Spices and Seasonings Market Size, Share, Trends, Industry Growth Report by Type, Application (Meat & Poultry Products, Snacks & Convenience Food, Soups, Sauces, and Dressings, Bakery & Confectionery, Frozen Products, Beverages), Nature, & Region - Global Trends and Forecast to 2026

Spices And Seasonings Market Growth Analysis, 2026

The global spices and seasonings market size was valued at USD 21.3 billion in 2021 and is poised to reach USD 27.4 billion by 2026, growing at a CAGR of 5.2% from 2021–2026.

The new research study comprises an examination of industry trends in the market. It encompasses a comprehensive analysis of market buying patterns, pricing trends, patent evaluations, conference and webinar materials, and key stakeholders. The demand for spices and seasonings in the market is mainly propelled by the increasing preference for delectable and unique cuisines, the growth of fast food and packaged food industries, and the shifting consumer inclination towards healthier and more natural products. The spice and seasoning market is a multi-billion dollar industry, as consumers demand a wide range of flavor options for their food and are willing to pay for high-quality, premium spices and seasonings. These products can be found in various forms, such as whole spices, ground spices, blends, rubs, marinades, and sauces. Manufacturers of convenience foods employ these qualities to enhance the flavour and quality of their products and lengthen the shelf life of their products.

To know about the assumptions considered for the study, Request for Free Sample Report

Spices and Seasonings Market Dynamics

Drivers: Clean Label: A clear trend across global food market

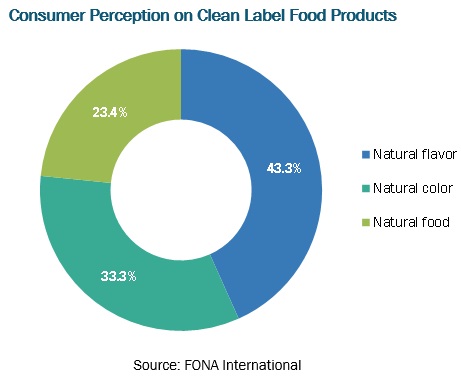

Increasing consumption of healthy food products among modern consumers has led to increasing interest in the origin of the ingredients used to produce these products. Consumers prefer natural and clean-label flavors and ingredients as they are constantly looking for ‘natural’ nutrition and are opting for products that incorporate inherently natural, fresh, wholesome, and balanced nutrition. They largely perceive “clean label” as having a natural flavor and natural color.

To know about the assumptions considered for the study, download the pdf brochure

The growing trend toward clean-label products, which is slowly becoming a requisite across the globe, is offering growth opportunities to the food manufacturers in spices and seasonings market to create new formulations and new products to cater to the rising consumer demand for healthier food products. One example of manufacturers introducing natural ingredients is “Verdad Powder F80”, a product launched by Corbion Purac (Netherlands) in 2013. This product is permitted to be labeled as ‘fermented sugar’ to meet consumer demand for natural, fresh, and authentic-tasting products.

The food industry faces the challenge of finding natural ingredients, which will maintain food quality and integrity without compromising on the shelf life, taste, and texture of the food products. Furthermore, natural ingredients are costlier when compared to artificial flavors.

Thus, the rising consumer demand for natural food ingredients is anticipated to increase the demand of spice industry in the near future.

Market Restraints: Adverse effects of excess spice consumption

The spices and seasonings segment has large-scale applications in various food sectors. However, consumption of spices in excess proved to affect one’s health negatively. Arguably, the most common side effect of spicy food deals with one’s digestion system. Heartburn or acid reflux occurs when stomach acid goes back up into the esophagus, causing a burning sensation in one’s chest portion. This acidity can be triggered by spicy foods containing capsaicin, which also slows down your digestion rate and increases the risk of heartburn developing. Another digestive issue spicy food can cause is stomach or intestine irritation, causing a laxative effect. Acute gastritis is also possible, with symptoms including nausea, vomiting, and fullness in one’s upper abdomen. Hence, the ill effects of excess spice consumption are a potential factor that hampers the market's growth in terms of value sales.

Spices and Seasonings Market Opportunities: Encapsulation of spices witness higher sales growth rate

Encapsulation of food products and ingredients has been on the rise over the past couple of years. The advancement of encapsulation has led to its application in almost every sector of the food & beverage industry. A similar kind of application pattern has also been witnessed in the market. Some of the key manufacturers in the flavor and fragrance industry have been availing the spices variants in encapsulated formats. The UK-based company, TasteTech has developed a new method for processing paprika and turmeric spices. The method is controlled-release encapsulation, whereby the oleoresins and essential oils of spices are extracted and encapsulated within invisible microfilm of hardened vegetable oil, resulting in a free-flowing, easy-to-handle powder. The company claims the flavor is enhanced, as is the coloring effect when compared with original and untreated spices. Thus, higher application of food encapsulation paves the way for the spices and seasoning market to grow significantly in terms of value sales during the forecast period.

Market Challenges: spices and seasonings are prone to microbial contamination

The perishability nature of spices and seasonings ingredients makes them prone to multiple pathogenic contaminations such as fungal infestation, bacterial infestation and other contamination. These require proper storage and maintenance facility to retain the quality of spices such as flavour, taste, smell etc. The lack of warehousing facilities substantiates the microbial contamination and acts as a challenge for growth in the market. India, being the largest producer of spices globally, lacks proper warehousing facilities, which ultimately lead to microbial contamination and deteriorates the quality.

Spices and Seasonings Market Report Scope

|

Report Metric |

Details |

|

Market Size in 2021 |

USD 21.3 billion |

|

Revenue Forecast in 2026 |

USD 27.4 billion |

|

Growth Rate |

CAGR of 5.2% |

|

Forecast Period |

2021-2026 |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Largest Market |

Asia Pacific |

|

Fastest Growing Market |

Europe |

|

Major Players |

McCormick & Company, Inc. (US), Olam International (Singapore), Ajinomoto Co. Inc. (Japan), Associated British Foods plc (UK), Kerry Group plc (Ireland), Sensient Technologies Corporation (US), Döhler Group (Germany), SHS Group (Ireland), Worlée Gruppe (Germany) |

Spices and Seasonings Market Report Segmentation

This research report categorizes the market based on type, application, nature and region.

|

Segment |

Subsegment |

|

Market By Type |

|

|

Spices and Seasonings Market By Application |

|

|

Market By Nature |

|

|

Market By Region |

|

Microwave Assisted Extraction (MAE) of spices

Microwaves are used to heat up the water content within the plant cell until it boils into steam. When it does, the water expands, rupturing the cell from within to release the phytochemicals. The process is quick, requires only a small amount of solvent, and is energy efficient. The MAE process is influenced by factors such as solvent type, compound type, and dielectric constants of the plant material. The advantages of using the MAE process to extract phytochemicals that include high extraction efficiency, low solvent consumption, good antioxidant-activity of the extracts, and short extraction times.

Pressurized hot water extraction technique improves extraction of spices

PHWE, also known as pressurized solvent extraction (PSE) or accelerated solvent extraction (ASE) uses high temperatures and pressures to improve the extraction of spices. The high pressure is used to maintain the solvent in the liquid phase even when heated above its boiling point. The process needs only a small amount of solvent, but still requires labour intensive washing and filtration after the extraction step. Extraction efficiency can be improved by selecting the appropriate solvent or mixture, pressure (usually 3-20 MPa), temperature (usually 100-200 °C), and extraction time. High temperature leads to an increase in the conductivity of the water as well as a decrease in surface tension and thus an increase in propagation of phytochemical molecules through the water.

Spices and Seasonings Market Regional Insights

The Asia Pacific region is projected to be the fastest growing market for spices and seasonings at a CAGR of 4.4% from 2021 to 2026.

The Asia Pacific region is projected to be the fastest-growing spices and seasoning market, at a CAGR of 4.4% from 2021 to 2026. The usage of spices and seasonings in the industrial sector is less in the Asia Pacific region as compared to that in developed regions, which presents food processing industries with considerable untapped potential. The overall economic growth in the Asia Pacific region has led to an increase in urbanization and rapid industrialization, with a resultant rise in per capita income. These factors play a major role in the changing preference of consumers towards value-added food products.

The region’s improved agricultural growth over the past decade, followed by advancements in the food industry, has provided new opportunities for the spices & seasonings industry. The rise in the middle-class population of the region with high disposable income who demand new & premium food products and the increase in demand for convenience foods drive the growth of the Asia Pacific spices and seasonings market. This region has a much-diversified flavor preference wherein consumers are constantly looking for new variants, which will drive the spices & seasonings market.

India’s spices & seasonings industry has witnessed increasing varieties of value-added spice & seasoning products in the ground, crushed, cracked blended, and dehydrated forms, in bulk and consumer packs.

Spices and Seasonings Market Key Players

The key players in this market include MOGUNTIA FOOD GROUP AG (Germany), Associated British Food plc (UK), Olam International (Singapore), McCormick & Company (US), and Ajinomoto Co., Inc (Japan), Paras Spices Private Limited (India), Worlée Gruppe (Germany), Döhler Group (Germany), Friedrich Ingredients (Germany), Kerry Group Plc (Ireland), ARIAKE JAPAN Co., Ltd (Japan) Pacific Spice Company (US), Sensient Technologies (US), SHS Group (Ireland), and VKL Seasonings Pvt Ltd (India).

Recent Developments in Spices and Seasonings Market

- In May 2021, Olam Food Ingredients (OFI) announced the acquisition of the leading US private-label spice & seasoning manufacturer, Olde Thompson. The acquisition would build on a 15-year partnership with Olde Thompson and mark a significant milestone for OFI’s spices business.

- In February 2021, Kerry announced the acquisition of Jining Nature Group, a leading manufacturer of savory flavors and seasonings in China. This acquisition will bring a wide range of authentic local and regional taste technologies and application capabilities to the Kerry portfolio.

- In February 2019, McCormick & Company, Incorporated announced its ongoing research collaboration with IBM Research to pioneer the application of artificial intelligence (AI) for flavor and food product development. This proprietary technology provided McCormick an advantage in its ability to develop more creative, better-tasting products and new flavor experiences across both its Consumer and Flavor Solutions business units..

- In September 2018, Ajinomoto announced plans to form Ajinomoto Food Manufacturing Co., Ltd., a new company in charge of manufacturing and packaging seasonings and processed foods in Japan. The new company would integrate the seasonings and processed foods manufacturing and packaging business of its Kawasaki administration & coordination office and Tokai plant.

Frequently Asked Questions (FAQ):

How big is the market for spices and seasonings?

The global spices and seasonings market is estimated to be valued at USD 21.3 billion in 2021. It is projected to reach USD 27.4 billion by 2026, recording a CAGR of 5.2% during the forecast period.

What is the estimated growth rate of the global spice industry?

The global spice industry is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2021 to 2026.

What are the major revenue pockets in the spices and seasonings market currently?

The Asia Pacific region is projected to be the fastest-growing market for spices & seasonings, at a CAGR of 4.4% from 2021 to 2026. The usage of spices and seasonings in the industrial sector is less in the Asia Pacific region as compared to that in developed regions, which presents food processing industries with considerable untapped potential.

Which players are involved in manufacturing of spices and seasonings market?

The key players in spice industry include MOGUNTIA FOOD GROUP AG (Germany), Associated British Food plc (UK), Olam International (Singapore), McCormick & Company (US), and Ajinomoto Co., Inc (Japan), Paras Spices Private Limited (India), Worlée Gruppe (Germany), etc.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION OF SPICES AND SEASONINGS MARKET(Page No. - 25)

1.1 OBJECTIVE OF THE STUDY

1.1.1 MARKET DEFINITION

1.2 MARKET SCOPE

1.2.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION: MARKET

1.2.2 INCLUSIONS AND EXCLUSIONS

1.2.3 GEOGRAPHIC SCOPE

1.3 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2017–2020

1.5 VOLUME UNITS CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 SPICES AND SEASONINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

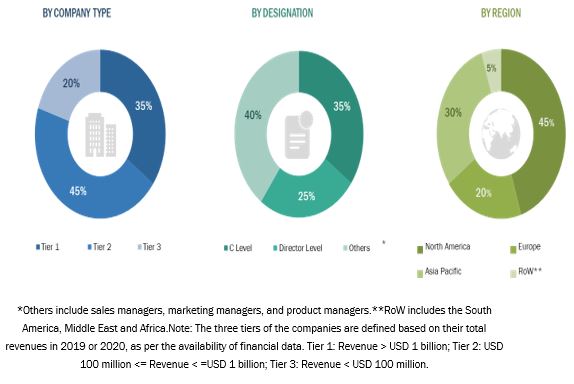

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Primary Insights

FIGURE 4 PRIMARY INSIGHTS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.1 SUPPLY SIDE

2.2.2 DEMAND SIDE

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS & RISK ASSESSMENT

2.5 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.5.1 SCENARIO-BASED MODELLING

2.6 INTRODUCTION TO COVID-19

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 8 COVID-19: GLOBAL PROPAGATION

FIGURE 9 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 10 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 11 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 12 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 13 SPICES AND SEASONINGS MARKET SIZE, BY TYPE, 2020 VS. 2026 (USD MILLION)

FIGURE 14 MARKET SIZE, BY APPLICATION, 2020 VS. 2026 (USD MILLION)

FIGURE 15 MARKET SIZE, BY NATURE, 2020 VS. 2026 (USD MILLION)

FIGURE 16 MARKET SHARE, BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 OPPORTUNITIES IN THE MARKET

FIGURE 17 RISE IN DEMAND FOR CONVENIENCE FOOD PRODUCTS ON A GLOBAL SCALE TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET, BY TYPE

FIGURE 18 GINGER TO ACCOUNT FOR THE LARGEST VALUE SHARE

4.3 MARKET, BY APPLICATION & REGION

FIGURE 19 ASIA PACIFIC DOMINATED THE MARKET ACROSS ALL APPLICATIONS IN 2020

4.4 MARKET, BY NATURE

FIGURE 20 CONVENTIONAL SPICES & SEASONINGS TO DOMINATE THE MARKET

4.5 ASIA PACIFIC: MARKET, BY TYPE & COUNTRY, 2017

FIGURE 21 GINGER ACCOUNTED FOR THE LARGEST SHARE, BY TYPE, IN 2020, IN ASIA PACIFIC

4.6 COVID-19 IMPACT ON THE MARKET

FIGURE 22 GROWTH IN 2020 IS REDUCED IN THE POST-COVID-19 SCENARIO COMPARED TO THE PRE-COVID-19 SCENARIO

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 MARKET DYNAMICS: SPICES AND SEASONINGS MARKET

5.2.1 DRIVERS

5.2.1.1 Growth in demand for convenience foods

5.2.1.1.1 Rapidly increasing urbanization and changing lifestyles

5.2.1.1.2 Rise in demand for convenience food

5.2.1.2 Clean label: A clear trend across global food markets

FIGURE 24 CONSUMER PERCEPTION ON CLEAN LABEL FOOD PRODUCTS

5.2.1.3 Increase in use of spices and seasonings as natural preservatives in meat & poultry products

5.2.1.4 Evolving consumer perception of spicy food products

FIGURE 25 CONSUMER PERCEPTION ON SPICY FOOD PRODUCTS, 2020

5.2.2 RESTRAINTS

5.2.2.1 Adulteration of spices

5.2.2.2 Adverse effects of excess spice consumption

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in demand for health and wellness products

5.2.3.2 Spice- and herb-infused beverages pave the way for market growth

5.2.3.3 Encapsulation of spices witness higher value sales growth rate

5.2.3.4 Organic spices & seasonings witness a higher level of demand

FIGURE 26 GLOBAL ORGANIC FOOD MARKET, 2012–2019 (USD BILLION)

5.2.4 CHALLENGES

5.2.4.1 Several spices & seasonings are prone to microbial contamination

6 REGULATORY FRAMEWORK (Page No. - 63)

6.1 INTRODUCTION

6.2 TRADE ORGANIZATIONS

6.3 REGIONAL REGULATIONS

6.4 SPICES AND HERB REGULATIONS

7 SPICES AND SEASONINGS MARKET, BY TYPE (Page No. - 66)

7.1 INTRODUCTION

FIGURE 27 MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 1 SPICES & SEASONINGS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 2 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 3 MARKET SIZE, BY TYPE, 2016–2020 (KT)

TABLE 4 MARKET SIZE, BY TYPE, 2021–2026 (KT)

7.2 COVID-19 IMPACT ON THE MARKET, BY TYPE

7.2.1 OPTIMISTIC SCENARIO

TABLE 5 COVID-19 IMPACT ON THE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

7.2.2 PESSIMISTIC SCENARIO

TABLE 6 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

7.2.3 REALISTIC SCENARIO

TABLE 7 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

7.3 PEPPER

7.3.1 BLACK PEPPER IS ONE OF THE MOST TRADED SPICES IN THE WORLD

TABLE 8 PEPPER MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 9 PEPPER MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 10 PEPPER MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 11 PEPPER MARKET SIZE, BY REGION, 2021–2026 (KT)

7.4 CAPSICUM: SPICES AND SEASONINGS MARKET

7.4.1 CAPSAICIN HAS PREVENTIVE AND THERAPEUTIC PROPERTIES FOR MANY AILMENTS

TABLE 12 CAPSICUM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 13 CAPSICUM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 14 CAPSICUM MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 15 CAPSICUM MARKET SIZE, BY REGION, 2021–2026 (KT)

7.5 GINGER

7.5.1 GINGER IS AN EXCELLENT SOURCE OF ANTIOXIDANTS

TABLE 16 GINGER MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 GINGER MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 18 GINGER MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 19 GINGER MARKET SIZE, BY REGION, 2021–2026 (KT)

7.6 CINNAMON

7.6.1 THE BARK OF THE CINNAMOMUM TREE IS GLOBALLY POPULAR AS A SPICE

TABLE 20 CINNAMON MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 CINNAMON MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 CINNAMON MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 23 CINNAMON MARKET SIZE, BY REGION, 2021–2026 (KT)

7.7 CUMIN

7.7.1 CUMIN IS ESSENTIAL IN MEXICAN, AFRICAN, AND ASIAN CUISINES

TABLE 24 CUMIN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 CUMIN MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 26 CUMIN MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 27 CUMIN MARKET SIZE, BY REGION, 2021–2026 (KT)

7.8 TURMERIC: SPICES AND SEASONINGS MARKET

7.8.1 TURMERIC CONTAINS CURCUMIN, A POTENT ANTIOXIDANT

TABLE 28 TURMERIC MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 29 TURMERIC MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 TURMERIC MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 31 TURMERIC MARKET SIZE, BY REGION, 2021–2026 (KT)

7.9 NUTMEG & MACE

7.9.1 THE USE OF NUTMEG IS INCREASING FOR ITS AROMATIC AND CURATIVE PROPERTIES

TABLE 32 NUTMEG & MACE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 NUTMEG & MACE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 34 NUTMEG & MACE MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 35 NUTMEG & MACE MARKET SIZE, BY REGION, 2021–2026 (KT)

7.10 CARDAMON

7.10.1 CARDAMOM IS A SPICE USED IN COOKING AND AS A NATURAL MEDICINE

TABLE 36 CARDAMOM MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 CARDAMOM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 CARDAMOM MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 39 CARDAMOM MARKET SIZE, BY REGION, 2021–2026 (KT)

7.11 CORIANDER

7.11.1 CORIANDER IS AN IMPORTANT PART OF THE “C” CLUB IN SPICES

TABLE 40 CORIANDER MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 41 CORIANDER MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 CORIANDER MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 43 CORIANDER MARKET SIZE, BY REGION, 2021–2026 (KT)

7.12 CLOVES

7.12.1 USING WHOLE OR GROUND CLOVES CAN BE BENEFICIAL FOR HEALTH

TABLE 44 CLOVES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 45 CLOVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 CLOVES MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 47 CLOVES MARKET SIZE, BY REGION, 2021–2026 (KT)

7.13 OTHER TYPES

TABLE 48 OTHER TYPES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 49 OTHER TYPES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 OTHER TYPES MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 51 OTHER TYPES MARKET SIZE, BY REGION, 2021–2026 (KT)

8 SPICES AND SEASONINGS MARKET, BY APPLICATION (Page No. - 92)

8.1 INTRODUCTION

FIGURE 28 MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 52 MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 53 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 54 MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 55 MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

8.2 COVID-19 IMPACT ON THE MARKET, BY APPLICATION

8.2.1 OPTIMISTIC SCENARIO

TABLE 56 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

8.2.2 PESSIMISTIC SCENARIO

TABLE 57 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

8.2.3 REALISTIC SCENARIO

TABLE 58 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

8.3 MEAT & POULTRY PRODUCTS

8.3.1 SPICES ARE ADDED TO MEAT PRODUCTS AS FLAVORANTS AND PRESERVATIVES

TABLE 59 MARKET SIZE IN MEAT & POULTRY PRODUCTS, BY REGION, 2016–2020 (USD MILLION)

TABLE 60 MARKET SIZE IN MEAT & POULTRY PRODUCTS, BY REGION, 2021–2026 (USD MILLION)

TABLE 61 THE MARKET SIZE IN MEAT & POULTRY PRODUCTS, BY REGION, 2016–2020 (KT)

TABLE 62 MARKET SIZE IN MEAT & POULTRY PRODUCTS, BY REGION, 2021–2026 (KT)

8.4 SNACKS & CONVENIENT PRODUCTS

8.4.1 SPICES & SEASONINGS ARE ESSENTIAL FOR CONSUMER INTEREST IN SNACKS AND CONVENIENCE FOODS

TABLE 63 THE MARKET SIZE IN SNACKS & CONVENIENT PRODUCTS, BY REGION, 2016–2020 (USD MILLION)

TABLE 64 MARKET SIZE IN SNACKS & CONVENIENT PRODUCTS, BY REGION, 2021–2026 (USD MILLION)

TABLE 65 MARKET SIZE IN SNACKS & CONVENIENT PRODUCTS, BY REGION, 2016–2020 (KT)

TABLE 66 THE MARKET SIZE IN SNACKS & CONVENIENT PRODUCTS, BY REGION, 2021–2026 (KT)

8.5 SOUPS, SAUCES, AND DRESSINGS

8.5.1 SPICES & SEASONINGS INTENSIFY THE FLAVOR OF SOUPS, SAUCES AND DRESSINGS

TABLE 67 MARKET SIZE IN SOUPS, SAUCES, AND DRESSINGS, BY REGION, 2016–2020 (USD MILLION)

TABLE 68 THE MARKET SIZE IN SOUPS, SAUCES, AND DRESSINGS, BY REGION, 2021–2026 (USD MILLION)

TABLE 69 MARKET SIZE IN SOUPS, SAUCES, AND DRESSINGS, BY REGION, 2016–2020 (KT)

TABLE 70 THE MARKET SIZE IN SOUPS, SAUCES, AND DRESSINGS, BY REGION, 2021–2026 (KT)

8.6 BAKERY & CONFECTIONERY

8.6.1 WITH THE INCREASE IN CONSUMPTION OF BAKED GOODS, THE USE OF BAKERY SPICES IS SET TO INCREASE

TABLE 71 MARKET SIZE IN BAKERY & CONFECTIONERY, BY REGION, 2016–2020 (USD MILLION)

TABLE 72 MARKET SIZE IN BAKERY & CONFECTIONERY, BY REGION, 2021–2026 (USD MILLION)

TABLE 73 THE MARKET SIZE IN BAKERY & CONFECTIONERY MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 74 THE MARKET SIZE IN BAKERY & CONFECTIONERY, BY REGION, 2021–2026 (KT)

8.7 FROZEN PRODUCTS

8.7.1 SPICES & SEASONINGS ARE USED IN FROZEN FOOD PRODUCTS AS COLORANTS WITH A LONGER SHELF LIFE

TABLE 75 MARKET SIZE IN FROZEN PRODUCTS, BY REGION, 2016–2020 (USD MILLION)

TABLE 76 MARKET SIZE IN FROZEN PRODUCTS, BY REGION, 2021–2026 (USD MILLION)

TABLE 77 MARKET SIZE IN FROZEN PRODUCTS, BY REGION, 2016–2020 (KT)

TABLE 78 SPICES AND SEASONINGS MARKET SIZE IN FROZEN PRODUCTS, BY REGION, 2021–2026 (KT)

8.8 BEVERAGES

8.8.1 NATURAL SPICES ARE USED TO OFFER CLEAN-LABEL SOLUTIONS IN BEVERAGE INNOVATION

TABLE 79 MARKET SIZE IN BEVERAGES, BY REGION, 2016–2020 (USD MILLION)

TABLE 80 MARKET SIZE IN BEVERAGES, BY REGION, 2021–2026 (USD MILLION)

TABLE 81 MARKET SIZE IN BEVERAGES, BY REGION, 2016–2020 (KT)

TABLE 82 THE MARKET SIZE IN BEVERAGES, BY REGION, 2021–2026 (KT)

8.9 OTHER APPLICATIONS

TABLE 83 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2020 (USD MILLION)

TABLE 84 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 85 THE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2020 (KT)

TABLE 86 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (KT)

9 SPICES AND SEASONINGS MARKET, BY NATURE (Page No. - 110)

9.1 INTRODUCTION

FIGURE 29 MARKET SIZE, BY NATURE, 2021 VS. 2026 (USD MILLION)

TABLE 87 MARKET SIZE, BY NATURE, 2016–2020 (USD MILLION)

TABLE 88 MARKET SIZE, BY NATURE, 2021–2026 (USD MILLION)

TABLE 89 THE MARKET SIZE, BY NATURE, 2016–2020 (KT)

TABLE 90 MARKET SIZE, BY NATURE, 2021–2026 (KT)

9.2 COVID-19 IMPACT ON THE MARKET, BY NATURE

9.2.1 OPTIMISTIC SCENARIO

TABLE 91 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY NATURE, 2018–2021 (USD MILLION)

9.2.2 PESSIMISTIC SCENARIO

TABLE 92 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY NATURE, 2018–2021 (USD MILLION)

9.2.3 REALISTIC SCENARIO

TABLE 93 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY NATURE, 2018–2021 (USD MILLION)

9.3 CONVENTIONAL

9.3.1 CONVENTIONAL SPICES ARE BULK-PRODUCED AND SOLD AT LOWER COSTS

TABLE 94 CONVENTIONAL MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 95 CONVENTIONAL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 96 CONVENTIONAL MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 97 CONVENTIONAL MARKET SIZE, BY REGION, 2021–2026 (KT)

9.4 ORGANIC

9.4.1 ORGANIC SPICES ARE PREFERRED AS THE DEMAND FOR NATURAL INPUTS INCREASES

TABLE 98 ORGANIC MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 99 ORGANIC MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 100 ORGANIC MARKETSIZE, BY REGION, 2016–2020 (KT)

TABLE 101 ORGANIC MARKET SIZE, BY REGION, 2021–2026 (KT)

10 SPICES AND SEASONINGS MARKET, BY REGION (Page No. - 118)

10.1 INTRODUCTION

TABLE 102 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 103 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 104 MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 105 MARKET SIZE, BY REGION, 2021–2026 (KT)

10.1.1 COVID-19 IMPACT ON THE MARKET, BY REGION

10.1.2 OPTIMISTIC SCENARIO

TABLE 106 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.1.3 PESSIMISTIC SCENARIO

TABLE 107 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.1.4 REALISTIC SCENARIO

TABLE 108 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

FIGURE 30 RUSSIA IS ESTIMATED TO GROW AT THE HIGHEST GROWTH RATE IN THE MARKET, 2021–2026

10.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 109 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (KT)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 118 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

TABLE 119 NORTH AMERICA: MARKET SIZE, BY NATURE, 2016–2020 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET SIZE, BY NATURE, 2021–2026 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET SIZE, BY NATURE, 2016–2020 KT)

TABLE 122 NORTH AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY NATURE, 2021–2026 (KT)

10.2.1 US

10.2.1.1 Higher demand for meat & poultry products drives the demand for spices & seasonings in the country

TABLE 123 US: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 124 US: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 125 US: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 126 US: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.2.2 CANADA

10.2.2.1 Snacks & convenience foods witness substantial growth in the country, driving the demand for various spices and seasonings

TABLE 127 CANADA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 128 CANADA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 129 CANADA: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 130 CANADA: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.2.3 MEXICO

10.2.3.1 Rise in demand for processed food products help drive the market

TABLE 131 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 132 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 133 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 134 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.3 EUROPE

TABLE 135 EUROPE: SPICES AND SEASONINGS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (KT)

TABLE 138 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 139 EUROPE: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 140 EUROPE: SPICES ANDSEASONINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY TYPE, 2016–2020 (KT)

TABLE 142 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 143 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 144 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 145 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 146 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

TABLE 147 EUROPE MARKETSIZE, BY NATURE, 2016–2020 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY NATURE, 2021–2026 (USD MILLION)

TABLE 149 EUROPE: MARKET SIZE, BY NATURE, 2016–2020 (KT)

TABLE 150 EUROPE: MARKET SIZE, BY NATURE, 2021–2026 (KT)

10.3.1 GERMANY

10.3.1.1 Advanced infrastructure and strong distribution base make Germany a key player in the market

TABLE 151 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 152 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 153 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 154 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.3.2 UK

10.3.2.1 Rise in demand for Indian cuisines in the UK drives the market

TABLE 155 UK: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 156 UK: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 157 UK: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 158 UK: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.3.3 FRANCE

10.3.3.1 Rare spices such as vanilla are gaining higher traction in France

TABLE 159 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 160 FRANCE: THE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 161 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 162 FRANCE: THE MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.3.4 ITALY

10.3.4.1 Higher consumption rate of traditional Italian cuisine drives the demand for spices & seasonings

TABLE 163 ITALY: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 164 ITALY: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 165 ITALY: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 166 ITALY: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.3.5 SPAIN

10.3.5.1 Surge in demand for spices such as paprika and saffron drives market growth in Spain

TABLE 167 SPAIN: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 168 SPAIN: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 169 SPAIN: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 170 SPAIN: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.3.6 RUSSIA

10.3.6.1 Higher dependence on imported spices & seasonings from India, China, and Lithuania

TABLE 171 RUSSIA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 172 RUSSIA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 173 RUSSIA: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 174 RUSSIA: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.3.7 REST OF EUROPE

TABLE 175 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 176 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 177 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 178 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.4 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (KT)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 183 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 185 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2020 (KT)

TABLE 186 ASIA PACIFIC: SPICES AND SEASONINGS MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 187 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 188 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 189 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 190 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

TABLE 191 ASIA PACIFIC: MARKET SIZE, BY NATURE, 2016–2020 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET SIZE, BY NATURE, 2021–2026 (USD MILLION)

TABLE 193 ASIA PACIFIC: MARKET SIZE, BY NATURE, 2016–2020 KT)

TABLE 194 ASIA PACIFIC: MARKET SIZE, BY NATURE, 2021–2026 (KT)

10.4.1 CHINA

10.4.1.1 Rise in demand for premium ethnic food drives market growth in China

TABLE 195 CHINA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 196 CHINA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 197 CHINA: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 198 CHINA: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.4.2 INDIA

10.4.2.1 The country assumes dominance in terms of production as well as consumption of spices in the global market

TABLE 199 INDIA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 200 INDIA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 201 INDIA: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 202 INDIA: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.4.3 JAPAN

10.4.3.1 Ginger and garlic gain higher level of traction in the country

TABLE 203 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 204 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 205 JAPAN: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 206 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.4.1 The countries play a pivotal role in the trade of spices & seasonings

TABLE 207 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 208 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 209 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 210 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.4.5 REST OF ASIA PACIFIC

TABLE 211 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 212 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 213 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 214 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.5 SOUTH AMERICA

TABLE 215 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 216 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 217 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (KT)

TABLE 218 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 219 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 220 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 221 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (KT)

TABLE 222 SOUTH AMERICA: SPICES AND SEASONINGS MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 223 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 224 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 225 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 226 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

TABLE 227 SOUTH AMERICA: MARKET SIZE, BY NATURE, 2016–2020 (USD MILLION)

TABLE 228 SOUTH AMERICA: MARKET SIZE, BY NATURE, 2021–2026 (USD MILLION)

TABLE 229 SOUTH AMERICA: MARKET SIZE, BY NATURE, 2016–2020 KT)

TABLE 230 SOUTH AMERICA: MARKET SIZE, BY NATURE, 2021–2026 (KT)

10.5.1 BRAZIL

10.5.1.1 The growth in the food processing industry in the country is expected to drive the market

TABLE 231 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 232 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 233 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 234 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.5.2 ARGENTINA

10.5.2.1 The increase in the use of spices in meat recipes are expected to drive the market in Argentina

TABLE 235 ARGENTINA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 236 ARGENTINA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 237 ARGENTINA: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 238 ARGENTINA: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.5.3 CHILE

10.5.3.1 The increase in the use of spices in different Chilean beverages is expected to increase its usage

TABLE 239 CHILE: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 240 CHILE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 241 CHILE: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 242 CHILE: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.5.4 REST OF SOUTH AMERICA

TABLE 243 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 244 REST OF SOUTH AMERICA: THE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 245 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 246 REST OF SOUTH AMERICA: THE MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.6 REST OF WORLD (ROW)

TABLE 247 ROW: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 248 ROW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 249 ROW: MARKET SIZE, BY REGION, 2016–2020 (KT)

TABLE 250 ROW: MARKET SIZE, BY REGION, 2021–2026 (KT)

TABLE 251 ROW: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 252 ROW: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 253 ROW: MARKET SIZE, BY TYPE,2016–2020 (KT)

TABLE 254 ROW: MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 255 ROW: SEASONING AND SPICES MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 256 ROW: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 257 ROW: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 258 ROW: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

TABLE 259 ROW: MARKET SIZE, BY NATURE, 2016–2020 (USD MILLION)

TABLE 260 ROW: MARKET SIZE, BY NATURE, 2021–2026 (USD MILLION)

TABLE 261 ROW: MARKET SIZE, BY NATURE, 2016–2020 KT)

TABLE 262 ROW: MARKET SIZE, BY NATURE, 2021–2026 (KT)

10.6.1 MIDDLE EAST

10.6.1.1 The use of various unique spices to flavor Middle Eastern dishes is expected to drive the market in the region

TABLE 263 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 264 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 265 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 266 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

10.6.2 AFRICA

10.6.2.1 The use of different spice marinades for the preparation of sausages and meat is expected to propel the market in Africa

TABLE 267 AFRICA: SPICES AND SEASONINGS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 268 AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 269 AFRICA: MARKET SIZE, BY APPLICATION, 2016–2020 (KT)

TABLE 270 AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (KT)

11 COMPETITIVE LANDSCAPE (Page No. - 208)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS, 2020

TABLE 271 MCCORMICK & COMPANY DOMINATE THE MARKET IN 2020

FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018-2020 (USD MILLION)

11.3 COMPANY EVALUATION MATRIX: DEFINITION & METHODOLOGY (KEY PLAYERS)

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

FIGURE 34 MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

11.4 COMPANY EVALUATION MATRIX: DEFINITION & METHODOLOGY (START-UPS/SMES)

11.4.1 PROGRESSIVE COMPANIES

11.4.2 STARTING BLOCKS

11.4.3 RESPONSIVE COMPANIES

11.4.4 DYNAMIC COMPANIES

FIGURE 35 MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UPS/SMES)

11.5 PRODUCT FOOTPRINT

TABLE 272 SPICES AND SEASONINGS MARKET: COMPANY TYPE FOOTPRINT (BY PARAMETERS)

TABLE 273 MARKET: COMPANY REGION FOOTPRINT

TABLE 274 MARKET: PRODUCT FOOTPRINT (OVERALL)

11.6 MARKET EVALUATION FRAMEWORK

TABLE 275 OVERVIEW OF STRATEGIES DEPLOYED BY SPICES & SEASONINGS COMPANIES

11.6.1 DEALS

TABLE 276 MARKET: DEALS, JANUARY 2018–FEBRUARY 2021

11.6.2 OTHERS

TABLE 277 MARKET: OTHERS, JANUARY 2018–FEBRUARY 2021

12 COMPANY PROFILES (Page No. - 220)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 MCCORMICK & COMPANY, INC.

TABLE 278 MCCORMICK & COMPANY, INC.: BUSINESS OVERVIEW

FIGURE 36 MCCORMICK & COMPANY, INC.: COMPANY SNAPSHOT

TABLE 279 MCCORMICK & COMPANY, INC.: DEALS

12.1.2 OLAM INTERNATIONAL

TABLE 280 OLAM INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 37 OLAM INTERNATIONAL: COMPANY SNAPSHOT

TABLE 281 OLAM INTERNATIONAL: DEALS

12.1.3 AJINOMOTO CO., INC

TABLE 282 AJINOMOTO CO., INC: SPICES AND SEASONINGS MARKET BUSINESS OVERVIEW

FIGURE 38 AJINOMOTO CO., INC: COMPANY SNAPSHOT

TABLE 283 AJINOMOTO CO., INC: OTHERS

12.1.4 ASSOCIATED BRITISH FOODS PLC

TABLE 284 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

FIGURE 39 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

12.1.5 KERRY GROUP PLC

TABLE 285 KERRY GROUP PLC: BUSINESS OVERVIEW

FIGURE 40 KERRY GROUP PLC: COMPANY SNAPSHOT

TABLE 286 KERRY GROUP PLC: DEALS

12.1.6 ARIAKE JAPAN CO., LTD.

TABLE 287 ARIAKE JAPAN CO., LTD.: BUSINESS OVERVIEW

FIGURE 41 ARIAKE JAPAN CO., LTD.: COMPANY SNAPSHOT

12.1.7 SENSIENT TECHNOLOGIES CORPORATION

TABLE 288 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 42 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 289 SENSIENT TECHNOLOGIES CORPORATION: DEALS

12.1.8 DÖHLER GROUP

TABLE 290 DÖHLER GROUP: BUSINESS OVERVIEW

12.1.9 SHS GROUP

TABLE 291 SHS GROUP: BUSINESS OVERVIEW

12.1.10 WORLÉE GRUPPE

TABLE 292 WORLÉE GROUP: BUSINESS OVERVIEW

12.1.11 PACIFIC SPICE COMPANY

TABLE 293 PACIFIC SPICE COMPANY: SPICES AND SEASONINGS MARKET BUSINESS OVERVIEW

12.1.12 PARAS SPICES PRIVATE LIMITED

TABLE 294 PARAS SPICES PRIVATE LIMITED: BUSINESS OVERVIEW

12.1.13 VKL SEASONINGS PVT LTD

TABLE 295 VKL SEASONINGS PVT LTD: BUSINESS OVERVIEW

12.1.14 FRIEDRICH INGREDIENTS

TABLE 296 FRIEDRICH INGREDIENTS: BUSINESS OVERVIEW

12.1.15 MOGUNTIA FOOD GROUP AG

TABLE 297 MOGUNTIA FOOD GROUP AG: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 SPICE HOME COMPANY

12.2.2 SHAMA SPICES

12.2.3 EVEREST FOOD PRODUCTS PVT. LTD

12.2.4 ELITE SPICES

12.2.5 TERANA, S.A.

13 APPENDIX (Page No. - 271)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.3.1 SEGMENT ANALYSIS

13.3.1.1 Geographic Analysis

13.3.1.2 Company Information

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involves four major activities to estimate the current size of the spices and seasonings market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of various segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as the Food and Agriculture organization (FAO), United States Department of Agriculture (USDA), European Commission, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, and trade directories.

Primary Research

The spices and seasonings market comprises several stakeholders such as in the Supply-side: spices and seasonings producers, suppliers, distributors, importers, and exporters, and in the Demand-side: processed food product manufacturers, food and beverage manufacturers, cosmetic producting companies, and research organizations. Regulatory-side: Related government authorities, commercial research & development (R&D) institutions, FDA, EFSA, USDA, FSANZ, EUFIC government agencies & NGOs, and other regulatory bodies, Food product consumers, Regulatory bodies, including government agencies and NGOs, Commercial research & development (R&D) institutions and financial institutions, Government and research organizations

To know about the assumptions considered for the study, download the pdf brochure

Spices and Seasonings Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market.

Spices and Seasonings Market Report Objectives

- To define, segment, and estimate the size of the plant extracts market with respect to ingredients type, applications, form, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and product approvals, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the market report:

Geographic Analysis

- A further breakdown of the Rest of Europe spices and seasonings market, by key countries such as Ireland, Netherlands, Sweden, Turkey, Belgium, and other-EU-&non-EU countries.

- A further breakdown of the Rest of Asia-Pacific market, by key countries such as Vietnam, Malaysia, Thailand, Indonesia, the Philippines, and South Korea.

- A further breakdown of the Rest of South American market, by key countries such as Colombia, Venezuela and Peru.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Spices and Seasonings Market