Cholesterol Screening/ Cholesterol Testing Services Market by Type of Customer (Physician/Provider, Hospital, Employer, Health Plan, MCO, Government, ACO, IDN, Patient), Geography (North America, Europe) & Qualitative Assessment - - Global Forecast to 2021

[139 Pages Pages] The global cholesterol testing services market is expected to reach USD 17.57 Billion by 2021 from an estimated value of USD 11.96 Billion in 2016, growing at a CAGR of 8% during the forecast period. The cholesterol testing market is driven by factors such as increasing incidence of cardiovascular diseases and obesity, physician preference of laboratory testing rather self-testing, government initiatives to improve quality of testing, and rapid growth in the geriatric population are propelling the growth of this market. However, rapidly growing home/self-testing and advent of noninvasive cholesterol testing methods are the major factors that may hinder growth of the market.

The cholesterol testing market is segmented on the basis type of customer and region. Based on type of customer, the market is segmented into physicians/providers and hospitals; employers, health plans, and Managed Care Organizations (MCOs); government agencies, Accountable Care Organizations (ACOs), and Integrated Delivery Networks (IDNs); and patients. Companies in the market are coming up with innovative offerings to provide accurate and up-to-date diagnostic information to their customers. In November 2016, Quest Diagnostics (U.S.) launched the QuestDirect, a new patient-initiated testing service, in the U.S. This new service will allow the customers better manage their health by ordering certain lab tests directly without any physician intervention.

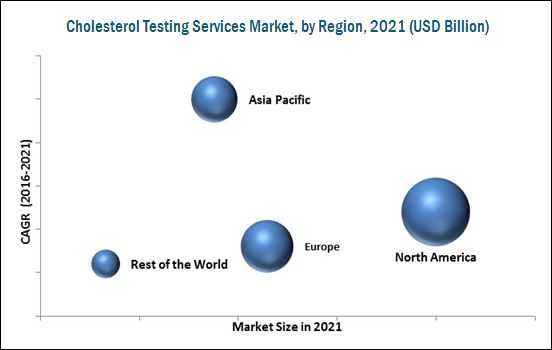

Based on region, the cholesterol testing services market is segmented into North America, Europe, Asia, and RoW. North America is expected to dominate the global cholesterol testing market in 2016, with the U.S. accounting for a major share. Asia is projected to be the fastest-growing region in terms of CAGR during the forecast period. This is due to the large population base, increased prevalence of cardiovascular diseases, and growing number of testing facilities in the Asian region.

Major players in the cholesterol testing market include Laboratory Corporation of America Holdings (LabCorp) (U.S.), Quest Diagnostics Incorporated (U.S.), Eurofins Scientific (Luxembourg), Spectra Laboratories Inc. (U.S.), Unilabs (Switzerland), SYNLAB International GmbH (Germany), Bio-Reference Laboratories Inc. (U.S.), Clinical Reference Laboratory, Inc. (CRL) (U.S.), ACM Medical Laboratory (U.S.), and Adicon Clinical Laboratory (China).

Target Audience/Stakeholders:

- Cholesterol Testing Service Providers

- Cholesterol Testing Kit Manufacturers

- Public and Private Physicians

- Healthcare Institutions (Medical Data Centers)

- Diagnostic & Clinical Laboratories

- Distributors and Suppliers of Cholesterol Testing Kits

- Health Insurance Companies/Payers

- Pharmaceutical Companies

- Employers/Organizations

- Market Research and Consulting Firms

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

This report categorizes the cholesterol testing services market into the following segments and subsegments:

Cholesterol Testing Services Market, by Type of Customer

- Physicians/Providers and Hospitals

- Employers, Health Plans, and Managed Care Organizations (MCOs)

- Government Agencies, Accountable Care Organizations (ACOs), and Integrated Delivery Networks (IDNs)

- Patients

Cholesterol Testing Services Market, by Region

-

North America

- U.S.

- Canada

-

Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe (RoE)

- Asia

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs.

The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Asian cholesterol testing services market size and growth rate estimates for India, China, Japan, and Rest of Asia (RoA).

- Further breakdown of the Rest of the World cholesterol testing market size and growth rate estimates for Latin America (LATAM), Pacific countries, the Middle East, and Africa (MEA).

The global cholesterol testing services market is expected to reach USD 17.57 Billion by 2021 from USD 11.96 Billion in 2016, growing at a CAGR of 8% during the forecast period.

The market for cholesterol testing services is expected to register significant growth in the coming years with the increasing incidence of cardiovascular diseases and obesity, physician preference for lab testing over self-testing, growing awareness and adoption of preventive healthcare, government initiatives to improve the quality of testing, and rapid growth in the geriatric population. On the other hand, the rapidly growing home/self-testing market and emergence of noninvasive cholesterol testing methods are expected to restrain the growth of this cholesterol testing market to a certain extent.

The report categorizes the cholesterol testing market on the basis of type of customer and region. Based on type of customer, the market is segmented into physicians/providers and hospitals; employers, health plans, and Managed Care Organizations (MCOs); government agencies, Accountable Care Organizations (ACOs), and Integrated Delivery Networks (IDNs); and patients. In 2016, the physicians/providers and hospitals segment is projected to account for the largest share of the market. The large share of this segment can be attributed to factors such as dependence of physicians on cholesterol test results for making CVD risk assessments and treatment decisions and reimbursement of tests that are prescribed by physicians/doctors.

The patient-driven approach for cholesterol testing is expected to grow at the highest CAGR during the forecast period. Growing health awareness and adoption of preventive healthcare, availability of lab test services for patients without any physician intervention, and online access to reports and readings through smartphones are contributing to the growth of the patients segment.

In 2016, North America is expected to account for the largest share of the market followed by Europe, Asia, and RoW. One of the major factors contributing to this large share in North America is the rising geriatric population, which has expanded the addressable patient population base. This change is expected to put the spotlight on preventive measures such as clinical diagnostics, especially cholesterol tests, to reduce adverse events caused by diseases such as stroke, diabetes, and cardiovascular disease (CVD). In North America, the U.S. is a major market for cholesterol testing service providers. The dominance of the U.S. in cholesterol testing services market is due to the increase in Clinical Laboratory Improvement Amendments (CLIA) waivers for certain diagnostic tests, including blood cholesterol.

In 2016, Europe is expected to hold the second position in this cholesterol testing services market. Factors such as high incidence of chronic diseases, technological advancements in lab tests, and increasing patient awareness are driving the growth of this regional segment. On the other hand, Asia is expected to register the highest growth rate during the forecast period.

Leading players in the cholesterol testing services market are Laboratory Corporation of America Holdings (LabCorp) (U.S.), Quest Diagnostics Incorporated (U.S.), Eurofins Scientific (Luxembourg), Spectra Laboratories Inc. (U.S.), Unilabs (Switzerland), SYNLAB International GmbH (Germany), Bio-Reference Laboratories Inc. (U.S.), Clinical Reference Laboratory, Inc. (CRL) (U.S.), ACM Medical Laboratory (U.S.), and Adicon Clinical Laboratory (China).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Introduction

1.3 Market Definition

1.4 Market Scope

1.5 Years Considered for the Study

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.3 Key Data From Secondary Sources

2.4 Key Data From Primary Sources

2.5 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Market Overview

4.2 Cholesterol Testing Services Market, By Type of Customer

4.3 Geographic Snapshot: Cholesterol Testing Services Market

5 Industry Insights

5.1 Cost Structure & Pricing Analysis

5.2 Reimbursement Scenario

6 Market Dynamics

6.1 Introduction

6.2 Market Drivers

6.2.1 Increasing Incidence of Cardiovascular Diseases (CVDS) and Obesity

6.2.2 Physician’s Preference for Lab Testing Over Self-Testing

6.2.3 Growing Awareness and Adoption of Preventive Healthcare

6.2.4 Government Initiatives to Improve Quality of Testing

6.2.5 Rapid Growth in the Geriatric Population

6.3 Market Restraints

6.3.1 Rapidly Growing Cholesterol Home/Self-Testing Market

6.3.2 Emergence of Noninvasive Cholesterol Testing Methods

6.4 Market Opportunities

6.4.1 High Growth Potential in Emerging Economies

6.4.2 Patient-Initiated Testing to Foster Market Growth in Developed Countries

6.5 Market Challenges

6.5.1 Patient Data Security

6.5.2 Evolving Regulatory Policies

7 Non-Pharmacological Treatment Market

7.1 Introduction

7.1.1 Cognitive Behavioral Therapy for Insomnia (CBTI)

7.1.2 Hypnotherapy

7.1.3 Other Alternative Therapies

7.2 Therapy Recommendation, 2015 (%)

7.3 Qualitative Assessment

8 Cholesterol Testing/Cholesterol Screening Services Market, By Type of Customer

8.1 Physicians/Providers and Hospitals

8.2 Employers, Health Plans, and Managed Care Organizations (MCOS)

8.3 Government Agencies, Accountable Care Organizations, and Integrated Delivery Networks (IDNS)

8.4 Patients

9 Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.3.1 U.K.

9.3.2 Germany

9.3.3 France

9.3.4 Italy

9.3.5 Spain

9.3.6 Rest of Europe

8.4 Asia

8.5 Rest of the World

10 Competitive Landscape

10.1 Overview

10.2 Market Share Analysis

10.3 Competitive Situation and Trends

10.3.1 Acquisitions

10.3.2 Expansions and Investments

10.3.3 Agreements

10.3.4 Service Launches

11 Company Profiles

11.1 Laboratory Corporation of America Holdings (LabCorp)

11.2 Quest Diagnostics Incorporated

11.3 Eurofins Scientific

11.4 Spectra Laboratories, Inc.

11.5 Unilabs

11.6 Synlab International GmbH

11.7 Bio-Reference Laboratories, Inc.

11.8 Clinical Reference Laboratory, Inc.

11.9 ACM Medical Laboratory)

11.10 Adicon Clinical Laboratory

12 Appendix

12.1 Key Industry Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Related Reports

List of Tables (33 Tables)

Table 1 Cholesterol Testing Services Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 2 Market Size for Tests Referred By Physicians/Providers, By Region, 2014–2021 (USD Million)

Table 3 North America: vices Market Size for Tests Referred By Physicians/Providers, By Country, 2014–2021 (USD Million)

Table 4 Europe: Market Size for Tests Referred By Physicians/Providers, By Country, 2014–2021 (USD Million)

Table 5 Market Size for Tests Referred By Employers, Health Plans, and MCOS, By Region, 2014–2021 (USD Million)

Table 6 North America: Market Size for Tests Referred By Employers, Health Plans, and MCOS, By Country, 2014–2021 (USD Million)

Table 7 Europe: Market Size for Tests Referred By Employers, Health Plans, and MCOS, By Country, 2014–2021 (USD Million)

Table 8 Market Size for Tests Referred By Government Agencies, ACOS, and IDNS, By Region, 2014–2021 (USD Million)

Table 9 North America: Cholesterol Testing Services Market Size for Tests Referred By Government Agencies, ACOS, and IDNS, By Country, 2014–2021 (USD Million)

Table 10 Europe: Market Size for Tests Referred By Government Agencies, ACOS, and IDNS, By Country, 2014–2021 (USD Million)

Table 11 Patient-Driven Cholesterol Testing Services Market Size, By Region, 2014–2021 (USD Million)

Table 12 North America: Patient-Driven Cholesterol Testing Services Market Size, By Country, 2014–2021 (USD Million)

Table 13 Europe: Patient-Driven Cholesterol Testing Services Market Size, By Country, 2014–2021 (USD Million)

Table 14 Global Market Size, By Region, 2014–2021 (USD Million)

Table 15 North America: Market Size, By Country, 2014–2021 (USD Million)

Table 16 North America: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 17 U.S.: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 18 Canada: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 19 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 20 Europe: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 21 U.K.: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 22 Germany: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 23 France: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 24 Italy: Cholesterol Testing Services Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 25 Spain: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 26 RoE: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 27 Asia: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 28 RoW: Market Size, By Type of Customer, 2014–2021 (USD Million)

Table 29 Indicative List of Other Cholesterol Testing Service Providers

Table 30 Acquisitions (2013–2016)

Table 31 Expansions and Investments (2013–2016)

Table 32 Agreements (2013-2016)

Table 33 Service Launches (2013-2016)

List of Figures (21 Figures)

Figure 1 Segmentation & Coverage

Figure 2 Research Design

Figure 3 Market - Bottom Up Approach

Figure 4 Market - Top Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Cholesterol Testing Services Market Size, By Type of Customer, 2016 vs 2021

Figure 7 Geographical Snapshot of the Market: Asia to Witness the Highest CAGR From 2016 to 2021

Figure 8 Increasing Incidence of Cardiovascular Diseases and Obesity: Major Factor Driving the Growth of the Cholesterol Testing Services Market

Figure 9 Physicians/Providers and Hospitals Segment to Dominate the Market in 2016

Figure 10 Geographic Growth Opportunities: Asia to Witness the Highest CAGR in the Cholesterol Testing Services Market From 2016 to 2021

Figure 11 Pricing Analysis

Figure 12 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 13 Key Developments in the Cholesterol Testing Market, 2013–2016

Figure 14 Global Market Share, By Key Player, 2015

Figure 15 Acquisitions Accounted for the Largest Share of the Total Developments in the Cholesterol Testing Services Market (2013–2016)

Figure 16 Laboratory Corporation of America Holdings: Company Snapshot (2015)

Figure 17 Quest Diagnostics Incorporated: Company Snapshot (2015)

Figure 18 Eurofins Scientific: Company Snapshot (2015)

Figure 19 Fresenius Medical Care: Company Snapshot (2015)

Figure 20 Health, Inc.: Company Snapshot (2015)

Figure 21 Insights From Industry Experts

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cholesterol Screening/ Cholesterol Testing Services Market