Cardiovascular Ultrasound System Market by Test Type (Transesophageal, Stress, Transthoracic, Fetal), Technology (2D, 3D & 4D, Doppler Imaging), Device Display (Black & White, Color), End User (Hospitals, Home Care, Ambulatory)- Global Forecast to 2022

The global cardiovascular ultrasound system market size is projected to grow at a CAGR of 5.4%. In this report, the global market is segmented on the basis of test type, technology, device display, end user, and region.

Based on test type, the cardiovascular ultrasound system market is categorized into transthoracic echocardiogram, transesophageal echocardiogram, stress echocardiogram, and other echocardiograms. The other echocardiograms include fetal & intracardiac echocardiograms. The stress echocardiogram segment is expected to account for the fastest growth during the forecast period. This growth can be attributed to the advantages of the stress echocardiogram that it can provide data of the cardiac muscles and valves before and after the stress of the heart muscle.

Based on technology, the market is segmented into 2D, 3D & 4D, and Doppler imaging. The 3D & 4D technology segment is estimated to account for the highest CAGR during the forecast period due to better image resolution provided by this technology. On the basis of end user, the cardiovascular ultrasound system market is classified into hospitals, home care & ambulatory, and other end users (research institutes, laboratories, and pharmaceutical companies). The hospitals segment is estimated to account for the highest growth of the market in 2016 due to increasing usage of echocardiographs in hospitals especially in intensive care units (ICUs).

The growth of the cardiovascular ultrasound system market is propelled by increasing incidence of CVDs, technological advancements, and advantages of echocardiography over invasive cardiac diagnostic procedures. However, factors such as insufficient reimbursement scenario and economic impact of adopting new technologies are hindering the growth of the market.

The major key players in the cardiovascular ultrasound system market include GE Healthcare (U.S.), Philips Healthcare (The Netherlands), Siemens Healthcare (Germany), Hitachi Medical Corporation (Japan), and Toshiba Medical Systems Corporation (Japan).

Target Audience:

- Cardiovascular ultrasound system manufacturers

- Cardiovascular ultrasound system distributors and wholesalers

- Pharmaceutical companies

- Various research and consulting firms

- Research institutes

- Contract manufacturing organizations (CMOs)

- Original equipment manufacturers (OEMs)

To know about the assumptions considered for the study, download the pdf brochure

Cardiovascular Ultrasound System Market Report Scope

- This study covers the global and regional market for the cardiovascular ultrasound system market —by test type, technology, device display, and end user

|

Particular |

Scope |

|

Region |

|

|

Revenue Currency |

USD |

Market Segmentation

By Test Type

- Transthoracic Echocardiogram

- Transesophageal Echocardiogram

- Stress Echocardiogram

- Other Echocardiograms (Fetal and Intracardiac Echocardiograms)

By Technology

- 2D

- 3D & 4D

- Doppler Imaging

By Device Display

- Color Display

- Black & White (B/W) Display

By End User

- Hospitals/Cardiology Centers

- Ambulatory/Home Care

- Other End Users (Research Institutes, Medical Device and Pharmaceutical Companies)

By Region

-

North America

- U.S.

- Canada

- Europe

-

Asia-Pacific

- India

- China

- Japan

- Australia

- New Zealand

- Rest of the Asia-Pacific (RoAPAC)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the European cardiovascular ultrasound system market into Germany, France, the U.K., Italy, and Spain

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Increasing incidence of cardiovascular diseases, technological advancements, and advantages of echocardiography over invasive cardiac diagnostic procedures is driving the growth of this market during the forecast period.

By test type the stress echocardiogram segment is expected to be the faster growing in the cardiovascular ultrasound system market during the forecast period.

The stress echocardiogram segment is projected to grow at the highest CAGR. The stress echocardiogram can provide data of the cardiac muscles and valves before and after the stress of the heart muscle.

By end user, the home care & ambulatory segment is growing at the highest rate.

The home care & ambulatory segment is projected to grow at the highest rate in the market, by end user. The highest growth is due increase in the usage of echocardiographs at the patient’s house itself

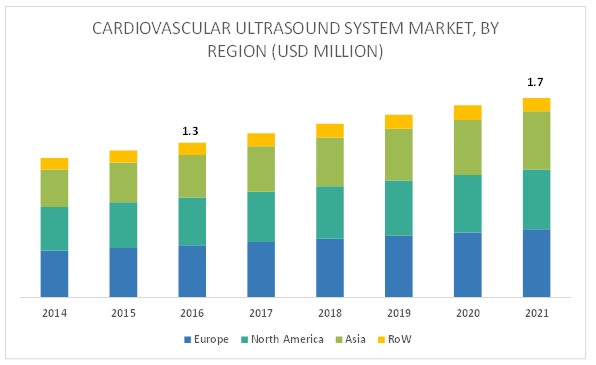

Europe is expected to account for the largest market share during the forecast period.

The cardiovascular ultrasound system market is divided into four major regions-North America, Europe, Asia Pacific, and the Rest of the World (RoW). In 2016, Europe is expected to account for the largest share of this market, followed by North America. Factors such as growing product commercialization, expansion in clinical applications of HIFU coupled with their early commercialization in Europe, and growing emphasis on non-invasive procedures by patients and physicians are driving the growth of this market

On the other hand, the market in the Asia Pacific is estimated to grow at the highest CAGR during the forecast period. The presence of emerging economies such as China and India and the increasing healthcare spending, research and innovation, and medical tourism supporting the growth of the Asia Pacific cardiovascular ultrasound system market.

Key Market Players

Key players in the cardiovascular ultrasound system market include GE Healthcare (U.S.), Philips healthcare (The Netherlands), Siemens Healthcare (Germany), Hitachi Medical Corporation (Japan), and Toshiba Medical Systems Corporation (Japan).

GE Healthcare (U.S.) is the largest player in the global cardiovascular ultrasound systems market. The company focuses on growth strategies such as product launches, acquisitions, expansions, agreements, collaborations, and partnerships, in order to sustain its foothold in the market. For instance, in August 2016, the company launched the Vivid iq, a high-end portable, compact cardiovascular ultrasound product at the European Society of Cardiology Congress in Rome, Italy. This launch strengthened the company’s echocardiography product portfolio. In September 2015, GE Healthcare established its new business unit-Sustainable Healthcare Solutions (SHS) at New York City, U.S.

Recent Developments:

- In 2015, GE Healthcare signed a memorandum of understanding with the Oregon Health & Science University (U.S.) to undertake collaborative R&D studies in the field of cardiovascular imaging & treatment as well as in big data research

- In 2015, GE Healthcare launched a new 4D cardiac ultrasound software—cSound—for three new ultrasound systems, namely, VividS70, VividE90, and VividE95 in the U.S. and some countries in Europe, Asia, and LatinAmerica.

Key questions addressed by the report:

- Who are the major market players in the cardiovascular ultrasound system market?

- What are the regional growth trends and the largest revenue-generating regions for cardiovascular ultrasound system market?

- What are the major drivers and challenges in the cardiovascular ultrasound system market?

- What are the major product segments in the cardiovascular ultrasound system market?

- What are the major end users for cardiovascular ultrasound system?

Frequently Asked Questions (FAQ):

What is the size of Cardiovascular Ultrasound System Market ?

The global Cardiovascular Ultrasound System Market size is growing at a CAGR of 5.4%

What are the major growth factors of Cardiovascular Ultrasound System Market ?

The growth of the cardiovascular ultrasound system market is propelled by increasing incidence of CVDs, technological advancements, and advantages of echocardiography over invasive cardiac diagnostic procedures. However, factors such as insufficient reimbursement scenario and economic impact of adopting new technologies are hindering the growth of the market.

Who all are the prominent players of Cardiovascular Ultrasound System Market ?

The major key players in the cardiovascular ultrasound system market include GE Healthcare (U.S.), Philips Healthcare (The Netherlands), Siemens Healthcare (Germany), Hitachi Medical Corporation (Japan), and Toshiba Medical Systems Corporation (Japan). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Geographic Scope

1.5 Years Considered for the Study

1.6 Currency

1.7 Limitations

1.8 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Breakdown and Data Triangulation Method

2.3 Market Breakdown and Data Triangulation

2.4 Market Size Estimation

3 Executive Summary

3.1 Global Cardiovascular Ultrasound Systems Market

3.2 Global Cardiovascular Ultrasound Systems Market, By Test Type

3.3 Global Cardiovascular Ultrasound Systems Market, By Region, 2016

3.4 Global Cardiovascular Ultrasound Systems Market, By End User

4 Premium Insights

4.1 Global Cardiovascular Ultrasound Systems: Market Overview

4.2 Geographicsnapshot: Cardiovascular Ultrasound Systems Market, By Test Type (2016)

4.3 Global Cardiovascular Ultrasound Systems Market, By Region, 2016–2021

4.4 Global Cardiovascular Ultrasound Systems Market, By Technology, 2016 vs 2021

5 Market Overview

5.1 Introduction

5.2 Drivers

5.2.1 Growing Incidence of CVDs

5.2.2 Technological Advancements

5.2.3 Advantages of Echocardiography Over Invasive Cardiac Diagnostic Procedures

5.3 Restraints

5.3.1 Unfavourable Reimbursement Scenario

5.3.2 Economic Impact of Adopting New Technologies

5.4 Opportunities

5.4.1 Growth Potential in Untapped Emerging Markets

5.4.2 Miniaturization of Ultrasound Devices

5.5 Challenges

5.5.1 Dearth of Skilled and Experienced Sonographers

6 Cardiovascular Ultrasound System Market -By Test Type

6.1 Introduction

6.2 Transthoracic Echocardiogram

6.3 Transesophageal Echocardiogram

6.4 Stress Echocardiogram

6.5 Other Echocardiograms

7 Cardiovascular Ultrasound Systems Market -By Technology

7.1 Introduction

7.2 2D Ultrasound

7.3 3D & 4D Ultrasound

7.4 Doppler Imaging

8 Cardiovascular Ultrasound System Market -By Device Display

8.1 Introduction

8.2 Colordisplay

8.3 Black & White (B/W) Display

9 Cardiovascular Ultrasound System Market -By End User

9.1 Introduction

9.2 Hospital and Cardiology Centers

9.3 Home and Ambulatory Care Settings

9.4 Other End Users

10 Cardiovascular Ultrasound System Market -By Region

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.4 Asia-Pacific

10.4.1 Japan

10.4.2 China

10.4.3 Australia

10.4.4 India

10.4.5 New Zealand

10.4.6 Rest of Asia-Pacific (RoAPAC)

10.5 RoW

11 Competitive Analysis

11.1 Overview

11.2 Growth Strategies Adopted By Major Players in the Cardiovascular Ultrasound System Market (2014–2016)

11.3 Rank of Companies in the Global Cardiovascular Ultrasound System Market, 2015

12 Company Profiles

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

12.1 Introduction

12.2 GE Healthcare

12.3 Philips Healthcare

12.4 Siemens Healthcare

12.5 Hitachi Medical Corporation

12.6 Toshiba Medical Systems Corporation

12.7 Mindray Medical International Limited

12.8 Samsung Electronics Co., Ltd.

12.9 Fujifilm Holdings Corporation

12.10 Esaote S.P.A.

12.11 Chison Medical Imaging Co., Ltd.

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Authors Details

List of Tables (93 Tables)

Table 1 Cardiovascular Ultrasound System Market, By Test Type, 2016

Table 2 List of Invasive and Noninvasive Cardiac Diagnostic Procedures

Table 3 Global Cardiovascular Ultrasound System Market Size, By Test Type, 2014–2021 (USD Million)

Table 4 Transthoracic Echocardiogram Market Size, By Region, 2014–2021 (USD Million)

Table 5 North America: Transthoracic Echocardiogram Market Size, By Country, 2014–2021 (USD Million)

Table 6 Asia-Pacific: Transthoracic Echocardiogram Market Size, By Country, 2014–2021 (USD Million)

Table 7 Transesophageal Echocardiogram Market Size, By Region, 2014–2021 (USD Million)

Table 8 North America: Transesophageal Echocardiogram Market Size, By Country, 2014–2021 (USD Million)

Table 9 Asia-Pacific: Transesophageal Echocardiogram Market Size, By Country, 2014–2021 (USD Million)

Table 10 Stress Echocardiogram Market Size, By Region, 2014–2021 (USD Million)

Table 11 North America: Stress Echocardiogram Market Size, By Country, 2014–2021 (USD Million)

Table 12 Asia-Pacific: Stress Echocardiogram Market Size, By Country, 2014–2021 (USD Million)

Table 13 Other Echocardiograms Market Size, By Region, 2014–2021 (USD Million)

Table 14 North America: Other Echocardiograms Market Size, By Country, 2014–2021 (USD Million)

Table 15 Asia-Pacific: Other Echocardiograms Market Size, By Country, 2014–2021 (USD Million)

Table 16 Global Cardiovascular Ultrasound System Market Size, By Technology, 2014–2021 (USD Million)

Table 17 2D Ultrasound Market Size, By Region, 2014–2021 (USD Million)

Table 18 North America: 2D Ultrasound Market Size, By Country, 2014–2021 (USD Million)

Table 19 Asia-Pacific: 2D Ultrasound Market Size, By Country, 2014–2021 (USD Million)

Table 20 3D & 4D Ultrasound Market Size, By Region, 2014–2021 (USD Million)

Table 21 North America: 3D & 4D Ultrasound Market Size, By Country, 2014–2021 (USD Million)

Table 22 Asia-Pacific: 3D & 4D Ultrasound Market Size, By Country, 2014–2021 (USD Million)

Table 23 Doppler Imaging Ultrasound Market Size, By Region, 2014–2021 (USD Million)

Table 24 North America: Doppler Imaging Ultrasound Market Size, By Country, 2014–2021 (USD Million)

Table 25 Asia-Pacific: Doppler Imaging Ultrasound Market Size, By Country, 2014–2021 (USD Million)

Table 26 Global Cardiovascular Ultrasound System Market Size, By Device Display, 2014–2021 (USD Million)

Table 27 Color Displays Market Size, By Region, 2014–2021 (USD Million)

Table 28 North America: Color Displays Market Size, By Country, 2014–2021 (USD Million)

Table 29 Asia-Pacific: Color Displays Market Size, By Country, 2014–2021 (USD Million)

Table 30 B/W Displays Market Size, By Region, 2014–2021 (USD Million)

Table 31 North America: B/W Displays Market Size, By Country, 2014–2021 (USD Million)

Table 32 Asia-Pacific: B/W Displays Market Size, By Country, 2014–2021 (USD Million)

Table 33 Global Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

Table 34 Cardiovascular Ultrasound Systems Market Size for Hospitals & Cardiology Centers, By Region, 2014–2021 (USD Million)

Table 35 North America: Cardiovascular Ultrasound Systems Market Size for Hospitals & Cardiology Centers, By Country, 2014–2021 (USD Million)

Table 36 Asia-Pacific: Cardiovascular Ultrasound Systems Market Size for Hospitals & Cardiology Centers, By Country, 2014–2021 (USD Million)

Table 37 Cardiovascular Ultrasound Systems Market Size for Home & Ambulatory Care Settings, By Region, 2014–2021 (USD Million)

Table 38 North America: Cardiovascular Ultrasound System Market Size for Home & Ambulatory Care Settings, By Country, 2014–2021 (USD Million)

Table 39 Asia-Pacific: Cardiovascular Ultrasound System Market Size for Home & Ambulatory Care Settings, By Country, 2014–2021 (USD Million)

Table 40 Cardiovascular Ultrasound System Market Size for Other End Users, By Region, 2014–2021 (USD Million)

Table 41 North America: Cardiovascular Ultrasound System Market Size for Other End Users, By Country, 2014–2021 (USD Million)

Table 42 Asia-Pacific: Cardiovascular Ultrasound System Market Size for Other End Users, By Country, 2014–2021 (USD Million)

Table 43 Global Cardiovascular Ultrasound Systems Market Size, By Region, 2014 -2021 (USD Million)

Table 44 North America: Cardiovascular Ultrasound Systems Market Size, By Country, 2014–2021 (USD Million)

Table 45 North America: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 46 North America: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 47 North America: Cardiovascular Ultrasound System Market Size, By Device Display, 2014–2021 (USD Million)

Table 48 North America: Cardiovascular Ultrasound System Market Size, By End User, 2014–2021 (USD Million)

Table 49 U.S.: Cardiovascular Ultrasound System Market Size, By Test Type, 2014–2021 (USD Million)

Table 50 U.S.: Cardiovascular Ultrasound System Market Size, By Technology, 2014–2021 (USD Million)

Table 51 U.S.: Cardiovascular Ultrasound System Market Size, By Device Display, 2014–2021 (USD Million)

Table 52 U.S.: Cardiovascular Ultrasound System Market Size, By End User, 2014–2021 (USD Million)

Table 53 Canada: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 54 Canada: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 55 Canada: Cardiovascular Ultrasound Systems Market Size, By Device Display, 2014–2021 (USD Million)

Table 56 Canada: Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

Table 57 Europe: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 58 Europe: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 59 Europe: Cardiovascular Ultrasound Systems Market Size, By Device Display, 2014–2021 (USD Million)

Table 60 Europe: Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

Table 61 Asia-Pacific: Cardiovascular Ultrasound Systems Market Size, By Country, 2014–2021 (USD Million)

Table 62 Asia-Pacific: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 63 Asia-Pacific: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 64 Asia-Pacific: Cardiovascular Ultrasound Systems Market Size, By Device Display, 2014–2021 (USD Million)

Table 65 Asia-Pacific: Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

Table 66 Japan: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 67 Japan: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 68 Japan: Cardiovascular Ultrasound Systems Market Size, By Device Display, 2014–2021 (USD Million)

Table 69 Japan: Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

Table 70 China: Cardiovascular Ultrasound Systems Market Size, By Device Display, 2014–2021 (USD Million)

Table 71 China: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 72 China: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 73 China: Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

Table 74 Australia: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 75 Australia: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 76 Australia: Cardiovascular Ultrasound Systems Market Size, By Device Display, 2014–2021 (USD Million)

Table 77 Australia: Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

Table 78 India: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 79 India: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 80 India: Cardiovascular Ultrasound Systems Market Size, By Device Display, 2014–2021 (USD Million)

Table 81 India: Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

Table 82 New Zealand: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 83 New Zealand: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 84 New Zealand: Cardiovascular Ultrasound Systems Market Size, By Device Display, 2014–2021 (USD Million)

Table 85 New Zealand: Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

Table 86 RoAPAC: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 87 RoAPAC: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 88 RoAPAC: Cardiovascular Ultrasound Systems Market Size, By Device Display, 2014–2021 (USD Million)

Table 89 RoAPAC: Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

Table 90 RoW: Cardiovascular Ultrasound Systems Market Size, By Test Type, 2014–2021 (USD Million)

Table 91 RoW: Cardiovascular Ultrasound Systems Market Size, By Technology, 2014–2021 (USD Million)

Table 92 RoW: Cardiovascular Ultrasound Systems Market Size, By Device Display, 2014–2021 (USD Million)

Table 93 RoW: Cardiovascular Ultrasound Systems Market Size, By End User, 2014–2021 (USD Million)

List of Figures (43 Figures)

Figure 1 Research Design: Cardiaovascular Ultrasound Systems Market

Figure 2 Cardiovascular Ultrasound Systems Market Share, By Test Type (2016) vs (2021)

Figure 3 Cardiovascular Ultrasound Systems Market Share, By Region (2016)

Figure 4 Home and Ambulatory Care Settings Segment to Register the Highest Growth During the Forecast Period

Figure 5 Increasing Incidence of Cardiovascular Diseases to Drive Market Growth

Figure 6 Transthoracic Echocardiogram Segment to Command the Largest Market Share in 2016

Figure 7 Cardiovascular Ultrasound Systems Market in Asia to Grow at the Highest Rate

Figure 8 3D & 4D Segment to Grow at the Highest Rate During the Forecast Period

Figure 9 Cardiovascular Ultrasound Systems Market Dynamics: Drivers, Restraints, Opportunities, and Challenges

Figure 10 Number of Deaths Due to CVD, 1990 vs 2012 vs 2030

Figure 11 Technological Advancements in Echocardiography Devices

Figure 12 Europe to Account for the Largest Share in 2016

Figure 13 Europe to Account for Largest Share of Tee Market in 2016

Figure 14 Europe to Command Largest Share in 2016

Figure 15 3D and 4D Ultrasound Segment to Grow at Highest Rate During Forecast Period (2016-2021)

Figure 16 Asia-Pacific to Grow at Highest CAGR in 2D Ultrasound Market in 2016

Figure 17 Asia-Pacific to Grow at Highest CAGR in 3D and 4D Ultrasound Market During Forecast Period (2016-2021)

Figure 18 Color Displays Segment to Register Highest Growth During Forecast Period (2016-2021)

Figure 19 Asia-Pacific to Register Highest Growth in Color Displa Segment During Forecast Period (2016-2021)

Figure 20 RoW to Grow at Highest CAGR in B/W Displaysegment During Forecast Perio (2016-2021)

Figure 21 Home and Ambulatory Care Settings to Register Highest Growth During Forecast Period (2016-2021)

Figure 22 Asia-Pacific Hospitals and Cardiology Centers Segment to Register Highest Growth During Forecast Period (2016-2021)

Figure 23 Asia-Pacific Other End Users Segment to Register Highest Growth During Forecast Period (2016-2021)

Figure 24 Asian Market to Grow at the Highest Rate in the Forecast Period

Figure 25 North America: Stress Echocardiogram Segment to Grow at Highest CAGR During Forecast Period (2016-2021)

Figure 26 North America: Home and Ambulatory Care Settings Segment to Grow at Highest CAGR During Forecast Period (2016-2021)

Figure 27 U.S.: Home and Ambulatory Care Settings Segment to Register Highest Growth During Forecast Period (2016-2021)

Figure 28 Canada: Stress Echocardiogram Segment to Register Highest Growth During Forecast Period (2016-221)

Figure 29 Canada: 3D and 4D Segment to Register Highest Growth During Forecast Period (2016-2021)

Figure 30 Canada: Color Displays Segment to Register Highest Growth During Forecast Period (2016-2021)

Figure 31 Canada: Home and Ambulatory Care Settings Segment to Register Highest Growth During Forecast Period (2016-2021)

Figure 32 Europe: Stress Echocardiogram Segment to Register Highest Growth During Forecast Period (2016-2021)

Figure 33 Europe: Home and Ambulatory Care Settings Segment to Grow at Highest CAGR During Forecast Period (2016-2021)

Figure 34 Asia-Pacific: Transesophageal Echocardiogram Segment to Grow at Highest CAGR During Forecast Period (2016-2021)

Figure 35 Japan: Stress Echocardiogram Segment to Grow at Highest CAGR During Forecast Period (2016-2021)

Figure 36 New Zealand: Stress Echocardiogram Segment to Grow at Highest CAGR During Forecast Period (2016-2021)

Figure 37 RoAPAC: Stress Echocardiogram Segment to Grow at Highest CAGR During Forecast Period (2016-2021)

Figure 38 RoW: 2D and 3D Segment to Grow at Highest CAGR During Forecast Period (2016-2021)

Figure 39 RoW: Color Displays Segment to Grow at Highest CAGR During Forecast Period (2016-2021)

Figure 40 RoW: Home and Ambulatory Care Settings Segment to Grow at Highest CAGR During Forecast Period (2016-2021)

Figure 41 Growth Strategies Adopted By Major Players in Cardiovascular Ultrasound Systems Market (2014–2016)

Figure 42 Top 3 Cardiovascular Ultrasound Systems Market Players, 2015

Figure 43 Geographic Revenue Mix of Top 5 Market Players (2015)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cardiovascular Ultrasound System Market