Mission Management Systems Market by Application (Defense, Commercial), End-User (Air Based, Naval Based, Land Based and Unmanned Systems Based) and Region (North America, Europe, Asia-Pacific, Rest of the World) - Global Forecast to 2022

[140 Pages Report]

Mission management system Market Analysis:

The mission management systems market is projected to grow from USD 13.97 Billion in 2016 to USD 27.50 Billion by 2022, at a CAGR of 11.95% from 2016 to 2022. The objective of this study is to analyze, define, describe, and forecast the market based on application, end user, and region. The report also focuses on the competitive landscape of this market by profiling companies based on their financial position, product portfolio, growth strategies, and analyzing their core competencies and market share to anticipate the degree of competition prevailing in the market. This report also tracks and analyzes competitive developments, such as partnerships, mergers & acquisitions, new product developments, and research & development (R&D) activities in the market. The base year considered for this study is 2015 and the forecast period is from 2016 to 2022.

Objectives of the Study:

The report analyzes the mission management system market on the basis of application (defense, commercial), end user (Air, Naval, Land and Unmanned Systems), and region (North America, Europe, Asia-Pacific, and RoW).

The report provides in-depth market intelligence regarding the mission management system market and major factors, including drivers, restraints, opportunities, and challenges that may influence the growth of the market. It also provides an analysis of micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market.

The report also covers competitive developments such as long-term contracts, new product launches and developments, and research & development activities in the mission management market, in addition to business and corporate strategies adopted by key market players.

Defense Segment is Expected to Grow the Mission Management System Market from 2018 and 2023

Mission management systems aid in enhancing situational awareness capabilities of the defense forces by bringing the air, land, and naval forces to a common platform. This results in better decision making and better situation assessment of the opponent’s forces.

Increasing demand for UAVs in defense missions to perform various tasks in hostile environment is the prime cause for the increase in demand for mission management systems in the defense segment driving the growth of the mission management system market.

Mission management system Market Dynamics

Drivers

- Enhanced situational awareness

- Growing need of emergency and search & rescue management

- Increased use of mission management systems for unmanned aerial vehicles

Restraints

- Declining defense budgets

Opportunities

- Civilian/commercial applications

- Increased border patrol & surveillance

hallenges

- Vulnerability of sensors

- Cyber security

Key Questions

- How will the mission management system market drivers, restraints and future opportunities affect the market dynamics and subsequent market analysis of the associated trends

- What are the key sustainability strategies adopted by mission management system market players?

Mission Management System Market Insights

The mission management systems market is projected to grow from USD 13.97 Billion in 2016 to USD 27.50 Billion by 2022, at a CAGR of 11.95% from 2016 to 2022. Increasing need for enhanced situational awareness, growing need of emergency and search & rescue management is the major factor expected to drive the market in the coming years.

Based on application, the defense segment was the largest segment of the mission management systems market. The defense forces are investing heavily on new technologies to modernize their forces and determine the best technology that offers exceptional performance in the long run with lesser development cost.

Based on end user, the air segment of the mission management systems market is projected to grow at the highest CAGR during the forecast period. Air platform involves a wide range of products and solutions for aircraft platforms that include integrated mission systems, airborne radars and sensors, electronic warfare systems, on-board avionics, aerial target systems, and simulation systems.

North America led the mission management systems market in 2016. Countries in this region include the U.S. and Canada. Factor contributing to this dominance include heavy investments in defense institutional reforms. Frequent use of mission systems in overseas operations carried out by the U.S. Army in countries such as Afghanistan and Iraq highlights its increased demand in the North American defense market, which is projected to drive the mission management systems market during the forecast period.

Regional market analysis

North America is estimated to account for the largest share of the mission management system market in 2018. This can be attributed to the increasing investments on mission management systems in this region to maintain its superiority and overcome the risk of potential threats from countries such as China, India, Japan, and Israel, who are also increasing their military expenditure to gain competitive advantage over each other. Frequent use of mission systems in overseas operations carried out by the U.S. Army in countries such as Afghanistan and Iraq highlight its increased demand in the North American defense market, which is projected to drive the mission management systems market during the forecast period

LEADING mission management system providers ARE DEVELOPING advanced technologies AND softwares TO DRIVE THE defense INDUSTRY FORWARD

Several major players are present in the mission management systems market. Some of these players are were Lockheed Martin Corporation (U.S.), SAAB AB (Sweden), Thales Group (France), and Northrop Grumman Corporation (U.S.), Honeywell, Inc. (U.S.), among others. Contracts has been the key growth strategy adopted by the major players in mission management systems market.

Mission management system market industry analysis

|

Qualitative Market Analysis |

Quantitative Market Analysis |

|

|

|

|

|

|

|

|

|

|

Mission management systems ensures seamless exchange of information across end users resulting in enhanced situational awareness

In the current battlespace, forces need to differentiate between friendly forces and enemies to make right and effective decisions, which require accurate data and information. The information includes force’s own location and knowledge about its enemy’s location in real-time. This awareness plays a vital role in achieving mission success.

End User, 2016 (%)

Naval

Naval end users have a unique feature to operate simultaneously in the air, sea, and under the sea. These end users also have the ability to provide both, rapid strike and projected sustained force. In 2016, Quintiq developed ViewFinder, an advanced naval system which provides intelligent fusion of all sensor data, radars, Sonar, IFF, and Datalink. ViewFinder provides enhanced situational awareness by identifying and highlighting abnormal activity such as patroling. It also provides solutions for the combat systems such as offshore patrol vessels, corvettes, and frigates.

Air

Air end user involves a wide range of products and solutions for aircraft that include integrated mission systems, airborne radars and sensors, electronic warfare systems, on-board avionics, aerial target systems and simulation systems. ATOS (airborne, tactical, observation, and surveillance systems) provides wide area and targeted surveillance, anti-submarine warfare, and environmental and border control. It is an advanced, flexible, open architecture mission management system integrating a number of sensors and sub-systems in a highly modular design.

Unmanned Systems

Unmanned systems can carry cameras, sensors, communications equipment, or other payloads. Several top market players such as Curtiss-Wright, Northrop Grumman Corporation are developing MMS for UAVs that enable them to see and avoid obstacles, detect movement, navigate accurately, find the enemy, warn for buried improvised explosive devices, carry out military and civil surveillance activities amongst others.

Land

Mission management systems play a significant role in improving connectivity of land based end users. There are certain land based objects that cannot be tracked, located or identified with accuracy. The land segment is categorized into main battle tanks (MBT), light protected vehicles (LPV), amphibious armored vehicles (AAV), infantry fighting vehicles (IFV), mine-resistant ambush protected (MRAP), armored personnel carriers, and others

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

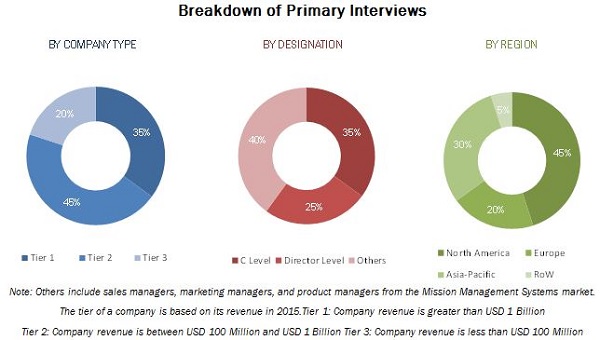

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increased Demand for Integration of UAVs in Mission Management Systems

2.2.3 Supply-Side Analysis

2.2.3.1 Advancements in Sensor Technology

2.2.3.2 Miniaturization of Electronics Equipment Used in Defense Systems

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Mission Management Systems Market, By Application

4.2 Market, By End User

4.3 Market Share and Growth Analysis, By Region

4.4 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Application

5.2.2 By End User

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Enhanced Situational Awareness

5.3.1.2 Growing Need of Emergency and Search & Rescue Management

5.3.1.3 Increased Use of Mission Management Systems for Unmanned Aerial Vehicles

5.3.2 Restraints

5.3.2.1 Declining Defense Budgets

5.3.3 Opportunities

5.3.3.1 Civilian/Commercial Applications

5.3.3.2 Increased Border Patrol & Surveillance

5.3.4 Challenges

5.3.4.1 Vulnerability of Sensors

5.3.4.2 Cyber Security

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Future Trends

6.3 Technology Trends

6.3.1 Autonomous Mission Management System for UAV

6.3.2 Hierarchical Contingency Management System With AMMS for UAV

6.3.3 Open Architecture

6.3.4 Human-Machine Interface (HMI)

6.3.5 Multi-Sensor Data Fusion Used to Enhance Mms

6.4 Patents

7 Mission Management Systems Market, By Application (Page No. - 47)

7.1 Introduction

7.2 Defense

7.3 Commercial

8 Mission Management Systems Market, By End User (Page No. - 50)

8.1 Introduction

8.2 Air

8.2.1 Combat Aircraft

8.2.2 Special Mission Aircraft

8.2.3 Tankers

8.2.4 Transport Aircraft

8.2.5 Combat Helicopters

8.2.6 Training Aircraft & Helicopters

8.3 Naval

8.3.1 Large Ships

8.3.2 Medium Ships

8.3.3 Small Ships

8.3.4 Submarines

8.4 Land

8.4.1 Mine-Resistant Ambush Protected (MRAP) Vehicles

8.4.2 Main Battle Tanks

8.4.3 Armored Personnel Carriers

8.4.4 Light Protected Vehicles

8.4.5 Infantry Fighting Vehicles

8.4.6 Amphibious Armored Vehicles

8.4.7 Others

8.5 Unmanned Systems

8.5.1 Defense Unmanned Systems

8.5.2 Commercial Unmanned Systems

9 Geographic Analysis (Page No. - 68)

9.1 Introduction

9.2 North America

9.2.1 By Application

9.2.2 By End User

9.2.3 By Country

9.2.3.1 U.S.

9.2.3.1.1 By Application

9.2.3.1.2 By End User

9.2.3.2 Canada

9.2.3.2.1 By Application

9.2.3.2.2 By End User

9.3 Europe

9.3.1 By Application

9.3.2 By End User

9.3.3 By Country

9.3.3.1 Russia

9.3.3.1.1 By Application

9.3.3.1.2 By End User

9.3.3.2 France

9.3.3.2.1 By Application

9.3.3.2.2 By End User

9.3.3.3 U.K.

9.3.3.3.1 By Application

9.3.3.3.2 By End User

9.3.3.4 Italy

9.3.3.4.1 By Application

9.3.3.4.2 By End User

9.3.3.5 Germany

9.3.3.5.1 By Application

9.3.3.5.2 By End User

9.4 Asia-Pacific

9.4.1 By Application

9.4.2 By End User

9.4.3 By Country

9.4.3.1 China

9.4.3.1.1 By Application

9.4.3.1.2 By End User

9.4.3.2 India

9.4.3.2.1 By Application

9.4.3.2.2 By End User

9.4.3.3 Japan

9.4.3.3.1 By Application

9.4.3.3.2 By End User

9.4.3.4 Australia

9.4.3.4.1 By Application

9.4.3.4.2 By End User

9.5 Rest of the World

9.5.1 By Application

9.5.2 By End User

10 Competitive Landscape (Page No. - 94)

10.1 Introduction

10.2 Key Players in the Mission Management Systems Market, By Region, (2015)

10.3 Product Mapping

10.4 Market Ranking Analysis

10.5 Competitive Situations and Trends

10.5.1 Contracts

10.5.2 New Product Launches

10.5.3 Acquisitions, Agreements & Partnerships

11 Company Profiles (Page No. - 104)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Introduction

11.2 Financial Highlights of Major Players in the Mission Management Systems Market

11.3 Lockheed Martin Corporation

11.4 Northrop Grumman Corporation

11.5 Thales Group

11.6 Saab Group

11.7 Honeywell International, Inc.

11.8 Curtiss-Wright Corporation

11.9 Quinetiq Group PLC.

11.10 Neya Systems, LLC.

11.11 Piaggio Aero Industries S.P.A

11.12 Aerocomputers, Inc.

11.13 Bird Aerosystem Ltd

11.14 Dharma Magna

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 132)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (68 Tables)

Table 1 Segment Definition, By Application

Table 2 Segment Definition, By End User

Table 3 Innovation & Patent Registrations, 2010-2016

Table 4 Mission Management Systems Market Size, By Application, 2014-2022 (USD Million)

Table 5 Market Size, By End User, 2014-2022(USD Million)

Table 6 Market Size in Air Segment, By Region, 2014-2022(USD Million)

Table 7 Market Size in Air Segment, By Type, 2014–2022 (USD Million)

Table 8 Market Size in Combat Aircraft Subsegment, By Region, 2014-2022 (USD Million)

Table 9 Market Size in Special Mission Aircraft Subsegment, By Region, 2014-2022 (USD Million)

Table 10 Market Size in Tankers Subsegment, By Region, 2014-2022 (USD Million)

Table 11 Market Size in Transport Aircraft Subsegment, By Region, 2014-2022 (USD Million)

Table 12 Market Size in Combat Helicopters Subsegment, By Region, 2014-2022 (USD Million)

Table 13 Mission Management Systems Market Size in Training Aircraft & Helicopters Subsegment, By Region, 2014-2022 (USD Million)

Table 14 Market Size in Naval Segment, By Region, 2014-2022 (USD Million)

Table 15 Market Size in Naval Segment, By Type, 2014–2022 (USD Million)

Table 16 Market Size in Large Ships Subsegment, By Region, 2014-2022 (USD Million)

Table 17 Mission Management Systems Market Size in Medium Ships Subsegment, By Region, 2014-2022 (USD Million)

Table 18 Market Size in Small Ships Subsegment, By Region, 2014-2022 (USD Million)

Table 19 Market Size in Submarines Subsegment, By Region, 2014-2022 (USD Million)

Table 20 Market Size in Land Segment, By Region, 2014-2022 (USD Million)

Table 21 Market Size in Land Segment, By Type, 2014–2022 (USD Million)

Table 22 Mission Management Systems Market Size in Mine-Resistant Ambush Protected Vehicles Subsegment, By Region, 2014-2022 (USD Million)

Table 23 Market Size in Main Battle Tanks Subsegment, By Region, 2014-2022 (USD Million)

Table 24 Market Size in Armored Personnel Carriers Subsegment, By Region, 2014-2022 (USD Million)

Table 25 Market Size in Light Protected Vehicles Subsegment, By Region, 2014-2022 (USD Million)

Table 26 Market Size in Infantry Fighting Vehicles Subsegment, By Region, 2014-2022 (USD Million)

Table 27 Market Size in Amphibious Armored Vehicles Subsegment, By Region, 2014-2022 (USD Million)

Table 28 Market Size in Others Subsegment, By Region, 2014-2022 (USD Million)

Table 29 Market Size in Unmanned Systems Segment, By Region, 2014-2022(USD Million)

Table 30 Market Size in Defense Unmanned Systems Subsegment, By Region, 2014-2022 (USD Million)

Table 31 Market Size in Commercial Unmanned Systems Subsegment, By Region, 2014-2022 (USD Million)

Table 32 Market Size, By Region, 2014-2022 (USD Million)

Table 33 North America Mission Management Systems Market Size, By Application, 2014-2022 (USD Million)

Table 34 North America Market Size, By End User, 2014-2022 (USD Million)

Table 35 North America Market Size, By Country, 2014-2022 (USD Million)

Table 36 U.S. Market Size, By Application, 2014-2022 (USD Million)

Table 37 U.S. Market Size, By End User, 2014-2022 (USD Million)

Table 38 Canada Mission Management Systems Market Size, By Application, 2014-2022 (USD Million)

Table 39 Canada Market Size, By End User, 2014-2022 (USD Million)

Table 40 Europe: Market Size, By Application, 2014-2022 (USD Million)

Table 41 Europe Market Size, By End User, 2014-2022 (USD Million)

Table 42 Europe Market Size, By Country, 2014-2022 (USD Million)

Table 43 Russia Market Size, By Application, 2014-2022 (USD Million)

Table 44 Russia Market Size, By End User, 2014-2022 (USD Million)

Table 45 France Mission Management Systems Market Size, By Application, 2014-2022 (USD Million)

Table 46 France Market Size, By End User, 2014-2022 (USD Million)

Table 47 U.K. Market Size, By Application, 2014-2022 (USD Million)

Table 48 U.K. Market Size, By End User, 2014-2022 (USD Million)

Table 49 Italy : Market Size, By Application, 2014-2022 (USD Million)

Table 50 Italy Market Size, By End User, 2014-2022 (USD Million)

Table 51 Germany Mission Management Systems Market Size, By Application, 2014-2022 (USD Million)

Table 52 Germany Market Size, By End User, 2014-2022 (USD Million)

Table 53 Asia-Pacific : Market Size, By Application, 2014-2022 (USD Million)

Table 54 Asia-Pacific Market Size, By End User, 2014-2022 (USD Million)

Table 55 Asia-Pacific : Market Size, By Country, 2014-2022 (USD Million)

Table 56 China Market Size, By Application, 2014-2022 (USD Million)

Table 57 China : Market Size, By End User, 2014-2022 (USD Million)

Table 58 India Market Size, By Application, 2014-2022 (USD Million)

Table 59 India : Market Size, By End User, 2014-2022 (USD Million)

Table 60 Japan Market Size, By Application, 2014-2022 (USD Million)

Table 61 Japan Mission Management Systems Market Size, By End User, 2014-2022 (USD Million)

Table 62 Australia Market Size, By Application, 2014-2022 (USD Million)

Table 63 Australia Mission Management Systems Market Size, By End User, 2014-2022 (USD Million)

Table 64 RoW : Market Size, By Application, 2014-2022 (USD Million)

Table 65 RoW : Market Size, By End User, 2014-2022 (USD Million)

Table 66 Contracts, March, 2010- December, 2016

Table 67 New Product Launches, March, 2010-December, 2016

Table 68 Partnerships, Agreements & Acquisitions, March, 2010–December, 2016

List of Figures (53 Figures)

Figure 1 Research Process Flow

Figure 2 Mission Management Systems Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 4 Estimated Total Funding for Unmanned Systems of the Department of Defense From 2014-2018, (USD Million)

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 North America Accounted for the Largest Share of the Mission Management Systems Market in 2016

Figure 10 The Defense Segment is Projected to Be the Larger Segment of the Market By 2022

Figure 11 The Air Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Contracts has Been the Key Growth Strategy Adopted By the Major Players in the Market

Figure 13 Increasing Demand for Mission Management Systems to Drive the Market Growth During the Forecast Period

Figure 14 The Defense Segment is Expected to Lead the Market During the Forecast Period

Figure 15 Air Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Mission Management Systems Market in North America is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 17 North America Region to Witness the Highest Growth During the Forecast Period

Figure 18 Market Segmentation: By Application

Figure 19 Market Segmentation: By End User

Figure 20 Market Dynamics for Market

Figure 21 HMI: Human Problem Solving

Figure 22 Data Processing From Multi-Sensors

Figure 23 Defense is Projected to Be A Larger Segment of the Market By 2022

Figure 24 The Air Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Training Aircraft & Helicopters Subsegment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 26 The Medium Ships Subsegment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 27 The Main Battle Tanks Subsegment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 28 North America Accounted for the Largest Share of the Mission Management System Market in 2016

Figure 29 North America Mission Management System Market Snapshot

Figure 30 The U.S. is Projected to Be Largest Market for Mission Management Systems During the Forecast Period

Figure 31 Europe Mission Management System Market Snapshot

Figure 32 The Market in Germany is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 33 Asia-Pacific Mission Management System Market Snapshot

Figure 34 The Market in China Projected to Grow at the Highest CAGR During the Forecast Period

Figure 35 Companies Adopted Contracts as A Key Growth Strategy From March 2010 to December 2016

Figure 36 Lockheed Martin Corporation is One of the Top Players in the Market

Figure 37 Market Ranking Analysis, By Key Players, 2015

Figure 38 Influencing Factors and Their Impacts on Regional Mission Management Systems Market, 2015

Figure 39 Contracts Have Been the Most Aggressive Strategy Adopted By Key Players in the Market in 2015

Figure 40 Contracts Contributed A Major Share to Overall Developments By Key Players in the Market From March 2010 to December 2016

Figure 41 Regional Revenue Mix of Top 5 Market Players, 2015

Figure 42 Lockheed Martin Corporation: Company Snapshot

Figure 43 Lockheed Martin Corporation: SWOT Analysis

Figure 44 Northrop Grumman Corporation: Company Snapshot

Figure 45 Northrop Grumman Corporation: SWOT Analysis

Figure 46 Thales Group: Company Snapshot

Figure 47 Thales Group: SWOT Analysis

Figure 48 Saab Group: Company Snapshot

Figure 49 Saab AB: SWOT Analysis

Figure 50 Honeywell International Inc. : Company Snapshot

Figure 51 Honeywell International, Inc. : SWOT Analysis

Figure 52 Curtiss-Wright Corporation: Company Snapshot

Figure 53 Quinetiq Group PLC.: Company Snapshot

The research methodology used to estimate and forecast the mission management systems market includes study of data and revenues of key market players through secondary resources, such as annual reports, Yahoo Finance, Federal Aviation Administration (FAA), International Civil Aviation Organization (ICAO), International Air Transport Association (IATA), and Stockholm International Peace Research Institute (SIPRI). The bottom-up procedure was employed to arrive at the overall size of the mission management systems market from the revenue of key players in the market. After arriving at the overall market size, the market was split into several segments and sub segments, which were then verified through primary research by conducting extensive interviews with key industry experts, such as CEOs, VPs, directors, executives, and engineers. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. Breakdown of profiles of primaries is shown in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the mission management system market comprises space agencies, intelligence communities, service providers, software providers, and end users.

Mission management system Market Insights

The ecosystem of the mission management systems market has been segmented based on application, end user, and region. The key players operating in the mission management systems market includes component suppliers, such as Lockheed Martin Corporation (U.S.), SAAB AB (Sweden), Thales Group (France), and Northrop Grumman Corporation (U.S.), Honeywell International, Inc. (U.S.), among others are some of the manufacturers. Contracts, agreements and acquisitions & partnerships are the major strategies adopted by key players operational in the market.

Key Target Audience:

- Manufacturers of Mission Management Systems

- Original Equipment Manufacturers (OEMs)

- Sub-component Manufacturers

- Technology Support Providers

- Government and Certification Bodies

- Aircraft Manufacturer Associations

- Naval Manufacturer Associations

- Land Manufacturer Associations

- Unmanned Manufacturer Associations

Scope of the Report:

This research report categorizes the mission management system market into the following segments and subsegments:

Mission management system Market, By Application

- Defense

- Commercial

Mission management system Market, By End User

- Air

- Land

- Naval

- Unmanned Systems

Mission management system Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Customizations Available for the Report:

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Mission Management Systems Market

I am interested in identifying all of the major/minor mission management systems on the market, who their manufacturers/producers are, the type of active aircraft they are provided on, and the quantity of aircraft they are on currently.