Communication Platform as a Service Market by Component (Solutions (Message, Voice, Video) and Services (Professional and Managed)), Organization Size (SMEs and Large Enterprises), Vertical and Region - Global Forecast to 2027

Communication Platform as a Service Market Summary

The global Communication Platform as a Service (CPaaS) market size was estimated at USD 12.50 billion in 2022 and is projected to reach USD 45.30 billion by 2027, growing at a CAGR of 29.4% from 2022 to 2027. The market growth is driven by the demand for improved customer service and client engagement. The cost effectiveness of CPaaS solutions is one of the primary factors driving the market growth. Moreover, large enterprises entering the market is driving the adoption of CPaaS solutions.

Key Market Trends & Insights

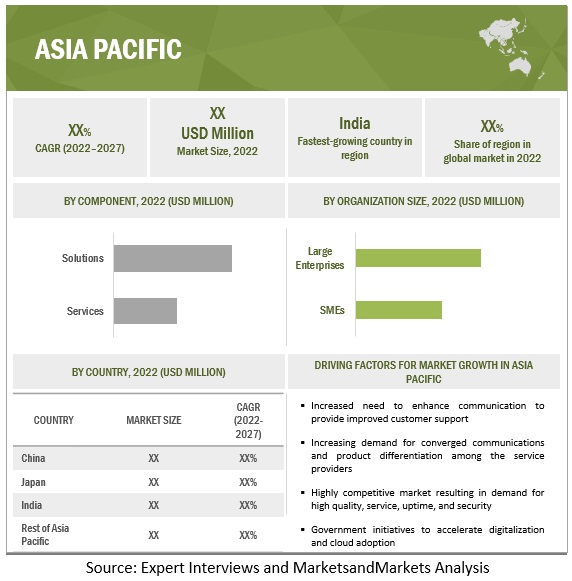

- Region Growth: Asia Pacific is expected to record the highest growth during the forecast period, driven by cloud adoption, mobility trends, and government-led digital infrastructure initiatives in China, India, and Japan.

- Country Highlights: India and China are major contributors to regional growth, with increasing demand for converged communication solutions.

- Component Share: Professional services accounted for the largest market share among service categories in 2022, driven by strong demand for training, consulting, and support services.

- Fastest-growing Segment: Services, including professional and managed services, are projected to register the fastest growth during the forecast period, supported by the need for operational and technical support in CPaaS deployments.

Market Size & Forecast

- 2022 Market Size: USD 12.50 Billion

- 2027 Projected Market Size: USD 45.30 Billion

- CAGR (2022–2027): 29.4%

- Largest Market in 2022: Asia Pacific

To know about the assumptions considered for the study, Request for Free Sample Report

CPaaS Market Dynamics

Driver: Demand for improved customer service and client engagement

Today, most organizations are customer-centric and looking for solutions that better suit customer service. The emergence of CPaaS solutions and services has overcome the drawbacks of traditional systems. Many organizations utilize CPaaS to send customer messages including appointment confirmations and reminders, purchase confirmations, and order tracking. CPaaS Solutions such as chatbots can be used to fulfill customer requests. Furthermore, enterprises demand ease of access to omnichannel service providers with a single integrated API. Therefore, enterprises are adopting to CPaaS solutions to offer enhanced customer service.

Restraint: Security concerns over public cloud

There are many benefits of the public cloud, but there are several concerns over its security that need to be considered by organizations before adopting it. The public cloud is a multi-tenant environment. Due to this, security threats are always there; multitenancy may allow a hacker to view the data or assume the identity of another client to access the data. Furthermore, organizations are well-aware of the compliance regulations that need to be followed. Hence, security concerns related to the public cloud are expected to act as a restraint in the communication platform as a service (CPaaS) market as the majority of CPaaS solutions are deployed on the public cloud.

Opportunity: New channels to transform digital transformation

The new and emerging channels such as Rich Communication Services (RCS) and social media messaging provide vast new opportunities for digital communication. While standard SMS is limited to 160 characters in black and white, the new OTT channels have introduced full rich media experiences including images, videos, group chats, and interactions that smartphone users now take for granted in their person-to-person (P2P) communication with friends and family. This has led to the increasing adoption of CPaaS solutions to manage the complexity and facilitate the opportunities these new technologies present.

Challenge: Security limitations and weakness issues

While CPaaS APIs have given developers tools to integrate real-time communication, such as voice and video communication, into their apps without building interfaces and backend infrastructure, it comes at the cost of decision-making power over API security. The potential for communication platform as a service data breaches not only applies to data in motion such as in the case of real-time voice and video communication, but also to data at rest such as data stored in services at the edge of the network. Without strong security controls, CPaaS companies are vulnerable to fraud attacks.

CPaaS Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By component, the services segment to grow at a higher CAGR during the forecast period

By component, the services segment is expected to grow at a higher CAGR during the forecast period. The services segment has been broadly classified into professional and managed services. The Professional services are further classified into implementation & integration, training & consulting, and support & maintenance. On the other hand, managed services are the services offered by the third-party provider to manage the additional and operational challenges of the enterprise.

By services, the professional services subsegment is expected to account for the largest market size during the forecast period

The professional services subsegment is expected to account for the largest market share among services. The training & consulting services enable the enterprises to choose the best possible solutions and services depending on the company size, requirement, usage, and many more. Support & maintenance services provide the enterprises with technical support, customer support, and backup support to ensure uninterrupted operational activities. With the higher adoption of CPaaS solutions across the industry verticals, the demand for supporting services is also increasing among organizations.

By region, Asia Pacific is expected to record the highest growth during the forecast period

The growth of the market in this region is driven by the rising adoption of cloud and mobility trends in countries such as China, India, and Japan. Government initiatives to promote the digital infrastructure are also driving the adoption of CPaaS solutions in the region. The rapid increase in the adoption of these solutions in the Asia Pacific has made it highly lucrative and one of the fastest-growing markets globally. The increasing demand for converged communication and product differentiation among the service providers are the key factors driving the growth of the communication platform as a service market in this region. The competition in this region is fragmented and the service providers are looking at expanding the base of services to most of the countries in the region as a result of improvements in infrastructure and other business strategy moves. The industries in Asia Pacific demand for a high level of quality, service, uptime, and security related to the CPaaS solutions and services.

Asia Pacific: CPaaS Market Snapshot

Key Market Players

The report includes the study of key players offering CPaaS solutions and services. The major vendors in the market include Twilio (US), Sinch (Sweden), Avaya (US), Vonage (US), Bandwidth (US), RingCentral (US), TeleSign (US), Infobip (UK), CM.com (Netherlands), and 8x8 (US).

The study includes an in-depth competitive analysis of these key players in the CPaaS market, including their company profiles and strategies undertaken.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 12.5 billion |

|

Market size value in 2027 |

USD 45.3 billion |

|

Growth rate |

CAGR of 29.4% |

| Segments covered | By Component, Organization Size, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Companies covered | Major vendors include Twilio (US), Sinch (Sweden), Avaya (US), Vonage (US), and Bandwidth (US) |

This research report categorizes the communication platform as a service market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Solutions

-

Message

- Short Message Services (SMS)

- Multimedia Message Services (MMS)

- Social Channels (WhatsApp, Facebook Messenger, WeChat, and others)

- Rich Communication Services (RCS)

-

Voice

- Outbound & Inbound Voice Calls

- Interactive Voice Response (IVR) Calls

- Voice Over Internet Protocol (VoIP)

- SIP Trunking Services

- WebRTC-based Calling

-

Video

- Video Calling

- Video Conferencing

- WebRTC-based Video

-

Other Solutions

- Security

- Reporting & Analytics

-

Message

-

Services

- Managed Services

-

Professional Services

- Implementation & Integration

- Training & Consulting

- Support & Maintenance

By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Retail & eCommerce

- IT & Telecom

- Government

- Healthcare

- Education

- Manufacturing

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- United Arab Emirates

- Kingdom of Saudi Arabia

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments:

- In October 2022, Sinch added the KakaoTalk channel to its Conversation API, which enables omnichannel interaction with customers around the world. This helped businesses to interact with customers in South Korea without worrying about deciphering Korean documents.

- In September 2022, Vonage launched AI Studio, a low code/no code tool to design, create, and deploy customer engagement solutions that operate in natural language using AI. Vonage AI Studio helps businesses elevate customer engagement through personalized and automated interactions across channels, such as voice, SMS, and messaging apps, such as WhatsApp.

- In June 2022, Bandwidth partnered with Alianza to accelerate cloud migration for communication service providers (CSPs). Bandwidth's network platform and APIs, along with Alianza's full-stack CSP platform, will enable CSPs to transform their legacy infrastructure and remain competitive by offering high-growth, cloud-based voice, messaging and videoconferencing services.

- In May 2022, Twilio partnered with Syniverse to drive innovation and accelerate seamless connectivity and engagement. Twilio invested USD 750 million in Syniverse for a minority ownership stake to strengthen its position in the communication platform as a service market.

- In February 2022, Airtel Africa signed a memorandum of understanding (MoU) with Avaya to deliver effortless customer experiences across the continent. As per the agreement, Airtel Africa would bundle Airtel Africa voice services with the Avaya OneCloud platform, which includes Avaya OneCloud CCaaS, OneCloud UCaaS and OneCloud CPaaS.

Frequently Asked Questions (FAQ):

What is the projected market value of the global CPaaS market?

The global CPaaS market is projected to grow from USD 12.5 billion in 2022 to USD 45.3 billion by 2027, at a CAGR of 29.4% during the forecast period.

Which region has the largest market share in the CPaaS market?

North America is estimated to account for the largest share in the CPaaS market in 2022.

Which component is expected to account for a higher growth during the forecast period?

The services segment is expected to achieve higher growth during the forecast period.

Which vertical is expected to account for the largest market size during the forecast period?

By vertical, the IT & Telecom segment is expected to account for the largest market size during the forecast period.

Who are the major vendors in the CPaaS market?

The major vendors in the CPaaS market include Twilio (US), Sinch (Sweden), Avaya (US), Vonage (US), Bandwidth (US), RingCentral (US) and many more.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

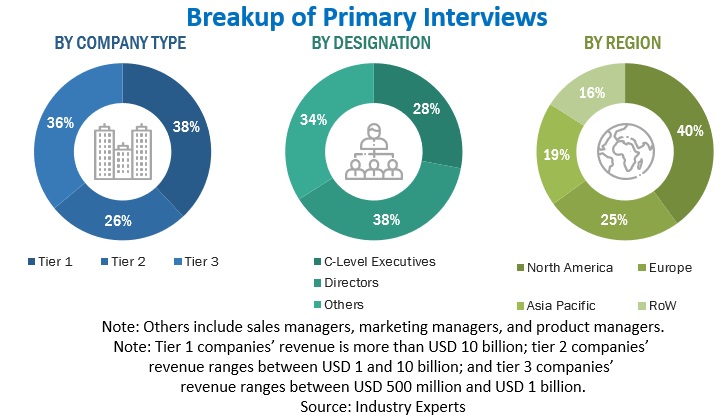

The study involves four major activities in estimating the current size of the communication platform as a service market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the CPaaS market.

Secondary Research

The market size of companies offering CPaaS solutions and services was arrived at based on the secondary data available through paid and unpaid sources, by analyzing the product portfolios of major companies in the ecosystem, and by rating the companies based on their product capabilities and business strategies.

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, and product data sheets, white papers, journals, certified publications, and articles from recognized authors, government websites, directories, and databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the CPaaS market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs); the installation teams of governments/end users using CPaaS solutions and services; and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of solutions solutions affecting the overall communication platform as a service market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the CPaaS market and various other dependent subsegments. The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

In the bottom-up approach, the adoption trend of CPaaS solutions and services among industry verticals in key countries with respect to regions that contribute to most of the market share was identified. For cross-validation, the adoption trend of CPaaS solution and services, along with different use cases with respect to their business segments, was identified and extrapolated. Weightage was given to the use cases identified in different solution areas for the calculation. An exhaustive list of all vendors offering solutions and services in the CPaaS market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with CPaaS solution and service offerings were considered to evaluate the market size. Each vendor was evaluated based on its solutions and service offerings across verticals. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration. Based on these numbers, the region split was determined by primary and secondary sources.

In the top-down approach, an exhaustive list of all vendors in the communication platform as a service market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The market size was estimated from revenues generated by vendors from different CPaaS solutions and service offerings. Revenue generated from each component (solutions and services) from different vendors was identified with the help of secondary and primary sources and combined to arrive at market size. Further, the procedure included an analysis of the CPaaS market’s regional penetration. With the data triangulation procedure and data validation through primaries, the exact values of the overall CPaaS market size and its segments’ market size were determined and confirmed using the study. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global CPaaS market on the basis of component (solutions and services), organization size, vertical, and region

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the communication platform as a service market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market.

Micromarkets are defined as the further segments and subsegments of the CPaaS market included in the report.

The core competencies of the companies are captured in terms of their key developments and key strategies adopted by them to sustain their position in the market.

Customization Options

Along with the market data, MarketsandMarkets offers customizations as per the company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Communication Platform as a Service Market