Cast Polymers Market by Type (Solid Surface, Engineered Stone, Cultured Marble), Material (Alumina Trihydrate, Calcium Carbonate, Resins, Natural Stone/Quartz), End User (Non-Residential, and Residential) and Region - Global Forecast to 2022

The cast polymers market is projected to reach USD 11.97 Billion by 2022, at a CAGR of 5.7%. Among end users, the non-residential segment is projected to lead the cast polymer market during the forecast period, in terms of value. Based on type, the solid surface segment is projected to lead the cast polymers market between 2017 and 2022, in terms of value. Among materials, the alumina trihydrate segment is leading the cast polymer market while the Asia Pacific cast polymers market is projected to grow the highest CAGR during the forecast period, in terms of value. Rapid industrialization in the Asia Pacific region is driving the overall demand for cast polymers in the region.

The Objectives of Cast Polymers Market Study are

- To define, describe, and forecast the cast polymers market based on type, end user, material, and region

- To strategically analyze micromarkets (further segments and subsegments of the cast polymer market included in the report) with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the cast polymers market for the stakeholders and draw a competitive landscape for market leaders

- To forecast size of the cast polymer market, in terms of value and volume with respect to five main regions, namely, Asia Pacific, North America, Europe, Middle East & Africa, and Latin America, along with their key countries

- To strategically profile the key players operating in the cast polymers market and comprehensively analyze their core competencies

- To analyze competitive developments such as expansions, mergers & acquisitions, new product launches, and research & development (R&D) activities in the cast polymer market

Years considered for the study are:

- Base Year – 2016

- Estimated Year – 2017

- Projected Year – 2022

- Forecast Period – 2017 to 2022

For company profiles, 2016 has been considered as the base year. In cases, wherein information was unavailable for the base year, the years prior to it have been considered.

Cast Polymers Market Research Methodology

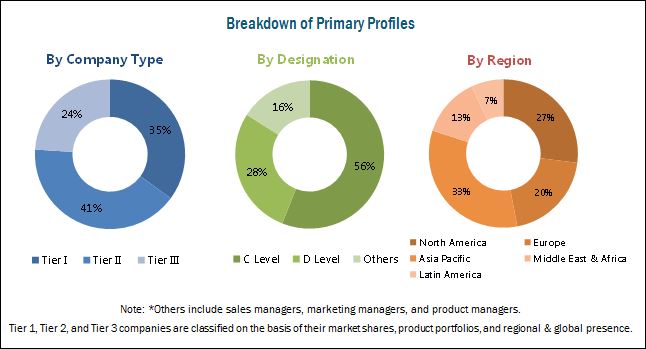

This study aims to estimate the size of the cast polymers market for 2017 and projects the demand for cast polymers till 2022. It also provides a detailed qualitative and quantitative analysis of the cast polymer market. Various secondary sources that include directories, industry journals, and various associations have been used to identify and collect information useful for this extensive commercial study of the cast polymers market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess future prospects of the cast polymer market. The breakdown of profiles of primaries has been shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Key Cast Polymers Market Industry Players

The value chain of the cast polymers market includes raw material suppliers and service providers. The leading players operating in the cast polymer market include Breton S.p.A. (Italy), Cosentino S.A. (Spain), Bradley Corporation (US), Caesarstone Ltd. (Israel), Oppein Home Group Inc. (China), The R.J. Marshall Company (US), BLANCO (Germany), Huber Engineered Materials (US), AGCO, Inc. (US), DuPont (US), Compac (Spain), and Kingkonree International Surface Industrial Co., Ltd. (China), among others.

Key Target Audience in Cast Polymers Market

- Manufacturers, Dealers, and Suppliers of Cast Polymers

- Government Bodies

- End Users

- Suppliers of Natural Stones

- Companies Engaged in R&D Activities Related to Materials

- Defense and Military Organizations

- Feedstock Suppliers

- Industrial Associations

- Large Infrastructure Companies

- Investment Banks

- Consulting Companies/Consultants in the Chemicals & Materials Sector

Scope of the Report: This research report categorizes the cast polymers market based on type, material, end user, and region. The report forecasts revenue and analyzes trends in each of these submarkets.

Cast Polymers Market, by End User:

- Non-residential

- Residential

Cast Polymers Market, by Type:

- Solid Surface

- Engineered Stone

- Cultured Marble

Cast Polymer Market, by Material:

- Alumina Trihydrate

- Calcium Carbonate

- Resins

- Natural Stone/Quartz

- Others

Cast Polymers Market, by Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- Latin America

Cast Polymers Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

-

Cast Polymers Market Application Analysis

- Further breakdown of the type and end user segments into various subsegments

The cast polymers market is projected to grow from USD 9.08 Billion in 2017 to USD 11.97 Billion by 2022, at a CAGR of 5.7% from 2017 to 2022. The growth of the construction & remodeling industry across the globe, along with increased demand for high-quality cast polymers products is expected to fuel the growth of the cast polymer market during the forecast period.

Based on type, the cast polymers market has been segmented into solid surface, engineered stone, and cultured marble. Solid surface is a man-made product, which is usually composed of marble dust, acrylic, or polyester resins and pigments. It is primarily used for seamless countertop installations. In terms of value, the solid surface segment is projected to lead the cast polymer market during the forecast period, owing to the wide use of solid surface products in kitchen and bathroom applications. The engineered stone segment of the market is projected to grow at the highest CAGR between 2017 and 2022, in terms of value due to increased demand for engineered stones from the residential and non-residential sectors. The increased demand for these stones from the residential and non-residential sectors can be attributed to the high performance offered by engineered stones in comparison to other materials.

Based on end user, the cast polymers market has been classified into non-residential and residential segments. The non-residential segment of the market is projected to grow at a higher CAGR than the residential segment during the forecast period, in terms of value. The growth of the non-residential segment of the cast polymer market can be attributed to the increased demand for these materials from non-residential constructions such as hospitals, and schools, among others.

Based on material, the cast polymers market has been classified into alumina trihydrate, calcium carbonate, resins, natural stone/quartz, and others. Alumina trihydrate, calcium carbonate, and resins are the major raw materials used for manufacturing cast polymers. The alumina trihydrate segment is estimated to lead the cast polymer market in 2017, in terms of value. The growth of this segment of the market can be attributed to the versatile properties such as high durability and scratch resistance offered by alumina trihydrate. Moreover, it is cost-effective. In terms of value, the natural stone/quart segment of the cast polymers market is projected to grow at the highest CAGR during the forecast period.

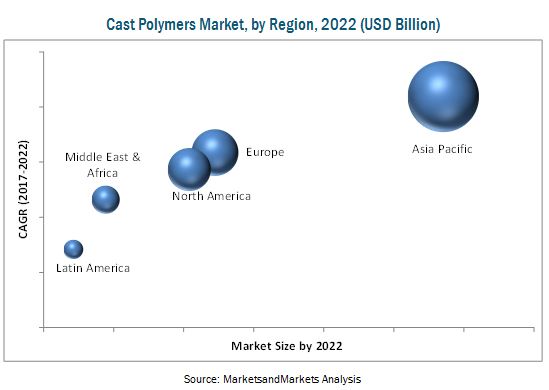

The Asia Pacific cast polymers market is projected to grow at the highest CAGR during the forecast period, in terms of value. Rapid industrialization in the Asia Pacific region and increased demand for cast polymers from non-residential units such as corporate offices, public toilets, malls and shopping complexes, hospitals, and schools, among others, are driving the growth of the Asia Pacific cast polymer market.

The key factors contributing to the increased demand for cast polymers across the globe include rise in the construction activities in emerging economies, worldwide and increase in disposable income of consumers that have resulted in the procurement of high-quality and advanced construction materials.

In the past few years, the construction industry has grown by a considerable margin, especially in the emerging economies such as India, China, UAE, and Indonesia. Moreover, the remodeling industry is also witnessing significant growth in the US, Germany, and Japan. High prices and limited availability of raw materials used for manufacturing cast polymers are expected to restrict the growth of the cast polymers market during the forecast period. The high costs of cast polymers can be attributed to technical complexities involved in the manufacturing of these products in comparison to the naturally available products and substitutes such as ceramics and concrete. Moreover, the cast polymer market is dominated by a few players, which leads to the limited availability of products made from cast polymers.

Key Cast Polymers Market Industry Players

Breton S.p.A. (Italy), Cosentino S.A. (Spain), Bradley Corporation (US), Caesarstone Ltd. (Israel), Oppein Home Group Inc. (China), The R.J. Marshall Company (US), BLANCO (Germany), Huber Engineered Materials (US), AGCO, Inc. (US), DuPont (US), Compac (Spain), and Kingkonree International Surface Industrial Co., Ltd. (China), among others are the key players operating in the cast polymers market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered in the Report

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Growth Opportunities in the Cast Polymers Market

4.2 Market, By End User

4.3 Market, By Material and Region

4.4 Market, By Type

4.5 Market, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of the Construction & Remodeling Industry

5.2.1.2 High Demand for Technically-Advanced and Superior-Quality Products

5.2.2 Restraints

5.2.2.1 High Price of Raw Materials

5.2.3 Opportunities

5.2.3.1 Initiatives Undertaken By Various Groups and Associations to Raise Awareness

5.2.4 Challenges

5.2.4.1 High Cost of Finished Products

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.1.1 Limited Number of Substitutes

5.3.2 Threat of New Entrants

5.3.2.1 Highly Consolidated Market

5.3.2.2 Small Players Restricted to Local Markets

5.3.3 Bargaining Power of Buyers

5.3.3.1 Brand-Sensitive Market

5.3.3.2 Sufficient Number of Suppliers

5.3.4 Bargaining Power of Suppliers

5.3.4.1 Fluctuation in Crude Oil Prices

5.3.4.2 Development of New Variants of Cast Polymers

5.3.5 Intensity of Competitive Rivalry

5.3.5.1 Market LED By A Few Established Players

5.3.5.2 Product Differentiation and Upgrade

5.4 Macroeconomic Indicators

6 Cast Polymers Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Solid Surface

6.3 Engineered Stone

6.4 Cultured Marble

7 Cast Polymers Market, By Material (Page No. - 47)

7.1 Introduction

7.2 Alumina Trihydrate

7.3 Calcium Carbonate

7.4 Resin

7.5 Natural Stone/Quartz

7.6 Others

8 Cast Polymers Market, By End User (Page No. - 56)

8.1 Introduction

8.2 Non-Residential

8.3 Residential

9 Regional Analysis (Page No. - 61)

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 Australia

9.2.5 South Korea

9.2.6 Rest of Asia Pacific

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Russia

9.3.5 Italy

9.3.6 Belgium

9.3.7 Spain

9.3.8 Rest of Europe

9.4 North America

9.4.1 US

9.4.2 Canada

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

9.6 Latin America

9.6.1 Mexico

9.6.2 Brazil

9.6.3 Colombia

10 Competitive Landscape (Page No. - 101)

10.1 Market Share Analysis

11 Company Profiles (Page No. - 102)

Business Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments

11.1 Cosentino S.A.

11.2 Bradley Corporation

11.3 Caesarstone Ltd.

11.4 The R.J. Marshall Company

11.5 E.I. Du Pont De Nemours and Company

11.6 Breton S.P.A.

11.7 Oppein Home Group Inc.

11.8 Agco, Inc.

11.9 Swan Surfaces, LLC

11.10 Eastern Surfaces

11.11 Kingkonree International Surface Industrial Co., Ltd.

11.12 Blanco

11.13 United States Marble, Inc.

11.14 Coritec Solid Surface Manufacturers

*Details Might Not Be Captured in Case of Unlisted Companies.

11.15 Other Companies

11.15.1 Huber Engineered Materials

11.15.2 Aristech Surfaces

11.15.3 California Crafted Marble

11.15.4 Central Marble Products

11.15.5 Compac

11.15.6 Eos Surfaces

11.15.7 Lehigh Surfaces

11.15.8 Technistone

11.15.9 Hanwha Surfaces

11.15.10 Royal Stone Industries

11.15.11 Meganite Inc.

12 Appendix (Page No. - 138)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (115 Tables)

Table 1 Cast Polymers Market Snapshot

Table 2 Geographic Mix of 15 Largest Construction Markets Worldwide, 2010 & 2020

Table 3 Country-Wise GDP Contribution of the Construction Industry, 2014-2021 (USD Billion)

Table 4 Cast Polymers Market, By Type, 2015-2022 (USD Million)

Table 5 Market, By Type, 2015-2022 (Million Square Meters)

Table 6 Solid Surface Market, By Region, 2015-2022 (USD Million)

Table 7 Solid Surface Market, By Region, 2015-2022 (Million Square Meters)

Table 8 Engineered Stone Market, By Region, 2015-2022 (USD Million)

Table 9 Engineered Stone Market, By Region, 2015-2022 (Million Square Meters)

Table 10 Cultured Marble Market, By Region, 2015-2022 (USD Million)

Table 11 Cultured Marble Market, By Region, 2015-2022 (Million Square Meters)

Table 12 Market, By Material, 2015-2022 (USD Million)

Table 13 Market, By Material, 2015-2022 (Million Square Meters)

Table 14 Market in Alumina Trihydrate, By Region, 2015-2022 (USD Million)

Table 15 Market in Alumina Trihydrate, By Region, 2015-2022 (Million Square Meters)

Table 16 Market in Calcium Carbonate, By Region, 2015-2022 (USD Million)

Table 17 Market in Calcium Carbonate, By Region, 2015-2022 (Million Square Meters)

Table 18 Market in Resins, By Region, 2015-2022 (USD Million)

Table 19 Market in Resins, By Region, 2015-2022 (Million Square Meters)

Table 20 Market in Natural Stone/Quartz, By Region, 2015-2022 (USD Million)

Table 21 Market in Natural Stone/Quartz, By Region, 2015-2022 (Million Square Meters)

Table 22 Market in Others, By Region, 2015-2022 (USD Million)

Table 23 Market in Others, By Region, 2015-2022 (Million Square Meters)

Table 24 Market, By End User, 2015-2022 (USD Million)

Table 25 Market, By End User, 2015-2022 (Million Square Meters)

Table 26 Market for Non-Residential, By Region, 2015-2022 (USD Million)

Table 27 Market for Non-Residential, By Region, 2015-2022 (Million Square Meters)

Table 28 Market for Residential, By Region, 2015-2022 (USD Million)

Table 29 Market for Residential, By Region, 2015-2022 (USD Million)

Table 30 Market, By Region, 2015–2022 (USD Million)

Table 31 Market, By Region, 2015–2022 (Million Square Meters)

Table 32 Asia Pacific: Cast Polymers Market, By Country, 2015-2022 (USD Million)

Table 33 Asia Pacific: Market, By Country, 2015-2022 (Million Square Meters)

Table 34 Asia Pacific: Market, By Type, 2015-2022 (USD Million)

Table 35 Asia Pacific: Market, By Type, 2015-2022 (Million Square Meters)

Table 36 Asia Pacific: Market, By Material, 2015-2022 (USD Million)

Table 37 Asia Pacific: Market, By Material, 2015-2022 (Million Square Meters)

Table 38 Asia Pacific: Market, By End User, 2015-2022 (USD Million)

Table 39 Asia Pacific: Market, By End User, 2015-2022 (Million Square Meters)

Table 40 China: Cast Polymer Market, By End User, 2015-2022 (USD Million)

Table 41 China: Market, By End User, 2015-2022 (Million Square Meters)

Table 42 India: Cast Polymers Market, By End User, 2015-2022 (USD Million)

Table 43 India: Market, By End User, 2015-2022 (Million Square Meters)

Table 44 Japan: Cast Polymer Market, By End User, 2015-2022 (USD Million)

Table 45 Japan: Market, By End User, 2015-2022 (Million Square Meters)

Table 46 Australia: Cast Polymers Market, By End User, 2015-2022 (USD Million)

Table 47 Australia: Market, By End User, 2015-2022 (Million Square Meters)

Table 48 South Korea: Cast Polymer Market, By End User, 2015-2022 (USD Million)

Table 49 South Korea: Market, By End User, 2015-2022 (Million Square Meters)

Table 50 Rest of Asia Pacific: Cast Polymers Market, By End User, 2015-2022 (USD Million)

Table 51 Rest of Asia Pacific: Market, By End User, 2015-2022 (Million Square Meters)

Table 52 Europe: Cast Polymer Market, By Country, 2015-2022 (USD Million)

Table 53 Europe: By Market, By Country, 2015-2022 (Million Square Meters)

Table 54 Europe: Market, By Type, 2015-2022 (USD Million)

Table 55 Europe: Market, By Type, 2015-2022 (Million Square Meters)

Table 56 Europe : Market, By Material, 2015-2022 (USD Million)

Table 57 Europe : Market, By Material, 2015-2022 (Million Square Meters)

Table 58 Europe: Market, By End User, 2015-2022 (USD Million)

Table 59 Europe: Market, By End User, 2015-2022 (Million Square Meters)

Table 60 Germany: Cast Polymers Market, By End User, 2015-2022 (USD Million)

Table 61 Germany: Market, By End User, 2015-2022 (Million Square Meters)

Table 62 UK: Cast Polymer Market, By End User, 2015-2022 (USD Million)

Table 63 UK: Market, By End User, 2015-2022 (Million Square Meters)

Table 64 France: Cast Polymers Market, By End User, 2015-2022 (USD Million)

Table 65 France: Market, By End User, 2015-2022 (Million Square Meters)

Table 66 Russia: Cast Polymer Market, By End User, 2015-2022 (USD Million)

Table 67 Russia: Market, By End User, 2015-2022 (Million Square Meters)

Table 68 Italy: Cast Polymers Market, By End User, 2015-2022 (USD Million)

Table 69 Italy: Market, By End User, 2015-2022 (Million Square Meters)

Table 70 Belgium: Cast Polymer Market, By End User, 2015-2022 (USD Million)

Table 71 Belgium: Market, By End User, 2015-2022 (Million Square Meters)

Table 72 Spain: Cast Polymers Market, By End User, 2015-2022 (USD Million)

Table 73 Spain: Market, By End User, 2015-2022 (Million Square Meters)

Table 74 Rest of Europe: Cast Polymer Market, By End User, 2015-2022 (USD Million)

Table 75 Rest of Europe: Market, By End User, 2015-2022 (Million Square Meters)

Table 76 North America: Cast Polymers Market, By Country, 2015-2022 (USD Million)

Table 77 North America: Market, By Country, 2015-2022 (Million Square Meters)

Table 78 North America: Market, By Type, 2015-2022 (USD Million)

Table 79 North America: Market, By Type, 2015-2022 (Million Square Meters)

Table 80 North America: Market, By Material, 2015-2022 (USD Million)

Table 81 North America: Market, By Material, 2015-2022 (Million Square Meters)

Table 82 North America: Market, By End User, 2015-2022 (USD Million)

Table 83 North America: Market, By End User, 2015-2022 (Million Square Meters)

Table 84 US: Market, By End User, 2015-2022 (USD Million)

Table 85 US: Market, By End User, 2015-2022 (Million Square Meters)

Table 86 Canada: Market, By End User, 2015-2022 (USD Million)

Table 87 Canada: Market, By End User, 2015-2022 (Million Square Meters)

Table 88 Middle East & Africa: Cast Polymer Market, By Country, 2015-2022 (USD Million)

Table 89 Middle East & Africa: Market, By Country, 2015-2022 (Million Square Meters)

Table 90 Middle East & Africa: Market, By Type, 2015-2022 (USD Million)

Table 91 Middle East & Africa: Market, By Type, 2015-2022 (Million Square Meters)

Table 92 Middle East & Africa: Market, By Material, 2015-2022 (USD Million)

Table 93 Middle East & Africa: Market, By Material, 2015-2022 (Million Square Meters)

Table 94 Middle East & Africa: Market, By End User, 2015-2022 (USD Million)

Table 95 Middle East & Africa: Market, By End User, 2015-2022 (Million Square Meters)

Table 96 Saudi Arabia: Market, By End User, 2015-2022 (USD Million)

Table 97 Saudi Arabia: Market, By End User, 2015-2022 (Million Square Meters)

Table 98 UAE: Market, By End User, 2015-2022 (USD Million)

Table 99 UAE: Market, By End User, 2015-2022 (Million Square Meters)

Table 100 South Africa Market, By End User, 2015-2022 (USD Million)

Table 101 South Africa: Market, By End User, 2015-2022 (Million Square Meters)

Table 102 Latin America: Cast Polymers Market, By Country, 2015-2022 (USD Million)

Table 103 Latin America: Market, By Country, 2015-2022 (Million Square Meters)

Table 104 Latin America: Market, By Type, 2015-2022 (USD Million)

Table 105 Latin America: Market, By Type, 2015-2022 (Million Square Meters)

Table 106 Latin America: Market, By Material, 2015-2022 (USD Million)

Table 107 Latin America: Market, By Material, 2015-2022 (Million Square Meters)

Table 108 Latin America: Market, By End User, 2015-2022 (USD Million)

Table 109 Latin America: Market, By End User, 2015-2022 (Million Square Meters)

Table 110 Mexico: Cast Polymer Market, By End User, 2015-2022 (USD Million)

Table 111 Mexico: Market, By End User, 2015-2022 (Million Square Meters)

Table 112 Brazil: Cast Polymers Market, By End User, 2015-2022 (USD Million)

Table 113 Brazil: Market, By End User, 2015-2022 (Million Square Meters)

Table 114 Colombia Market, By End User, 2015-2022 (USD Million)

Table 115 Colombia : Market, By End User, 2015-2022 (Million Square Meters)

List of Figures (37 Figures)

Figure 1 Cast Polymers Market: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Cast Polymers Market: Data Triangulation

Figure 5 Cast Polymer Market, By Type, 2017 vs 2022

Figure 6 Cast Polymers Market, By Region and By Material, 2017

Figure 7 Cast Polymer Market, By End User, 2017 vs 2022

Figure 8 Cast Polymers Market, By Region 2017

Figure 9 Increasing Demand for Cast Polymers From the Housing and Remodeling Industry is Anticipated to Drive the Market Growth

Figure 10 The Non-Residential End User Segment of the Cast Polymers Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 11 The Alumina Trihydrate Material Segment is Estimated to Account for the Largest Market Share of the Cast Polymers in 2017

Figure 12 The Solid Surface Type Segment is Projected to Lead the Market of Cast Polymers Between 2017 and 2022

Figure 13 The Cast Polymers in India Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 14 Drivers, Restraints, Opportunities, and Challenges for the Cast Polymers Market

Figure 15 Cast Polymers Market: Porter’s Five Forces Analysis

Figure 16 The Engineered Stone Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Asia Pacific is Anticipated to Lead the Solid Surface Segment During the Forecast Period

Figure 18 Asia Pacific is Anticipated to Lead the Engineered Stone Segment During the Forecast Period

Figure 19 Asia Pacific is Anticipated to Lead the Cultured Marble Segment During the Forecast Period

Figure 20 Alumina Trihydrate Segment is Expected to Lead Market of the Cast Polymers Between 2017 & 2022

Figure 21 The Asia Pacific Region is Projected to Lead the Alumina Trihydrate Market During the Forecast Period

Figure 22 The Asia Pacific Region is Projected to Lead the Calcium Carbonate Segment of the Cast Polymers Market During the Forecast Period

Figure 23 The Asia Pacific Region is Projected to Lead the Resins Segment of the Cast Polymers Market During the Forecast Period

Figure 24 The Asia Pacific Region is Projected to Lead the Natural Stone/Quartz Segment of the Cast Polymers Market During the Forecast Period

Figure 25 The Asia Pacific Region is Projected to Lead the Others Segment of the Cast Polymers Market During the Forecast Period

Figure 26 The Non-Residential Segment is Projected to Be the Largest End User Market Segment of the Cast Polymers

Figure 27 Asia Pacific is Anticipated to Lead the Non-Residential Segment During the Forecast Period

Figure 28 Asia Pacific is Projected to Lead the Residential Segment During the Forecast Period

Figure 29 Cast Polymers Market Share, By Region, 2016

Figure 30 Asia Pacific Market Snapshot

Figure 31 Europe Market Snapshot

Figure 32 North America Market Snapshot

Figure 33 Middle East & Africa Market Snapshot

Figure 34 Latin America Market Snapshot

Figure 35 Market Share of Key Players, 2016

Figure 36 Caesarstone Ltd.: Company Snapshot

Figure 37 E.I. Du Pont De Nemours and Company: Company Snapshot

Growth opportunities and latent adjacency in Cast Polymers Market

Cast polymer market

Deep dive data on Indian market opportunities for Cast Polymers with a business potential in global terms.