Distributed Generation Market by Technology (Solar PV, Wind, Reciprocating Engines, Microturbines, Fuel Cells, Gas Turbines), Application (On-Grid, Off-Grid), End-User (Industrial, Commercial, Residential), and Region - Global Forecast to 2022

[149 Pages Report] The distributed generation market was USD 54.26 Billion in 2016 and is expected to grow at a CAGR of 11.48% from 2017 to 2022 to reach a market size of USD 103.38 Billion by 2022. This growth can be attributed to the increased global demand for electricity, decreasing costs of solar technology, and rising efforts to reduce global greenhouse gas emissions. The market is segmented by application, technology, end-user, and region.

The years considered for the study are as follows:

- Base Year: 2016

- Estimated Year: 2017

- Projected Year: 2022

- Forecast Period: 2017 to 2022

The base year considered for company profiles is 2016. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, and forecast the market by technology, application, end-user, and region

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future prospects, and the contribution of each segment to the market

- To track and analyze competitive developments such as contracts & agreements, new product launches, expansions and investments, and partnerships and collaborations in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the market. Primary sources are mainly industry experts from the core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standard and certification organizations of companies, and organizations related to all the segments of this industrys value chain. The points given below explain the research methodology.

- Study of the annual revenue and market developments of major players that provide distributed generation

- Assessment of future trends and growth of end-users

- Assessment of the market with respect to the type of technology used for different applications

- Study of contracts and developments related to the market by key players across different regions

- Finalization of overall market sizes by triangulating the supply-side data, which includes product developments, supply chain, and annual revenues of companies supplying distributed generation across the globe

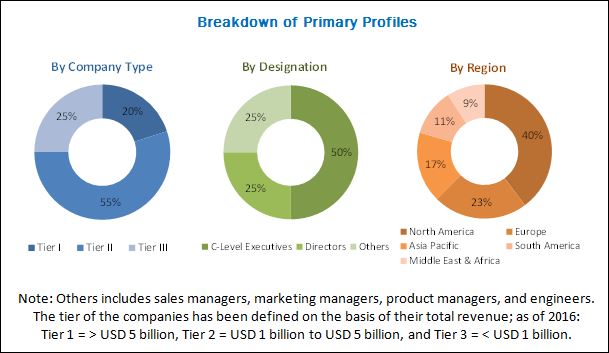

After arriving at the overall market size, the total market has been split into several segments and sub-segments. The figure given below illustrates the breakdown of primaries conducted during the research study on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

Distributed generation refers to power generation at the point of consumption. The distributed generation market starts with the manufacturing of basic components of distributed power technologies which include turbines, engines, solar panels, combustion chambers, motors, and catalyst layers. In the later stage, the assembling of distributed generation technologies takes place where all the components are integrated. These equipment are then distributed to various industrial, commercial, and residential end-users where they are commissioned. The leading players in the distributed generation industry include Siemens (Germany), GE (US), Schneider (France), Mitsubishi (Japan), Doosan (South Korea), and Capstone (US).

Target Audience:

The reports target audience includes:

- Distributed generation solution providers

- Distribution grid operators

- Electric utilities

- Energy storage device/equipment manufacturers and integrators

- Government and research organizations

- Institutional investors

- Distribution consultancies

- Microgrid developers

Scope of the report:

- On-Grid

- Off-Grid

- Industrial

- Commercial

- Residential

- Solar PV

- Wind

- Reciprocating engines

- Microturbines

- Fuel cells

- Gas turbines

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

By Application

By End-User

By Technology

By Region

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of region/country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The distributed generation market is projected to reach a market size of USD 60.04 Billion in 2017 and is expected to grow at a CAGR of 11.48% from 2017 to 2022. The growing demand for electric power accompanied with regulatory incentives for clean energy generation have shifted the focus toward distributed generation technologies.

The report segments the market, on the basis of application, into on-grid and off-grid systems. The on-grid segment led the market in 2016. Grid-connected installations are largely used as a long-term investment to provide energy for local loads and for the exchange of power with utility grids. These are used for power generation by various end-users including industries and manufacturing applications.

The global market, by technology, is segmented into solar PV, wind, microturbines, reciprocating engines, fuel cells, and gas turbines, of which, solar PV is the fastest growing segment. The decreasing costs of solar installations, attractive incentives, and greenhouse gas emission restrictions are expected to drive the adoption of solar PV technology for power generation during the forecast period.

The report further segments the market, by end-user into industrial, commercial, and residential segments. The commercial segment of distributed generation is expected to grow at the highest CAGR during the forecast period. Government initiatives toward green solutions, the growing demand for reliable power, and easy availability of fuel are expected to drive the growth of the global market during the forecast period.

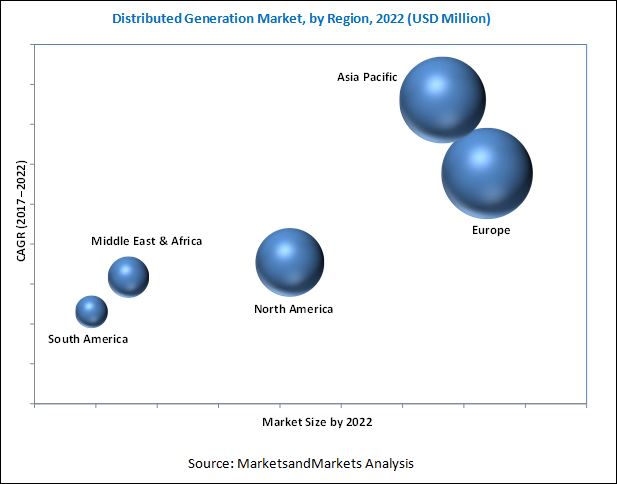

In this report, the market has been analyzed with respect to six regions, namely, North America, Europe, Asia Pacific, South America, the Middle East, and Africa. Europe is expected to dominate the market during the forecast period, owing to the continued increase in energy consumption mainly from by the industrial and commercial sectors, which contributed to the largest demand for distributed generations. The demands from the IT and telecommunication sectors are also driving the market. The figure given below shows the market size of the year 2022 in various regions, with the respective CAGRs.

The major factor restraining the growth of the market is the reluctance to spend on distributed generations technologies as it takes a lot of investments, effort, and time to alter and switch to decentralized business models which were earlier functioning in a traditional centralized way.

Some of the leading players in the distributed generation market include Siemens (Germany), GE (US), Schneider (France), Mitsubishi (Japan), and Capstone (US). These players have adopted growth strategies such as new product launches, contracts & agreements, mergers & acquisitions, and expansions to capture a larger share in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered For the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Distributed Generation Market

4.2 Distributed Generations Market, By Application

4.3 Distributed Generations Market, By Technology

4.4 Distributed Generations Market, By End-User

4.5 European Distributed Generations Market Size, By Application & Country

4.6 Distributed Generations Market, By Country

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Share of Renewable Power Generation and Increasing Government Mandates

5.2.1.2 Shift From Centralized to Distributed Generation

5.2.1.3 Increasing Electricity Consumption

5.2.2 Restraints

5.2.2.1 Reluctance to Spend on Distributed Generation

5.2.3 Opportunities

5.2.3.1 Application in Hybrid Energy Systems

5.2.4 Challenges

5.2.4.1 Grid Functionality and System Balance

5.2.4.2 Islanding in Power Systems

5.2.4.3 Intermittent and Variable Nature of Sources Such as Solar and Wind

6 Distributed Generation Market, By Technology (Page No. - 36)

6.1 Introduction

6.2 Solar PV

6.3 Wind

6.4 Reciprocating Engines

6.5 Fuel Cells

6.6 Microturbines

6.7 Gas Turbines

6.8 Others

7 Distributed Generations Market, By Application (Page No. - 45)

7.1 Introduction

7.2 On-Grid

7.3 Off-Grid

8 Distributed Generations Market, By End-User (Page No. - 49)

8.1 Introduction

8.2 Industrial

8.2.1 Oil & Gas

8.2.2 Manufacturing and Process Industry

8.2.3 Mining

8.2.4 Others

8.3 Commercial

8.3.1 Shopping Malls

8.3.2 Hospitals

8.3.3 Airports

8.3.4 Others

8.4 Residential

9 Distributed Generations Market, By Region (Page No. - 58)

9.1 Introduction

9.2 Europe

9.2.1 By Technology

9.2.2 By Application

9.2.3 By End-User

9.2.4 By Country

9.2.4.1 Russia

9.2.4.2 UK

9.2.4.3 Germany

9.2.4.4 France

9.2.4.5 Rest of Europe

9.3 Asia Pacific

9.3.1 By Technology

9.3.2 By Application

9.3.3 By End-User

9.3.4 By Country

9.3.4.1 China

9.3.4.2 Australia

9.3.4.3 India

9.3.4.4 Japan

9.3.4.5 Rest of Asia Pacific

9.4 North America

9.4.1 By Technology

9.4.2 By Application

9.4.3 By End-User

9.4.4 By Country

9.4.4.1 US

9.4.4.2 Canada

9.4.4.3 Mexico

9.5 Middle East & Africa

9.5.1 By Technology

9.5.2 By Application

9.5.3 By End-User

9.5.4 By Country

9.5.4.1 South Africa

9.5.4.2 Saudi Arabia

9.5.4.3 UAE

9.5.4.4 Nigeria

9.5.4.5 Rest of the Middle East & Africa

9.6 South America

9.6.1 By Technology

9.6.2 By Application

9.6.3 By End-User

9.6.4 By Country

9.6.4.1 Brazil

9.6.4.2 Argentina

9.6.4.3 Rest of South America

10 Competitive Landscape (Page No. - 97)

10.1 Introduction

10.2 Market Ranking Analysis

10.3 Strength of Product Portfolio

10.4 Business Strategy Excellence

10.5 Competitive Scenario

10.5.1 Contracts & Agreements

10.5.2 Partnerships, Collaborations, & Joint Ventures

10.5.3 New Product Launches

10.5.4 Investments & Expansions

10.5.5 Mergers & Acquisitions

11 Company Profiles (Page No. - 105)

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, and MnM View)*

11.1 Siemens

11.2 General Electric

11.3 Schneider Electric

11.4 Mitsubishi Heavy Industries

11.5 Caterpillar

11.6 Capstone

11.7 Ansaldo Energia

11.8 Cummins

11.9 Fuelcell Energy

11.10 Bloom Energy

11.11 Flexenergy

11.12 Bergey

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 142)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (70 Tables)

Table 1 Distributed Generation Market Snapshot

Table 2 Market, By Technology, 2015 vs 2022 (Gw)

Table 3 Market Size, By Technology, 20152022 (USD Billion)

Table 4 Solar PV: Market Size, By Region, 20152022 (USD Million)

Table 5 Wind: Market Size, By Region, 20152022 (USD Million)

Table 6 Reciprocating Engines: Market Size, By Region, 20152022 (USD Million)

Table 7 Fuel Cells: Market Size, By Region, 20152022 (USD Million)

Table 8 Microturbines: Market Size, By Region, 20152022 (USD Million)

Table 9 Gas Turbines: Market Size, By Region, 20152022 (USD Million)

Table 10 Others: Market Size, By Region, 20152022 (USD Million)

Table 11 Distributed Generation Market Size, By Application, 20152022 (USD Billion)

Table 12 On-Grid: Market Size, By Region,20152022 (USD Million)

Table 13 Off-Grid: Market Size, By Region, 20152022 (USD Million)

Table 14 Market Size, By End-User, 20152022 (USD Billion)

Table 15 Industrial: Market Size, By Region, 20152022 (USD Million)

Table 16 Oil & Gas: Market Size, By Region, 20152022 (USD Million)

Table 17 Manufacturing and Process Industry: Market Size, By Region, 20152022 (USD Million)

Table 18 Mining: Market Size, By Region, 20152022 (USD Million)

Table 19 Others: Market Size, By Region, 20152022 (USD Million)

Table 20 Commercial: Market Size, By Region, 20152022 (USD Million)

Table 21 Residential: Market Size, By Region, 20152022 (USD Million)

Table 22 Distributed Generations Market Size, By Region, 20152022 (USD Billion)

Table 23 Distributed Generation Policy Support in Select Eu Countries

Table 24 Europe: Distributed Generation Market Size, By Technology,20152022 (USD Billion)

Table 25 Europe: Market Size, By Application, 20152022 (USD Billion)

Table 26 Europe: Market Size, By End-User, 20152022 (USD Billion)

Table 27 Europe: Market Size, By Country, 20152022 (USD Billion)

Table 28 Russia: Market Size, By End-User, 20152022 (USD Million)

Table 29 UK: Distributed Generation Market Size, By End-User, 20152022 (USD Million)

Table 30 Germany: Market Size, By End-User, 20152022 (USD Million)

Table 31 France: Market Size, By End-User, 20152022 (USD Million)

Table 32 Rest of Europe: Market Size, By End-User, 20152022 (USD Million)

Table 33 Asia Pacific: Distributed Generation Market Size, By Technology, 20152022 (USD Billion)

Table 34 Asia Pacific: Market Size, By Application, 20152022 (USD Billion)

Table 35 Asia Pacific: Market Size, By End-User, 20152022 (USD Billion)

Table 36 Asia Pacific: Market, By Country, 20152022 (USD Billion)

Table 37 China: Distributed Generation Market Size, By End-User, 20152022 (USD Million)

Table 38 Australia: Market Size, By End-User, 20152022 (USD Million)

Table 39 India: Market Size, By End-User, 20152022 (USD Million)

Table 40 Japan: Market Size, By End-User, 20152022 (USD Million)

Table 41 Rest of Asia Pacific: Market Size, By End-User, 20152022 (USD Million)

Table 42 North America: Distributed Generation Market Size, By Technology, 20152022 (USD Billion)

Table 43 North America: Market Size, By Application, 20152022 (USD Billion)

Table 44 North America: Market Size, By End-User, 20152022 (USD Billion)

Table 45 North America: Market Size, By Country, 20152022 (USD Billion)

Table 46 US: Distributed Generation Market Size, By End-User, 20152022 (USD Million)

Table 47 Canada: Market Size, By End-User, 20152022 (USD Million)

Table 48 Mexico: Market Size, By End-User, 20152022 (USD Million)

Table 49 Middle East & Africa: Market Size, By Technology, 20152022 (USD Million)

Table 50 Middle East & Africa: Market Size, By Application, 20152022 (USD Million)

Table 51 Middle East & Africa: Market Size, By End-User, 20152022 (USD Million)

Table 52 Middle East & Africa: Distributed Generation Market, By Country/ Region, 20152022 (USD Million)

Table 53 South Africa: Market Size, By End-User, 20152022 (USD Million)

Table 54 Saudi Arabia: Market Size, By End-User, 20152022 (USD Million)

Table 55 UAE: Market Size, By End-User, 20152022 (USD Million)

Table 56 Nigeria: Market Size, By End-User, 20152022 (USD Million)

Table 57 Rest of the Middle East & Africa: Market Size, By End-User, 20152022 (USD Million)

Table 58 South America: Distributed Generation Market Size, By Technology, 20152022 (USD Million)

Table 59 South America: Market Size, By Application, 20152022 (USD Million)

Table 60 South America: Market Size, By End-User, 20152022 (USD Million)

Table 61 South America: Market, By Country/ Region, 20152022 (USD Million)

Table 62 Brazil: Distributed Generation Market Size, By End-User,20152022 (USD Million)

Table 63 Argentina: Market Size, By End-User, 20152022 (USD Million)

Table 64 Rest of South America: Market Size, By End-User, 20152022 (USD Million)

Table 65 Market Developments From 2014 to 2017

Table 66 Contracts & Agreements, 20162017

Table 67 Partnerships, Collaborations, & Joint Ventures, 20162017

Table 68 New Product Launches, 20142017

Table 69 Investments & Expansions, 20152017

Table 70 Mergers & Acquisitions, 20162017

List of Figures (57 Figures)

Figure 1 Distributed Generation Market: Market Segmentation

Figure 2 Distributed Generations Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 The Commercial Segment is Expected to Dominate the Distributed Generation Market During the Forecast Period

Figure 8 The Reciprocating Engines Segment is Expected to Lead the Distributed Generation Market During the Forecast Period

Figure 9 The On-Grid Segment is Expected to Dominate the Distributed Generation Market in 2017

Figure 10 Europe Dominated the Distributed Generation Market in 2016

Figure 11 Increasing Focus on the Generation of Clean Energy and Rising Demand For Energy are Expected to Drive the Distributed Generation Market During the Forecast Period

Figure 12 The On-Grid Segment is Projected to Dominate the Distributed Generation Market, By Application, During the Forecast Period

Figure 13 The Reciprocating Engines Segment is Expected to Lead the Distributed Generation Market, By Technology, During the Forecast Period

Figure 14 The Commercial End-User Segment is Expected to Dominate the Distributed Generation Market During the Forecast Period

Figure 15 The On-Grid Application Segment & The German Market Held The Maximum Shares of The Distributed Generation Market in 2016

Figure 16 The Chinese Market is Expected to Grow at the Fastest CAGR From 2017 to 2022

Figure 17 Drivers, Restraints, Opportunities, & Challenges

Figure 18 Global Primary Energy Consumption Across All Regions, By Fuel Type, 2016

Figure 19 Distributed Generation Market, By Technology, 20172022 (USD Billion)

Figure 20 Number of Distributed Generation Projects in the US, By End-User, 2016

Figure 21 Distributed Generation Market, By Application, 2016

Figure 22 The Commercial End-User Segment Held the Largest Share of the Distributed Generation Market in 2016

Figure 23 Regional Snapshot: Rapid Growth in Developing Markets

Figure 24 The European Market Led the Distributed Generation Market in 2016

Figure 25 Europe: Distributed Generation Market Snapshot

Figure 26 Primary Energy Consumption in Russia, 2015 & 2035

Figure 27 Russia: Distributed Generation Market, By End-User, 20172022

Figure 28 Energy Consumption in the UK, By Sector, 2016

Figure 29 Electricity Generation in Germany, 2017

Figure 30 Total Installed Capacity in France, 2016

Figure 31 Asia Pacific: Distributed Generation Market Snapshot

Figure 32 Power Generation Mix in China, 2016

Figure 33 Renewable Generation in Australia, By Technology, 2016

Figure 34 India: Total Installed Capacity (MW) Until August 2017

Figure 35 Japan: Projected Energy Mix, 2030

Figure 36 Electricity Generation in North America, 2015 & 2025

Figure 37 Electricity Consumption in the US, 20152018

Figure 38 US: Distributed Generation Market, By End-User, 20172022

Figure 39 Electricity Generation in Canada, By Source, 2015

Figure 40 Electricity Consumption in Mexico, 20152030

Figure 41 Share of Installed Capacity in the Middle East From Renewable & Non -Renewable Energy Technologies, 2016

Figure 42 Installed Power Generation Capacity, By Fuel, in Africa, 2040

Figure 43 UAE Energy Goals, 2050

Figure 44 Electricity Demand in Argentina, By End-User, 2016

Figure 45 Key Developments in the Distributed Generation Market, 20142017

Figure 46 Market Ranking Based on Revenue, 2016

Figure 48 Market Evaluation Framework: Contracts & Agreements, Partnerships, Collaborations, & Joint Ventures Have Fueled Growth of Companies, 20142017

Figure 49 Siemens: Company Snapshot

Figure 50 GE: Company Snapshot

Figure 51 Schneider Electric: Company Snapshot

Figure 52 Mitsubishi Heavy Industries: Company Snapshot

Figure 53 Caterpillar: Company Snapshot

Figure 54 Capstone: Company Snapshot

Figure 55 Ansaldo Energia: Company Snapshot

Figure 56 Cummins: Company Snapshot

Figure 57 Fuelcell Energy: Company Snapshot

Growth opportunities and latent adjacency in Distributed Generation Market