Blockchain in Retail Market by Provider, Application (Compliance Management, Identity Management, Loyalty & Rewards Management, Payment, Smart Contracts, and Supply Chain Management), Organization Size, and Region - Global Forecast to 2023

[125 Pages Report] The blockchain in retail market expected to grow from $44.2 million in 2017 to reach $2,339.5 million by 2023, at a Compound Annual Growth Rate (CAGR) of 96.4% during the forecast period. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

The major drivers of the market include the growing interest in the adoption of blockchain technology in retail and supply chain management industry, and increasing need efficiency and speed in retail and supply chain transaction. Additionally, rapidly transforming international trade and retail industry scenario backed by increasing venture funding and investments towards the blockchain technology providers has further proliferated the growth prospects for the market.

The objective of the blockchain in retail market research report is to define, describe, and forecast the market by provider, application, organization size and region. The report analyzes the opportunities in the market for stakeholders by identifying the high-growth segments of the market. It profiles the key players of the market and comprehensively analyzes their core competencies, such as new product launches, partnerships, agreements, and collaborations. The report also covers detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

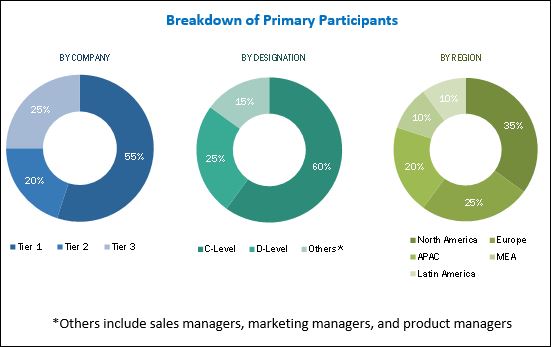

The research methodology used to estimate and forecast the blockchain in retail market begins with capturing data from various industry associations and consortiums, such as Enterprise Ethereum Alliance (EEA), Hyperledger Consortium, Blockchain Collaborative Consortium (BCCC), and R3CEV Blockchain Consortium; and other sources, including company financials, journals, press releases, paid databases, and annual reports. The bottom-up procedure was employed to arrive at the overall market size from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, executives, and blockchain specialists. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of primary profiles is depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The blockchain in retail market comprises major service providers, such as, IBM (US), SAP (Germany), Microsoft (US), Oracle (US), AWS (US), Bitfury (the Netherlands), Auxesis Group (India), Cegeka (the Netherlands), BTL (Canada), Guardtime (Estonia), CoinBase (US), loyyal (US), Sofocle (India), BigchainDB (Germany), RecordsKeeper (Spain), BitPay (US), Abra (US), Reply (Italy), Provenance (UK), ModulTrade (UK), Blockverify (UK), OGYDocs (Israel), Warranteer (Israel) and Blockchain Foundary (Singapore). The stakeholders include retail companies, blockchain technology vendors, independent software vendors, consulting firms, system integrators, Value-added Resellers (VARs), and Information Technology (IT) agencies.

Target audience for blockchain in retail market

- Regulatory bodies

- Blockchain technology solution vendors

- Independent Software Vendors (ISVs)

- Consulting firms

- VARs

The study answers several questions for the stakeholders; primarily, which market segments to focus on in the next 2 to 5 years for prioritizing their efforts and investments.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20182023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Providers, Application, Organization Size and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

IBM (US), SAP (Germany), Microsoft (US), Oracle (US), AWS (US), Bitfury (the Netherlands), Auxesis Group (India), Cegeka (the Netherlands), BTL (Canada), Guardtime (Estonia), CoinBase (US), loyyal (US), Sofocle (India), BigchainDB (Germany), RecordsKeeper (Spain), BitPay (US), Abra (US), Reply (Italy), Provenance (UK), ModulTrade (UK), Blockverify (UK), OGYDocs (Israel), Warranteer (Israel) and Blockchain Foundary (Singapore). |

The research report segments the blockchain in retail market into the following submarkets:

Providers

- Application Providers

- Middleware Providers

- Infrastructure Providers

Applications

- Compliance Management

- Identity Management

- Loyalty and Rewards Management

- Payments

- Smart Contracts

- Supply Chain Management

- Others (Anti-Counterfeiting, Advertising, and Consumer Data Management)

Organization Size

- SMEs

- Large Enterprises

Blockchain in Retail Market by Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

The blockchain in retail market study aims at estimating the market size and future growth potential of the market across segments, such as provider, application, and region. The application segment includes compliance management, identity management, loyalty and rewards management, payments, smart contracts, supply chain management, and others (anti-counterfeiting, advertising, and consumer data management). The supply chain management segment is expected to dominate the application segment in terms of contribution to the overall market, as various multinational retail and supply chain management corporations are deploying blockchain technologies across various business processes to bring reduction in costs of verification, execution, arbitration, and fraud prevention.

The blockchain in retail market has been segmented on the basis of providers into 3 categories: application providers, middleware providers, and infrastructure providers. These providers offer infrastructure to develop the blockchain-based platforms. Among these types, application providers is the fastest growing segment in the overall market. The introduction of technologically advanced blockchain solutions has witnessed certain level of adoption in retail and supply chain management corporations thereby fueling the overall market growth.

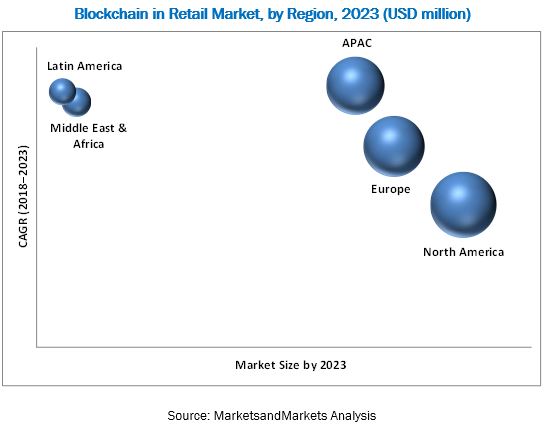

In terms of geographic coverage, the blockchain in retail market has been segmented into 5 regions, namely, North America, Asia Pacific (APAC), Europe, the Middle East and Africa (MEA), and Latin America. North America is estimated to account for the largest share of the overall market in 2018. North America is considered as the most advanced region with regard to technology adoption and infrastructure. The wide presence of key industry players of blockchain technology solutions in this region is the main driving factor responsible for the growth of the market. Major multinational retailers such as Walmart and supply chain management/logistics companies UPS and FedEx in this region are adopting the blockchain technology. Europe is expected gain pace in terms of adoption in the coming years, as companies across different business processes are increasingly adopting the blockchain technology. Furthermore, APAC is expected to record the highest growth rate during the forecast period, due to the increasing funding-backed startup activities in the blockchain technology aimed at transforming the retail industry scenario.

The key financial and retailing hubs, and massive shipping and trading markets, including Hong Kong and Singapore, provide huge growth opportunities for the adoption of the blockchain in the retail and supply chain management sector in APAC. However, lack of awareness and technical understanding about blockchain technology could restrain the blockchain in retail market growth across regions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American blockchain in retail market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

Detailed analysis was performed to get detailed information regarding the competitors in the market by their solution offerings and business strategies. The report reviews the major players offering blockchain technology solutions and services. In addition, the report will outline the findings and analysis on how well each blockchain technology solution provider performs within the MarketsandMarkets criteria.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Introduction

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Blockchain in Retail Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the market

4.2 Market, By Provider

4.3 Market, By Application

4.4 Market, By Region

5 Blockchain in Retail Market Overview and Industry Trends (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Interests in the Adoption of the Blockchain Technology in the Retail Industry

5.2.1.2 Rising Efficiency and Speed in Retail and Supply Chain Transactions

5.2.1.3 Reduced Total Cost of Ownership

5.2.2 Restraints

5.2.2.1 Uncertain Regulatory and Compliance Environment

5.2.3 Opportunities

5.2.3.1 Rapidly Transforming International Trade and Retail Sector

5.2.3.2 Increasing Venture Funding and Investments in the Blockchain Technology

5.2.4 Challenges

5.2.4.1 Lack of Standards and Best Practices

5.2.4.2 Lack of Awareness and Technical Understanding About the Blockchain Technology

5.3 Industry Trends

5.3.1 Types of Blockchain Technology

5.3.1.1 Private Blockchain

5.3.1.2 Public Blockchain

5.3.2 Blockchain Associations and Consortiums

5.3.2.1 Enterprise Ethereum Alliance

5.3.2.2 Hyperledger Consortium

5.3.2.3 Blockchain Collaborative Consortium

5.3.2.4 R3cev Blockchain Consortium

5.4 Use Cases

5.4.1 Blockchain Technology for Automated Customer Services

5.4.2 Blockchain Project for Supply Chain and Inventory Management

5.4.3 Blockchain for Payments and Ecommerce

5.4.4 Blockchain for Kyc Compliance in Retail

6 Market By Provider (Page No. - 38)

6.1 Introduction

6.2 Application Providers

6.3 Middleware Providers

6.4 Infrastructure Providers

7 Blockchain in Retail Market, By Application (Page No. - 43)

7.1 Introduction

7.2 Compliance Management

7.3 Identity Management

7.4 Loyalty and Rewards Management

7.5 Payments

7.6 Smart Contracts

7.7 Supply Chain Management

7.8 Others

8 Market by Organization Size (Page No. - 51)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Blockchain in Retail Market, By Region (Page No. - 55)

9.1 Introduction

9.2 North America

9.2.1 By Provider

9.2.2 By Application

9.2.3 By Organization Size

9.2.4 By Country

9.2.4.1 United States

9.2.4.2 Canada

9.3 Europe

9.3.1 By Provider

9.3.2 By Application

9.3.3 By Organization Size

9.3.4 By Country

9.3.4.1 United Kingdom

9.3.4.2 Germany

9.3.4.3 Rest of Europe

9.4 Asia Pacific

9.4.1 By Provider

9.4.2 By Application

9.4.3 By Organization Size

9.4.4 By Country

9.4.4.1 China

9.4.4.2 India

9.4.4.3 Australia and New Zealand

9.4.4.4 Rest of Asia Pacific

9.5 Middle East and Africa

9.5.1 By Provider

9.5.2 By Application

9.5.3 By Organization Size

9.5.4 By Subregion

9.5.4.1 Middle East

9.5.4.2 Africa

9.6 Latin America

9.6.1 By Provider

9.6.2 By Application

9.6.3 By Organization Size

9.6.4 By Country

9.6.4.1 Brazil

9.6.4.2 Mexico

9.6.4.3 Rest of Latin America

10 Competitive Landscape (Page No. - 72)

10.1 Overview

10.2 Market Ranking and Key Players

10.3 Competitive Scenario

10.3.1 New Product Launches and Product Enhancements

10.3.2 Partnerships, Agreements, and Collaborations

11 Company Profiles (Page No. - 76)

(Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 IBM

11.2 Microsoft

11.3 SAP

11.4 AWS

11.5 Oracle

11.6 Bitfury

11.7 Cegeka

11.8 Auxesis Group

11.9 Blockpoint

11.10 Coinbase

11.11 Loyyal

11.12 Abra

11.13 Bitpay

11.14 Blockverify

11.15 BTL Group

11.16 Modultrade

11.17 Recordskeeper

11.18 Guardtime

11.19 Blockchain Foundry

11.20 Bigchaindb

11.21 Sofocle Technologies

11.22 OGY Docs

11.23 Reply

11.24 Project Provenance

11.25 Warranteer Digital

*Details on Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 118)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (41 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 Blockchain in Retail Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y %)

Table 3 Market Size, By Provider, 20162023 (USD Million)

Table 4 Application Providers: Market Size, By Region, 20162023 (USD Million)

Table 5 Middleware Providers: Market Size, By Region, 20162023 (USD Million)

Table 6 Infrastructure Providers: Market Size, By Region, 20162023 (USD Million)

Table 7 Blockchain in Retail Market Size, By Application, 20162023 (USD Million)

Table 8 Compliance Management: Market Size, By Region, 20162023 (USD Million)

Table 9 Identity Management: Market Size, By Region, 20162023 (USD Million)

Table 10 Loyalty and Rewards Management: Market Size, By Region, 20162023 (USD Million)

Table 11 Payments: Market Size, By Region, 20162023 (USD Million)

Table 12 Smart Contracts: Market Size, By Region, 20162023 (USD Million)

Table 13 Supply Chain Management: Market Size, By Region, 20162023 (USD Million)

Table 14 Others: Market Size, By Region, 20162023 (USD Million)

Table 15 Market Size, By Organization Size, 20162023 (USD Million)

Table 16 Small and Medium-Sized Enterprises: Blockchain in Retail Market Size, By Region, 20162023 (USD Million)

Table 17 Large Enterprises: Market Size, By Region, 20162023 (USD Million)

Table 18 Market Size, By Region, 20162023 (USD Million)

Table 19 North America: Market Size, By Provider, 20162023 (USD Million)

Table 20 North America: Market Size, By Application, 20162023 (USD Million)

Table 21 North America: Blockchain in Retail Market Size, By Organization Size, 20162023 (USD Million)

Table 22 North America: Market Size, By Country, 20162023 (USD Million)

Table 23 Europe: Market Size, By Provider, 20162023 (USD Million)

Table 24 Europe: Market Size, By Application, 20162023 (USD Million)

Table 25 Europe: Market Size, By Organization Size, 20162023 (USD Million)

Table 26 Europe: Market Size, By Country, 20162023 (USD Million)

Table 27 Asia Pacific: Market Size, By Provider, 20162023 (USD Million)

Table 28 Asia Pacific: Market Size, By Application, 20162023 (USD Million)

Table 29 Asia Pacific: Market Size, By Organization Size, 20162023 (USD Million)

Table 30 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 31 Middle East and Africa: Market Size, By Provider, 20162023 (USD Million)

Table 32 Middle East and Africa: Market Size, By Application, 20162023 (USD Million)

Table 33 Middle East and Africa: Market Size, By Organization Size, 20162023 (USD Million)

Table 34 Middle East and Africa: Blockchain in Retail Market Size, By Subregion, 20162023 (USD Million)

Table 35 Latin America: Market Size, By Provider, 20162023 (USD Million)

Table 36 Latin America: Market Size, By Application, 20162023 (USD Million)

Table 37 Latin America: Market Size, By Organization Size, 20162023 (USD Million)

Table 38 Latin America: Market Size, By Country, 20162023 (USD Million)

Table 39 Blockchain in Retail Market: Market Ranking, 2018

Table 40 New Product Launches and Product Enhancements, 20162018

Table 41 Partnerships, Agreements, and Collaborations, 20162017

List of Figures (29 Figures)

Figure 1 Blockchain in Retail Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Blockchain in Retail Market: Assumptions

Figure 8 Supply Chain Management and North America are Estimated to Have the Largest Market Shares in 2018

Figure 9 Market Share, By Provider, 2018

Figure 10 North America is Estimated to Hold the Largest Market Share in 2018

Figure 11 High Adoption of the Blockchain Technology Across Various Application Areas to Provide Significant Growth Opportunities in the Blockchain in Retail Market During the Forecast Period

Figure 12 Application Providers Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Loyalty and Rewards Management Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Blockchain in Retail Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Application Providers Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Loyalty and Rewards Management Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 19 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Key Developments By the Leading Players in the Blockchain in Retail Market, 20162018

Figure 23 IBM: Company Snapshot

Figure 24 Microsoft: Company Snapshot

Figure 25 SAP: Company Snapshot

Figure 26 AWS: Company Snapshot

Figure 27 Oracle: Company Snapshot

Figure 28 Cegeka: Company Snapshot

Figure 29 Reply: Company Snapshot

Growth opportunities and latent adjacency in Blockchain in Retail Market