Active Protection System Market by Kill System Type (Soft Kill System, Hard Kill System, Reactive Armor), End User (Defense, Homeland Security), Platform (Ground, Marine, Airborne), and Region - Global Forecast to 2027

Update: 10/22/2024

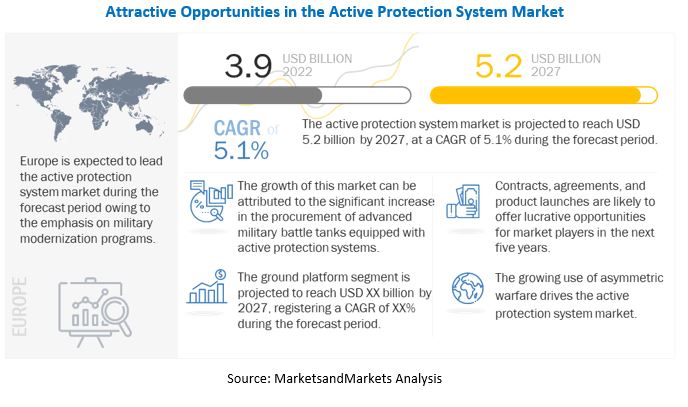

The Active Protection System Market is projected to grow from USD 3.9 billion in 2022 to USD 5.2 billion by 2027, at a CAGR of 5.5% from 2022 to 2027.

Active protection systems are widely used in the military, mostly to provide safety to armored fighting vehicles from enemy fire. They can be installed on tracked or wheeled armored fighting or logistics vehicles, combat helicopters, naval warfare ships, and other systems. Modular optoelectronic sensor systems, target acquisition systems, digital radar processors for target detection, and thermal imaging devices provide optimized field surveillance and combat by day/night or under poor visibility. Several countries are focusing on increasing their armored vehicle fleets owing to the rise in cross-border conflicts, which has directly led to the growth of the Active Protection System Industry.

The US Army and Israeli defense forces, among other armed forces, have carried out practical analyses of numerous active protection systems developed by Raytheon (US), Artis LLC (US), Israel Military Industries (Israel), and Rafael Advanced Defense Systems (Israel) to equip and install active protection systems on their armored vehicles.

For instance, in January 2022, the Hungarian government awarded a contract to Rheinmetall AG of Germany to install StrikeShield hard-kill active protection systems on 209 new Lynx infantry fighting vehicles. In January 2022, the US Army awarded a contract to the team of Unified Business Technologies (UBT) and Rheinmetall Protection Systems to test the StrikeShield active protection system at Redstone Test Center in Huntsville, Alabama. Various players such as Rheinmetall AG (Germany), Saab AB (Sweden), Raytheon Company (US), Airbus (Netherlands), and ASELSAN AS (Turkey) among others, are prominent players operating in the active protection system market.

To know about the assumptions considered for the study, Request for Free Sample Report

Active protection system Market Ecosystem

The key stakeholders in the active protection system market ecosystem include companies which provide platforms and soldier systems. The major influencers in this market are investors, funders, academic researchers, integrators, service providers, and licencing agencies.

Active protection system Market Segment Overview

Defense segment held largest market share in terms of value in active protection system market

Active protection systems are widely used in the military, mostly to provide safety to armored fighting vehicles from enemy fire.

They can be installed on tracked or wheeled armored fighting or logistics vehicles, combat helicopters, naval warfare ships, and other systems. Modular optoelectronic sensor systems, target acquisition systems, digital radar processors for target detection, and thermal imaging devices provide optimized field surveillance and combat by day/night or under poor visibility. Several countries are focusing on increasing their armored vehicle fleets owing to the rise in cross-border conflicts, which has directly led to the growth of the active protection system industry.

The US Army and Israeli defense forces, among other armed forces, have carried out practical analyses of numerous active protection systems developed by Raytheon (US), Artis LLC (US), Israel Military Industries (Israel), and Rafael Advanced Defense Systems (Israel) to equip and install active protection systems on their armored vehicles.

Ground segment is anticipated to grow at highest CAGR during forecast period

Militaries around the world are focusing on countering improvised explosive devices (IEDs). Anti-IED technologies such as double V-hulls, IED jammers, and other protection technologies can be integrated with active protection systems to provide full security to the platform. These systems are expected to be significant to a large variety of land combat platforms worldwide, as they can be equipped with a variety of sensors, radars, decoys, chaffs, and weapon mountings, which make them scalable, reliable, and flexible.

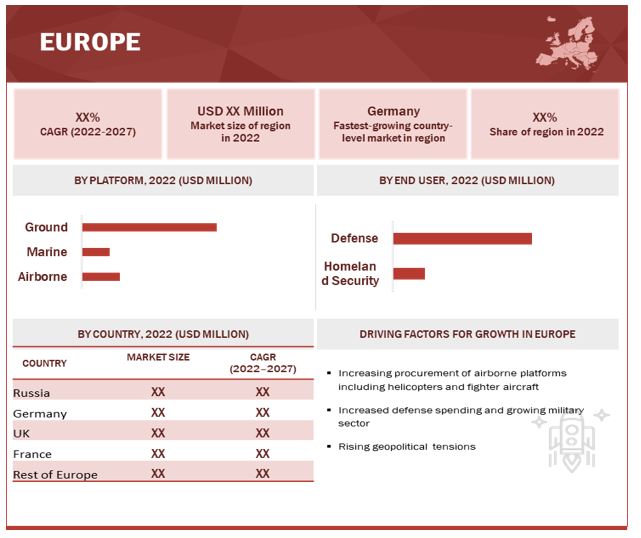

In terms of value, Europe led the active protection system market

Top European economies, including the UK, France, and Germany, are expected to invest in the modernization and upgrade programs of their military capabilities to build an army that is capable of asymmetric warfare. Hence, the market for active protection systems in Europe is projected to witness significant growth during the forecast period. Rheinmetall Defense, Aselsan Inc., SAAB Group, Safran Electronics and Defense, Airbus Group, Thales Group, and Israel Military Industries are the leading manufacturers of active protection systems in the region.

To know about the assumptions considered for the study, download the pdf brochure

Top 5 Key Market Players in Active protection system Market

- Rheinmetall AG (Germany),

- Saab AB (Sweden),

- Raytheon Company (US),

- Airbus (Netherlands), and

- ASELSAN AS (Turkey)

Active protection system Market Scope

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Platform, Kill System Type, End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Rest of the World |

|

Companies covered |

Rheinmetall AG (Germany), Saab AB (Sweden), Raytheon Company (US), Airbus (Netherlands), and Aselsan AS (Turkey) among others |

Active protection system Market Dynamics

Driver: Development of advanced combat systems

Developing economies such as China, India, Brazil, and South Africa are expected to significantly invest in advanced combat systems to prepare themselves for war. Armed with higher budgets, these countries are investing substantially to augment their defense power; this involves upgrading their legacy surveillance systems. The GDP growth of these countries in the last decade is also leading to an increase in their defense budgets.

In January 2022, the US Army awarded a contract to the team of Unified Business Technologies (UBT) and Rheinmetall Protection Systems (Germany) for testing the StrikeShield Active Protection System at the Redstone Test Center in Huntsville, Alabama.

In April 2021, Raytheon Corporation (US) demonstrated its Quick Kill 2.0 system, which uses a vertical launch countermeasure against incoming threats, in the armored vehicle display area.

Restraint: High development and maintenance costs

The high cost incurred on the development of radar systems is one of the major factors hindering the growth of the radar systems market and thus, affecting the active protection systems market.

Since radar is one of the major components of active protection systems, which help to track, engage, and detect the incoming target and send signals to the receptor to act against the threats, they are required to be accurate. Thus, significant investments are required at different stages of the value chain of radar systems, such as research & development, manufacturing, system integration, and assembly. Radar systems are mainly utilized in defense applications. To improve the reliability and performance of radar systems, they need to be durable and energy-efficient with a wide detection range. In the current competitive scenario, to maintain a technological leadership position and develop highly functional and efficient radar systems, key market players have made considerable investments in weapon testing fields and infrastructure and have also collaborated with universities, research institutes, and other companies for research & development.

Opportunity: Development of secure networks against cyber-attack

The major opportunity for market players is to offer a network that can secure sensitive data. The number of cyberattacks in the defense industry has increased in the last few years.

According to the Center for Strategic and International Studies, there have been more than 65 cyber-attacks on various government agencies across the globe between January 2022 and June 2022. Any loss of data can threaten national security. There are several forms of cyber-attacks, from malware injection and phishing to social engineering, DDoS, and brute-force attack. These attacks are becoming more damaging, resulting in huge financial and data losses for defense forces. These threats also pose a risk to the defense industry, as security departments are frequently targeted by hackers for information on defense projects and systems. To counter such cyber attacks, market players are required to take initiatives to provide secured forms of networks for active protection systems.

Challenges: Weapon integration

North American smart weapon manufacturers develop weapons adhering to US standards and policies. There are several countries that do not follow the US standards and use defense systems that are sourced from other countries, especially from Russia, France, and Germany, or use indigenous ones.

Integrating US standard weapons into these systems is a difficult process and needs massive alterations and modernization. For instance, countries such as Israel, Japan, and Saudi Arabia use US F-15/F-16 Fighter jets. They are expected to find it easy to follow the US standards for munitions, as minimal alteration is needed in these aircraft. However, countries such as China, India, France, Germany, and Angola have different fighter aircraft in their inventory, and thus, they will require heavy alterations and upgrades to configure western smart weapon systems. Upgraded munition control units, precision strike packages, and related training and simulation of weapons and their incorporated systems are difficult to integrate and implement in a cost-effective way. These factors are expected to act as a challenge to the integration of active protection systems.

Active protection system Market Categorization

This research report categorizes the Active protection system Market based on Platform, Kill System Type, End User, and Region.

By Platform

- Ground

- Airborne

- Marine

By Kill System Type

- Soft Kill System

- Hard Kill System

- Reactive Armor

By End User

- Defense

- Homeland Security

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In March 2022, Raytheon and Lockheed Martin manufactured the Patriot (MIM-104) air defense system, a long-range, all-altitude, all-weather air defense system to deal with cruise missiles, advanced aircraft, and tactical ballistic missiles.

- In October 2021, At the AUSA Annual Meeting & Exposition (Washington), Rheinmetall presented its next-Gen Technology (HX3 Tactical Truck) that meets the US Army's highest priority modernization challenges. It has enhanced driving comfort, increased mobility, improved crew protection, enhanced driving comfort, and digital interface architecture.

- In October 2021, Rheinmetall Defence Australia confirmed plans to build at the company's Queensland, Australia, factory and export order for the Lynx infantry fighting vehicle's (IFV) test chassis to the US.

- In May 2021, ASELSAN and REHÝS Sector Presidencies started the development of the KAMA active protection system, which is effective at close range and results in low environmental damage.

- In May 2021, French defense procurement agency, Direction Générale De L'armement (DGA), awarded a contract to Saab to deliver its Barracuda multispectral camouflage systems to France.

Frequently Asked Questions (FAQs):

What is the current size of the active protection system market?

The global active protection system market size is projected to grow from USD 3.9 billion in 2022 to USD 5.2 billion by 2027, at a CAGR of 5.5% from 2022 to 2027.

Who are the winners in the active protection system market?

Rheinmetall AG (Germany), Saab AB (Sweden), Raytheon Company (US), Airbus (Netherlands), and ASELSAN AS (Turkey) are some of the winners in the market.

What are some of the technological advancements in the market?

Infrared technology, electro-optical jammers, counter-directed energy weapons and nanotechnology and micro-electro-mechanical systems (MEMS) are some of the technological advancements in the active protection system market.

What are the factors driving the growth of the market?

The active protection system market is being driven by factors such as rising demand for advanced military fleets across globe.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.4.1 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 INCLUSIONS & EXCLUSIONS

1.7 SUMMARY OF CHANGES

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 REPORT PROCESS FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key industry insights

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE ANALYSIS

2.2.2.1 Increase in military spending of emerging countries

2.2.2.2 Global militarization index

2.2.2.3 Rising incidences of regional disputes, terrorism, and political conflicts

2.2.3 SUPPLY-SIDE INDICATORS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 6 ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2022 & 2027 (USD MILLION)

FIGURE 7 ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022 & 2027 (USD MILLION)

FIGURE 8 ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022 & 2027 (USD MILLION)

FIGURE 9 EUROPE ESTIMATED TO LEAD ACTIVE PROTECTION SYSTEM MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ACTIVE PROTECTION SYSTEM MARKET

FIGURE 10 INCREASING DEMAND FOR FIGHTER AIRCRAFT TO DRIVE MARKET FROM 2022 TO 2027

4.2 ACTIVE PROTECTION SYSTEM MARKET, BY SOFT KILL SYSTEM

FIGURE 11 RADAR DECOYS TO LEAD ACTIVE PROTECTION SYSTEM MARKET IN 2022

4.3 ACTIVE PROTECTION SYSTEM MARKET, BY HARD KILL SYSTEM

FIGURE 12 ROCKET/MISSILE-BASED SYSTEMS TO DOMINATE MARKET FROM 2022 TO 2027

4.4 GROUND ACTIVE PROTECTION SYSTEM MARKET, BY TYPE

FIGURE 13 MINE-RESISTANT AMBUSH PROTECTED VEHICLES TO COMMAND LARGEST SHARE

4.5 MARINE ACTIVE PROTECTION SYSTEM MARKET, BY TYPE

FIGURE 14 SUBMARINES TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2022 TO 2027

4.6 AIRBORNE ACTIVE PROTECTION SYSTEM MARKET, BY TYPE

FIGURE 15 HELICOPTERS TO LEAD AMONG AIRBORNE ACTIVE PROTECTION SYSTEMS FROM 2022 TO 2027

4.7 ACTIVE PROTECTION SYSTEM MARKET, BY COUNTRY

FIGURE 16 SOUTH KOREA TO REGISTER HIGHEST CAGR IN ACTIVE PROTECTION SYSTEM MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 ACTIVE PROTECTION SYSTEM MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing procurement of combat vehicles

5.2.1.2 Increasing geopolitical instabilities

5.2.1.3 Development of advanced combat systems

5.2.1.4 Automation of defense systems

5.2.1.5 Increase in asymmetric warfare

5.2.2 RESTRAINTS

5.2.2.1 Increasing prevalence of cyber-warfare

5.2.2.2 High development and maintenance costs

5.2.3 OPPORTUNITIES

5.2.3.1 Development of secure networks against cyber-attack

5.2.4 CHALLENGES

5.2.4.1 Weapon integration

5.2.4.2 Electromagnetic compatibility of radar antennas in military vehicles

5.3 VALUE CHAIN ANALYSIS OF ACTIVE PROTECTION SYSTEM MARKET

FIGURE 18 VALUE CHAIN ANALYSIS

5.4 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 19 REVENUE SHIFT FOR ACTIVE PROTECTION SYSTEM MARKET PLAYERS

5.4.2 ACTIVE PROTECTION SYSTEM MARKET ECOSYSTEM

5.4.3 PROMINENT COMPANIES

5.4.4 PRIVATE AND SMALL ENTERPRISES

5.5 MARKET ECOSYSTEM

FIGURE 20 ACTIVE PROTECTION SYSTEM MARKET ECOSYSTEM

TABLE 1 ACTIVE PROTECTION SYSTEM MARKET ECOSYSTEM

5.6 ACTIVE PROTECTION SYSTEM MARKET: PATENT ANALYSIS

5.7 KEY PATENTS

5.8 AVERAGE SELLING PRICE OF ACTIVE PROTECTION SYSTEM

TABLE 2 AVERAGE SELLING PRICE TREND OF ACTIVE PROTECTION SYSTEM, 2021 (USD MILLION)

5.9 PORTER'S FIVE FORCES ANALYSIS

TABLE 3 ACTIVE PROTECTION SYSTEM: PORTER'S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.9.6 ACTIVE PROTECTION SYSTEM MARKET: TRADE DATA

TABLE 4 NAVIGATIONAL INSTRUMENTS: COUNTRY-WISE IMPORTS, 2019–2020 (USD THOUSAND)

TABLE 5 NAVIGATIONAL INSTRUMENTS: COUNTRY-WISE EXPORTS, 2019–2020 (USD THOUSAND)

TABLE 6 COUNTRY-WISE EXPORTS, 2019–2020 (USD THOUSAND)

TABLE 7 COUNTRY-WISE IMPORTS, 2019–2020 (USD THOUSAND)

5.9.7 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 8 ACTIVE PROTECTION SYSTEM MARKET: CONFERENCES & EVENTS

5.9.8 TARIFF AND REGULATORY LANDSCAPE

5.9.8.1 Regulatory bodies, government agencies, and other organizations

TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.9 REGULATORY LANDSCAPE

5.9.9.1 North America

5.9.9.2 Europe

5.9.10 KEY STAKEHOLDERS & BUYING CRITERIA

5.9.10.1 Key stakeholders in buying process

FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

5.9.11 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR END USERS

TABLE 14 KEY BUYING CRITERIA FOR END USERS

6 INDUSTRY TRENDS (Page No. - 77)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

FIGURE 23 TECHNOLOGY TRENDS IN ACTIVE PROTECTION SYSTEM MARKET

6.2.1 SOFT KILL SYSTEM

6.2.1.1 Infrared Technology

6.2.1.2 Electro-optic Jammers

6.2.2 HARD KILL SYSTEM

6.2.3 REACTIVE ARMOR

6.2.4 COUNTER-DIRECTED ENERGY WEAPONS

6.2.5 MICRO-ELECTRO-MECHANICAL SYSTEMS (MEMS) AND NANOTECHNOLOGY

6.2.6 SENSOR FUSION

6.3 IMPACT OF MEGATRENDS

6.3.1 AI AND COGNITIVE APPLICATIONS

6.3.2 MACHINE LEARNING

6.3.3 DEEP LEARNING

6.3.4 BIG DATA

6.4 USE CASE ANALYSIS

TABLE 15 ACTIVE PROTECTION SYSTEM FOR HX3 TACTICAL TRUCK

TABLE 16 STRIKESHIELD ACTIVE PROTECTION SYSTEM

7 ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE (Page No. - 83)

7.1 INTRODUCTION

FIGURE 24 SOFT KILL SYSTEMS TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 17 ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 18 ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2022–2027 (USD MILLION)

7.2 SOFT KILL SYSTEMS

TABLE 19 SOFT KILL ACTIVE PROTECTION SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 20 SOFT KILL ACTIVE PROTECTION SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2.1 ELECTRO-OPTIC JAMMERS

7.2.1.1 Used to disrupt command to target designator’s line of sight

7.2.2 RADAR DECOYS

7.2.2.1 Growing use as countermeasure system

7.2.3 INFRARED DECOYS

7.2.3.1 Used to counter infrared homing surface-to-air or air-to-air missile

7.2.4 OTHERS

7.3 HARD KILL SYSTEMS

TABLE 21 HARD KILL ACTIVE PROTECTION SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 22 HARD KILL ACTIVE PROTECTION SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.3.1 ROCKET/MISSILE-BASED

7.3.1.1 Rapid technological progress of enemy tank rounds, missiles, and RPGs

7.3.2 LIGHT WEAPON DEFENSE

7.3.2.1 Growing use to counter sea-skimming missiles

7.3.3 DIRECTED ENERGY

7.3.3.1 Growing adoption of counter-directed energy weapons

7.3.4 OTHERS

7.4 REACTIVE ARMOR

8 ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM (Page No. - 89)

8.1 INTRODUCTION

FIGURE 25 GROUND PLATFORM PROJECTED TO LEAD MARKET FROM 2022 TO 2027

TABLE 23 ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 24 ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

8.2 GROUND

TABLE 25 GROUND: ACTIVE PROTECTION SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 26 GROUND: ACTIVE PROTECTION SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2.1 MAIN BATTLE TANKS (MBT)

8.2.1.1 Increasing procurement to drive segment

8.2.2 LIGHT PROTECTED VEHICLES (LPV)

8.2.2.1 Used in homeland security applications

8.2.3 AMPHIBIOUS ARMORED VEHICLES (AAV)

8.2.3.1 Increasing need to support surface assault elements

8.2.4 MINE-RESISTANT AMBUSH PROTECTED (MRAP) VEHICLES

8.2.4.1 Used to counter IED attacks and ambushes

8.2.5 INFANTRY FIGHTING VEHICLES (IFV)

8.2.5.1 Wide-scale adoption in anti-air operations

8.2.6 ARMORED PERSONNEL CARRIERS (APC)

8.2.6.1 Used to transport infantry personnel to battlefield safely

8.2.7 OTHERS

8.3 AIRBORNE

TABLE 27 AIRBORNE: ACTIVE PROTECTION SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 28 AIRBORNE: ACTIVE PROTECTION SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.3.1 FIGHTER AIRCRAFT

8.3.1.1 Increasing competition for airborne dominance

8.3.2 SPECIAL MISSION AIRCRAFT

8.3.2.1 Growing use in tactical and strategic missions

8.3.3 HELICOPTERS

8.3.3.1 Increasing ISR missions and rescue operations

8.3.4 OTHERS

8.4 MARINE

TABLE 29 MARINE: ACTIVE PROTECTION SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 30 MARINE: ACTIVE PROTECTION SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.4.1 DESTROYERS

8.4.1.1 Demand driven by multi-mission capabilities

8.4.2 FRIGATES

8.4.2.1 Growing procurement by naval forces of various countries

8.4.3 AIRCRAFT CARRIERS

8.4.3.1 Segment driven by growing integration of APS on aircraft carriers

8.4.4 SUBMARINES

8.4.4.1 Segment fueled by demand to conduct independent underwater operations

8.4.5 OTHERS

9 ACTIVE PROTECTION SYSTEM MARKET, BY END USER (Page No. - 98)

9.1 INTRODUCTION

FIGURE 26 DEFENSE SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 31 ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 32 ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

9.2 DEFENSE

9.2.1 INCREASING DEMAND FOR ARMORED VEHICLES DUE TO RISE IN CROSS-BORDER CONFLICTS

TABLE 33 DEFENSE: ACTIVE PROTECTION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 DEFENSE: ACTIVE PROTECTION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 HOMELAND SECURITY

9.3.1 INCREASING ADOPTION OF ADVANCED MILITARY TECHNOLOGY FOR HOMELAND SECURITY

TABLE 35 HOMELAND SECURITY: ACTIVE PROTECTION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 HOMELAND SECURITY: ACTIVE PROTECTION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

10 REGIONAL ANALYSIS (Page No. - 103)

10.1 INTRODUCTION

FIGURE 27 ACTIVE PROTECTION SYSTEM MARKET IN EUROPE PROJECTED TO GROW AT HIGHEST RATE FROM 2022 TO 2027

TABLE 37 ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 38 ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 39 ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 40 ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 41 ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 42 ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 43 ACTIVE PROTECTION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 ACTIVE PROTECTION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 28 NORTH AMERICA: ACTIVE PROTECTION SYSTEM MARKET SNAPSHOT

TABLE 45 NORTH AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.2 US

10.2.2.1 Increased spending on procurement of armored vehicles

TABLE 53 US: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 54 US: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 55 US: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 56 US: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.2.3 CANADA

10.2.3.1 Increasing military procurement and growing demand for UAVs

TABLE 57 CANADA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 58 CANADA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 59 CANADA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 60 CANADA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 29 EUROPE: ACTIVE PROTECTION SYSTEM MARKET SNAPSHOT

TABLE 61 EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 62 EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 63 EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 64 EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 65 EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 66 EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 67 EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 68 EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Procurement of new airborne platforms to drive market

TABLE 69 UK: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 70 UK: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 71 UK: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 72 UK: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increased military spending to fuel market growth

TABLE 73 FRANCE: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 74 FRANCE: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 75 FRANCE: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 76 FRANCE: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3.4 GERMANY

10.3.4.1 High investments in multifunctional land-based operations

TABLE 77 GERMANY: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 78 GERMANY: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 79 GERMANY: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 80 GERMANY: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3.5 RUSSIA

10.3.5.1 Rising geopolitical tensions and increasing military expenditure

TABLE 81 RUSSIA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 82 RUSSIA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 83 RUSSIA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 84 RUSSIA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 85 REST OF EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 86 REST OF EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 87 REST OF EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 88 REST OF EUROPE: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET SNAPSHOT

TABLE 89 ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 90 ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 92 ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 93 ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 94 ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Rapid growth in defense funding

TABLE 97 CHINA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 98 CHINA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 99 CHINA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 100 CHINA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 In-house development of military equipment

TABLE 101 INDIA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 102 INDIA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 103 INDIA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 104 INDIA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4.4 JAPAN

10.4.4.1 Wide-scale adoption of next-generation soft kill systems

TABLE 105 JAPAN: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 106 JAPAN: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 107 JAPAN: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 108 JAPAN: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4.5 SOUTH KOREA

10.4.5.1 Increased spending on UAVs to drive market

TABLE 109 SOUTH KOREA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 110 SOUTH KOREA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 111 SOUTH KOREA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 112 SOUTH KOREA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4.6 AUSTRALIA

10.4.6.1 Increasing modernization of combat fleets

TABLE 113 AUSTRALIA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 114 AUSTRALIA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 115 AUSTRALIA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 116 AUSTRALIA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

TABLE 117 REST OF ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 118 REST OF ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 119 REST OF ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST

10.5.1 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 31 MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET SNAPSHOT

TABLE 121 MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 122 MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 123 MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 124 MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 125 MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 126 MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 127 MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 128 MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.2 TURKEY

10.5.2.1 High military expenditure to drive market growth

TABLE 129 TURKEY: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 130 TURKEY: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 131 TURKEY: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 132 TURKEY: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.5.3 ISRAEL

10.5.3.1 Increase in R&D of varied countermeasure systems

TABLE 133 ISRAEL: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 134 ISRAEL: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 135 ISRAEL: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 136 ISRAEL: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.5.4 REST OF MIDDLE EAST

TABLE 137 REST OF MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 138 REST OF MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 139 REST OF MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 140 REST OF MIDDLE EAST: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.6 REST OF THE WORLD

10.6.1 PESTLE ANALYSIS: REST OF THE WORLD

TABLE 141 REST OF THE WORLD: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 142 REST OF THE WORLD: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 143 REST OF THE WORLD: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 144 REST OF THE WORLD: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 145 REST OF THE WORLD: ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 146 REST OF THE WORLD: ACTIVE PROTECTION SYSTEM MARKET, BY KILL SYSTEM TYPE, 2022–2027 (USD MILLION)

TABLE 147 REST OF THE WORLD: ACTIVE PROTECTION SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 148 REST OF THE WORLD: ACTIVE PROTECTION SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6.2 LATIN AMERICA

10.6.2.1 Increasing demand for military armored vehicles from Brazil

TABLE 149 LATIN AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 150 LATIN AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 151 LATIN AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 152 LATIN AMERICA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

10.6.3 AFRICA

10.6.3.1 Increase in procurement of defense equipment

TABLE 153 AFRICA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 154 AFRICA: ACTIVE PROTECTION SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 155 AFRICA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 156 AFRICA: ACTIVE PROTECTION SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

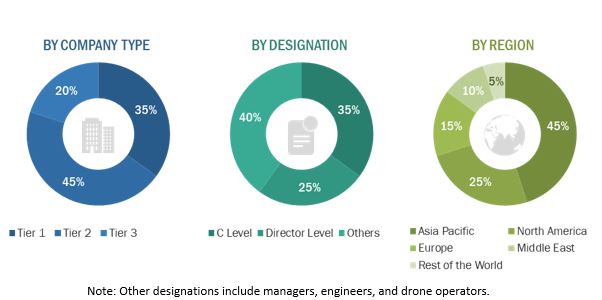

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the active protection system market. Primary sources included industry experts from the core and related industries as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as to assess prospects for the growth of the market during the forecast period.

Secondary Research

The share of companies in the active protection system market was determined using secondary data made available through paid and unpaid sources and by analyzing their product portfolios. The companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources that were referred to for this research study on the active protection system market included financial statements of companies offering and developing active protection system products and solutions and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the active protection system market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the active protection system market through secondary research. Several primary interviews were conducted with market experts from both, the demand- and supply-side across 5 major regions, namely, North America, Europe, Asia Pacific, and the Middle East and Rest of the World. This primary data was collected through questionnaires, mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

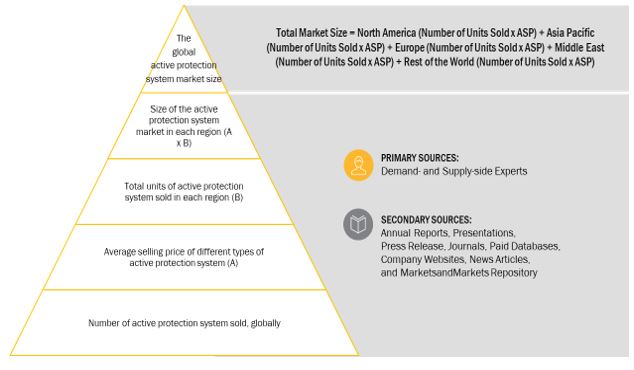

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the size of the active protection system market.

The research methodology that was used to estimate the size of the active protection system market includes the following details.

Key players in the active protection system market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders such as chief executive officers, directors, and marketing executives of the leading companies operating in the active protection system market.

All percentage shares, splits, and breakdowns were determined using secondary sources and were verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the active protection system market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

Data Triangulation

After arriving at the overall size of the active protection system market from the market size estimation process explained above, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures explained below have been implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both, top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the size of the active protection system market based on platform, kill system type, end user, and region for the forecast period from 2022 to 2027

- To forecast the size of various segments of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW), along with the major countries in each of these regions

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify opportunities for stakeholders in the market by studying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and R&D activities in the market

- To estimate the procurement of active protection system by different countries to track the market size of active protection system

- To provide a comprehensive competitive landscape of the market along with an overview of the different strategies adopted by key players to strengthen their position in the market

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers & acquisitions, partnerships, agreements, and product developments in the active protection system market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations:

Along with market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Market analysis of additional countries (subject to the data availability)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Active Protection System Market