Cloud Data Security Market by Offering, Organization Size (Large Enterprises and SMEs), Offering Type, Vertical (BFSI, Retail & eCommerce, Government and Defense, Healthcare and Life Sciences, IT and ITeS, Telecom) and Region - Global Forecast to 2027

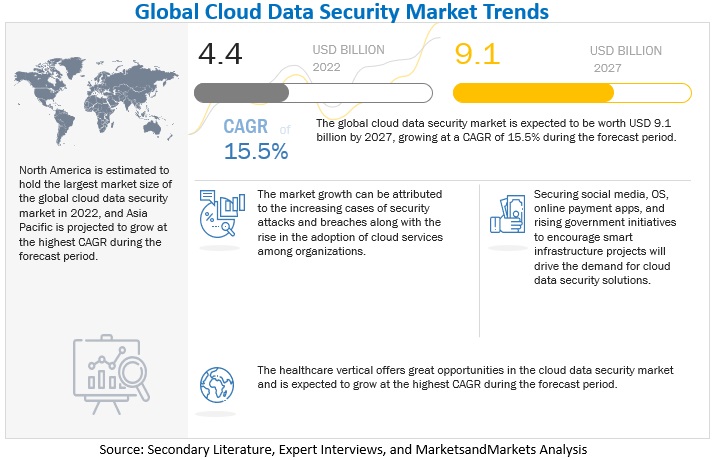

The global Cloud Data Security Market size is projected to grow from USD 4.4 billion in 2022 to USD 9.1 billion by 2027 at a CAGR of 15.5% during the forecast period. The rising occurrences of thefts and breaches and the rising popularity of cloud services among organizations are the primary factors driving the market growth. Moreover, securing social media, OS, online payment apps, and rising government initiatives to encourage smart infrastructure projects will drive the demand for these products in the near future.

To know about the assumptions considered for the study, Request for Free Sample Report

Cloud Data Security Market Dynamics

Driver: Rising adoption of cloud services by enterprises

Growth in the usage of cloud services across several sectors leads to an increase in reliance on the cloud for storage and other applications. The increasing number of internet users and the increased use of cloud services are the primary factors driving the adoption of cloud security solutions. As internet commerce develops, its significance will become more apparent. Businesses moving to the cloud increased quickly as a result of the speedy move to remote labor. Specifically, in their respective conference calls, Microsoft and Amazon noted the expansion of their cloud operations. Unlike Microsoft, which reported a 27% rise in revenue from Microsoft Azure and a 39% increase in overall cloud-related revenue, AWS recorded a 33% increase in sales to surpass the USD 10 billion mark. New channels for interacting with and reaching consumers, changes to organizational practices, and maintaining a competitive edge are other significant factors driving the rise in cloud use.

Additionally, the cloud is essential for helping organizations withstand lockout situations and erratic IT infrastructure, enabling them to grow more swiftly and increase their speed to market, agility, and responsiveness. The poll found that 67% of large companies had progressed cloud adoption, compared to 39% of medium-sized enterprises and 38% of small businesses that had just begun their cloud adoption journeys. However, 88% of medium-sized organizations and 92% of small enterprises have trouble managing security-related risks. To close the skill gap and address the significant lack of digital capabilities, organizations focused on new talent acquisition initiatives (73%) and launched automation projects (66%). The different cloud models and cloud service options offer organizations alternatives to implement the cloud in different ways and enable them to plan their technology budgets.

Restraint: Lack of cooperation and distrust between businesses and cloud security service providers

Due to the suspicion of cloud service providers, both big and small organizations are wary of moving their operations to the cloud (CSPs). There is a widespread lack of trust in these services due to unclear Service Level Agreements (SLAs), security or privacy standards, general terms and conditions, the infancy of cloud services, data breaches, and several other issues. Cloud service providers' infrastructure stores critical data for organizations, making them vulnerable to frequent and sophisticated cyberattacks. As a result, businesses may be hesitant to entrust these service providers with their confidential data. Cloud security service providers can assist companies in gaining clients by employing an open information security strategy. Such distrust in cloud computing technology for data storage inhibits the growth of the cloud security market.

Opportunity: Securing social media, OS, and online payment apps

Many financial services firms now require the use of cloud-based payment security solutions. Increased flexibility, security, data integration, and scalability are benefits of cloud-based security technology. The Payment Card Industry Data Security Standard (PCI DSS) must be followed for payment systems and cloud security programs to be compliant. In 2019, an Instagram user data breach exposed the sensitive personal data of at least 49 million users. The breach was caused by a vulnerable AWS server that was connected to the internet. These occurrences act as a warning to social media businesses to spend heavily on cloud security services to avoid security mistakes in the future. Cloud security companies are giving more services to protect home PCs. To secure personal computers, cloud security firms are increasingly providing security cloud subscription services (PCs) for Mac, Android, Windows, or Apple iOS mobile devices as BYOD, CYOD, and work-from-home practices are gaining traction.

Challenge: DevOps, DevSecOps, & automation and privileges & key management

Teams in DevOps and DevSecOps flourish when tasks are finished swiftly and effectively. They create highly automated CI/CD systems to do this. Automation makes faster software development cycles possible by ensuring that security measures are properly identified and applied in all code and templates from the beginning of the software development cycle. However, after the workload has been delivered, security-related changes might threaten the organization's entire security posture. They may possibly lengthen the time to market. Consequently, this poses problems for the industry for cloud data protection. The configuration of cloud user roles is typically quite lax, granting privileges that are neither necessary nor intended. For instance, giving database write or delete privileges to an inexperienced user or a person with no business need to add or delete database assets. Another critical risk at the application level may occur when improperly configured keys and privileges expose sessions to security risks. Thus, creating a challenge for the cloud security market.

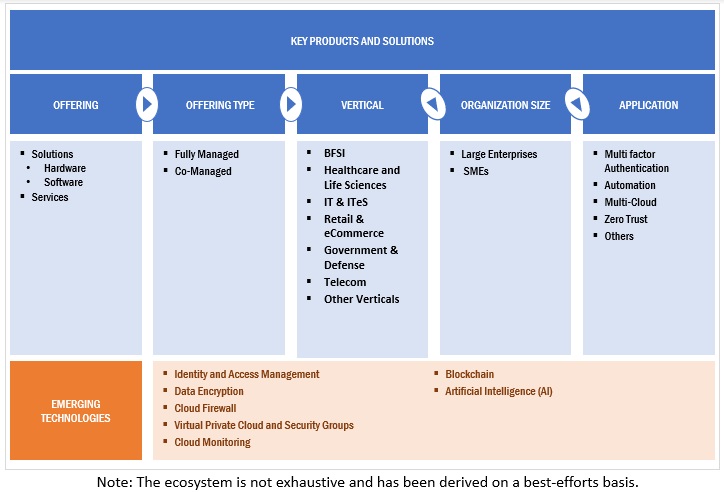

Cloud data security market ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By offering, solutions segment to account for larger market size during forecast period

By offering, the market is segmented into solutions and services. The demand for cloud security solutions has increased within the last two years as many businesses have quickly adopted these solutions to support remote work. This is due to the fact that cloud-based security solutions offer increased flexibility, security, data integration, and scalability. A complete data lifecycle, from creation to disposal, is protected by a strong cloud security solution. Furthermore, a scalable cloud computing solution can adapt capacity, security coverage, and pricing in response to changes in demand. For instance, server capacity is increased to prevent server breakdowns during times of high demand. Additionally, a cloud security solution gives ongoing support for a business's digital assets and offers remedies when environmental disruptions pose a hazard. This includes continuous live monitoring to handle problems immediately, 24x7x365. Thus, cloud security solutions have the highest market size during the forecast period.

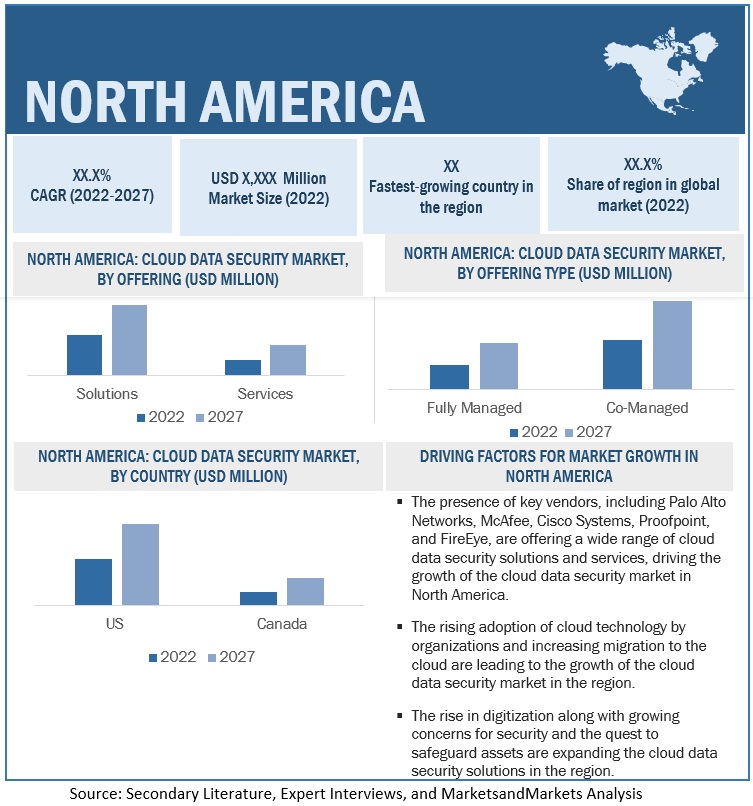

By region, North America to have the largest market size during the forecast period

North America dominates the global cloud data security market with a large number of vendors, such as Crowdstrike, Check Point, IBM, Palo Alto Networks, and Digital Guardian, resulting in the adoption of cloud data security solutions in the region. Increasing incidents of security breaches, rising adoption of cloud technology by organizations in their businesses, and increasing migration to the cloud are leading to the growth of the cloud data security market in the region. Furthermore, the rise in digitization, growing concerns for security, and the quest to safeguard assets are expanding the cloud data security solutions in the North American region.

Key Market Players

CrowdStrike (US), Check Point (US), Palo Alto Networks (US), Zscaler (US), IBM (US), Imperva (US), Veritas (US), Digital Guardian (US), VMware (US), and Thales (France) are some of the key players operating in the global cloud data security market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Offering, By Organization Size, By Offering Type, By Vertical, and By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Major companies covered |

Major vendors in the global cloud data security market include CrowdStrike (US), Check Point (US), Palo Alto Networks (US), Zscaler (US), IBM (US), Imperva (US), Veritas (US), Digital Guardian (US), VMware (US), Thales (France), Sophos (UK), Polar (Israel), Netwrix (US), Informatica (US), Commvault (US), Orca Security (US), Radware (US), Rubrik (US), Veeam (US), Infrascale (US), Druva (US), Faction (US), Cohesity (US), Netskope (US), and Cloudian (US). |

Cloud Data Security Market Highlights

This research report categorizes the Cloud Data Security Market to forecast revenues and analyze trends in each of the following submarkets:

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Organization Size: |

|

|

By Offering Type: |

|

|

By Vertical: |

|

|

By Region: |

|

Recent Development

- In October 2022, Check Point enhanced its solution named Check Point's Quantum Titan, which combines AI and deep learning technology to defend against the most sophisticated attacks, such as zero-day phishing and domain name system exploits. This provides better and more efficient security across a company's complex, distributed networks, both on-premises and in the cloud.

- In July 2022, Crowdstrike unveiled a new service, Falcon OverWatch Cloud Threat Hunting, a service that enables security teams to continually find hidden and sophisticated threats. It continually scans the cloud for suspicious behaviours and threats. The system is built on a cloud sensor network that protects over 1.5 billion containers daily and gives real-time visibility into cloud-based threats.

- In November 2021, Palo Alto Networks partnered with Siemens (Germany). Palo Alto Networks announced the extension of its technology partnership with Siemens to improve the security of mission-critical networks and prevent the threat of cyberattacks on critical infrastructure.

- In October 2021, ZScaler partnered with Crowdstrike (US). This integration allows Zscaler ZIATM to use CrowdStrike Falcon ZTA (Zero Trust Assessment) device scores to configure access policies. With this partnership, clients of Zscaler and CrowdStrike may now extend zero trust security to both internal and external apps using Zscaler.

Frequently Asked Questions (FAQ):

What is the definition of the cloud data security market?

Cloud data security refers to the technology, rules, services, and security procedures that prevent the loss, leakage, or exploitation of any data stored in the cloud through breaches, exfiltration, and unauthorized access.

What is the projected market value of the global cloud data security market?

The global cloud data security market is projected to grow from USD 4.4 billion in 2022 to USD 9.1 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 15.5% during the forecast period.

Who are the key companies influencing the market growth of the cloud data security market?

CrowdStrike (US), Check Point (US), Palo Alto Networks (US), Zscaler (US), IBM (US), Imperva (US), Veritas (US), Digital Guardian (US), VMware (US), Thales (France), Sophos (UK), Polar (Israel), Netwrix (US), Informatica (US), Commvault (US), Orca Security (US), Radware (US), Rubrik (US), Veeam (US), Infrascale (US), Druva (US), Faction (US), Cohesity (US), Netskope (US), and Cloudian (US) are the major vendors in the cloud data security market and are recognized as the star players. These companies account for a major share of the cloud data security market. They offer wide solutions related to cloud data security solutions and services. These vendors offer customized solutions per user requirements and adopt growth strategies to consistently achieve the desired growth and make their presence in the market.

What is the COVID-19 impact on the cloud data security market?

The COVID-19 epidemic has altered how businesses function. Back-end support services are under pressure due to the rise in the number of people working from home. Only service providers with enough architecture and a consistent level of customer service will be able to handle the additional load. In order to ensure they are proactive about meeting demand; cloud providers must also keep an eye on how things are developing. Those that choose a reactive approach will struggle.

What are some of the mandates for cloud data security?

There are several stringent government regulations and policies in Europe, North America, and Asia Pacific countries, such as the International Organization for Standardization (ISO), Sarbanes-Oxley Act of 2002 (SOX), GDPR, HIPAA, and The Payment and Settlements Systems Act (PSS). These sets of regulations and policies are meant to protect individuals and organizations from criminal activities and mandate the incorporation of advanced security solutions, such as cloud data security solutions, in organizations and also for individuals. In case of any breach or security attacks, heavy penalties and fines are imposed per these mandates; therefore, these regions are rapidly adopting cloud data security solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of cloud services by enterprises- Increasing number of cyberattacksRESTRAINTS- Lack of cooperation and distrust between businesses and cloud security service providers- Complexities associated with deployment and operations of cloud data security solutionsOPPORTUNITIES- Rising investments by social media companies in cloud security services- Government initiatives encouraging smart infrastructure projectsCHALLENGES- Timely delivery of products and security-related issues with DevOps, DevSecOps, and automation- Cloud compliance and governance- Complex environments and constantly changing workloads

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: LOOKOUT’S SOLUTION TO IMPROVE SECURITY AND COMPLIANCE FOR LEADING FINANCIAL TECHNOLOGYCASE STUDY 2: 360LEARNING TO IMPROVE ITS CLOUD SECURITY POSTURE WITH ORCA CLOUD SECURITY PLATFORMCASE STUDY 3: VARONIS EDGE TO FORTIFY CLOUD DATA SECURITY

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

-

5.8 TECHNOLOGY ANALYSISINCREASED USAGE OF AI AND MLCLOUD SECURITY POSTURE MANAGEMENTENCRYPTIONIDENTITY AND ACCESS MANAGEMENTBLOCKCHAIN IN CLOUD COMPUTINGVIRTUAL PRIVATE CLOUD AND SECURITY GROUPS

-

5.9 PATENT ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING BUYERS

-

5.11 TARIFF AND REGULATORY LANDSCAPEINTRODUCTIONPAYMENT CARD INDUSTRY DATA SECURITY STANDARDCALIFORNIA CONSUMER PRIVACY ACTPAYMENT SERVICES DIRECTIVE 2PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACTELECTRONIC IDENTIFICATION, AUTHENTICATION, AND TRUST SERVICESINTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARD 27001FEDERAL INFORMATION PROCESSING STANDARDSGRAMM-LEACH-BLILEY ACT OF 1999EUROPEAN UNION GENERAL DATA PROTECTION REGULATIONSERVICE ORGANIZATION CONTROL 2 COMPLIANCEHIPAA COMPLIANCE

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.13 KEY CONFERENCES AND EVENTS, 2023

-

6.1 INTRODUCTIONOFFERING: MARKET DRIVERS

-

6.2 SOLUTIONSADVANCED CLOUD DATA SECURITY SOLUTIONS TO BOOST MARKET

-

6.3 SERVICESSIGNIFICANT GROWTH IN CLOUD DATA MONITORING TO GENERATE DEMAND FOR SECURITY SERVICES

-

7.1 INTRODUCTIONORGANIZATION SIZE: MARKET DRIVERS

-

7.2 LARGE ENTERPRISESRISING CONCERNS ABOUT REGULATORY COMPLIANCE TO FUEL ADOPTION OF CLOUD DATA SECURITY

-

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)FLEXIBILITY AND AFFORDABILITY TO BOOST SALES OF SECURITY SOLUTIONS

-

8.1 INTRODUCTIONOFFERING TYPE: MARKET DRIVERS

-

8.2 FULLY MANAGEDCUSTOMIZATION OF FULLY MANAGED OFFERING TYPE TO FUEL DEMAND FOR SECURITY OPERATIONS

-

8.3 CO-MANAGEDCOST OPTIMIZATION, SCALABILITY, AND FLEXIBILITY TO DRIVE DEMAND FOR INTERNAL SECURITY

-

9.1 INTRODUCTIONVERTICAL: MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCERISING DEMAND FOR DATA PROTECTION SERVICES IN BANKING COMPANIES TO DRIVE MARKET

-

9.3 RETAIL & E-COMMERCEAUTOMATION ACROSS RETAIL CHANNELS FOR CURBING DATA THEFT TO PROPEL MARKET

-

9.4 GOVERNMENT & DEFENSERISING CONCERNS ABOUT IDENTITY THEFT AND BUSINESS FRAUD TO FUEL MARKET GROWTH

-

9.5 HEALTHCARE & LIFE SCIENCESNEED TO SECURE CRITICAL PATIENT DATA ACROSS CLOUD ENVIRONMENT TO BOOST SEGMENT GROWTH

-

9.6 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICESGROWING CONCERNS OF FRAUD AND COMPLIANCE TO PROPEL MARKET

-

9.7 TELECOMNEED TO SECURE CLOUD TELECOM INFRASTRUCTURE TO FUEL SEGMENT GROWTH

- 9.8 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Stringent regulations and technological advancementsCANADA- Increased data breaches and government efforts

-

10.3 EUROPEEUROPE: CLOUD SECURITY MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Increasing adoption of cloud services and strict regulationsGERMANY- Robust economy and increased demand for compliance solutionsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: CLOUD DATA SECURITY MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Growing cloud computing market and increasing use of smart technologyJAPAN- High internet penetration and digitally connected countryINDIA- Fastest developing country and highly prone to security attacksREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: CLOUD DATA SECURITY DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Growing adoption of cloud-based security and digital transformationAFRICA- Adoption of cloud technology to tackle rising cases of cybercrimes

-

10.6 LATIN AMERICALATIN AMERICA: CLOUD DATA SECURITY MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Deployment of private and hybrid cloud and investment by cloud service vendorsMEXICO- Rise in digitization and investments by key organizationsREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 REVENUE SHARE ANALYSIS OF LEADING PLAYERS, 2022

- 11.3 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.4 HISTORICAL REVENUE ANALYSIS

- 11.5 RANKING OF KEY PLAYERS

-

11.6 EVALUATION MATRIX FOR KEY PLAYERSDEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 COMPETITIVE BENCHMARKINGEVALUATION CRITERIA FOR KEY COMPANIESEVALUATION CRITERIA FOR STARTUPS/SMES

-

11.8 EVALUATION MATRIX FOR STARTUPS/SMESDEFINITIONS AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.9 COMPETITIVE SCENARIOPRODUCT/SOLUTION LAUNCHESDEALS

-

12.1 KEY PLAYERSCROWDSTRIKE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHECK POINT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPALO ALTO NETWORKS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZSCALER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIMPERVA- Business overview- Products/Solutions/Services offered- Recent developmentsVERITAS- Business overview- Products/Solutions/Services offered- Recent developmentsDIGITAL GUARDIAN- Business overview- Products/Solutions/Services offered- Recent developmentsVMWARE- Business overview- Products/Solutions/Services offered- Recent developmentsTHALES- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER PLAYERSSOPHOSPOLARNETWRIXINFORMATICACOMMVAULTORCA SECURITYRADWARERUBRIKVEEAMINFRASCALEDRUVAFACTIONCOHESITYNETSKOPECLOUDIAN

- 13.1 INTRODUCTION TO ADJACENT MARKETS

- 13.2 LIMITATIONS

-

13.3 CLOUD DATA SECURITY MARKET ECOSYSTEM AND ADJACENT MARKETSDATA-CENTRIC SECURITY MARKETCLOUD SECURITY POSTURE MANAGEMENT MARKETCONTAINER SECURITY MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 CLOUD DATA SECURITY MARKET AND GROWTH RATE, 2018–2021 (USD MILLION, Y-O-Y %)

- TABLE 4 MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 MARKET: PRICING LEVELS

- TABLE 7 MARKET: PATENTS

- TABLE 8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 10 CONFERENCES AND EVENTS, 2023

- TABLE 11 CLOUD DATA SECURITY MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 12 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 13 SOLUTIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 14 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 15 SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 16 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 17 MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 18 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 19 LARGE ENTERPRISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 20 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 21 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 22 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 24 MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 25 FULLY MANAGED: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 26 FULLY MANAGED: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 CO-MANAGED: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 28 CO-MANAGED: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 30 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 31 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 32 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 RETAIL & E-COMMERCE: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 34 RETAIL & E-COMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 36 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 38 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 40 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 TELECOM: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 42 TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 OTHER VERTICALS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 44 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 46 MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 48 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 50 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 57 US: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 58 US: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 59 US: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 60 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 61 US: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 62 US: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 63 US: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 64 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 65 CANADA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 66 CANADA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 67 CANADA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 68 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 69 CANADA: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 70 CANADA: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 71 CANADA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 72 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 73 EUROPE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 74 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 75 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 77 EUROPE: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 78 EUROPE: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 83 UK: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 84 UK: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 85 UK: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 86 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 87 UK: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 88 UK: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 89 UK: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 90 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 91 GERMANY: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 92 GERMANY: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 93 GERMANY: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 94 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 95 GERMANY: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 96 GERMANY: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 97 GERMANY: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 98 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 99 REST OF EUROPE: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 100 REST OF EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 101 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 102 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 103 REST OF EUROPE: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 104 REST OF EUROPE: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 105 REST OF EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 106 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 117 CHINA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 118 CHINA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 119 CHINA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 120 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 121 CHINA: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 122 CHINA: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 123 CHINA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 124 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 125 JAPAN: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 126 JAPAN: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 127 JAPAN: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 128 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 130 JAPAN: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 131 JAPAN: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 132 JAPAN: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 133 JAPAN: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 134 INDIA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 135 INDIA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 136 INDIA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 137 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 138 INDIA: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 139 INDIA: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 140 INDIA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 141 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 160 MIDDLE EAST: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 161 MIDDLE EAST: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 162 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 163 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 164 MIDDLE EAST: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 165 MIDDLE EAST: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 166 MIDDLE EAST: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 167 MIDDLE EAST: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 168 AFRICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 169 AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 170 AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 171 AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 172 AFRICA: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 173 AFRICA: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 174 AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 175 AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 176 LATIN AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 177 LATIN AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 178 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 179 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 180 LATIN AMERICA: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 181 LATIN AMERICA: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 182 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 183 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 184 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 185 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 186 BRAZIL: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 187 BRAZIL: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 188 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 189 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 190 BRAZIL: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 191 BRAZIL: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 192 BRAZIL: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 193 BRAZIL: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 194 MEXICO: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 195 MEXICO: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 196 MEXICO: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 197 MEXICO: CLOUD DATA SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 198 MEXICO: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 199 MEXICO: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 200 MEXICO: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 201 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 202 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 203 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 204 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 205 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 206 REST OF LATIN AMERICA: MARKET, BY OFFERING TYPE, 2018–2021 (USD MILLION)

- TABLE 207 REST OF LATIN AMERICA: MARKET, BY OFFERING TYPE, 2022–2027 (USD MILLION)

- TABLE 208 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 209 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 210 MARKET: DEGREE OF COMPETITION

- TABLE 211 COMPANY VERTICAL FOOTPRINT

- TABLE 212 KEY STARTUPS

- TABLE 213 MARKET: PRODUCT/SOLUTION LAUNCHES, 2020–2022

- TABLE 214 MARKET: DEALS, 2020–2022

- TABLE 215 CROWDSTRIKE: BUSINESS OVERVIEW

- TABLE 216 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 CROWDSTRIKE: PRODUCT LAUNCHES

- TABLE 218 CROWDSTRIKE: DEALS

- TABLE 219 CHECK POINT: BUSINESS OVERVIEW

- TABLE 220 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 CHECK POINT: PRODUCT LAUNCHES

- TABLE 222 CHECK POINT: DEALS

- TABLE 223 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- TABLE 224 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- TABLE 226 PALO ALTO NETWORKS: DEALS

- TABLE 227 ZSCALER: BUSINESS OVERVIEW

- TABLE 228 ZSCALER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 ZSCALER: PRODUCT LAUNCHES

- TABLE 230 ZSCALER: DEALS

- TABLE 231 IBM: BUSINESS OVERVIEW

- TABLE 232 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 IBM: PRODUCT LAUNCHES

- TABLE 234 IBM: DEALS

- TABLE 235 IMPERVA: BUSINESS OVERVIEW

- TABLE 236 IMPERVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 IMPERVA: PRODUCT LAUNCHES

- TABLE 238 IMPERVA: DEALS

- TABLE 239 VERITAS: BUSINESS OVERVIEW

- TABLE 240 VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 VERITAS: PRODUCT LAUNCHES

- TABLE 242 VERITAS: DEALS

- TABLE 243 DIGITAL GUARDIAN: BUSINESS OVERVIEW

- TABLE 244 DIGITAL GUARDIAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 DIGITAL GUARDIAN: DEALS

- TABLE 246 VMWARE: BUSINESS OVERVIEW

- TABLE 247 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 VMWARE: PRODUCT LAUNCHES

- TABLE 249 VMWARE: DEALS

- TABLE 250 THALES: BUSINESS OVERVIEW

- TABLE 251 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 THALES: PRODUCT LAUNCHES

- TABLE 253 THALES: DEALS

- TABLE 254 ADJACENT MARKETS AND FORECASTS

- TABLE 255 DATA-CENTRIC SECURITY MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 256 DATA-CENTRIC SECURITY MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 257 ON-PREMISES: DATA-CENTRIC SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 258 ON-PREMISES: DATA-CENTRIC SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 259 CLOUD: DATA-CENTRIC SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 260 CLOUD: DATA-CENTRIC SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 261 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 262 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 263 CLOUD SECURITY POSTURE MANAGEMENT MARKET IN SMALL & MEDIUM ENTERPRISES, BY REGION, 2016–2021 (USD MILLION)

- TABLE 264 CLOUD SECURITY POSTURE MANAGEMENT MARKET IN SMALL & MEDIUM ENTERPRISES, BY REGION, 2022–2027 (USD MILLION)

- TABLE 265 CLOUD SECURITY POSTURE MANAGEMENT MARKET IN LARGE ENTERPRISES, BY REGION, 2016–2021 (USD MILLION)

- TABLE 266 CLOUD SECURITY POSTURE MANAGEMENT MARKET IN LARGE ENTERPRISES, BY REGION, 2022–2027 (USD MILLION)

- TABLE 267 CONTAINER SECURITY MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

- TABLE 268 CONTAINER SECURITY MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 269 CLOUD: CONTAINER SECURITY MARKET, BY REGION, 2015–2020 (USD MILLION)

- TABLE 270 CLOUD: CONTAINER SECURITY MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 271 ON-PREMISES: CONTAINER SECURITY MARKET, BY REGION, 2015–2020 (USD MILLION)

- TABLE 272 ON-PREMISES: CONTAINER SECURITY MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 CLOUD DATA SECURITY MARKET: RESEARCH FLOW

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF CLOUD DATA SECURITY VENDORS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3 (DEMAND SIDE), TOP-DOWN APPROACH

- FIGURE 5 LIMITATIONS OF MARKET

- FIGURE 6 GLOBAL MARKET SIZE AND Y-O-Y GROWTH RATE

- FIGURE 7 MARKET SHARE OF SEGMENTS WITH HIGH GROWTH RATES DURING FORECAST PERIOD

- FIGURE 8 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2022

- FIGURE 9 SECURITY BREACHES, STRINGENT REGULATIONS, AND ADOPTION OF IOT AND CLOUD TRENDS TO DRIVE MARKET GROWTH

- FIGURE 10 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 12 CO-MANAGED SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE

- FIGURE 13 BFSI AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARES

- FIGURE 14 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 15 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 VALUE CHAIN ANALYSIS: MARKET

- FIGURE 17 CLOUD DATA SECURITY MARKET: ECOSYSTEM

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS

- FIGURE 20 PATENTS PUBLISHED, YEAR-WISE

- FIGURE 21 TOP PATENTS BY JURISDICTION

- FIGURE 22 CHANGES AND TRENDS AFFECTING BUYERS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 24 SOLUTIONS SEGMENT PROJECTED TO HAVE LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 25 LARGE ENTERPRISES TO HAVE LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 26 CO-MANAGED SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 27 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 28 ASIA PACIFIC TO GROW AT HIGHEST CAGR BY 2027

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 31 REVENUE SHARE ANALYSIS OF CLOUD DATA SECURITY MARKET, 2022

- FIGURE 32 SEGMENTAL REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS (USD MILLION)

- FIGURE 33 RANKING OF TOP FIVE CLOUD DATA SECURITY PLAYERS, 2022

- FIGURE 34 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 35 EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 36 EVALUATION QUADRANT FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 37 EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 38 CROWDSTRIKE: COMPANY SNAPSHOT

- FIGURE 39 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 40 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 41 ZSCALER: COMPANY SNAPSHOT

- FIGURE 42 IBM: COMPANY SNAPSHOT

- FIGURE 43 VMWARE: COMPANY SNAPSHOT

- FIGURE 44 THALES: COMPANY SNAPSHOT

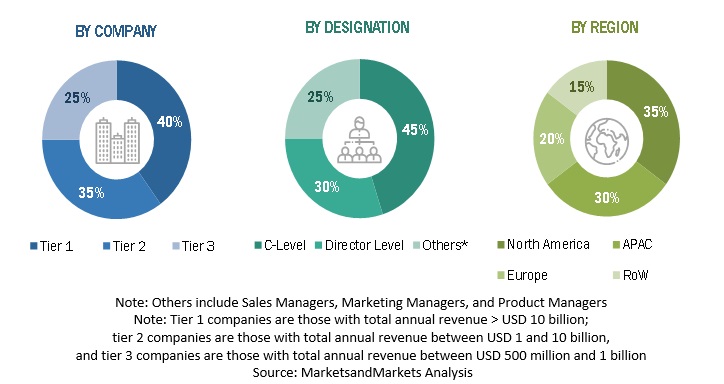

The study involved major activities in estimating the current market size for the cloud data security market. Exhaustive secondary research was done to collect information on the cloud data security industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the cloud data security market.

Secondary research

In the secondary research process, various sources were referred to for identifying and collecting information regarding the study. The secondary sources included annual reports, press releases, investor presentations of cloud data security software and service vendors, forums, certified publications, and white papers. The secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources. The factors considered for estimating the regional market size are technological initiatives undertaken by governments of different countries, Gross Domestic Product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of major cloud data security solution providers.

Primary research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the cloud data security market.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of cloud data security market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global market and estimate the size of various other dependent sub-segments in the overall cloud data security market. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report objectives

To define, describe, and forecast the cloud data security market based on offerings, organization sizes, offering types, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the cloud data security market

- To profile the key players of the market and comprehensively analyze their market size and core competencies.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global cloud data security market

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Data Security Market