Cloud DLP Market by Component (Solution and Service), Service (Professional, and Managed Services), Organization Size, Vertical (BFSI, Healthcare and Life Sciences, Retail and Consumer Goods), and Region - Global Forecast to 2022

[104 Pages Report] The cloud data loss prevention market expected to grow from $654.9 Million in 2016 and to reach $2,508.9 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 27.5% during the forecast period. The increasing need to prevent mission-critical data from being exposed either through internal or external breach is one the major factors that is expected to be fueling the growth of the cloud DLP market across the globe. The base year considered for this study is 2016, and the forecast period is 20172022.

Objectives of the Study

- To describe and forecast the global Cloud Data Loss Prevention market on the basis of components (solution and services), organization sizes, verticals, and regions

- To forecast the market size of the 5 main regional segments, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments with respect to individual growth trends, prospects, and contribution to the total market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the major players

- To profile key players and comprehensively analyze their core competencies and market positioning

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches, business expansions, partnerships, agreements, and collaborations in the cloud DLP market

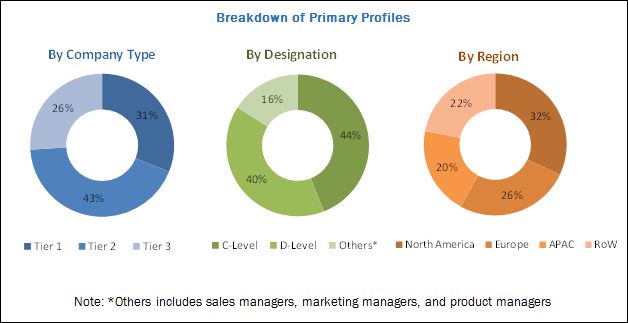

The research methodology used to estimate and forecast the cloud data loss prevention market began with the capturing of data on the revenues of the key vendors through secondary sources, such as annual reports; press releases; associations including Cloud Computing Association, Information Systems Security Association (ISSA), and ISACA; databases such as Factiva, D&B Hoovers, and BusinessWeek; company websites; and news articles. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global cloud DLP market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments. The breakdown of the primary profiles is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The cloud data loss prevention market includes providers, such as Symantec (California, US), Check Point Software Technologies (Tel Aviv, Israel), Digital Guardian (Massachusetts, US), Forcepoint (Texas, US), and McAfee (California, US). Other stakeholders include the data protection solution providers, DLP vendors Cloud Service Providers (CSPs), Independent Software Vendors (ISVs), system integrators, consulting companies, and enterprise customers.

Key Target Audience for cloud data loss prevention market

- Data protection solution providers

- DLP vendors

- Security solution vendors

- CSPs

- ISVs

- System integrators

- Research organizations

- Consulting companies

- Government agencies

The research study answers several questions for the stakeholders, primarily which market segments to focus on in the next 2 to 5 years, for prioritizing the efforts and investments.

Scope of the Report

The research report categorizes the cloud DLP market to forecast the revenues and analyze the trends in each of the following submarkets:

Cloud Data Loss Prevention Market By Component

- Solution

- Services

By Service

- Professional services

- Managed services

Cloud Data Loss Prevention Market By Organization Size

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Retail and consumer goods

- Healthcare and life sciences

- Manufacturing

- IT and telecommunications

- Government and public sector

- Education

- Others (travel and hospitality, and energy and utilities)

Cloud DLP Market By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the companys specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

The cloud DLP market is expected to grow from USD 744.4 Million in 2017 to USD 2,508.9 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 27.5%. The demand for cloud DLP services is expected to be driven by many factors, such as achievement of regulatory compliances, heavy increase in cloud adoption, and the increasing employee mobility and Bring Your Own Device (BYOD) trend.

The Cloud Data Loss Prevention Market has been segmented on the basis of components, organization sizes, verticals, and regions. Among the components, the services segment is expected to grow at the highest CAGR during the forecast period and the solutions segment is estimated to have the largest market size in 2017. Cloud DLP solutions and services, based on the central policies, protect the data-at-rest, data-in-transit, and data-in-use of enterprises, which are moving into or already present in the cloud. Cloud DLP solutions empower enterprises with data discovery and visibility capabilities in the cloud and enable the security of critical data in the cloud. The adoption of cloud DLP solutions and services among various enterprises has increased, as they help enterprises secure their critical and sensitive data.

Among the organization sizes, the large enterprises segment is estimated to hold the largest market size during the forecast period. Large enterprises have been operating in a highly saturated market, wherein, they are left behind with limited growth opportunities. As these enterprises are larger in size and have various types of IT infrastructure, they are faced with the difficult task of effectively managing the security of cloud data across enterprises.

North America is estimated to have the largest market share in 2017, whereas the Asia Pacific (APAC) region is projected to grow at the highest CAGR during the forecast period in the cloud DLP market. The heavy increase in cloud adoption, and the increasing employee mobility and BYOD trend are expected to drive the demand for cloud DLP, globally.

The adoption of cloud DLP is said to be increasing in the market, owing to the heavy increase in cloud adoption, the need for achievement of regulatory compliances, and the increasing employee mobility and BYOD trend. However, the major issues faced by enterprises while adopting cloud DLP solutions and services is enterprise budgetary concerns, and the lack of awareness and education.

The major vendors providing cloud DLP market solutions and services are CA Technologies (New York, US), Check Point Software Technologies (Tel Aviv, Israel), Cisco Systems (California, US), Clearswift (Berkshire, UK), Digital Guardian (Massachusetts, US), Forcepoint (Texas, US), McAfee (California, US), Netskope (California, US), Symantec (California, US), and Zscaler (California, US). These players have adopted various strategies, such as new product developments; partnerships, agreements, and collaborations; mergers and acquisitions; and business expansions to expand their presence in the global cloud DLP market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Cloud DLP Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Cloud Data Loss Prevention Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 20)

4 Premium Insights (Page No. - 24)

4.1 Attractive Market Opportunities in the Cloud Data Loss Prevention Market

4.2 Cloud DLP Market: Market Share By Component, 2017

4.3 Market: Market Share By Organization Size, 2017

4.4 Market : Market Share By Top 3 Verticals, 2017 vs 2022

4.5 Cloud DLP Market: Market Share of Verticals and Regions, 2017

4.6 Market Scenario, By Region

5 Cloud Data Loss Prevention Market Overview and Industry Trends (Page No. - 27)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Regulatory Compliance and Enforcement

5.1.1.2 Rapidly Increasing Cloud Adoption

5.1.1.3 Increasing Employee Mobility and Byod

5.1.2 Restraints

5.1.2.1 Excessive False Positives

5.1.3 Opportunities

5.1.3.1 Growing Data Sprawl

5.1.3.2 Proliferation of Shadow IT

5.1.4 Challenges

5.1.4.1 Enterprise Budgetary Constraints

5.1.4.2 Lack of Awareness and Education

5.2 Regulatory Landscape

5.2.1 General Data Protection Regulation

5.2.2 Payment Card Industry Data Security Standard

5.2.3 Health Insurance Portability and Accountability Act

5.2.4 Federal Information Processing Standards

5.2.5 SarbanesOxley Act

5.3 Cloud Data Loss Prevention Applications

5.3.1 Cloud Storage

5.3.2 Cloud Email

5.3.3 Others

6 Cloud DLP Market, By Component (Page No. - 33)

6.1 Introduction

6.2 Solution

6.3 Services

6.3.1 Professional Services

6.3.1.1 Training, Consulting, and Integration

6.3.1.2 Support and Maintenance

6.3.2 Managed Services

7 Cloud Data Loss Prevention Market, By Organization Size (Page No. - 41)

7.1 Introduction

7.2 Large Enterprises

7.3 Small and Medium-Sized Enterprises

8 Cloud DLP Market, By Vertical (Page No. - 45)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.3 Healthcare and Life Sciences

8.4 IT and Telecommunications

8.5 Government and Public Sector

8.6 Retail and Consumer Goods

8.7 Manufacturing

8.8 Education

8.9 Others

9 Cloud Data Loss Prevention Market, By Region (Page No. - 55)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 71)

10.1 Overview

10.2 Competitive Scenario

10.2.1 New Product Launches/Product Upgradations

10.2.2 Partnerships, Agreements, and Collaborations

10.2.3 Mergers and Acquisitions

10.2.4 Business Expansions

11 Company Profiles (Page No. - 75)

11.1 Introduction

11.2 Check Point Software Technologies

(Business Overview, Products and Services Offered, Recent Developments, MnM View, and SWOT Analysis)

11.3 Digital Guardian

11.4 Forcepoint

11.5 Mcafee

11.6 Symantec

11.7 CA Technologies

11.8 Cisco Systems

11.9 Clearswift

11.10 Netskope

11.11 Zscaler

*Details on Business Overview, Products and Services Offered, Recent Developments, MnM View, and SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 98)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (52 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Cloud Data Loss Prevention Market Size, 20152022 (USD Million)

Table 3 Cloud DLP Market Size, By Component, 20152022 (USD Million)

Table 4 Solution: Market Size, By Region, 20152022 (USD Million)

Table 5 Services: Market Size, By Region, 20152022 (USD Million)

Table 6 Services: Cloud DLP Market Size, By Type, 20152022 (USD Million)

Table 7 Professional Services Market Size, By Type, 20152022 (USD Million)

Table 8 Training, Consulting, and Integration Market Size, By Region, 20152022 (USD Million)

Table 9 Support and Maintenance: Market Size, By Region, 20152022 (USD Million)

Table 10 Managed Services: Market Size, By Region, 20152022 (USD Million)

Table 11 Market Size, By Organization Size, 20152022 (USD Million)

Table 12 Large Enterprises: Cloud DLP Market Size, By Region, 20152022 (USD Million)

Table 13 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 14 Cloud Data Loss Prevention Market Size, By Vertical, 20152022 (USD Million)

Table 15 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 16 Healthcare and Life Sciences: Cloud DLP Market Size, By Region, 20152022 (USD Million)

Table 17 IT and Telecommunications: Market Size, By Region, 20152022 (USD Million)

Table 18 Government and Public Sector: Market Size, By Region, 20152022 (USD Million)

Table 19 Retail and Consumer Goods: Cloud DLP Market Size, By Region, 20152022 (USD Million)

Table 20 Manufacturing: Cloud Data Loss Prevention Market Size, By Region, 20152022 (USD Million)

Table 21 Education: Market Size, By Region, 20152022 (USD Million)

Table 22 Others: Cloud DLP Market Size, By Region, 20152022 (USD Million)

Table 23 Cloud DLP Market Size, By Region, 20152022 (USD Million)

Table 24 North America: Market Size, By Component, 20152022 (USD Million)

Table 25 North America: Cloud DLP Market Size, By Service, 20152022 (USD Million)

Table 26 North America: Market Size, By Professional Service, 20152022 (USD Million)

Table 27 North America: Cloud Data Loss Prevention Market Size, By Organization Size, 20152022 (USD Million)

Table 28 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 29 Europe: Market Size, By Component, 20152022 (USD Million)

Table 30 Europe: Market Size, By Service, 20152022 (USD Million)

Table 31 Europe: Market Size, By Professional Service, 20152022 (USD Million)

Table 32 Europe: Cloud DLP Market Size, By Organization Size, 20152022 (USD Million)

Table 33 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 34 Asia Pacific: Market Size, By Component, 20152022 (USD Million)

Table 35 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 36 Asia Pacific: Cloud Data Loss Prevention Market Size, By Professional Service, 20152022 (USD Million)

Table 37 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 38 Asia Pacific: Cloud DLP Market Size, By Vertical, 20152022 (USD Million)

Table 39 Middle East and Africa: Cloud Data Loss Prevention Market Size, By Component, 20152022 (USD Million)

Table 40 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 41 Middle East and Africa: Market Size, By Professional Service, 20152022 (USD Million)

Table 42 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 43 Middle East and Africa: Cloud DLP Market Size, By Vertical, 20152022 (USD Million)

Table 44 Latin America: Cloud Data Loss Prevention Market Size, By Component, 20152022 (USD Million)

Table 45 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 46 Latin America: Market Size, By Professional Service, 20152022 (USD Million)

Table 47 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 48 Latin America: Cloud Data Loss Prevention Market Size, By Vertical, 20152022 (USD Million)

Table 49 New Product Launches/Product Upgradations

Table 50 Partnerships, Agreements, and Collaborations

Table 51 Mergers and Acquisitions

Table 52 Business Expansions

List of Figures (30 Figures)

Figure 1 Cloud Data Loss Prevention Market: Market Segmentation

Figure 2 Cloud DLP Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Cloud DLP Market Size Estimation Methodology: Top-Down Approach

Figure 6 Cloud Data Loss Prevention Market Size, 20152022 (USD Million)

Figure 7 Market, By Vertical (2017 vs 2022)

Figure 8 Cloud DLP Market: Regional Snapshot

Figure 9 Top 3 Segments for the Market, 2017

Figure 10 Increasing Adoption of Cloud Technologies is Expected to Fuel the Growth of the Cloud DLP Market During the Forecast Period

Figure 11 Solution Segment is Estimated to Hold the Larger Market Share in 2017

Figure 12 Large Enterprises Segment is Estimated to Hold the Larger Market Share in 2017

Figure 13 Banking, Financial Services, and Insurance Vertical is Expected to Hold the Largest Market Share During the Forecast Period

Figure 14 Banking, Financial Services, and Insurance, and North America to Hold the Largest Market Share in 2017

Figure 15 Asia Pacific is Expected to Emerge as the Best Market for Investments Over the Next 5 Years

Figure 16 Cloud Data Loss Prevention Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Solution Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 18 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 19 Training, Consulting, and Integration Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 20 Large Enterprises Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 21 Retail and Consumer Goods Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 23 North America: Cloud Data Loss Prevention Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Development By Leading Players in the Cloud DLP Market for 20142017

Figure 26 Geographic Revenue Mix of Top Market Players

Figure 27 Check Point Software Technologies: Company Snapshot

Figure 28 Symantec: Company Snapshot

Figure 29 CA Technologies: Company Snapshot

Figure 30 Cisco Systems: Company Snapshot

Growth opportunities and latent adjacency in Cloud DLP Market