Patient Flow Management Solutions Market by Type (RTLS, Event Driven), Product (Integrated, Standalone), Component (Hardware, Software, Services) & Delivery Mode (Web-based, On-premise, Cloud-based) - Trends & Global Forecasts to 2019

The global patient flow management solutions market is segmented on the basis of components, delivery modes, products, type and geographies. The market by component is categorized into hardware, software and services. Based on delivery modes, the market is categorized into web-based, on-premise, and cloud-based. The market by type is segmented into Real Time Locating System (RTLS) and event driven solutions. The market by product is categorized into integrated and standalone. Based on geography, the market is divided into North America, Europe, Asia, and Rest of the World (RoW: Pacific countries, Africa, and Latin America).

A number of factors such as the legislative reform of the Affordable Care Act (ACA) in the U.S., adoption of patient centric approach by healthcare givers, reduced costs of hardware and software, high return on investment for healthcare givers and incentives by various governments for the adoption of patient flow management solutions are driving the growth of this market. The benefits provided by the patient management solutions such as cost reduction, streamlined operational processes, increased patient throughput, and improved quality of healthcare are resulting in an increase in the deployment of these solutions.

However, in spite of the numerous benefits of patient flow management solutions certain barriers such as huge investments, lack of skilled IT professionals and concerns regarding security of patient data are hindering the growth of this market.

North America is the largest market. The high growth in the North American region can be attributed to factors such as the rising healthcare expenditure, legislative reforms, funding and training initiatives, technological innovations and government support for patient flow management. Similarly, government impetus to HCIT and patient flow management in various countries in the European and Asian regions as well as need for quality care at affordable costs is expected to stimulate the growth of the market in Europe and Asia.

The prominent players in the global market include Allscripts Healthcare Solutions, Inc. (U.S.), Cerner Corporation (U.S.), McKesson Corporation (U.S.), TeleTracking Technologies, Inc. (U.S.), Central Logic, Inc. (U.S.), Medworxx Solutions, Inc. (Canada), STANLEY Healthcare (U.S.), Awarepoint Corporation (U.S.), Care Logistics, LLC (U.S.), Intelligent InSites, Inc. (U.S.), Sonitor Technologies, Inc. (U.S.), and Epic Systems (U.S.) among others.

Patient Flow Management Solutions Market : Scope of the Report

This research report categorizes the global patient flow management solutions market into the following segments and sub-segments:

By Product

- Integrated

- Standalone

By Type

- Real Time Locating System

- Event Driven Solutions

By Component

- Hardware

- Software

- Services

By Delivery Mode

- Web-based

- Cloud- based

- On- premise

By Region

- North America

- Europe

- Asia

- RoW (RoW includes Pacific countries, Africa, and Latin America)

Patient flow management solutions are increasingly being adopted by healthcare providers across the globe and particularly in the U.S. This report studies the global market over the forecast period of 2014 to 2019. This market is estimated to grow at a CAGR of 22% to reach $678.4 million by 2019 from $251 million in 2014.

The market is categorized into five broad segments, namely, components, delivery modes, types, products, and geographies. The market by component comprises of hardware, software and services. The software segment accounted for the major share of the global market by component. The market by delivery mode comprises of web-based, cloud-based, and on-premise solutions. The web-based solutions accounted for the largest share of the global market by delivery mode in 2014.

The adoption of patient follow management solutions enables the healthcare industry to improve the efficiency of patient flow, better utilize existing resources, and reduce costs while improving the quality of healthcare. The solutions also provide high returns on investment. Furthermore, initiatives and incentives by governments across the globe for adopting and increased burden on healthcare systems due to rising hospital admissions has stimulated the adoption of patient flow management solutions in the healthcare industry. However, in spite of the numerous benefits certain barriers such as huge investments, lack of skilled analysts, and concerns over security of patient data are restraining the growth of this market.

The patient flow management solutions market is divided into Real Time Locating System (RTLS) and event driven solutions on the basis of product type. The event driven solutions market accounted for the largest share of 92.5% of the global market. This market was valued at $232.2 Million in 2014 and is expected to grow at a healthy CAGR of 21.1% from 2014 to 2019, to reach $603.8 Million by 2019. However, the RTLS segment is expected to have the highest CAGR of 31.7% from 2014 to 2019. Based on products, the market is divided into integrated and standalone solutions. Standalone solutions commanded three-fourth of the market in 2014 and will continue to remain the dominant market through 2019. Integrated solutions are expected to grow at a faster pace with a CAGR of 29.7% during the forecast period. Based on geography, the market is divided into North America, Europe, Asia, and Rest of the World (RoW: Pacific countries, Africa, and Latin America)

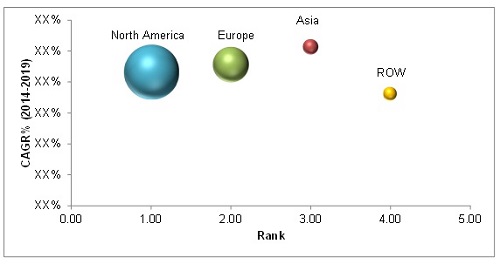

Patient Flow Management Solutions Market, By Geography, 2014

Source: Press Releases, Society for Participatory Medicine, Association for Patient Experience, American Association of Healthcare Administrative Management (AAHAM), Australian Health Services Financial Management Association (AHSFMA), Japanese Association of Healthcare Information Systems Industry (JAHIS), European Health Management Association (EHMA), The Institute for Health Technology Transformation (iHT2), Healthcare Information and Management Systems Society (HIMSS),, Agency for Healthcare Research and Quality (AHRQ), American Hospital Association (AHA), International Association of Health Policy (IAHP), Public Health Agency of Canada, Expert Interviews, and MarketsandMarkets Analysis

The North American market dominated the global market. The largest share of the market can be attributed to the various government initiatives that encourage adoption of patient flow management solutions directly or indirectly, increasing pressure to reduce healthcare costs, focus on improving the quality of care, and shift towards a patient centric system. Europe represents the second largest market. The Asian market is relatively new to healthcare analytics; however, the increasing HCIT adoption, proficiency of IT skills, and growing healthcare spending in the region will drive this market.

The global Patient Flow Management Solutions Market is a fragmented market with some major players such as Allscripts Healthcare Solutions, Inc. (U.S.), Awarepoint Corporation (U.S.), Care Logistics, LLC (U.S.), Central Logic, Inc. (U.S.), Cerner Corporation (U.S.), Intelligent InSites, Inc. (U.S.), McKesson Corporation (U.S.), Medworxx Solutions, Inc. (Canada), STANLEY Healthcare (U.S.), Sonitor Technologies, Inc. (U.S.), TeleTracking Technologies, Inc. (U.S.), and Epic Systems Corporation (U.S.), among others.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives Of The Study

1.2 Markets Covered

1.3 Stakeholders

1.4 Market Scope

2 Research Methodology (Page No. - 15)

2.1 Secondary And Primary Research Methodology

2.1.1 Secondary Research

2.1.2 Key Data From Secondary Sources

2.1.3 Primary Research

2.1.4 Key Data From Primary Sources

2.1.4.1 Key Insights From Primary Sources

2.2 Market Size Estimation Methodology

2.2.1 Market Forecast Methodology

2.2.2 Market Data Validation & Data Triangulation

2.2.3 Assumptions

2.2.4 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities In The Patient Flow Management Solutions Market

4.2 Global Market, By Component

4.3 Growth Rate Across Geographies

4.4 Patient Flow Management: Life Cycle Analysis, By Geography

5 Patient Flow Management Solutions Market Overview (Page No. - 31)

5.1 Introduction

5.2 Drivers

5.2.1 Adoption Of A Patient-Centric Approach By Healthcare Providers

5.2.2 Reduced Costs Of Hardware & Software

5.2.3 Government Incentives For Hcit Adoption

5.2.4 High Roi, An Impetus To Install Patient Flow Management Solutions

5.2.5 Shortage Of Nursing Staff & Doctors Will Increase The Need For Solutions

5.2.6 Need For Cost-Curtailment Measures

5.3 Restraints

5.3.1 Lack Of Skilled It Professionals Restraining Market Growth

5.3.2 Security Concerns, Rising Incidences Of Data Security Breach

5.3.3 Lack Of Adequate Infrastructure

5.4 Opportunities

5.4.1 Asian Region Offers Huge Potential

5.4.2 Increasing Usage Of Smartphones, Tablets & Pdas To Boost Adoption Of Solutions

5.4.3 Cloud-Based Models To Offer Significant Growth Opportunities

6 Industry Insights (Page No. - 39)

6.1 Pest Analysis

6.1.1 Political Factors

6.1.2 Economic Factors

6.1.3 Social Factors

6.1.4 Technological Factors

6.2 Porters Five Forces Analysis

6.2.1 Threat From New Entrants

6.2.2 Threat From Substitutes

6.2.3 Bargaining Power Of Buyers

6.2.4 Bargaining Power Of Suppliers

6.2.5 Intensity Of Competitive Rivalry

6.3 Patient Flow Management Market: Empirical Assessment Of Growth Strategies

6.3.1 Route To Strategic Growth: Organic And Inorganic Growth Strategies

6.3.2 Organic Growth Strategies

6.3.3 Inorganic Growth Strategies

7 Patient Flow Management Solutions Market, By Product (Page No. - 48)

7.1 Introduction

7.2 Integrated

7.3 Standalone

8 Market, By Type (Page No. - 54)

8.1 Introduction

8.2 Event-Driven Patient Tracking

8.3 Real-Time Locating Systems

9 Market, By Delivery Mode (Page No. - 61)

9.1 Introduction

9.1.1 On-Premise

9.1.2 Web-Based

9.1.3 Cloud-Based

10 Market, By Component (Page No. - 69)

10.1 Introduction

10.2 Hardware

10.3 Software

10.4 Services

10.4.1 Consulting Services

10.4.2 Ongoing It Support & Implementation Services

10.4.3 Post-Sale & Maintenance Services

11 Geographic Analysis (Page No. - 77)

11.1 Introduction

11.2 North America

11.2.1 Patient Flow Management: Strategic Solution To Curtail Healthcare Costs In The U.S. & Canada

11.2.2 Regulatory Mandates Stimulating Patient Flow Management Solutions Market In The U.S.

11.2.3 Funding & Training Initiatives In The U.S. & Canada To Boost Market

11.2.4 1.4 Substantial Investment Plans Expected To Trigger Patient Flow Markets In The U.S.

11.2.5 1.5 Technological Innovations Propelling The Market

11.3 Europe

11.3.1 Clinical Utilization Review Programs To Offer Opportunities For Market

11.3.2 Healthcare Improvement Programs In The U.K. To Boost The Market

11.4 Asia

11.4.1 Rapidly Growing Indian Healthcare Industry To Adopt Patient Flow Management In The Coming Years

11.4.2 New Outline By Japans Information & Communication Technology Propels Market

11.5 Row

11.5.1 New Zealand Government Emphasizing On A Better Patient Flow Management Approach

11.5.2 Research Initiatives In Australia To Aid Patient Flow Management Solutions Market

12 Competitive Landscape (Page No. - 105)

12.1 Introduction

12.2 Client Acquisitions

12.3 Agreements, Partnerships, And Collaborations

12.4 New Product Launches

12.5 Acquisitions

12.6 Expansions

12.7 Others

13 Company Profiles (Page No. - 114)

13.1 Teletracking Technologies Inc.

13.2 Allscripts Healthcare Solutions, Inc.

13.3 Cerner Corporation

13.4 Mckesson Corporation

13.5 Central Logic, Inc.

13.6 Medworxx Solutions, Inc.

13.7 Stanley Healthcare (Stanley Black & Decker, Inc.)

13.8 Sonitor Technologies

13.9 Awarepoint Corporation

13.10 Care Logistics Llc

13.11 Intelligent Insites, Inc.

13.12 Epic Systems Corporation

14 Appendix (Page No. - 151)

14.1 Discussion Guide

14.2 Introducing Rt: Real Time Market Intelligence

14.3 Available Customizations

14.4 Related Reports

List of Tables (67 Tables)

Table 1 High Roi On Patient Flow Management Solutions To Drive The Market

Table 2 Lack Of Skilled It Professionals And Security Concerns Restraining The Market

Table 3 Asian Region Offers High Growth Potential For Market

Table 4 Global Market Size, By Product, 20122019 ($Million)

Table 5 Integrated Patient Flow Management Solutions Market Size, By Region, 20122019 ($Million)

Table 6 European Integrated Patient Flow Management Solutions Market Size, By Region, 20122019 ($Million)

Table 7 Standalone Patient Flow Management Solutions Market Size, By Region, 20122019 ($Million)

Table 8 European Standalone Patient Flow Management Market Size, By Region, 20122019 ($Million)

Table 9 Global Market Size, By Type, 20122019 ($Million)

Table 10 Event-Driven Patient Flow Management Market Size, By Region, 20122019 ($Million)

Table 11 European Event-Driven Patient Flow Management Market Size, By Region, 20122019 ($Million)

Table 12 RTLS Patient Flow Management Market Size, By Region, 20122019 ($Million)

Table 13 European Rtls Patient Flow Management Market Size, By Region, 20122019 ($Million)

Table 14 Global Market Size, By Delivery Mode, 20122019 ($Million)

Table 15 On-Premise Patient Flow Management Solutions Market Size, By Region, 20122019 ($Million)

Table 16 European On-Premise Patient Flow Management Market Size, By Region, 20122019 ($Million)

Table 17 Web-Based Patient Flow Management Market Size, By Region, 20122019 ($Million)

Table 18 European Web-Based Patient Flow Management Market Size, By Region, 20122019 ($Million)

Table 19 Cloud-Based Patient Flow Management Market Size, By Region, 20122019 ($Million)

Table 20 European Cloud-Based Patient Flow Management Market Size, By Region, 20122019 ($Million)

Table 21 Global Market Size, By Component, 20122019 ($Million)

Table 22 Patient Flow Management Hardware Market Size, By Region, 20122019 ($Million)

Table 23 European Hardware Market Size, By Region, 20122019 ($Million)

Table 24 Patient Flow Management Solutions Market Size, By Region, 20122019 ($Million)

Table 25 European Patient Flow Management Software Market Size, By Region, 20122019 ($Million)

Table 26 Market, By Region, 20122019 ($Million)

Table 27 European Patient Flow Management Solutions Services Market, By Region, 20122019 ($Million)

Table 28 Global Market Size, By Region, 20122019 ($Million)

Table 29 European Patient Flow Management Solutions Market Size, By Region, 20122019 ($Million)

Table 30 North America: Patient Flow Management Solutions Market Size, By Component, 20122019 ($Million)

Table 31 North America: Market Size, By Type, 20122019 ($Million)

Table 32 North America: Market Size, By Product, 20122019 ($Million)

Table 33 North America: Market Size, By Delivery Mode, 20122019 ($Million)

Table 34 Europe: Market Size, By Type, 20122019 ($Million)

Table 35 German: Market Size, By Type, 20122019 ($Million)

Table 36 U.K.: Market Size, By Type, 20122019 ($Million)

Table 37 France: Market Size, By Type, 20122019 ($Million)

Table 38 ROE: Market Size, By Type, 20122019 ($Million)

Table 39 Europe: Market Size, By Product, 20122019 ($Million)

Table 40 Germany: Market Size, By Product, 20122019 ($Million)

Table 41 U.K.: Market Size, By Product, 20122019 ($Million)

Table 42 France: Market Size, By Product, 20122019 ($Million)

Table 43 ROE: Market Size, By Product, 20122019 ($Million)

Table 44 Europe: Market Size, By Component, 20122019 ($Million)

Table 45 Germany: Market Size, By Component, 20122019 ($Million)

Table 46 U.K.: Market Size, By Component, 20122019 ($Million)

Table 47 France: Market Size, By Component, 20122019 ($Million)

Table 48 ROE: Market Size, By Component, 20122019 ($Million)

Table 49 Europe: Market Size, By Delivery Mode, 20122019 ($Million)

Table 50 Germany: Market Size, By Delivery Mode, 20122019 ($Million)

Table 51 U.K.: Market Size, By Delivery Mode, 20122019 ($Million)

Table 52 France: Market Size, By Delivery Mode, 20122019 ($Million)

Table 53 ROE: Market Size, By Delivery Mode, 20122019 ($Million)

Table 54 Asia: Market Size, By Type, 20122019 ($Million)

Table 55 Asia: Market Size, By Product, 20122019 ($Million)

Table 56 Asia: Market Size, By Component, 20122019 ($Million)

Table 57 Asia: Market Size, By Delivery Mode, 20122019 ($Million)

Table 58 RoW: Market Size, By Type, 20122019 ($Million)

Table 59 RoW: Market Size, By Product, 20122019 ($Million)

Table 60 RoW: Market Size, By Component, 20122019 ($Million)

Table 61 RoW: Market Size, By Delivery Mode, 20122019 ($Million)

Table 62 Client Acquisitions, 20122014

Table 63 Agreements, Partnerships, & Collaborations, 20122014

Table 64 New Product Launches, 20122014

Table 65 Acquisitions, 20122014

Table 66 Expansions, 20122014

Table 67 Other Strategies, 20122014

List of Figures (30 Figures)

Figure 1 Market Segmentation

Figure 2 Research Methodology Steps

Figure 3 Breakdown Of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Forecast Methodology

Figure 7 Data Triangulation Methodology

Figure 8 Global Market Size Snapshot (2014 Vs. 2019)

Figure 9 Global Market, Geographical Ranking

Figure 10 Market To Grow By A Cagr Of 22% Between 2014 And 2019

Figure 11 Software Segment Commands Largest Share Of 72.5% In The Global Market

Figure 12 Asian Market To Grow At The Highest Rate

Figure 13 Asian And European Markets In The Growth Phase

Figure 14 Major Drivers

Figure 15 Porters Five Forces Analysis

Figure 16 Growth Startegies For the Market

Figure 17 Indicative List Of Organic Growth Strategies (20122014)

Figure 18 Organic Growth Strategies, By Company (20122014)

Figure 19 Indicative List Of Inorganic Growth Strategies (20122014)

Figure 20 Inorganic Growth Strategies, By Company (20122014)

Figure 21 Standalone Solutions Will Continue To Hold Major Share of Market

Figure 22 North America Market Is Largest Integrated Solutions Market

Figure 23 Rtls Is The Fastest-Growing Solution Type in Market

Figure 24 North America Is The Fastest-Growing Region in Event-Driven Market

Figure 25 Cloud-Based Patient Flow Management Solutions To Grow At Fastest Rate Between 2014 And 2019

Figure 26 Cloud-Based Segment Revenue Poised To Triple By 2019

Figure 27 Patient Flow Management Software Market Will Continue To Command Major Share Of The Market

Figure 28 North American Patient Flow Management Solutions Market Is Expected To Grow By Over 160% Between 2014 And 2019

Figure 29 Software Segment To Remain The Largest Component Segment In 2019 In North America

Figure 30 Battle For Market Share: Client Acquisitions Was The Key Strategy

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Patient Flow Management Solutions Market