Coal Bed Methane (CBM) Market by Technology, Geography, Application, Regulation, Market Trends & Global Forecasts (2011 – 2021)

Coal bed methane (CBM) is an unconventional natural gas found adsorbed in coal seams. It is primarily extracted from bituminous and sub-bituminous coals. The gas is stored in the coal matrix through adsorption. Coal seam methane can be extracted before, during, or after coal mining operations take place; based on which it can be classified as CBM, coal mine methane (CMM) or abandoned mine methane (AMM). In this report, we have only covered CBM. In Australia, the methane thus extracted is called coal seam gas (CSG). The top six countries with the largest CBM resources are Russia, China, U.S., Canada, Indonesia, and Australia.

CBM can be used as a substitute for conventional natural gas in a wide variety of consumer and industrial applications. The porosity of coal bed reservoirs is usually very small, ranging from 0.1 to 10%. Coal bed methane is used to heat homes, propel vehicles, generate electricity and as feedstock in industries, such as for the manufacture of ethylene. The widely used technology for CBM production is multistage hydraulic fracturing combined with horizontal drilling. The report covers the trends and forecasts for 2009-2011, 2016 and 2021 in terms of production and consumption of CBM, along with production costs and average selling prices, and regulations affecting the sector in key geographies. As of 2010, CBM is mostly exploited in North America and Australia, with pilot production planned in China, India, and Indonesia.

Currently, horizontal drilling, combined with hydraulic fracturing is the predominant technology used for CBM extraction. The combination of these technologies has played a key role in increasing the production of unconventional gas in North America. However, some concerns have been raised regarding these technologies. A typical CBM well utilizes about thousands of gallons of water per day, and a CBM well’s life can be as long as 50 years. In addition, the water used in the hydraulic fracturing is said to contain chemical additives; which may sometimes leach into underground water resources through permeable rock pores. The fracturing fluid injected into deep rock formations may sometimes return to the surface. Such fluids may contain significant amounts of hazardous chemicals, including benzene, toluene, and glycol ethers, which can cause health disorders.

Total costs of the well vary with geologic rock formations and depth of the coal seam. Enhanced Coal Bed Methane (ECBM, currently in the pilot testing phase) could affect CBM economics by enhancing methane flow and providing operators an opportunity to earn carbon credits.

This report estimates the CBM market size in terms of volumes and value. The market has been further segmented on the basis of applications such as commercial, and industrial, as well as by technologies such as hydraulic fracturing and horizontal drilling. The details are given for major regions and key countries in those regions. Market drivers, restraints, challenges, and opportunities and challenges have been discussed in detail. Market players are also entailed in the report. We have also profiled leading players of this industry including BG Group, Origin Energy, Santos, and others.

Coal Bed Methane (CBM) Market by Technology, Geography, Application, Regulation, Market Trends & Global Forecasts (2011 – 2021)

As the unconventional gas sector begins to take off on the shale gas boom, other types of unconventional gas – tight gas and CBM – are attracting renewed interest. The natural gas sector, as a whole, is growing due to global annual increase of 1.73% in natural gas consumption. Though the source and process of extracting CBM, conventional, shale, and tight gas differ significantly, the end product is largely methane. Global CBM production is expected to grow from 3,654 billion cubic feet in 2011 to 5,150 billion cubic feet in 2021 at a CAGR of 3.5% for the same period. Between 2016 and 2021, the CBM market is expected to grow at 5.8%. Russia (34.6%), China (14.7%), Indonesia (14.9%), and Canada (11.1%) are expected to lead the growth in the CBM market.

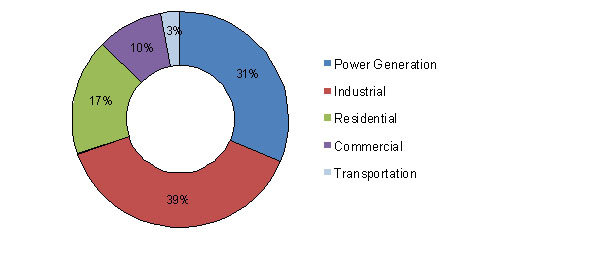

CBM is consumed in the power generation, commercial, residential, industrial, and transportation sectors. Most of the CBM global consumption can be attributed to industrial utilization, which has a share of 39%, followed by power generation with a share of 31%.

CBM is used in the applications mentioned above as it is the cleanest burning fossil fuel. In addition, it is easy to store and transport. The detailed breakdown is illustrated below:

Global CBM Consumption, by Applications, 2010

Source: MarketsandMarkets, EIA

The major drivers for the CBM market are its capacity for greenhouse gas mitigation, provision of improved safety to the coal mining industry, and opportunity for GHG sequestration and carbon credits. In addition, ongoing natural gas pipeline projects and fossil-fuel importing countries’ efforts to diversify their fuel mix are also drawing interest to the CBM sector. On the other hand, the long dewatering period and the ongoing debate and studies into environmental concerns hinder CBM development. The CBM sector provides opportunities in the ethylene and NGL manufacturing areas. Further, new coal bearing regions are being opened up to players in countries such as India, China and Indonesia.

Majority of CBM extraction operations use a combination of multistage hydraulic fracturing and horizontal drilling. Various companies and consortiums are studying the feasibility of enhanced CBM production; combined with carbon sequestration. However, this technology is currently only in the testing phase.

Major CBM producing companies include Arrow Energy Ltd. (Australia), BG Group PLC (UK), Santos Ltd. (Australia), Origin Energy Ltd. (Australia), BP PLC (UK), EnCana Corp. (Canada), Petronas (Malaysia), Metgasco Ltd. (Australia), and China United Coal Bed Methane Corp. Ltd. (China). Oil and gas majors including BP (UK) and ConocoPhillips (U.S.) are also acquiring CBM assets in regions with high potential. In addition, Halliburton and Schlumberger are significant oilfield services companies that participate in CBM development.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 KEY QUESTIONS ANSWERED

1.6 RESEARCH METHODOLOGY

1.6.1 MARKET SIZE

1.6.2 SOURCES OF KEY DATA POINTS

1.6.3 ASSUMPTIONS

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 INTRODUCTION

3.1.1 DEFINITION – COAL BED METHANE/COAL SEAM GAS (CBM/CSG)

3.1.2 CHEMICAL COMPOSITION OF CBM

3.1.3 CBM RESOURCES CLASSIFICATION

3.1.3.1 Total gas-in-place

3.1.3.2 Contingent resources

3.1.3.3 Proved resources

3.2 BURNING ISSUES

3.2.1 CHALLENGE OF MANAGING PRODUCED WATER & METHANE MIGRATION

3.2.2 CONFLICTS OVER RESOURCE RIGHTS

3.2.3 COST COMPETITIVENESS OF CBM AS COMPARED TO SHALE GAS

3.3 WINNING IMPERATIVES

3.3.1 MERGERS & ACQUISITIONS

3.3.2 UPSTREAM INTEGRATION BY CBM OPERATOR

3.4 MARKET DYNAMICS

3.4.1 DRIVERS

3.4.1.1 Potential for greenhouse gas mitigation

3.4.1.2 Benefits to coal mining industry

3.4.1.3 Opportunity for GHG sequestration and carbon credits

3.4.1.4 Ongoing natural gas pipeline projects

3.4.1.5 Efforts to diversify fuel mix

3.4.2 RESTRAINTS

3.4.2.1 Long dewatering period

3.4.2.2 Environmental concerns

3.4.3 OPPORTUNITIES

3.4.3.1 Increased CBM output likely to boost NGLs and ethylene production

3.4.3.2 Previously unexplored areas opening up

3.5 IMPACT OF MARKET DYNAMICS

3.6 GLOBAL NATURAL GAS MARKET

3.7 UNCONVENTIONAL NATURAL GAS MARKET

3.8 CBM COST ANALYSIS

3.8.1 CBM CAPITAL COSTS

3.8.1.1 Land and permit costs

3.8.1.2 Well drilling & completion costs

3.8.1.3 Support infrastructure costs

3.8.1.4 Water management costs

3.8.2 CBM OPERATING & MAINTENANCE COSTS

3.9 CBM VALUE CHAIN

3.9.1 EXPLORATION

3.9.2 EXTRACTION

3.9.3 PRODUCTION

3.9.4 TRANSPORTATION

3.9.5 STORAGE

3.9.6 DISTRIBUTION

3.9.7 MARKETING

3.10 CBM PROJECT LIFE CYCLE

3.11 PORTER’S FIVE FORCES ANALYSIS

3.11.1 THREAT OF NEW ENTRANTS

3.11.2 THREAT OF SUBSTITUTES

3.11.3 BARGAINING POWER OF BUYERS

3.11.4 BARGAINING POWER OF SUPPLIERS

3.11.5 COMPETITIVE RIVALRY WITHIN AN INDUSTRY

3.12 POLICY & REGULATIONS

3.12.1 MAIN REGULATIONS GOVERNING CBM DEVELOPMENT IN U.S.

3.12.1.1 Federal regulations

3.12.1.2 Land use plans

3.12.1.3 NEPA

3.12.1.4 Leasing

3.12.1.5 Development

3.12.1.6 Laws governing water

3.12.1.7 Laws governing air

3.12.1.8 Split estates

3.12.1.9 Other regulations

3.12.2 MAIN REGULATIONS GOVERNING CBM DEVELOPMENT IN AUSTRALIA

3.13 MAJOR PLAYERS

3.13.1 AUSTRALIA: CBM/CSG RESERVES, BY COMPANY

4 GLOBAL CBM MARKET, BY GEOGRAPHY

4.1 INTRODUCTION

4.2 NORTH AMERICA

4.2.1 NORTH AMERICA: CBM BASINS

4.3 EUROPE, MIDDLE EAST & AFRICA

4.4 ASIA-PACIFIC

4.4.1 CHINA: CBM BASINS

4.4.2 INDIA: CBM BASINS

4.4.3 INDONESIA: CBM BASINS

4.4.4 AUSTRALIA: CBM/CSG BASINS

4.5 REST OF THE WORLD

4.5.1 COLOMBIA: CBM BASINS

5 GLOBAL CBM MARKET, BY APPLICATION

5.1 INTRODUCTION

5.1.1 POWER GENERATION

5.1.2 INDUSTRIAL UTILIZATION

5.1.3 RESIDENTIAL UTILIZATION

5.1.4 COMMERCIAL UTILIZATION

5.1.5 TRANSPORTATION

5.2 CBM APPLICATIONS, BY GEOGRAPHY

5.2.1 NORTH AMERICA

5.2.2 EMEA

5.2.3 ASIA-PACIFIC

5.2.4 REST OF THE WORLD

6 GLOBAL CBM MARKET, BY TECHNOLOGY

6.1 INTRODUCTION

6.2 EXPLORATION & DRILLING

6.2.1 HORIZONTAL DRILLING

6.2.2 FRACTURE STIMULATION

6.2.3 COSTS ASSOCIATED WITH CBM HORIZONTAL DRILLING

6.2.4 WATER USAGE ISSUES

6.3 FRACTURING FLUID

6.3.1 WATER REQUIREMENT FOR CBM OPERATIONS

6.3.2 CHEMICAL ADDITIVES REQUIREMENT FOR CBM OPERATIONS

6.3.3 PROPPANT REQUIREMENT FOR CBM OPERATIONS

6.3.3.1 Main types of proppants

6.3.3.2 Main types of proppants

6.3.3.2.1 Silica sand (fracsand)

6.3.3.2.2 Resin-coated sand

6.3.3.2.3 Ceramic proppants

6.3.3.3 Proppant consumption, by types

6.3.3.4 Major suppliers of Proppants

6.4 ENHANCED COAL BED METHANE (ECBM) RECOVERY

6.5 POTENTIAL IMPACT OF TECHNOLOGY ADVANCEMENT

7 COMPETITIVE LANDSCAPE

7.1 INTRODUCTION

7.1.1 CBM JOINT VENTURES, MERGERS & ACQUISITIONS, R&D, EXPANSION TRENDS

8 COMPANY PROFILES

8.1 ARROW ENERGY

8.1.1 OVERVIEW

8.1.2 PRODUCTS & SERVICES

8.1.3 FINANCIALS

8.1.4 STRATEGY

8.1.5 DEVELOPMENTS

8.2 BAKER HUGHES

8.2.1 OVERVIEW

8.2.2 PRODUCTS & SERVICES

8.2.3 FINANCIALS

8.2.4 STRATEGY

8.3 BG GROUP PLC

8.3.1 OVERVIEW

8.3.2 PRODUCTS & SERVICES

8.3.3 FINANCIALS

8.3.4 STRATEGY

8.3.5 DEVELOPMENTS

8.4 BLUE ENERGY LTD

8.4.1 OVERVIEW

8.4.2 PRODUCTS & SERVICES

8.4.3 FINANCIALS

8.4.4 STRATEGY

8.4.5 DEVELOPMENTS

8.5 BP PLC

8.5.1 OVERVIEW

8.5.2 PRODUCTS & SERVICES

8.5.3 FINANCIALS

8.5.4 STRATEGY

8.5.5 DEVELOPMENTS

8.6 CONOCOPHILLIPS

8.6.1 OVERVIEW

8.6.2 PRODUCTS & SERVICES

8.6.3 FINANCIALS

8.6.4 STRATEGY

8.6.5 DEVELOPMENTS

8.7 CHINA UNITED COALBED METHANE CO

8.7.1 OVERVIEW

8.7.2 PRODUCTS & SERVICES

8.7.3 FINANCIALS

8.7.4 STRATEGY

8.7.5 DEVELOPMENTS

8.8 DART ENERGY LTD

8.8.1 OVERVIEW

8.8.2 PRODUCTS & SERVICES

8.8.3 FINANCIALS

8.8.4 STRATEGY

8.8.5 DEVELOPMENTS

8.9 ENCANA CORP

8.9.1 OVERVIEW

8.9.2 PRODUCTS & SERVICES

8.9.3 FINANCIALS

8.9.4 STRATEGY

8.9.5 DEVELOPMENTS

8.10 EPHINDO (PT ENERGI PASIR HITAM INDONESIA)

8.10.1 OVERVIEW

8.10.2 PRODUCTS & SERVICES

8.10.3 FINANCIALS

8.10.4 STRATEGY

8.10.5 DEVELOPMENTS

8.11 FAR EAST ENERGY CORP

8.11.1 OVERVIEW

8.11.2 PRODUCTS & SERVICES

8.11.3 FINANCIALS

8.11.4 STRATEGY

8.11.5 DEVELOPMENTS

8.12 FORTUNE OIL PLC

8.12.1 OVERVIEW

8.12.2 PRODUCTS & SERVICES

8.12.3 FINANCIALS

8.12.4 STRATEGY

8.12.5 DEVELOPMENTS

8.13 HALLIBURTON CO

8.13.1 OVERVIEW

8.13.2 PRODUCTS & SERVICES

8.13.3 FINANCIALS

8.13.4 STRATEGY

8.14 METGASCO LTD

8.14.1 OVERVIEW

8.14.2 PRODUCTS & SERVICES

8.14.3 FINANCIALS

8.14.4 STRATEGY

8.14.5 DEVELOPMENTS

8.15 NEXEN INC

8.15.1 OVERVIEW

8.15.2 PRODUCTS & SERVICES

8.15.3 FINANCIALS

8.15.4 STRATEGY

8.15.5 DEVELOPMENTS

8.16 ORIGIN ENERGY LTD

8.16.1 OVERVIEW

8.16.2 PRODUCTS & SERVICES

8.16.3 FINANCIALS

8.16.4 STRATEGY

8.16.5 DEVELOPMENTS

8.17 PETROLIAM NASIONAL BERHAD (PETRONAS)

8.17.1 OVERVIEW

8.17.2 PRODUCTS & SERVICES

8.17.3 FINANCIALS

8.17.4 STRATEGY

8.17.5 DEVELOPMENTS

8.18 QUICKSILVER RESOURCES INC

8.18.1 OVERVIEW

8.18.2 PRODUCTS & SERVICES

8.18.3 FINANCIALS

8.18.4 STRATEGY

8.18.5 DEVELOPMENTS

8.19 SANTOS LTD

8.19.1 OVERVIEW

8.19.2 PRODUCTS & SERVICES

8.19.3 FINANCIALS

8.19.4 STRATEGY

8.19.5 DEVELOPMENTS

LIST OF TABLES

TABLE 1 CBM MARKET, 2021

TABLE 2 GLOBAL UNCONVENTIONAL GAS RESERVES, BY GEOGRAPHY, 2010

TABLE 3 CHEMICAL COMPOSITION OF CBM

TABLE 4 METHANE CONTENT (CUBIC METERS PER TON OF COAL), BY DEPTH (METERS)

TABLE 5 TOTAL DISSOLVED SOLIDS IN CBM PRODUCED WATER

TABLE 6 CO2 EMISSIONS PER GJ ENERGY PRODUCED, BY SOURCE

TABLE 7 COMPARISON OF CERS ISSUED BASED ON ACTIVITY

TABLE 8 ONGOING/PLANNED NATURAL GAS PIPELINE PROJECTS

TABLE 9 NGL PRODUCTION USING CBM AS FEEDSTOCK, BY GEOGRAPHY, 2011 - 2021 (THOUSAND TONS)

TABLE 10 ETHYLENE PRODUCTION USING CBM AS FEEDSTOCK, BY GEOGRAPHY, 2011 - 2021 (THOUSAND TONS)

TABLE 11 GLOBAL ETHYLENE PRODUCTION USING CBM AS FEEDSTOCK, BY GEOGRAPHY, 2011 - 2021 ($MILLION)

TABLE 12 IMPACT OF MARKET DYNAMICS

TABLE 13 GLOBAL NATURAL GAS PRODUCTION, BY TYPES, 2009 - 2021 (BCF)

TABLE 14 GLOBAL NATURAL GAS PRODUCTION, BY TYPES, 2009 – 2021 ($MILLION)

TABLE 15 GLOBAL NATURAL GAS CONSUMPTION, BY TYPES, 2009 - 2021, (BCF) TABLE 16 GLOBAL NATURAL GAS CONSUMPTION, BY TYPES, 2009 – 2021 ($MILLION)

TABLE 17 GLOBAL UNCONVENTIONAL GAS PRODUCTION, BY TYPES, 2009 - 2021 (BCF)

TABLE 18 GLOBAL UNCONVENTIONAL GAS PRODUCTION, BY TYPES, 2009 - 2021 ($MILLION)

TABLE 19 GLOBAL UNCONVENTIONAL GAS CONSUMPTION, BY TYPES, 2009 - 2021 (BCF)

TABLE 20 GLOBAL UNCONVENTIONAL GAS CONSUMPTION, BY TYPES, 2009 - 2021 ($MILLION)

TABLE 21 CBM APPRAISAL WELL COST BREAK DOWN, 2011

TABLE 22 PERCENTAGE BREAKUP OF CAPITAL COSTS FOR A CBM WELL DRILLED TO 600 FEET

TABLE 23 CBM WELL DRILLING & COMPLETION COST BREAKDOWN (%)

TABLE 24 CBM WELL OPERATING COST BREAK DOWN (%)

TABLE 25 NATURAL GAS PRODUCTION, BY COMPANY, 2010

TABLE 26 CBM RESERVES (TCF), 2005 METHANE EMISSIONS (MILLION METRIC TONS CO2 EQUIVALENT) & 2009 COAL PROVED RESERVES (MILLION TONS), BY COUNTRY

TABLE 27 CBM PRODUCTION, BY GEOGRAPHY, 2009 – 2021 (BCF)

TABLE 28 CBM PRODUCTION, BY GEOGRAPHY, 2009 – 2021 ($MILLION)

TABLE 29 CBM CONSUMPTION, BY GEOGRAPHY, 2009 - 2021 (BCF)

TABLE 30 CBM CONSUMPTION, BY GEOGRAPHY, 2009 – 2021 ($MILLION)

TABLE 31 NORTH AMERICA: CBM PRODUCTION, BY COUNTRY, 2009 – 2021 (BCF)

TABLE 32 NORTH AMERICA: CBM CONSUMPTION, BY COUNTRY, 2009 - 2021 (BCF)

TABLE 33 NORTH AMERICA: CBM PRODUCTION, BY COUNTRY, 2009-2021 ($MILLION)

TABLE 34 NORTH AMERICA: CBM CONSUMPTION, BY COUNTRY, 2009 - 2021 ($MILLION)

TABLE 35 U.S. CBM BASIN CHARACTERISTICS

TABLE 36 CANADA CBM RESERVES, BY BASIN

TABLE 37 EMEA: CBM PRODUCTION, BY COUNTRY, 2009 - 2021 (BCF)

TABLE 38 EMEA: CBM CONSUMPTION, BY COUNTRY, 2009 - 2021 (BCF)

TABLE 39 EMEA: CBM PRODUCTION, BY COUNTRY, 2009 - 2021 ($MILLION)

TABLE 40 EMEA: CBM CONSUMPTION, BY COUNTRY, 2009 – 2021 ($MILLION)

TABLE 41 APAC: CBM PRODUCTION, BY COUNTRY, 2009 - 2021 (BCF)

TABLE 42 APAC: CBM CONSUMPTION, BY COUNTRY, 2009 - 2021 (BCF)

TABLE 43 APAC: CBM PRODUCTION, BY COUNTRY, 2009 - 2021 ($MILLION)

TABLE 44 APAC: CBM CONSUMPTION, BY COUNTRY, 2009 - 2021 ($MILLION)

TABLE 45 CHINA: CBM RESERVES (TCF), BY BASIN/COAL BEARING AREA

TABLE 46 INDONESIA: CBM RESERVES & AREA, BY BASIN

TABLE 47 AUSTRALIA: CBM RESERVES, BY BASIN

TABLE 48 ROW: CBM PRODUCTION, BY COUNTRY, 2009 - 2021 (BCF)

TABLE 49 ROW: CBM CONSUMPTION, BY COUNTRY, 2009 - 2021 (BCF)

TABLE 50 ROW: CBM PRODUCTION, BY COUNTRY, 2009 - 2021 ($MILLION)

TABLE 51 ROW: CBM CONSUMPTION, BY COUNTRY, 2009 - 2021 ($MILLION)

TABLE 52 COLOMBIA: CBM RESERVES, BY BASIN

TABLE 53 NGV FUELING STATION COUNT, BY COUNTRY, 2010

TABLE 54 GLOBAL CBM CONSUMPTION, BY APPLICATIONS, 2009 - 2021 (BCF)

TABLE 55 GLOBAL CBM CONSUMPTION, BY APPLICATIONS, 2009 - 2021 ($MILLION)

TABLE 56 NORTH AMERICA: CBM CONSUMPTION, BY APPLICATIONS, 2009 - 2021 (BCF)

TABLE 57 NORTH AMERICA: CBM CONSUMPTION, BY APPLICATIONS, 2009 - 2021 ($MILLION)

TABLE 58 EMEA: CBM CONSUMPTION, BY APPLICATIONS, 2009 – 2021 (BCF)

TABLE 59 EMEA: CBM CONSUMPTION, BY APPLICATIONS, 2009 – 2021 ($MILLION)

TABLE 60 ASIA PACIFIC: CBM CONSUMPTION, BY APPLICATIONS, 2009 – 2021 (BCF)

TABLE 61 ASIA PACIFIC: CBM CONSUMPTION, BY APPLICATIONS, 2009 – 2021 ($MILLION)

TABLE 62 ROW: CBM CONSUMPTION, BY APPLICATIONS, 2009 – 2021 (BCF)

TABLE 63 ROW: CBM CONSUMPTION, BY APPLICATIONS, 2009 - 2021 ($MILLION) TABLE 64 LEASE EQUIPMENT COSTS FOR U.S. CBM PRODUCTION, 2009 – 2021 ($THOUSAND)

TABLE 65 DIRECT ANNUAL OPERATING COSTS FOR U.S. CBM PRODUCTION, 2009 – 2021 ($THOUSAND)

TABLE 66 COMPOSITION OF FRACTURING FLUID

TABLE 67 PURPOSE OF CHEMICAL ADDITIVES & TYPICAL PRODUCTS

TABLE 68 GLOBAL PROPPANT CONSUMPTION, BY TYPES, 2009 – 2021 (THOUSAND TONS)

TABLE 69 CARBON SEQUESTRATION CAPACITY (BILLION TONS OF CO2)

TABLE 70 POTENTIAL IMPACT OF CBM TECHNOLOGY ADVANCEMENTS

TABLE 71 MERGERS & ACQUISITIONS

TABLE 72 NEW PRODUCT/R&D

TABLE 73 PARTNERSHIP/COLLABORATION/JOINT VENTURE/AGREEMENT

TABLE 74 EXPANSION

TABLE 75 INVESTMENT

LIST OF FIGURES

FIGURE 1 CLASSIFICATION OF NATURAL GAS

FIGURE 2 GLOBAL NATURAL GAS PRODUCTION, BY TYPES, 2010

FIGURE 3 TYPES OF COAL SEAM GAS BASED ON EXTRACTION TIMING

FIGURE 4 CBM RESOURCES CLASSIFICATION

FIGURE 5 POTENTIAL USES OF CBM PRODUCED WATER

FIGURE 6 CBM DEWATERING & GAS PRODUCTION

FIGURE 7 NATURAL GAS LIQUID END USES

FIGURE 8 GLOBAL CBM, SHALE GAS & TIGHT GAS PRODUCTION, 2009 – 2021

FIGURE 9 CBM VALUE CHAIN

FIGURE 10 CBM PROJECT LIFE CYCLE

FIGURE 11 PORTER’S FIVE FORCE ANALYSIS FOR CBM

FIGURE 12 EASTERN AUSTRALIA: CBM RESERVES, BY COMPANY

FIGURE 13 NORTH AMERICA: PRIMARY ENERGY CONSUMPTION, BY SOURCE, 2009

FIGURE 14 INDIA: ESTABLISHED RESERVES BY BLOCK, MAY 2010

FIGURE 15 GLOBAL CBM CONSUMPTION, BY APPLICATIONS, 2010

FIGURE 16 POWER GENERATION USING CBM, BY GEOGRAPHY, 2021 (BCF)

FIGURE 17 INDUSTRIAL UTILIZATION OF CBM, BY GEOGRAPHY, 2021 (BCF)

FIGURE 18 RESIDENTIAL UTILIZATION OF CBM, BY GEOGRAPHY, 2021 (BCF)

FIGURE 19 COMMERCIAL UTILIZATION OF CBM, BY GEOGRAPHY, 2021 (BCF)

FIGURE 20 CBM UTILIZATION FOR TRANSPORTATION, BY GEOGRAPHY, 2021 (BCF)

FIGURE 21 VERTICAL VS HORIZONTAL DRILLING

FIGURE 22 CONSIDERATIONS WHILE INTEGRATING CBM RESOURCE, SIMULATION DATA

FIGURE 23 OPERATING WELL COST BREAKDOWN, 2010

FIGURE 24 CAPITAL WELL COST BREAKDOWN, 2010

FIGURE 25 GLOBAL CONSUMPTION OF PROPPANTS, BY TYPES, 2010

FIGURE 26 GLOBAL DEVELOPMENTS, BY TYPES, 2008 TO JULY 2011

FIGURE 27 GLOBAL DEVELOPMENTS, BY GEOGRAPHY, 2008 TO JULY 2011

FIGURE 28 GLOBAL DEVELOPMENTS, BY YEAR, 2008 - 2011

Growth opportunities and latent adjacency in Coal Bed Methane (CBM) Market