Distributed Cloud Market by Service Type (Data Security, Data Storage, Networking), Application (Edge Computing, Content Delivery, Internet of Things), Organization Size, Vertical (BFSI, IT & Telecom, Government) and Region - Global Forecast to 2027

Updated on : April 3, 2023

Distributed Cloud Market Analysis

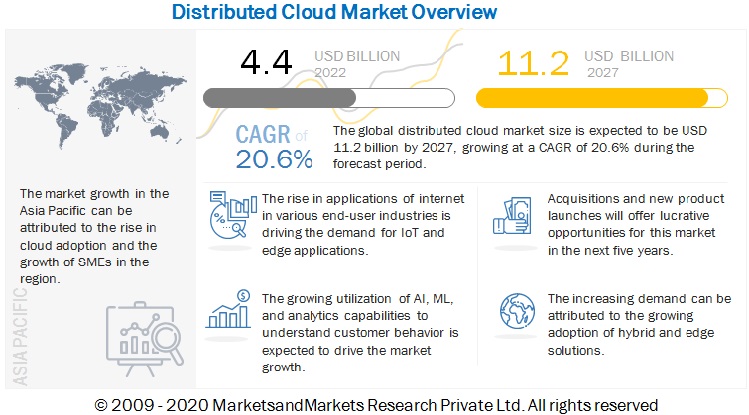

The global distributed cloud market size in terms of revenue was reasonably estimated at $4.4 billion in 2022 and is anticipated to rise to $11.2 billion by 2027, presenting a CAGR of 20.6%. An industry trend analysis of the market is part of the latest research report. The latest research study includes market buying trends, pricing analysis, patent analysis, conference and webinar materials, and important stakeholders. Need for network scalability to meet business requirements, growing focus on enhancing user experience, and growing need for digital transformation is expected to drive the demand for distributed cloud technology.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The impact of the COVID-19 pandemic on the market is covered throughout the report. The pandemic has had a positive impact on the distributed cloud market. The distributed nature of cloud services is a natural fit for managing virtual work. In fact, digital productivity and collaboration platforms have been a saving grace during the current pandemic. The cloud services now ensure more dependable and secure remote work for corporate enterprises. As the impact of the global pandemic continues to change the nature of work, distributed cloud technologies are now set to reshape the post-COVID world. Alongside travel restrictions and the dangers posed by disease transmission, the world’s international economic system is changing as well. Given this economic reorientation, cloud computing is becoming the default feature of contemporary business enterprises. Distributed cloud computing expands the traditional, large data center-based cloud model to a set of distributed cloud infrastructure components that are geographically dispersed. Where distributed computing segregates computation workload across multiple, interconnected servers, distributed cloud computing generalizes this to the cloud infrastructure.

Distributed Cloud Market Dynamics

Driver: Growing focus on enhancing user experiences

Distributed cloud computing models enable businesses to process data in real time. Businesses can enhance user experiences by focusing on new and innovative strategies with accuracy, relevant data, and consistency. Distributed cloud computing solutions enable businesses to customize their solutions to create long-term relationships with their customers. With this advanced version of cloud services, businesses can enhance their responses to customer choices and offer seamless services.

Restraint: Implementing distributed cloud architecture at a global scale

The rise in distributed cloud applications and computing will pose a challenge for IT organizations to implement distributed cloud architecture globally. Designing and implementing distributed cloud architecture is complex due to the unique architecture of each cloud service provider, such as Google, AWS, and Azure, as well as a particular requirement for an organization’s private cloud deployments and edge computing architectures. Thus, IT organizations must combine the capabilities of IaaS to supply security, visibility, and control of dedicated network support and security.

Opportunity: Development in 5G network to drive growth of distributed cloud architecture

Distributed cloud infrastructure is the combination of edge computing and cloud computing models where the edge locations will act as a network between physical locations, centralized data centers, base stations, remote locations, and on-premises. This proliferation of distributed cloud sites will require a number of mini data centers owned by service providers and organizations. It will require strong and cost-effective network connectivity, which can manage and provide network slicing provided by the 5G network. The software can play an important part in advancing the 5G network and delivering new network solutions to offer speed and security and reduce cost. For instance, in 2020, Microsoft announced the acquisition of Affirmed Networks to deliver new opportunities in the wake of 5G adoption. Microsoft intended to transform the telecom industry as the industry moves towards 5G network operations. Hence, 5G will play an important role in the adoption of distributed cloud architecture in different geographic locations.

Challenge: Performance fluctuations with low bandwidth

Performance fluctuation is another challenge while operating in a cloud environment. As multiple applications are running altogether on a single server, chances are their performance issue because of the shared resources. Performance can also be affected when the cloud service providers limit the bandwidth. If a company runs out of its quota, it has to pay an additional charge, which could be expensive.

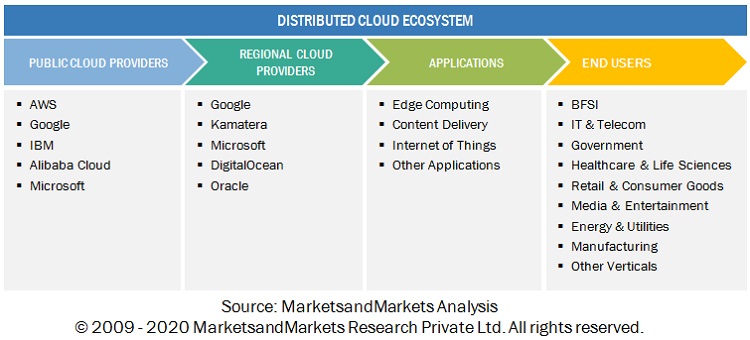

Distributed Cloud Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on service type, data security is the second largest contributor to the distributed cloud market growth during the forecast period

Distributed cloud architecture maps out each component’s dependency on the distributed cloud to improve the visibility across distributed cloud environments. Due to the scalable nature of cloud computing, it is necessary to scale applications considering security implications. Distributed cloud architecture ensures certain data resources and processes remain in organization’s private cloud or data center to which the public cloud is integrated. Thus, this architecture ensures the security of confidential information by hosting it on a private cloud.

Based on organization size, the large enterprises to be a larger contributor to the Distributed cloud market growth during the forecast period

Large enterprises focus on gaining market presence by adopting the latest technology to remain ahead of the competition. The adoption of distributed cloud technology among large enterprises is likely to be higher as compared to SMEs. Large organizations have customers across geographical locations. Thus, these organizations focus on serving customers in each location to improve customer experiences and build strong relationships. To accommodate a large number of customers and data, these organizations are now making a strategic shift to the latest technologies to become cloud-driven companies. Thus, large organizations have accelerated cloud adoption with the advent of the distributed cloud.

Based on vertical, retail & consumer goods to grow at a higher CAGR during the forecast period.

The retail & consumer goods vertical is growing at a higher pace with the increasing purchasing power of customers. This vertical deals with a huge amount of customer data, which helps improve customer behavior and maintain a healthy relationships. The growing demand for internet services and the usage of smartphones are driving the demand for mobility solutions in this sector. The retailers constantly focus on improving their customer base and offering improved customer support. To meet the challenges with the data handling during the festive seasons, these industries can shift their non-critical workloads to the public cloud while creating additional infrastructure. This is likely to support the adoption of hybrid cloud solutions, which provisions the utilization of distributed cloud technology in this sector.

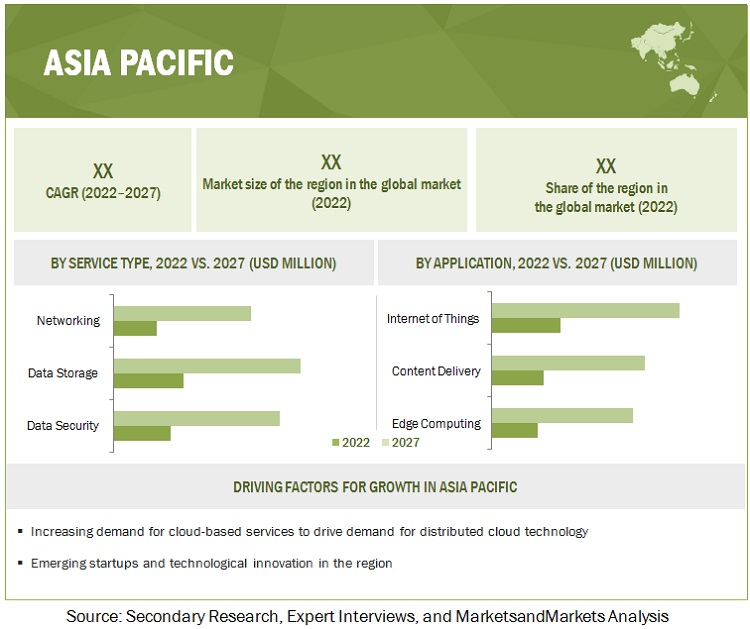

Asia Pacific to grow at the highest CAGR during the forecast period.

The Asia Pacific market is gaining huge traction among global businesses. The region consists of countries with a complex ecosystem of startups, governments, SMEs, and large multinational companies providing valuable ICT solutions. Major factors for technological advancements in the region are the rising levels of urbanization, technological innovation, and government support for the digital economy. Rapid advancements in telecommunications, cloud computing, and IoT have led to several organizations adopting cloud-based strategies. The region is expected to experience huge growth during the forecast period. With the increasing adoption of cloud technologies and the rising amount of business processes, there has been a significant rise in the adoption of distributed services.

Key Market Players

The Distributed cloud market is dominated by companies such as Google (US), IBM (US), Microsoft (US), AWS (US), VMware (US), Alibaba Cloud (China), Teradata (US), F5 (US), Cohesity (US), Oracle (US) Commvault (US), SCC (UK) Wind River Systems (US), Cubbit (Italy), PhoenixNAP (US), Pluribus Networks (US), Anyscale(US), Panzura (US), Platform9 (US), Zededa (US), and Hazelcast (US). These vendors have a large customer base and strong geographic presence with distribution channels globally to drive business revenue and growth.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2022-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Service Type (Data Security, Data Storage, Networking), Application (Edge Computing, Content Delivery, Internet of Things), Organization Size, Vertical (BFSI, IT & Telecom, Government), and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Companies covered |

Google (US), IBM (US), Microsoft (US), AWS (US), VMware (US), Alibaba Cloud (China), Teradata (US), F5 (US), Cohesity (US), Oracle (US) Commvault (US), SCC (UK) Wind River Systems (US), Cubbit (Italy), PhoenixNAP (US), Pluribus Networks (US), Anyscale(US), Panzura (US), Platform9 (US), Zededa (US), and Hazelcast (US). |

This research report categorizes the distributed cloud market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Service Type:

- Data Security

- Data Storage

- Networking

- Autonomy

- Other Service Types

Based on the Application:

- Edge Computing

- Content Delivery

- Internet of Things

- Other Applications

Based on the Organization Size:

- Large Enterprises

- Small and Medium Size Enterprises

Based on the Vertical:

- BFSI

- IT & Telecom

- Government

- Healthcare & Life Sciences

- Retail & Consumer Goods

- Media & Entertainment

- Energy & Utilities

- Manufacturing

- Other Verticals

Based on Regions:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In February 2022, F5 announced the expansion of its application security and delivery portfolio with F5 Distributed Cloud Services that provide security, multi-cloud networking, and edge-based computing solutions on a unified Software-as-a-Service (SaaS) platform.

- In March 2021, IBM announced the hybrid cloud services via IBM Cloud Satellite. Lumen Technologies and IBM integrated IBM Cloud Satellite with the Lumen’s edge platform to help the customers utilize hybrid cloud services in real time and develop solutions at the edge.

- In June 2021, Google partnered with Ericsson to develop 5G and edge computing solutions for telecommunication service providers to transform and unlock new opportunities and use cases digitally.

- In June 2021, Microsoft launched Azure Arc-enabled SQL, which extends the Azure services capabilities to instances hoisted on the edge or in a multi-cloud environment.

- In August 2020, Alibaba Cloud partnered with Universiti Tunku Abdul Rahman to transform the cloud computing education offerings for students and staff.

Frequently Asked Questions (FAQ):

What is the projected market value of the global distributed cloud market?

What is the estimated growth rate (CAGR) of the global distributed cloud market for the next five years?

What are the major revenue pockets in the distributed cloud market currently?

Which are the major vendors in the Distributed cloud market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 DISTRIBUTED CLOUD MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 LIST OF KEY PRIMARY INTERVIEW PARTICIPANTS

2.1.2.1 Breakup of primary profiles

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF DISTRIBUTED CLOUD FROM VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF DISTRIBUTED CLOUD VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): DISTRIBUTED CLOUD MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 9 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 10 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 11 DISTRIBUTED CLOUD MARKET: GLOBAL SNAPSHOT, 2020–2027

FIGURE 12 TOP-GROWING SEGMENTS IN MARKET

FIGURE 13 DATA STORAGE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 14 EDGE COMPUTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 15 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 16 RETAIL & CONSUMER GOODS VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 17 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 BRIEF OVERVIEW OF DISTRIBUTED CLOUD MARKET

FIGURE 18 GROWTH IN SOLUTIONS AND SERVICES FOR CLOUD COMPUTING TO DRIVE DEMAND FOR DISTRIBUTED CLOUD

4.2 MARKET, BY SERVICE TYPE, 2022 VS. 2027

FIGURE 19 DATA STORAGE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY APPLICATION, 2022 VS. 2027

FIGURE 20 INTERNET OF THINGS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

FIGURE 21 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY VERTICAL, 2022 VS. 2027

FIGURE 22 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.6 MARKET—INVESTMENT SCENARIO

FIGURE 23 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DISTRIBUTED CLOUD MARKET

5.2.1 DRIVERS

5.2.1.1 Need for network scalability to meet business requirements

5.2.1.2 Growing focus on enhancing user experience

5.2.1.3 Growing need for digital transformation

5.2.2 RESTRAINTS

5.2.2.1 Implementing distributed cloud architecture on global scale

5.2.3 OPPORTUNITIES

5.2.3.1 Development of 5G network

5.2.3.2 Growing adoption of cloud services across industry verticals

5.2.4 CHALLENGES

5.2.4.1 Security and data privacy concerns with public cloud architecture

5.2.4.2 Performance fluctuations with low bandwidth

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: GREGGS MANAGED AND SECURED HYBRID AND MULTI-CLOUD ENVIRONMENTS DEPLOYING MICROSOFT SOLUTIONS

5.3.2 CASE STUDY 2: DENIZBANK INNOVATED BANKING PLATFORM WITH GOOGLE TO MEET CUSTOMER DEMAND

5.3.3 CASE STUDY 3: TIPICO OPERATED WITHIN STRICT GOVERNMENT REGULATIONS WITH AWS’ SOLUTIONS

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 25 DISTRIBUTED CLOUD MARKET: SUPPLY CHAIN

5.5 ECOSYSTEM

FIGURE 26 MARKET: ECOSYSTEM

5.6 COVID-19-DRIVEN MARKET DYNAMICS

FIGURE 27 DRIVERS AND OPPORTUNITIES

FIGURE 28 RESTRAINTS AND CHALLENGES

5.7 TECHNOLOGICAL ANALYSIS

5.7.1 EDGE COMPUTING

5.7.2 INTERNET OF THINGS

5.7.3 5G

5.7.4 ARTIFICIAL INTELLIGENCE & MACHINE LEARNING

5.8 PRICING ANALYSIS

TABLE 4 PRICING ANALYSIS OF VENDORS IN MARKET

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 5 KEY STAKEHOLDERS IN BUYING PROCESS BY TOP THREE INDUSTRY VERTICALS

5.9.2 BUYING CRITERIA

TABLE 6 DISTRIBUTED CLOUD VENDOR SELECTION CRITERIA

5.10 EMERGING TRENDS IN DISTRIBUTED CLOUD MARKET

FIGURE 29 MAJOR DISRUPTING TRENDS TO DRIVE FUTURE REVENUE PROSPECTS IN MARKET

5.11 PATENT ANALYSIS

FIGURE 30 NUMBER OF PATENTS PUBLISHED, 2012–2022

FIGURE 31 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 7 TOP TEN PATENT APPLICANTS (UNITED STATES)

TABLE 8 MARKET - PATENTS GRANTED TO DISTRIBUTED CLOUD SOLUTION PROVIDERS

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 9 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 DEGREE OF COMPETITION

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF NEW ENTRANTS

5.12.5 THREAT OF SUBSTITUTES

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 10 DISTRIBUTED CLOUD MARKET: KEY CONFERENCES AND EVENTS

5.14 TARIFF AND REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 REGULATIONS

5.14.2.1 North America

5.14.2.2 Europe

5.14.2.3 Asia Pacific

5.14.2.4 Middle East & South Africa

5.14.2.5 Latin America

6 DISTRIBUTED CLOUD MARKET, BY SERVICE TYPE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 33 NETWORKING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 15 MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 16 MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

6.1.1 SERVICE TYPE: MARKET DRIVERS

6.1.2 SERVICE TYPE: COVID-19 IMPACT

6.2 DATA SECURITY

TABLE 17 DATA SECURITY: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 DATA SECURITY: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 DATA STORAGE

TABLE 19 DATA STORAGE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 20 DATA STORAGE: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.4 NETWORKING

TABLE 21 NETWORKING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 22 NETWORKING: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.5 AUTONOMY

TABLE 23 AUTONOMY: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 AUTONOMY: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.6 OTHER SERVICE TYPES

TABLE 25 OTHER SERVICE TYPES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 OTHER SERVICE TYPES: MARKET, BY REGION, 2021–2027 (USD MILLION)

7 DISTRIBUTED CLOUD MARKET, BY APPLICATION (Page No. - 82)

7.1 INTRODUCTION

FIGURE 34 EDGE COMPUTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 27 MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 28 MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

7.1.1 APPLICATION: MARKET DRIVERS

7.1.2 APPLICATION: COVID-19 IMPACT

7.2 EDGE COMPUTING

TABLE 29 EDGE COMPUTING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 EDGE COMPUTING: MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3 CONTENT DELIVERY

TABLE 31 CONTENT DELIVERY: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 CONTENT DELIVERY: MARKET, BY REGION, 2021–2027 (USD MILLION)

7.4 INTERNET OF THINGS

TABLE 33 INTERNET OF THINGS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 INTERNET OF THINGS: MARKET, BY REGION, 2021–2027 (USD MILLION)

7.5 OTHER APPLICATIONS

TABLE 35 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 OTHER APPLICATIONS: MARKET, BY REGION, 2021–2027 (USD MILLION)

8 DISTRIBUTED CLOUD MARKET, BY ORGANIZATION SIZE (Page No. - 88)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 35 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 37 MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 38 MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 39 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 LARGE ENTERPRISES: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 41 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2021–2027 (USD MILLION)

9 DISTRIBUTED CLOUD MARKET, BY VERTICAL (Page No. - 93)

9.1 INTRODUCTION

FIGURE 36 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 43 MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 44 MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 45 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.3 IT & TELECOM

TABLE 47 IT & TELECOM: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 IT & TELECOM: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.4 GOVERNMENT

TABLE 49 GOVERNMENT: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 GOVERNMENT: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.5 HEALTHCARE & LIFE SCIENCES

TABLE 51 HEALTHCARE & LIFE SCIENCES: DISTRIBUTED CLOUD MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.6 RETAIL & CONSUMER GOODS

TABLE 53 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 54 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.7 MEDIA & ENTERTAINMENT

TABLE 55 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 56 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.8 ENERGY & UTILITIES

TABLE 57 ENERGY & UTILITIES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 58 ENERGY & UTILITIES: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.9 MANUFACTURING

TABLE 59 MANUFACTURING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 60 MANUFACTURING: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.10 OTHER VERTICALS

TABLE 61 OTHER VERTICALS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 62 OTHER VERTICALS: MARKET, BY REGION, 2021–2027 (USD MILLION)

10 DISTRIBUTED CLOUD MARKET, BY REGION (Page No. - 105)

10.1 INTRODUCTION

FIGURE 37 ASIA PACIFIC TO GROW AT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 63 MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2021–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

TABLE 65 NORTH AMERICA: DISTRIBUTED CLOUD MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.2.3 US

TABLE 75 UNITED STATES: DISTRIBUTED CLOUD MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 76 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.2.4 CANADA

TABLE 77 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 78 CANADA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 79 EUROPE: DISTRIBUTED CLOUD MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.3.3 UK

TABLE 89 UNITED KINGDOM: DISTRIBUTED CLOUD MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 90 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.3.4 GERMANY

TABLE 91 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 92 GERMANY: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.3.5 FRANCE

TABLE 93 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 94 FRANCE: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 95 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 96 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: DISTRIBUTED CLOUD MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 97 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.4.3 CHINA

TABLE 107 CHINA: DISTRIBUTED CLOUD MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 108 CHINA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.4.4 JAPAN

TABLE 109 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 110 JAPAN: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.4.5 AUSTRALIA AND NEW ZEALAND

TABLE 111 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 112 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 113 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 114 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: DISTRIBUTED CLOUD MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 115 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

TABLE 117 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 118 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 119 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 120 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.5.3 KINGDOM OF SAUDI ARABIA

TABLE 125 KINGDOM OF SAUDI ARABIA: DISTRIBUTED CLOUD MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 126 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 127 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 128 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 129 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 130 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 131 LATIN AMERICA: DISTRIBUTED CLOUD MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 132 LATIN AMERICA: DISTRIBUTED CLOUD MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

TABLE 133 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 134 LATIN AMERICA: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 135 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 136 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 137 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 138 LATIN AMERICA: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 139 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 140 LATIN AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.6.3 BRAZIL

TABLE 141 BRAZIL: DISTRIBUTED CLOUD MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 142 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.6.4 MEXICO

TABLE 143 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 144 MEXICO: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 145 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 146 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 142)

11.1 INTRODUCTION

FIGURE 40 MARKET EVALUATION FRAMEWORK, 2019–2022

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 147 OVERVIEW OF STRATEGIES BY KEY DISTRIBUTED CLOUD VENDORS

11.3 MARKET SHARE ANALYSIS

FIGURE 41 DISTRIBUTED CLOUD MARKET: VENDOR SHARE ANALYSIS

11.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 42 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2017-2021

11.5 COMPETITIVE SCENARIO

TABLE 148 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2019–2022

TABLE 149 MARKET: DEALS, 2019–2022

11.6 COMPANY EVALUATION QUADRANT

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 43 DISTRIBUTED CLOUD MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

11.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 150 COMPANY APPLICATION FOOTPRINT

TABLE 151 COMPANY VERTICAL FOOTPRINT

TABLE 152 COMPANY REGION FOOTPRINT

TABLE 153 COMPANY FOOTPRINT

11.8 SME EVALUATION QUADRANT

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 DYNAMIC COMPANIES

11.8.4 STARTING BLOCKS

FIGURE 44 DISTRIBUTED CLOUD MARKET: SME EVALUATION QUADRANT, 2021

11.8.5 COMPETITIVE BENCHMARKING

TABLE 154 MARKET: DETAILED LIST OF KEY STARTUP/SMES

11.9 SME/STARTUP PRODUCT FOOTPRINT ANALYSIS

TABLE 155 SME/STARTUP APPLICATION FOOTPRINT

TABLE 156 SME/STARTUP VERTICAL FOOTPRINT

TABLE 157 SME/STARTUP REGION FOOTPRINT

TABLE 158 SME/STARTUP FOOTPRINT

12 COMPANY PROFILES (Page No. - 160)

12.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

12.1.1 ALIBABA CLOUD

TABLE 159 ALIBABA CLOUD: BUSINESS OVERVIEW

FIGURE 45 ALIBABA CLOUD: COMPANY SNAPSHOT

TABLE 160 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 161 ALIBABA CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 162 ALIBABA CLOUD: DEALS

12.1.2 AMAZON WEB SERVICES

TABLE 163 AMAZON WEB SERVICES: BUSINESS OVERVIEW

FIGURE 46 AMAZON WEB SERVICES: COMPANY SNAPSHOT

TABLE 164 AMAZON WEB SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.3 COMMVAULT

TABLE 165 COMMVAULT: BUSINESS OVERVIEW

FIGURE 47 COMMVAULT: COMPANY SNAPSHOT

TABLE 166 COMMVAULT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 167 COMMVAULT: DEALS

12.1.4 F5

TABLE 168 F5: BUSINESS OVERVIEW

FIGURE 48 F5: COMPANY SNAPSHOT

TABLE 169 F5: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 170 F5: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 171 F5: DEALS

12.1.5 GOOGLE

TABLE 172 GOOGLE: BUSINESS OVERVIEW

FIGURE 49 GOOGLE: COMPANY SNAPSHOT

TABLE 173 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 174 GOOGLE: PRODUCT LAUNCHES

TABLE 175 GOOGLE: DEALS

12.1.6 IBM

TABLE 176 IBM: BUSINESS OVERVIEW

FIGURE 50 IBM: COMPANY SNAPSHOT

TABLE 177 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 178 IBM: PRODUCT LAUNCHES

TABLE 179 IBM: DEALS

12.1.7 MICROSOFT

TABLE 180 MICROSOFT: BUSINESS OVERVIEW

FIGURE 51 MICROSOFT: COMPANY SNAPSHOT

TABLE 181 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 182 MICROSOFT: PRODUCT LAUNCHES

TABLE 183 MICROSOFT: DEALS

12.1.8 TERADATA

TABLE 184 TERADATA: BUSINESS OVERVIEW

FIGURE 52 TERADATA: COMPANY SNAPSHOT

TABLE 185 TERADATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 186 TERADATA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 187 TERADATA: DEALS

12.1.9 VMWARE

TABLE 188 VMWARE: BUSINESS OVERVIEW

FIGURE 53 VMWARE: COMPANY SNAPSHOT

TABLE 189 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 190 VMWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 191 VMWARE: DEALS

12.1.10 ORACLE

TABLE 192 ORACLE: BUSINESS OVERVIEW

FIGURE 54 ORACLE: COMPANY SNAPSHOT

TABLE 193 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 194 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 195 ORACLE: DEALS

12.1.11 WIND RIVER SYSTEMS

TABLE 196 WIND RIVER SYSTEMS: BUSINESS OVERVIEW

TABLE 197 WIND RIVER SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 198 WIND RIVER SYSTEMS: DEAL

12.1.12 SCC

TABLE 199 SCC: BUSINESS OVERVIEW

FIGURE 55 SCC: COMPANY SNAPSHOT

TABLE 200 SCC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 201 SCC: DEALS

12.1.13 COHESITY

TABLE 202 COHESITY: BUSINESS OVERVIEW

TABLE 203 COHESITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 204 COHESITY: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 205 COHESITY: DEALS

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12.2 SMES/STARTUPS

12.2.1 CUBBIT

12.2.2 PHOENIXNAP

12.2.3 PLURIBUS NETWORKS

12.2.4 ANYSCALE

12.2.5 PANZURA

12.2.6 PLATFORM9

12.2.7 ZEDEDA

12.2.8 HAZELCAST

13 ADJACENT MARKET (Page No. - 198)

13.1 INTRODUCTION

13.1.1 RELATED MARKET

13.2 HYBRID CLOUD MARKET

TABLE 206 HYBRID CLOUD MARKET, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 207 HYBRID CLOUD MARKET, BY SERVICE TYPE, 2016–2023 (USD MILLION)

TABLE 208 HYBRID CLOUD MARKET, BY SERVICE MODEL, 2016–2023 (USD MILLION)

TABLE 209 HYBRID CLOUD MARKET, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 210 HYBRID CLOUD MARKET, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 211 HYBRID CLOUD MARKET, BY REGION, 2016–2023 (USD MILLION)

14 APPENDIX (Page No. - 201)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

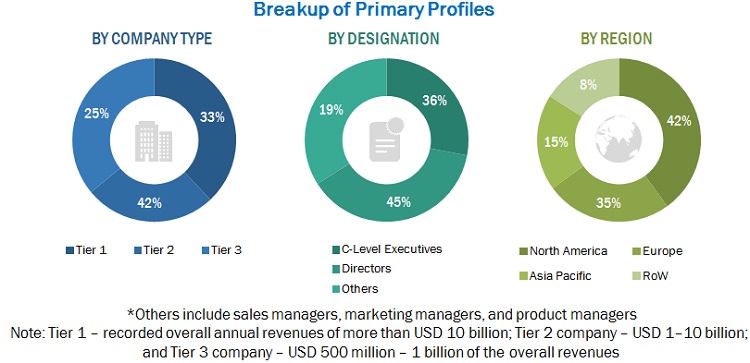

The study involved 4 major activities to estimate the current market size of distributed cloud market. Extensive secondary research was done to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the various segments in the distributed cloud.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to for identifying and collecting information useful for this technical, market-oriented, and commercial study of the Distributed cloud market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom up and top down approaches were utilized to estimate and validate the total distributed cloud market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through paid and unpaid secondary resources.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the Distributed cloud market.

Report Objectives

- To define, describe, and forecast the Distributed cloud market based on service type, application, organization size, industry verticals, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the impact of COVID-19 on the market

- To forecast the market size of main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the Distributed cloud market and comprehensively analyze their core competencies in each subsegment

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches, and partnerships and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Distributed Cloud Market