Vascular Imaging Market Size, Growth, Share & Trends Analysis

Vascular Imaging Market by Technology (MRI, Ultrasound, CT, Hybrid, OCT), Application (Atherosclerosis, DVT, Vasculitis, Aneurysmal Disorders, AV Malformations, Tumours, Others), End User (Hospitals, Diagnostic Imaging Centers) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

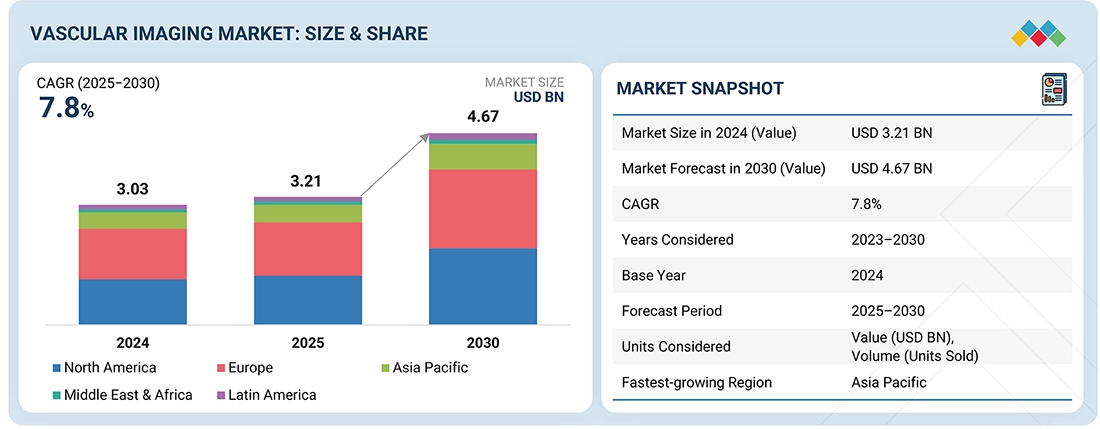

The vascular imaging market is projected to reach USD 4.54 billion by 2030 from USD 3.19 billion in 2025, at a CAGR of 7.3% from 2025 to 2030. The growth of the vascular imaging market is driven by the rising prevalence of cardiovascular diseases, including atherosclerosis, peripheral artery disease, and stroke, which demand early diagnosis and monitoring. Technological advancements, such as high-resolution ultrasound, CT angiography, and MRI angiography, enhance imaging accuracy and patient safety, fueling adoption.

KEY TAKEAWAYS

-

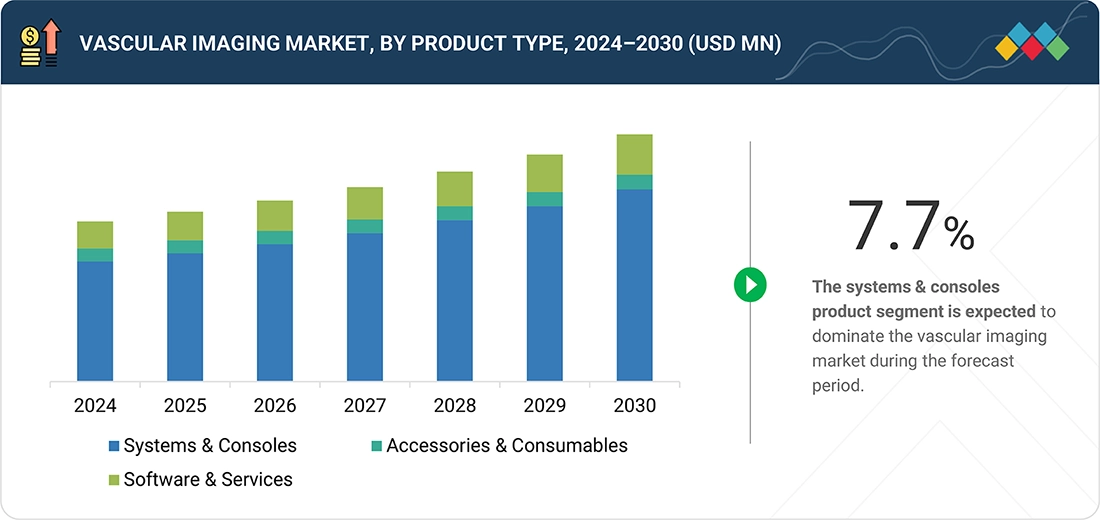

BY PRODUCT TYPEProduct type comprises systems & consoles, accessories & consumables, software & services. Systems and consoles hold the largest share in the vascular imaging market because they form the core hardware for performing high-quality imaging procedures across various modalities, including CT, MRI, and ultrasound.

-

BY APPLICATIONAtherosclerosis accounts for the highest market share in vascular imaging because it is the most common underlying cause of cardiovascular diseases, including heart attack, stroke, and peripheral artery disease. Its global prevalence is rising due to aging populations, sedentary lifestyles, poor dietary habits, diabetes, hypertension, and obesity. Since the disease develops silently over time and often remains asymptomatic until severe complications arise, there is a strong demand for early detection and monitoring through vascular imaging modalities, such as ultrasound, CT angiography, and MR angiography.

-

BY END USERThe end users comprise hospitals, diagnostic imaging centers, ambulatory surgery centers, and other healthcare facilities. Hospitals account for the largest share of the vascular imaging market because they serve as primary centers for the diagnosis and treatment of complex cardiovascular and peripheral vascular diseases, requiring advanced imaging infrastructure and skilled professionals.

-

BY REGIONThe market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is witnessing the highest CAGR in the vascular imaging market due to its rapidly growing patient population and rising prevalence of cardiovascular diseases. Factors such as sedentary lifestyles, increasing rates of obesity, diabetes, and hypertension are fueling a surge in demand for advanced diagnostic imaging across the region.

-

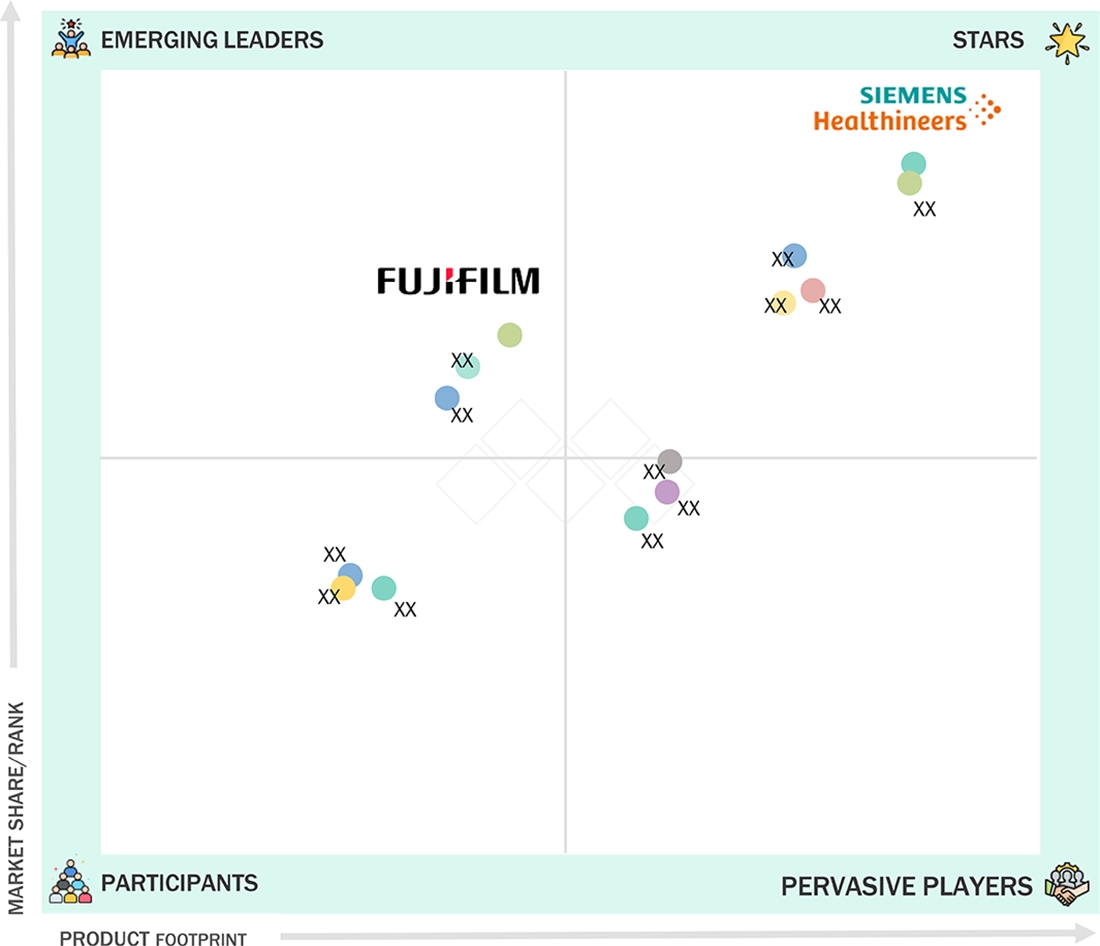

COMPETITIVE LANDSCAPEAs of 2024, the prominent players in the market are Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), FUJIFILM Corporation (Japan), Hologic Inc. (US), Samsung Electronics Co., Ltd. (South Korea), Mindray Medical International Limited (China), among several others.

The vascular imaging market is driven by the rising incidence of cardiovascular and peripheral vascular diseases worldwide, increasing demand for early and accurate diagnosis, and the growing preference for minimally invasive procedures. Technological advancements, such as AI-powered imaging, 3D/4D visualization, and hybrid imaging systems, enhance diagnostic precision and workflow efficiency, further boosting adoption.

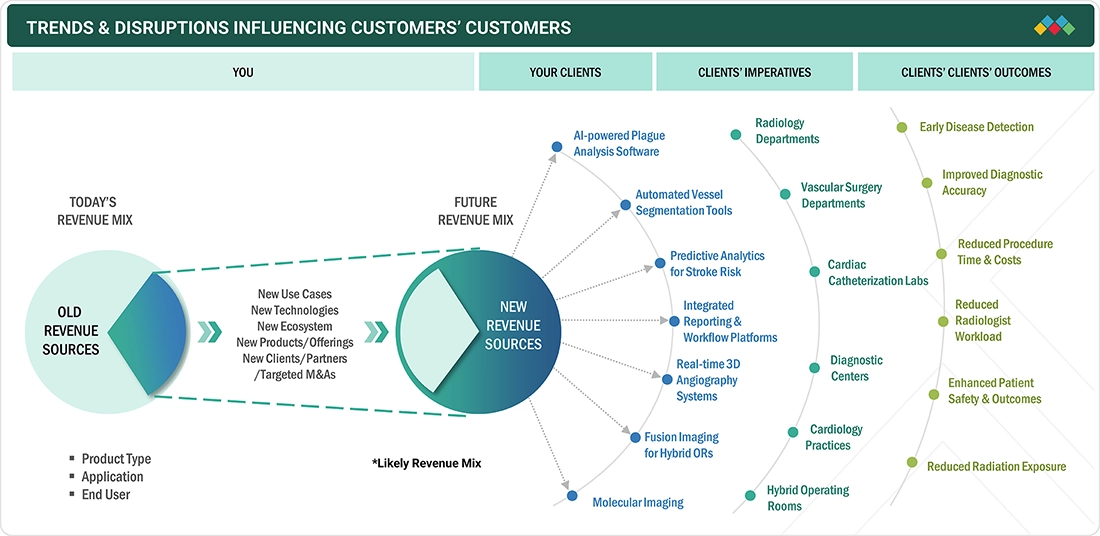

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Emerging trends and technological disruptions in vascular imaging are transforming the market by enabling more precise, efficient, and personalized patient care. The integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing image analysis, automating vessel segmentation, plaque characterization, and flow dynamics assessment, which significantly reduces diagnostic time and human error.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising Prevalence of cardiovascular diseases

-

Minimally invasive and personalized interventions

Level

-

High cost and resource requirements

-

Radiation exposure and contrast related risks

Level

-

Expanding economies offer high growth potential

-

Increasing establishment of hospitals and diagnostic imaging centers

Level

-

Dearth of trained professionals

-

Hospital budget cuts

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising prevalence of cardiovascular diseases

The rising prevalence of cardiovascular diseases (CVDs) directly drives the vascular imaging market, as more people develop heart and vascular conditions, resulting in a greater demand for accurate, timely, and non-invasive diagnostic tools. Advanced imaging techniques, such as ultrasound, intravascular ultrasound (IVUS), optical coherence tomography (OCT), and CT/MR angiography, help clinicians detect, monitor, and guide treatment for CVDs. Higher patient volumes translate into increased utilization of imaging systems in hospitals, diagnostic centers, and ambulatory clinics, prompting healthcare providers to invest in state-of-the-art vascular imaging technologies to improve patient outcomes and support preventive care. • The stable age-standardized CVD prevalence indicates that overall preventive efforts have had limited net impact, while declining age-standardized mortality reflects improved medical care. However, crude cardiovascular deaths are expected to rise sharply due to global aging, with atherosclerotic diseases driving much of the growing burden. (Source: PubMed, 2025) • Globally, cardiovascular risk is driven by a combination of clinical factors, hypertension (24%), diabetes (10%), dyslipidemia (39%), and lifestyle behaviors like smoking (36%), alcohol use (16%), tobacco use (causing 1.9 million deaths), poor diet (12%), and physical inactivity (11%). Psychosocial stress, depression, major life events (32%), along with genetic and socio-economic factors, further increase the risk of intravascular thrombosis and cardiovascular events, creating varied outcomes across populations. (Source: PubMed, 2024) • By 2050, Asia’s crude CVD prevalence is expected to reach 729.5 million, a 109% increase from 2025, with ischemic heart disease (338 million), peripheral artery disease (151 million), and stroke (144.3 million) comprising nearly 87% of cases. Heart failure is projected at 74.5 million, a 127.6% rise from 2025. (Source: Elsevier, 2024) The rising prevalence of cardiovascular diseases driven by aging populations, lifestyle risk factors, and the increasing burden of conditions such as ischemic heart disease, stroke, and peripheral artery disease is fueling demand for accurate and timely diagnostic tools. This surge in CVD cases directly boosts the need for advanced vascular imaging technologies, including ultrasound, IVUS, OCT, and CT/MR angiography, as healthcare providers seek to detect, monitor, and manage vascular conditions effectively. Consequently, the growing patient pool and the emphasis on early diagnosis and minimally invasive interventions are key factors driving sustained growth in the vascular imaging market.

Restraint: High cost and resource requirements

Advanced vascular imaging systems, such as CT angiography, MR angiography, intravascular ultrasound (IVUS), and AI-enabled OCT, involve substantial initial investments. The equipment itself is expensive, and additional costs arise from maintenance, software updates, and specialized consumables, such as contrast agents and catheters. These high capital and operational expenses often limit access, particularly in smaller hospitals or developing regions, restricting the widespread adoption of these technologies. Beyond the financial burden, these systems demand significant human and technical resources. Skilled radiologists, cardiologists, and trained technicians are essential for accurate image acquisition and interpretation. Furthermore, infrastructure requirements, such as dedicated imaging suites, IT integration, and data storage, add to the complexity and cost. As a result, the deployment of vascular imaging technologies remains concentrated in well-resourced centers, slowing equitable access to advanced vascular care. In emerging nations like Brazil, the average cost of high- and very-high-field MRI systems ranges from USD 1.3 million to USD 2.0 million. A mid-range slice CT system costs approximately USD 150,000 to USD 300,000. The cost of a PET system ranges from USD 400,000 to USD 600,000, while a SPECT system costs between USD 250,000 and USD 400,000. These high costs, along with maintenance expenses, tend to hinder market growth. In the US, a CT system can cost up to USD 2.5 million. MRI machines are slightly more expensive, reaching around USD 3 million. Ultrasound systems range from USD 10,000 to USD 200,000, depending on brand and type. Due to the rising demand for affordable medical imaging equipment, the adoption of refurbished devices is increasing, which may restrict market growth during the forecast period. Moreover, healthcare facilities that purchase such costly systems often depend on third-party payers (such as Medicare, Medicaid, or private health insurance plans) for reimbursement for the costs incurred in the diagnostic, screening, and therapeutic procedures performed using these systems. As a result, continuous cuts in reimbursements for diagnostic imaging scans and the increasing cost of vascular imaging systems are preventing medium-sized and small healthcare facilities from investing in technologically advanced systems.

Opportunity: Emerging economies offer high growth potential

Emerging economies such as India, China, Brazil, South Korea, Turkey, Russia, and South Africa present attractive opportunities for the vascular imaging market. These countries are experiencing a surge in the prevalence of chronic diseases, including cardiovascular and neurological disorders, peripheral artery disease, and stroke, which are major drivers for diagnostic imaging demand. The large patient base, coupled with growing healthcare awareness and improved access to screening programs, is creating a strong need for advanced vascular imaging solutions. Governments and private healthcare providers in these countries are making substantial investments in diagnostic facilities, which are improving access to vascular imaging services. Manufacturers are responding by expanding their presence through local production units, partnerships with hospitals and diagnostic chains, and the launch of cost-effective imaging systems designed for high-volume use. For example, Siemens Healthineers has strengthened its presence in Asia by setting up a manufacturing facility in India to produce magnetic resonance imaging (MRI) systems. Furthermore, regulatory policies in the Asia Pacific and other emerging markets are becoming more supportive, enabling faster product approvals and encouraging global players to introduce the latest imaging technologies in these regions. As competition and pricing pressure intensify in developed markets, manufacturers are increasingly prioritizing emerging markets to capture untapped demand. This focus is expected to drive the adoption of modern vascular imaging technologies, improve clinical outcomes, and generate sustainable long-term growth for market participants. Imaging systems locally, reducing costs and improving availability.

Challenge: Hospital budget cuts

Hospitals in the US are facing increasing financial pressure, which limits their ability to invest in advanced imaging technologies. While overall operating costs have risen sharply in recent years, reimbursement rates have failed to keep pace, resulting in squeezed profit margins and forcing administrators to delay or scale back capital investments. Many hospitals are now operating with reduced cash reserves and older equipment, as capital budgets shrink and equipment replacement cycles lengthen. The average age of diagnostic imaging systems is increasing, and planned upgrades are frequently postponed. These trends are particularly pronounced in rural and community hospitals, where financial vulnerabilities are more pronounced. In parallel, hospitals are absorbing substantial underpayments from public insurance programs such as Medicare and Medicaid, further limiting available funds for infrastructure upgrades. This has led to difficult choices, with spending often prioritized for immediate patient care needs over long-term investments in technology. As a result, there is a growing migration of imaging procedures from hospital-based settings to outpatient imaging centers, which offer lower-cost alternatives. Hospitals face declining imaging volumes, further weakening the financial justification for high-cost imaging system purchases or upgrades. This shift is contributing to a reduction in imaging capacity within hospitals and delayed access to advanced diagnostics for patients.

vascular-imaging-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integration of advanced 3D rotational angiography and AI-assisted image processing in vascular imaging systems (Azurion series) | Enables high-resolution 3D visualization of vessels, improves diagnostic accuracy, and supports minimally invasive interventions with reduced contrast use |

|

Deployment of advanced vascular imaging technologies through LOGIQ ultrasound systems integrated with AI-driven vascular analysis tools | Delivers superior image sharpness and vessel delineation at lower radiation and contrast dose; Enhances diagnostic confidence in detecting vascular blockages and abnormalities, improves workflow efficiency with automated vessel tracking, and supports precise pre- and post-intervention assessment. |

|

Application of dual-source CT angiography technology in SOMATOM Force scanners for vascular imaging | Provides superior temporal resolution, faster scan times, and improved visualization of small vessels with reduced contrast agent requirements. |

|

Compact CT scanners Supria Series (Supria 32, Supria 128) equipped with iterative reconstruction technology and low-dose protocols for vascular imaging studies | Improves the visualization of plaque and vessel lumen, offers high-resolution vascular imaging at low radiation doses, and facilitates quick picture capture for effective workflow and precise diagnosis |

|

Aplio i-series Ultrasound Systems – Incorporates Micro-Vascular Imaging (SMI) and contrast-enhanced ultrasound (CEUS) for vascular imaging in peripheral and abdominal applications | Enables visualization of low-velocity blood flow in micro vessels, enhances detection of vascular lesions and plaque morphology, supports real-time evaluation without ionizing radiation, and improves diagnostic accuracy in early vascular disease detection |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The vascular imaging market comprises various stakeholders, including manufacturers, suppliers, software developers, distributors, healthcare providers, and regulators. Manufacturers lead innovation with AI and wireless technology, while suppliers provide essential hardware and software. Distributors ensure market access, and regulatory bodies uphold safety standards. Healthcare professionals promote the adoption of technology across various care settings, supporting a market for accessible diagnostic imaging. The key companies include Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems (Japan), Siemens Healthineers (Germany), Fujifilm (Japan), Hologic (US), Mindray (China), among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Vascular Imaging Market, By Product Type

Systems & consoles account for the largest market share in the vascular imaging market, as they represent the core hardware necessary for performing imaging procedures across hospitals, clinics, and diagnostic centers. These devices, including ultrasound machines, OCT, and angiography systems, are essential for acquiring high-resolution vascular images, which are critical for diagnosis, treatment planning, and intraoperative guidance.

Vascular Imaging Market, By Application

Atherosclerosis accounts for the highest market share in vascular imaging because it is the most common underlying cause of cardiovascular diseases, including heart attack, stroke, and peripheral artery disease. Its global prevalence is rising due to aging populations, sedentary lifestyles, poor dietary habits, diabetes, hypertension, and obesity. Since the disease develops over time and often remains asymptomatic until severe complications arise, there is a strong demand for early detection and monitoring through vascular imaging modalities, such as ultrasound, CT angiography, and MR angiography. This widespread need for screening and diagnosis makes atherosclerosis the leading application area for vascular imaging. Moreover, atherosclerosis requires long-term disease management and follow-up, which drives repeated use of imaging to assess plaque buildup, vessel narrowing, and treatment efficacy after interventions like stenting or bypass surgery. The integration of advanced imaging technologies, including 3D/4D imaging, Doppler techniques, and AI-assisted analysis, further enhances diagnostic accuracy and risk stratification for atherosclerotic disease. As a result, the combination of high prevalence, severe health impact, and continuous monitoring needs ensures that atherosclerosis dominates the vascular imaging market.

Vascular Imaging Market, By End User

Hospitals account for the highest market share in the vascular imaging market primarily due to their comprehensive infrastructure, advanced imaging facilities, and high patient throughput. Hospitals are equipped with a wide range of imaging modalities such as ultrasound, CT, MRI, and OCT systems, enabling them to perform complex vascular diagnostics, including cardiovascular, peripheral, and neurovascular assessments.

REGION

Asia Pacific to be fastest-growing region in global vascular imaging market during forecast period

The Asia Pacific region is expected to witness the highest CAGR in the vascular imaging market due to its rapidly growing patient population and rising prevalence of cardiovascular diseases. Factors such as sedentary lifestyles, increasing rates of obesity, diabetes, and hypertension are fueling a surge in demand for advanced diagnostic imaging across the region. Additionally, the region’s large aging population is particularly vulnerable to vascular disorders, driving the need for early detection and monitoring technologies. Governments and healthcare organizations are also investing heavily in expanding healthcare infrastructure and screening programs, further boosting the adoption of vascular imaging systems.

vascular-imaging-market: COMPANY EVALUATION MATRIX

In the vascular imaging market matrix, Siemens is one of the top players (Star) due to its strong global presence, broad product portfolio, and advanced imaging technologies. The company offers a wide range of vascular imaging solutions, including high-end ultrasound systems, CT angiography, MRI, and hybrid imaging platforms, which are widely adopted in hospitals and specialized centers. Fujifilm is a prominent player (Emerging Leader) in vascular imaging due to its innovative imaging solutions and expanding global presence, particularly in advanced ultrasound and digital imaging systems. The company leverages its strong R&D capabilities to introduce technologies such as high-resolution vascular ultrasound, elastography, and AI-assisted imaging, which enhance diagnostic accuracy and workflow efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.03 Billion |

| Market Forecast in 2030 (Value) | USD 4.54 Billion |

| Growth Rate | CAGR of 7.8% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Units Sold) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Product (Systems & Consoles, Accessories & Consumables and Software & Services), Application (Atherosclerosis, Aneurysm, Vasculitis, Deep Vein thrombosis, Arteriovenous malformations and fistulas and other applications), End User (Hospitals, Diagnostic Imaging Centers, ambulatory surgery centers, and other end users), Region (North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa) |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

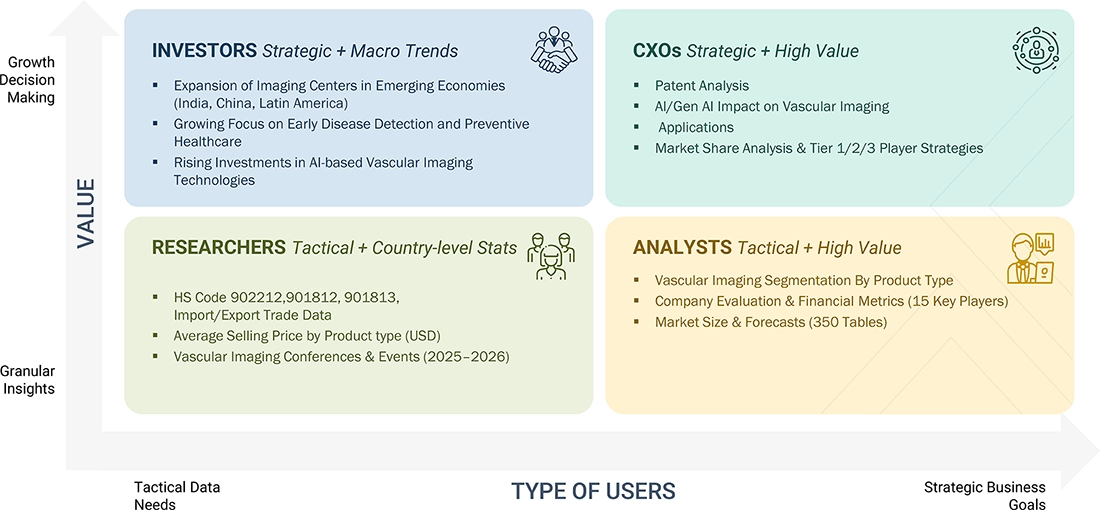

WHAT IS IN IT FOR YOU: vascular-imaging-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Contrast Media Manufacturer |

|

|

| Medical Imaging OEM |

|

|

| Government / Public Health Agency |

|

|

| Hospital Chain / Diagnostic Center |

|

|

| Imaging Software Developer |

|

|

RECENT DEVELOPMENTS

- March 2025 : GE HealthCare plans to develop AI-powered X-ray and ultrasound systems by leveraging NVIDIA’s Isaac for Healthcare platform, which utilizes three NVIDIA computers, including NVIDIA Omniverse for robotic simulation workflows, to advance physical AI technologies.

- July 2024 : GE Healthcare (US) acquired Intelligent Ultrasound Group Plc (UK). The company plans to integrate these solutions across its ultrasound portfolio, enhancing its capabilities with technology designed to improve workflows and streamline usability, ultimately benefiting both clinicians and patients.

- November 2022 : Canon (US) established a new subsidiary, Canon Healthcare USA, Inc. With this strategic move, Canon strengthened its position in the influential American medical market and accelerated the expansion of its medical business.

- March 2022 : Philips Healthcare (Netherlands) partnered with React (US) to successfully develop and introduce the world’s inaugural integrated tele-ultrasound capability.

- September 2023 : Hologic (US) entered into a definitive agreement to sell its SSI ultrasound imaging business to SSH Holdings Limited (UK) with a sales price of USD 1.9 million.

Table of Contents

Methodology

The research methodology used to analyze the global vascular imaging market is comprehensively outlined on the website. It clearly explains the structure, processes, and practices followed for collecting and analyzing field data, ensuring both accuracy and reliability. This level of transparency enables stakeholders to effectively evaluate the credibility of the findings, conclusions, and recommendations presented in the report, supporting well-informed decision-making.

Secondary Research

For this secondary research, we relied on diverse sources such as D&B Hoovers, Bloomberg Businessweek, Factiva, white papers, annual reports, company filings, investor presentations, and SEC filings. This in-depth approach helped build a robust database of key players in the industry. The database provides essential insights into established companies, detailed multi-level market segmentation, trends within each segment, notable mergers and acquisitions, and the impact of cutting-edge technological innovations shaping the vascular imaging market.

Primary Research

The primary research involved both qualitative and quantitative techniques and was conducted in depth with participants from both the supply and demand sides through interviews.

On the supply side, interviews were held with high-level executives, including CEOs, vice presidents, marketing directors, sales directors, regional sales managers, and directors of technology and innovation, from leading companies and organizations that produce and deliver therapy products.

On the demand side, professionals interviewed included clinicians, procurement managers, purchasing managers, department heads, and subject-matter experts from hospitals, surgical centers, diagnostic centers, maternity centers, ambulatory centers, research institutions, and academia, as well as other end users.

Overall, this research provided valuable insights into market segmentation, key players, trends, dynamics, and growth drivers in the market.

A breakdown of the primary respondents is provided below:

Note 1: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers

Note 2: Companies are classified into tiers based on their total revenue. As of 2024 Tier 1 = >USD 1 billion, Tier 2 = USD 500 million, and Tier 3 = USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The report offers an in-depth analysis of the Vascular imaging market, identifying key players through both primary and secondary research. Secondary research drew on annual and financial reports from major market companies, while primary research included detailed interviews with key opinion leaders such as CEOs, directors, and senior marketing executives.

To estimate the global market value, a segment-based methodology was applied, using revenue data from leading solution and supplier providers.

This involved:

- Identifying major participants in the global Vascular imaging market.

- Reviewing their reported annual revenues, whether directly related to vascular imaging or reflecting broader business units and product lines.

The data was then projected to arrive at the overall value for the vascular imaging market.

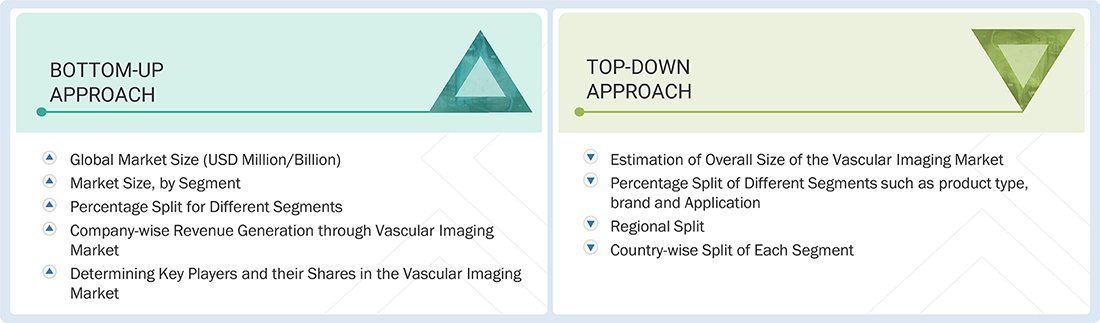

Vascular Imaging Market : Top-Down and Bottom-Up Approach

Data Triangulation

The research approach involved dividing the global vascular imaging market into different participant groups and categories. Data triangulation and segmentation methods were applied to ensure the accuracy of information across all market segments. Multiple analyses were carried out to assess both the demand and supply aspects of the market. By combining top-down and bottom-up approaches, the study provided a comprehensive understanding of the vascular imaging market.

Market Definition

The vascular imaging market refers to the segment of the medical imaging industry focused on technologies and systems used to visualize blood vessels and assess vascular health. It includes modalities such as ultrasound, computed tomography angiography (CTA), magnetic resonance angiography (MRA), and other advanced imaging techniques that help in detecting, diagnosing, and monitoring conditions like atherosclerosis, aneurysms, blood clots, and peripheral artery disease. This market encompasses imaging equipment, contrast agents, and related software solutions that support early disease detection, treatment planning, and improved patient outcomes in cardiovascular care.

Key Stakeholders

- Healthcare Institutions (Hospitals and Diagnostic Centers)

- Research Institutions

- Clinical Research Organizations

- Academic Medical Centers and Universities

- Reference Laboratories

- Accountable Care Organizations (ACOs)

- Research and Consulting Firms

- Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

- Academic Medical Centers and Universities

- Market Research and Consulting Firms

- Group Purchasing Organizations (GPOs)

- Medical Research Laboratories

- Academic Medical Centers and Universities

Report Objectives

- To define, describe, and forecast the global vascular imaging market based on product type, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges), along with the current trends

- To strategically analyze micromarkets with respect to their individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments for five regions: North America (US and Canada), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments in the vascular imaging market, such as acquisitions, product launches, expansions, agreements, joint ventures, alliances, and collaborations

Available Customizations

Based on the available market data, MarketsandMarkets offers tailored customization to meet the specific needs of a company. The following customization options are available for the global Vascular imaging market:

Product Analysis

- A product matrix that provides an in-depth comparison of the top 5 companies’ product portfolios

Company Information

- In-depth analysis and profiling of up to 5 additional market participants

Geographic Analysis

- Detailed analysis of the Rest of Europe vascular imaging market (including Russia, Belgium, Netherlands, Switzerland, Sweden, Austria, Portugal, Finland, Poland, and other countries)

- Detailed analysis of the Rest of Asia Pacific Vascular imaging market (including Singapore, Philippines, Taiwan, New Zealand, Malaysia, and other countries)

- Detailed analysis of the Rest of the World Vascular imaging market (including Latin America and the Middle East & Africa)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Vascular Imaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Vascular Imaging Market