Cellular Health Screening Market by Type (Single (Telomere, Oxidative Stress, Inflammation, Heavy Metal), Multitest), Sample (Blood, Saliva, Serum, Urine), Collection Site (Home, Office, Hospital, Diagnostic Labs), and Region - Global Forecast to 2022

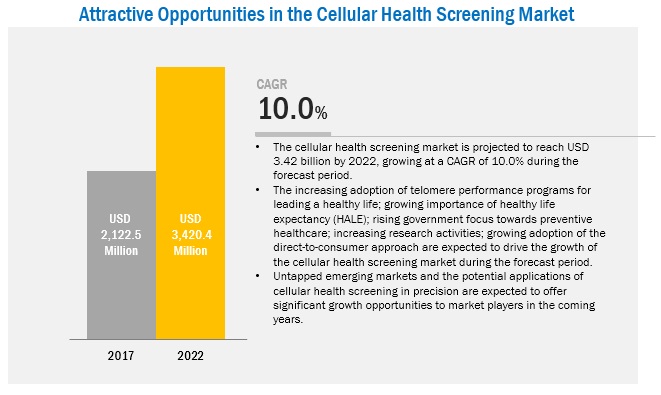

The global cellular health screening market is estimated to grow at a CAGR of 10.0%. Factors such as the increasing adoption of telomere performance programs for leading a healthy life; growing importance of healthy life expectancy (HALE); rising government focus towards preventive healthcare; rising geriatric population and resultant growth in the need for cellular health screening; increasing research activities; growing adoption of the direct-to-consumer approach; and the increasing burden of chronic diseases are expected to drive the growth of this market. On the other hand, problems associated with the transport of samples and differences in the cost of test kits offered by different companies are expected to restrain the growth of this market during the forecast period.

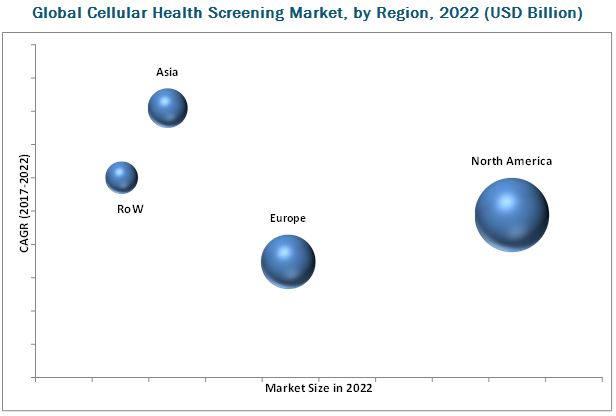

North America is expected to account for the largest share of the market, followed by Europe. However, Asia is projected to register the highest CAGR during the forecast period. The high growth of the Asian market can be attributed to the rising geriatric population, increasing burden of chronic diseases, expansion opportunities for market players, and growing number of initiatives to create awareness about healthy lifestyles and preventive healthcare in several Asian countries.

The report segments market based on type, sample type, sample collection type and region.

On the basis of type, the global market is segmented into single test panels and multi test panels. Cellular health screening comprises four major tests, namely, telomere tests, oxidative stress tests, inflammation tests, and heavy metals tests. These are risk assessment tests that help detect biological age, cellular toxicity, and the risk of diseases. These test kits are categorized into single and multi-test panels. In every test, there are different Biomarkers that are tested to draw a conclusion. Single test panels are used to examine individual biomarkers for specific results, while tests for a combination of cellular biomarkers are carried out using multi-test panels/kits. The single test panels segment is expected to dominate the market in 2017, and this trend is expected to continue during the forecast period. However, the multi-test panels segment is estimated to register a relatively higher growth rate between 2017 and 2022.

The global market is highly competitive with the presence of several small and big players. Prominent players in the cellular heath screening market include Genova Diagnostics (US), Telomere Diagnostics (US), Life Length (Spain), Quest Diagnostics (US), Repeat Diagnostics (Canada), SpectraCell Laboratories (US), Zimetry LLC (US), Cell Science Systems (US), Titanovo, Inc. (US), Segterra, Inc. (US), LabCorp Holdings (US), BioReference Laboratories (US), Immundiagnostik AG (Germany), and Cleveland HeartLab, Inc. (US).

Major Market Developments:

- In 2016, Telomere Diagnostics launched TeloYears, its new telomere test.

- In 2015, SpectraCell announced the expansion of its specialized testing menu to include several new diagnostic panels for cardiometabolic biomarkers, pre-diabetic screening, male and female hormone panels, thyroid, and adrenal function and cardiovascular-related genetic tests.

- In 2016, Life Length partenered with Eastern Biotech & Life Sciences to launch telomere tests in GCC countries.

- In 2015, Titanovo launched an at-home, saliva-based telomere testing kit.

To know about the assumptions considered for the study, download the pdf brochure

Stakeholders:

- Cellular health screening service providers

- Clinical laboratories

- Healthcare institutions (hospitals and outpatient clinics)

- Academic institutes and universities

- Distributors and suppliers of cellular health screening kits and services

Scope of the Report

This report categorizes the global cellular health screening market into following segments and subsegments.

By Type

-

Single-test Panels

- Telomere Tests

- Oxidative Stress Tests

- Inflammation Tests

- Heavy Metal Tests

- Multi-test Panels

By Sample Type

- Blood

- Others Samples*

By Sample Collection Site

- At-home

- In office

- Other Sites**

By Region

- North America

- Europe

- Asia

- RoW

Note: 1. *Other samples include body fluids such as urine, saliva, and serum

2. **Other sites include hospitals and diagnostic laboratories.

Critical Questions which the report answers:

- Which regions will provide the high growth opportunities?

- Which type market will dominate in future?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs.

The following customization options are available for this report.

Company Information

Detailed analysis and profiling of additional market players (up to 5)

The global market is expected to reach USD 3.42 billion by 2022 from USD 2.12 billion in 2017, at a CAGR of 10.0% during the forecast period.

A number of factors such as increasing adoption of telomere performance programs for leading a healthy life; growing importance of healthy life expectancy (HALE); rising government focus towards preventive healthcare; rising geriatric population and resultant growth in the need for cellular health screening; increasing research activities; growing adoption of the direct-to-consumer approach; and the increasing burden of chronic diseases are driving the demand for global cellular health screening. On the other hand, problems associated with the transport of samples and differences in the cost of test kits offered by different companies are some of the factors that may hinder the overall growth of this market.

This report segments the global market into type, sample type, sample collection site, and region. On the basis of type, the global market is segmented single test panels and multi-test panels. The multi-test panels segment is expected to grow at the highest CAGR during the forecast period. The preference for multi-test panels is increasing in the market as they provide results for multiple biomarkers in a single exam.

The global market, by sample type is segmented into blood samples and other samples. In 2017, the blood samples segment is expected to account for the largest share of the market. The large share and high growth of this segment can primarily be attributed to the advantages associated with the use of blood samples, such as the accuracy and reliability of test results.

By sample collection site, the global market is segmented into at-home, in-office, and other sample collection sites. In 2017, the at-home segment is expected to account for the largest share of the market. The large share of this segment can be attributed to the availability of diagnostic and therapeutic products that can be used by patients at home without assistance from healthcare professionals.

In 2017, North America is expected to dominate the global market. Factors such as growing government focus towards preventive healthcare, increasing burden of chronic diseases, increasing research activities, rising geriatric population, and growing number of local players operating in the region are expected to drive the growth of this regional segment.

Asia is projected to register the highest CAGR during the forecast period. The high growth of the Asian market can be attributed to the rising geriatric population, increasing burden of chronic diseases, expansion opportunities for market players, and growing number of initiatives to create awareness about healthy lifestyles and preventive healthcare in several Asian countries

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

At-home segment site dominates the market by sample collection site

At-home sample collection

The Home Healthcare market is witnessing rapid growth across the globe. This can primarily be attributed to the availability of diagnostic and therapeutic products that can be used by patients at home without assistance from healthcare professionals. Moreover, home healthcare is convenient for patients, and it helps save time and costs incurred in visiting healthcare professionals in hospitals and clinics. With the growing demand for self-medication and self-testing, several companies in the market have launched kits that can directly be used by patients. These kits are easy to handle and can be used without any assistance.

In-office sample collection

Though there is a growing trend of self-medication and self-testing, in several cases, it is essential to have the assistance of physicians for diagnostic and therapeutic purposes. As a result, several market players offer their testing services only under the guidance of physicians. Though several cellular health screening tests are provided directly to patients, certain companies still prefer providing their services through a physician to ensure patient safety and the accuracy of the sample collection process

Other Sites

Hospitals and diagnostic laboratories are the other sites that can be considered as safe locations for sample collection. Diagnostic tests of the in-patient population are generally conducted in hospitals. Moreover, some physicians recommend reliable diagnostic laboratories for sample collection and testing processes. As both hospitals as well as diagnostic laboratories have trained personnel, it is safe and easy for patients to get tested at these facilities

The global market is highly competitive with the presence of several small and big players. Prominent players in the cellular heath screening market include Genova Diagnostics (US), Telomere Diagnostics (US), Life Length (Spain), Quest Diagnostics (US), Repeat Diagnostics (Canada), SpectraCell Laboratories (US), Zimetry LLC (US), Cell Science Systems (US), Titanovo, Inc. (US), Segterra, Inc. (US), LabCorp Holdings (US), BioReference Laboratories (US), Immundiagnostik AG (Germany), DNA Labs (India), and Cleveland HeartLab, Inc. (US).

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Secondary Data

2.2 Primary Data

2.3 Key Industry Insights

2.4 Market Size Estimation

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions for the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Market: Market Overview

4.2 Market Size, By Sample Collection Site, 2017–2022

4.3 Market, By Type

4.4 Market for Single Test Panels (2017)

4.5 Market, By Sample Type

4.6 Geographic Snapshot of the Cellular Health Screening Market

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of Telomere Performance Programs for Leading A Healthy Life

5.2.1.2 Growing Importance of Healthy Life Expectancy (HALE)

5.2.1.3 Rising Government Focus Towards Preventive Healthcare

5.2.1.4 Rising Geriatric Population and Resultant Growth in the Need for Cellular Health Screening

5.2.1.5 Increasing Research Activities

5.2.1.6 Growing Adoption of Direct-To-Consumer Approach for the Availability of Kits

5.2.1.7 Increasing Burden of Chronic Diseases

5.2.2 Restraints

5.2.2.1 Problems Associated With the Transport of Samples

5.2.2.2 Differences in the Cost of Test Kits Offered By Different Companies

5.2.3 Opportunities

5.2.3.1 Potential Applications of Cellular Health Screening in Precision and Personalized Medicine

5.2.3.2 Expansion in Emerging Economies

5.2.4 Challenge

5.2.4.1 Limited Reimbursement

5.2.5 Trends

5.2.5.1 Adoption of Digital Technologies for Testing

5.2.5.2 Label-Free Detection Technologies are Set to Transform the Market

5.2.5.3 Ngs-Based Telomere Length Measurement Techniques

6 Market, By Type (Page No. - 45)

6.1 Introduction

6.2 Single Test Panels

6.2.1 Telomere Tests

6.2.2 Oxidative Stress Tests

6.2.3 Inflammation Tests

6.2.4 Heavy Metals Tests

6.3 Multi-Test Panels

7 Market, By Sample Type (Page No. - 55)

7.1 Introduction

7.2 Blood Samples

7.3 Other Samples

8 Market, By Sample Collection Site (Page No. - 61)

8.1 Introduction

8.2 At-Home Sample Collection

8.3 In-Office Sample Collection

8.4 Other Sites

9 Market, By Region (Page No. - 68)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.1.1 Rising Geriatric Population and Subsequent Growth in the Prevalence of Chronic Diseases

9.2.1.2 Increasing Initiatives for Preventive Healthcare

9.2.1.3 Presence of Major Market Players in the U.S.

9.2.2 Canada

9.2.2.1 Government Initiatives to Promote A Healthy Lifestyle

9.2.2.2 Growing Research Activities

9.3 Europe

9.3.1 Increasing Burden of Chronic Diseases

9.3.2 Initiatives to Create Awareness About Cellular Biomarkers

9.3.3 Initiatives By Governments and Major Market Players

9.4 Asia

9.4.1 Rising Geriatric Population and Increasing Burden of Chronic Diseases

9.4.2 Expansion Opportunities for Market Players

9.4.3 Initiatives to Create Awareness on Healthy Lifestyles and Preventive Healthcare

9.5 Rest of the World

9.5.1 Growing Prevalence of Chronic Diseases

9.5.2 Increasing Research and Development Activities

9.5.3 Strategic Initiatives By Market Players

10 Competitive Landscape (Page No. - 92)

10.1 Introduction

10.2 Company Ranking: Telomere Testing Market

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Competitive Benchmarking

10.4.1 Business Strategies Excellence

10.4.2 Strength of Product Portfolio

*Top 25 Companies Analyzed for This Study are - Genova Diagnostics; Quest Diagnostics; Life Length; Zimetry LLC; Telomere Diagnostics; Repeat Diagnostics; Spectracell Laboratories; Cell Science Systems; Titanovo, Inc.; Insidetracker; DNA Labs India; Laboratory Corporation of America Holdings; Cleveland Heartlab, Inc.; Bioreference Laboratories; Immundiagnostik Ag; Spectra Laboratories; Cell Biolabs Inc.; Aml Diagnostics; Enzo Clinical Lab; Access Medical Labs; Life Line Screening; Mayo Medical Laboratories; Clinical Reference Labotory; Synlab Internatinal; Acm Medical Laboratory

11 Company Profiles (Page No. - 97)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships)*

11.1 Telomere Diagnostics, Inc. (TDX)

11.2 Spectracell Laboratories

11.3 Life Length

11.4 Repeat Diagnostics Inc. (Repeat DX)

11.5 Titanovo

11.6 Cell Science Systems

11.7 Quest Diagnostics

11.8 Labcorp Holdings

11.9 Biorefrence Laboratories

11.10 Cleveland Heartlab, Inc.

11.11 Genova Diagnostics

11.12 Zimetry LLC

11.13 Immundiagnostik AG

11.14 Segterra, Inc.

11.15 DNA Labs India

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 132)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (71 Tables)

Table 1 Life Expectancy and Healthy Life Expectancy at Birth, By Region (Years)

Table 2 Life Expectancy and Healthy Life Expectancy for Individuals Aged 60 Years, By Region (Years)

Table 3 Government Initiatives to Promote Life Science Research

Table 4 Initiatives From Private Organizations to Promote Life Science Research

Table 5 Global Market, By Type, 2015-2022 (USD Million)

Table 6 Single Test Panels Market, By Type, 2015-2022 (USD Million)

Table 7 Single Test Panels Market, By Region, 2015-2022 (USD Million)

Table 8 North America: Single Test Panels Market, By Country, 2015-2022 (USD Million)

Table 9 Telomere Tests Market, By Region, 2015-2022 (USD Million)

Table 10 North America: Telomere Tests Market, By Country, 2015-2022 (USD Million)

Table 11 Oxidative Stress Tests Market, By Region, 2015-2022 (USD Million)

Table 12 North America: Oxidative Stress Tests Market, By Country, 2015-2022 (USD Million)

Table 13 Developments in the Inflammation Tests Market

Table 14 Inflammation Tests Market, By Region, 2015-2022 (USD Million)

Table 15 North America: Inflammation Tests Market, By Country, 2015-2022 (USD Million)

Table 16 Heavy Metals Tests Market, By Region, 2015-2022 (USD Million)

Table 17 North America: Heavy Metals Tests Market, By Country, 2015-2022 (USD Million)

Table 18 Multi-Test Panels Market, By Region, 2015-2022 (USD Million)

Table 19 North America: Multi-Test Panels Market, By Country, 2015-2022 (USD Million)

Table 20 Global Market, By Sample Type, 2015-2022 (USD Million)

Table 21 Developments in the Blood Tests Market

Table 22 Cellular Health Screening Market for Blood Samples, By Region, 2015-2022 (USD Million)

Table 23 North America: Market for Blood Samples, By Country, 2015-2022 (USD Million)

Table 24 Europe: Market for Blood Samples, By Country, 2015-2022 (USD Million)

Table 25 Asia: Market for Blood Samples, By Country, 2015-2022 (USD Million)

Table 26 Cellular Health Screening Market for Other Samples, By Region, 2015-2022 (USD Million)

Table 27 North America: Market for Other Samples, By Country, 2015-2022 (USD Million)

Table 28 Europe: Market for Other Samples, By Country, 2015-2022 (USD Million)

Table 29 Asia: Market for Other Samples, By Country, 2015-2022 (USD Million)

Table 30 Global Market, By Sample Collection Site, 2015-2022 (USD Million)

Table 31 Cellular Health Screening Market Size for At-Home Sample Collection, By Region, 2015-2022 (USD Million)

Table 32 North America: Market Size for At-Home Sample Collection, By Country, 2015-2022 (USD Million)

Table 33 Europe: Market for At-Home Sample Collection, By Country, 2015-2022 (USD Million)

Table 34 Cellular Health Screening Market Size for In-Office Sample Collection, By Region, 2015-2022 (USD Million)

Table 35 North America: Market Size for In-Office Sample Collection, By Country, 2015-2022 (USD Million)

Table 36 Europe: Market for In-Office Sample Collection, By Country, 2015-2022 (USD Million)

Table 37 Global Market for Other Sample Collection Sites, By Region, 2015-2022 (USD Million)

Table 38 North America: Market for Other Sample Collection Sites, By Country, 2015-2022 (USD Million)

Table 39 Europe: Market for Other Sample Collection Sites, By Country, 2015-2022 (USD Million)

Table 40 Market, By Region, 2015–2022 (USD Million)

Table 41 North America: Market, By Country, 2015–2022 (USD Million)

Table 42 North America: Market, By Type, 2015–2022 (USD Million)

Table 43 North America: Market for Single Test Panels, By Type, 2015–2022 (USD Million)

Table 44 North America: Market, By Sample Type, 2015–2022 (USD Million)

Table 45 North America: Market, By Sample Collection Site, 2015–2022 (USD Million)

Table 46 U.S.: Market, By Type, 2015–2022 (USD Million)

Table 47 U.S.: Market for Single Test Panels, By Type, 2015–2022 (USD Million)

Table 48 U.S.: Market, By Sample Type, 2015–2022 (USD Million)

Table 49 U.S.: Market, By Sample Collection Site, 2015–2022 (USD Million)

Table 50 Canada: Research Activities in the Field of Cellular Health

Table 51 Canada: Market, By Type, 2015–2022 (USD Million)

Table 52 Canada: Market for Single Test Panels, By Type, 2015–2022 (USD Million)

Table 53 Canada: Market, By Sample Type, 2015–2022 (USD Million)

Table 54 Canada: Market, By Sample Collection Site, 2015–2022 (USD Million)

Table 55 Europe: Important Events Focusing on Cellular Biomarkers

Table 56 Europe: Market, By Country, 2015-2022 (USD Million)

Table 57 Europe: Market, By Type, 2015–2022 (USD Million)

Table 58 Europe: Market for Single Test Panels, By Type, 2015–2022 (USD Million)

Table 59 Europe: Market, By Sample Type, 2015–2022 (USD Million)

Table 60 Europe: Market, By Sample Collection Site, 2015–2022 (USD Million)

Table 61 Asia: Market, By Country, 2015-2022 (USD Million)

Table 62 Asia: Market, By Type, 2015–2022 (USD Million)

Table 63 Asia: Market for Single Test Panels, By Type, 2015–2022 (USD Million)

Table 64 Asia: Market, By Sample Type, 2015–2022 (USD Million)

Table 65 Asia: Market, By Sample Collection Site, 2015–2022 (USD Million)

Table 66 RoW: Market, By Type, 2015–2022 (USD Million)

Table 67 RoW: Market for Single-Test Panels, By Type, 2015–2022 (USD Million)

Table 68 RoW: Market, By Sample Type, 2015–2022 (USD Million)

Table 69 RoW: Market, By Sample Collection Site, 2015–2022 (USD Million)

Table 70 Ranking of Top Players in the Telomere Testing Market

Table 71 Repeat DX: List of Accreditations

List of Figures (32 Figures)

Figure 1 Global Cellular Health Screening: Market Segmentation

Figure 2 Research Design

Figure 3 Key Data From Secondary Sources

Figure 4 Key Data From Primary Sources

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Size Estimation: Top-Down Approach

Figure 7 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 8 Data Triangulation Methodology

Figure 9 Market Size, By Type, 2017 vs 2022 (USD Million)

Figure 10 Market Size, By Sample Type, 2017 vs 2022 (USD Million)

Figure 11 Market Size, By Sample Collection Site, 2017 vs 2022 (USD Million)

Figure 12 North America to Dominate the Market During the Forecast Period

Figure 13 Rising Focus Towards Preventive Healthcare is Expected to Drive the Global Market

Figure 14 At-Home Sample Collection Segment to Dominate the Market During the Forecast Period

Figure 15 Multi-Test Panels Segment to Register the Highest CAGR Between 2017 & 2022

Figure 16 Inflammation Tests to Command the Largest Share of the Market for Single Test Panels in 2017

Figure 17 Blood Samples Segment to Register the Highest CAGR Between 2017 & 2022

Figure 18 Asian Market Projected to Witness the Highest Growth During the Forecast Period

Figure 19 Market: Drivers, Restraints, Opportunities, and Challenge

Figure 20 Single Test Panels Segment to Dominate the Market During the Forecast Period

Figure 21 Blood Samples Segment to Dominate the Market During the Forecast Period

Figure 22 At-Home Sample Collection Segment to Witness Highest Growth During the Forecast Period

Figure 23 North America to Dominate the Market During the Forecast Period

Figure 24 North America: Market Snapshot

Figure 25 Prevalence of Coronary Heart Disease By Age and Sex (2009–2012)

Figure 26 Europe: Market Snapshot

Figure 27 Asia: Market Snapshot

Figure 28 RoW: Market Snapshot

Figure 29 Global Market, Competitive Leadership Mapping 2017

Figure 30 Quest Diagnostics: Company Snapshot (2016)

Figure 31 Labcorp Holdings: Company Snapshot (2016)

Figure 32 Opko Health, Inc.: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cellular Health Screening Market