Cattle Feed & Feed Additives Market by Application (Dairy, Beef, Calf), Ingredient (Corn, Soymeal, Wheat, Other Oilseeds & Grains), Type (Vitamins, Minerals, Amino Acids, Enzymes, Acidifiers, Antibiotics, Antioxidants), & by Region - Global Forecasts to 2020

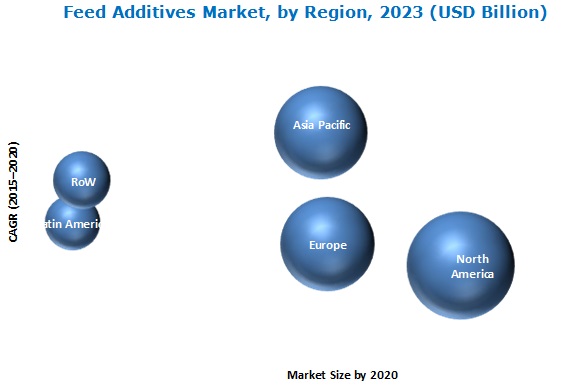

[214 Pages Report] The global cattle feed market size is expected to grow from USD 63.15 billion in 2015 to USD 72.13 billion by 2020, at a CAGR of 2.7% from 2016 to 2020. The overall cattle feed additives market size is expected to grow from USD 2.25 billion in 2015 to USD 2.72 billion by 2020, at a CAGR of 3.9% from 2016 to 2020. Cattle feed commercially produced by compound feed manufacturers is directly fed or mixed with feed concentrates or roughages before feeding the animals. As defined by FAO “compound feed is a mixture of products of vegetable or animal origin in their natural state, fresh or preserved, or products derived from the industrial processing thereof, or organic or inorganic substances, whether or not containing additives, for oral feeding in the form of a complete feed.” Commercial feed is compounded to be fed as a sole ration by specific formulations prepared according to each growth phase of the cattle. Compound cattle feed are fed to beef cattle, dairy cattle, calves, and others. The base year considered for the study is 2014, and the forecast has been provided for the period between 2015 and 2020.

Market Dynamics

Drivers

- Gradual shift from unorganized livestock farming to organized sector

- Increased focus on animal health to prevent disease outbreaks

Restraints

- Higher chances of negative price relationship with final farm products

- Stringent & time-consuming regulatory policies

Opportunities

- Beef cattle sector serves as a major contributor for growth in developing countries

Challenges

- Monitoring mycotoxin contamination in cattle feed

Increased focus on animal health to prevent disease outbreaks drives the global cattle feed & feed additives market

Unsafe and adulterated feed ingredients neutralize the immunity of farm animals, thereby causing loss of productivity to the farmers. The increase in the prevalence of disease outbreaks encouraged livestock farmers to purchase quality feed premixes. Assurance of safety and quality of products has been of high priority among customers. Diseases can affect the trade of livestock products such as dairy products, meat, and by-products as well. The disease affected areas are banned from exporting these products for a prolonged period until completely quarantined and controlled. The Asia Pacific region, which experienced recent outbreaks such as H5N1 influenza virus (2014) and foot-and-mouth disease (2011), had brought about significant consumer awareness towards the utilization of quality feed premixes.

The following are the major objectives of the study.

- To define, segment, and project the size of the cattle feed market with respect to ingredient type and application of cattle feed, and type of cattle feed additives

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To project the market size, in terms of value (USD million) and volume (kilotons), on the basis of cattle feed usage by cattle bred for different purposes (beef cattle, dairy cattle, calves, and others)

- To project the market size, in terms of value (USD million) and volume (kilotons), on the basis of key cattle feed additives (vitamins, minerals, amino acids, antioxidants, acidifiers, enzymes, and antibiotics)

- To analyze opportunities in the cattle feed market for stakeholders and study the details of a competitive landscape, to be provided to the key market leaders

- To strategically profile the key players and comprehensively analyze their market strategies and core competencies

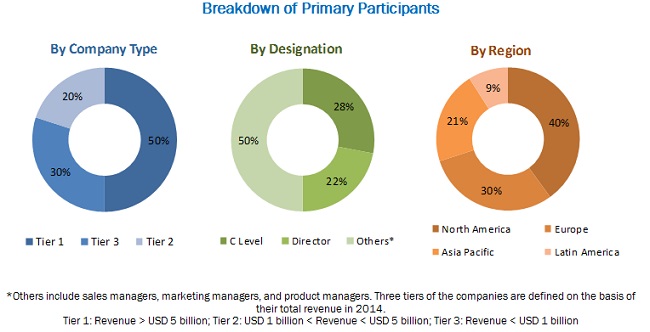

During this research study, major players operating in the cattle feed & feed additives market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The cattle feed & feed additives market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the cattle feed & feed additives market are Archer Daniels Midland Company (US), BASF SE (Germany), Cargill, Incorporated (US), Royal DSM N.V. (Netherlands), Nutreco N.V. (Netherlands), Charoen Pokphand Foods PCL (Thailand), and Land O’Lakes Inc. (US).

Major Market Developments

- In July 2015, Archer Daniels Midland Company (US) and Quality Liquid Feeds, Inc. (US) entered into a 50-50 percent joint venture for the production and sale of liquid feed supplements for livestock.

- In July 2015, Cargill, Incorporated (US) launched Proviox Breeder at the International Production & Processing Expo which is a new version of Cargill’s plant-based antioxidant Proviox, specially tailored for breeder birds.

- In December 2014, Nutreco N.V. (Netherlands) acquired two animal nutrition companies in Brazil, namely, Fatec Indústria de Nutrição e Saúde Animal Ltd, which is a supplier and producer of premixes and BRNova Sistemas Nutriconais S.A., which is a supplier of premixes and feed specialties

Target Audience

- Feed manufacturers, suppliers, traders, and distributors

- Feed grain ingredient importers and exporters

- Feed manufacturing associations & industry bodies

- Animal & dairy co-operative societies

- Regulatory authorities and research organizations

- Agricultural crop producers and warehouse owners

Report Scope

By Ingredient Type

- Corn

- Soybean meal

- Wheat

- Other oilseeds & grains

- Other ingredients

By Application

- Beef cattle

- Dairy cattle

- Calves

- Others

By Additive Type:

- Vitamins

- Trace minerals

- Amino acids

- Feed antibiotics

- Feed acidifiers

- Feed enzymes

- Antioxidants

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Rest of the World (RoW)

Critical questions which the report answers

- What are new types of cattle feed additives which the companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe cattle feed & feed additives market into Russia, Ukraine, Ireland, and Poland

- Further breakdown of the Rest of Asia Pacific cattle feed & feed additives market into New Zealand, Indonesia, Vietnam, and the Philippines

- Further breakdown of the Rest of the Latin American cattle feed & feed additives market into Colombia, Venezuela, and Paraguay

- Further breakdown of the cattle feed & feed additives market of other countries in the RoW region into Iran, Egypt, Morocco, and Saudi Arabia

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The gradual shift from unorganized livestock farming to the organized sector; and increased focus on animal health to prevent disease outbreaks are the key factors driving the growth of this market.

The demand for cattle feed additives has been rising because of the increasing number of facilities for mass meat production. To ensure superior quality of animal products, livestock breeders use feed additives as supplements to meet the dietary requirements of the livestock. In the last 60 years, significant dietary changes in animals resulted in increasing demand for feed additives such as vitamins, minerals, amino acids, antibiotics, and other ingredients to enhance meat production, and to reduce phosphate levels and ammonia pollution caused due to animal waste. The economic significance of feed additives has helped in reducing the amount of protein feed supply.

The cattle feed market has been segmented, on the basis of ingredient type, into corn, soybean meal, wheat, other & grains, and other ingredients. The market for corn is expected to account for the largest share in the global cattle feed market in 2016. Corn can serve as the exclusive grain source in backgrounding (a beef production system where one-year-old calves are placed after weaning) and finishing diets. Corn is either prepared as a meal or is available as distiller’s dried grains with soluble DDGS (a corn-based co-product from ethanol production), corn gluten meal, corn germ meal, or corn gluten feed.

The cattle feed market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. In some Asian countries, the livestock population, especially cattle, is associated with rising human population, growing per capita incomes, changing technologies, availability of new practices such as urea addition to roughage to increase digestibility within cattle, and varying tastes. Further, the meat industries have been strengthening their numbers in the Asia Pacific regions due to the increasing demand for meat.

Cattle feed applications in beef cattle, dairy cattle, and calves drive the growth of cattle feed market

Beef Cattle

After completing one year, the young ones are placed in feedlots or backgrounding operations. Backgrounding operations take place between 1 and 2 years of age before sending them to the feedlots. Up to 3 years of age, the male young beef cattle are called as steers, and the female beef cattle are known as heifer/beef heifers. For a 300 pound (136 kg) steer/heifer to have an average daily gain (ADG) of 2 pounds (0.9 kg), the individual must consume about 8.2 pounds (3.7 kg) of dry matter per day with a dietary composition of 22.2% of crude protein, 1.17% calcium, and 0.51% of phosphorus. This diet can help the beef cattle in reaching a bodyweight of 1,100 pounds (498 kg) at a mature stage. The dietary composition of the beef cattle changes according to the weight gained and the age of the cattle. The mature herd is provided with high-quality pasture along with grains, corn silage, and protein supplements. However, in the feedlots, which hosts around 200–300 cattle, corn silage, haylage, corn gluten, and dry corn account for a major part of the beef cattle’s rations, instead of pasture grazing

Dairy Cattle

Dairy cattle diets are divided into two segments—lactating and dry phase. Each phase comprises of 6 months, where the lactating phase is the first 6 months after giving birth, and dry phase is the latter 6 months, after reaching peak milk production. During the dry phase, the cows are impregnated with semen for the next calving cycle. The lactating phase requires both energy and protein-based diets to increase the milk yield as well as the milk protein content. The feed content is reduced for the dairy cows as there is not much feed conversion during the lactating phase. The dry phase includes mostly energy-based diets, in order to improve the strength of the pregnant cows while giving birth.

Calves

The calves segment covers feed required for both new-born calves (from 0 to 6 months old) and weaners (which are placed on milk replacer diets). After the calving period, suitable individuals are selected for the dairy purpose and the others are sent to slaughterhouse or feedlot systems (up to 3 years).

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming ingredient types for cattle feed?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Higher chances of negative price relationship with final farm products a major factor restraining the growth of the market. The profit margin for a livestock owner depends on the price of final products such as milk and beef in a cattle farm. In 2014, milk prices witnessed a decline in price due to a higher supply of milk in the global market. The higher demand in the Chinese market for milk and milk products increased the price value of milk. However, milk production increased by 5% from 2013 according to Rabobank International and with that followed a chain of events starting from the decline in milk prices to a drop in feed demand among dairy cattle farmers. With commodity prices of soybean and corn remaining lower in the last 2 years, farmers are not able to reap better value from their livestock due to lesser returns from milk.

Key players in the market include Archer Daniels Midland Company (US), BASF SE (Germany), Cargill, Incorporated (US), Royal DSM N.V. (Netherlands), Nutreco N.V. (Netherlands), Charoen Pokphand Foods PCL (Thailand), and Land O’Lakes Inc. (US). These players are increasingly undertaking expansions & investments, and agreements, joint ventures, collaborations & partnerships to grow their presence in the market.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered for This Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Rising Per Capita Consumption of Cattle-Based Products

2.2.2.2 Growth in Compound Feed Consumption

2.2.3 Supply-Side Analysis

2.2.3.1 Strong Supply of Feed Grains and Oilseed for Feed Preparation

2.2.3.2 Declining Pasture Land Had Increased Reliability on Commercial Feed

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 40)

4.1 Extensive Market Opportunities in the Cattle Feed Market

4.2 Asia-Pacific: the Third Largest Consumer of Cattle Feed

4.3 Cattle Feed Market, By Country, 2014

4.4 Cattle Feed Market: Developed vs Developing Nations, 2015–2020 (USD Million)

4.5 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Cattle Feed Market

5.3.1.1 Cattle Feed, By Ingredient Type

5.3.1.2 Cattle Feed, By Application

5.3.2 Cattle Feed Additive Market

5.3.2.1 Cattle Feed Additives, By Additive Type

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Gradual Shift From Unorganized Livestock Farming to Organized Sector

5.4.1.2 Increased Focus on Animal Health to Prevent Disease Outbreaks

5.4.2 Restraints

5.4.2.1 Higher Chances of Negative Price Relationship With Final Farm Products

5.4.2.2 Stringent & Time-Consuming Regulatory Policies

5.4.3 Opportunities

5.4.3.1 Beef Cattle Sector Serves as Major Contributor for Growth in Developing Countries

5.4.4 Challenges

5.4.4.1 Monitoring Mycotoxin Contamination in Cattle Feed

5.5 Trading & Regulatory Environment

5.5.1 Trade Analysis

5.5.1.1 Global Feed Imports

5.5.1.2 Global Feed Exports

5.5.2 Regulatory Framework

5.5.2.1 U.S.

5.5.2.2 Brazil

5.5.2.3 China

5.5.2.4 Canada

5.5.2.5 European Union

5.5.2.6 Japan

5.5.2.7 South Africa

6 Industry Trends (Page No. - 58)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Value Chain Analysis

6.4 Industry Insights

6.5 Porter’s Five Forces Analysis

6.5.1 Intensity of Competitive Rivalry

6.5.2 Threat of New Entrants

6.5.3 Threat of Substitutes

6.5.4 Bargaining Power of Suppliers

6.5.5 Bargaining Power of Buyers

7 Market For Cattle Feed, By Ingredient Type (Page No. - 64)

7.1 Introduction

7.2 Corn

7.3 Soybean Meal

7.4 Wheat

7.5 Other Oilseeds & Grains

7.5.1 Oilseeds

7.5.2 Grains

7.6 Others

8 Market For Cattle Feed, By Application (Page No. - 75)

8.1 Introduction

8.2 Beef Cattle

8.2.1 Feeding Operations

8.2.1.1 Backgrounding

8.2.1.2 Feedlot

8.2.2 Gender

8.2.2.1 Beef Cows & Heifers

8.2.2.2 Steers

8.3 Dairy Cattle

8.3.1 Growth Phase

8.3.1.1 Heifers

8.3.1.2 Dairy Cows

8.4 Calves

8.4.1 Growth Phase

8.4.1.1 Calf

8.4.1.2 Weaners

8.5 Others

9 Market For Cattle Feed, By Additive Type (Page No. - 88)

9.1 Introduction

9.2 Vitamins

9.3 Trace Minerals

9.4 Amino Acids

9.5 Feed Antibiotics

9.6 Feed Acidifiers

9.7 Feed Enzymes

9.8 Antioxidants

9.9 Other Additives

10 Cattle Feed & Feed Additives Market, By Region (Page No. - 105)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Mexico

10.2.3 Canada

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Spain

10.3.4 U.K.

10.3.5 Italy

10.3.6 The Netherlands

10.3.7 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Australia

10.4.3 Japan

10.4.4 South Korea

10.4.5 India

10.4.6 Rest of Asia-Pacific

10.5 Latin America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of Latin America

10.6 Rest of the World (RoW)

10.6.1 Turkey

10.6.2 South Africa

10.6.3 Others in RoW

11 Competitive Landscape (Page No. - 173)

11.1 Overview

11.2 Market Scenario and Trends

11.2.1 Cattle Feed Market

11.2.2 Cattle Feed Additives Market

11.3 Competitive Situation & Trends

11.3.1 Expansions & Investments

11.3.2 Acquisitions

11.3.3 Agreements, Joint Ventures, Collaborations, and Partnerships

11.3.4 New Product Launches

12 Company Profiles (Page No. - 179)

12.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2 Archer Daniels Midland Company

12.3 BASF SE

12.4 Cargill, Incorporated

12.5 Royal DSM N.V.

12.6 Nutreco N.V.

12.7 Charoen Pokphand Group

12.8 Land O’lakes Inc.

12.9 Country Bird Holdings

12.10 New Hope Group

12.11 Alltech Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 207)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

List of Tables (175 Tables)

Table 1 Market Exploration & Business Consolidation: Major Trends Among Key Market Players

Table 2 Cattle Feed Market Size, By Ingredient, 2013–2020 (USD Million)

Table 3 Cattle Feed Market Size, By Ingredient, 2013–2020 (‘000 Tons)

Table 4 Corn in Cattle Feed Market Size, By Region, 2013–2020 (USD Million)

Table 5 Corn in Cattle Feed Market Size, By Region, 2013–2020 (‘000 Tons)

Table 6 Soybean Meal in Cattle Feed Market Size, By Region, 2013–2020 (USD Million)

Table 7 Soybean Meal in Cattle Feed Market Size, By Region, 2013–2020 (‘000 Tons)

Table 8 Wheat in Cattle Feed Market Size, By Region, 2013–2020 (USD Million)

Table 9 Wheat in Cattle Feed Market Size, By Region, 2013–2020 (‘000 Tons)

Table 10 Other Oilseed & Grains in Cattle Feed Market Size, By Region, 2013–2020 (USD Million)

Table 11 Other Oilseed & Grains in Cattle Feed Market Size, By Region, 2013–2020 (‘000 Tons)

Table 12 Other Ingredients in Cattle Feed Market Size, By Region, 2013–2020 (USD Million)

Table 13 Other Ingredients in Cattle Feed Market Size, By Region, 2013–2020 (‘000 Tons)

Table 14 Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 15 Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 16 Beef Cattle Feed Market Size, By Region, 2013–2020 (USD Million)

Table 17 Beef Cattle Feed Market Size, By Region, 2013–2020 (‘000 Tons)

Table 18 Beef Cattle Feed Market Size, By Feeding Operation, 2013–2020 (USD Million)

Table 19 Beef Cattle Feed Market Size, By Feeding Operation, 2013–2020 (‘000 Tons)

Table 20 Beef Cattle Feed Market Size, By Gender, 2013–2020 (‘000 Tons)

Table 21 Beef Cattle Feed Market Size, By Gender, 2013–2020 (USD Million)

Table 22 Dairy Cattle Feed Market Size, By Region, 2013–2020 (USD Million)

Table 23 Dairy Cattle Feed Market Size, By Region, 2013–2020 (‘000 Tons)

Table 24 Dairy Cattle Feed Market Size, By Growth Phase, 2013–2020 (‘000 Tons)

Table 25 Dairy Cattle Feed Market Size, By Growth Phase, 2013–2020 (USD Million)

Table 26 Calf Feed Market Size, By Region, 2013–2020 (USD Million)

Table 27 Calf Feed Market Size, By Region, 2013–2020 (’000 Tons)

Table 28 Calf Feed Market Size, By Growth Phase, 2013–2020 (USD Million)

Table 29 Calf Feed Market Size, By Growth Phase, 2013–2020 (‘000 Tons)

Table 30 Other Cattle Feed Market Size, By Region, 2013–2020 (USD Million)

Table 31 Other Cattle Feed Market Size, By Region, 2013–2020 (‘000 Tons)

Table 32 Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 33 Cattle Feed Additives Market Size, By Type, 2013–2020 (000’ Tons)

Table 34 Vitamins: Cattle Feed Additives Market Size, By Region, 2013–2020 (USD Million)

Table 35 Vitamins: Cattle Feed Additives Market Size, By Region, 2013–2020 (000’ Tons)

Table 36 Trace Minerals: Cattle Feed Additives Market Size, By Region, 2013–2020 (USD Million)

Table 37 Trace Minerals: Cattle Feed Additives Market Size, By Region, 2013–2020 (000’ Tons)

Table 38 Amino Acids: Cattle Feed Additives Market Size, By Region, 2013–2020 (USD Million)

Table 39 Amino Acids: Cattle Feed Additives Market Size, By Region, 2013–2020 (000’ Tons)

Table 40 Antibiotics: Cattle Feed Additives Market Size, By Region, 2013–2020 (USD Million)

Table 41 Antibiotics: Cattle Feed Additives Market Size, By Region, 2013–2020 (000’ Tons)

Table 42 Acidifiers: Cattle Feed Additives Market Size, By Region, 2013–2020 (USD Million)

Table 43 Acidifiers: Cattle Feed Additives Market Size, By Region, 2013–2020 (000’ Tons)

Table 44 Enzymes: Cattle Feed Additives Market Size, By Region, 2013–2020 (USD Million)

Table 45 Enzymes: Cattle Feed Additives Market Size, By Region, 2013–2020 (000’ Tons)

Table 46 Antioxidants: Cattle Feed Additives Market Size, By Region, 2013–2020 (USD Million)

Table 47 Antioxidants: Cattle Feed Additives Market Size, By Region, 2013–2020 (000’ Tons)

Table 48 Other Additives: Cattle Feed Additives Market Size, By Region, 2013–2020 (USD Million)

Table 49 Other Additives: Cattle Feed Additives Market Size, By Region, 2013–2020 (000’ Tons)

Table 50 Cattle Feed Market Size, By Region, 2013–2020 (USD Million)

Table 51 Cattle Feed Market Size, By Region, 2013–2020 (‘000 Tons)

Table 52 Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 53 Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 54 North America: By Market Size, By Country, 2013–2020 (USD Million)

Table 55 North America: Cattle Feed Market Size, By Country, 2013–2020 (USD Million)

Table 56 North America: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 57 North America: By Market Size, By Application, 2013–2020 (‘000 Tons)

Table 58 North America: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 59 North America: By Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 60 U.S.: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 61 U.S.: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 62 U.S.: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 63 U.S.: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 64 Mexico: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 65 Mexico: By Market Size, By Application, 2013–2020 (‘000 Tons)

Table 66 Mexico: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 67 Mexico: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 68 Canada: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 69 Canada: By Market Size, By Application, 2013–2020 (‘000 Tons)

Table 70 Canada: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 71 Canada: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 72 Europe: By Market Size, By Country, 2013–2020 (USD Million)

Table 73 Europe: Cattle Feed Market Size, By Country, 2013–2020 (‘000 Tons)

Table 74 Europe: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 75 Europe: By Market Size, By Application, 2013–2020 (‘000 Tons)

Table 76 Europe: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 77 Europe: Cattle Feed Additive Market Size, By Type, 2013–2020 (‘000 Tons)

Table 78 Germany: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 79 Germany: By Market Size, By Application, 2013–2020 (‘000 Tons)

Table 80 Germany: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 81 Germany: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 82 France: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 83 France: By Market Size, By Application, 2013–2020 (‘000 Tons)

Table 84 France: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 85 France: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 86 Spain: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 87 Spain: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 88 Spain: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 89 Spain: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 90 U.K.: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 91 U.K.: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 92 U.K.: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 93 U.K.: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 94 Italy: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 95 Italy: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 96 Italy: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 97 Italy: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 98 The Netherlands: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 99 The Netherlands: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 100 The Netherlands: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 101 The Netherlands: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 102 Rest of Europe: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 103 Rest of Europe: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 104 Rest of Europe: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 105 Rest of Europe: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 106 Asia Pacific: Cattle Feed Market Size, By Country, 2013–2020 (USD Million)

Table 107 Asia Pacific: Cattle Feed Market Size, By Country, 2013–2020 (‘000 Tons)

Table 108 Asia Pacific: Size, By Application, 2013–2020 (USD Million)

Table 109 Asia Pacific: Size, By Application, 2013–2020 (‘000 Tons)

Table 110 Asia Pacific: Market Size, By Type, 2013–2020 (USD Million)

Table 111 Asia Pacific: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 112 China: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 113 China: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 114 China: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 115 China: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 116 Australia: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 117 Australia: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 118 Australia: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 119 Australia: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 120 Japan: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 121 Japan: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 122 Japan: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 123 Japan: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 124 South Korea: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 125 South Korea: Market Size, By Application, 2013–2020 (‘000 Tons)

Table 126 South Korea: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 127 South Korea: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 128 India: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 129 India: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 130 India: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 131 India: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 132 Rest of Asia-Pacific: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 133 Rest of Asia-Pacific: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 134 Rest of Asia-Pacific: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 135 Rest of Asia-Pacific: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 136 Latin America: Cattle Feed Market Size, By Country, 2013–2020 (USD Million)

Table 137 Latin America: Cattle Feed Market Size, By Country, 2013–2020 (‘000 Tons)

Table 138 Latin America: Market Size, By Application, 2013–2020 (USD Million)

Table 139 Latin America: Market Size, By Application, 2013–2020 (‘000 Tons)

Table 140 Latin America: Market Size, By Type, 2013–2020 (USD Million)

Table 141 Latin America: Cattle Feed Additive Market Size, By Type, 2013–2020 (‘000 Tons)

Table 142 Brazil: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 143 Brazil: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 144 Brazil: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 145 Brazil: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 146 Argentina: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 147 Argentina: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 148 Argentina: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 149 Argentina: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 150 Rest of Latin America: Market Size, By Application, 2013–2020 (USD Million)

Table 151 Rest of Latin America: Market Size, By Application, 2013–2020 (‘000 Tons)

Table 152 Rest of Latin America: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 153 Rest of Latin America: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 154 RoW: Cattle Feed Market Size, By Country, 2013–2020 (USD Million)

Table 155 RoW: Market Size, By Country, 2013–2020 (USD Million)

Table 156 RoW: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 157 RoW: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 158 RoW: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 159 RoW: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 160 Turkey: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 161 Turkey: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 162 Turkey: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 163 Turkey: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 164 South Africa: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 165 South Africa: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 166 South Africa: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 167 South Africa: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 168 Others in RoW: Cattle Feed Market Size, By Application, 2013–2020 (USD Million)

Table 169 Others in RoW: Cattle Feed Market Size, By Application, 2013–2020 (‘000 Tons)

Table 170 Others in RoW: Cattle Feed Additives Market Size, By Type, 2013–2020 (USD Million)

Table 171 Others in RoW: Cattle Feed Additives Market Size, By Type, 2013–2020 (‘000 Tons)

Table 172 Expansions & Investments, 2014–2015

Table 173 Acquisitions, 2014–2015

Table 174 Agreements, Joint Ventures, Collaborations, and Partnerships, 2013–2015

Table 175 New Product Launches, 2013–2015

List of Figures (67 Figures)

Figure 1 Cattle Feed & Feed Additive Market Segmentation

Figure 2 Research Design: Cattle Feed & Feed Additives Market

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 4 Per Capita Beef Consumption of Brazil and China, 2010–2016 (Kg/Person)

Figure 5 Global Compound Feed Production, 2011–2014 (Million Tons)

Figure 6 Global Supply and Feed Consumption of Important Grains and Oilseeds, 2015

Figure 7 Gradual Decline in Pasture Lands of Key Beef Producers, 2010–2013

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Market Size Estimation Methodology: Top-Down Approach

Figure 10 Data Triangulation

Figure 11 Assumptions of the Study

Figure 12 Cattle Feed Ingredients Snapshot: 2015 vs 2020 (USD Million)

Figure 13 Beef Cattle is Projected to Be the Fastest-Growing Segment, 2015–2020 (USD Million)

Figure 14 Vitamins & Minerals: Promising Ingredient Segments for Investment, 2015–2020 (‘000 Tons)

Figure 15 Cattle Feed Market Snapshot: North America Accounted for the Largest Share, 2014 (‘000 Tons)

Figure 16 Emerging Markets With Promising Growth Potential, 2015–2020 (USD Million)

Figure 17 Evolving Livestock Management Practices Strengthens Demand in the Asia-Pacific Region, 2015

Figure 18 U.S. Accounted for the Largest Share of the Cattle Feed Market, 2014 (USD Million)

Figure 19 Developing Markets Exhibit Large Demand as Well as Strong Growth Opportunities in the Next 5 Years, 2015–2020 (USD Million)

Figure 20 European Markets Approaching Maturity Phase, 2014

Figure 21 Cattle Feed & Feed Additives: Market Evolution

Figure 22 Cattle Feed, By Ingredient Type

Figure 23 Cattle Feed, By Application

Figure 24 Cattle Feed Additives, By Additive Type

Figure 25 Farm to Consumer Integration in the Livestock Industry Improved the Demand for High-Quality Feed

Figure 26 Key Global Importers of Feed, 2014

Figure 27 Global Exporters of Feed, 2014

Figure 28 Sourcing Quality Ingredients & End Product Distribution: Critical Checkpoints

Figure 29 Customized Product Formulation & Blending: Main Phases of Value Addition

Figure 30 Porter’s Five Forces Analysis: Industrial Rivalry Intensified Through Efficient Procurement Strategies

Figure 31 Cattle Feed Market Size, By Ingredient, 2015 vs 2020 (USD Billion)

Figure 32 Corn in Cattle Feed Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 33 Soybean Meal in Cattle Feed Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 34 Wheat in Cattle Feed Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 35 Cattle Feed Market Size, By Application, 2014 vs 2020 (USD Billion)

Figure 36 Beef Cattle: the Fastest-Growing Cattle Feed Market, By Region, 2015 vs 2020 (USD Million)

Figure 37 Dairy Cattle Feed Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 38 Calf Feed Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 39 Cattle Feed Additives Market Size, By Type, 2015 vs 2020 (USD Million)

Figure 40 Vitamins: Cattle Feed Additives Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 41 Trace Minerals: Cattle Feed Additives Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 42 Amino Acids: Cattle Feed Additives Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 43 Antibiotics: Cattle Feed Additives Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 44 Acidifiers: Cattle Feed Additives Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 45 Enzymes: Cattle Feed Additives Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 46 Antioxidants: Cattle Feed Additives Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 47 Other Additives: Cattle Feed Additives Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 48 Cattle Feed Market Size, By Region, 2015–2020 (USD Million)

Figure 49 North American Cattle Feed & Feed Additives Market Snapshot

Figure 50 European Cattle Feed & Feed Additives Market Snapshot

Figure 51 Asia Pacific Cattle Feed & Feed Additives Market Snapshot

Figure 52 Latin America Cattle Feed & Feed Additives Market Snapshot

Figure 53 Expansions & Agreements: Leading Approaches of Key Companies, 2010–2015

Figure 54 Geographic Revenue Mix of Top Five Market Players, 2014

Figure 55 Archer Daniels Midland Company: Company Snapshot

Figure 56 Archer Daniels Midland Company: SWOT Analysis

Figure 57 BASF SE: Company Snapshot

Figure 58 BASF SE Company: SWOT Analysis

Figure 59 Cargill, Incorporated.: Company Snapshot

Figure 60 Cargill Incorporated.: SWOT Analysis

Figure 61 Royal DSM N.V.: Company Snapshot

Figure 62 Royal DSM N.V.: SWOT Analysis

Figure 63 Nutreco N.V.: Company Snapshot

Figure 64 Nutreco N.V.: SWOT Analysis

Figure 65 Charoen Pokphand Group: Company Snapshot

Figure 66 Land O’lakes Inc.: Company Snapshot

Figure 67 Country Bird Holdings: Company Snapshot

Growth opportunities and latent adjacency in Cattle Feed & Feed Additives Market

Thanks for the information. Really informative and useful content. Hope to see more of these articles relating to cattle feeds.