Ceramic Coatings Market by Type (Oxide coatings, Carbide coatings, Nitride coatings, and others), by Technology (Thermal spray, PVD, CVD, and Others), by Application (Transportation & Automotive, Energy, Aerospace & Defense, Industrial goods, Healthcare, and Others) - Global Trends & Forecasts to 2020

Ceramic coatings are the inorganic materials that are processed and used at high temperatures. Ceramic coatings are normally alumina, alumina-magnesia, chromia, hafnia, silica, silicon carbide, titania, silicon nitride, and zirconia based compositions. The global ceramic coatings market is expected to grow at a CAGR of 7.50% from 2015 to 2020 to reach a value of $10.12 Billion. The transportation & automotive industry is one of the major factors responsible for this growth. A large number of new product launches, and expansions in the last five years point towards the strong growth of this market in the near future.

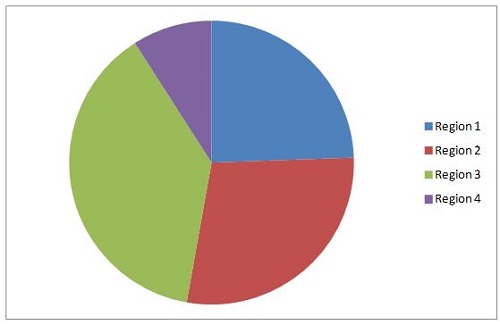

Asia-Pacific dominated the ceramic coatings market in 2014, accounting for over 38% of the market by value and around 43% of the market by consumption. The market by value and consumption for China was the largest in Aisa-Pacific in 2014 and is projected to grow at a CAGR of 8.72% by value from 2015 to 2020 to garner a market size of $1,633.43 Million by 2020 from $984.52 in 2014. RoW region is projected to grow at the fastest CAGR of 9.72% by value and 9.09% by consumption from 2015 to 2020.

Ceramic coatings can be used in various industries. It can be derived by devising various technologies such as thermal spray, physical vapour deposition (PVD), chemical vapour deposition (CVD), and others. Other techniques involves dipping, sol gel, micro-oxidation, packed diffusion, ionic beam surface treatment, and laser assisted techniques.

This market research study provides a detailed qualitative and quantitative analysis of the global ceramic coatings market and aims to estimate the global market of ceramic coatings for 2015 and to project the expected demand of the same by 2020. Various secondary sources such as directories, encyclopedia, and databases are used to identify and collect information useful for this extensive commercial study of the ceramic coatings market. Various primary sources like related industry experts, consultants and so on are interviewed so as to get an overall idea about the ceramic coating market and understand various qualitative aspects concerning the ceramic coatings market. The future trends and forecasts are also validated through the primary sources.

Competitive scenarios of the key players in the ceramic coatings market have been discussed in detail. Leading players of this market, including APS Materials Inc., Bodycote PLC, Praxair Surface Technologies Inc., Kurt J. Lesker Co., with their recent developments and other strategic activities are also profiled in the report.

Scope of the report:

This research report categorizes the global market for ceramic coatings on the basis of product type, technology, and application by region in terms of values and volumes, and analyzes trends in each of the submarkets.

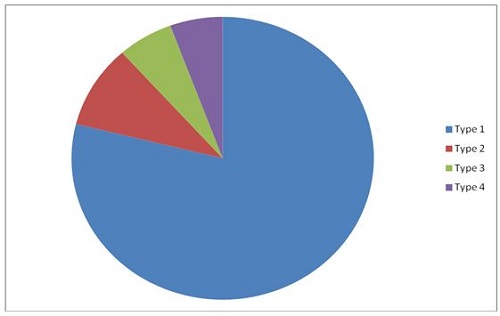

By Type:

- Oxide coatings

- Carbide coatings

- Nitride coatings

- Others

By Technology:

- Thermal spray

- Physical vapor deposition (PVD)

- Chemical vapor deposition (CVD)

- Others

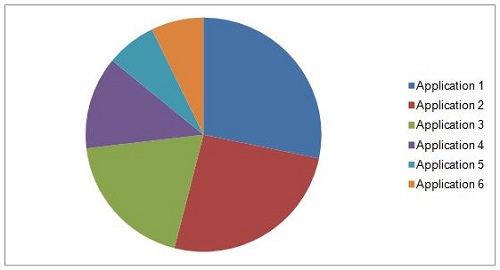

By Application:

- Transportation & Automotive

- Energy

- Aerospace & Defense

- Industrial goods

- Healthcare

- Others

By Region:

- Asia-Pacific

- Europe

- North America

- RoW

Ceramic coatings comprise of a large family of materials with diverse compositions and properties. These are generally alumina, aluminamagnesia, chromium, silica, silicon carbide, titania, silicon nitride, and zirconia based compositions. The global ceramic coatings market by product type, technology, and application, has witnessed a significant growth for the past few years and this growth is projected to persist in the near future. Oxide coatings were the most widely used type of ceramic coating in 2014 and is projected to hold the largest share by 2020.

Asia-Pacific dominated the ceramic coatings market in 2014 and accounted for over 42% of the market by consumption. Country wise, China is the largest consumer of ceramic coatings in Asia-Pacific and is projected to witness a CAGR of 8.72% in terms of value from 2015 to 2020. On the other hand, Rest of the world is projected to witness the highest growth rate by 2020. High performance ceramic coatings are widely preferred nowadays by many manufacturers which are used in transportation & automotive, energy, aerospace & defense, healthcare, industrial goods, fiber-optic communications, and environmental protection sectors.

With the interest of the market participants growing in ceramic coatings, the global ceramic coatings market is expected to register strong growth in the near future with expansions and new investments for ceramic coating plants. Largely, the ceramic coatings market is fragmented in nature with leading participants being APS Materials Inc., Bodycote PLC, Praxair Surface Technologies Inc., and Kurt J. Lesker Co.

Ceramic Coatings Market, by Application, 2014

Ceramic Coatings Market, by Type, 2014

Ceramic Coatings Market, by Region, 2014

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

This report covers the ceramic coatings market by key regions along with their major countries. It also provides a detailed segmentation of the ceramic coatings market on the basis of product type, technology, and application along with projections till 2020.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Market Size Estimation

2.2 Market Share Estimation

2.2.1 Data From Secondary Sources

2.2.2 Data From Primary Sources

2.2.3 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Significant Market Opportunities for Ceramic Coatings

4.2 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Segmentation

5.2.1 By Application

5.2.2 By Type

5.2.3 By Technology

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Plasma Sprayed Coating in Semiconductors & Electronics Equipment

5.3.1.2 Growing Healthcare Market

5.3.1.3 Increasing Demand in the Asia-Pacific Region

5.3.1.4 Efficiency of Ceramic Coatings

5.3.2 Restraints

5.3.2.1 Huge Total Cost of Ownership

5.3.2.2 Highly Capital Intensive

5.3.3 Opportunities

5.3.3.1 Emerging Markets

5.3.3.2 New Technological Developments

5.3.4 Challenges

5.3.4.1 Developing Cheaper Substitutes

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Supply-Chain Analysis

6.2.1 Raw Material Suppliers

6.2.2 Ceramic Coating Manufacturers/Formulators

6.2.3 Ceramic Coatings Suppliers/Distributors

6.2.4 End Users

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Rivalry

6.4 Strategic Benchmarking

6.4.1 Regional Integration & Product Enhancement

6.4.2 Entry Into Potential Markets for Ceramics Coatings

7 Ceramic Coatings Market, By Type (Page No. - 51)

7.1 Introduction

7.2 Oxide Coatings

7.3 Carbide Coatings

7.4 Nitride Coatings

7.5 Others

8 Ceramic Coatings Market, By Technology (Page No. - 60)

8.1 Introduction

8.2 Thermal Spray

8.3 Physical Vapor Deposition (PVD)

8.4 Chemical Vapor Deposition (CVD)

8.5 Others

9 Ceramic Coatings Market, By Application (Page No. - 70)

9.1 Introduction

9.2 Transportation & Automotive

9.3 Energy

9.4 Aerospace & Defense

9.5 Industrial Goods

9.6 Healthcare

9.7 Others

10 Ceramic Coatings Market, By Region (Page No. - 82)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 Japan

10.2.3 South Korea

10.2.4 India

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Russia

10.4 North America

10.4.1 U.S.

10.4.2 Canada

10.4.3 Mexico

10.5 Rest of the World

10.5.1 Brazil

10.5.2 Argentina

11 Competitive Landscape (Page No. - 136)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 Expansions

11.2.2 New Product/Technology Development

11.2.3 Agreements

11.2.4 Mergers & Acquisitions

11.2.5 Product Showcase

12 Company Profiles (Page No. - 143)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.1 Introduction

12.2 Bodycote PLC

12.3 Praxair Surface Technologies Inc.

12.4 Kurt J. Lesker Company Ltd.

12.5 APS Materials Inc.

12.6 E.I. Du Pont De Nemours & Company

12.7 Aremco Products Inc.

12.8 Cetek Ceramic Technologies Ltd.

12.9 Keronite Group Limited

12.10 Morgan Technical Ceramics

12.11 Saint Gobain S.A.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 168)

13.1 Industry Expert Insights

13.2 Discussion Guide

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (155 Tables)

Table 1 Growing Automotive, Healthcare, and Electronics Markets are Driving the Ceramic Coatings Market

Table 2 High Cost of Ownership

Table 3 New Developments and Emerging Marktes Will Revive the Ceramic Coatings Market in the Near Future

Table 4 Cheaper Substitutes and Sustainability Issues

Table 5 Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 6 Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 7 Oxide Coatings Market Size, By Region, 20132020 ($Million)

Table 8 Oxide Coatings Market Size, By Region, 20132020 (Kilotons)

Table 9 Carbide Coatings Market Size, By Region, 20132020 ($Million)

Table 10 Carbide Coatings Market Size, By Region, 20132020 (Kilotons)

Table 11 Nitride Coatings Market Size, By Region, 20132020 ($Million)

Table 12 Nitride Coatings Market Size, By Region, 20132020 (Kilotons)

Table 13 Others Market Size, By Region, 20132020 ($Million)

Table 14 Others Market Size, By Region, 20132020 (Kilotons)

Table 15 Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 16 Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 17 Ceramic Coatings Market Size in Thermal Spray Technology, By Region, 20132020 ($Million)

Table 18 Ceramic Coatings Market Size in Thermal Spray Technology, By Region, 20132020 (Kilotons)

Table 19 Ceramic Coatings Market Size in PVD Technology, By Region, 20132020 ($Million)

Table 20 Ceramic Coatings Market Size in PVD Technology, By Region, 20132020 (Kilotons)

Table 21 Ceramic Coatings Market Size in CVD Technology, By Region, 20132020 ($Million)

Table 22 Ceramic Coatings Market Size in CVD Technology, By Region, 20132020 (Kilotons)

Table 23 Ceramic Coatings Market Size in Other Technologies, By Region, 20132020 ($Million)

Table 24 Ceramic Coatings Market Size in Other Technologies, By Region, 20132020 (Kilotons)

Table 25 Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 26 Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 27 Ceramic Coatings Market Size in Transportation & Automotive Application, By Region, 20132020 ($Million)

Table 28 Ceramic Coatings Market Size in Transportation & Automotive Application, By Region, 20132020 (Kilotons)

Table 29 Ceramic Coatings Market Size in Energy Application, By Region, 20132020 ($Million)

Table 30 Ceramic Coatings Market Size in Energy Application, By Region, 20132020 (Kilotons)

Table 31 Ceramic Coatings Market Size in Aerospace & Defense Application,By Region, 20132020 ($Million)

Table 32 Ceramic Coatings Market Size in Aerospace & Defense Application,By Region, 20132020 (Kilotons)

Table 33 Ceramic Coatings Market Size in Industrial Goods Application, By Region, 20132020 ($Million)

Table 34 Ceramic Coatings Market Size in Industrial Goods Application,By Region, 20132020 (Kilotons)

Table 35 Ceramic Coatings Market Size in Healthcare Application, By Region, 20132020 ($Million)

Table 36 Ceramic Coatings Market Size in Healthcare Application, By Region, 20132020 (Kilotons)

Table 37 Ceramic Coatings Market Size in Other Applications, By Region, 20132020 ($Million)

Table 38 Ceramic Coatings Market Size in Other Applications, By Region, 20132020 (Kilotons)

Table 39 Ceramic Coatings Market Size, By Region, 20132020 ($Million)

Table 40 Ceramic Coatings Market Size, By Region, 20132020 (Kilotons)

Table 41 Asia-Pacific: Ceramic Coatings, By Type, 20132020 ($Million)

Table 42 Asia-Pacific: Ceramic Coatings, By Type, 20132020 (Kilotons)

Table 43 Asia-Pacific: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 44 Asia-Pacific: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 45 Asia-Pacific: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 46 Asia-Pacific: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 47 Asia-Pacific: Ceramic Coatings Market Size, By Country, 20132020 ($Million)

Table 48 Asia-Pacific: Ceramic Coatings Market Size, By Country, 20132020 (Kilotons)

Table 49 China: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 50 China: Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 51 China: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 52 China: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 53 China: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 54 China: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 55 Japan: Ceramic Coatings Market, By Type, 20132020 ($Million)

Table 56 Japan: Ceramic Coatings Market, By Type, 20132020 (Kilotons)

Table 57 Japan: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 58 Japan: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 59 Japan: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 60 Japan: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 61 South Korea: Ceramic Coatings Market, By Type, 20132020 ($Million)

Table 62 South Korea: Ceramic Coatings Market, By Type, 20132020 (Kilotons)

Table 63 South Korea: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 64 South Korea: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 65 South Korea: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 66 South Korea: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 67 India: Ceramic Coatings Market, By Type, 20132020 ($Million)

Table 68 India: Ceramic Coatings Market, By Type, 20132020 (Kilotons)

Table 69 India: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 70 India: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 71 India: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 72 India: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 73 Europe: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 74 Europe: Ceramic Coatings Market Size By Type, 20132020 (Kilotons)

Table 75 Europe: Ceramic Coatings Market Size By Technology, 20132020 ($Million)

Table 76 Europe: Ceramic Coatings Market Size By Technology, 20132020 (Kilotons)

Table 77 Europe: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 78 Europe: Ceramic Coatings Market Size By Application, 20132020 (Kilotons)

Table 79 Europe: Ceramic Coatings Market Size , By Country, 20132020 ($Million)

Table 80 Europe: Ceramic Coatings Market Size By Country, 20132020 (Kilotons)

Table 81 Germany: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 82 Germany: Ceramic Coatings Market Size , By Type, 20132020 (Kilotons)

Table 83 Germany: Ceramic Coatings Market Size , By Technology, 20132020 ($Million)

Table 84 Germany: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 85 Germany: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 86 Germany: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 87 France: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 88 France: Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 89 France: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 90 France: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 91 France: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 92 France: Ceramic Coatings Market Size By Application, 20132020 (Kilotons)

Table 93 U.K.: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 94 U.K.: Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 95 U.K.: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 96 U.K.: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 97 U.K.: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 98 U.K.: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 99 Russia: Ceramic Coatings Market Size By Type, 20132020 ($Million)

Table 100 Russia: Ceramic Coatings Market Size By Type, 20132020 (Kilotons)

Table 101 Russia: Ceramic Coatings Market Size By Technology, 20132020 ($Million)

Table 102 Russia: Ceramic Coatings Market Size By Technology, 20132020 (Kilotons)

Table 103 Russia: Ceramic Coatings Market Size By Application, 20132020 ($Million)

Table 104 Russia: Ceramic Coatings Market Size By Application, 20132020 (Kilotons)

Table 105 North America: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 106 North America: Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 107 North America: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 108 North America: Ceramic Coatings Market Size, By Technology, 20132020(Kilotons)

Table 109 North America: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 110 North America: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 111 North America: Ceramic Coatings Market Size, By Country, 20132020 ($Million)

Table 112 North America: Ceramic Coatings Market Size, By Country, 20132020 (Kilotons)

Table 113 U.S.: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 114 U.S.: Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 115 U.S.: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 116 U.S.: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 117 U.S.: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 118 U.S.: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 119 Canada: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 120 Canada: Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 121 Canada: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 122 Canada: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 123 Canada: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 124 Canada: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 125 Mexico: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 126 Mexico: Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 127 Mexico: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 128 Mexico: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 129 Mexico: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 130 Mexico: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 131 RoW: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 132 RoW: Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 133 RoW: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 134 RoW: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 135 RoW: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 136 RoW: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 137 RoW: Ceramic Coatings Market Size, By Country, 20132020 ($Million)

Table 138 RoW: Ceramic Coatings Market Size, By Country, 20132020 (Kilotons)

Table 139 Brazil: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 140 Brazil: Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 141 Brazil: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 142 Brazil: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 143 Brazil: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 144 Brazil: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 145 Argentina: Ceramic Coatings Market Size, By Type, 20132020 ($Million)

Table 146 Argentina: Ceramic Coatings Market Size, By Type, 20132020 (Kilotons)

Table 147 Argentina: Ceramic Coatings Market Size, By Technology, 20132020 ($Million)

Table 148 Argentina: Ceramic Coatings Market Size, By Technology, 20132020 (Kilotons)

Table 149 Argentina: Ceramic Coatings Market Size, By Application, 20132020 ($Million)

Table 150 Argentina: Ceramic Coatings Market Size, By Application, 20132020 (Kilotons)

Table 151 Expansions, 201o2015

Table 152 New Product/Technology Development, 20102015

Table 153 Agreements, 20102015

Table 154 Mergers & Acquisitions, 20102015

Table 155 Product Showcase, 20102015

List of Figures (47 Figures)

Figure 1 Ceramic Coatings Market Segmentation

Figure 2 Ceramic Coatings Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Break Down of Primary Interviews: By Company Type, Designation, & Region

Figure 6 Oxide Coatings Projected to Account for the Highest Market Size By Value, By 2020

Figure 7 Thermal Spray Technology Accounted for the Highest Market Size By Value, in 2014

Figure 8 Rest of the World Expected to Grow at the Highest Rate Between 2015 & 2020

Figure 9 Attractive Opportunities in Ceramic Coatings Market

Figure 10 Transportation & Automotive Was the Largest Application Segment in the Ceramic Coatings Market (2014)

Figure 11 India, Brazil & Argentina to Be the Fastest-Growing Countries in the Ceramic Coatings Market By Value, Between 2015 and 2020

Figure 12 Healthcare Projected to Be the Fastest-Growing Application Segment Between 2015 & 2020

Figure 13 Asia-Pacific & Rest of the World Projected to Grow at High Rate By Technology Between 2015 & 2020 ($Million)

Figure 14 North America has Entered the Maturity Stage Whereas Europe is Entering the Decline Stage

Figure 15 Ceramic Coatings Market, By Application

Figure 16 Ceramic Coatings Market, By Type

Figure 17 Ceramic Coatings Market, By Technology

Figure 18 Ceramic Coatings: Market Dynamics

Figure 19 Supply Chain: Ceramic Coatings Suppliers/Distributors Act as A Bridge

Figure 20 Ceramic Coatings: Porters Five Forces Analysis

Figure 21 Strategic Benchmarking: Companies Focusing on Product Enhancement

Figure 22 Strategic Benchmarking: Expansions and Mergers & Acquisitions to Leverage the Attractive Markets for Ceramic Coatings

Figure 23 Ceramic Coatings Market, By Type

Figure 24 Oxide Coatings Projected to Account for the Largest Market Size (20152020)

Figure 25 Carbide Coatings Market for RoW to Register the Highest CAGR(20152020)

Figure 26 Thermal Spray is the Most Widely Used Technology in the Ceramic Coatings Market, 20152020

Figure 27 Asia-Pacific is Projected to Account for the Largest Share of Thermal Spray Technology in Ceramic Coatings Market By 2020

Figure 28 RoW is the Fastest-Growing Market for Other Technologies, 20152020

Figure 29 Transportation & Automotive is the Largest Application in Ceramic Coatings Market, 2015 & 2020

Figure 30 Asia-Pacific is Projected to Account for the Largest Share in Transportation & Automotive Application By 2020

Figure 31 RoW is Projected to Be the Fastest-Growing Market for Healthcare Application, 20152020

Figure 32 Increasing Application in Healthcare Industry Driving the Asia-Pacific Market

Figure 33 Demand Will Be Driven By Growing Healthcare Industry

Figure 34 Growth Strategies Adopted By Leading Companies Between 2010 and 2015

Figure 35 Expansion Projects is the Key Strategy Adopted By Companies and 2012 Was the Most Active Year

Figure 36 Battle for Market Share: Expansion Projects and New Product/Technology Development is the Key Strategy

Figure 37 Ceramic Coatings Application Mapping of Leading Market Players

Figure 38 Bodycote PLC: Company Snapshot

Figure 39 Bodycote PLC: SWOT Analysis

Figure 40 Praxair Surface Technologies Inc.: Company Snapshot

Figure 41 Praxair Surface Technologies Inc: SWOT Analysis

Figure 42 Kurt J. Lesker Company Ltd: SWOT Analysis

Figure 43 APS Materials Inc.: SWOT Analysis

Figure 44 Du Pont: Company Snapshot

Figure 45 E.I. Du Pont De Numerous & Company: SWOT Analysis

Figure 46 Morgan Technical Ceramics: Company Snapshot

Figure 47 Saint Gobain Coating Solutions: Company Snapshot

Growth opportunities and latent adjacency in Ceramic Coatings Market

Interested in Titanium Dioxide; Carbon Black; Iron Oxide; Caustic Soda, Soda Ash; Calcium Carbonate; Industrial Minerals; Rare Earths; Industrial Chemicals; Plastics Raw Materials; Agricultural Chemicals; Pharmaceutical Raw Materials reports

Intrested in the information on car aesthetics

General information on applications and testing process of Ceramic Coatings

Market information on european ceramic coating market

Ceramic Coatings Market information

Looking for only quantitative information of the report

Report on ceramic coatings market