Ceramic Inks Market by Type (Decorative and Functional), Technology (Digital and Analog), Application (Ceramic Tiles, Glass Printing, and Food Container Printing), and Region (APAC, Europe, North America, and South America) - Global Forecast to 2022

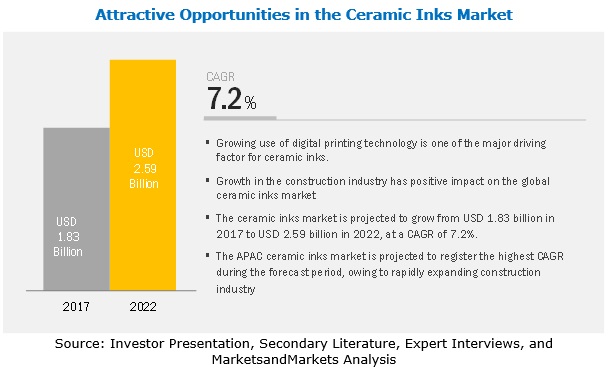

[108 Pages Report] MarketsandMarkets forecasts the ceramic inks market was valued at USD 1.71 billion in 2016 and is projected to reach USD 2.59 billion by 2022, at a CAGR of 7.2% between 2017 and 2022. Ceramic ink are used in various applications namely ceramic tiles, glass printing, and food container printing. Ceramic tiles is the largest application segment of the ceramic inks market. The demand for ceramic ink is growing due to the growing construction industry globally. The objective of the report is to define, describe, and forecast the ceramic inks market size based on application, end-use industry, formulation, type, technology, and region.

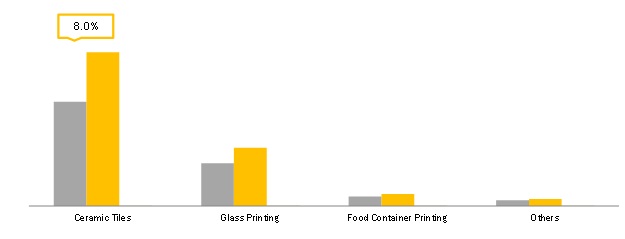

By Application, ceramic tiles is projected to be the largest and fastest-growing segment

The ceramic tiles segment is expected to be the fastest-growing application segment of the ceramic inks market during the forecast period, in terms of value. The ceramic inks market in the ceramic tiles application segment accounted for the largest market share in the overall ceramic inks market. The increased demand for customized tiles and evolution of the digital printing technology are the major driving forces for the high consumption of ceramic inks in the ceramic tiles application.

Ceramic tiles application to be the fastest growing in the ceramic inks market

By Technology, Digital Printing is projected to be the largest and fastest-growing segment

The ceramic inks market is moving toward the complete replacement of analog printing technology with digital printing technology. The major markets such as China, Brazil, and India are rapidly moving toward digital printing. If this scenario continues, more than 95% of the market will be occupied by digital printing technology for ceramic decoration application by 2022. Digital printing is used by ceramic decorators to print in short runs, reduce inventory cost, and effectively fulfill the changing requirements of the ceramic inks market. In addition, it also allows the decorators to respond quickly to a rapid design changeover as per the market demand to cater the consumer requirements.

By Type, Decorative Inks accounted for the largest market share

Ceramic inks are used in glass printing, ceramic tiles, and food container printing applications. These inks are available in various colors and shades such as black, brown, red, white, blue, maroon, and others. The demand for blue, black, and brown color ink is high. There is a high demand for decorative inks in ceramic tiles application. These inks are used to improve the appearance of ceramics, glass, metal, and tiles.

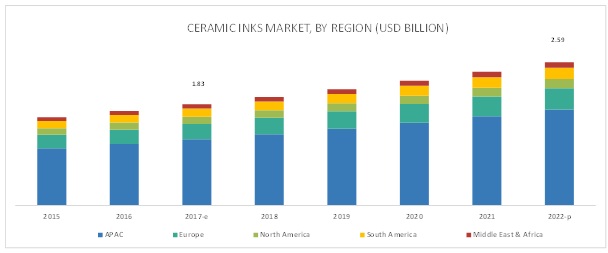

APAC dominated the ceramic inks market

In 2016, the ceramic inks market was dominated by APAC with a largest share in the global ceramic inks market. APAC is the emerging ceramic inks market due to its high consumption in the ceramic tiles application. The major factor, which is expected to drive the ceramic inks market, is the increased production of the ceramic tiles, worldwide. Manufacturers are increasing their tiles manufacturing capacity, which is further expected to drive the market of ceramic inks during the forecast period

Market Dynamics

Driver: Growing use of digital printing technology

The growing use of digital printing technology allowed the manufacturers to produce in bulk and offer variety in product designs at competitive prices. This contributed to the ceramic inks market growth with the increasing penetration of digital printing technology. Currently, almost 75% ceramic tiles are produced and decorated with digital printing technology in the world. The wide use of this technology is due to its advantages over analog printing technology, such as cheap production cost, increased production speed, excellent printing quality, and custom product offerings. This resulted in increased production and consumption of ceramic inks

Restraint: High cost involved in switching from analog to digital printing technology

Analog printing and digital printing are the only technologies used in the ceramic inks market. The boom in demand for ceramic inks was mainly due to the introduction of digital printing technology. The switching cost from analog to digital is very high. Expensive digital printers coupled with expensive ceramic digital printer inks require high investment for its end users.

Opportunity: High demand for ceramic tiles in APAC and the Middle East & Africa

APAC produces 70.0% of the total ceramic tiles produced in the world. Ceramic inks manufacturers are concentrated in Spain, Italy, and China and are supplying the inks from these countries to high growth markets such as India, Saudi Arabia, Vietnam, Indonesia, and others. Setting up production base near the consumer market always provide a competitive advantage. The growing demand for ceramic tiles from these regions and expanding construction industry across these regions are expected to present an opportunity for ceramic ink manufacturers to expand their business in these regions.

Challenge: Developing new application areas for ceramic inks

Ceramic ink is used in glass printing, ceramic tiles, and food container printing applications. The market for ceramic inks is mainly driven by the digital printing technology. But, the use of digital printing technology is limited mainly to the ceramic tiles application, which is the major consumer of ceramic inks. For Example, textile printing can be a newer application area for ceramic ink manufacturers, but for this application, they will have to change the composition of inks and the technology. It has become a challenge for the ceramic ink manufacturers to develop new application areas.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Million (USD) |

|

Segments covered |

By Application (Ceramic Tiles, Glass Printing, And Food Container Printing), Technology (Digital and Analog), Type (Decorative and Functional), By Formulation (Solvent Based and Water Based), End-Use Industry (Construction, Consumer Products, Food & Beverage, and Others) |

|

Geographies covered |

APAC, North America, Europe, Middle East & Africa, South America |

|

Companies covered |

Ferro Corporation (US), Zschimmer & Schwarz (Germany), Esmalglass Itaca Grupo (Spain), Torrecid Group (Spain), Fritta (Spain), Colorobbia Holdings S.p.A. (Italy), Sicer S.P.A (Italy), Kao Chimigraf (Spain), Sun Chemical (US), and Tecglass (Italy) |

The research report categorizes the ceramic inks to forecast the revenues and analyze the trends in each of the following sub-segments:

On the Basis of Application:

- Ceramic Tiles

- Glass Printing

- Food Container Printing

On the Basis of Technology:

- Analog

- Digital

On the Basis of Formulation:

- Solvent Based

- Water Based

On the Basis of Type:

- Decorative

- Functional

On the Basis of End-Use Industry:

- Construction

- Consumer Products

- Food & Beverage

- Others

The key players operating in the ceramic inks market include Ferro Corporation (US), Zschimmer & Schwarz (Germany), Esmalglass Itaca Grupo (Spain), Torrecid Group (Spain), and Fritta (Spain), among others. are among the key players who are adopting organic and inorganic growth strategies to strengthen their foothold ceramic inks markets.

Recent Developments

- In 2017, Ferro Corporation acquired Endeka Group (US), a global producer of raw materials for the ceramics market. The acquisition helped the companys backward integration into raw materials manufacturing, which is used in ceramic coatings materials

- In 2017, Torrecid Group launched ECOINK-CID, a water-based digital ink for ceramic and tiles decoration applications

- In 2015, Zschimmer & Schwarz acquired Switzerland-based Gevartis AG. This acquisition complemented the chemical auxiliary divisions product portfolio

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the ceramic inks market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.3.2 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Significant Opportunities in Ceramic Inks Market

4.2 Ceramic Inks Market, By Application

4.3 Ceramic Inks Market in APAC, 2016

4.4 Ceramic Inks Market Size, By Type

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Use of Digital Printing Technology

5.2.1.2 Growing Construction Industry

5.2.1.3 Increased Demand for Decorated and Customized Ceramic Tiles

5.2.2 Restraints

5.2.2.1 High Cost Involved in Switching From Analog to Digital Printing Technology

5.2.3 Opportunities

5.2.3.1 High Demand for Ceramic Tiles in APAC and the Middle East & Africa

5.2.4 Challenges

5.2.4.1 Developing New Application Areas for Ceramic Inks

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Ceramic Inks Market, By Type (Page No. - 34)

6.1 Introduction

6.2 Functional Inks

6.2.1 Functional Inks Market, By Region, 2015-2022, USD Million

6.3 Decorative Inks

6.3.1 Decorative Inks Market, By Region, 2015-2022, USD Million

7 Ceramic Inks Market, By Formulation (Page No. - 34)

7.1 Introduction

7.2 Solvent Based

7.2.1 Solvent Based Inks Market, By Region, 2015-2022, USD Million

7.3 Water Based

7.3.1 Water Based Inks Market, By Region, 2015-2022, USD Million

8 Ceramic Inks Market, By Application (Page No. - 38)

(Note: Market Sizes are Not Provided for the Sub-Segments)

8.1 Introduction

8.2 Ceramic Tiles

8.2.1 Residential Decorative Tiles

8.2.1.1 Floor Tiles

8.2.1.2 Inner Wall Tiles

8.2.2 Commercial Decorative Tiles

8.2.2.1 Floor Tiles

8.2.2.2 Inner Wall Tiles

8.3 Glass Printing

8.3.1 Decorative Glass Printing

8.3.2 Functional Glass Printing

8.4 Food Container Printing

8.4.1 Tin and Glass Bottle Printing

8.5 Others

9 Ceramic Inks Market, By Technology (Page No. - 41)

9.1 Introduction

9.2 Digital Printing Technology

9.2.1 Digital Printing Ceramic Inks Market, By Region, 2015-2022, USD Million

9.3 Analog Printing Technology

9.2.1 Analog Printing Ceramic Inks Market, By Region, 2015-2022, USD Million

10 Ceramic Inks Market, By End-Use Industry (Page No. - 42 )

10.1 Introduction

10.2 Construction

10.2.1 Construction: Ceramic Inks Market, By Region, 2015-2022, USD Million

10.3 Consumer Products

10.3.1 Consumer Products: Ceramic Inks Market, By Region, 2015-2022, USD Million

10.4 Food & Beverage

10.3.1 Food & Beverage: Ceramic Inks Market, By Region, 2015-2022, USD Million

10.5 Others

11 Ceramic Inks Market, By Region (Page No. - 44)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 US: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.2.2 Mexico

11.2.2.1 Mexico: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.2.3 Canada

11.2.3.1 Canada: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.3 APAC

11.3.1 China

11.3.1.1 China: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.3.2 India

11.3.2.1 India: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.3.3 South Korea

11.3.3.1 South Korea: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.3.4 Japan

11.3.4.1 Japan: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.3.5 Vietnam

11.3.5.1 Vietnam: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.3.6 Indonesia

11.3.6.1 Indonesia: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.3.7 Rest of APAC

11.4 Europe

11.4.1 Spain

11.4.1.1 Spain: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.4.2 Germany

11.4.2.1 Germany: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.4.3 Italy

11.4.3.1 Italy: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.4.4 UK

11.4.4.1 UK: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.4.5 Rest of Europe

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.1.1 Saudi Arabia: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.5.2 South Africa

11.5.2.1 South Africa: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.5.3 Turkey

11.5.3.1 Turkey: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.5.4 Iran

11.5.4.1 Iran: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.5.5 Rest of Middle East & Africa

11.6 South America

11.6.1 Brazil

11.6.1.1 Brazil: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

11.6.2 Rest of South America

12 Competitive Landscape (Page No. - 81)

12.1 Overview

12.2 Competitive Situation and Trends

12.2.1 Acquisition

12.2.2 New Product Launch

13 Company Profiles (Page No. - 84)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Ferro Corporation

13.1.1 Business Overview

13.1.2 Products Offered

13.2.3 Recent Developments

13.1.4 SWOT Analysis

13.1.5 MnM View

13.2 Torrecid Group

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 Recent Developments

13.2.4 SWOT Analysis

13.2.5 MnM View

13.3 Colorobbia Holding S.P.A

13.3.1 Business Overview

13.3.2 Products Offered

13.3.3 Recent Developments

13.3.4 SWOT Analysis

13.3.5 MnM View

13.4 Esmalglass - Itaca Grupo

13.4.1 Business Overview

13.4.2 Products Offered

13.4.3 Recent Developments

13.4.4 SWOT Analysis

13.4.5 MnM View

13.5 Fritta

13.5.1 Business Overview

13.5.2 Products Offered

13.5.3 Recent Developments

13.5.4 SWOT Analysis

13.5.5 MnM View

13.6 Zschimmer & Schwarz

13.6.1 Business Overview

13.6.2 Products Offered

13.6.3 Recent Developments

13.6.6 SWOT Analysis

13.6.5 MnM View

13.7 Sicer S.P.A.

13.7.1 Business Overview

13.7.2 Products Offered

13.7.3 Recent Developments

13.7.7 SWOT Analysis

13.7.5 MnM View

13.8 KAO Chimigraf

13.8.1 Business Overview

13.8.2 Products Offered

13.8.3 Recent Developments

13.8.4 SWOT Analysis

13.8.5 MnM View

13.9 SUN Chemical

13.9.1 Business Overview

13.9.2 Products Offered

13.9.3 Recent Developments

13.9.4 SWOT Analysis

13.9.5 MnM View

13.10 Tecglass

13.10.1 Business Overview

13.10.2 Products Offered

13.10.3 Recent Developments

13.10.4 SWOT Analysis

13.10.5 MnM View

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13.11 Other Companies

13.11.1 Colores Olucha, S.L.

13.11.2 Six Star Ceramic Colours Co., Ltd.

13.11.3 Smalticeram Unicer Spa

13.11.4 Shandong Sinocera Create-Tide New Materials High-Tech Co., Ltd.

13.11.5 Colores Cerαmicos Elcom, S.L.

13.11.6 Vernis SA

13.11.7 Colores Cerαmicos S.A.

13.11.8 Innovative Ceramic Corp

13.11.9 Quimicer

13.11.10 Kerafrit SA

13.11.11 Afford Digital Inks

13.11.12 Belgium Glass and Ceramics (P) Ltd

13.11.13 Megacolor Productos Cerαmicos

13.11.14 Guangdong Dow Technology Co., Ltd.

14 Appendix (Page No. - 102)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Related Reports

14.6 Author Details

List of Tables (64 Tables)

Table 1 Ceramic Inks Market Size, By Type, 20152022 (USD Million)

Table 2 Ceramic Inks Market Size, By Application, 20152022 (USD Million)

Table 3 Ceramic Inks Market Size, By Technology, 20152022 (USD Million)

Table 4 Ceramic Inks Market Size, By Region, 20152022 (USD Million)

Table 5 Ceramic Inks Market Size, By Type, 20152022 (USD Million)

Table 6 Ceramic Inks Market Size, By Technology, 20152022 (USD Million)

Table 7 Ceramic Inks Market Size, By Application, 20152022 (USD Million)

Table 8 Ceramic Inks Market Size in Ceramic Tile Application, By Region,20152022 (USD Million)

Table 9 Ceramic Inks Market Size in Glass Printing Application, By Region, 20152022 (USD Million)

Table 10 Ceramic Inks Market Size in Food Containers Printing Application,By Region, 20152022 (USD Million)

Table 11 North America: Ceramic Inks Market Size, By Country,20152022 (USD Million)

Table 12 North America: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 13 North America: Ceramic Inks Market Size in Ceramic Tiles Application, Market Size, By Country, 20152022 (USD Million)

Table 14 North America: Ceramic Inks Market Size in Glass Printing Application, By Country, 20152022 (USD Million)

Table 15 North America: Ceramic Inks Market Size in Food Container Printing Application, By Country, 20152022 (USD Million)

Table 16 North America: Ceramic Inks Market Size in Others Applications,By Country, 20152022 (USD Million)

Table 17 US: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

Table 18 Mexico: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 19 Canada: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 20 APAC: Ceramic Inks Market Size, By Country, 20152022 (USD Million)

Table 21 APAC: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

Table 22 LAPAC: Ceramic Inks Market Size in Ceramic Tiles Application,By Country, 20152022 (USD Million)

Table 23 APAC: Ceramic Inks Market Size in Glass Printing Application,By Country, 20152022 (USD Million)

Table 24 APAC: Ceramic Inks Market Size in Food Container Printing Application, By Country, 20152022 (USD Million)

Table 25 APAC: Ceramic Inks Market Size in Other Applications, By Country, 20152022 (USD Million)

Table 26 China: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 27 India: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

Table 28 South Korea: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 29 Japan: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 30 Vietnam: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 31 Indonesia: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 32 Rest of APAC: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 33 Europe: Ceramic Inks Market Size, By Country, 20152022 (USD Million)

Table 34 Europe: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 35 Europe: Ceramic Inks Market Size in Ceramic Tiles Application,By Country, 20152022 (USD Million)

Table 36 Europe: Ceramic Inks Market Size in Glass Printing Application,By Country, 20152022 (USD Million)

Table 37 Europe: Ceramic Inks Market Size in Food Container Printing Application, By Country, 20152022 (USD Million)

Table 38 Europe: Ceramic Inks Market Size in Other Applications,By Country, 20152022 (USD Million)

Table 39 Spain: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 40 Germany: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 41 Italy: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

Table 42 UK: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

Table 43 Rest of Europe: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 44 Middle East & Africa: Ceramic Inks Market Size, By Country,20152022 (USD Million)

Table 45 Middle East & Africa: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 46 Middle East & Africa: Ceramic Inks Market Size in Ceramic Tiles Application, By Country, 20152022 (USD Million)

Table 47 Middle East & Africa: Ceramic Inks Market in Glass Printing Application, By Country, 20152022 (USD Million)

Table 48 Middle East & Africa: Ceramic Inks Market Size in Food Container Printing Application, By Country, 20152022 (USD Million)

Table 49 Middle East & Africa: Ceramic Inks Market Size in Other Applications,By Country, 20152022 (USD Million)

Table 50 Saudi Arabia: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 51 South Africa: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 52 Turkey: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 53 Iran: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

Table 54 Rest of Middle East & Africa: Ceramic Inks Market Size, By Application, 20152022 (USD Million)

Table 55 South America: Ceramic Inks Market Size, By Country,20152022 (USD Million)

Table 56 South America: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 57 South America: Ceramic Inks Market Size in Ceramic Tiles Application, By Country, 20152022 (USD Million)

Table 58 South America: Ceramic Inks Market Size in Glass Printing Application, By Country, 20152022 (USD Million)

Table 59 South America: Ceramic Inks Market Size in Food Container Printing Application, By Country, 20152022 (USD Million)

Table 60 South America: Ceramic Inks Market Size in Other Applications,By Country, 20152022 (USD Million)

Table 61 Brazil: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 62 Rest of South America: Ceramic Inks Market Size, By Application,20152022 (USD Million)

Table 63 Acquisition, 20152017

Table 64 New Product Launches, 20152017

List of Figures (28 Figures)

Figure 1 Ceramic Inks Market Segmentation

Figure 2 Ceramic Inks Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Assumptions

Figure 7 Limitations

Figure 8 Digital Printing to Dominate Ceramic Inks Market Between2017 and 2022

Figure 9 Ceramic Tiles to Be Largest Application of Ceramic Inks Between2017 and 2022

Figure 10 Ceramic Inks Market Size, By Country, 20110 (USD Million)

Figure 11 Ceramic Inks Market Share (Value), By Region, 20110

Figure 12 Attractive Market Opportunities in Global Ceramic Inks Market,2017 vs. 2022

Figure 13 Ceramic Tiles to Be Fastest-Growing Application of Ceramic Tiles

Figure 14 China to Be Largest Market in APAC

Figure 15 Decorative Inks to Be Largest Type of Ceramic Inks

Figure 16 Factors Governing Ceramic Inks Market

Figure 17 Decorative Inks to Account for Largest Market Share

Figure 18 Ceramic Tiles to Be Dominating Application of Ceramic Inks

Figure 19 Digital Printing Technology to Register Highest Cagr

Figure 20 India, China, and Spain to Be Fastest-Growing Markets of Ceramic Inks

Figure 21 North America: Ceramic Inks Market Snapshot

Figure 22 APAC: Ceramic Inks Market Snapshot

Figure 23 Europe: Ceramic Inks Market Snapshot

Figure 24 Ceramic Tiles Application to Dominate Ceramic Inks MarketIn the Middle East & Africa

Figure 25 Ceramic Tiles Application to Dominate Ceramic Inks MarketIn South America

Figure 27 Companies Adopted Acquisition as the Key Growth Strategy, 20152017

Figure 28 Ferro Corporation: Company Snapshot

Growth opportunities and latent adjacency in Ceramic Inks Market

Specific request for global digital printing market size and its segmentation

Interested in global and countries market size of Ceramic Digital inkjet and forecast