Europe Fuel Cell Technology Market By Applications (Portable, Stationary, Transport), Types (PEMFC, DMFC, PAFC, SOFC, MCFC), Fuel (Hydrogen, Natural Gas, Methanol, Anaerobic Digester Gas) & Geography- European Trends And Forecast To 2018

The technology of converting chemical energy into electrical energy through electromechanical reaction is used in fuel cells, performing functions like an engine for converting fuel into electricity without burning it. Fuel cells are differentiated on the basis of the components used and the type of reaction taking place within the cell. Fuels required by them include hydrogen, methanol, biogas, natural gas, and hydrocarbons. When working with hydrogen, fuel cell generates water as an outcome and generates electricity with zero emission. The growing environmental concerns and rise in demand for clean energy are propelling the growth of fuel cells. Europe is at the forefront of this technology with EU funding such ventures and European companies developing more efficient fuel cell systems.

The European fuel cell market is segmented on the basis of applications, types, primary fuel sources, and countries. The data is analyzed over a period of 2011 to 2018. The quantitative data regarding all the above segmentations is given in terms of value ($million).

The European fuel cell market revenue is estimated to reach $613.7 Million by 2018. The unit shipments of fuel cells are expected to increase from 3,776 units in 2012 to 338,727 units by 2018. Stationary applications are rising as they are very efficient sources of off grid power. With Europes target of reducing the carbon footprint by 80%, fuel cells offer a great alternative with zero emission and clean energy source due to which it is experiencing a high demand. Commercialization of fuel cells and establishment of fuel cell infrastructure are challenging from Europes point of view.

The report covers major market drivers, restraints, opportunities, winning imperatives, and key burning issues of the fuel cell market. Key players in the industry such as AFC Energy (U.K.), Heliocentris (Germany), Topsoe (Denmark), Genport SRL (Italy), SFC Energy (Germany), and Ceres Power (U.K.) are profiled in detail.

Customer Interested in this report also can view

-

Fuel Cell Technology Market: By Applications (Portable, Stationary, Transport), Types (PEMFC, DMFC, PAFC, SOFC, MCFC), Fuel (Hydrogen, Natural Gas, Methanol, Anaerobic Digester Gas) & Geography- Global Trends and Forecast to 2018

-

North America Fuel Cell Technology Market: By Applications (Portable, Stationary, Transport), Types (PEMFC, DMFC, PAFC, SOFC, MCFC), Fuel (Hydrogen, Natural Gas, Methanol, Anaerobic Digester Gas) & Geography- Trends And Forecast To 2018

Fuel Cell Technology is a clean energy source getting commercialized widely for its applications. The fuel cell industry has been growing at a promising growth rate in past few years. The technological developments and growing commercialization have fuelled the demand for fuel cells. This growing demand of fuel cells has been positively affecting the development of hydrogen infrastructure globally. The stationary units used for telecommunication and household purposes are primarily designed keeping in mind the cost. The primary fuel source is a major aspect of the fuel cells as its availability affects the use of fuel cells.

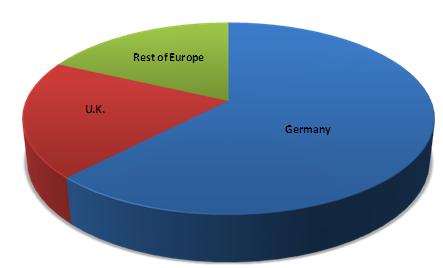

European fuel cell market is witnessing decent growth based on increased clean energy demand and large investments related to hydrogen infrastructure development, especially in Germany and U.K. Germany holds the major market share followed by U.K. and Rest of Europe. In terms of applications of the fuel cell, the market is dominated by stationary applications due to the off grid applications and household applications.

Fuel Cell Market Share, By Geography, 2012

Source: MarketsandMarkets Analysis

AFC Energy (U.K.), Topsoe (Denmark), Ceres Power (U.K.), and SFC Energy(Germany) are the major players constituting major share of the European market for fuel cell technology.

Most of these companies mainly relied on growth strategies such as agreements and contracts, joint ventures and collaborations, mergers and acquisitions, and expansions in diversified geographic areas. The growing demand for technologically advanced clean energy solutions has prompted most of the companies to launch highly innovative and integrated fuel cell solutions.

Agreements, collaborations & partnerships are the key strategies that are helping the companies to penetrate the existing market, and expansion into the new and emerging markets.

Major fuel type/technologies include Polymer/Proton Exchange Membrane (PEM) Fuel Cell, Direct Methanol Fuel Cell, and Phosphoric Acid Fuel Cell, Solid Oxide Fuel Cell, Molten Carbonate Fuel Cell and others. Polymer/Proton Exchange Membrane (PEM) Fuel Cell are the largest type in terms of revenue generating more than half of the revenue. The major primary fuel source for fuel cells is Hydrogen.

Table Of Contents

1 Introduction (Page No. - 12)

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodolgy

1.5.1 Market Size

1.5.2 Key Data Points Taken From Secondary Sources

1.5.3 Key Data Points Taken From Primary Sources

1.5.4 Assumptions Made For This Report

2 Executive Summary (Page No. - 16)

3 Premium Insights (Page No. - 18)

3.1 Germany Dominating European Market

3.2 Germany Lead Market, By Capacity

3.3 Germany Holding Major Share, By Unit Shipments

3.4 Stationary And Portable Major Fuel Cell Applications

3.5 PEMFC & MCFC Dominate Market By Capacity While DMFC, PAFC & SOFC Show Towering Growth

3.6 PEMFC Dominating The Fuel Cell Market

3.7 Hydrogen - Most Effective Fuel

4 Market Overview (Page No. - 29)

4.1 Introduction

4.2 Burning Issue

4.2.1 Decreasing Co2 Emission By 80% Till 2050

4.2.2 Target Of Low Carbon Economy

4.3 Winning Imperatives

4.3.1 Collaborations/Partnership For Research

4.3.2 Mergers & Acquisition

4.4 Market Dynamics

4.4.1 Drivers

4.4.1.1 Public Private Partnerships

4.4.1.2 Increase In Oil Prices

4.4.1.3 Growing Demand For Fuel Cells From Power Suppliers, Automobile Companies, Residential Builders And Electronics Companies

4.4.1.4 Maintain Technology Leadership

4.4.2 Restraints

4.4.2.1 Pending Policies

4.4.3 Opportunities

4.4.3.1 Decrease Dependency On Oil Imports

4.4.3.2 Off-Grid Power Applications

4.4.3.3 Exports To The Developing Nations And Emerging Market

4.5 Investments In R&D

4.6 Value Chain Analysis

4.7 Porters Five Forces Analysis For Fuel Cells

4.8 Patent Analysis

5 European Fuel Cell Market, By Applications (Page No. - 43)

5.1 Introduction

5.2 European Fuel Cell Market- By Applications

5.3 Stationary Applications Market

5.4 Transportation Applications Market

5.5 Portable Applications Market

6 European Fuel Cell Market- By Country (Page No. - 62)

6.1 Market Overview

6.2 Germany

6.3 United Kingdom

6.4 Rest Of Europe

7 European Fuel Cell Market, By Types/ Technologies (Page No. - 87)

7.1 Introduction

7.2 Fuel Cell Market By Types/Technologies

7.3 Polymer/ Proton Exchange Membrane Fuel Cells (PEM)

7.4 Solid Oxide Fuel Cells (SOFC)

7.5 Molten Carbonate Fuel Cells (MCFC)

7.6 Phosphoric Acid Fuel Cells (PAFC)

7.7 Direct Methanol Fuel Cells (DMFC)

7.8 Alkaline Fuel Cells (AFC)

7.9 Direct Carbon Fuel Cells (DCFC)

7.10 Zinc Air Fuel Cells (ZAFC)

7.11 Protonic Ceramic Fuel Cells (PCFC)

7.12 Microbial Fuel Cells (MFC)

8 European Fuel Cells Market, By Fuel (Page No. - 111)

8.1 Introduction

8.2 Hydrogen

8.3 Natural Gas/ Methane

8.4 Methanol

8.5 Anaerobic Digester Gas

9 Competitive Landscape (Page No. - 125)

9.1 Introduction

9.2 Growth Strategies In The European Fuel Cell Market

9.3 Most Active Companies In The European Fuel Cell Market

9.4 Agreements, Collaborations & Partnerships

9.5 New Products Launch

9.6 Investments, Expansion & Other Developments

9.7 Mergers & Acquisitions

10 Company Profiles (Overview, Products And Services, Financials, Strategy And Developments)* (Page No. - 137)

10.1 AFC Energy PLC

10.2 Ceres Power Holdings PLC

10.3 Genport SRL

10.4 Nedstack Fuel Cell Technology B.V.

10.5 SFC Energy AG

10.6 Topsoe Fuel Cell

10.6.1 Overview

10.6.2 Financials

10.6.3 Products & Services

10.6.4 Strategy

10.6.5 Developments

List Of Tables (87 Tables)

Table 1 European Fuel Cell Market, By Units, 2011 - 2018

Table 2 Regional Dominance & Key Market Players

Table 3 Market Demand Variations

Table 4 Unit Shipments: Market Scenario

Table 5 Fuel Cell: Applications & Key Insights

Table 6 Fuel Cell: Market Growth, By Type

Table 7 Fuel Cell Market, By Types

Table 8 Fuel Cell Market Share, Fuel Types

Table 9 Porters Five Forces Analysis

Table 10 Fuel Cell: Characteristics, By Applications

Table 11 Fuel Cell: Market Volume, By Application,2011 2018 (Unit Shipments)

Table 12 Fuel Cell: Market Capacity, By Applications, 2011 2018 (MW)

Table 13 European Fuel Cell: Market Revenue, By Applications,2011 2018, ($ Million)

Table 14 Stationary Fuel Cells: Market Volume, By Geography,2011 2018 (Unit Shipments)

Table 15 Stationary Fuel Cells: Market Capacity, By Geography,2011 2018 (MW)

Table 16 Stationary Fuel Cells: Market Revenue, By Geography,2011 2018($ Million)

Table 17 Transportation Fuel Cells: Market Volume, By Geography, 2011 2018 (Unit Shipments)

Table 18 Transportation Fuel Cells: Market Capacity, By Geography, 2011 2018 (MW)

Table 19 Transportation Fuel Cells Market, By Geography,2011 2018 ($ Million)

Table 20 Different Portable Applications

Table 21 Portable Fuel Cells: Market Volume, By Geography,2011 2018 (Unit Shipments)

Table 22 Portable Fuel Cells: Market Capacity, By Geography,2011 2018 (MW)

Table 23 Portable Fuel Cells: Market Revenue, By Geography,2011 2018 ($ Million)

Table 24 European Fuel Cell: Market Volume, By Geography, 2011-2018 (Unit Shipments)

Table 25 European Fuel Cells: Market Capacity, By Geography,2011 2018 (MW)

Table 26 European Fuel Cells: Market Revenues, By Geography,2011 2018 ($Million)

Table 27 Germany: Fuel Cells, Market Volume, By Applications,2011 2018 (Unit Shipments)

Table 28 Germany: Fuel Cells, Market Capacity, By Applications,2011 2018 (MW)

Table 29 Germany: Fuel Cells, Market Revenue, By Applications,2011 2018 ($Million)

Table 30 Germany: Fuel Cells, Market Volume, By Fuel Cell Technology, 2011 2018 (Unit Shipments)

Table 31 Germany: Fuel Cells, Market Capacity, By Fuel Cell Technology Types, 2011 2018 (MW)

Table 32 Fuel Cells: Market Revenue, By Fuel Cell Technology Types, 2011 2018 ($Million)

Table 33 United Kingdom: Fuel Cells, Market Volume, By Applications, 2011 2018 (Unit Shipments)

Table 34 United Kingdom: Fuel Cells, Market Capacity, By Applications, 2011 2013 (MW)

Table 35 United Kingdom: Fuel Cells, Market Revenue, By Fuel Cell Technology Applications, 2011 2018 ($ Million)

Table 36 United Kingdom : Fuel Cells, Market Volume, By Fuel Cell Technology Types, 2011 2018 (Unit Shipments)

Table 37 United Kingdom : Fuel Cells, Market Capacity, By Fuel Cell Technology Types, 2011 2018 (MW)

Table 38 United Kingdom: Fuel Cells Market Revenues, By Fuel Cell Technology Types, 2011 2018 ($Million)

Table 39 Rest Of Europe: Fuel Cells, Market Volume, By Applications, 2011 2018 (Unit Shipments)

Table 40 Rest Of Europe: Fuel Cells, Market Capacity, By Applications, 2011 2018 (MW)

Table 41 Rest Of Europe : Fuel Cells, Market Revenues,By Applications, 2011 2018 ($Million)

Table 42 Rest Of Europe: Fuel Cells, Market Volume, By Fuel Cell Technology Types, 2011 2018 (Unit Shipments)

Table 43 Rest Of Europe: Fuel Cells, Market Capacity, By Fuel Cell Technology Types, 2011 2018 (MW)

Table 44 Rest Of Europe: Fuel Cells, Market Revenue, By Fuel Cell Technology Types, 2011 2018 ($Million)

Table 45 Fuel Cell Characteristics, By Types

Table 46 Types Of Fuel Cell- Pros & Cons

Table 47 European Fuel Cells: Market Volume, By Types,2011-2018 (Unit Shipments)

Table 48 European Fuel Cells: Market Capacity, By Types,2011 2018 (MW)

Table 49 European Fuel Cells: Market Revenues, By Types,2011 2018 ($Million)

Table 50 PEMFC: Market Volume, By Geography,2011 2018 (Unit Shipments)

Table 51 PEMFC: Market Capacity, By Geography, 2011 2018 (MW)

Table 52 PEMFC: Market Revenue, By Geography, 2011 2018 ($Million)

Table 53 SOFC: Market Volume, By Geography, 2011 2018 (Units)

Table 54 SOFC: Market Capacity, By Geography, 2011 2018 (MW)

Table 55 SOFC: Market Revenue, By Geography, 2011 2018 ($Million)

Table 56 MCFC: Market Volume, By Geography,2011 2018 (Unit Shipments)

Table 57 MCFC: Market Capacity, By Geography, 2011 2018 (MW)

Table 58 MCFC: Market Revenue, By Geography, 2011 2018 ($Million)

Table 59 PAFC: Market Volume, By Geography,2011 2018 (Unit Shipments)

Table 60 PAFC: Market Capacity, By Geography, 2011 2018 (MW)

Table 61 PAFC: Market Revenue, By Geography, 2011 2018 ($Million)

Table 62 DMFC: Market Volume, By Geography,2011 2018 (Unit Shipments)

Table 63 DMFC: Market Capacity, By Geography, 2011 2018 (MW)

Table 64 DMFC: Market Revenue, By Geography, 2011 2018 ($Million)

Table 65 Fuel Cells: Market Revenue, By Fuels, 2011 - 2018 ($Million)

Table 66 Hydrogen Fuel Cells: Market Volume, By Geography,2011 - 2018 (Unit Shipments)

Table 67 Hydrogen Fuel Cells: Market Capacity, By Geography,2011 - 2018 (MW)

Table 68 Hydrogen Fuel Cells: Market Revenue, By Geography,2011 - 2018 ($Million)

Table 69 Natural Gas Fuel Cells: Market Volume, By Geography,2011 - 2018 (Units)

Table 70 Natural Gas Fuel Cells: Market Capacity, By Geography,2011 - 2018 (MW)

Table 71 Natural Gas Fuel Cells: Market Revenue, By Geography,2011 - 2018 ($Million)

Table 72 Methanol Fuel Cells: Market volume, By Geography,2011 - 2018 (Units)

Table 73 Methanol Fuel Cells: Market Capacity, By Geography,2011 - 2018 (MW)

Table 74 Methanol Fuel Cells: Market Revenue, By Geography,2011 - 2018 ($Million)

Table 75 Anaerobic Digester Gas Fuel Cells: Market Volume,By Geography, 2011 - 2018 (Units)

Table 76 Anaerobic Digester Gas Fuel Cells: Market Capacity,By Geography, 2011 - 2018 (MW)

Table 77 Anaerobic Digester Gas Fuel Cells: Market Revenue,By Geography, 2011 - 2018 ($Million)

Table 78 Agreements, Collaborations & Partnerships, 2010 - 2013

Table 79 New Product Launches, 2010 - 2013

Table 80 Investments, Expansions & Other Developments, 2010 - 2013

Table 81 Mergers & Acquisitions, 2010 To 2013

Table 82 AFC Energy: Annual Revenue, 2010 - 2012 ($Million)

Table 83 Ceres Power: Annual Revenue, 2010 - 2012 ($Million)

Table 84 Genport: Products & Their Applications

Table 85 Nedstack: Products & Their Output

Table 86 SFC Energy: Annual Revenue, 2010 - 2012 ($Million)

Table 87 SFC Energy: Products & Their Applications

List Of Figures (25 Figures)

Figure 1 European Fuel Cell Market: Regional Scenario

Figure 2 European Fuel Cells: Regional Market, By Capacity

Figure 3 Europe Fuel Cell: Market Volume: 2013 2018

Figure 4 Fuel Cell: Market Share, By Applications, 2012 2018

Figure 5 Market Dynamics, By Capacity, 2013 2018 (MW)

Figure 6 Fuel Cell: Market Share, By Revenue & Types

Figure 7 Fuel Cell: Market, By Fuels

Figure 8 R&D Expenditure, By European Govt. Organisation, ($Million)

Figure 9 R&D Expenditure, European Private Sector ($Billion)

Figure 10 R&D Expenditure, By European Companies, 2010-2012 ($Million)

Figure 11 Value Chain For Fuel Cell Industry

Figure 12 Porters Five Forces

Figure 13 Number Of Patents For Fuel Cells, 2011 2013

Figure 14 Stationary Fuel Cells: Market Share Unit Volume By Geography, 2011 2018

Figure 15 Transportation Fuel Cells: Market Share Unit Volume By Geography, 2011 2018

Figure 16 Portable Fuel Cell: Market Share Unit Volume By Geography, 2011 2018

Figure 17 Shift Inmarket Share, By Fuel Cell Types, 2012 2018

Figure 18 Shift In Market Share, By Fuel Cell Types, 2011 2018

Figure 19 Shift In Market Share, By Fuel Cell Types, 2011 2018

Figure 20 Market Strategies

Figure 21 Most Active Companies Market Share, 2011 To 2013

Figure 22 Agreements, Collaborations & Partnerships, 2010 2013

Figure 23 New Products Launch, 2010 - 2013

Figure 24 Investments, Expansions & Other Developments, 2010 - 2013

Figure 25 Mergers & Acquisitions, 2010 - 2013

Growth opportunities and latent adjacency in Europe Fuel Cell Technology Market