Medical Bed Market by Usage (Acute Care, Long Term Care, Psychiatric Care, Maternity), Application (Intensive Care, Non Intensive), Type (Electric Beds, Semi Electric Bed, Manual Bed), End User (Hospital, Home Care, Elderly Care) & Geography - Global Forecast to 2022

The global Medical bed market is expected to grow at a CAGR of 5.6. Factors such as increasing investments in healthcare infrastructural development, technological innovations in ICU beds, increasing number of beds in private hospitals, and increasing volume of chronic care patients are expected to drive the growth of the medical beds market in the coming years. On the other hand, the declining number of beds in public hospitals may limit market growth to a certain extent. The growing trend of home care is expected to provide a wide range of opportunities to players in the market.

Market Dynamics

Drivers

- Increasing investments in healthcare infrastructural development

- Technological innovations in ICU beds

- Increasing number of beds in private hospitals

- Increasing volume of chronic care patients

Restraints

- Declining number of beds in public hospitals

Opportunities

- Growing trend of home care

Increasing investments in healthcare infrastructural development

The past few decades have witnessed a transformation in the global healthcare environment. Many countries across the globe have experienced unprecedented economic growth. While the global economic crisis in 2008 affected many of these countries, they appear to have recovered and continue to grow, albeit at much slower rates. As a result, these economies have witnessed a dramatic change in their economic, cultural, industrial, and healthcare environments. This rapid growth in the healthcare industry is largely fuelled by widespread policy reforms, economic liberalization, the rapidly growing middle-class populations with increasing purchasing power, and increased investments in infrastructural development.

Healthcare infrastructural development is a key issue in most developed and developing countries. Increased investments in healthcare infrastructure also have a positive impact on the medical beds market. Increased investments lead to increased costs allocated for medical beds, which is an important factor driving market growth.

Investments In healthcare infrastructural development

|

Investment Provided By |

Amount Invested |

|

Plan of Action |

|

TPG Asian investment |

USD 6 Billion |

|

To meet the unmet demand for 100,000 beds in Asia |

|

Fosun Pharma |

USD 111 Million |

|

To increase the number of beds by 2,000 in China |

|

Turkey’s Ministry of Health |

USD 10.3 Billion |

|

To build 95,000 new hospital beds by 2023 |

|

Ontario Budget (Canadian Province) |

USD 20 Billion |

|

To increase hospital budget allocations, which would, in turn, increase the number of hospital beds |

|

European Fund for Strategic Investments |

USD 450 Million |

|

New hospital scheme, which includes 670 beds |

|

TPG Asian investment |

USD 6 Billion |

|

To meet the unmet demand for 100,000 beds in Asia |

Since most of these infrastructural investments help hospitals build capacity, the adoption rate of medical beds is expected to increase in private hospitals in the coming years.

The following are the major objectives of the study.

- To define, measure, and describe the global medical beds market by type, application, usage, end user, and region

- To provide detailed information about the major factors influencing market growth (drivers, restraints, challenges, and opportunities)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, Asia Pacific, and RoW

- To strategically analyze the market structure and profile key players in the global medical beds market and comprehensively analyze their core competencies

- To track and analyze company developments such as partnerships, agreements, and collaborations; expansions; product approvals; and product launches in the medical beds market

The key players in the market were identified through secondary research and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and added to detailed inputs and analysis from MarketsandMarkets, and presented in this report.

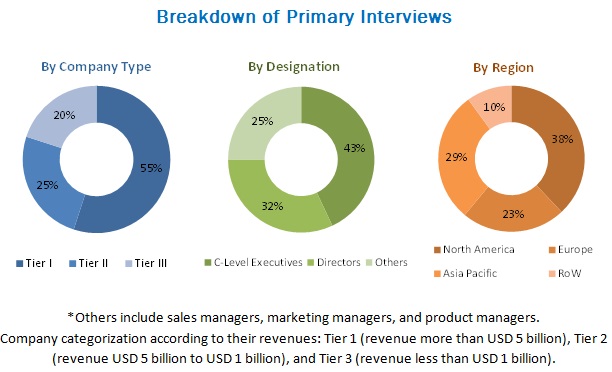

Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess the dynamics of this market. The breakdown of profiles of primaries is shown in the figure below:

The major players in the global medical beds market include Getinge AB (Sweden), Linet Spol. s.r.o. (Czech Republic), Stryker Corporation (U.S.), and Hill-Rom Holdings, Inc. (U.S.).

Target Audience:

- Healthcare Service Providers

- Health Insurance Payers

- Medical Device Companies

- Research And Consulting Firms

- Diagnostic Centers

- Research Institutions

Market Segmentation

This research report categorizes the medical beds market on the basis of type, usage, end user, application, and region

By Usage

- Acute Care Beds

- Psychiatric Care Beds

- Long-term Care Beds

- Other Beds (Maternity and Bariatric Beds)

By Application

- Intensive Care Beds

- Non-intensive Care Beds

By Type

- Electric Beds

- Semi-electric Beds

- Manual Beds

By End User

- Hospitals

- Home Care Settings

- Elderly Care Facilities

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Rest of Europe(RoE)

- Asia-Pacific

- Rest of the World (RoW)

Critical Questions which the report answers:

- Which are the key players in the market and how intense is the competition?

- What are new technological developments in the market?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Country-wise analysis of the Asia-Pacific medical beds market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global medical beds market is projected to reach USD 3.41 billion by 2022 from an estimated USD 2.59 billion in 2017, growing at a CAGR of 5.6% during the forecast period. increasing investments in healthcare infrastructural development, technological innovations in ICU beds, increasing number of beds in private hospitals, and increasing volume of chronic care patients are the key factors driving the growth of this market

Intensive Care beds is a largest segment in medical beds market. Technological innovations have led to specialized ICU beds, which now come with highly advanced features. Features such as continuous lateral rotation therapy, patient repositioning support, weight-based pressure redistribution in any bed position, and electrical bed retraction and extension greatly benefit caregivers while treating patients. These technologically advanced medical beds are also beneficial for patients as they increase comfort and improve compliance.

The medical beds market is segmented on the basis of type, application, end user, usage, and region. On the basis of type, the medical beds market is segmented into— manual beds, semi-electric beds, and electric beds. The electric beds segment is expected to dominate the medical beds market in 2017. The growing obesity rate is the major factor driving the demand for electric beds, as these are essential medical equipment in bariatric care. Moreover, the presence of favorable reimbursement policies in major markets such as the U.S. is also expected to support the growth of the electric beds market. For instance, Medicare provides a reimbursement of 7.5% on the purchase of new electric beds which can be used in home care settings. Such factors have increased the adoption rate of electric beds in home care and elderly care settings in developed regions such as the U.S.

Based on usage, the medical beds market is segmented into major four categories— acute care, psychiatric care and bariatric care, long-term care, and other beds (maternity and rehabilitative beds). The long-term care segment is expected to have the fastest-growing market during the forecast period owing to the increasing number of patients requiring long-term care.

On the basis of end user, the medical beds market is segmented into home care settings, hospitals, elderly care facilities. The hospitals segment is expected to account for the largest share of the medical beds market in 2017. However, the home care settings segment is expected to have the fastest growth rate in the forecast period. This can be attributed to increasing government support to decrease the length of stay of patients inside hospitals.

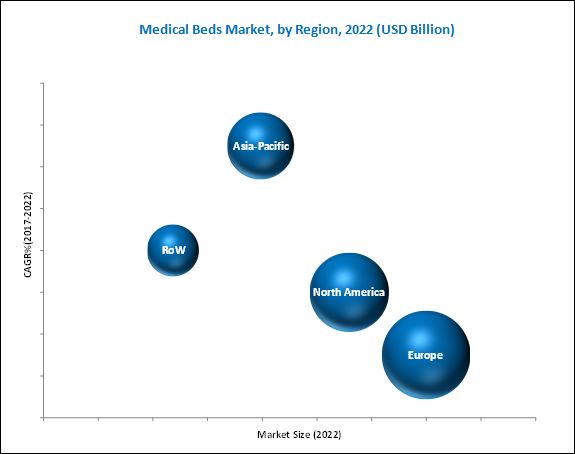

Geographically, Europe is expected to account for the largest share of the global medical beds market in 2017, followed by North America. Compared to mature markets, the Asia-Pacific region is expected to grow at the highest CAGR in the forecast period. Growth in this regional segment is propelled by the growing healthcare infrastructure, rising number of contract manufacturing organizations (CMOs), and increasing number of bariatric population requiring care.

Major players operating in the medical beds market include Stryker Corporation (U.S.), Hill-Rom Holding, Inc. (U.S.), Getinge Group (Sweden), and Invacare Corporation (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.2.1 Key Data From Secondary Sources

2.2.2 Key Data From Primary Sources

2.3 Key Industry Insights

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Medical Beds: Market Snapshot (2017 vs 2022)

4.2 Geographic Analysis: Medical Bed Market, By Usage (2017)

4.3 Global Market, By Type, 2017 vs 2022 (USD Billion)

4.4 Global Market, By End User, 2015 - 2022 (USD Million)

4.5 Geographic Snapshot of the Global Market

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Investments in Healthcare Infrastructural Development

5.2.1.2 Technological Innovations in Icu Beds

5.2.1.3 Increasing Number of Beds in Private Hospitals

5.2.1.4 Increasing Volume of Chronic Care Patients

5.2.2 Restraints

5.2.2.1 Declining Number of Beds in Public Hospitals

5.2.3 Opportunities

5.2.3.1 Growing Trend of Home Care

6 Medical Bed Market, By Usage (Page No. - 37)

6.1 Introduction

6.2 Acute Care

6.3 Long-Term Care

6.4 Psychiatric and Bariatric Care

6.5 Others

7 Medical Bed Market, By Application (Page No. - 48)

7.1 Introduction

7.2 Intensive Care

7.3 Non-Intensive Care

8 Medical Bed Market, By Type (Page No. - 53)

8.1 Introduction

8.2 Electric Beds

8.3 Semi-Electric Beds

8.4 Manual Beds

9 Medical Bed Market, By End User (Page No. - 60)

9.1 Introduction

9.2 Hospitals

9.3 Home Care Settings

9.4 Elderly Care Facilities

10 Medical Bed Market, By Region (Page No. - 68)

10.1 Introduction

10.2 Europe

10.2.1 U.K.

10.2.2 Germany

10.2.3 France

10.2.4 Rest of Europe (RoE)

10.3 North America

10.3.1 U.S.

10.3.2 Canada

10.4 Asia-Pacific

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 93)

11.1 Introduction

11.2 Vendor Dive Overview

11.2.1 Vanguards

11.2.2 Innovators

11.2.3 Dynamic Players

11.2.4 Emerging Players

11.3 Competitive Benchmarking

11.3.1 Product Offerings (For 25 Market Players)

11.3.2 Business Strategy (For 25 Market Players)

*Top 13 Companies Analysed for This Study are - Stryker Corporation (U.S.), Hill-Rom Holding, Inc. (U.S.), Getinge Group (Sweden), Invacare Corporation (U.S.), Medline Industries, Inc. (U.S.), Linet Spol. S R.O. (The Netherlands), Stiegelmeyer (Germany), Span America Medical Systems (U.S.), Malvestio Spa (Italy), Merivaara Corp (Finland), Antano Group S.R.L (Italy), Amico Corporation (Canada), Paramount Bed Holdings Co., Ltd. (Japan), Midmark Corporation (U.S.), Famed (Poland), Drive Devilbiss Healthcare, Inc. (U.S.), Meditek Engineers (India), Bakare Beds Ltd. (U.K.), Gendron, Inc. (U.S.), Benmor Medical Limited (U.K.), Carevel Medical Systems Private Limited (India), Hetech Hospital Equipments Technologies Co.Ltd. (Turkey), Nanning Passion Medical Equipment Co.,Ltd. (China), Jsc Taneta (Lithuania), Savion Industries (Israel)

12 Company Profiles (Page No. - 97)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Stryker Corporation

12.3 Hill-Rom Holdings, Inc.

12.4 Getinge AB

12.5 Invacare Corporation

12.6 Medline Industries, Inc.

12.7 Linet Spol. S.R.O.

12.8 Stiegelmeyer GmbH & Co. Kg

12.9 Span-America Medical Systems, Inc.

12.10 Malvestio S.P.A.

12.11 Merivaara Corp.

12.12 Antano Group S.R.L.

12.13 Amico Corporation

12.14 Paramount Bed Holdings Co., Ltd.

12.15 Midmark Corporation

12.16 Famed Zywiec Sp.Z O.O.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 135)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (85 Tables)

Table 1 Investments in Healthcare Infrastructural Development

Table 2 Technological Innovations in ICU Beds

Table 3 Global Medical Bed Market, By Usage, 2017–2022 (USD Million)

Table 4 Acute Care Market, By Region, 2015–2022 (USD Million)

Table 5 Europe: Acute Care Market, By Country, 2015–2022 (USD Million)

Table 6 North America: Acute Care Market, By Country, 2015–2022 (USD Million)

Table 7 Long-Term Care Market, By Region, 2015–2022 (USD Million)

Table 8 Europe: Long-Term Care Market, By Country, 2015–2022 (USD Million)

Table 9 North America: Long-Term Care Market, By Country, 2015–2022 (USD Million)

Table 10 Psychiatric and Bariatric Care Market, By Region, 2015–2022 (USD Million)

Table 11 Europe: Psychiatric and Bariatric Care Market, By Country, 2015–2022 (USD Million)

Table 12 North America: Psychiatric and Bariatric Care Market, By Country, 2015–2022 (USD Million)

Table 13 Other Medical Care Beds Market, By Region, 2015–2022 (USD Million)

Table 14 Europe: Other Medical Care Beds Market Size, By Country/Region, 2015–2022 (USD Million)

Table 15 North America: Other Medical Care Beds Market Size, By Country, 2015–2022 (USD Million)

Table 16 Medical Beds Market Size, By Application, 2015–2022 (USD Million)

Table 17 Medical Bed Market Size for Intensive Care, By Region, 2015–2022 (USD Million)

Table 18 Europe: Market Size for Intensive Care, By Country, 2015–2022 (USD Million)

Table 19 North America: Medical Bed Market Size for Intensive Care, By Country, 2015–2022 (USD Million)

Table 20 Market Size for Non-Intensive Care, By Region, 2015–2022 (USD Million)

Table 21 Europe: Market for Non-Intensive Care, By Country, 2015–2022 (USD Million)

Table 22 North America: Market for Non-Intensive Care, By Country, 2015–2022 (USD Million)

Table 23 Medical Bed Market Size, By Type, 2015–2022 (USD Million)

Table 24 Electric Beds Market Size, By Region, 2015–2022 (USD Million)

Table 25 Europe: Electric Beds Market Size, By Country/Region, 2015–2022 (USD Million)

Table 26 North America: Electric Beds Market Size, By Country, 2015–2022 (USD Million)

Table 27 Semi-Electric Beds Market Size, By Region, 2015–2022 (USD Million)

Table 28 Europe: Semi-Electric Beds Market Size, By Country/Region, 2015–2022 (USD Million)

Table 29 North America: Semi-Electric Beds Market Size, By Country, 2015–2022 (USD Million)

Table 30 Manual Beds Market Size, By Region, 2015–2022 (USD Million)

Table 31 Europe: Manual Beds Market Size, By Country/Region, 2015–2022 (USD Million)

Table 32 North America: Manual Beds Market Size, By Country, 2015–2022 (USD Million)

Table 33 Global Medical Bed Market, By End User, 2015–2022 (USD Million)

Table 34 Market for Hospitals, By Region, 2015–2022 (USD Million)

Table 35 Europe: Market for Hospitals, By Country, 2015–2022 (USD Million)

Table 36 North America: Market for Hospitals, By Country, 2015–2022 (USD Million)

Table 37 Medical Bed Market for Home Care Settings, By Region, 2015–2022 (USD Million)

Table 38 Europe: Market for Home Care Settings, By Country, 2015–2022 (USD Million)

Table 39 North America: Market for Home Care Settings, By Country, 2015–2022 (USD Million)

Table 40 Market for Elderly Care Facilities, By Region, 2015–2022 (USD Million)

Table 41 Europe: Market for Elderly Care Facilities, By Country, 2015–2022 (USD Million)

Table 42 North America: Medical Bed Market for Elderly Care Facilities, By Country, 2015–2022 (USD Million)

Table 43 Medical Bed Market Size, By Region, 2015–2022 (USD Million)

Table 44 Europe: Medical Bed Market Size, By Country, 2015–2022 (USD Million)

Table 45 Europe: Market Size, By Usage, 2015–2022 (USD Million)

Table 46 Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 47 Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 48 Europe: Market Size, By End User, 2015–2022 (USD Million)

Table 49 U.K.: Medical Bed Market Size, By Usage, 2015–2022 (USD Million)

Table 50 U.K.: Market Size, By Application, 2015–2022 (USD Million)

Table 51 U.K.: Market Size, By Type, 2015–2022 (USD Million)

Table 52 U.K.: Market Size, By End User, 2015–2022 (USD Million)

Table 53 Germany: Medical Bed Market Size, By Usage, 2015–2022 (USD Million)

Table 54 Germany: Market Size, By Application, 2015–2022 (USD Million)

Table 55 Germany: Market Size, By Type, 2015–2022 (USD Million)

Table 56 Germany: Market Size, By End User, 2015–2022 (USD Million)

Table 57 France: Medical Bed Market Size, By Usage, 2015–2022 (USD Million)

Table 58 France: Market Size, By Application, 2015–2022 (USD Million)

Table 59 France: Market Size, By Type, 2015–2022 (USD Million)

Table 60 France: Market Size, By End User, 2015–2022 (USD Million)

Table 61 RoE: Medical Bed Market Size, By Usage, 2015–2022 (USD Million)

Table 62 RoE: Market Size, By Application, 2015–2022 (USD Million)

Table 63 RoE: Market Size, By Type, 2015–2022 (USD Million)

Table 64 RoE: Market Size, By End User, 2015–2022 (USD Million)

Table 65 North America: Medical Bed Market Size, By Country, 2015–2022 (USD Million)

Table 66 North America: Market Size, By Usage, 2015–2022 (USD Million)

Table 67 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 68 North America: Medical Bed Market Size, By Type, 2015–2022 (USD Million)

Table 69 North America: Market Size, By End User, 2015–2022 (USD Million)

Table 70 U.S.: Medical Bed Market Size, By Usage, 2015–2022 (USD Million)

Table 71 U.S.: Market Size, By Application, 2015–2022 (USD Million)

Table 72 U.S.: Market Size, By Type, 2015–2022 (USD Million)

Table 73 U.S.: Market Size, By End User, 2015–2022 (USD Million)

Table 74 Canada: Market Size, By Usage, 2015–2022 (USD Million)

Table 75 Canada: Market Size, By Application, 2015–2022 (USD Million)

Table 76 Canada: Market Size, By Type, 2015–2022 (USD Million)

Table 77 Canada: Market Size, By End User, 2015–2022 (USD Million)

Table 78 Asia-Pacific: Medical Bed Market Size, By Usage, 2015–2022 (USD Million)

Table 79 Asia-Pacific: Market Size, By Application, 2015–2022 (USD Million)

Table 80 Asia-Pacific: Market Size, By Type, 2015–2022 (USD Million)

Table 81 Asia-Pacific: Market Size, By End User, 2015–2022 (USD Million)

Table 82 RoW: Medical Bed Market Size, By Usage, 2015–2022 (USD Million)

Table 83 RoW: Market Size, By Application, 2015–2022 (USD Million)

Table 84 RoW: Market Size, By Type, 2015–2022 (USD Million)

Table 85 RoW: Market Size, By End User, 2015–2022 (USD Million)

List of Figures (30 Figures)

Figure 1 Medical Beds Market Segmentation

Figure 2 Global Market for Medical Bed: Research Design

Figure 3 Market for Medical Bed: Size Estimation Methodology

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Data Triangulation Methodology

Figure 6 Medical Bed Market Size, By Usage, 2017 vs 2022 (USD Billion)

Figure 7 Global Market Size, By Application, 2017 vs 2022 (USD Billion)

Figure 8 Market for Medical Bed: Size, By Type, 2017 vs 2022 (USD Billion)

Figure 9 Global Market Size, By End User, 2017 vs 2022 (USD Billion)

Figure 10 Global Market, By Region, 2017

Figure 11 Rapid Growth in the Geriatric Population and Increasing Prevalence of Chronic Diseases are Driving the Global Medical Beds Market

Figure 12 Acute Care to Account for the Largest Share of the Market in 2017

Figure 13 Electric Beds Segment to Dominate the Market

Figure 14 Hospitals Form the Largest End Users in the Global Market

Figure 15 APAC to Register the Highest CAGR in the Forecast Period

Figure 16 Medical Beds Market: Drivers, Restraints, and Opportunities

Figure 17 The Acute Care Segment to Dominate the Market for Medical Bed in 2017

Figure 18 Intensive Care Segment to Account for the Largest Market Share in 2017

Figure 19 Electric Beds Segment to Dominate the Market in 2017

Figure 20 The Hospitals Segment Will Continue to Dominate the Market During the Forecast Period

Figure 21 Geographic Snapshot: Asia-Pacific Market to Register the Highest CAGR During the Forecast Period

Figure 22 Europe: Medical Beds Market Snapshot

Figure 23 Asia-Pacific: Market Snapshot

Figure 24 Vendor Dive Comparison Matrix: Medical Bed Market

Figure 25 Stryker Corporation: Company Snapshot (2016)

Figure 26 Hill-Rom Holdings, Inc.: Company Snapshot (2016)

Figure 27 Getinge AB: Company Snapshot (2016)

Figure 28 Invacare Corporation: Company Snapshot (2016)

Figure 29 Span-America Medical Systems, Inc.: Company Snapshot (2016)

Figure 30 Paramount Bed Holdings Co., Ltd.: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Bed Market