Broadcast Equipment Market by Type (Dish Antennas, Amplifiers, Encoders, Video Servers, Transmitters, Modulators, Power Control Systems), Technology (Analog & Digital), Radio Modulation (Amplitude & Frequency) & Region - Global Forecast to 2028

Updated on : October 22, 2024

Broadcast Equipment Market Size & Growth

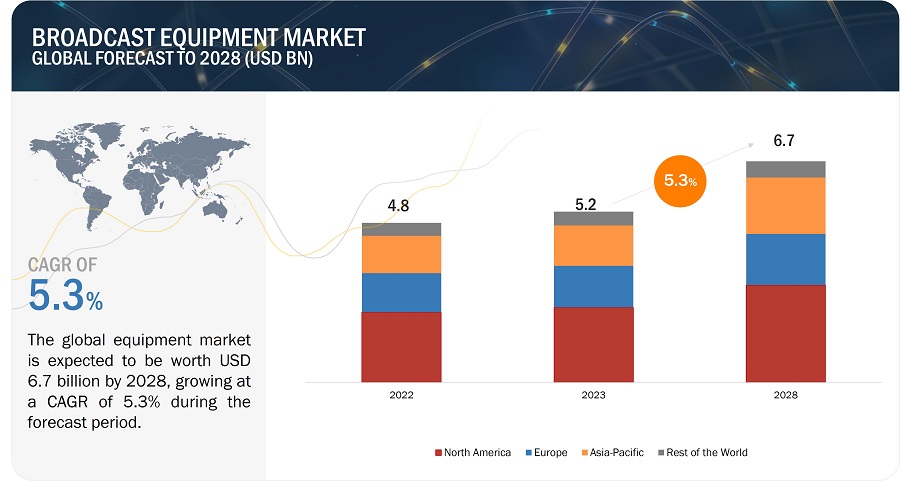

The global broadcast equipment market size was valued at USD 5.2 billion in 2023 and is estimated to reach USD 6.7 billion by 2028, growing at a CAGR of 5.3% between 2023 to 2028.

Growing digitalization and technological advancements has driven the need for advanced equipment to support higher-quality audio and video transmission. Also, the rise of D2C streaming platforms has created a need for equipment that can support seamless streaming, on-demand content delivery, and personalized viewer experiences. These factors are fueling the market growth for broadcast equipment.

Broadcast Equipment Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Broadcast Equipment Market Trends and Dynamics:

Driver: Growing Investments in Content Production is driving the market

In today's media landscape, people want to watch top-notch content whenever they want and in the best quality. This has put pressure on broadcasters to come up with exciting shows, movies, documentaries, live events, and more. To make this kind of captivating content, broadcasters and creators need really good broadcasting equipment. This includes things like cameras, video production gear, audio recording tools, editing software, and more. With these tools, professionals can create content that looks and sounds amazing, making it stand out in the crowded media world. Hence, when broadcasters invest in making great content, they also need to invest in top-notch equipment to do it right. This equipment helps them produce high-quality and interesting content that grabs the audience's attention. Since content is at the core of the broadcasting industry, these investments will keep driving the demand for broadcasting equipment.

Restraint: Complexities due to rapid change in broadcasting technologies

In recent times, broadcasting technologies have been advancing at an unprecedented pace. This includes the move towards high-definition (HD) and ultra-high-definition (UHD) content, the adoption of IP-based workflows, virtual reality (VR), augmented reality (AR), and the use of cloud-based services. This swift transformation is primarily driven by the expectations of a more digitally connected audience and the necessity for media companies to maintain their competitiveness and provide exceptional viewer experiences.However, this rapid evolution presents challenges for broadcasters and content creators when it comes to investing in broadcasting equipment. What is considered cutting-edge today could quickly become outdated due to the rapid emergence of newer technologies..

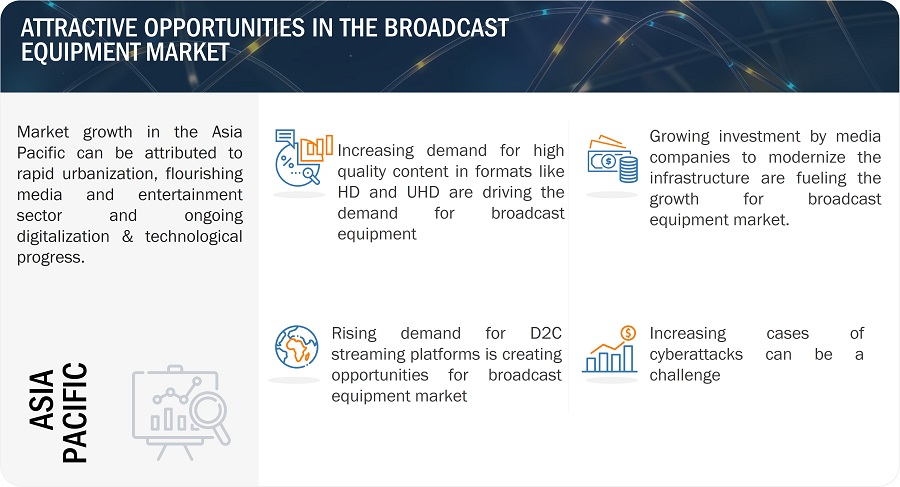

Opportunity: Rapid Urbanizatin and Digital Transformation creates opportunity for broadcast equipment manufacturers

The rapid growth of cities is closely linked to economic progress and technological advancements. This presents an exciting opportunity for the broadcasting equipment market because cities have a diverse and concentrated population. Urban areas often have excellent infrastructure, including high-speed internet and advanced communication networks. This creates a favorable environment for broadcasters to reach a large and engaged audience. As emerging markets go through digital transformations, there's a big change in how people consume media and content. This shift has created new possibilities for equipment manufacturers. The introduction of high-speed internet access in these markets has led to a surge in online streaming, video-on-demand, and over-the-top (OTT) services. This is creating an opportunity for the broadcasting equipment manufacturers

Challenge: Increasing cases of cyberattacks

Cyberattacks can inflict significant harm on a company, both in terms of financial losses and damage to its reputation. These attacks can potentially compromise users' data, including valuable content and sensitive information on a broadcasting operator's channel. Regardless of how robust a system's security measures may be, there are always vulnerabilities, which can make the system susceptible to cyber threats. The broadcasting equipment market heavily relies on various technologies, such as IT systems, the internet, internal networks, and web-connected networks, for tasks like content production, storage, and delivery. Given its importance within the broadcast equipment market, safeguarding data becomes a top priority. The challenge with cybersecurity is that cyberattacks are challenging to prevent and detect in real-time, which poses obstacles to the growth of the broadcasting equipment market.

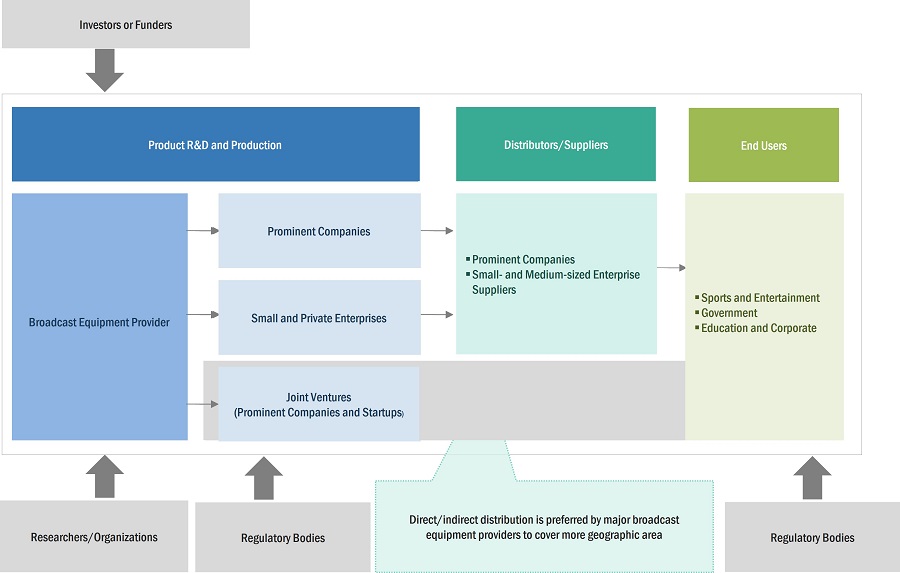

Broadcast Equipment Market Ecosystem

The broadcast equipment market is consolidated, with major companies such as Cisco Systems Inc., Telefonaktiebolaget LM Ericsson, CommScope, Evertz Microsystems, Ltd, Harmonic Inc., and numerous small- and medium-sized enterprises. Almost all players offer various products, including amplifiers, modulators, encoders, and transmitters. These components are used for applications including radio as well as television.

Broadcast Equipment Market Segmentation

Based on technology, Digital broadcasting segment is expected to dominate during the forecast period.

The digital broadcasting is expected to dominate the broadcast equipment market share during the forecast period. The proliferation of digital television sets, set-top boxes, and smart TVs is driving the demand for digital broadcasting. Viewers with these devices expect digital content, compelling broadcasters to invest in digital equipment. Also, The growth of online streaming services, video-on-demand (VOD) platforms, and over-the-top (OTT) content delivery has expanded the digital broadcasting ecosystem. These factors are having the positive impact on the market growth.

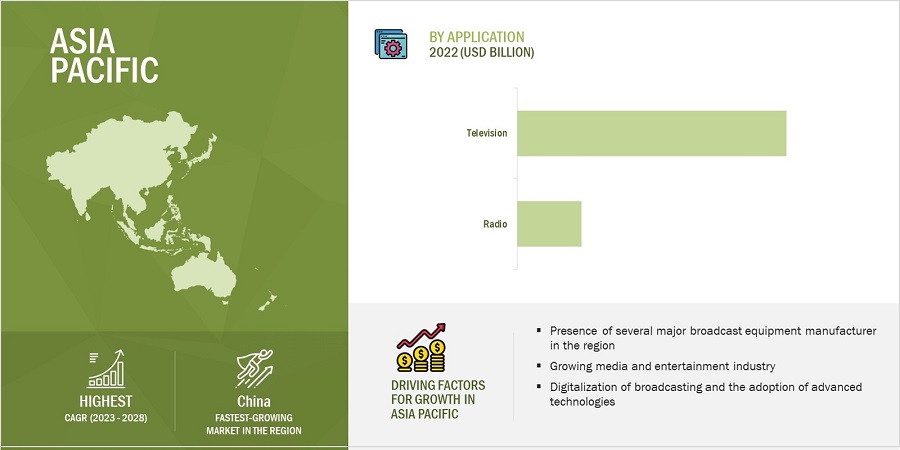

Based on application, the television segment is projected to have largest market share during the forecast period

Television has an extensive and enduring consumer base worldwide. It remains a primary source of news, entertainment, and information for billions of households. This consistent viewership drives the demand for broadcast equipment dedicated to television broadcasting. The television content is delivered through various platforms, including terrestrial, cable, satellite, and digital streaming. Each platform requires specialized equipment to ensure seamless transmission. Moreover, Governments in many countries invest in broadcasting infrastructure and technology. These factors are contributing towards the higher demand for broadcasting equipment for television applications.

Broadcast Equipment Industry Regional Analysis

Based on region, Asia Pacific is projected to grow fastest for the broadcast equipment market

Many countries in the Asia-Pacific region are experiencing robust economic growth, resulting in increased consumer spending and a growing middle class. This economic prosperity is driving demand for high-quality content and entertainment, leading to investments in broadcast equipment. Also, The media and entertainment industry in Asia-Pacific is expanding rapidly. The region is home to a large and diverse audience, leading to investments in content production and broadcasting infrastructure to cater to these markets thereby driving the market growth.

Broadcast Equipment Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Broadcast Equipment Companies - Key Market Players

- Cisco Systems Inc., (US),

- Telefonaktiebolaget LM Ericsson (Sweden),

- CommScope (US),

- Evertz Microsystems, Ltd (Canada),

- Harmonic Inc. (US),

- EVS Broadcast Equipment (Belgium),

- Grass Valley (Canada),

- Wellav Technologies Ltd. (China),

- Eletec Broadcast Telecom S.A.R.L (France),

- Clyde Broadcast (UK).

Broadcast Equipment Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 5.2 billion |

|

Expected Value |

USD 6.7 billion |

|

Growth Rate |

CAGR of 5.3% |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By type, technology, application, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies Covered |

Cisco Systems Inc., (US), Telefonaktiebolaget LM Ericsson (Sweden), CommScope (US), Evertz Microsystems, Ltd (Canada), Harmonic Inc. (US), EVS Broadcast Equipment (Belgium), Grass Valley (Canada), Wellav Technologies Ltd. (China), Eletec Broadcast Telecom S.A.R.L (France), and Clyde Broadcast (UK) |

Broadcast Equipment Market Highlights

This research report categorizes the broadcast equipment market share based on type, technology, application, and region

|

Segment |

Subsegment |

|

Based on type: |

|

|

Based on technology: |

|

|

Based on application: |

|

|

Based on region: |

|

Recent Developments in Broadcast Equipment Industry

- In July 2023, Telefonaktiebolaget LM Ericsson has collaborated with Vodafone and have initiated the rollout of a compact active-passive antenna. This endeavor aims to enhance 5G capacity, coverage, and performance without increasing the physical space taken up by antennas.

- In June 2023, Cisco and the Tribeca Festival have partnered having a mutual goal of promoting inclusivity. Cisco's Webex will take on the role of the official technology partner for the 2023 closing gala of the Tribeca Festival, which is titled "A Bronx Tale." Notably, this marks the first occasion where the festival's closing event will be made available for on-demand streaming through Webex Events, alongside the traditional live presentation at New York City's Beacon Theatre.

- In January 2023, CommScope, a renowned provider of network connectivity solutions on a global scale, has made an announcement regarding RUCKUS Networks. RUCKUS Networks is introducing a fresh line of edge switches that are both scalable and designed for entry-level usage. Notably, these switches come equipped with 25 Gbps uplink ports. This collection also encompasses the maiden entry-level enterprise switch capable of providing fiber-to-the-room connectivity.

- In April 2022, CommScope, a prominent figure in the domain of home network solutions worldwide, has joined forces with Orange Belgium. This partnership aims to equip Orange Belgium's subscribers with cutting-edge set-top boxes driven by the Android TV operating system. These set-top boxes are designed to offer a seamless blend of live television and high-quality streaming services.

- In January 2022, CommScope, in collaboration with ViacomCBS, has unveiled the launch of FAVE. Additionally, ViacomCBS has successfully transitioned its DABL and certain SHOWTIME linear channels from satellite-based distribution to the advanced Content Delivery Network (CDN) IP distribution. This transformation has been accomplished using CommScope's innovative DigiCipher Streaming system

Frequently Asked Questions (FAQs):

Which are the major companies in the broadcast equipment market? What are their major strategies to strengthen their market presence?

The major companies in the broadcast equipment market are – Cisco Systems Inc., (US), Telefonaktiebolaget LM Ericsson (Sweden), CommScope (US), Evertz Microsystems, Ltd (Canada), Harmonic Inc. (US), and EVS Broadcast Equipment (Belgium). The major strategies adopted bsy these players are product launches and developments, collaborations, acquisitions, and expansions.

Which is the potential market for the broadcast equipment in terms of the region?

The North America region is expected to dominate the broadcast equipment market due to the presence of leading players from the broadcast equipment market such as Cisco Systems Inc., Harmonic Inc, and CommScope.

What are the opportunities for new broadcast equipment market share entrants?

There are significant opportunities in the broadcast equipment market for start-up companies. These companies are providing innovative products.

What are the drivers and opportunities for the broadcast equipment market share?

Factors such as rapid urbanization and digitalization in emerging economies, heightened demand for encoders due to support for multiple formats, and transition from analog to digital broadcasting are among the factors driving the growth of the broadcast equipment market.

Who are the major applications of the broadcast equipment that are expected to drive the growth of the market in the next 5 years?

The major application for the broadcast equipment is television. The broadcast equipment also have a demand from government, sports and entertainment, and education industry. They are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rapid growth in over-the-top (OTT) subscriptions- Increased demand for encoders to support multiple formats- Transition from analog to digital broadcasting- Growing investments in content productionRESTRAINTS- Rise in instances of cyberattacks- Advancements in broadcasting technologiesOPPORTUNITIES- Implementation of AI-based technologies for broadcasting- Rapid urbanization and digital transformationCHALLENGES- Limited ultra-high-definition (UHD) content or 4K streaming

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICING ANALYSISPRICING ANALYSIS OF BROADCAST EQUIPMENT MARKET BASED ON TYPE, BY KEY PLAYERSINDICATIVE SELLING PRICE TREND

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSIS5G CONNECTIVITYARTIFICIAL INTELLIGENCE (AI)VIDEO COMPRESSION AND STREAMING PROTOCOLSREMOTE PRODUCTION SOLUTIONS

- 5.8 PORTER’S FIVE FORCES ANALYSIS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSCODECS AND STANDARDS RELATED TO BROADCAST EQUIPMENT

- 6.1 INTRODUCTION

- 6.2 LOW FREQUENCY

- 6.3 MEDIUM FREQUENCY

- 6.4 HIGH FREQUENCY

- 6.5 VERY HIGH FREQUENCY

- 6.6 ULTRA-HIGH FREQUENCY

- 6.7 SUPER HIGH FREQUENCY

- 7.1 SPORTS AND ENTERTAINMENT

- 7.2 GOVERNMENT

- 7.3 EDUCATION AND CORPORATE

- 8.1 INTRODUCTION

-

8.2 DISH ANTENNASDEPLOYMENT IN SATELLITE BROADCASTING FOR FLEXIBLE TRANSMISSIONS TO DRIVE MARKET

-

8.3 AMPLIFIERSRISING DEMAND FOR ENHANCED SIGNAL QUALITY TO FUEL SEGMENTAL GROWTH

-

8.4 SWITCHESNEED FOR SEAMLESS CONTENT DISTRIBUTION TO CONTRIBUTE TO DEMAND

-

8.5 ENCODERSDEPLOYMENT TO CONVERT ANALOG OR DIGITAL SIGNALS TO DIGITAL FORMAT AND ENHANCE PICTURE QUALITY TO BOOST MARKET

-

8.6 VIDEO SERVERSINCREASING INTEREST IN LIVE STREAMING TO PROPEL SEGMENTAL GROWTH

-

8.7 TRANSMITTERS/REPEATERSUTILIZATION IN CREATING RADIO WAVES TO BROADCAST DATA THROUGH ANTENNAS TO SUPPORT MARKET GROWTH

-

8.8 MODULATORSEMERGING BROADCASTING STANDARDS AND GROWING DEMAND FOR DIVERSE CONTENT DELIVERY TO DRIVE MARKET

- 8.9 OTHERS

- 9.1 INTRODUCTION

-

9.2 ANALOG BROADCASTINGCOST-EFFICIENCY AND RELIABLE LONG-DISTANCE COMMUNICATION CAPABILITIES TO FUEL SEGMENTAL GROWTH

-

9.3 DIGITAL BROADCASTINGHIGH-DEFINITION CONTENT TRANSMISSION CAPABILITIES FOR IMMERSIVE VIEWING EXPERIENCE TO PROPEL MARKET

- 10.1 INTRODUCTION

-

10.2 RADIOSAMPLITUDE MODULATION (AM)- High demand for AM radio in aviation and two-way radio systems to drive marketFREQUENCY MODULATION (FM)- Increased demand for clearer audio signals to boost market

-

10.3 TELEVISIONSDIRECT BROADCASTING SATELLITES (DBS)- Rising demand for global connectivity and direct-to-home entertainment to fuel market growthTERRESTRIAL TELEVISIONS- Analog terrestrial television- Digital terrestrial televisionCABLE TELEVISIONS- High speed and efficiency to propel deployment of cable televisionsIPTV- Requirement for personalized and on-demand video content to support market growth

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

-

11.3 IMPACT OF RECESSION ON BROADCAST EQUIPMENT MARKET IN NORTH AMERICAUS- Presence of several broadcast equipment manufacturers to boost marketCANADA- Establishment of Canadian Association of Broadcasters (CAB) to drive marketMEXICO- Growing demand for live broadcasting of sports events to propel market

- 11.4 EUROPE

-

11.5 IMPACT OF RECESSION ON BROADCAST EQUIPMENT MARKET IN EUROPEUK- Collaborations between media companies to boost marketGERMANY- Hosting major international trade fairs related to broadcasting to contribute to market growthFRANCE- High emphasis on broadcasting drama and literary programs to favor broadcast equipment market growthITALY- Robust presence of broadcasting companies to promote broadcast equipment market growthREST OF EUROPE

- 11.6 ASIA PACIFIC

-

11.7 IMPACT OF RECESSION ON BROADCAST EQUIPMENT MARKET IN ASIA PACIFICJAPAN- Rising demand for ultra-high-definition content to spur market growthCHINA- Government initiatives to boost media and entertainment industry to fuel market growthINDIA- Initiatives toward digitization of broadcasting sector to boost marketSOUTH KOREA- Collaborations by broadcast networks to strengthen broadcasting sectorTAIWAN- Terrestrial television networks to underpin broadcast equipment market growthREST OF ASIA PACIFIC

- 11.8 REST OF THE WORLD (ROW)

-

11.9 IMPACT OF RECESSION ON BROADCAST EQUIPMENT MARKET IN ROWMIDDLE EAST & AFRICA- Growing media and entertainment sector to fuel demand for broadcast equipmentSOUTH AMERICA- Growing broadband service adoption to drive marketBRAZIL- Increasing adoption of digital broadcasting to propel marketREST OF SOUTH AMERICA

- 12.1 OVERVIEW

-

12.2 KEY PLAYER STRATEGIES/RIGHT TO WINPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC STRATEGIES

- 12.3 FIVE-YEAR COMPANY REVENUE ANALYSIS, 2018–2022

- 12.4 MARKET SHARE ANALYSIS, 2022

-

12.5 KEY COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSBROADCAST EQUIPMENT MARKET: COMPANY FOOTPRINT

-

12.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)/STARTUPS EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSBROADCAST EQUIPMENT MARKET: SMES/STARTUPS

-

12.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSCISCO SYSTEMS, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTELEFONAKTIEBOLAGET LM ERICSSON- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCOMMSCOPE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEVERTZ- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHARMONIC INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEVS BROADCAST EQUIPMENT- Business overview- Products/Services/Solutions offered- Recent developmentsGRASS VALLEY CANADA- Business overview- Products/Services/Solutions Offered- Recent developmentsWELLAV TECHNOLOGIES LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsELETEC SARL RADIO BROADCASTING EQUIPMENT- Business overview- Products/Services/Solutions offered- Recent developmentsCLYDE BROADCAST- Business overview- Products/Services/Solutions offered

-

13.2 OTHER PLAYERSAVL TECHNOLOGIES, INC.NEC CORPORATIONETL SYSTEMS LTDGLOBAL INVACOMBROADCAST ELECTRONICSOMBBELDEN INC.TVC COMMUNICATIONSDATUM SYSTEMSHANGZHOU HAOXUN TECHNOLOGIES CO., LTDROHDE & SCHWARZACORDE TECHNOLOGIES S.A.FMUSER INTERNATIONAL GROUP LIMITEDTEKO BROADCASTGBSONLINE

- 14.1 INTRODUCTION

- 14.2 ENCODER MARKET, BY SIGNAL TYPE

-

14.3 INCREMENTALSIMPLIFIED HARDWARE AND FLEXIBLE FUNCTIONALITY TO DRIVE MARKET

-

14.4 ABSOLUTERELIABLE MEASUREMENT PERFORMANCE TO STRENGTHEN MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION

- TABLE 2 ROLE OF PARTICIPANTS IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE OF BROADCAST EQUIPMENT, BY KEY PLAYER (USD)

- TABLE 4 INDICATIVE SELLING PRICE OF BROADCAST EQUIPMENT, BY REGION (USD)

- TABLE 5 BROADCAST EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 7 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 8 WELLAV SMP100 HELPED PROVIDE BROADCASTING SERVICES ON SOUTH PACIFIC ISLANDS

- TABLE 9 NEC CORPORATION HELPED FUJI TELEVISION NETWORK CREATE STRUCTURE AND TRANSMISSION EQUIPMENT TO CONTINUE BROADCASTING IN EMERGENCIES

- TABLE 10 EVERTZ MICROSYSTEMS HELPED SPORTSNET BUILD SCALABLE REPLAY PLATFORM

- TABLE 11 GRASS VALLEY HELPED NEWS 12 MEET CONSUMER DEMAND FOR SEAMLESS CONTENT DISTRIBUTION

- TABLE 12 SCIENTOLOGY NETWORK USED GRASS VALLEY SOLUTIONS FOR GLOBAL REACH

- TABLE 13 TOP 20 PATENT OWNERS IN US FROM 2013 TO 2023

- TABLE 14 LIST OF PATENTS IN BROADCAST EQUIPMENT MARKET

- TABLE 15 BROADCAST EQUIPMENT MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- TABLE 19 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- TABLE 20 CODECS AND STANDARDS RELATED TO BROADCAST EQUIPMENT

- TABLE 21 BROADCAST EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 22 BROADCAST EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 24 BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 25 BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 RADIOS: BROADCAST EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 RADIOS: BROADCAST EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 BROADCAST EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 BROADCAST EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: BROADCAST EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: BROADCAST EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: BROADCAST EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: BROADCAST EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 39 US: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 40 US: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 41 US: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 42 US: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 43 CANADA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 44 CANADA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 45 CANADA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 46 CANADA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 MEXICO: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 48 MEXICO: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 49 MEXICO: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 MEXICO: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 EUROPE: BROADCAST EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 52 EUROPE: BROADCAST EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 53 EUROPE: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 54 EUROPE: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 55 EUROPE: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 56 EUROPE: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 57 EUROPE: BROADCAST EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 58 EUROPE: BROADCAST EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 UK: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 60 UK: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 61 UK: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 62 UK: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 63 GERMANY: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 64 GERMANY: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 65 GERMANY: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 GERMANY: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 FRANCE: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 68 FRANCE: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 69 FRANCE: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 70 FRANCE: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 ITALY: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 72 ITALY: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 73 ITALY: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 74 ITALY: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 REST OF EUROPE: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 76 REST OF EUROPE: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 77 REST OF EUROPE: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 78 REST OF EUROPE: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: BROADCAST EQUIPMENT MARKET BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 84 ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 JAPAN: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 88 JAPAN: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 89 JAPAN: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 JAPAN: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 CHINA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 92 CHINA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 93 CHINA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 94 CHINA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 INDIA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 96 INDIA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 97 INDIA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 98 INDIA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 SOUTH KOREA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 100 SOUTH KOREA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 101 SOUTH KOREA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 102 SOUTH KOREA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 TAIWAN: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 104 TAIWAN: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 105 TAIWAN: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 TAIWAN: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 ROW: BROADCAST EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 112 ROW: BROADCAST EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 113 ROW: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 114 ROW: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 115 ROW: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 116 ROW: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 ROW: BROADCAST EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 118 ROW: BROADCAST EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 SOUTH AMERICA: BROADCAST EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 124 SOUTH AMERICA: BROADCAST EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 125 SOUTH AMERICA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 126 SOUTH AMERICA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 127 SOUTH AMERICA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 128 SOUTH AMERICA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 129 BRAZIL: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 130 BRAZIL: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 131 BRAZIL: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 132 BRAZIL: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 REST OF SOUTH AMERICA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 134 REST OF SOUTH AMERICA: BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 135 REST OF SOUTH AMERICA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 136 REST OF SOUTH AMERICA: BROADCAST EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 137 OVERVIEW OF STRATEGIES DEPLOYED BY KEY BROADCAST EQUIPMENT MANUFACTURERS

- TABLE 138 BROADCAST EQUIPMENT MARKET: MARKET SHARE ANALYSIS, 2022

- TABLE 139 OVERALL COMPANY FOOTPRINT

- TABLE 140 COMPANY APPLICATION FOOTPRINT

- TABLE 141 COMPANY REGIONAL FOOTPRINT

- TABLE 142 BROADCAST EQUIPMENT MARKET: LIST OF KEY SMES/STARTUPS

- TABLE 143 BROADCAST EQUIPMENT MARKET: DETAILED DESCRIPTION OF SMES/STARTUPS

- TABLE 144 BROADCAST EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY SMES/STARTUPS (PRODUCT TYPE FOOTPRINT)

- TABLE 145 BROADCAST EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY SMES/STARTUPS (APPLICATION FOOTPRINT)

- TABLE 146 BROADCAST EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY SMES/STARTUPS (REGION FOOTPRINT)

- TABLE 147 BROADCAST EQUIPMENT MARKET: PRODUCT LAUNCHES, 2020−2023

- TABLE 148 BROADCAST EQUIPMENT MARKET: DEALS, 2020–2023

- TABLE 149 CISCO SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 150 CISCO SYSTEMS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 151 CISCO SYSTEMS, INC.: PRODUCT LAUNCHES

- TABLE 152 CISCO SYSTEMS, INC.: DEALS

- TABLE 153 TELEFONAKTIEBOLAGET LM ERICSSON: BUSINESS OVERVIEW

- TABLE 154 TELEFONAKTIEBOLAGET LM ERICSSON: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 155 TELEFONAKTIEBOLAGET LM ERICSSON: PRODUCT LAUNCHES

- TABLE 156 TELEFONAKTIEBOLAGET LM ERICSSON: DEALS

- TABLE 157 COMMSCOPE: BUSINESS OVERVIEW

- TABLE 158 COMMSCOPE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 159 COMMSCOPE: PRODUCT LAUNCHES

- TABLE 160 COMMSCOPE: DEALS

- TABLE 161 EVERTZ: BUSINESS OVERVIEW

- TABLE 162 EVERTZ: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 163 EVERTZ: PRODUCT LAUNCHES

- TABLE 164 EVERTZ: DEALS

- TABLE 165 HARMONIC INC.: BUSINESS OVERVIEW

- TABLE 166 HARMONIC INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 HARMONIC INC.: PRODUCT LAUNCHES

- TABLE 168 HARMONIC INC.: DEALS

- TABLE 169 EVS BROADCAST EQUIPMENT: BUSINESS OVERVIEW

- TABLE 170 EVS BROADCAST EQUIPMENT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 171 EVS BROADCAST EQUIPMENT: PRODUCT LAUNCHES

- TABLE 172 EVS BROADCAST EQUIPMENT: DEALS

- TABLE 173 GRASS VALLEY CANADA: BUSINESS OVERVIEW

- TABLE 174 GRASS VALLEY CANADA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 175 GRASS VALLEY CANADA: PRODUCT LAUNCHES

- TABLE 176 GRASS VALLEY CANADA: DEALS

- TABLE 177 WELLAV TECHNOLOGIES LTD.: BUSINESS OVERVIEW

- TABLE 178 WELLAV TECHNOLOGIES LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 WELLAV TECHNOLOGIES LTD.: PRODUCT LAUNCHES

- TABLE 180 WELLAV TECHNOLOGIES LTD.: DEALS

- TABLE 181 ELETEC SARL RADIO BROADCASTING EQUIPMENT: BUSINESS OVERVIEW

- TABLE 182 ELETEC SARL RADIO BROADCASTING EQUIPMENT: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 183 ELETEC SARL RADIO BROADCASTING EQUIPMENT: PRODUCT LAUNCHES

- TABLE 184 CLYDE BROADCAST: BUSINESS OVERVIEW

- TABLE 185 CLYDE BROADCAST: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 186 ENCODER MARKET, BY SIGNAL TYPE, 2019–2022 (USD MILLION)

- TABLE 187 ENCODER MARKET, BY SIGNAL TYPE, 2023–2028 (USD MILLION)

- TABLE 188 INCREMENTAL: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 189 INCREMENTAL: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 190 ABSOLUTE: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 191 ABSOLUTE: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- FIGURE 1 BROADCAST EQUIPMENT MARKET: SEGMENTATION

- FIGURE 2 BROADCAST EQUIPMENT MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)—REVENUE GENERATED BY COMPANIES FROM SALES OF BROADCAST EQUIPMENT

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 DIGITAL BROADCASTING SEGMENT TO EXHIBIT HIGHER CAGR IN BROADCAST EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 8 TELEVISIONS SEGMENT TO CAPTURE LARGER SIZE OF BROADCAST EQUIPMENT MARKET IN 2028

- FIGURE 9 ENCODERS SEGMENT TO DOMINATE BROADCAST EQUIPMENT MARKET IN 2028

- FIGURE 10 NORTH AMERICA HELD LARGEST SHARE OF BROADCAST EQUIPMENT MARKET IN 2022

- FIGURE 11 GROWING SUBSCRIPTIONS OF OVER-THE-TOP (OTT) STREAMING PLATFORMS TO FUEL GROWTH OF BROADCAST EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 12 VIDEO SERVERS SEGMENT TO HOLD LARGEST SHARE OF BROADCAST EQUIPMENT MARKET IN 2028

- FIGURE 13 DIGITAL BROADCASTING AND TELEVISIONS SEGMENTS TO ACCOUNT FOR LARGER SHARES OF BROADCAST EQUIPMENT MARKET IN 2028

- FIGURE 14 CHINA TO RECORD HIGHEST CAGR IN OVERALL BROADCAST EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 15 BROADCAST EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 RISE IN NUMBER OF OTT PLATFORMS FROM 2018 TO 2021

- FIGURE 17 BROADCAST EQUIPMENT MARKET DRIVERS AND THEIR IMPACT

- FIGURE 18 BROADCAST EQUIPMENT MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 19 BROADCAST EQUIPMENT MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 20 BROADCAST EQUIPMENT MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 21 BROADCAST EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 ECOSYSTEM ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE OF BROADCAST EQUIPMENT, BY KEY PLAYER

- FIGURE 24 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR BROADCAST EQUIPMENT MARKET PLAYERS

- FIGURE 25 BROADCAST EQUIPMENT MARKET: PORTER’S FIVE FORCES MODEL

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 27 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 28 IMPORT DATA, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 29 EXPORT DATA, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2013 TO 2023

- FIGURE 31 NUMBER OF PATENTS GRANTED PER YEAR FROM 2013 TO 2023

- FIGURE 32 BROADCAST EQUIPMENT MARKET, BY TYPE

- FIGURE 33 VIDEO SERVERS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 BROADCAST EQUIPMENT MARKET, BY TECHNOLOGY

- FIGURE 35 DIGITAL BROADCASTING SEGMENT TO RECORD HIGHER CAGR IN BROADCAST EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 36 BROADCAST EQUIPMENT MARKET, BY APPLICATION

- FIGURE 37 TELEVISIONS SEGMENT TO EXHIBIT HIGHER CAGR IN BROADCAST EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO RECORD HIGHEST CAGR FOR TELEVISIONS SEGMENT IN BROADCAST EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 39 REGIONAL SPLIT OF BROADCAST EQUIPMENT MARKET

- FIGURE 40 BROADCAST EQUIPMENT MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: BROADCAST EQUIPMENT MARKET SNAPSHOT

- FIGURE 42 TELEVISIONS SEGMENT TO LEAD BROADCAST EQUIPMENT MARKET IN NORTH AMERICA DURING FORECAST PERIOD

- FIGURE 43 EUROPE: BROADCAST EQUIPMENT MARKE SNAPSHOT

- FIGURE 44 ASIA PACIFIC: BROADCAST EQUIPMENT MARKET SNAPSHOT

- FIGURE 45 TELEVISIONS SEGMENT TO LEAD BROADCAST EQUIPMENT MARKET IN ASIA PACIFIC IN 2028

- FIGURE 46 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN BROADCAST EQUIPMENT MARKET

- FIGURE 47 MARKET SHARE OF PLAYERS IN BROADCAST EQUIPMENT MARKET, 2022

- FIGURE 48 BROADCAST EQUIPMENT MARKET (GLOBAL): KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 49 BROADCAST EQUIPMENT MARKET (GLOBAL): SME EVALUATION MATRIX, 2022

- FIGURE 50 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 51 TELEFONAKTIEBOLAGET LM ERICSSON: COMPANY SNAPSHOT

- FIGURE 52 COMMSCOPE: COMPANY SNAPSHOT

- FIGURE 53 EVERTZ: COMPANY SNAPSHOT

- FIGURE 54 HARMONIC INC.: COMPANY SNAPSHOT

- FIGURE 55 EVS BROADCAST EQUIPMENT: COMPANY SNAPSHOT

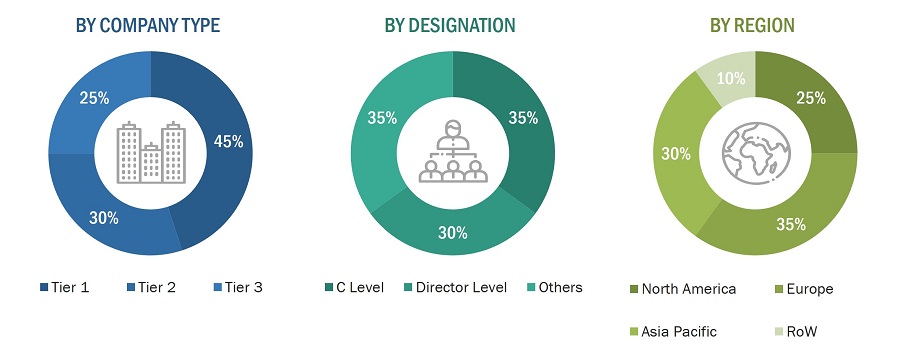

To estimate the size of the broadcast equipment market, the study utilized four major activities. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the broadcast equipment market. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

Report Metric |

Details |

|

The International Trade Association for Broadcast & Media Technology (IABM) |

|

|

Observatory of Economic Complexity (OEC) |

|

|

European Telecommunications Standards Institute (ETSI) |

|

|

Asia-Pacific Institute for Broadcasting Development (AIBD) |

Primary Research

To gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting, primary interviews were conducted. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using broadcast equipment, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of broadcast equipment, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

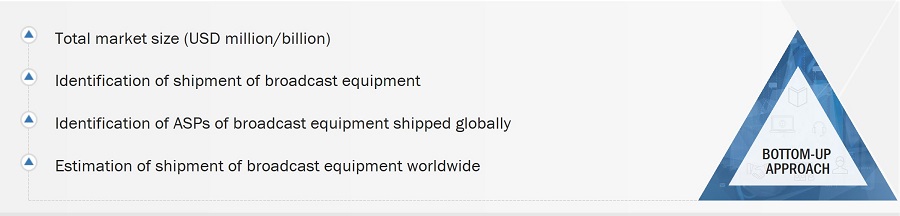

Market Size Estimation

To estimate and validate the size of the broadcast equipment market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying the annual and financial reports of top players and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were then verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Global Broadcast Equipment Market Size: Botton Up Approach

- First, companies offering broadcast equipment have been identified, and their product mapping with respect to different parameters, such as type, technology, and applications, has been carried out.

- The market size has been estimated based on the demand for different broadcast equipment types, for different applications. The anticipated change in demand for broadcast equipment offered by these companies in the recession and company revenues have been analyzed and estimated.

- Primary research has been conducted with a few major players operating in the broadcast equipment market to validate the global market size. Discussions included the impact of recession on the broadcast equipment ecosystem.

- Then, the size of the broadcast equipment market has been validated through secondary sources, which include the International Trade Centre (ITC), world trade organization, and world economic forum.

- The CAGR of the broadcast equipment market has been calculated considering the historical and future market trends and the impact of recession by understanding the adoption rate of broadcast equipment for different applications.

- The estimates at every level have been verified and cross-checked through discussions with key opinion leaders, such as corporate executives (CXOs), directors, and sales heads, as well as with the domain experts in MarketsandMarkets.

- Various paid and unpaid information sources, such as company websites, annual reports, press releases, research journals, magazines, white papers, and databases, have also been studied

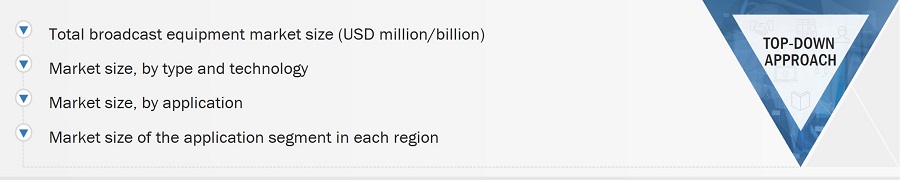

Global Broadcast Equipment Market Size: Top Down Approach

The top-down approach has been used to estimate and validate the total size of the broadcast equipment market.

- Focusing initially on the R&D investments and expenditures being made in the ecosystem of the broadcast equipment market; further splitting the market on the basis of type, technology, application, and region and listing the key developments.

- Identifying leading players in the broadcast equipment market through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications for which products are served by all identified players to estimate and arrive at percentage splits for all key segments.

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments.

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

Once the overall size of the broadcast equipment market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

Broadcasting entails delivering audio-video content to end users via electronic mass communication platforms. The apparatus utilized for this purpose is referred to as broadcast equipment. These devices play a pivotal role in converting raw data into accessible and user-friendly information. According to the Observatory of Economic Complexity (OEC), an array of electrical equipment is employed to oversee and regulate multiple aspects of broadcasting, encompassing audio and video quality, noise reduction, slow-motion effects, replays, and real-time content dissemination. As broadcast technology evolves, an increasing number of manufacturers are incorporating cutting-edge broadcast equipment to enhance the quality of content they provide.

Key Stakeholders

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- Original device manufacturers (ODM) and technology solution providers

- Research institutes

- Market research and consulting firms

- Broadcast equipment manufactures

- Broadcast forums, alliances, and associations

- Governments and financial institutions

- Analysts and strategic business planners

Report Objectives

- To define, describe, and forecast the broadcast equipment market based on type, technology, application, and region.

- To forecast the shipment data of broadcast equipment market based on type.

- To describe the operational frequencies of broadcast equipment

- To describe and forecast the market size of various segments across 4 key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the broadcast equipment market

- To provide an overview of the supply chain pertaining to the broadcast equipment ecosystem, along with the average selling prices of broadcast equipment

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market.

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the broadcast equipment market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the broadcast equipment market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the broadcast equipment market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Broadcast Equipment Market