Hexagonal-Boron Nitride Powder (h-BN) Market by Application (Coatings & Mold Release, Electrical Insulation, Lubrication-Industrial, Composites, Personal Care, Paints, Lubricants-Food, Thermal Spray) - Global Forecast to 2021

[152 Pages Report] The global hexagonal-Boron Nitride (h-BN) powder market was USD 611.5 Million in 2015, and is estimated to reach USD 821.0 Million by 2021, at a CAGR of 5.1% from 2016 to 2021.

The objectives of the report are as follows:

- To define and segment the global h-BN powder market on the basis of application and region

- To provide detailed information regarding major factors influencing the growth of the global h-BN powder market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the global market size of h-BN powder, in terms of value

- To analyze the market segmentation and make a projection of the market, in terms of value, for key regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

- To analyze competitive developments such as new product launches, expansions, mergers & acquisitions, and partnerships & agreements in the global h-BN powder market

- To strategically profile key players in the global h-BN powder market

The base year considered for the study is 2015, while the forecast period is from 2016 to 2021.

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global h-BN powder market and to estimate the sizes of various other dependent submarkets in the overall h-BN powder market. The research study involved the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the global h-BN powder market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the h-BN powder market starts with the sourcing of basic raw materials, manufacturing and supplying to intermediate product manufacturers, and ends with use in the various end-use applications. The raw materials for these products are boric acid, borax, calcium borate, melamine, ammonia, urea, nitrogen gas and other boron and nitrogen containing compounds. Suppliers of these raw materials include U.S. Borax, Inc. (the U.S.), Searles Valley Minerals (the U.S), Yara International (Norway), CF Industries Holdings, Inc. (the U.S.), Ab Etiproducts Oy (Finland), Russian Bor (Russia), Dalian Jinma Boron Technology Group., Inc. (China), and Dashiqiao Huaxin Chemical Co., Ltd. (China). The major manufacturers of h-BN powder include Saint-Gobain S.A. (France), 3M (U.S.), Denka Company ltd. (Japan), Showa Denko K.K. (Japan), Kennametal Inc. (U.S.), Momentive Performance Materials Inc. (U.S.), HC Starck GmbH (Germany), Mizushima Ferroalloy Co., Ltd. (Japan), ZYP Coatings, Inc. (U.S.), and Henze Boron Nitride Products AG (Germany).

Key Target Audience:

- Raw material suppliers

- H-BN powder manufacturers

- Traders, distributors, and h-BN powder suppliers

- Government and regional agencies

- Research organizations

- Investment research firms

Scope of the Report:

This research report categorizes the global h-BN powder market on the basis of application, and region.

On the basis of Application:

- Coatings & mold release

- Electrical insulation

- Lubrication-industrial

- Composites

- Personal care

- Paints

- Lubricants-food

- Thermal spray

- Others (dental cements, pencil leads and synthesizing of cubic-BN)

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Geographical Analysis:

- Country-level analysis of te hglobal h-BN powder market

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

The global hexagonal-boron nitride (h-BN) powder market is estimated to reach USD 821.0 Million by 2021, at a CAGR of 5.1% from 2016 to 2021. H-BN powder has high thermal stability and excellent electrical insulation properties, and H-BN powder products offer high performance and durability. These factors drive the market for the h-BN powder globally.

H-BN powder products find usage in applications such as, coatings & mold release, electrical insulation, lubrication-industrial, composites, personal care, paints, lubricants-food, thermal spray, others (dental cements, pencil lead and synthesizing of h-BN).

The coatings & mold release application accounted for the largest share of the overall h-BN powder market and is expected to continue to do so throughout the forecast period. The H-BN powder is used for coatings, die-casting and mold release as it exhibits excellent thermal stability which enables efficient operations at high temperatures.

Companies are carrying out intense research & development activities to innovate and develop new products which can open new avenues of applications. Saint-Gobain has introduced its CarboTherm h-BN products to enhance thermal conductivity and provide electrical insulation to thermoplastic compounds. The performance chemicals division of EMD chemicals has announced the launch of RonaFlair Boroneige, the functional filler line, specifically used for applications in the cosmetics industry.

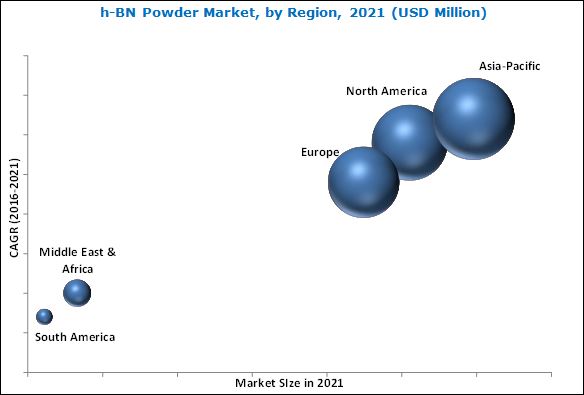

Growth in the coatings & mold release and electrical insulation applications has increased the demand for h-BN powder. The Asia-Pacific region accounts for the largest share of the global h-BN powder market and is also the fastest-growing market. China is expected to account for the largest share in the Asia-Pacific region till 2021 with India registering the fastest growth rate for the forecast period. Japan has prominent h-BN powder companies such as Denka Company ltd., Showa Denko K.K., and Mizushima Ferroalloy Co. Ltd. The U.S. is the largest market for the h-BN powder in North America.

The price of h-BN powder is high as compared to the available alternative substitutes. This is a major restraint in the global h-BN powder market. However, the h-BN powder is preferred over the others due to its superior performance at high temperatures.

Companies have adopted the new product development, expansions, partnerships, agreements, and collaborations strategies, to expand their market share and distribution network in the global h-BN powder market for the forecast period, 2016 to 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 By Region

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

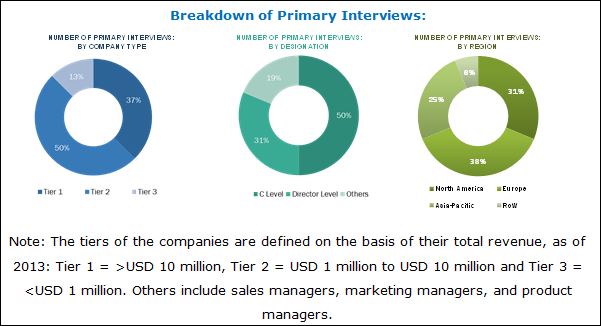

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Hexagonal Boron Nitride Market

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Segmentation

5.2.1 By Application

5.2.2 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 The Focus on Thermally Conductive and Electrically Insulating Plastic Components That Use Bn Powder in for Energy Saving

5.3.1.2 Demand for High Temperature Applications in Lubrication, Coating, Mold/Die Release

5.3.2 Restraints

5.3.2.1 High Cost of Hexagonal Boron Nitride Powder Compared to the Alternatives Used in Various Applications

5.3.3 Opportunities

5.3.3.1 Increasing Application Areas for Highly Thermal Conductive Polymer Materials

5.3.3.2 Innovation in Personal Care Industry

5.3.3.3 Coatings for Clearance Control Application in Aerospace and Defense Industry

5.3.4 Challenges

5.3.4.1 Lack of Awareness on the Advantages of Hexagonal Boron Nitride Powder Over Its Alternatives

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value-Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Boron Nitride and Its Types- an Overview (Page No. - 46)

7.1 Boron Nitride

7.1.1 Hexagonal Boron Nitride

7.1.2 Cubic Boron Nitride

7.1.3 Other

7.2 Market Trends of Boron Nitride Types

8 h-BN Powder Market, By Application (Page No. - 51)

8.1 Introduction

8.2 Coatings & Mold Release

8.3 Electrical Insulation

8.4 Lubrication- Industrial

8.5 Composites

8.6 Personal Care

8.7 Paints

8.8 Lubricants- Food

8.9 Thermal Spray

8.10 Other Applications

9 h-BN Powder Market, By Region (Page No. - 71)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 Italy

9.3.4 Russia

9.3.5 U.K.

9.3.6 Rest of the Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 South Korea

9.4.5 Indonesia

9.4.6 Thailand

9.4.7 Australia & New Zealand

9.4.8 Rest of Asia-Pacific

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 Rest of the Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of the South America

10 Competitive Landscape (Page No. - 120)

10.1 Overview

10.2 Competitive Situations and Trends

10.3 Mergers & Acquisitions: Most Popular Growth Strategy Between 2012 and 2016

10.3.1 Mergers & Acquisitions

10.3.2 New Product Launches

10.3.3 Expansion

11 Company Profiles (Page No. - 124)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Momentive Performance Materials Inc.

11.2 Saint-Gobain

11.3 The 3M Company

11.4 Denka Company Ltd

11.5 Kennametal

11.6 Showa Denko K.K.

11.7 H.C. Stark GmbH

11.8 Mizushima Ferroalloy Co., Ltd.

11.9 ZYP Coatings Inc.

11.10 Henze BNP AG

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 145)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (96 Tables)

Table 1 Hexagonal Boron Nitride Powder Market, By Application

Table 2 Properties of Different Forms of Boron Nitride

Table 3 h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 4 h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 5 h-BN Powder Market Size in Coatings & Mold Release, By Region, 2014–2021 (Tons)

Table 6 h-BN Powder Market Size in Coatings & Mold Release, By Region, 2014–2021 (USD Million)

Table 7 h-BN Powder Market Size in Electrical Insulation Application, By Region, 2014–2021 (Tons)

Table 8 h-BN Powder Market Size in Electrical Insulation Application, By Region, 2014–2021 (USD Million)

Table 9 h-BN Powder Market Size in Industrial Lubrication Application, By Region, 2014–2021 (Tons)

Table 10 h-BN Powder Market Size in Industrial Lubrication Application, By Region, 2014–2021 (USD Million)

Table 11 h-BN Powder Market Size in Composite Application, By Region, 2014–2021 (Tons)

Table 12 h-BN Powder Market Size in Composite Application, By Region, 2014–2021 (USD Million)

Table 13 h-BN Powder Market Size in Personal Care Application, By Region, 2014–2021 (Tons)

Table 14 h-BN Powder Market Size in Personal Care Application, By Region, 2014–2021 (USD Million)

Table 15 h-BN Powder Market Size in Paints Application, By Region, 2014–2021 (Tons)

Table 16 h-BN Powder Market Size in Paints Application, By Region, 2014–2021 (USD Million)

Table 17 h-BN Powder Market Size in Food Lubricants Application, By Region, 2014–2021 (Tons)

Table 18 h-BN Powder Market Size in Food Lubricants Application, By Region, 2014–2021 (USD Million)

Table 19 h-BN Powder Market Size in Thermal Spray Application, By Region, 2014–2021 (Tons)

Table 20 h-BN Powder Market Size in Thermal Spray Application, By Region, 2014–2021 (USD Million)

Table 21 h-BN Powder Market Size in Other Applications, By Region, 2014–2021 (Tons)

Table 22 h-BN Powder Market Size in Other Applications, By Region, 2014–2021 (USD Million)

Table 23 h-BN Powder Market Size, By Region, 2014–2021 (Tons)

Table 24 h-BN Powder Market Size, By Region, 2014–2021 (USD Million)

Table 25 h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 26 h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 27 North America: h-BN Powder Market Size, By Country, 2014–2021 (Tons)

Table 28 North America: h-BN Powder Market Size, By Country, 2014–2021 (USD Millions)

Table 29 h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 30 h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 31 U.S.:h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 32 U.S.:h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 33 Canada: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 34 Canada: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 35 Mexico: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 36 Mexico: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 37 Europe: h-BN Powder Market Size, By Country, 2014–2021 (Tons)

Table 38 Europe: h-BN Powder Market Size, By Country, 2014–2021 (USD Million)

Table 39 Europe: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 40 Europe: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 41 Germany: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 42 Germany: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 43 France: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 44 France: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 45 Italy: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 46 Italy: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 47 Russia: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 48 Russia: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 49 U.K.: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 50 U.K.: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 51 Rest of Europe: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 52 Rest of the Europe: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 53 Asia-Pacific: h-BN Powder Market Size, By Country, 2014–2021 (Tons)

Table 54 Asia-Pacific: h-BN Powder Market Size, By Country, 2014–2021 (USD Million)

Table 55 China Accounts for the Major Share of h-BN Powder in Asia-Pacific

Table 56 Asia-Pacific: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 57 Asia-Pacific: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 58 China: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 59 China: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 60 India: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 61 India: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 62 Japan: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 63 Japan: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 64 South Korea: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 65 South Korea: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 66 Indonesia: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 67 Indonesia: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 68 Thailand: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 69 Thailand: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 70 Australia & New Zealand: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 71 Australia & New Zealand: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 72 Rest of Asia-Pacific: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 73 Rest of Asia-Pacific: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 74 Middle East & Africa: h-BN Powder Market Size, By Country, 2014–2021 (Tons)

Table 75 Middle East & Africa: h-BN Powder Market Size, By Country, 2014–2021 (USD Million)

Table 76 Middle East & Africa: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 77 Middle East & Africa: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 78 Saudi Arabia: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 79 Saudi Arabia: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 80 UAE: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 81 UAE: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 82 Rest of the Middle East & Africa: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 83 Rest of Middle East & Africa: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 84 South America: h-BN Powder Market Size, By Country, 2014–2021 (Tons)

Table 85 South America: h-BN Powder Market Size, By Country, 2014–2021 (USD Million)

Table 86 South America: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 87 South America: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 88 Brazil: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 89 Brazil: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 90 Argentina: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 91 Argentina: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 92 Rest of the South America: h-BN Powder Market Size, By Application, 2014–2021 (Tons)

Table 93 Rest of the South America: h-BN Powder Market Size, By Application, 2014–2021 (USD Million)

Table 94 Mergers & Acquisitions, 2012–2016

Table 95 New Product Launches, 2012–2016

Table 96 Expansion, 2012–2016

List of Figures (59 Figures)

Figure 1 Market Segmentation: h-BN Powder

Figure 2 h-BN Powder Market: Research Design

Figure 3 Breakdown of Primary Interviews

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Data Triangulation: h-BN Powder Market

Figure 7 Coatings & Mold Release is Expected to Remain the Largest Application of Hexagonal Boron Nitride Till 2021, (Tons)

Figure 8 Asia-Pacific Projected to Be Fastest Growing Market (USD Million)

Figure 9 Global Market Overview and CAGR

Figure 10 Top Ten Markets for Hexagonal Boron Nitride Powder

Figure 11 Market Share Analysis for h-BN Market

Figure 12 Asia-Pacific and North America to Drive the Global Demand for Hexagonal Boron Nitride Powder

Figure 13 Asia-Pacific Hexagonal Boron Nitride Powder Market 2015

Figure 14 Top Five Fastest Growing Market for Hexagonal Boron Nitride Powder During Forecast Period

Figure 15 North America Projected to Lead the Market for Coatings & Mold Release Application, (USD Million)

Figure 16 Hexagonal Boron Nitride Powder Market, By Region

Figure 17 Hexagonal Boron Nitride Powder: Market Dynamics

Figure 18 Hexagonal Boron Nitride Powder Market: Value-Chain Analysis

Figure 19 Porter’s Five Forces Analysis

Figure 20 Properties of Hexagonal Boron Nitride and Its Competitive Materials

Figure 21 Comparison of Physical Properties of Boron Nitride and Its Competitive Materials

Figure 22 Global Boron Nitride Market in 2015 (Tons)

Figure 23 Global Hexagonal Boron Nitride Market in 2015, By Type (Tons )

Figure 24 Global Market Share of h-BN Powder in 2015 (Tons)

Figure 25 Global Market Share of h-BN Hot Press 2015 (Tons)

Figure 26 h-BN Powder Market Share, By Application, 2015 (USD Million)

Figure 27 North America Estimated to Lead h-BN Powder Market in Coatings & Mold Release Application

Figure 28 North America Estimated to Be the Fastest Growing Market for h-BN Powder in Electrical Insulation ApPLCiation

Figure 29 Asia-Pacific to Be the Fastest-Growing Region for h-BN Powder in Industrial Lubrication Application

Figure 30 Asia-Pacific Estimated to Be the Largest Market for h-BN Powder in Composite Application

Figure 31 Asia-Pacific is the Fastest Growing Region for h-BN Powder in Personal Care Application

Figure 32 Asia-Pacific Estimated to Lead h-BN Powder Market in Paints Application

Figure 33 North America to Be the Largest Market for h-BN Powder Market in Food Lubricants Application

Figure 34 Asia-Pacific Estimated to Be the Fastest Growing Market for h-BN Powder in Thermal Spray Application

Figure 35 North America Estimated to Lead h-BN Powder Market in Other Applications

Figure 36 Regional Snapshot: Rapid Growth Markets are Emerging as New Hotspots

Figure 37 North America Market Snapshot: the U.S. Leads the Market for h-BN Powder in North America

Figure 38 The U.S. Accounts for the Major Share of h-BN Powder in North America

Figure 39 U.S. Market Snapshot: 2016 vs 2021

Figure 40 European Market Snapshot: Russia to Be the Fastest Growing Market

Figure 41 Germany Accounts for the Major Share of h-BN Powder in Europe

Figure 42 Asia-Pacific Snapshot: India to Be the Fastest Growing Market in the Region

Figure 43 Asia-Pacific Market Snapshot: Country-Wise Market Share of h-BN Powder in Coatings & Mold Release, Electrical Insulation, and Industrial Lubrication -2015 (USD Million)

Figure 44 Saudi Arabia Accounts for the Major Share in Middle East & Africa

Figure 45 Brazil Accounted for Major Share of h-BN Powder Market in South America

Figure 46 Market Evaluation Framework: New Product Launches Fueled Growth Between 2014 and 2015

Figure 47 Merger & Acquisitions is to Be the Most Followed Strategy in h-BN Market

Figure 48 Momentive Prerformance Materials Inc: Company Snapshot

Figure 49 Momentive Performance Materials Inc.: SWOT Analysis

Figure 50 Saint-Gobain: Company Snapshot

Figure 51 Saint-Gobain.: SWOT Analysis

Figure 52 The 3M Company: Company Snapshot

Figure 53 The 3M Company: SWOT Analysis

Figure 54 Denka Company Ltd.: Company Snapshot

Figure 55 Denka Company Ltd.: SWOT Analysis

Figure 56 Kennametal : Company Snapshot

Figure 57 Kennametal: SWOT Analysis

Figure 58 Showa Denko K.K.: Company Snapshot

Figure 59 Showa Denko K.K.: SWOT Analysis

Growth opportunities and latent adjacency in Hexagonal-Boron Nitride Powder (h-BN) Market