Clinical Laboratory Services Market by Specialty (Biochemistry, Endocrinology, Microbiology, Hematology, Cytology, Histopathology, Genetic Testing), Providers (Independent Laboratory, Reference Laboratory, Hospital Laboratory) & Geography - Global Forecast to 2022

Inquire Now to get the global numbers on Clinical Laboratory Services Market

The clinical laboratory services market is expected to reach USD 146.41 billion by 2022 from USD 113.4 billion in 2017, at a CAGR of 5.2% during the forecast period. The rising demand for early and accurate disease diagnosis, growing public-private investments as well as research funding & grants to develop innovative laboratory testing procedures, and advancements in clinical diagnostic techniques are the key factors driving the growth of the market.

Objectives of the study are:

- To define, describe, and forecast the overall market on the basis of specialty, provider, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to their individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the clinical laboratory services market size (in terms of value) of individual segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches; agreements, partnerships, and collaborations; mergers and acquisitions; and research and development activities in the global market

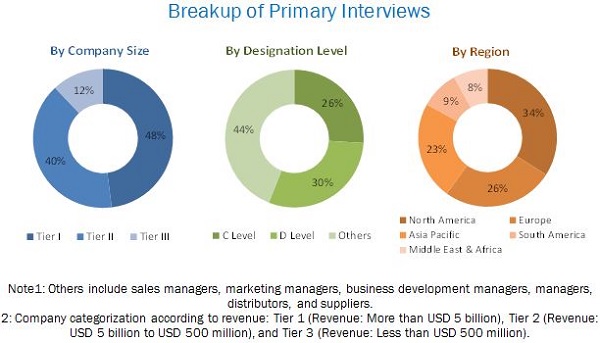

This research study involves the extensive usage of secondary sources, directories, and databases (such as, Bloomberg Business, Factiva, and Dun & Bradstreet), in order to identify and collect information useful for this technical, market-oriented, and financial study of the market. In-depth interviews were conducted with various primary respondents, including subject-matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify qualitative and quantitative information and to assess market prospects.

To know about the assumptions considered for the study, download the pdf brochure

In 2016, Mayo Medical Laboratories (US), Laboratory Corporation of America Holdings (US), Quest Diagnostics Incorporated (US), Spectra Laboratories Inc. (US), and DaVita Healthcare Partners (US), held the leading position in the global clinical laboratory services market. In the past three years, these companies adopted service launches, upgrades; agreements, collaborations & partnerships; mergers & acquisitions; and expansions as their key business strategies to ensure market dominance. Eurofins Scientific (Luxembourg), Unilabs (Switzerland), SYNLAB International (Germany), Bio-Reference Laboratories (US), Sonic Healthcare (UK), and Cerba HealthCare (France) were some of the other major players in the clinical laboratory services market.

Stakeholders

- Clinical laboratory testing service providers

- Clinical laboratory testing kit manufacturers

- Healthcare service providers (such as hospitals and surgical centers)

- Physicians and pathology laboratory personnel

- Diagnostic & clinical testing laboratories

- Reference testing laboratories

- Laboratory product distributors and suppliers

- Health insurance companies/payers

- Pharmaceutical, biopharmaceutical, and biotechnology companies

- Market research and consulting firms

Scope of the Report

This report categorizes the global clinical laboratory services market into the following segments and sub segments:

By Specialty

-

Clinical Chemistry Testing

- Routine Chemistry Testing

- Endocrinology Chemistry Testing

- Therapeutic Drug Monitoring (TDM) Testing

- Specialized Chemistry Testing

- Other Clinical Chemistry Testing

-

Microbiology Testing

- Infectious Disease Testing

- Transplant Diagnostic Testing

- Other Microbiology Testing

- Hematology Testing

- Immunology Testing

- Cytology Testing

- Genetic Testing

- Drug of Abuse Testing

By Provider

- Independent and Reference Laboratories

- Hospital-based Laboratories

- Nursing and Physician Office-based Laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Service Portfolio

- Service offering matrix, which gives a detailed comparison of the service portfolios of the top 5 companies profiled in the report

Geographic Analysis

- Further breakdown of the regional clinical laboratory services market into:

- RoW into Latin America, the Middle East, and Africa

This report broadly segments the clinical laboratory services market into specilaty, provider, and region. On the basis of specialty, the market is categorized into clinical chemistry, microbiology, hematology, immunology, cytology, genetic, and drugs of abuse testing. In 2017, the clinical chemistry segment is expected to account for the largest share of the market. The large market share of this segment is attributed to technological innovations in clinical chemistry, improving healthcare system, and rising per capita disposable income in developing countries.

Based on provider, the market is categorized into three segments, namely, independent and reference laboratories, hospital-based laboratories; and nursing and physician office-based laboratories. In 2017, independent and reference laboratories are expected to account for the largest share of the market. The dominant share of this segment is credited to the ongoing automation & digitalization of diagnostic laboratories across major countries and significant reimbursement coverage for clinical tests performed at reference/independent laboratories in developed countries.

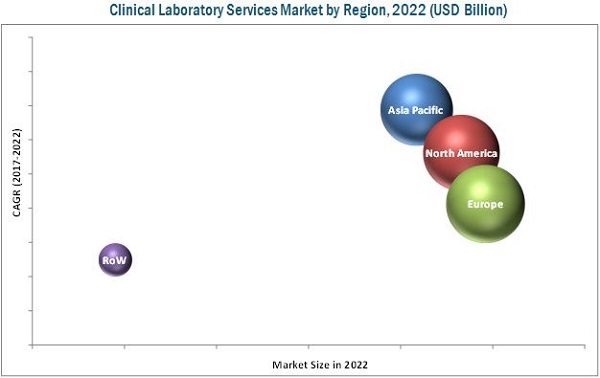

This report covers the clinical laboratory services market across four major geographies, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). Of the four geographic regions studied in the report, Europe is expected to command the largest share of the market in 2017. Government initiatives to promote awareness about preventive screening, growing public and private funding for research on the development of clinical laboratory tests, and increasing adoption of genome-based laboratory tests are driving the Clinical Laboratory Services Market in this region. However, Asia Pacific is expected to register the highest growth rate during the forecast period due to rising healthcare expenditure, increasing number of hospitals and clinical diagnostic laboratories in India and China, and strengthening research base for clinical laboratory testing procedures across India, China, and Japan.

Factors such as pricing pressure faced by healthcare payers and providers and procedural shift from lab-based diagnosis to home-based/point-of-care testing procedures are expected to restrain the growth of the market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Definition

1.3 Clinical Laboratory Services Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.2 Clinical Laboratory Services Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Clinical Laboratory Services Market Overview

4.2 Global Market, By Specialty

4.3 Clinical Laboratory Services Provider Market, By Region

4.4 Geographic Snapshot: Global Market

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Clinical Laboratory Services Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Global Burden of Target Diseases

5.2.1.2 Rising Demand for Early and Accurate Disease Diagnosis

5.2.1.3 Advancements in Clinical Diagnostic Techniques

5.2.1.4 Growing Public-Private Investments as Well as Research Funding & Grants to Develop Innovative Laboratory Testing Procedures

5.2.1.5 Rising Government Initiatives to Improve the Quality and Affordability of Clinical Diagnostic Testing Procedures

5.2.2 Restraints

5.2.2.1 Pricing Pressure Faced By Healthcare Payers and Providers

5.2.2.2 Procedural Shift From Lab-Based Diagnosis to Home-Based/Point-Of-Care Testing Procedures

5.2.3 Opportunities

5.2.3.1 Emerging Countries

5.2.3.2 Patient-Initiated Diagnostic Testing to Foster Market Growth in Developed Countries

5.2.3.3 Growing Adoption of Digital Pathology Platforms

5.2.3.4 Rising Preference for Comprehensive Health Checkups Offered By Clinical Laboratories

5.2.4 Challenge

5.2.4.1 Public Concerns Related to Data Security and Privacy

6 Clinical Laboratory Services Market, By Specialty (Page No. - 44)

6.1 Introduction

6.2 Clinical Chemistry Testing

6.2.1 Routine Chemistry Testing

6.2.2 Endocrinology Chemistry Testing

6.2.3 Therapeutic Drug Monitoring (TDM) Testing

6.2.4 Specialized Chemistry Testing

6.2.5 Other Clinical Chemistry Testing

6.3 Microbiology Testing

6.3.1 Infectious Disease Testing

6.3.2 Transplant Diagnostic Testing

6.3.3 Other Microbiology Testing

6.4 Hematology Testing

6.4.1 Routine Hematology Testing

6.4.2 Coagulation Testing

6.4.3 Specialized Hematology Testing

6.5 Immunology Testing

6.6 Cytology Testing

6.7 Genetic Testing

6.8 Drugs of Abuse Testing

7 Clinical Laboratory Services Market, By Provider (Page No. - 70)

7.1 Introduction

7.2 Independent & Reference Laboratories

7.3 Hospital-Based Laboratories

7.4 Nursing and Physician Office-Based Laboratories

8 Clinical Laboratory Services Market, By Region (Page No. - 75)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 France

8.3.4 Rest of Europe (RoE)

8.4 Asia Pacific

8.4.1 Japan

8.4.2 China

8.4.3 India

8.4.4 Rest of Asia Pacific (RoAPAC)

8.5 Rest of the World (RoW)

9 Competitive Landscape (Page No. - 100)

9.1 Overview

9.2 Clinical Laboratory Services Market Ranking Analysis

9.3 Competitive Scenario

9.3.1 Service Launches, Upgrades, and Approvals

9.3.2 Agreements, Partnerships, and Collaborations

9.3.3 Acquisitions

9.3.4 Expansions

10 Company Profiles (Page No. - 106)

(Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments)*

10.1 Mayo Medical Laboratories

10.2 Labcorp

10.3 Quest Diagnostics

10.4 Spectra Laboratories

10.5 Davita Healthcare Partners

10.6 Eurofins Scientific

10.7 Unilabs

10.8 Synlab International

10.9 Bio-Reference Laboratories

10.10 Sonic Healthcare

10.11 Clinical Reference Laboratory

10.12 ACM Medical Laboratory

10.13 Adicon Clinical Laboratory

10.14 Cerba Healthcare

10.15 Amedes Holding

10.16 Lifelabs Medical Laboratories

*Details on Marketsandmarkets View, Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 158)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (73 Tables)

Table 1 Global Market for Clinical Laboratory Services, By Specialty, 2015–2022 (USD Billion)

Table 2 Global Clinical Chemistry Testing Market, By Type, 2015–2022 (USD Billion)

Table 3 Clinical Chemistry Testing Market, By Region, 2015–2022 (USD Billion)

Table 4 Europe: Clinical Chemistry Testing Market, By Country, 2015–2022 (USD Billion)

Table 5 North America: Clinical Chemistry Testing Market, By Country, 2015–2022 (USD Billion)

Table 6 Asia Pacific: Clinical Chemistry Testing Market, By Country, 2015–2022 (USD Billion)

Table 7 Routine Chemistry Testing Market, By Region, 2015–2022 (USD Billion)

Table 8 Endocrinology Chemistry Testing Market, By Region, 2015–2022 (USD Billion)

Table 9 Therapeutic Drug Monitoring (TDM) Testing Market, By Region, 2015–2022 (USD Million)

Table 10 Specialized Chemistry Testing Market, By Region, 2015–2022 (USD Million)

Table 11 Other Clinical Chemistry Testing Market, By Region, 2015–2022 (USD Billion)

Table 12 Global Microbiology Testing Market, By Type, 2015–2022 (USD Billion)

Table 13 Microbiology Testing Market, By Region, 2015–2022 (USD Billion)

Table 14 Europe: Microbiology Testing Market, By Country, 2015–2022 (USD Billion)

Table 15 North America: Microbiology Testing Market, By Country, 2015–2022 (USD Billion)

Table 16 Asia Pacific: Microbiology Testing Market, By Country, 2015–2022 (USD Billion)

Table 17 Infectious Disease Testing Market, By Region, 2015–2022 (USD Billion)

Table 18 Transplant Diagnostic Testing Market, By Region, 2015–2022 (USD Million)

Table 19 Other Microbiology Testing Market, By Region, 2015–2022 (USD Million)

Table 20 Global Hematology Testing Market, By Type, 2015-2022 (USD Billion)

Table 21 Hematology Testing Market, By Region, 2015–2022 (USD Billion)

Table 22 Europe: Hematology Testing Market, By Country, 2015–2022 (USD Billion)

Table 23 North America: Hematology Testing Market, By Country, 2015–2022 (USD Billion)

Table 24 Asia Pacific: Hematology Testing Market, By Country, 2015–2022 (USD Billion)

Table 25 Routine Hematology Testing Market, By Region, 2015–2022 (USD Billion)

Table 26 Coagulation Testing Market, By Region, 2015–2022 (USD Billion)

Table 27 Specialized Hematology Testing Market, By Region, 2015–2022 (USD Million)

Table 28 Immunology Testing Market, By Region, 2015–2022 (USD Billion)

Table 29 Europe: Immunology Testing Market, By Country, 2015–2022 (USD Billion)

Table 30 North America: Immunology Testing Market, By Country, 2015–2022 (USD Billion)

Table 31 Asia Pacific: Immunology Testing Market, By Country, 2015–2022 (USD Billion)

Table 32 Cytology Testing Market, By Region, 2015–2022 (USD Billion)

Table 33 Europe: Cytology Testing Market, By Country, 2015–2022 (USD Million)

Table 34 North America: Cytology Testing Market, By Country, 2015–2022 (USD Million)

Table 35 Asia Pacific: Cytology Testing Market, By Country, 2015–2022 (USD Billion)

Table 36 Genetic Testing Market, By Region, 2015–2022 (USD Billion)

Table 37 Europe: Genetic Testing Market, By Country, 2015–2022 (USD Billion)

Table 38 North America: Genetic Testing Market, By Country, 2015–2022 (USD Billion)

Table 39 Asia Pacific: Genetic Testing Market, By Country, 2015–2022 (USD Billion)

Table 40 Drugs of Abuse Testing Market, By Region, 2015–2022 (USD Million)

Table 41 Europe: Drugs of Abuse Testing Market, By Country, 2015–2022 (USD Million)

Table 42 North America: Drugs of Abuse Testing Market, By Country, 2015–2022 (USD Million)

Table 43 Asia Pacific: Drugs of Abuse Testing Market, By Country, 2015–2022 (USD Million)

Table 44 Global Clinical Laboratory Services Market, By Provider, 2015-2022 (USD Billion)

Table 45 Global Market of Clinical Laboratory Services for Independent & Reference Laboratories, By Region, 2015-2022 (USD Billion)

Table 46 Global Market of Clinical Laboratory Services for Hospital-Based Laboratories, By Region, 2015-2022 (USD Billion)

Table 47 Global Market of Clinical Laboratory Services for Nursing & Physician Office-Based Laboratories, By Region, 2015-2022 (USD Billion)

Table 48 Global Market of Clinical Laboratory Services, By Region, 2015–2022 (USD Billion)

Table 49 North America: Clinical Laboratory Services Market, By Country, 2015–2022 (USD Billion)

Table 50 North America: Market of Clinical Laboratory Services, By Specialty, 2015–2022 (USD Billion)

Table 51 North America: Market of Clinical Laboratory Services, By Provider, 2015–2022 (USD Billion)

Table 52 US: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 53 Canada: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 54 Europe: Clinical Laboratory Services Market, By Country, 2015–2022 (USD Billion)

Table 55 Europe: Market of Clinical Laboratory Services, By Specialty, 2015–2022 (USD Billion)

Table 56 Europe: Clinical Laboratory Services Market of Clinical Laboratory Services, By Provider, 2015–2022 (USD Billion)

Table 57 Germany: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 58 UK: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 59 France: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 60 RoE: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 61 Asia Pacific: Clinical Laboratory Services Market, By Country, 2015–2022 (USD Billion)

Table 62 Asia Pacific: Market of Clinical Laboratory Services, By Specialty, 2015–2022 (USD Billion)

Table 63 Asia Pacific: Market of Clinical Laboratory Services, By Provider, 2015–2022 (USD Billion)

Table 64 Japan: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 65 China: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 66 India: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 67 RoAPAC: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 68 RoW: Clinical Laboratory Services Market, By Specialty, 2015–2022 (USD Billion)

Table 69 RoW: Clinical Laboratory Services Market, By Provider, 2015–2022 (USD Billion)

Table 70 Top 5 Service Launches, Upgrades, and Approvals, 2014–2017

Table 71 Top 5 Agreements, Partnerships, and Collaborations, 2014–2017

Table 72 Top 5 Acquisitions, 2014–2017

Table 73 Expansions, 2014–2017

List of Figures (31 Figures)

Figure 1 Global Clinical Laboratory Services Market: Research Methodology Steps

Figure 2 Research Design

Figure 3 Global Market of Clinical Laboratory Services: Bottom-Up Approach

Figure 4 Global Market of Clinical Laboratory Services: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Clinical Chemistry Testing Segment is Expected to Dominate the Global Market During Forecast Period

Figure 7 Routine Chemistry Testing Segment to Dominate the Clinical Chemistry Market During Forcast Period

Figure 8 Independent and Reference Laboratories Expected to Be the Fastest-Growing Segment During 2017-2022

Figure 9 Asia Pacific to Grow at the Highest Growth Rate in the Forecast Period

Figure 10 Rising Global Burden of Target Diseases to Drive the Global Market During the Forecast Period

Figure 11 Clinical Chemistry Testing to Dominate the Global Market During the Forecast Period

Figure 12 Europe to Dominate Clinical Laboratory Services Provider Market in 2017

Figure 13 India and China are the Fastest Growing Countries in Global Clinical Laboratory Services Market

Figure 14 Clinical Laboratory Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Global Clinical Laboratory Services Market of Clinical Laboratory Services, By Specialty (2017 vs 2022)

Figure 16 Global Market of Clinical Laboratory Services, By Provider (2017 vs 2022)

Figure 17 Geographic Snapshot: Asia Pacific to Witness the Highest Demand Growth for Clinical Laboratory Services During the Forecast Period

Figure 18 North America: Market Snapshot of Clinical Laboratory Services

Figure 19 Europe: Market Snapshot of Clinical Laboratory Services

Figure 20 Asia Pacific: Market Snapshot of Clinical Laboratory Services

Figure 21 RoW: Market Snapshot of Clinical Laboratory Services

Figure 22 Key Developments Adopted By Leading Players in Clinical Laboratory Market Between 2014 and 2017

Figure 23 Global Clinical Laboratory Services Market Ranking, By Key Service Providers, 2016

Figure 24 Mayo Foundation for Medical Education and Research: Company Snapshot

Figure 25 Labcorp: Company Snapshot

Figure 26 Quest Diagnostics: Company Snapshot

Figure 27 Fresenius Medical Care: Company Snapshot

Figure 28 Davita Healthcare Partners: Company Snapshot

Figure 29 Eurofins Scientific: Company Snapshot

Figure 30 Opko Health .: Company Snapshot

Figure 31 Sonic Healthcare: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clinical Laboratory Services Market