Aircraft Interface Device Market Size, Share, Trends, Growth Report by End-Use (Fixed Wing, Rotary Wing), Fit (Line Fit, Retrofit) Aircraft Type, Connectivity, and Region (North America, APAC, Europe, Middle East, Africa, Latin America) - Forecast to 2025

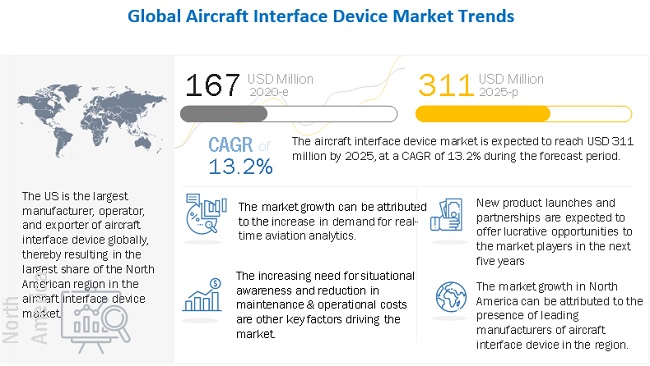

[232 Pages Report] The global Aircraft Interface Device Market size is projected to grow from USD 167 million in 2020 to USD 311 million by 2025, at a Compound Annual Growth Rate (CAGR) of 13.2% from 2020 to 2025. The Aircraft Interface Device Industry is driven by various factors, such as an increase in demand for real-time aviation analytics and a growing need for situational awareness.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Aircraft Interface Device Market

The aircraft interface device market includes major players Collins Aerospace (US), Thales SA (France), The Boeing Company (US), Astronics Corporation (US), and Elbit Systems Ltd (Israel). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, Africa, and Latin America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 could affect aircraft interface device production and services by 7–10% globally in 2020.

The COVID-19 pandemic has impacted the end-use industries adversely, resulting in a sudden dip in 2020 aircraft orders and deliveries. This is expected to negatively impact the aircraft market in the short term, with slow recovery expected in Q1 of 2021.

Aircraft Interface Device Market Dynamics

Driver: Increase in Demand for Real-Time Aviation Analytics

Real-time analytics is a new trend in the aviation analytics market. The use of real-time predictive solutions across verticals is expected to grow at a significant rate in the future, owing to the need for efficient business environments with optimum operational profitability. Real-time analytics enable enterprises to respond quickly and accurately to opportunities and emerging problems to ensure smooth operations. Real-time analytics not only offer flexibility but also help airlines in improving their flight operations by increasing fuel efficiency, enhancing flight risk management, and reducing unscheduled downtime significantly.

AID eEnabled architecture helps in generating datasets on a real-time basis. This would help airlines in optimizing operational and maintenance costs. This architecture also predicts the failure of the component by comparing and analyzing the data obtained from sensors and the history of a particular component installed in the aircraft. This integration enhances cross-platform aviation analytics.

In 2019, Bombardier and GE Aviation partnered to upgrade a new health monitoring unit, the Smart Link Plus, to all Challenger business jets in production and service. The Smark Link Plus box is a health monitoring unit that generates important data, which is used for analytics to identify the health of major components

Restraint: Certification From Regulatory Bodies and Regulations Associated With Airworthiness

Certificate clearance of an aircraft interface device is a major restraint for this market. The AID needs to be certified by the Federal Aviation Administration (FAA) and the International Civil Aviation Organization (ICAO) prior to its installation in an aircraft system. It is required to comply with the durability standards, structural design standards, and environmental standards before its installation. Thus, trials are carried out before certifying an AID.

Regulations associated with airworthiness are another major restraint that this market faces since variations in hardware and software failure can severely affect the safety of aircraft during flight and landing. Variations can limit an aircraft’s ability to fly under adverse circumstances. The cost of software certification is determined by the functions implemented, and different functions require different certification levels. These tedious regulations and certification procedures are restraining new market players from entering the AID market.

Opportunity: Benefits Associated With Advanced in-Flight Entertainment Services

Currently, the use of most of aircraft interface devices is limited to connecting electronic fight bags of class 2 & 3 in airlines and aircraft; these devices can also connect with standard avionics systems like flight management system (FMS), GNSS, and IRS so that moving maps and E-Tech logs can be accessible to pilots. Inflight entertainment benefits associated with aircraft interface device has immense potential and opportunities.

IFEC, when interfaced with AID, can provide passengers with options, including online games, chatting, calling, SMS, emails, and shopping. The demand for a variety of entertainment options by passenger fuels the growth of the AID market.

Challenge: Cybersecurity Issues With Wireless Devices

Airlines using wireless aircraft interface device are vulnerable to cyber-attacks. Thus, the protection of the EFB data is a major concern for airlines. It is challenging to manage risks associated with cybersecurity in the aviation industry as it is majorly handled by IT. The aviation industry is highly e-enabled. According to the MarketsandMarkets analysis, 40% of airlines fail to have an active EFB cybersecurity plan.

The aviation industry relies extensively on the avionic system for both ground and flight operations. The security of the airline systems can directly impact the operational safety and efficiency of the industry.

Various applications in wireless in-flight entertainment system and crew management system through AID could allow the hacker to infiltrate the security software. This could lead to a breach of the entire aircraft security. The control of Boeing 777 can be obtained with a small device by sending a radio signal. Despite the advantage of wireless AID for ease in installation and operations, the security threat associated with it is a huge challenge.

Optimizing Cockpit Systems and in-Flight Entertainment Systems With AID is Driving the Growth of Fixed-wing Aircraft

The fixed wing segment is expected to be the largest market by value. The growth of the fixed wing segment of the aircraft interface device market can be attributed to the growing demand for to replace the conventional aircraft components with more efficient and advanced avionic components such as electronic flight bag (EFB) and in-flight entertainment & connectivity (IFEC) systems.

The Retrofit Segment is Projected to Witness a Higher CAGR During the Forecast Period

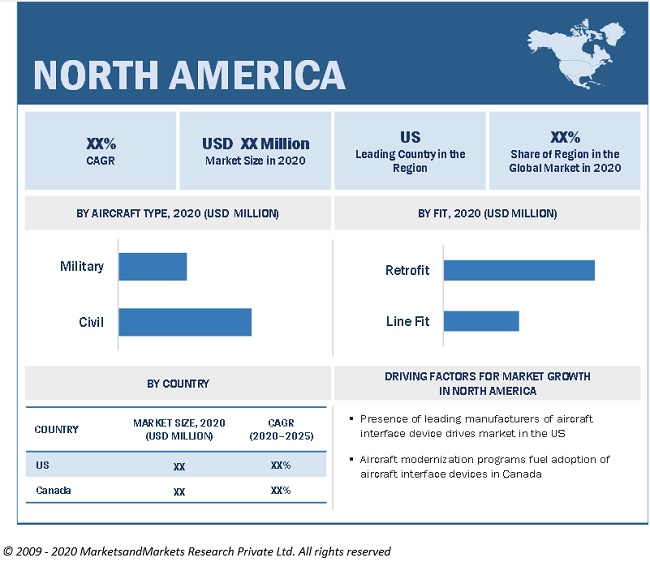

Based on fit, the retrofit segment is projected to be the highest CAGR rate for the aircraft interface device market during the forecast period. Technological advancements in the field of the aircraft interface device, the development of safety systems, and the increasing demand for real-time data are key factors propelling the growth of advanced cockpit systems among airlines. The rise in demand for replacement with a technologically-advanced aircraft interface device has propelled the growth of the retrofit segment.

The Military Segment is Projected to Witness a Higher CAGR During the Forecast Period

Based on the aircraft type, the military segment is projected to be the highest CAGR rate for the aircraft interface device market during the forecast period. The military segment covers military aircraft, such as military transport, military helicopters, fighter jets, and special mission aircraft. Some of the key factors influencing military operations are internal and external threats and the growing number of immigrants in various countries. Governments of various countries, such as the US and China, are investing in enhancing their defense capabilities. Increasing spending on military avionics equipment is further expected to drive the market for aircraft interface device.

The Wireless Segment is Projected to Witness a Higher CAGR During the Forecast Period

Based on the connectivity, the wireless segment is projected to be the highest CAGR rate for the aircraft interface device market during the forecast period. In wireless connectivity, the data transferred between aircraft and the MRO engineers located on the ground are routed using radiofrequency and satellites. The data, including aircraft’s location, destination, speed, and other relevant information, is provided by the aircraft to MRO operators in real-time. All this data requires more bandwidth to get the information transferred from aircraft to the on-ground MRO operators. Currently, most of the avionics systems require advanced connectivity, which facilitates easier ground connections. This offers a high opportunity for the growth of wireless connectivity.

The North America Market is Projected to Contribute the Largest Share From 2020 to 2025

North America is projected to be the largest regional share during the forecast period. The key factor responsible for North America, is the high demand for new aircraft in the region. The growing demand for aircraft for commercial applications and their increasing utility in the defense sector to carry out transport and surveillance activities are additional factors influencing the growth in North America.

Leading aircraft manufacturers, such as The Boeing Company and Bombardier, and major aircraft system and component manufacturers, such as Collins Aerospace, Astronics Corporation, Viasat, Inc., and Teledyne Controls LLC are headquartered in North America. Some of the largest commercial airlines (based on fleet size), such as American Airlines Group, Delta Air Lines, Inc., and United Airlines, are also headquartered in the region. The aircraft interface device market is growing in this region owing to the increased demand for fixed wing and rotary wing aircraft, which are being widely used in civil, military, and security applications.

To know about the assumptions considered for the study, download the pdf brochure

Aircraft Interface Device Companies: Top Key Market Players

The Aircraft Interface Device Companies is dominated by a few globally established players such as Collins Aerospace (US), Thales SA (France), The Boeing Company (US), Astronics Corporation (US), and Elbit Systems Ltd (Israel).

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 167 million in 2020 |

|

Projected Market Size |

USD 311 million by 2025 |

|

Growth Rate |

13.2% |

|

Forecast Period |

2020 to 2025 |

|

On Demand Data Available |

2030 |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

|

Key Market Driver |

Increase in Demand for Real-time Aviation Analytics |

| Key Market Opportunity |

Benefits Associated With Advanced in-Flight Entertainment Services |

|

Largest Growing Region |

North America |

|

Largest Market Share Segment |

Fixed Wing Segment |

|

Highest CAGR Segment |

Retrofit Segment |

|

Largest Application Market Share |

Military Segment |

The study categorizes the aircraft interface device market based on End Use, Fit, Aircraft Type, Connectivity, and Region.

By End Use

- Fixed Wing

- Rotary Wing

By Fit

- Line Fit

- Retrofit

By Aircraft Type

- Civil

- Military

By Connectivity

- Wired

- Wireless

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Africa

- Latin America

Recent Developments

- In September 2020, Universal Helicopters selected SKYTRAC Systems to automate crew position and flight reports and track airframe maintenance metrics for their AS350, Bell 206, and Bell 407 aircraft.

- In June 2020, Gardner Standard LLC announced the acquisition of Shadin, L.P. d.b.a Shadin Avionics from The Wright Group.

- In March 2020, SKYTRAC Systems released SkyForms – custom automated crew and flight reports. SKYTRAC’s unique solution fully digitizes the client’s existing paper-based processes. SKYTRAC provides mobile and tablet-friendly forms and stores these on the SKYTRAC ISAT-200A onboard data acquisition hardware.

- In February 2020, SKYTRAC Systems announced that DAC International, a Greenwich AeroGroup company specializing in avionics sales and distribution, joined the company’s partner program as a regional distributor. DAC will expand the reach of SKYTRAC’s aviation solutions throughout Latin America, Oceania, and Asia. DAC will distribute SKYTRAC’s ISAT-200A transceiver along with a wide range of specialized fleet management services, including business support services, flight tracking, and Flight Data Monitoring (FOQA/FDM).

Frequently Asked Questions (FAQ):

What Are Your Views on the Growth Prospect of the Aircraft Interface Device Market?

The aircraft interface device market is expected to grow substantially owing to the increasing demand for real time analytics and modern instrumentation in commercial aircraft.

What Are the Key Sustainability Strategies Adopted by Leading Players Operating in the Aircraft Interface Device Market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft interface device market. The major players include Collins Aerospace (US), Thales SA (France), The Boeing Company (US), Astronics Corporation (US), and Elbit Systems Ltd (Israel), these players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market further.

What Are the New Emerging Technologies and Use Cases Disrupting the Aircraft Interface Device Market?

Some of the major emerging technologies and use cases disrupting the market include connected aircraft, e-enabled architecture, and tablet interface module.

Who Are the Key Players and Innovators in the Ecosystem of the Aircraft Interface Device Market?

The key players in the aircraft interface device market include Collins Aerospace (US), Thales SA (France), The Boeing Company (US), Astronics Corporation (US), and Elbit Systems Ltd (Israel).

Which Region is Expected to Hold the Highest Market Share in the Aircraft Interface Device Market?

Aircraft interface device market in North America is projected to hold the highest market share during the forecast period due to the North American countries awarding a number of contracts to major players of the aircraft interface device market for the delivery of commercial aircraft with advanced inflight connectivity capabilities. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SEGMENTATION

1.3.2 INCLUSIONS & EXCLUSIONS

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

FIGURE 2 AIRCRAFT INTERFACE DEVICE MARKET TO GROW AT A LOWER RATE COMPARED TO PREVIOUS REPORT ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 3 REPORT PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.1.2.2 Breakdown of primaries

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increasing demand for efficient aircraft models

2.2.2.2 Cockpit improvement and crew resource management

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Advancements in technology

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET DEFINITION & SCOPE

2.3.2 SEGMENTS AND SUBSEGMENTS

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.2 AIRCRAFT INTERFACE DEVICE MARKET FOR OEM

2.4.3 AIRCRAFT INTERFACE DEVICE AFTERMARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.4 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 TRIANGULATION & VALIDATION

FIGURE 7 DATA TRIANGULATION

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.6 ASSUMPTIONS FOR THE RESEARCH STUDY

TABLE 1 ASSUMPTIONS FOR THE RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 8 FIXED WING SEGMENT ESTIMATED TO ACCOUNT FOR A LARGER SHARE IN 2020

FIGURE 9 AIRCRAFT TYPE, 2020

FIGURE 10 RETROFIT SEGMENT ESTIMATED TO ACCOUNT FOR A LARGER SHARE IN 2020

FIGURE 11 AIRCRAFT INTERFACE DEVICE INDUSTRY IN ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 REDUCTION IN MAINTENANCE AND OPERATIONAL COSTS IS EXPECTED TO DRIVE THE MARKET FROM 2O20 TO 2025

FIGURE 12 ATTRACTIVE GROWTH OPPORTUNITIES

4.2 AIRCRAFT INTERFACE DEVICE MARKET, BY FIT

FIGURE 13 RETROFIT SEGMENT PROJECTED TO LEAD THE MARKET FROM 2020 TO 2025

4.3 AIRCRAFT INTERFACE DEVICE MARKET, BY COUNTRY

FIGURE 14 AIRCRAFT INTERFACE MARKET IN INDIA IS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in situational awareness to drive operations

5.2.1.2 Reduction of maintenance cost

5.2.1.3 Increase in demand for real-time aviation analytics

5.2.1.4 Reduction in operational costs with minimal fuel consumption

5.2.1.5 Large existing aircraft fleet for retrofitting

TABLE 2 AIRCRAFT TYPES AND THEIR FLEET SIZE (UNITS)

5.2.2 RESTRAINTS

5.2.2.1 Certification from regulatory bodies and regulations associated with airworthiness

5.2.3 OPPORTUNITIES

5.2.3.1 Benefits associated with advanced in-flight entertainment services

5.2.3.2 Installations in commercial helicopters

5.2.4 CHALLENGES

5.2.4.1 Cybersecurity issues with wireless devices

5.2.4.2 Software errors and program design

5.2.4.3 Compatibility issues with retrofitting

5.2.4.4 Impact of COVID-19 on cancellations and delaying orders from end users

5.3 AVERAGE SELLING PRICE

FIGURE 16 AVERAGE SELLING PRICE: LINE FIT AIRCRAFT INTERFACE DEVICE, 2020 AND 2025

FIGURE 17 AVERAGE SELLING PRICE: RETROFIT AIRCRAFT INTERFACE DEVICE, 2020 AND 2025

5.4 VOLUME DATA

TABLE 3 LINE FIT CIVIL AIRCRAFT SIZE, BY REGION (UNITS)

TABLE 4 LINE FIT MILITARY AIRCRAFT SIZE, BY REGION (UNITS)

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 18 SUPPLY CHAIN ANALYSIS

5.6 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS

5.7 MARKET ECOSYSTEM MAP

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

FIGURE 20 MARKET ECOSYSTEM MAP

5.8 DISRUPTION IMPACTING CUSTOMER’S BUSINESS

5.8.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR AIRCRAFT INTERFACE DEVICE MANUFACTURERS

FIGURE 21 REVENUE IMPACT

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 INTENSITY OF COMPETITIVE RIVALRY

5.10 TRADE DATA STATISTICS

TABLE 5 TRADE DATA TABLE FOR AIRCRAFT INTERFACE DEVICE

5.11 TARIFF AND REGULATORY LANDSCAPE

6 INDUSTRY TRENDS (Page No. - 61)

6.1 TECHNOLOGY EVOLUTION

6.2 TECHNOLOGY TRENDS

6.2.1 CONNECTED AIRCRAFT

6.2.2 E-ENABLED ARCHITECTURE

FIGURE 23 TYPICAL ARCHITECTURE OF E-ENABLED AIRCRAFT

6.2.3 TABLET INTERFACE MODULE

6.3 AIRCRAFT INTERFACE DEVICE - APPLICATIONS

6.4 IMPACT OF MEGATRENDS

6.5 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 6 INNOVATIONS AND PATENT REGISTRATIONS, 2015-2020

7 AIRCRAFT INTERFACE DEVICE MARKET, BY END-USE (Page No. - 65)

7.1 INTRODUCTION

FIGURE 24 FIXED WING SEGMENT IS PROJECTED TO LEAD DURING FORECAST PERIOD

TABLE 7 SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 8 SIZE, BY END-USE, 2020-2025 (USD MILLION)

7.2 FIXED WING

TABLE 9 FIXED WING END-USE SEGMENT SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 10 FIXED WING END-USE SEGMENT SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 11 FIXED WING END-USE SEGMENT SIZE, BY END USER, 2017-2019 (USD MILLION)

TABLE 12 FIXED WING END-USE SEGMENT SIZE, BY END USER, 2020-2025 (USD MILLION)

7.2.1 AIRLINES & OPERATORS

7.2.1.1 Increasing demand for advanced avionics is driving the demand for fixed wing aircraft

7.2.2 OEMS

7.2.2.1 Optimizing cockpit systems and in-flight entertainment systems with AID to drive the market

7.2.3 MROS

7.2.3.1 Increased modernization of aircraft is fueling the growth of this segment

7.3 ROTARY WING

TABLE 13 ROTARY WING END-USE SEGMENT SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 14 ROTARY WING END-USE SEGMENT SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 15 ROTARY WING END-USE SEGMENT SIZE, BY END USER, 2018-2025 (USD MILLION)

TABLE 16 ROTARY WING END-USE SEGMENT SIZE, BY END USER, 2020-2025 (USD MILLION)

7.3.1 OPERATORS

7.3.1.1 Increasing procurement of helicopters with advanced avionics is driving the market

7.3.2 OEMS

7.3.2.1 Requirement for advanced avionic systems is expected to drive the market

7.3.3 MROS

7.3.3.1 Rise in demand to upgrade helicopters is expected to fuel the growth of this segment

8 AIRCRAFT INTERFACE DEVICE MARKET, BY FIT (Page No. - 72)

8.1 INTRODUCTION

FIGURE 25 LINE FIT SEGMENT PROJECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 17 MARKET SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 18 MARKET SIZE, BY FIT, 2020-2025 (USD MILLION)

8.2 LINE FIT

8.2.1 INCREASED DEMAND FOR COMMERCIAL AIRLINERS FUEL DEMAND FOR AIRCRAFT INTERFACE DEVICES

TABLE 19 SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 20 SIZE, BY REGION, 2020-2025 (USD MILLION)

8.3 RETROFIT

8.3.1 GROWING COCKPIT UPGRADATION AND MODIFICATION DRIVING MARKET GROWTH

TABLE 21 SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 22 SIZE, BY REGION, 2020-2025 (USD MILLION)

9 AIRCRAFT INTERFACE DEVICE MARKET, BY AIRCRAFT TYPE (Page No. - 77)

9.1 INTRODUCTION

FIGURE 26 CIVIL SEGMENT EXPECTED TO LEAD DURING FORECAST PERIOD

TABLE 23 SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 24 SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

9.2 CIVIL

9.2.1 INCREASING DEMAND FOR COMMERCIAL AVIATION POST COVID-19 IS EXPECTED TO DRIVE THE MARKET

TABLE 25 CIVIL SEGMENT SIZE, BY TYPE, 2017-2019 (USD MILLION)

TABLE 26 CIVIL SEGMENT SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 27 CIVIL SEGMENT SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 28 CIVIL SEGMENT SIZE, BY REGION, 2020-2025 (USD MILLION)

9.2.2 NARROW BODY AIRCRAFT

9.2.2.1 Increasing domestic air travel to drive the market for aircraft interface devices in narrow body aircraft

TABLE 29 NARROW BODY TYPE MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 30 NARROW BODY TYPE MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.2.3 WIDE BODY AIRCRAFT

9.2.3.1 Increasing global air passenger traffic expected to drive procurement of wide body aircraft

TABLE 31 WIDE BODY TYPE MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 32 WIDE BODY TYPE MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.2.4 BUSINESS JETS

9.2.4.1 High demand for business class travel aircraft expected to drive the market for AID

TABLE 33 BUSINESS JETS INTERFACE DEVICE MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 34 BUSINESS JETS INTERFACE DEVICE MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.2.5 REGIONAL TRANSPORT AIRCRAFT

9.2.5.1 Increasing demand for short-distance transport fuels demand for aircraft interface device in regional transport aircraft

TABLE 35 REGIONAL TRANSPORT MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 36 REGIONAL TRANSPORT MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.2.6 CIVIL HELICOPTERS

9.2.6.1 Demand for civil helicopters for domestic use expected to drive market

TABLE 37 CIVIL HELICOPTERS INTERFACE DEVICE MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 38 CIVIL HELICOPTERS INTERFACE DEVICE MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.3 MILITARY

9.3.1 INCREASING INVESTMENTS IN MILITARY AVIONICS EXPECTED TO DRIVE THE MARKET

TABLE 39 MILITARY SEGMENT SIZE, BY TYPE, 2017-2019 (USD MILLION)

TABLE 40 MILITARY SEGMENT SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 41 MILITARY SEGMENT SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 42 MILITARY SEGMENT SIZE, BY REGION, 2020-2025 (USD MILLION)

9.3.2 FIGHTER AIRCRAFT

9.3.2.1 Increasing procurement and modernization programs by militaries across the globe expected to drive this segment

TABLE 43 FIGHTER SEGMENT MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 44 FIGHTER SEGMENT MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.3.3 TRANSPORT AIRCRAFT

9.3.3.1 Increasing demand for military transport aircraft expected to drive the market

TABLE 45 TRANSPORT SEGMENT MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 46 TRANSPORT SEGMENT MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.3.4 SPECIAL MISSION AIRCRAFT

9.3.4.1 Increasing demand for special mission aircraft expected to drive the market

TABLE 47 SPECIAL MISSION SEGMENT MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 48 SPECIAL MISSION AIRCRAFT INTERFACE DEVICE MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.3.5 MILITARY HELICOPTERS

9.3.5.1 Increasing procurement of military helicopters by emerging economies boosts the market growth

TABLE 49 MILITARY HELICOPTERS INTERFACE DEVICE MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 50 MILITARY HELICOPTERS INTERFACE DEVICE MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

10 AIRCRAFT INTERFACE DEVICE MARKET, BY CONNECTIVITY (Page No. - 93)

10.1 INTRODUCTION

FIGURE 27 WIRELESS SEGMENT PROJECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

TABLE 51 INDUSTRY SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 52 INDUSTRY SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

10.2 WIRED

10.2.1 HIGH RELIABILITY AND LOW MAINTENANCE OF WIRED CONNECTIVITY EXPECTED TO DRIVE THIS SEGMENT

TABLE 53 WIRED CONNECTIVITY SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 54 WIRED CONNECTIVITY SIZE, BY REGION, 2020-2025 (USD MILLION)

10.3 WIRELESS

10.3.1 DEMAND FOR WIRELESS CONNECTIVITY IS EXPECTED TO GROW DUE TO LOW INSTALLATION AND MAINTENANCE COSTS

TABLE 55 WIRELESS CONNECTIVITY MARKET SIZE, BY REGION, 2017-2019 (USD MILLION)

TABLE 56 WIRELESS CONNECTIVITY SIZE, BY REGION, 2020-2025 (USD MILLION)

11 REGIONAL ANALYSIS (Page No. - 98)

11.1 INTRODUCTION

FIGURE 28 ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

11.2 COVID-19 IMPACT BY REGION

FIGURE 29 COVID-19 IMPACT ON AVIATION REVENUE IN 2020, BY REGION

FIGURE 30 IMPACT OF COVID-19

11.3 NORTH AMERICA

11.3.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 31 NORTH AMERICA REGIONAL SNAPSHOT

TABLE 57 NORTH AMERICA: INDUSTRY SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 58 NORTH AMERICA: INDUSTRY SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 59 NORTH AMERICA: INDUSTRY SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 60 NORTH AMERICA: INDUSTRY SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 61 NORTH AMERICA: INDUSTRY SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 62 NORTH AMERICA: INDUSTRY SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 63 NORTH AMERICA: INDUSTRY SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 64 NORTH AMERICA: INDUSTRY SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

TABLE 65 NORTH AMERICA: INDUSTRY, BY COUNTRY, 2017-2019 (USD MILLION)

TABLE 66 NORTH AMERICA: INDUSTRY, BY COUNTRY, 2020-2025 (USD MILLION)

11.3.2 US

11.3.2.1 Presence of leading manufacturers of aircraft interface device drives the market in the US

TABLE 67 US: REGIONAL SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 68 US: REGIONAL SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 69 US: REGIONAL SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 70 US: REGIONAL SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 71 US: REGIONAL SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 72 US: REGIONAL SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 73 US: REGIONAL SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 74 US: REGIONAL SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.3.3 CANADA

11.3.3.1 Aircraft modernization programs fuel adoption of aircraft interface devices in Canada

TABLE 75 CANADA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 76 CANADA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 77 CANADA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 78 CANADA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 79 CANADA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 80 CANADA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 81 CANADA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 82 CANADA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.4 EUROPE

11.4.1 PESTLE ANALYSIS: EUROPE

FIGURE 32 EUROPE AIRCRAFT INTERFACE DEVICE MARKET SNAPSHOT

TABLE 83 EUROPE: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 84 EUROPE: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 85 EUROPE: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 86 EUROPE: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 87 EUROPE: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 88 EUROPE: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 89 EUROPE: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 90 EUROPE: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

TABLE 91 EUROPE: REGIONAL MARKET, BY COUNTRY, 2017-2019 (USD MILLION)

TABLE 92 EUROPE: REGIONAL MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

11.4.2 FRANCE

11.4.2.1 Presence of aircraft OEMs drives the market in France

TABLE 93 FRANCE: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 94 FRANCE: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 95 FRANCE: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 96 FRANCE: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 97 FRANCE: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 98 FRANCE: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 99 FRANCE: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 100 FRANCE: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.4.3 RUSSIA

11.4.3.1 Constant R&D focus on advanced aircraft will propel the market in Russia

TABLE 101 RUSSIA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 102 RUSSIA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 103 RUSSIA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 104 RUSSIA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 105 RUSSIA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 106 RUSSIA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 107 RUSSIA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 108 RUSSIA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.4.4 UK

11.4.4.1 Presence of military aircraft OEMs fuels demand for aircraft interface device in the UK

TABLE 109 UK: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 110 UK: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 111 UK: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 112 UK: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 113 UK: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 114 UK: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 115 UK: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 116 UK: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.4.5 GERMANY

11.4.5.1 Growing investment in air travel connectivity boosts demand for aircraft interface device in Germany

TABLE 117 GERMANY: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 118 GERMANY: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 119 GERMANY: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 120 GERMANY: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 121 GERMANY: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 122 GERMANY: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 123 GERMANY: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 124 GERMANY: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.4.6 ITALY

11.4.6.1 High demand for civil and military helicopters expected to drive aircraft interface device market in Italy

TABLE 125 ITALY: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 126 ITALY: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 127 ITALY: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 128 ITALY: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 129 ITALY: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 130 ITALY: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 131 ITALY: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 132 ITALY: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.4.7 SPAIN

11.4.7.1 Increasing aircraft fleet size drives the market growth

TABLE 133 SPAIN: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 134 SPAIN: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 135 SPAIN: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 136 SPAIN: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 137 SPAIN: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 138 SPAIN: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 139 SPAIN: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 140 SPAIN: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.4.8 REST OF EUROPE

11.4.8.1 Increasing aircraft fleet size due to increasing air passenger traffic will fuel the market in this region

TABLE 141 REST OF EUROPE: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 142 REST OF EUROPE: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 143 REST OF EUROPE: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 144 REST OF EUROPE: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 145 REST 0F EUROPE: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 147 REST OF EUROPE: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 148 REST OF EUROPE: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.5 ASIA PACIFIC

11.5.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 33 ASIA PACIFIC AIRCRAFT INTERFACE DEVICE MARKET SNAPSHOT

TABLE 149 ASIA PACIFIC: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 150 ASIA PACIFIC: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 151 ASIA PACIFIC: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 152 ASIA PACIFIC: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 153 ASIA PACIFIC: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 154 ASIA PACIFIC: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 155 ASIA PACIFIC: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 156 ASIA PACIFIC: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

TABLE 157 ASIA PACIFIC: SIZE, BY COUNTRY, 2017-2019 (USD MILLION)

TABLE 158 ASIA PACIFIC: SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

11.5.2 CHINA

11.5.2.1 Growing demand for aerospace products increases the demand for aircraft interface devices in China

TABLE 159 CHINA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 160 CHINA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 161 CHINA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 162 CHINA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 163 CHINA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 164 CHINA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 165 CHINA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 166 CHINA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.5.3 INDIA

11.5.3.1 Improving domestic capabilities of the aerospace industry offer growth opportunities to market in India

TABLE 167 INDIA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 168 INDIA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 169 INDIA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 170 INDIA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 171 INDIA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 172 INDIA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 173 INDIA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 174 INDIA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.5.4 JAPAN

11.5.4.1 Increasing orders for new aircraft fuel the growth of the market in Japan

TABLE 175 JAPAN: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 176 JAPAN: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 177 JAPAN: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 178 JAPAN: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 179 JAPAN: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 180 JAPAN: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 181 JAPAN: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 182 JAPAN: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.5.5 AUSTRALIA

11.5.5.1 Use of advanced technology in air transport results in demand for aircraft interface device in Australia

TABLE 183 AUSTRALIA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 184 AUSTRALIA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 185 AUSTRALIA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 186 AUSTRALIA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 187 AUSTRALIA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 188 AUSTRALIA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 189 AUSTRALIA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 190 AUSTRALIA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.5.6 REST OF ASIA PACIFIC

11.5.6.1 Aging aircraft fleets and an increase in the defense budget are expected to drive demand for aircraft interface device in this region

TABLE 191 REST OF ASIA PACIFIC: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 192 REST OF ASIA PACIFIC: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 193 REST OF ASIA PACIFIC: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 194 REST OF ASIA PACIFIC: SIZE, BY FIT, 2018-2025 (USD MILLION)

TABLE 195 REST OF ASIA PACIFIC: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 196 REST OF ASIA PACIFIC: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 197 REST OF ASIA PACIFIC: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 198 REST OF ASIA PACIFIC: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.6 MIDDLE EAST

11.6.1 PESTLE ANALYSIS: MIDDLE EAST

TABLE 199 MIDDLE EAST: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 200 MIDDLE EAST: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 201 MIDDLE EAST: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 202 MIDDLE EAST: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 203 MIDDLE EAST: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 204 MIDDLE EAST: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 205 MIDDLE EAST: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 206 MIDDLE EAST: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

TABLE 207 MIDDLE EAST: SIZE, BY COUNTRY, 2017-2019 (USD MILLION)

TABLE 208 MIDDLE EAST: SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

11.6.2 UAE

11.6.2.1 Increasing upgradation of commercial airlines and rising military expenditure expected to drive the market

TABLE 209 UAE: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 210 UAE: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 211 UAE: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 212 UAE: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 213 UAE: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 214 UAE: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 215 UAE: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 216 UAE: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.6.3 ISRAEL

11.6.3.1 Indigenous aircraft development programs and increasing air passenger traffic boosting demand for new aircraft

TABLE 217 ISRAEL: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 218 ISRAEL: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 219 ISRAEL: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 220 ISRAEL: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 221 ISRAEL: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 222 ISRAEL: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 223 ISRAEL: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 224 ISRAEL: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.6.4 SAUDI ARABIA

11.6.4.1 Significant growth in airline business drives demand for aircraft interface device in Saudi Arabia

TABLE 225 SAUDI ARABIA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 226 SAUDI ARABIA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 227 SAUDI ARABIA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 228 SAUDI ARABIA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 229 SAUDI ARABIA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 230 SAUDI ARABIA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 231 SAUDI ARABIA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 232 SAUDI ARABIA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.6.5 QATAR

11.6.5.1 Presence of certified commercial aircraft repair stations offer opportunities to the market to grow

TABLE 233 QATAR: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 234 QATAR: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 235 QATAR: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 236 QATAR: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 237 QATAR: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 238 QATAR: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 239 QATAR: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 240 QATAR: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.6.6 REST OF MIDDLE EAST

11.6.6.1 Increasing number of aircraft repair stations increases the demand for aircraft interface device in this region

TABLE 241 REST OF MIDDLE EAST: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 242 REST OF MIDDLE EAST: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 243 REST OF MIDDLE EAST: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 244 REST OF MIDDLE EAST: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 245 REST OF MIDDLE EAST: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 246 REST OF MIDDLE EAST: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 247 REST OF MIDDLE EAST: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 248 REST OF MIDDLE EAST: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.7 LATIN AMERICA

11.7.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 249 LATIN AMERICA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 250 LATIN AMERICA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 251 LATIN AMERICA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 252 LATIN AMERICA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 253 LATIN AMERICA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 254 LATIN AMERICA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 255 LATIN AMERICA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 256 LATIN AMERICA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

TABLE 257 LATIN AMERICA: SIZE, BY COUNTRY, 2017-2019 (USD MILLION)

TABLE 258 LATIN AMERICA: SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

11.7.2 BRAZIL

11.7.2.1 Presence of OEMs and airlines offer opportunities to the market in Brazil

TABLE 259 BRAZIL: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 260 BRAZIL: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 261 BRAZIL: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 262 BRAZIL: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 263 BRAZIL: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 264 BRAZIL: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 265 BRAZIL: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 266 BRAZIL: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.7.3 MEXICO

11.7.3.1 Use of special mission aircraft by the government for surveillance drives the market in Mexico

TABLE 267 MEXICO: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 268 MEXICO: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 269 MEXICO: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 270 MEXICO: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 271 MEXICO: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 272 MEXICO: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 273 MEXICO: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 274 MEXICO: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.7.4 REST OF LATIN AMERICA

11.7.4.1 Increased fleet size of airlines propel the market in this region

TABLE 275 REST OF LATIN AMERICA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 276 REST OF LATIN AMERICA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 277 REST OF LATIN AMERICA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 278 REST OF LATIN AMERICA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 279 REST OF LATIN AMERICA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 280 REST OF LATIN AMERICA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 281 REST OF LATIN AMERICA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 282 REST OF LATIN AMERICA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.8 AFRICA

TABLE 283 AFRICA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 284 AFRICA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 285 AFRICA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 286 AFRICA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 287 AFRICA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 288 AFRICA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 289 AFRICA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 290 AFRICA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

TABLE 291 AFRICA: SIZE, BY COUNTRY, 2017-2019 (USD MILLION)

TABLE 292 AFRICA: SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

11.8.1 SOUTH AFRICA

11.8.1.1 Demand for replacement of aircraft components fuels market in South Africa

TABLE 293 SOUTH AFRICA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 294 SOUTH AFRICA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 295 SOUTH AFRICA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 296 SOUTH AFRICA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 297 SOUTH AFRICA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 298 SOUTH AFRICA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 299 SOUTH AFRICA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 300 SOUTH AFRICA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

11.8.2 REST OF AFRICA

11.8.2.1 Availability of low-cost raw materials fuels market growth in the Rest of Africa

TABLE 301 REST OF AFRICA: SIZE, BY END-USE, 2017-2019 (USD MILLION)

TABLE 302 REST OF AFRICA: SIZE, BY END-USE, 2020-2025 (USD MILLION)

TABLE 303 REST OF AFRICA: SIZE, BY FIT, 2017-2019 (USD MILLION)

TABLE 304 REST OF AFRICA: SIZE, BY FIT, 2020-2025 (USD MILLION)

TABLE 305 REST OF AFRICA: SIZE, BY AIRCRAFT TYPE, 2017-2019 (USD MILLION)

TABLE 306 REST OF AFRICA: SIZE, BY AIRCRAFT TYPE, 2020-2025 (USD MILLION)

TABLE 307 REST OF AFRICA: SIZE, BY CONNECTIVITY, 2017-2019 (USD MILLION)

TABLE 308 REST OF AFRICA: SIZE, BY CONNECTIVITY, 2020-2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 182)

12.1 INTRODUCTION

FIGURE 34 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS

12.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2019

FIGURE 35 RANKING ANALYSIS OF TOP 5 PLAYERS IN 2019

12.3 SHARE OF KEY MARKET PLAYERS, 2019

12.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2019

12.5 COMPETITIVE LEADERSHIP MAPPING

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

FIGURE 36 COMPETITIVE LEADERSHIP MAPPING, 2019

TABLE 309 COMPANY PRODUCT FOOTPRINT

TABLE 310 COMPANY END USE FOOTPRINT

TABLE 311 COMPANY AIRCRAFT TYPE FOOTPRINT

TABLE 312 COMPANY REGION FOOTPRINT

12.6 COMPETITIVE SCENARIO

12.6.1 NEW PRODUCT LAUNCHES

TABLE 313 NEW PRODUCT LAUNCHES, 2016-2020

12.6.2 CONTRACTS

TABLE 314 CONTRACTS, 2016-2020

12.6.3 ACQUISITIONS/PARTNERSHIPS

TABLE 315 ACQUISITIONS/PARTNERSHIPS, 2016-2020

13 COMPANY PROFILES (Page No. - 194)

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

13.1 KEY PLAYERS

13.1.1 COLLINS AEROSPACE

FIGURE 37 COLLINS AEROSPACE: COMPANY SNAPSHOT

13.1.2 THALES SA

FIGURE 38 THALES SA: COMPANY SNAPSHOT

13.1.3 THE BOEING COMPANY

FIGURE 39 THE BOEING COMPANY: COMPANY SNAPSHOT

13.1.4 ASTRONICS CORPORATION

FIGURE 40 ASTRONICS CORPORATION.: COMPANY SNAPSHOT

13.1.5 ELBIT SYSTEMS LTD.

FIGURE 41 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

13.1.6 VIASAT, INC.

FIGURE 42 VIASAT, INC.: COMPANY SNAPSHOT

13.1.7 TELEDYNE CONTROLS LLC

13.1.8 HONEYWELL INTERNATIONAL INC.

FIGURE 43 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

13.1.9 GLOBAL EAGLE ENTERTAINMENT INC.

FIGURE 44 GLOBAL EAGLE ENTERTAINMENT INC.: COMPANY SNAPSHOT

13.1.10 AVIONICA, INC.

13.1.11 SKYTRAC SYSTEMS LTD.

13.1.12 SANMINA CORPORATION

FIGURE 45 SANMINA CORPORATION: COMPANY SNAPSHOT

13.1.13 DAC INTERNATIONAL, INC.

13.1.14 SHADIN AVIONICS

13.1.15 CONCEPT DEVELOPMENT, INC.

13.1.16 CMC ELECTRONICS INC.

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 ADJACENT MARKET (Page No. - 221)

14.1 INTRODUCTION

14.2 AVIONICS MARKET

14.2.1 MARKET DEFINITION

14.2.2 AVIONICS MARKET, BY END-USER

FIGURE 46 BY END-USER, OEM SEGMENT ESTIMATED TO LEAD AVIONICS MARKET DURING FORECAST PERIOD

TABLE 316 AVIONICS MARKET SIZE, BY END-USER, 2017-2024 (USD MILLION)

14.2.3 AVIONICS MARKET, BY PLATFORM

FIGURE 47 BY PLATFORM, COMMERCIAL AVIATION SEGMENT ESTIMATED TO LEAD AVIONICS MARKET DURING FORECAST PERIOD

TABLE 317 AVIONICS MARKET SIZE, BY PLATFORM, 2017-2024 (USD MILLION)

14.2.3.1 Commercial aviation

TABLE 318 COMMERCIAL AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2017-2024 (USD MILLION)

14.2.3.2 Military aviation

TABLE 319 MILITARY AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2017-2024 (USD MILLION)

14.2.3.3 Business jets & general aviation

TABLE 320 BUSINESS JETS & GENERAL AVIATION: AVIONICS MARKET, BY AIRCRAFT TYPE, 2017-2024 (USD MILLION)

14.2.3.4 Helicopters

TABLE 321 HELICOPTERS: AVIONICS MARKET, BY AIRCRAFT TYPE, 2017-2024 (USD MILLION)

15 APPENDIX (Page No. - 226)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATION

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

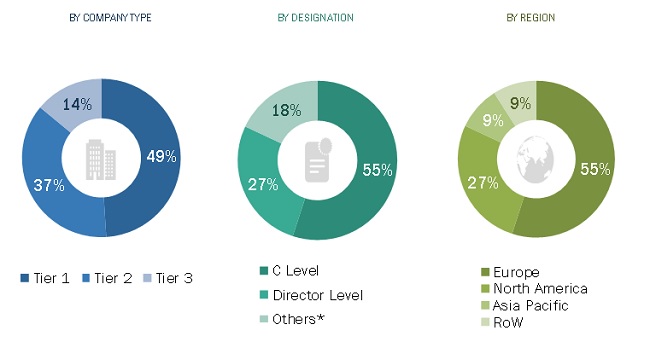

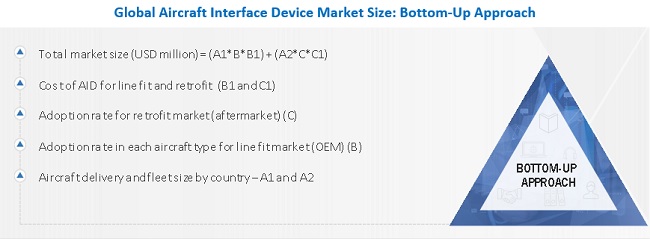

The study involved four major activities in estimating the current size of the aircraft interface device industry. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Statista, Global Firepower, SIPRI report, UN Comtrade World Bank, Factiva, Bloomberg, BusinessWeek, SEC filings, annual reports, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the Aircraft Interface Device Market.

Primary Research

The aircraft interface device market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, service providers, and system integrators in its supply chain. The demand side of this market is characterized by various end-users such as commercial, government & private organizations of different countries. The supply side is characterized by suppliers, manufacturers, solution providers, technology developers, alliances, and organizations. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft interface device market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the Aircraft Interface Device Market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides.

Report Objectives

- To define, describe, and forecast the size of the aircraft interface device market based on end use, fit, aircraft type, connectivity, and region

- To forecast the size of the various segments of the aircraft interface device market based on six regions: North America, Asia Pacific, Europe, the Middle East, Africa, and Latin America, along with key countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as new product developments, contracts, partnerships, mergers, product enhancements, and collaborations adopted by key players in the market

- To identify the detailed financial position, key products, unique selling points, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aircraft interface device market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Aircraft Interface Device Market

Growth opportunities and latent adjacency in Aircraft Interface Device Market