 2021–2026 (KILOTON)

TABLE 108 EUROPE: MARKET SIZE, BY POLYMER, 2021–2026 (USD MILLION)

10.3.3 EUROPE: BIOCOMPOSITES MARKET, BY PRODUCT

TABLE 109 EUROPE: MARKET SIZE, BY PRODUCT, 2017–2020 (KILOTON)

TABLE 110 EUROPE: MARKET SIZE, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY PRODUCT, 2021–2026 (KILOTON)

TABLE 112 EUROPE: MARKET SIZE, BY PRODUCT, 2021–2026 (USD MILLION)

10.3.4 EUROPE: BIOCOMPOSITES MARKET, BY END-USE INDUSTRY

TABLE 113 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 114 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 116 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.3.5 EUROPE: BIOCOMPOSITES MARKET, BY COUNTRY

TABLE 117 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 118 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 120 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.5.1 Germany

TABLE 121 GERMANY: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 122 GERMANY: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 123 GERMANY: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 124 GERMANY: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.3.5.2 France

TABLE 125 FRANCE: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 126 FRANCE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 127 FRANCE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 128 FRANCE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.3.5.3 UK

TABLE 129 UK: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 130 UK: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 131 UK: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 132 UK: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.3.5.4 Turkey

TABLE 133 TURKEY: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 134 TURKEY: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 135 TURKEY: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 136 TURKEY: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.3.5.5 Russia

TABLE 137 RUSSIA: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 138 RUSSIA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 139 RUSSIA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 140 RUSSIA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.3.5.6 Rest of Europe

TABLE 141 REST OF EUROPE: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 142 REST OF EUROPE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 143 REST OF EUROPE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 144 REST OF EUROPE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: BIOCOMPOSITES MARKET SNAPSHOT

10.4.1 ASIA PACIFIC: BIOCOMPOSITES MARKET, BY FIBER TYPE

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.4.2 ASIA PACIFIC: BIOCOMPOSITES MARKET, BY POLYMER

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY POLYMER, 2017–2020 (KILOTON)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY POLYMER, 2017–2020 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY POLYMER, 2021–2026 (KILOTON)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY POLYMER, 2021–2026 (USD MILLION)

10.4.3 ASIA PACIFIC: BIOCOMPOSITES MARKET, BY PRODUCT

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY PRODUCT, 2017–2020 (KILOTON)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY PRODUCT, 2021–2026 (KILOTON)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY PRODUCT, 2021–2026 (USD MILLION)

10.4.4 ASIA PACIFIC: BIOCOMPOSITES MARKET, BY END-USE INDUSTRY

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.4.5 ASIA PACIFIC: BIOCOMPOSITES MARKET, BY COUNTRY

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.5.1 China

TABLE 165 CHINA: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 166 CHINA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 167 CHINA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 168 CHINA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.4.5.2 Japan

TABLE 169 JAPAN: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 170 JAPAN: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 171 JAPAN: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 172 JAPAN: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.4.5.3 India

TABLE 173 INDIA: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 174 INDIA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 175 INDIA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 176 INDIA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.4.5.4 South Korea

TABLE 177 SOUTH KOREA: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 178 SOUTH KOREA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 179 SOUTH KOREA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 180 SOUTH KOREA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.4.5.5 Indonesia

TABLE 181 INDONESIA: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 182 INDONESIA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 183 INDONESIA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 184 INDONESIA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.4.5.6 Thailand

TABLE 185 THAILAND: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 186 THAILAND: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 187 THAILAND: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 188 THAILAND: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.4.5.7 Rest of Asia Pacific

TABLE 189 REST OF ASIA PACIFIC: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 190 REST OF ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 191 REST OF ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 192 REST OF ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 LATIN AMERICA: BIOCOMPOSITES MARKET, BY FIBER TYPE

TABLE 193 LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.5.2 LATIN AMERICA: BIOCOMPOSITES MARKET, BY POLYMER

TABLE 197 LATIN AMERICA: MARKET SIZE, BY POLYMER, 2017–2020 (KILOTON)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY POLYMER, 2017–2020 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY POLYMER, 2021–2026 (KILOTON)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY POLYMER, 2021–2026 (USD MILLION)

10.5.3 LATIN AMERICA: BIOCOMPOSITES MARKET, BY PRODUCT

TABLE 201 LATIN AMERICA: MARKET SIZE, BY PRODUCT, 2017–2020 (KILOTON)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY PRODUCT, 2021–2026 (KILOTON)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY PRODUCT, 2021–2026 (USD MILLION)

10.5.4 LATIN AMERICA: BIOCOMPOSITES MARKET, BY END-USE INDUSTRY

TABLE 205 LATIN AMERICA: BIOCOMPOSITES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.5.5 LATIN AMERICA: BIOCOMPOSITES MARKET, BY COUNTRY

TABLE 209 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.5.1 Brazil

TABLE 213 BRAZIL: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 214 BRAZIL: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 215 BRAZIL: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 216 BRAZIL: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.5.5.2 Mexico

TABLE 217 MEXICO: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 218 MEXICO: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 219 MEXICO: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 220 MEXICO: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.5.5.3 Rest of Latin America

TABLE 221 REST OF LATIN AMERICA: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 222 REST OF LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 223 REST OF LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 224 REST OF LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 MIDDLE EAST & AFRICA: BIOCOMPOSITES MARKET, BY FIBER TYPE

TABLE 225 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 226 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 227 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 228 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.6.2 MIDDLE EAST & AFRICA: BIOCOMPOSITES MARKET, BY POLYMER

TABLE 229 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYMER, 2017–2020 (KILOTON)

TABLE 230 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYMER, 2017–2020 (USD MILLION)

TABLE 231 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYMER, 2021–2026 (KILOTON)

TABLE 232 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYMER, 2021–2026 (USD MILLION)

10.6.3 MIDDLE EAST & AFRICA: BIOCOMPOSITES MARKET, BY PRODUCT

TABLE 233 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT, 2017–2020 (KILOTON)

TABLE 234 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 235 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT, 2021–2026 (KILOTON)

TABLE 236 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT, 2021–2026 (USD MILLION)

10.6.4 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY

TABLE 237 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 238 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 239 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 240 MIDDLE EAST & AFRICA: BIOCOMPOSITES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.6.5 MIDDLE EAST & AFRICA: BIOCOMPOSITES MARKET, BY COUNTRY

TABLE 241 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 242 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 243 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 244 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.6.5.1 UAE

TABLE 245 UAE: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 246 UAE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 247 UAE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 248 UAE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.6.5.2 Saudi Arabia

TABLE 249 SAUDI ARABIA: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 250 SAUDI ARABIA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 251 SAUDI ARABIA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 252 SAUDI ARABIA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.6.5.3 South Africa

TABLE 253 SOUTH AFRICA: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 254 SOUTH AFRICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 255 SOUTH AFRICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 256 SOUTH AFRICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10.6.5.4 Rest of Middle East & Africa

TABLE 257 REST OF MIDDLE EAST & AFRICA: BIOCOMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 258 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 259 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 260 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 172)

11.1 INTRODUCTION

11.2 MARKET SHARE ANALYSIS

FIGURE 40 SHARE OF TOP COMPANIES IN BIOCOMPOSITES MARKET

TABLE 261 DEGREE OF COMPETITION: BIOCOMPOSITES MARKET

11.3 MARKET RANKING

FIGURE 41 RANKING OF TOP FIVE PLAYERS IN BIOCOMPOSITES MARKET

11.4 MARKET EVALUATION FRAMEWORK

TABLE 262 BIOCOMPOSITES MARKET: DEALS, 2016–2021

TABLE 263 MARKET: OTHERS, 2016–2021

TABLE 264 MARKET: NEW PRODUCT DEVELOPMENT, 2016–2021

11.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

11.6 COMPANY EVALUATION MATRIX

TABLE 265 COMPANY PRODUCT FOOTPRINT

TABLE 266 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 267 COMPANY REGION FOOTPRINT

TABLE 268 BIOCOMPOSITES MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 269 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

11.6.1 STAR

11.6.2 PERVASIVE

11.6.3 PARTICIPANTS

11.6.4 EMERGING LEADERS

FIGURE 42 BIOCOMPOSITES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

11.6.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 43 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN BIOCOMPOSITES MARKET

11.6.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 44 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN BIOCOMPOSITES MARKET

11.7 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

11.8 START-UP/ SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 DYNAMIC COMPANIES

11.8.4 STARTING BLOCKS

FIGURE 45 BIOCOMPOSITES MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2020

12 COMPANY PROFILES (Page No. - 188)

12.1 KEY COMPANIES

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 TREX COMPANY, INC.

TABLE 270 TREX COMPANY, INC.: COMPANY OVERVIEW

FIGURE 46 TREX COMPANY, INC.: COMPANY SNAPSHOT

12.1.2 UPM

TABLE 271 UPM: COMPANY OVERVIEW

FIGURE 47 UPM: COMPANY SNAPSHOT

12.1.3 UNIVERSAL FOREST PRODUCTS, INC.

TABLE 272 UNIVERSAL FOREST PRODUCTS, INC.: COMPANY OVERVIEW

FIGURE 48 UNIVERSAL FOREST PRODUCTS, INC.: COMPANY SNAPSHOT

12.1.4 CELANESE CORPORATION

TABLE 273 CELANESE CORPORATION: COMPANY OVERVIEW

FIGURE 49 CELANESE CORPORATION: COMPANY SNAPSHOT

12.1.5 DAICEL CORPORATION

TABLE 274 DAICEL CORPORATION: COMPANY OVERVIEW

FIGURE 50 DAICEL CORPORATION: COMPANY SNAPSHOT

12.1.6 FLEXFORM TECHNOLOGIES

TABLE 275 FLEXFORM TECHNOLOGIES: COMPANY OVERVIEW

12.1.7 SAPPI

TABLE 276 SAPPI: COMPANY OVERVIEW

FIGURE 51 SAPPI: COMPANY SNAPSHOT

12.1.8 TECNARO GMBH

TABLE 277 TECNARO GMBH: COMPANY OVERVIEW

12.1.9 JELU-WERK J. EHRLER GMBH & CO. KG

TABLE 278 JELU-WERK J. EHRLER GMBH & CO. KG: COMPANY OVERVIEW

12.1.10 GREEN BAY DECKING LLC

TABLE 279 GREEN BAY DECKING LLC: COMPANY OVERVIEW

12.1.11 EASTMAN CHEMICAL COMPANY

TABLE 280 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 52 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

12.1.12 FIBERON LLC

TABLE 281 FIBERON LLC: COMPANY OVERVIEW

12.1.13 MESHLIN COMPOSITES ZRT

TABLE 282 MESHLIN COMPOSITES ZRT: COMPANY OVERVIEW

12.1.14 AZTRON TECHNOLOGIES

TABLE 283 AZTRON TECHNOLOGIES: COMPANY OVERVIEW

12.1.15 HUANGSHAN HUASU NEW MATERIAL SCIENCE & TECHNOLOGY CO., LTD.

TABLE 284 HUANGSHAN HUASU NEW MATERIAL SCIENCE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

12.1.16 NEWTECHWOOD LTD.

TABLE 285 NEWTECHWOOD LTD.: COMPANY OVERVIEW

12.1.17 NANJING JUFENG ADVANCED MATERIALS CO., LTD.

TABLE 286 NANJING JUFENG ADVANCED MATERIALS CO., LTD.: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER KEY PLAYERS

12.2.1 ADVANCED ENVIRONMENTAL RECYCLING TECHNOLOGIES, INC.

12.2.2 MCG BIOCOMPOSITES LLC

12.2.3 A B COMPOSITES PVT. LTD.

12.2.4 BCOMP LTD.

12.2.5 TTS (TEKLE TECHNICAL SERVICES), INC.

12.2.6 GREEN DOT HOLDING LLC

12.2.7 LINGROVE

12.2.8 POLYVLIES FRANZ BEYER GMBH & CO. KG

12.2.9 WEYERHAEUSER

12.2.10 TAMKO BUILDING PRODUCTS INC.

12.2.11 WINRIGO

12.2.12 YIXING HUALONG NEW MATERIAL LUMBER CO., LTD.

12.2.13 ANHUI HUIYUN WOOD PLASTIC COMPOSITE CO., LTD.

13 APPENDIX (Page No. - 223)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

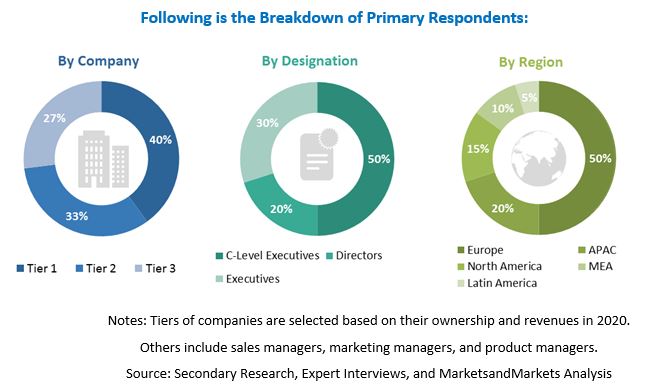

The study involved two major activities in estimating the current size of the biocomposites market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The biocomposites market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the transportation, building & construction, and consumer goods end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total biocomposites market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall biocomposites market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the transportation, building & construction, consumer goods, and other end-use industries.

Report Objectives

- To define, describe, and forecast the size of the biocomposites market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on fiber type, polymer type, product, and end-use industry

- To analyze and project the market based on five regions, namely, Europe, North America, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific biocomposites market

- Further breakdown of Rest of Europe biocomposites market

- Further breakdown of Rest of North America biocomposites market

- Further breakdown of Rest of Middle East & Africa biocomposites market

- Further breakdown of Rest of Latin American biocomposites market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biocomposites Market