Medicated Feed Additives Market by Type (Antioxidants, Antibiotics, Probiotics & Prebiotics, Enzymes, Amino Acids), Livestock (Ruminants, Poultry, Swine, Aquaculture), Mixture Type, Category, and Region - Global Forecast to 2022

[142 Pages Report] The medicated feed ingredients market stood at USD 10,595.9 million in 2015; it is projected to grow at a CAGR of 5.41% from 2016, to reach USD 15,320.4 million by 2022. The base year considered for the study is 2015 and the forecast period is from 2016 to 2022. The main objective of the report is to define, segment, and project the global market size for medicated feed ingredients on the basis of type, livestock mixture type, category, and region. It also helps to understand the structure of the medicated feed ingredients market by identifying its various segments. The other objectives include analyzing the opportunities in the market for stakeholders and providing a competitive landscape of market trends, analyzing the macro- and micro-indicators of this market, and projecting the size of the medicated feed ingredients market and its submarkets, in terms of value as well as volume.

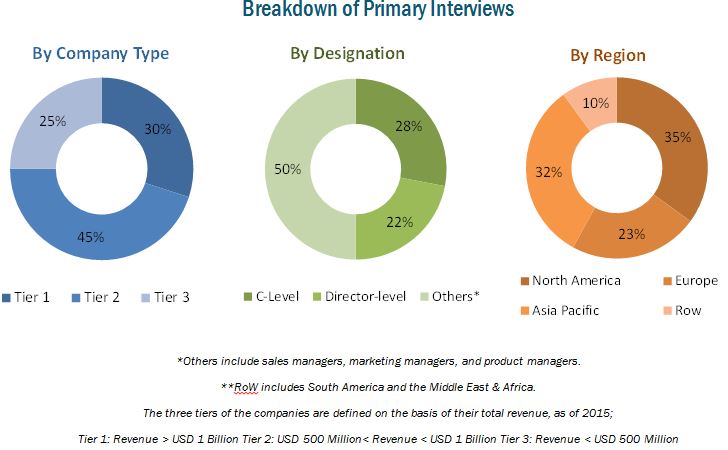

This report includes estimations of the market size in terms of value (USD million) and volume (KT). Both, the top-down and bottom-up approaches have been used to estimate and validate the size of the medicated feed ingredients market and to estimate the size of various other dependent submarkets in the overall market. The key players in the market have been identified through secondary research; some of these sources are press releases, paid databases such as Factiva and Bloomberg, annual reports, and financial journals; their market shares in respective regions have also been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. The figure below shows the breakdown of profiles of industry experts that participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the medicated feed ingredients market are manufacturers, medicated feed ingredients manufacturers, distributors & suppliers, associations and industry bodies and end users. Archer Daniels Midland Company (US), Cargill (US), CHS Inc. (US), Zoetis Inc. (US), and Purina Animal Nutrition (Land O’Lakes) (US) are some of the leading players in the global medicated feed ingredients market.

This report is targeted at the existing stakeholders in the industry, which include the following:

- Supply side: Medicated feed ingredients manufacturers, formulators, traders, distributors, and suppliers

- Demand side: Animal feed manufacturers, food processing industries, feed producers, large animal husbandry companies, large-scale ranches & poultry farms, and researchers

- Other related associations, research organizations, and industry bodies: the Food and Agriculture Organization (FAO), the International Feed Industry Federation (IFIF), Agriculture and Agri-Food Canada.

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report

On the basis of type, the medicated feed ingredients market has been segmented as follows:

- Antioxidants

- Antibiotics

- Probiotics & prebiotics

- Enzymes

- Amino acids

On the basis of mixture type, the medicated feed ingredients market has been segmented as follows:

- Supplements

- Concentrates

- Premix Feeds

- Base Mixes

On the basis of livestock, the medicated feed ingredients market has been segmented as follows:

- Ruminants

- Poultry

- Swine

- Aquaculture

On the basis of category, the medicated feed ingredients market has been segmented as follows:

- Category I

- Category II

On the basis of region, the medicated feed ingredients market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Segment Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia Pacific medicated feed ingredients market, by country

- Further breakdown of the Rest of Europe medicated feed ingredients market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Medicated feed additives improve the quality and nutritional content of the feed. These additives help in the growth & development of animals and increase the feed intake. Increase in the awareness of high-quality meat, which is rich in nutrients, has resulted in an increase in the usage of medicated feed additives. The growing awareness about meat & dairy products and concerns related to livestock health and industrialization of animal processed products are the major drivers of the medicated feed additives market.

On the basis of livestock, the poultry segment is estimated to dominate the medicated feed additives market in 2016. On a global level, the poultry production has been increasing with the rise in consumption of poultry products; it has become important for meat producers to focus more on the quality of additives fed to these birds. This boosts the medicated feed additives market to provide complete nutritional feed for poultry birds.

On the basis of mixture type, the supplements segment accounted for the largest market share in 2015. Supplements include trace elements and micro feeds such as protein supplements, which are included in animal diet to overcome deficiencies.. They are a concentrated source of nutrients and therefore have higher nutritive value than fibrous fodder, making them the most preferred mixture type for medicated food additives.

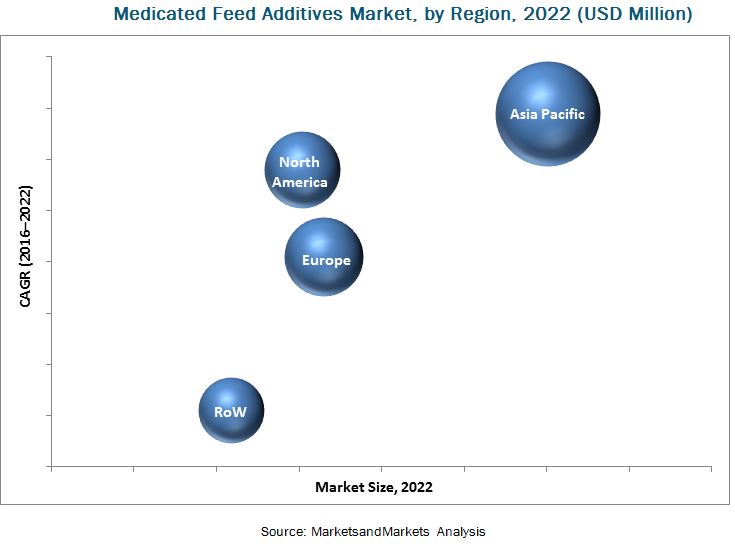

The Asia Pacific region accounted for the major market share for medicated feed additives between 2016 and 2022. Asia Pacific records the maximum consumption of medicated feed additives due to the increase in population and rise in disposable income. Key players focus on research & developments to develop products conforming to European regulations for medicated feed additives, since these regulations are considered to be benchmarks in terms of certain feed additives such as antibiotics.

Asia Pacific is projected to be the largest market for medicated feed additives, followed by Europe, by 2022, owing to increased awareness about medicated feed additives and their associated benefits in controlling livestock epidemic outbreaks. It remains one of the important markets for medicated feed additives manufacturers due to its livestock population size and its regulatory environment. The RoW countries are increasingly adopting medicated feed additives, due to a change in consumer lifestyles and increase in demand for meat products.

The medicated feed additives market is dominated by major players such as Archer Daniels Midland Company (US), Cargill, Incorporated (US), and CHS Incorporated (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered for the Study

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Macroindicators

2.2.1 Rising Livestock Population

2.2.2 Increasing Demand for Milk and Meat Products

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Medicated Feed Additives Market

4.2 Market: Key Countries

4.3 Life Cycle Analysis: Medicated Feed Additives Market, By Region

4.4 Market, By Type

4.5 Developed vs Emerging Medicated Feed Additives Markets

4.6 Market, By Category & Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Livestock

5.2.3 By Category

5.2.4 By Mixture Type

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Epidemic Outbreaks in Animals

5.3.1.2 Shift of the Livestock Industry From an Unorganized Sector to an Organized One

5.3.2 Restraints

5.3.2.1 Stringent Regulations Regarding the Use of Medicated Feed Additives

5.3.2.2 Some Medicated Feed Ingredients Posing Risk to Humans

5.3.3 Opportunities

5.3.3.1 Implementation of Innovative Animal Husbandry Practices to Improve the Quality of Meat

5.3.4 Challenges

5.3.4.1 Replacement By Organic Products

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Key Influencers

7 Medicated Feed Additives Market, By Mixture Type (Page No. - 49)

7.1 Introduction

7.2 Supplements

7.3 Concentrates

7.4 Premix Feeds

7.5 Base Mixes

8 Medicated Feed Additives Market, By Type (Page No. - 53)

8.1 Introduction

8.2 Antioxidants

8.3 Antibiotics

8.4 Probiotics & Prebiotics

8.4.1 Probiotics

8.4.2 Prebiotics

8.5 Enzymes

8.6 Amino Acids

8.7 Others

9 Medicated Feed Additives Market, By Category (Page No. - 60)

9.1 Introduction

9.2 Category I

9.3 Category II

10 Medicated Feed Additives Market, By Livestock (Page No. - 63)

10.1 Introduction

10.2 Ruminants

10.3 Poultry

10.4 Swine

10.5 Aquaculture

10.6 Others

11 Medicated Feed Additives Market, By Region (Page No. - 69)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Spain

11.3.2 U.K.

11.3.3 Netherlands

11.3.4 France

11.3.5 Germany

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 Australia

11.4.5 Rest of Asia-Pacific

11.5 RoW

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of RoW

12 Competitive Landscape (Page No. - 99)

12.1 Overview

12.2 Competitive Situation & Trends

12.3 Market Share Analysis

12.3.1 Investments and Expansions

12.3.2 New Product Launch

12.3.3 Acquisitions

12.3.4 Agreements, Partnership, Collaborations and Joint Venture

13 Company Profiles (Page No. - 108)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Zoetis Inc.

13.2 Cargill

13.3 Archer Daniels Midland Company

13.4 CHS Inc.

13.5 Purina Animal Nutrition (Land O’ Lakes)

13.6 Adisseo France Sas

13.7 Alltech Inc. (Ridley)

13.8 Biostadt India Limited

13.9 Zagro

13.10 Hipro Animal Nutrtion

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 131)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.2.1 Investments and Expansions

14.2.2 New Product Launch

14.2.3 Acquisitions

14.2.4 Agreements, Partnership, Collaborations and Joint Venture

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (68 Tables)

Table 1 Medicated Feed Additives Market Size, By Mixture Type, 2014–2022 (USD Million)

Table 2 Supplements: Market Size, By Region, 2014–2022 (USD Million)

Table 3 Concentrates: Market Size, By Region, 2014–2022 (USD Million)

Table 4 Premix Feeds:Market Size, By Region, 2014–2022 (USD Million)

Table 5 Base Mixes: Market Size, By Region, 2014–2022 (USD Million)

Table 6 Medicated Feed Additives Market Size, By Type, 2014-2022 (USD Million)

Table 7 Antioxidants: Market Size, By Region, 2014-2022 (USD Million)

Table 8 Antibiotics: Market Size, By Region, 2014-2022 (USD Million)

Table 9 Probiotics & Prebiotics Market Size, By Region, 2014-2022 (USD Million)

Table 10 Enzymes Market Size, By Region, 2014-2022 (USD Million)

Table 11 Amino Acids Market Size, By Region, 2014-2022 (USD Million)

Table 12 Other Medicated Feed Additives Market Size, By Region, 2014-2022 (USD Million)

Table 13 Medicated Feed Additives Market Size, By Category, 2014–2022 (USD Million)

Table 14 Category I: Medicated Feed Additives Market Size, By Region, 2014–2022 (USD Million)

Table 15 Category II: Medicated Feed Additives Market Size, By Region, 2014–2022 (USD Million)

Table 16 Medicated Feed Additives Market Size, By Livestock, 2014–2022 (USD Million)

Table 17 Medicated Ruminant Feed Additives Market Size, By Region, 2014–2022 (USD Million)

Table 18 Medicated Poultry Feed Additives Market Size, By Region, 2014–2022 (USD Million)

Table 19 Medicated Swine Feed Additives Market Size, By Region, 2014–2022 (USD Million)

Table 20 Medicated Aquaculture Feed Additives Market Size, By Region, 2014–2022 (USD Million)

Table 21 Medicated Other Livestock Feed Additives Market Size, By Region, 2014–2022 (USD Million)

Table 22 Market Size, By Region, 2014-2022 (USD Million)

Table 23 Market Size, By Region, 2014-2022 (KT)

Table 24 North America: Market Size, By Country, 2014-2022 (USD Million)

Table 25 North America: Market Size, By Type, 2014-2022 (USD Million)

Table 26 North America: Market Size, By Livestock, 2014-2022 (USD Million)

Table 27 North America: Market Size, By Mixture Type, 2014-2022 (USD Million)

Table 28 North America:Market Size, By Category, 2014-2022 (USD Million)

Table 29 U.S.: Market Size, By Type, 2014-2022 (USD Million)

Table 30 Canada: Market Size, By Type, 2014-2022 (USD Million)

Table 31 Mexico: Market Size, By Type, 2014-2022 (USD Million)

Table 32 Europe: Market Size, By Country, 2014–2022 (USD Million)

Table 33 Europe: Market Size, By Type, 2014–2022 (USD Million)

Table 34 Europe: Market Size, By Livestock, 2014–2022 (USD Million)

Table 35 Europe: Market Size, By Mixture Type, 2014-2022 (USD Million)

Table 36 Europe: Market Size, By Category, 2014-2022 (USD Million)

Table 37 Spain: Market Size, By Type, 2014–2022 (USD Million)

Table 38 U.K.: Market Size, By Type, 2014–2022 (USD Million)

Table 39 Netherlands: Market Size, By Type, 2014–2022 (USD Million)

Table 40 France: Market Size, By Type, 2014–2022 (USD Million)

Table 41 Germany: Market Size, By Type, 2014–2022 (USD Million)

Table 42 Rest of Europe: Market Size, By Type, 2014–2022 (USD Million)

Table 43 Asia-Pacific: Market Size, By Country, 2014–2022 (USD Million)

Table 44 Asia-Pacific: Market Size, By Type, 2014–2022 (USD Million)

Table 45 Asia-Pacific: Market Size, By Livestock, 2014–2022 (USD Million)

Table 46 Asia-Pacific: Market Size, By Mixture Type, 2014-2022 (USD Million)

Table 47 Asia-Pacific: Market Size, By Category, 2014-2022 (USD Million)

Table 48 China: Market Size, By Type, 2014–2022 (USD Million)

Table 49 India: Market Size, By Type, 2014–2022 (USD Million)

Table 50 Japan: Market Size, By Type, 2014–2022 (USD Million)

Table 51 Australia: Market Size, By Type, 2014–2022 (USD Million)

Table 52 Rest of Asia-Pacific : Market Size, By Type, 2014–2022 (USD Million)

Table 53 RoW: Market Size, By Country, 2014–2022 (USD Million)

Table 54 RoW: Market Size, By Type, 2014–2022 (USD Million)

Table 55 RoW: Market Size, By Livestock, 2014–2022 (USD Million)

Table 56 RoW: Market Size, By Mixture Type, 2014-2022 (USD Million)

Table 57 RoW: Market Size, By Category, 2014-2022 (USD Million)

Table 58 Brazil: Market Size, By Type, 2014–2022 (USD Million)

Table 59 Argentina: Market Size, By Type, 2014–2022 (USD Million)

Table 60 Rest of RoW: Market Size, By Type, 2014–2022 (USD Million)

Table 61 Investments and Expansions, 2011–2016

Table 62 New Product Launch 2011–2016

Table 63 Acquisitions 2011–2016

Table 64 Agreements, Partnership, Collaboration, and Joint Ventures, 2011–2016

Table 65 Investments and Expansions, 2011–2016

Table 66 New Product Launch 2011–2016

Table 67 Acquisitions 2011–2016

Table 68 Agreements, Partnership, Collaboration, and Joint Ventures, 2011–2016

List of Figures (51 Figures)

Figure 1 Medicated Feed Additives Market Segmentation

Figure 2 Research Design: Medicated Feed Additives Market

Figure 3 Breakdown of Primary Interviews, By Company Type, Designation, and Region

Figure 4 Global Cattle Population, 2000–2013 (Billion Heads)

Figure 5 Per Capita Consumption of Livestock Products

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Assumptions of the Study

Figure 10 Limitations of the Study

Figure 11 Amino Acids to Have the Largest Share Throughout the Forecast Period

Figure 12 Category I of Medicated Feed Additives is Estimated to Account for the Larger Share in 2016

Figure 13 Supplements Dominated the Market Throughout the Forecast Period

Figure 14 Aquaculture Segment is Projected to Grow at the Highest Growth Rate

Figure 15 Asia-Pacific is Estimated to Lead the Medicated Feed Additives Market in 2016

Figure 16 Asia-Pacific Region to Witness Highest Growth Rate Through 2022

Figure 17 an Emerging Market With Promising Growth Potential, 2016-2022

Figure 18 India and China to Be the Fastest-Growing Markets for Medicated Feed Additives, 2016 to 2022

Figure 19 Market in Asia-Pacific is Experiencing High Growth

Figure 20 Amino Acids Expected to Dominate the Market Throughout the Forecast Period

Figure 21 India & Brazil Emerging to Be the Most Attractive Markets for Medicated Feed Additives During the Forecast Period

Figure 22 Asia-Pacific Accounted for the Largest Share in Both Categories in 2015

Figure 23 Market, By Type

Figure 24 Market, By Livestock

Figure 25 Market, By Category

Figure 26 Market, By Mixture Type

Figure 27 Medicated Feed Additives: Market Dynamics

Figure 28 Value Chain Analysis of Medicated Feed Additives (2015): A Major Contribution From the R&D Phase

Figure 29 Supply Chain Analysis for the Medicated Feed Additives Market

Figure 30 Market Size, By Mixture Type, 2016 vs 2022 (USD Million)

Figure 31 Market Size, By Type, 2016 vs 2022

Figure 32 Market Size, By Category, 2016–2022 (USD Million)

Figure 33 Market Size, By Livestock, 2016 vs 2022 (USD Million)

Figure 34 India is Projected to Grow at the Highest Rate

Figure 35 U.S. Accounted for the Largest Share for Medicated Feed Additives in North America

Figure 36 Asia-Pacific Accounted for the Largest Market Share in 2015

Figure 37 Investments and Expansions Were Preferred By Key Medicated Feed Additive Companies in the Last Five Years

Figure 38 Strengthening Market Presence Through Investments and Expansions Between 2013 to 2016

Figure 39 Market Share, By Key Company, 2015

Figure 40 Agreements, Partnership, Collaboration, and Mergers: the Key Strategies, 2011-2016

Figure 41 Zoetis Inc. : Company Snapshot

Figure 42 Zoetis Inc. : SWOT Analysis

Figure 43 Cargill: Company Snapshot

Figure 44 Cargill : SWOT Analysis

Figure 45 Archer Daniels Midland Company : Company Snapshot

Figure 46 Archer Daniels SWOT Analysis

Figure 47 CHS Inc.: Company Snapshot

Figure 48 CHS Inc.: SWOT Analysis

Figure 49 Purina Animal Nutrition (Land O’ Lakes): Company Snapshot

Figure 50 Purina Animal Health Nutrition (Land O’ Lakes): SWOT Analysis

Figure 51 Zagro: Company Snapshot

Growth opportunities and latent adjacency in Medicated Feed Additives Market