Breast Lesion Localization Market by Type (Wire, Radioisotope (ROLL, RSL), Magnetic, Electromagnetic Localization), Usage (Breast Biopsy, Lumpectomy), End User (Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers) - Global Forecast to 2028

Market Growth Outlook Summary

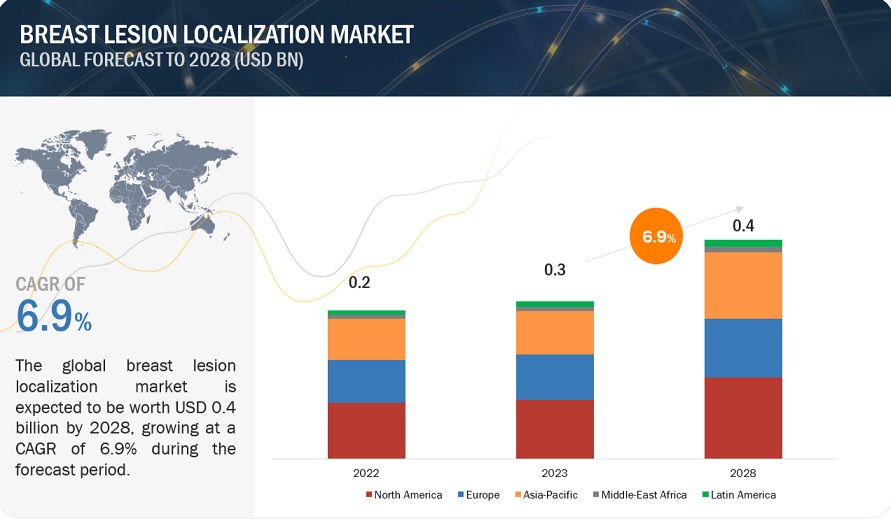

The global breast lesion localization market, valued at US$0.2 billion in 2022, stood at US$0.3 billion in 2023 and is projected to advance at a resilient CAGR of 6.9% from 2023 to 2028, culminating in a forecasted valuation of US$0.4 billion by the end of the period. The increasing number of breast cancer screening programs and improved reimbursement scenarios are expected to drive market growth. Additionally, the rising number of breast cancer surgeries and increasing awareness of early detection are further supporting the growth of this market.

However, factors such as errors in screening alongside misdiagnosis and uncertainty in regulatory approval procedures are expected to hinder the growth of the breast lesion localization market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Breast Lesion Localization Market Dynamics

Driver: Growing rate of the aging population

Breast cancer is most common in women over the age of 50, and the number of people in this age group is increasing as the population ages. In the United States, the number of people over the age of 50 is projected to increase by 35% between 2010 and 2030. This means that there will be more women in danger of developing breast cancer, and the overall number of cases is projected to surge. In addition to age, other factors which are contributing to the risk of breast cancer cases are genetics, lifestyle changes and family history. However, among these, the age is the most significant risk factor. Thus, the aging population is the foremost reason for increase in breast cancer cases in years to come. The aging increases the multipotent progenitors, which are a type of adult stem cell at the root of many breast cancers and decreases the number of myoepithelial cells. The myoepithelial cells line the breast’s milk-producing luminal cells and assist as tumor suppressors.

According to the WHO, about 70% of breast cancer cases are diagnosed in women over the age of 50, in the United States. The risk of developing breast cancer intensifies by about 1% each year over the age of 50. Furthermore, according to the American Cancer Society, around 1 out of 8 invasive breast cancers can develop in women less than 45 years. In disparity, approximately 2 out of 3 of the invasive breast cancers occur in women aged 55 and above. In addition to this, as per GLOBOCAN 2020 estimates, the number of new breast cancer cases diagnosed in the women above 70 age was estimated to be 507,000 in 2020 and is expected to reach 975,000 by 2040, across the globe. Thus, the growing rate of the aging population is expected to increase the number of breast cancer cases and drive the demand for breast lesion localization devices and procedures market across the globe.

Restraint: Uncertainty in regulatory approval procedures

The regulatory process for approving medical devices is complex and can involve multiple agencies and departments. This can lead to delays and uncertainty, as different agencies may have different priorities or interpretations of the regulations. Organizations such as the US FDA need complete clinical analysis pertaining to the efficacy and safety of the medical product which is under approval process. Thus, under such strict guidelines and requirements, getting clearance becomes difficult for the market players operating in the breast lesion localization market.

Especially when it comes to the radioisotope localization, which requires mandatory nuclear regulatory clearance from the Nuclear Regulatory Commission. This clearance is necessary to certify the safe use of radioactive seeds during the lesion localization procedures. Hence, approval for the radioisotope localization products becomes very costly and time consuming, making it tough for small players with limited budget to sustain in the market.

The breast localization devices are grouped into Class II and III medical devices and thus must endure a stringent regulatory procedure for FDA approval. Approximately, 3 to 7 years are required in the US to prove the medical safety of any new product. Even a new size of any previously approved product needs to go through the entire stringent process of approval before getting commercially approved, as per the law. Moreover, the regulatory requirements are becoming more difficult with new technological advancements and increased focus on the patient care. Thus, these regulations demand extensive documentation and data for the approval and validation of new product and technologies.

Across the mature markets, mostly the US, the pipeline developments are delayed majorly by pricing pressure faced by key product manufacturers due to obstructive government reforms undertaken in the last few years.

Opportunity: Increasing adoption of technologically advanced localization procedures

Traditionally, wire localization was considered as a benchmark procedure for the preoperative localization of non-palpable breast lesions. Wire-guided localization (WL) is the most widely used method for the localization of non-palpable breast lesions. The limitations of WL include patient discomfort, potential need to perform localization the day of surgery, creating logistic challenges, which limit operating room (OR) efficiency, possible wire migration and transaction, the lack of a point source for reorientation during surgery, and suboptimal cosmetic outcome.

These disadvantages have led to the development of alternative approaches, such as radioactive seed localization (RSL), non-radioactive radar localization (SAVI SCOUT), magnetic seed (Magseed) localization (MSL), radiofrequency identification (RFID), and hematoma ultrasound-guided (HUG) localization.

Over the years, breast localization techniques have witnessed significant advancements and have evolved from wire and radio-guided localization to non-radio-guided localization, such as electromagnetic reflectors and magnetic tracers. These advancements have helped improve workflows, efficiency, and cost-effectiveness and eliminate the issues related to radioactive technologies. In May 2021, the US FDA approved MOLLI Surgical's new wire-free localization technology for breast cancer surgery. The device is a small, implantable marker that is placed in the breast lesion using a needle. The marker can be detected using a handheld wand during surgery, which helps the surgeon to precisely locate the lesion.

Furthermore, In April 2022, the FDA approved Merit Medical System's Scout Bx delivery system, a wire-free breast localization solution used during stereotactic and MRI-guided biopsy in breast cancer surgery. The system uses a small, radiopaque marker that is placed in the breast lesion using a needle. The marker can be detected using a handheld wand during surgery, which helps the surgeon to precisely locate the lesion.Further research and increasing investments by new players in this field will drive the breast localization methods market in the coming years.

Challenge: Shortage of oncologists

Breast surgical oncologists are surgeons who have completed extra training in the diagnosis and treatment of breast cancer. They are experts in performing a variety of breast surgeries, including, Lumpectomy, Mastectomy, Sentinel lymph node biopsy and Reconstruction surgery. Breast surgical oncologists work closely with other cancer specialists, such as medical oncologists, radiation oncologists, and plastic surgeons, to provide comprehensive care for patients with breast cancer. They are also involved in research on new treatments for breast cancer. However, there is a shortage of oncologists in breast surgeries.

The ASCO projects that there will be a shortage of 2,200 oncologists by 2025. Also, the Association of American Medical Colleges (AAMC) projects that there will be a shortage of 55,200 physicians by 2030, including 12,700 oncologists. According to the most recent “2021 ASCO Snapshot: State of the Oncology Workforce in America,” there are 13,146 oncologists engaged in active patient care in 1638 oncology practices. Of those oncologists, 21.1% are nearing retirement (age 64+), whereas only 14.5% are early-career oncologists (age <40); the overall median age was 53 years. Female oncologists in practice represent 35.2% of the total, while they represent approximately 45% in oncology fellowship programs. Only 11.2% of oncologists practice in areas defined as rural. The fewest oncologists practice in the West North Central and West South-Central regions.

Over the years, the incidence of breast cancer has increased significantly and is expected to increase further in the coming years. However, there has not been a subsequent growth in the number of oncologists, and this situation is more pronounced in developing countries. This dearth of trained professionals is thus expected to hamper the growth of the breast lesion localization market during the forecast period.

Breast Lesion Localization Market Ecosystem

Leading players in this market include well-established and financially stable manufacturers of breast lesion localization. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence. Prominent companies in this market include Hologic, Inc. (US), Becton, Dickinson and Company (US), Merit Medical Systems (US), Leica Biosystems Nussloch GmbH (US), Argon Medical Devices (US).

The electromagnetic localization segment of the Breast Lesion Localization Industry is expected to register the highest CAGR during the forecast period.

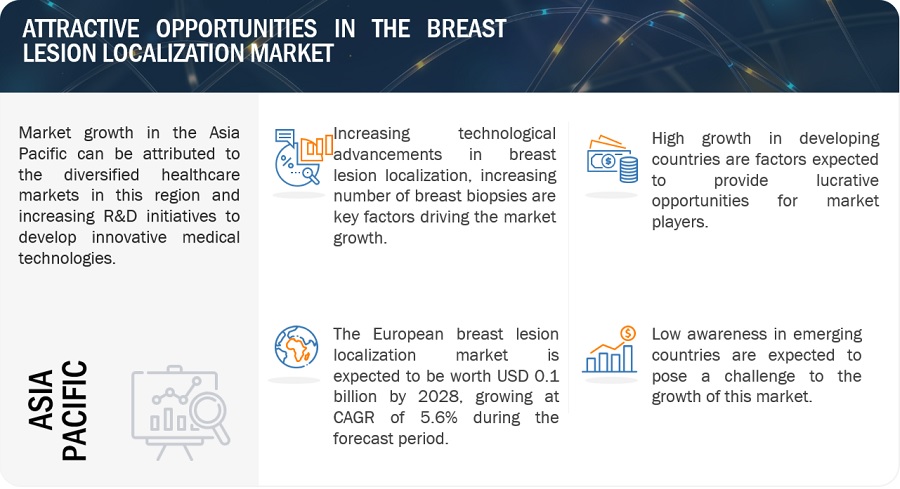

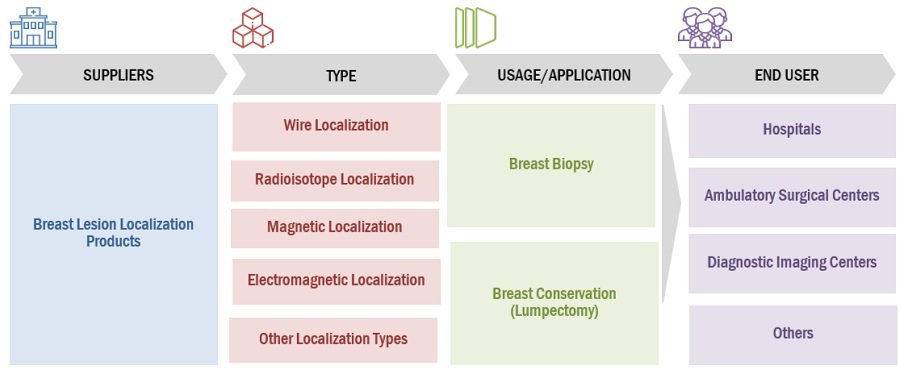

Based on type, the breast lesion localization market is segmented into wire localization, radioisotope localization, magnetic localization, electromagnetic localization, and other localization types. The electromagnetic localization segment is projected to grow at the highest CAGR during 2023 to 2028. Factors such as reduction in surgical delays, improved patient satisfaction, optimal surgical planning, and no need for radioactive components are driving the segment growth. Electromagnetic localization make smaller incisions which are more precise and save more of the normal tissue during surgeries.

The breast conservation segment of breast lesion localization industry is estimated to grow at a higher CAGR during the forecast period.

Based on usage (application), the breast lesion localization market is segmented into breast biopsy and breast conservation (lumpectomy). The breast conservation segment is estimated to grow at a higher CAGR during the forecast period. Growth in this segment can be attributed to the increasing early-stage breast cancer diagnosis and the shift toward minimally invasive procedures.

The ambulatory surgical centers segment of the breast lesion localization industry is expected to grow at the highest CAGR during the forecast period.

Based on end user, the breast lesion localization market is segmented into hospitals and clinics, ambulatory surgical centers, diagnostic imaging centers, and other end users. The growth of the ambulatory surgical centers segment is attributed to the ongoing increase in the number of minimally invasive procedures and the increasing number of image-guided breast lesion localization procedures performed in ambulatory surgical centers.

APAC is estimated to be the fastest-growing regional market for breast lesion localization industry

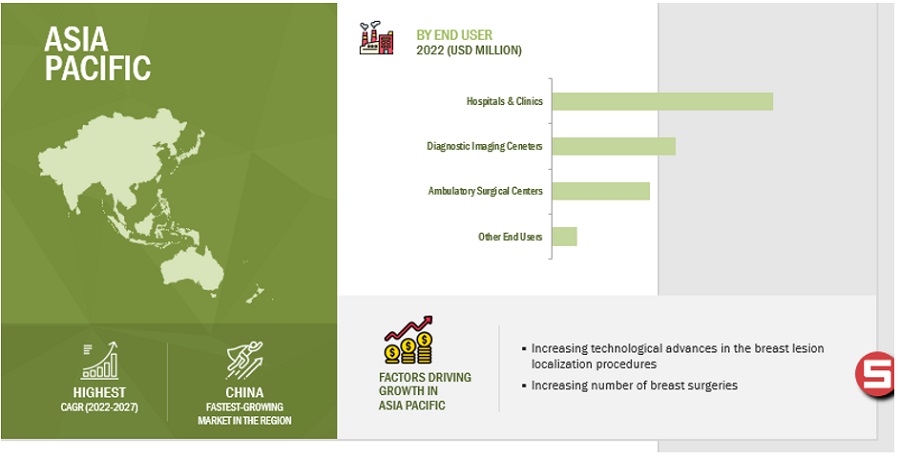

The global breast lesion localization market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, APAC is estimated to be the fastest-growing regional market for breast lesion localization. The high growth in this market can majorly be attributed to the rising number of hospitals and increasing healthcare expenditure, the significant growth in patient volume, and the demand for healthcare services.

To know about the assumptions considered for the study, download the pdf brochure

The breast lesion localization market is dominated by a few globally established players such as GE Healthcare (US), Dragerwerk Ag & Co. KGAA (Germany), Koninklijke Philips N.V. (Netherlands), Ambu AS (Denmark), Medline Industries Inc. (US). Major players adopt growth strategies to expand their geographical presence and garner higher shares in the global market, such as product launches and approvals, expansions, collaborations, and acquisitions.

Scope of the Breast Lesion Localization Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.3 billion |

|

Projected Revenue by 2028 |

$0.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 6.9% |

|

Market Driver |

Growing rate of the aging population |

|

Market Opportunity |

Increasing adoption of technologically advanced localization procedures |

The study categorizes the breast lesion localization market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Wire Localization

-

Radioisotope Localization

- Radioguided Occult Lesion Localization (ROLL)

- Radioactive Seed Localization (RSL)

- Magnetic Localization

- Electromagnetic Localization

- Other Localization Methods

By Usage

- Breast Biopsy

- Breast Conservation (Lumpectomy)

By End User

- Hospitals & Clinics

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments of Breast Lesion Localization Industry

- In December 2022, Merit Medical Systems launched Scout Bx. Scout Bx is a wireless, radar-guided localization system used to assist breast surgeons in identifying biopsied tumors for removal.

- In August 2022, Leica Biosystems Nussloch GmbH launched DualCore Dual Stage Core Biopsy System. The Mammotome DualCore biopsy system is the first dual stage core biopsy instrument for needle biopsies.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global breast lesion localization market between 2023 and 2028?

The global breast lesion localization market is projected to grow from USD 0.3 billion in 2023 to USD 0.4 billion by 2028, demonstrating a robust CAGR of 6.9%.

What are the key factors driving the breast lesion localization market?

Key factors driving the market include an aging population at higher risk of breast cancer, increasing breast cancer surgeries, and growing awareness of early detection methods.

What are the challenges facing the breast lesion localization market?

The market faces challenges such as uncertainty in regulatory approval processes and the high costs associated with radioisotope localization, which require nuclear regulatory clearance.

Which breast lesion localization technique is expected to show the highest growth?

Electromagnetic localization is expected to grow at the highest CAGR, driven by improved surgical planning, patient satisfaction, and the avoidance of radioactive components.

What are the most common breast lesion localization methods?

The most common methods include wire localization, radioisotope localization, magnetic localization, and newer methods like electromagnetic localization and RFID-guided localization.

How is the aging population impacting the breast lesion localization market?

The aging population is significantly increasing the number of breast cancer cases, as breast cancer is most common in women over 50, driving demand for localization procedures.

What are the recent technological advancements in breast lesion localization?

Recent advancements include wire-free localization technologies like MOLLI Surgical's and Merit Medical Systems' Scout Bx, which improve surgical precision and patient outcomes.

Which segment of the breast lesion localization market is expected to grow at the fastest rate?

The ambulatory surgical centers segment is expected to grow the fastest due to the rising demand for minimally invasive procedures and convenience of outpatient surgeries.

What are the opportunities for new players in the breast lesion localization market?

New players have opportunities to invest in non-radioactive localization technologies, which are becoming increasingly popular due to safety and efficiency improvements in surgical planning.

What role do hospitals and clinics play in the breast lesion localization market?

Hospitals and clinics are major players in the breast lesion localization market, particularly due to the increasing number of breast cancer surgeries performed in these settings.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing incidence of breast cancer- Growth in aging population- Increasing awareness on early detection of breast cancerRESTRAINTS- Uncertainty in regulatory approval proceduresOPPORTUNITIES- High growth potential in emerging economies- Increasing adoption of technologically advanced localization proceduresCHALLENGES- Shortage of oncologists

-

6.1 INDUSTRY TRENDSELECTROMAGNETIC WAVES FOR LOCALIZATION OF BREAST LESIONSRADIOFREQUENCY IDENTIFICATION IN BREAST LESION LOCALIZATIONMACHINE LEARNING ALGORITHMS FOR COMPUTER-AIDED BREAST LESION DETECTION

- 6.2 IMPACT OF ECONOMIC RECESSION ON BREAST LESION LOCALIZATION MARKET

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 REIMBURSEMENT ANALYSIS

-

6.5 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Wire-guided localization (WL)- Carbon marking- Radioguided occult lesion localization (ROLL)- Radioactive seed localization (RSL)- Magnetic seed localization (MSL)- Radiofrequency reflector (RFR)COMPLEMENTARY TECHNOLOGIES- Mammography- 3D mammography or tomosynthesis- Magnetic resonance imaging- UltrasoundADJACENT TECHNOLOGIES- Computer vision and artificial intelligence

- 6.6 SUPPLY CHAIN ANALYSIS

-

6.7 ECOSYSTEM MARKET MAPPING

- 6.8 CASE STUDY ANALYSIS

-

6.9 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.10 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- India

-

6.11 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR BREAST LESIONSINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

-

6.12 INDICATIVE PRICING MODEL ANALYSISAVERAGE SELLING PRICE TRENDS

- 6.13 KEY CONFERENCES AND EVENTS IN 2023–2024

-

6.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 WIRE LOCALIZATIONWIRE LOCALIZATION SEGMENT TO COMMAND LARGEST SHARE OF BREAST LESION LOCALIZATION MARKET

-

7.3 RADIOISOTOPE LOCALIZATIONRADIOGUIDED OCCULT LESION LOCALIZATION- Radioguided occult lesion localization to result in shorter operating times and higher rates of tumor-free marginsRADIOACTIVE SEED LOCALIZATION- Decreased operative time and long half-life of radioactive seed localization to drive segment

-

7.4 MAGNETIC LOCALIZATIONINCREASED WORKFLOW EFFICIENCY AND COST-EFFECTIVENESS TO DRIVE MARKET

-

7.5 ELECTROMAGNETIC LOCALIZATIONELECTROMAGNETIC LOCALIZATION TO ENABLE SMALLER INCISIONS DURING SURGERIES

- 7.6 OTHER LOCALIZATION TYPES

- 8.1 INTRODUCTION

-

8.2 BREAST BIOPSYGROWING INCIDENCE OF BREAST CANCER TO DRIVE MARKET

-

8.3 BREAST CONSERVATION (LUMPECTOMY)INCREASING ADOPTION OF BREAST CONSERVATION PROCEDURES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 HOSPITALS AND CLINICSHOSPITALS TO PERFORM LARGE NUMBER OF BREAST LESION LOCALIZATION PROCEDURES

-

9.3 DIAGNOSTIC IMAGING CENTERSINCREASED DEMAND FOR EARLY DIAGNOSIS TO DRIVE MARKET

-

9.4 AMBULATORY SURGICAL CENTERSINCREASING NUMBER OF OUTPATIENT VISITS TO DRIVE MARKET

- 9.5 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- High adoption of innovative technologies to drive marketCANADA- Supportive government initiatives for breast cancer awareness to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Favorable reimbursement policies for healthcare procedures to drive marketFRANCE- Rising incidences of breast cancer among aged women to drive marketUK- Increasing public-private initiatives for breast cancer awareness to drive marketITALY- Increasing demand for breast lesion localization systems to drive marketSPAIN- Growing access to advanced cancer screening programs to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Increasing patient pool and developing government healthcare initiatives to drive marketJAPAN- Increasing number of universal healthcare reimbursement policies to drive marketINDIA- Increasing government Initiatives for female health improvement to drive marketAUSTRALIA- Growing breast cancer awareness campaigns by public and private organizations to drive marketSOUTH KOREA- Growing government awareness campaigns and rising incidences of breast cancer to drive marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICARISING GERIATRIC POPULATION AND PRESENCE OF FAVORABLE REGULATORY ENVIRONMENT TO DRIVE MARKETLATIN AMERICA: RECESSION IMPACT

-

10.6 MIDDLE EAST & AFRICARISING GOVERNMENT INVESTMENTS AND INCREASING BREAST CANCER AWARENESS PROGRAMS TO DRIVE MARKETMIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.1 INTRODUCTION

- 11.2 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.3 MARKET SHARE ANALYSIS

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 COMPANY EVALUATION MATRIX FOR START-UPSPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIES

- 11.6 COMPANY PRODUCT FOOTPRINT

- 11.7 REGIONAL FOOTPRINT OF MAJOR PLAYERS IN BREAST LESION LOCALIZATION MARKET

- 11.8 COMPETITIVE BENCHMARKING

-

11.9 COMPETITIVE SITUATIONS AND TRENDSKEY PRODUCT LAUNCHESKEY DEALS

- 11.10 BREAST LESION LOCALIZATION METHODS: COMPARATIVE ANALYSIS

- 11.11 BREAST LESION LOCALIZATION METHODS: COMPARATIVE ANALYSIS

- 11.12 BREAST LESION LOCALIZATION METHODS: SELECTION CRITERIA EVALUATION

- 11.13 QUALITATIVE ASSESSMENT OF REPLACEMENT TRENDS

-

12.1 KEY PLAYERSHOLOGIC, INC.- Business overview- Products offered- Recent developments- MnM viewBECTON, DICKINSON AND COMPANY- Business overview- Products offered- MnM viewMERIT MEDICAL SYSTEMS- Business overview- Products offered- Recent developments- MnM viewLEICA BIOSYSTEMS NUSSLOCH GMBH- Business overview- Products offered- MnM viewARGON MEDICAL DEVICES- Business overview- Products offered- MnM viewLAURANE MEDICAL LLC- Business overview- Products offeredENDOMAGNETICS LTD. (ENDOMAG)- Business overview- Products offered- Recent developmentsINTRAMEDICAL IMAGING, LLC- Business overview- Products offeredISOAID- Business overview- Products offeredSURGICEYE GMBH- Business overview- Products offered

-

12.2 OTHER PLAYERSRANFAC CORP.- Business overview- Products offeredMERMAID MEDICAL GROUP- Business overview- Products offered- Recent developmentsIZI MEDICAL PRODUCTS, LLC- Business overview- Products offered- Recent developmentsMATEK MEDIKAL- Business overview- Products offeredTSUNAMI MEDICAL SRL- Business overview- Products offeredBPB MEDICA- Business overview- Products offeredSIRIUS MEDICAL SYSTEMS B.V.- Business overview- Products offered- Recent developmentsMOLLI SURGICAL INC.- Business overview- Products offered- Recent developmentsSTERYLAB S.R.L.- Business overview- Products offeredCP MEDICAL- Business overview- Products offeredMDL SRL- Business overview- Products offeredBIOMEDICAL SRL- Business overview- Products offeredELUCENT MEDICAL- Business overview- Products offeredVIGEO SRL- Business overview- Products offeredMEDAX MEDICAL DEVICES- Business overview- Products offered

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS

- TABLE 1 BREAST LESION LOCALIZATION MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 2 TOP 10 COUNTRIES WITH HIGHEST INCIDENCE OF BREAST CANCER, 2020

- TABLE 3 MEDICARE REIMBURSEMENT FOR BREAST LESION LOCALIZATION METHODS

- TABLE 4 CASE STUDY 1: ESTIMATING MARKET SIZE OF BREAST LESION LOCALIZATION METHODS AND MARKET SHARE ANALYSIS FOR KEY PRODUCTS AT COUNTRY LEVEL

- TABLE 5 CASE STUDY 2: ESTIMATING MARKET SIZE OF BREAST BIOPSY AND MARKET SHARE ANALYSIS FOR KEY PRODUCTS AT COUNTRY LEVEL

- TABLE 6 BREAST LESION LOCALIZATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 8 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 9 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 10 CLASSIFICATION OF BREAST LESION LOCALIZATION DEVICES ACCORDING TO GOVERNMENT OF CANADA

- TABLE 11 AVERAGE SELLING PRICE OF BREAST LESION LOCALIZATION CONSUMABLES (2023)

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BREAST LESION LOCALIZATION TYPE

- TABLE 13 KEY BUYING CRITERIA FOR BREAST LESION LOCALIZATION

- TABLE 14 BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 15 BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 16 WIRE LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 17 WIRE LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 19 RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 20 RADIOISOTOPE LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 21 RADIOISOTOPE LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 RADIOGUIDED OCCULT LESION LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 23 RADIOGUIDED OCCULT LESION LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 RADIOACTIVE SEED LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 25 RADIOACTIVE SEED LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 MAGNETIC LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 27 MAGNETIC LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 ELECTROMAGNETIC LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 29 ELECTROMAGNETIC LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 OTHER LOCALIZATION TYPES MARKET, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 31 OTHER LOCALIZATION TYPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 33 BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 34 BREAST LESION LOCALIZATION MARKET FOR BREAST BIOPSY, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 35 BREAST LESION LOCALIZATION MARKET FOR BREAST BIOPSY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 BREAST LESION LOCALIZATION MARKET FOR BREAST CONSERVATION, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 37 BREAST LESION LOCALIZATION MARKET FOR BREAST CONSERVATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 39 BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 40 BREAST LESION LOCALIZATION MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 41 BREAST LESION LOCALIZATION MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 BREAST LESION LOCALIZATION MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 43 BREAST LESION LOCALIZATION MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 BREAST LESION LOCALIZATION MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 45 BREAST LESION LOCALIZATION MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 BREAST LESION LOCALIZATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 47 BREAST LESION LOCALIZATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 BREAST LESION LOCALIZATION MARKET, BY REGION, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 49 BREAST LESION LOCALIZATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: BREAST LESION LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 51 NORTH AMERICA: BREAST LESION LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 53 NORTH AMERICA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 55 NORTH AMERICA: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 57 NORTH AMERICA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 59 NORTH AMERICA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 60 US: KEY MACROINDICATORS

- TABLE 61 US: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 62 US: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 63 US: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 64 US: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 US: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 66 US: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 67 US: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 68 US: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 69 CANADA: KEY MACROINDICATORS

- TABLE 70 CANADA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 71 CANADA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 CANADA: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 73 CANADA: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 CANADA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 75 CANADA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 76 CANADA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 77 CANADA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: BREAST LESION LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 79 EUROPE: BREAST LESION LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 81 EUROPE: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 EUROPE: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 83 EUROPE: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 EUROPE: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 85 EUROPE: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 86 EUROPE: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 87 EUROPE: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 88 GERMANY: KEY MACROINDICATORS

- TABLE 89 GERMANY: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 90 GERMANY: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 GERMANY: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 92 GERMANY: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 GERMANY: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 94 GERMANY: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 95 GERMANY: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 96 GERMANY: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 FRANCE: KEY MACROINDICATORS

- TABLE 98 FRANCE: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 99 FRANCE: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 FRANCE: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 101 FRANCE: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 FRANCE: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 103 FRANCE: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 104 FRANCE: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 105 FRANCE: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 106 UK: KEY MACROINDICATORS

- TABLE 107 UK: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 108 UK: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 UK: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 110 UK: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 UK: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 112 UK: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 113 UK: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 114 UK: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 115 ITALY: KEY MACROINDICATORS

- TABLE 116 ITALY: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 117 ITALY: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 ITALY: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 119 ITALY: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 ITALY: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 121 ITALY: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 122 ITALY: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 123 ITALY: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 124 SPAIN: KEY MACROINDICATORS

- TABLE 125 SPAIN: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 126 SPAIN: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 127 SPAIN: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 128 SPAIN: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 129 SPAIN: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 130 SPAIN: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 131 SPAIN: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 132 SPAIN: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 REST OF EUROPE: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 134 REST OF EUROPE: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 REST OF EUROPE: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 136 REST OF EUROPE: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 REST OF EUROPE: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 138 REST OF EUROPE: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 139 REST OF EUROPE: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 140 REST OF EUROPE: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 142 ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 144 ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 146 ASIA PACIFIC: RADIOISOTOPE LOCALIZATION PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 148 ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 150 ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 151 CHINA: KEY MACROINDICATORS

- TABLE 152 CHINA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 153 CHINA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 154 CHINA: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 155 CHINA: RADIOISOTOPE LOCALIZATION PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 CHINA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 157 CHINA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 158 CHINA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 159 CHINA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 160 JAPAN: KEY MACROINDICATORS

- TABLE 161 JAPAN: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 162 JAPAN: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 JAPAN: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 164 JAPAN: RADIOISOTOPE LOCALIZATION PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 JAPAN: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 166 JAPAN: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 167 JAPAN: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 168 JAPAN: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 169 INDIA: KEY MACROINDICATORS

- TABLE 170 INDIA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 171 INDIA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 INDIA: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 173 INDIA: RADIOISOTOPE LOCALIZATION PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 INDIA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 175 INDIA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 176 INDIA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 177 INDIA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 178 AUSTRALIA: KEY MACROINDICATORS

- TABLE 179 AUSTRALIA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 180 AUSTRALIA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 181 AUSTRALIA: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 182 AUSTRALIA: RADIOISOTOPE LOCALIZATION PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 AUSTRALIA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 184 AUSTRALIA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 185 AUSTRALIA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 186 AUSTRALIA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 187 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 188 SOUTH KOREA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 189 SOUTH KOREA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 SOUTH KOREA: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 191 SOUTH KOREA: RADIOISOTOPE LOCALIZATION PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 SOUTH KOREA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 193 SOUTH KOREA: BREAST LESION LOCALIZATION PRODUCTS MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 194 SOUTH KOREA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 195 SOUTH KOREA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 197 REST OF ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 199 REST OF ASIA PACIFIC: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 201 REST OF ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 203 REST OF ASIA PACIFIC: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 205 LATIN AMERICA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 206 LATIN AMERICA: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 207 LATIN AMERICA: RADIOISOTOPE LOCALIZATION PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 209 LATIN AMERICA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 210 LATIN AMERICA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 211 LATIN AMERICA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 213 MIDDLE EAST & AFRICA: BREAST LESION LOCALIZATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 215 MIDDLE EAST & AFRICA: RADIOISOTOPE LOCALIZATION PRODUCTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 217 MIDDLE EAST & AFRICA: BREAST LESION LOCALIZATION MARKET, BY USAGE, 2021–2028 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 219 MIDDLE EAST & AFRICA: BREAST LESION LOCALIZATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 220 BREAST LESION LOCALIZATION MARKET: PRODUCT PORTFOLIO ANALYSIS

- TABLE 221 BREAST LESION LOCALIZATION MARKET: GEOGRAPHICAL REVENUE MIX

- TABLE 222 BREAST LESION LOCALIZATION MARKET: KEY START-UPS

- TABLE 223 BREAST LESION LOCALIZATION MARKET: KEY PRODUCT LAUNCHES (2020–2023)

- TABLE 224 KEY DEALS (2020–2021)

- TABLE 225 HOLOGIC, INC.: COMPANY OVERVIEW

- TABLE 226 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 227 MERIT MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 228 DANAHER: COMPANY OVERVIEW

- TABLE 229 ARGON MEDICAL DEVICES: COMPANY OVERVIEW

- TABLE 230 LAURANE MEDICAL LLC: COMPANY OVERVIEW

- TABLE 231 ENDOMAGNETICS LIMITED: COMPANY OVERVIEW

- TABLE 232 INTRAMEDICAL IMAGING, LLC: COMPANY OVERVIEW

- TABLE 233 ISOAID: COMPANY OVERVIEW

- TABLE 234 SURGICEYE GMBH: COMPANY OVERVIEW

- TABLE 235 RANFAC CORP.: COMPANY OVERVIEW

- TABLE 236 MERMAID MEDICAL GROUP: COMPANY OVERVIEW

- TABLE 237 IZI MEDICAL PRODUCTS, LLC: COMPANY OVERVIEW

- TABLE 238 MATEK MEDIKAL: COMPANY OVERVIEW

- TABLE 239 TSUNAMI MEDICAL SRL: COMPANY OVERVIEW

- TABLE 240 BPB MEDICA: COMPANY OVERVIEW

- TABLE 241 SIRIUS MEDICAL SYSTEMS B.V.: COMPANY OVERVIEW

- TABLE 242 MOLLI SURGICAL INC.: COMPANY OVERVIEW

- TABLE 243 STERYLAB S.R.L.: COMPANY OVERVIEW

- TABLE 244 CP MEDICAL: COMPANY OVERVIEW

- TABLE 245 MDL SRL: COMPANY OVERVIEW

- TABLE 246 BIOMEDICAL SRL: COMPANY OVERVIEW

- TABLE 247 ELUCENT MEDICAL: COMPANY OVERVIEW

- TABLE 248 VIGEO SRL: COMPANY OVERVIEW

- TABLE 249 MEDAX MEDICAL DEVICES: COMPANY OVERVIEW

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

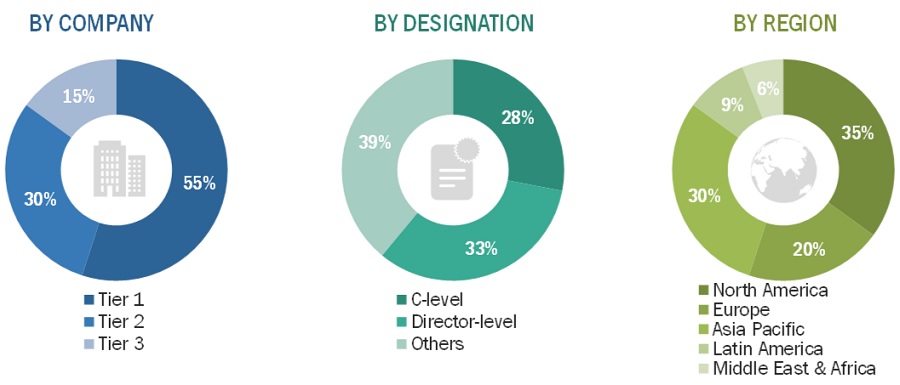

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION: HOLOGIC, INC.

- FIGURE 8 BREAST LESION LOCALIZATION MARKET: REVENUE SHARE ANALYSIS OF FOUR KEY COMPANIES (2022)

- FIGURE 9 BREAST LESION LOCALIZATION MARKET: CAGR PROJECTION FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 11 TOP-DOWN APPROACH

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 BREAST LESION LOCALIZATION MARKET, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 14 BREAST LESION LOCALIZATION MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 16 RADIOISOTOPE LOCALIZATION MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 BREAST LESION LOCALIZATION MARKET, BY USAGE, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 18 BREAST LESION LOCALIZATION MARKET, BY USAGE, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 BREAST LESION LOCALIZATION MARKET, BY END USER, 2023 VS. 2028 (THOUSAND PROCEDURES)

- FIGURE 20 BREAST LESION LOCALIZATION MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 21 GEOGRAPHICAL ANALYSIS: GLOBAL BREAST LESION LOCALIZATION MARKET (PROCEDURES)

- FIGURE 22 GEOGRAPHICAL ANALYSIS: GLOBAL BREAST LESION LOCALIZATION MARKET (VALUE)

- FIGURE 23 RISING AWARENESS ABOUT BREAST CANCER AND INCREASING GOVERNMENT INITIATIVES GLOBALLY TO DRIVE MARKET

- FIGURE 24 WIRE LOCALIZATION HELD LARGEST SHARE OF ASIA PACIFIC BREAST LESION LOCALIZATION MARKET IN 2022

- FIGURE 25 ASIA PACIFIC TO WITNESS HIGHEST GROWTH IN BREAST LESION LOCALIZATION MARKET DURING FORECAST PERIOD

- FIGURE 26 NORTH AMERICA TO DOMINATE BREAST LESION LOCALIZATION MARKET TILL 2028

- FIGURE 27 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING STUDY PERIOD

- FIGURE 28 BREAST LESION LOCALIZATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 ESTIMATED GLOBAL NUMBER OF NEW BREAST CANCER CASES (2020–2040)

- FIGURE 30 GDP GROWTH FORECAST: COMPARISON AMONG INDIA, CHINA, US, AND GERMANY, 2020 VS. 2040

- FIGURE 31 BREAST LESION LOCALIZATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 32 BREAST LESION LOCALIZATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 33 BREAST LESION LOCALIZATION MARKET: ECOSYSTEM MARKET MAPPING

- FIGURE 34 EUROPE: CLASS III MEDICAL DEVICES

- FIGURE 35 PATENT PUBLICATION TRENDS (JANUARY 2013–MAY 2023)

- FIGURE 36 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR BREAST LESION PATENTS (JANUARY 2013–MAY 2023)

- FIGURE 37 TOP APPLICANT COUNTRIES/REGIONS FOR BREAST LESION PATENTS (JANUARY 2013–MAY 2023)

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BREAST LESION LOCALIZATION TYPE

- FIGURE 39 KEY BUYING CRITERIA FOR BREAST LESION LOCALIZATION

- FIGURE 40 NUMBER OF BREAST CANCER CASES VS. NUMBER OF DEATHS IN 2020 (THOUSANDS)

- FIGURE 41 BREAST LESION LOCALIZATION MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 42 NORTH AMERICA: NUMBER OF BREAST CANCER CASES IN 2020 (THOUSANDS)

- FIGURE 44 EUROPE: NUMBER OF BREAST CANCER CASES IN 2020 (THOUSANDS)

- FIGURE 46 ASIA PACIFIC: NUMBER OF BREAST CANCER CASES, 2020 (IN THOUSANDS)

- FIGURE 48 KEY DEVELOPMENTS IN BREAST LESION LOCALIZATION MARKET

- FIGURE 49 BREAST LESION LOCALIZATION MARKET: REVENUE ANALYSIS OF KEY PLAYERS (2018–2022)

- FIGURE 50 MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 51 BREAST LESION LOCALIZATION MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 52 BREAST LESION LOCALIZATION MARKET: COMPANY EVALUATION MATRIX FOR START-UPS (2022)

- FIGURE 53 COMPARATIVE ANALYSIS: DETECTION RATE, SUCCESS RATE, AND RE-EXCISION RATE

- FIGURE 54 SELECTION CRITERIA EVALUATION

- FIGURE 55 REPLACEMENT TRENDS

- FIGURE 56 HOLOGIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 57 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- FIGURE 58 MERIT MEDICAL SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 59 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the breast lesion localization market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, chief medical information officers related to the breast lesion localization, breast biopsy, breast reconstruction, breast conservation, and breast imaging markets. Primary sources from the demand side include professionals from hospitals, breast imaging centers, cancer research centers & institutes, medical schools & universities, clinical research organizations, and physicians in diagnostic centers.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Interviews: Supply-Side Participants, by Company Type, Designation, and Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 =< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

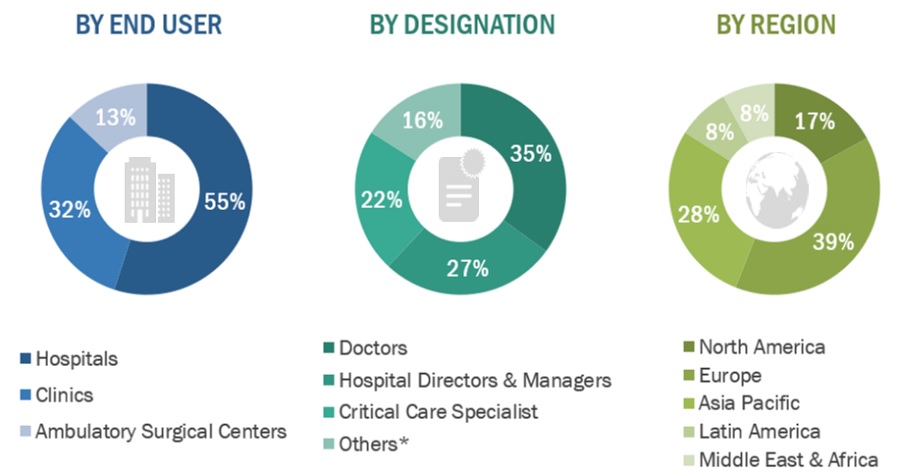

Breakdown of Primary Interviews: Demand-Side Participants, by End-User, Designation, and Region

Note: Others include department heads, research scientists, and professors.

Market Size Estimation

The total size of the breast lesion localization market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Global Breast lesion localization Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Market Definiion

Breast lesion localization is a pre-surgical procedure where devices such as magnetic tracers, radioisotopes, and wires are used to localize non-palpable lesions at the time of surgical excision. This procedure is carried out using different guidance systems, such as mammography, ultrasound, and MRI, depending on the type of lesion and its location.

Key Stakeholders

- Breast lesion localization product manufacturers

- Breast biopsy devices manufacturers

- Hospitals, outpatient settings, and oncology centers

- Health insurance payers

- Regulatory authorities

- Radiologists

- Radiologists

- Research institutes and government organizations

- Venture capitalists and investors

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the breast lesion localization market based on type, usage, end user and region

- To provide detailed information on the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details about the competitive landscape for market leaders

- To forecast the size of market segments for key regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments (such as acquisitions, product launches, and agreements) in the breast lesion localization market

- To evaluate the different parameters considered for the selection of breast lesion localization

- To study end user preferences for different breast lesion localization methods as well as study the replacement trends and buying behavior of end users

- To strategically analyze the economic recession impact on the market under study

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoE breast lesion localization market into Austria, Finland, and others

- Further breakdown of the RoLATAM breast lesion localization market into Argentina, Colombia, Chile, and others

Competitive Landscape Assessment

Market share analysis for the North America and Europe region, which provides market shares of the top 3–5 key players in the breast lesion localization market

- Competitive leadership mapping for established players in the US

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Breast Lesion Localization Market

Which are the key strategies Adopted by global leaders of the Breast Lesion Localization Market?

Which geography holds the major share of the Global Breast Lesion Localization Market?

Can you share more light on the emerging trends in the global Breast Lesion Localization Market?