Blockchain Identity Management Market by Offering (Software and Services), Provider Type (Application Provider, Middleware Provider, and Infrastructure Provider), Network, Organization Size, Vertical and Region - Global Forecast to 2028

Blockchain Identity Management Market Overview

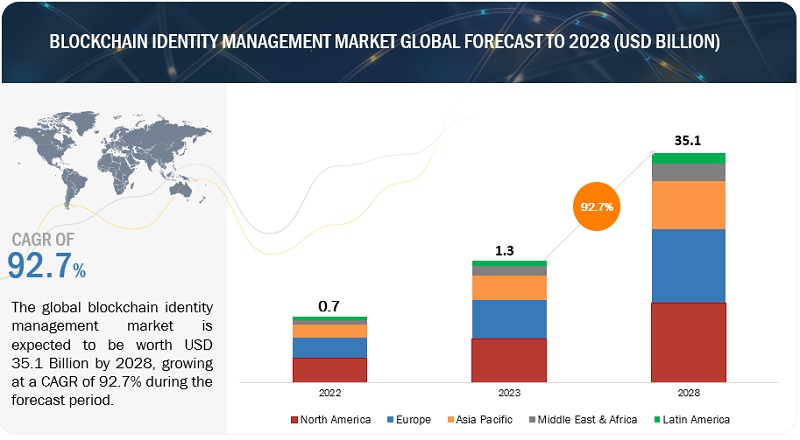

The global Blockchain Identity Management Market was reached $1.3 billion in 2023 and is anticipated to reach over $35.1 billion by 2028, growing at a robust CAGR of 92.7% during forecast period.

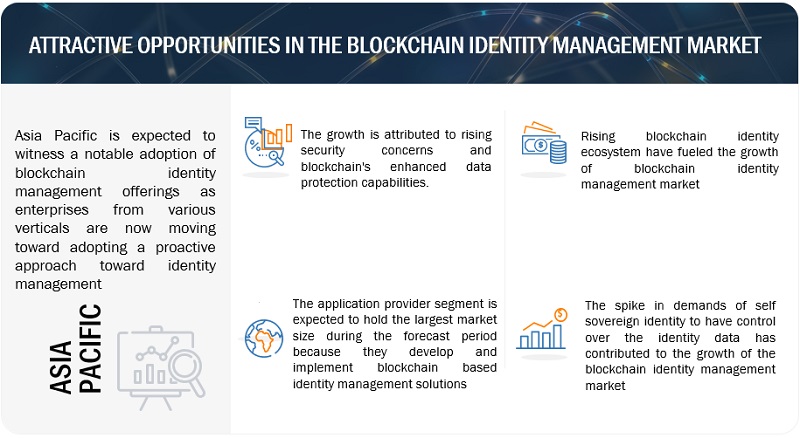

The rise in security concerns drives the expansion of the blockchain identity management market, creating a strong demand for robust blockchain identity management solutions. These solutions help verify, audit, and manage identity accomplished within seconds.

Additionally, the rapid growth of blockchain identity ecosystems has played a significant role in promoting the adoption of blockchain identity management measures. Hackers are increasingly targeting traditional identity management due to their extensive usage and access to valuable data, further bolstering the growth of the blockchain identity management market. Moreover, the easing of business functions and growing demand for digital identity management are contributing to the growth of the market. These factors indicate a promising growth trajectory for the market as organizations actively seek improved security and data control measures. Consequently, the demand for blockchain identity management solutions is expected to witness a significant upsurge shortly.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Blockchain Identity Management Market Dynamics

Driver: Proliferation of digital identity ecosystem and blockchain gaming vertical

The surge in blockchain gaming and the digital identity ecosystem has led to a rapid rise in blockchain identity management. The demand for blockchain ID management is driven by the increased use of digital identities for online services, the widespread adoption of mobile devices, and rising data breaches. Blockchain identity management ensures secure and decentralized storage of identity data, protecting against theft and fraud while improving verification processes. It is also crucial in blockchain gaming, providing a secure way to manage player identities and assets, preventing fraud, and ensuring transparency. Examples of platforms in this space include Evernym, Socure, Enjin, and The Sandbox, all leveraging blockchain technology for identity verification and asset protection.

Restraint: Uncertainty in regulations and absence of uniform standards

Regulatory bodies struggle to keep up with technological advancements, including blockchain identity management. The lack of regulations hinders the widespread adoption of blockchain in various industries, and gaining acceptance from financial institutions is challenging. The early stage of distributed ledger technology raises questions about its applications, security, and authenticity, making regulators hesitant. Specific use cases like payments, smart contracts, and digital identity can be regulated, but comprehensive technology regulation is complex due to challenges like standardization and interoperability, leaving the regulatory status uncertain.

Opportunity: Government efforts promoting the adoption of blockchain technology

Blockchain technology has gained significant attention from governments and various industries in recent years. Governments worldwide are investing in research and development to explore blockchain's potential for identity management solutions. By using distributed ledgers, blockchain can enhance transparency, efficiency, and public service delivery. Estonia, for example, has become a leader in blockchain-based electronic voting and identity management, allowing secure voting from anywhere and efficient access to public services with citizens retaining control over their data.

Challenge: Limited expertise in blockchain principles

Blockchain technology has gained significant attention, but many users struggle to grasp its technical aspects. Despite its benefits, like security and decentralized control, the adoption of blockchain identity management solutions is still limited. Understanding blockchain and its platforms is essential as its applications grow. Technical knowledge of cryptographic algorithms and decentralized systems is necessary to explore their advantages fully. Legacy infrastructure also poses a challenge as it differs from traditional IT development. Overcoming these obstacles is crucial for unlocking blockchain identity management’s full potential.

Blockchain Identity Management Market Ecosystem

By vertical, the Healthcare segment is to grow at the highest CAGR during the forecast period.

The healthcare sector is witnessing the highest CAGR in the blockchain identity management market, primarily due to its numerous advantages. The enhanced security and privacy features of blockchain technology make it an ideal solution for safeguarding sensitive healthcare data from hacking or tampering. By creating a secure, shared platform for patient data storage and exchange, blockchain improves interoperability, resulting in reduced duplication of tests, enhanced patient care, and cost savings. Additionally, blockchain streamlines administrative processes like patient identity verification, leading to increased efficiency and reduced expenses. Moreover, the technology ensures healthcare organizations' compliance with regulations by enabling secure and auditable management of patient data, protecting them from potential fines and penalties.

By network, the permissionless segment is to grow at the highest CAGR during the forecast period.

The permissionless segment is thriving in the blockchain identity market due to its decentralized, trustless nature, granting users autonomy and control over their identities. With higher privacy and security, it reduces data breach risks. Its open access and inclusivity attract a global user base, and interoperability fosters a unified identity ecosystem. Additionally, resistance to censorship and scalability make permissionless blockchains highly attractive for identity management across verticals like healthcare and finance, fueling its rapid growth.

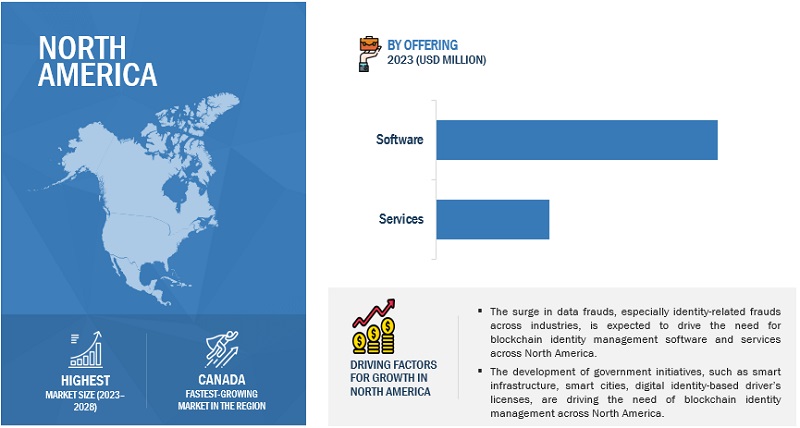

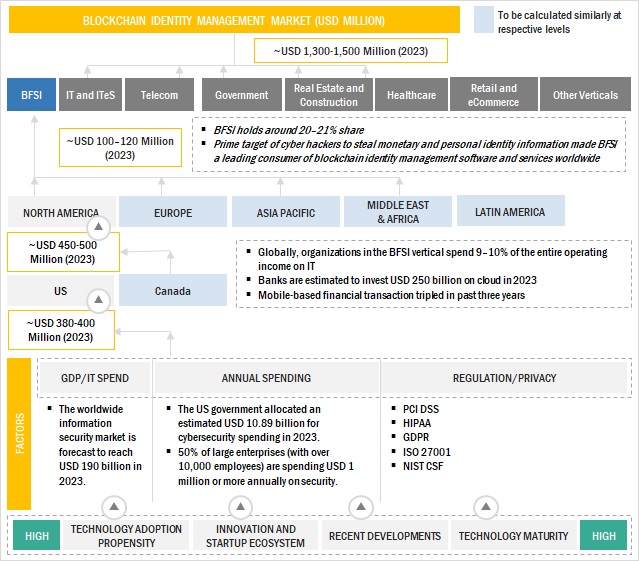

By region, North America accounts for the highest market size during the forecast period.

The blockchain identity management market in North America is experiencing rapid growth, driven by escalating adoption of digital identity solutions. As businesses and individuals increasingly operate online, secure and decentralized identity management becomes crucial. With the rising demand for privacy and security, blockchain-based solutions offer enhanced protection against fraud and data breaches. The availability of such solutions from prominent technology companies has facilitated widespread adoption. Additionally, North America's supportive regulatory environment has fostered a favorable landscape for the blockchain identity management market's expansion, solidifying the region's position with the highest market share.

Key Market Players

AWS (US), IBM (US), Oracle (US), Microsoft (US), Bitfury (US), NEC (Japan), Dock (Switzerland), and Hu-manity.co (US), Metadium (Cayman Islands), Serto (US), Coinfirm (UK), Accumulate (US), Neuroware (Malaysia), Tradle (US), Peer Ledger (Canada), Procivis (Switzerland), SpringRole (US), Blockchains (US), Oaro (Canada), Fractal (Germany), NuID (US), Validated ID (Spain), KYC-Chain (Hong Kong), TRM Labs (US) and Factom (US) are the key players and other players in the blockchain identity management market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Offering, Provider Type, Organization Size, Network, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors in the global blockchain identity management market include AWS (US), IBM (US), Oracle (US), Microsoft (US), Bitfury (US), NEC (Japan), Dock (Switzerland), and Hu-manity.co (US), Metadium (Cayman Islands), Serto (US), Coinfirm (UK), Accumulate (US), Neuroware (Malaysia), Tradle (US), Peer Ledger (Canada), Procivis (Switzerland), SpringRole (US), Blockchains (US), Oaro (Canada), Fractal (Germany), NuID (US), Validated ID (Spain), KYC-Chain (Hong Kong), TRM Labs (US) and Factom (US). |

The study categorizes the blockchain identity management market by segments - offering, provider type, organization size, network, vertical, and region.

By Offering:

- Software

- Services

By Provider Type:

- Application Provider

- Middleware Provider

- Infrastructure Provider

By Organization Size:

- SMEs

- Large Enterprise

By Network

- Permissioned

- Permissionless

Vertical:

- BFSI

- IT and ITeS

- Telecom

- Government

- Real Estate and Construction

- Healthcare

- Retail and eCommerce

- Media and Entertainment

- Travel and Hospitality

- Other Verticals (Energy and Utilities; Transportation and Logistics; Research and Academia; and others)

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In January 2023, AWS (US) partnered with Ava Labs to promote blockchain adoption in enterprises, institutions, and governments. The collaboration aims to simplify node deployment and management on Avalanche, strengthen the network, and enhance the dApp ecosystem.

- In July 2021, Oracle Financial Services Software Ltd and Everest joined forces to bring blockchain technology to global banks. The partnership allows Oracle's banking clients to verify customer credentials and store them securely on the blockchain platform across multiple countries. Additionally, the integration improves Oracle's banking software and facilitates remote customer onboarding for financial institutions.

- In May 2022, Microsoft launched Microsoft Entra, a new product family that includes Azure Active Directory (Azure AD), and introduced two new categories: Microsoft Entra Permissions Management and Microsoft Entra Verified ID. The latter is based on decentralized identity standards, offering a secure, interoperable, and self-owned identity solution. Entra Permissions Management enables comprehensive visibility and management of permissions across multi-cloud environments, reducing access risks.

Frequently Asked Questions (FAQ):

What are the opportunities in the global blockchain identity management market?

The initiatives taken by the government and widespread usage of blockchain-based identity solutions are a few factors contributing to the growth and creating new opportunities for the blockchain identity management market.

What is the definition of the blockchain identity management market?

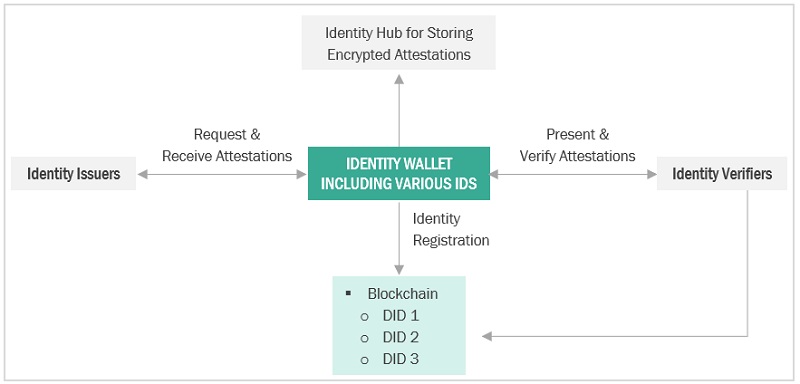

Identity management involves identifying and authorizing individuals or entities to access organizational resources by providing them with the rights they are entitled to. Although identity management has many concerns related to information security, blockchain technology offers a solution through its distributed ledger technology. In this method, all transactions and information on individuals, groups, or organization entities are stored in blocks, and overriding these blocks is not possible. Blockchain technology delivers a secure solution that eliminates the need for central authorities and third parties. It makes it easier for individuals to manage and control their personal information and its access.

Which region is expected to show the highest market share in the blockchain identity management market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors in the global blockchain identity management market include AWS (US), IBM (US), Oracle (US), Microsoft (US), Bitfury (US), NEC (Japan), Dock (Switzerland), Hu-manity.co (US), Metadium (Cayman Islands), Serto (US), Coinfirm (UK), Accumulate (US), Neuroware (Malaysia), Tradle (US), Peer Ledger (Canada), Procivis (Switzerland), SpringRole (US), Blockchains (US), Oaro (Canada), Fractal (Germany), NuID (US), Validated ID (Spain), KYC-Chain (Hong Kong), TRM Labs (US) and Factom (US).

What is the current size of the global blockchain identity management market?

The global blockchain identity management market size is projected to grow from USD 1.3 billion in 2023 to USD 35.1 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 92.7% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing global security concerns to drive demand for blockchain identity solutions across various verticals- Enhancing business operations with fast transactions and data immutability- Rise of digital identity ecosystem and blockchain gaming verticalRESTRAINTS- Issues regarding legitimacy of users- Regulatory ambiguity and lack of standardized normsOPPORTUNITIES- Government initiatives driving blockchain technology adoption- Widespread implementation of blockchain-based identity solutions across various sectorsCHALLENGES- Limited expertise, technical proficiency, and comprehension of blockchain principles

-

5.3 USE CASESCASE STUDY 1: AWS AIDED SGX IN IMPROVING EFFICIENCY, TRANSPARENCY, AND SETTLEMENT TIME FOR TRADECASE STUDY 2: BITFURY HELPED SYNERGY UNIVERSITY COMBAT ACADEMIC CERTIFICATE FRAUD WITH BLOCKCHAINCASE STUDY 3: SERES LEVERAGES ORACLE BLOCKCHAIN PLATFORM TO ENHANCE TRUST, TRACEABILITY, AND TRANSPARENCY

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM: BLOCKCHAIN IDENTITY MANAGEMENT MARKET

-

5.6 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 5.7 PRICING ANALYSIS

-

5.8 TECHNOLOGY ANALYSISSELF-SOVEREIGN IDENTITY (SSI)DECENTRALIZED IDENTIFIERS (DIDS)VERIFIABLE CREDENTIALSZERO-KNOWLEDGE PROOFS (ZKPS)INTEROPERABILITY AND STANDARDS

-

5.9 PATENT ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

-

5.11 BLOCKCHAIN ASSOCIATIONS AND CONSORTIUMSENTERPRISE ETHEREUM ALLIANCEHYPERLEDGER CONSORTIUMGLOBAL BLOCKCHAIN BUSINESS COUNCILBLOCKCHAIN COLLABORATIVE CONSORTIUMR3CEV BLOCKCHAIN CONSORTIUMCONTINUOUS LINKED SETTLEMENT GROUPGLOBAL PAYMENTS STEERING GROUPFINANCIAL BLOCKCHAIN SHENZHEN CONSORTIUMCU LEDGERWALL STREET BLOCKCHAIN ALLIANCEOTHER ASSOCIATIONS

-

5.12 TARIFF AND REGULATORY LANDSCAPEKNOW YOUR CUSTOMER (KYC)ANTI-MONEY LAUNDERINGGENERAL DATA PROTECTION REGULATION (GDPR)PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD (PCI-DSS)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

6.1 INTRODUCTIONOFFERING: MARKET DRIVERS

-

6.2 SOFTWAREUSE OF BLOCKCHAIN-BASED IDENTITY WALLETS TO DRIVE MARKET

-

6.3 SERVICESSERVICES TO ENSURE SEAMLESS DEPLOYMENT AND MAINTENANCE

-

7.1 INTRODUCTIONPROVIDER TYPE: MARKET DRIVERS

-

7.2 APPLICATION PROVIDERSAPPLICATION PROVIDERS TO ENABLE ENTERPRISES TO BUILD BLOCKCHAIN-BASED APPLICATIONS

-

7.3 MIDDLEWARE PROVIDERSMIDDLEWARE PROVIDERS TO ENSURE SEAMLESS INTEROPERABILITY AMONG BLOCKCHAIN PLATFORMS

-

7.4 INFRASTRUCTURE PROVIDERSINFRASTRUCTURE PROVIDERS TO DEVELOP AND MAINTAIN BLOCKCHAIN NETWORKS

-

8.1 INTRODUCTIONNETWORK: MARKET DRIVERS

-

8.2 PERMISSIONED NETWORKPERMISSIONED NETWORK TO PROMOTE PROOF OF CONCEPT AND CONSENSUS MECHANISM

-

8.3 PERMISSIONLESS NETWORKOPEN NATURE OF PERMISSIONLESS NETWORK TO MAKE IDENTITY VERIFICATION COMPLEX

-

9.1 INTRODUCTIONORGANIZATION SIZE: MARKET DRIVERS

-

9.2 SMALL- AND MEDIUM-SIZED ENTERPRISESINTEGRATION OF BLOCKCHAIN TECHNOLOGY IN AUTOMATED PROCESSES TO HELP ACCELERATE GROWTH OF BUSINESSES

-

9.3 LARGE ENTERPRISESFASTER INTERACTIONS, COST REDUCTION, AND ENHANCED SECURITY ASPECTS TO FUEL EXPANSION OF BLOCKCHAIN TECHNOLOGY AMONG LARGE ENTERPRISES

-

10.1 INTRODUCTIONVERTICAL: BLOCKCHAIN IDENTITY MANAGEMENT MARKET DRIVERS

-

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCERISING DEMAND FOR DECENTRALIZED BANKING PLATFORMS TO DRIVE MARKET

-

10.3 IT AND ITESSMART TECHNOLOGIES TO MITIGATE ADVANCED CYBERATTACKS

-

10.4 TELECOMURGE TO PROTECT SENSITIVE TELECOM DATA TO FUEL SEGMENT GROWTH

-

10.5 GOVERNMENTSMART TECHNOLOGIES TO MITIGATE ADVANCED CYBERATTACKS

-

10.6 REAL ESTATE AND CONSTRUCTIONELIMINATION OF MIDDLEMEN AND COMPLETE TRANSPARENCY TO DRIVE MARKET

-

10.7 HEALTHCARENEED TO SECURE CRITICAL PATIENT DATA ACROSS NODES TO BOOST SEGMENT GROWTH

-

10.8 RETAIL AND ECOMMERCEAUTOMATION ACROSS RETAIL CHANNELS FOR CURBING IDENTITY THEFTS TO PROPEL GROWTH

-

10.9 MEDIA AND ENTERTAINMENTEASIER COPYRIGHT MANAGEMENT AND ABILITY TO SUPPORT MICROPAYMENTS WITHOUT INTERMEDIARY PAYMENT NETWORK TO BOOST MARKET

-

10.10 TRAVEL AND HOSPITALITYREDUCED COSTS AND INCREASED TRANSPARENCY TO DRIVE MARKET

- 10.11 OTHER VERTICALS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: BLOCKCHAIN IDENTITY MANAGEMENT MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Growing number of startups and vast vendor database to drive market in USCANADA- Initiatives taken by government and other organizations to drive market

-

11.3 EUROPEEUROPE: BLOCKCHAIN IDENTITY MANAGEMENT MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Government initiatives to drive implementation of blockchain identity solutionsGERMANY- Increasing adoption of blockchain identity solutions among financial organizations to fuel market growthFRANCE- Active use of blockchain for identity management to drive marketREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: BLOCKCHAIN IDENTITY MANAGEMENT MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Need for secure and reliable identity verification systems to boost market in ChinaJAPAN- Rapid adoption of Industry 4.0 technologies to drive utilization of blockchain identity in financial sectorINDIA- Government strategies to drive blockchain identity management landscapeSINGAPORE- Active promotion of blockchain adoption and favorable regulatory environment to drive marketREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: BLOCKCHAIN IDENTITY MANAGEMENT MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Rapid digital transformation across various sectors to drive marketAFRICA- Increase in adoption and implementation of verification solutions to fuel market growth

-

11.6 LATIN AMERICALATIN AMERICA: BLOCKCHAIN IDENTITY MANAGEMENT MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Development of blockchain-based identity solutions across Brazil to boost marketMEXICO- Government regulations and initiatives to address corruption issues to drive marketREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 REVENUE ANALYSIS OF LEADING PLAYERS

- 12.3 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- 12.4 HISTORICAL REVENUE ANALYSIS

- 12.5 RANKING OF KEY PLAYERS

-

12.6 EVALUATION MATRIX FOR KEY PLAYERSDEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 COMPETITIVE BENCHMARKINGCOMPANY EVALUATION CRITERIA FOR KEY PLAYERSCOMPANY EVALUATION CRITERIA FOR SMES/STARTUPS

-

12.8 COMPANY EVALUATION QUADRANT (SMES/STARTUPS)DEFINITIONS AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.9 COMPETITIVE SCENARIO AND TRENDSNEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTSDEALS

-

13.1 KEY PLAYERSAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBITFURY- Business overview- Products/Solutions/Services offered- MnM viewNEC- Business overview- Products/Solutions/Services offeredDOCK- Business overview- Products/Solutions/Services offeredHU-MAINTY.CO- Business overview- Products/Solutions/Services offeredMETADIUM- Business overview- Products/Solutions/Services offeredSERTO- Business overview- Products/Solutions/Services offered

-

13.2 OTHER PLAYERSCOINFIRMACCUMULATENEUROWARETRADLEPEER LEDGERPROCIVISSPRINGROLEBLOCKCHAINS INC.OAROFRACTALNUIDVALIDATED IDKYC-CHAINTRM LABSFACTOM

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 BLOCKCHAIN IDENTITY MANAGEMENT ECOSYSTEM AND ADJACENT MARKETSBLOCKCHAIN MARKET- Blockchain market, by organization size- Blockchain market, by component

-

14.4 DECENTRALIZED IDENTITY MARKETDECENTRALIZED IDENTITY MARKET, BY ORGANIZATION SIZEDECENTRALIZED IDENTITY MARKET, BY IDENTITY TYPE

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 4 MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON MARKET

- TABLE 6 PRICING MODELS OF DOCK.IO

- TABLE 7 PRICING MODELS OF ORACLE

- TABLE 8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 10 MARKET: KEY CONFERENCES AND EVENTS

- TABLE 11 MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 12 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 13 SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 14 SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 15 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 16 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 18 MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 19 APPLICATION PROVIDERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 APPLICATION PROVIDERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 MIDDLEWARE PROVIDERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 MIDDLEWARE PROVIDERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 INFRASTRUCTURE PROVIDERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 24 INFRASTRUCTURE PROVIDERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 26 BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 27 PERMISSIONED NETWORK: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 PERMISSIONED NETWORK: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 PERMISSIONLESS NETWORK: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 PERMISSIONLESS NETWORK: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 32 MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 33 SMALL- AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 SMALL- AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 38 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 39 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 IT AND ITES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 IT AND ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 TELECOM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 GOVERNMENT: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 GOVERNMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 REAL ESTATE AND CONSTRUCTION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 REAL ESTATE AND CONSTRUCTION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 HEALTHCARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 US: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 74 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 75 US: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 76 US: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 77 US: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 78 US: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 79 US: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 80 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 81 US: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 82 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 83 CANADA: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 84 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 85 CANADA: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 86 CANADA: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 87 CANADA: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 88 CANADA: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 89 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 90 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 91 CANADA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 92 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 UK: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 106 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 107 UK: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 108 UK: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 109 UK: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 110 UK: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 111 UK: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 112 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 113 UK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 114 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 115 GERMANY: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 116 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 117 GERMANY: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 118 GERMANY: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 119 GERMANY: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 120 GERMANY: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 121 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 122 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 123 GERMANY: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 124 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 125 FRANCE: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 126 FRANCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 127 FRANCE: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 128 FRANCE: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 129 FRANCE: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 130 FRANCE: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 131 FRANCE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 132 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 133 FRANCE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 134 FRANCE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 135 REST OF EUROPE: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 136 REST OF EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 137 REST OF EUROPE: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 138 REST OF EUROPE: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 139 REST OF EUROPE: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 140 REST OF EUROPE: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 141 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 142 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 143 REST OF EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 144 REST OF EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: BLOCKCHAIN IDENTITY MANAGEMENT SECURITY MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 156 ASIA PACIFIC: BLOCKCHAIN IDENTITY MANAGEMENT SECURITY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 157 CHINA: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 158 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 159 CHINA: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 160 CHINA: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 161 CHINA: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 162 CHINA: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 163 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 164 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 165 CHINA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 166 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 167 JAPAN: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 168 JAPAN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 169 JAPAN: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 170 JAPAN: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 171 JAPAN: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 172 JAPAN: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 173 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 174 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 175 JAPAN: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 176 JAPAN: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 177 INDIA: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 178 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 179 INDIA: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 180 INDIA: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 181 INDIA: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 182 INDIA: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 183 INDIA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 184 INDIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 185 INDIA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 186 INDIA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 187 SINGAPORE: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 188 SINGAPORE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 189 SINGAPORE: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 190 SINGAPORE: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 191 SINGAPORE: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 192 SINGAPORE: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 193 SINGAPORE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 194 SINGAPORE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 195 SINGAPORE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 196 SINGAPORE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: BLOCKCHAIN IDENTITY MANAGEMENT SECURITY MARKET, BY SUBREGION, 2017–2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: BLOCKCHAIN IDENTITY MANAGEMENT SECURITY MARKET, BY SUBREGION, 2023–2028 (USD MILLION)

- TABLE 219 MIDDLE EAST: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 220 MIDDLE EAST: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 221 MIDDLE EAST: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 222 MIDDLE EAST: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 224 MIDDLE EAST: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 225 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 226 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 227 MIDDLE EAST: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 228 MIDDLE EAST: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 229 AFRICA: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 230 AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 231 AFRICA: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 232 AFRICA: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 233 AFRICA: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 234 AFRICA: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 235 AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 236 AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 237 AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 238 AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 239 LATIN AMERICA: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 240 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 241 LATIN AMERICA: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 242 LATIN AMERICA: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 243 LATIN AMERICA: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 244 LATIN AMERICA: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 245 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 246 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 247 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 248 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: BLOCKCHAIN IDENTITY MANAGEMENT SECURITY MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 250 LATIN AMERICA: BLOCKCHAIN IDENTITY MANAGEMENT SECURITY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 251 BRAZIL: BLOCKCHAIN IDENTITY MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 252 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 253 BRAZIL: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 254 BRAZIL: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 255 BRAZIL: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 256 BRAZIL: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 257 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 258 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 259 BRAZIL: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 260 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 261 MEXICO: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 262 MEXICO: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 263 MEXICO: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 264 MEXICO: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 265 MEXICO: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 266 MEXICO: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 267 MEXICO: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 268 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 269 MEXICO: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 270 MEXICO: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 271 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 272 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 273 REST OF LATIN AMERICA: MARKET, BY PROVIDER TYPE, 2017–2022 (USD MILLION)

- TABLE 274 REST OF LATIN AMERICA: MARKET, BY PROVIDER TYPE, 2023–2028 (USD MILLION)

- TABLE 275 REST OF LATIN AMERICA: MARKET, BY NETWORK, 2017–2022 (USD MILLION)

- TABLE 276 REST OF LATIN AMERICA: MARKET, BY NETWORK, 2023–2028 (USD MILLION)

- TABLE 277 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 278 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 279 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 280 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 281 MARKET: DEGREE OF COMPETITION

- TABLE 282 COMPETITIVE BENCHMARKING OF KEY PLAYERS: REGIONAL FOOTPRINT

- TABLE 283 BLOCKCHAIN IDENTITY MANAGEMENT MARKET: DETAILED LIST OF STARTUPS

- TABLE 284 REGIONAL FOOTPRINT OF SMES/STARTUPS

- TABLE 285 MARKET: NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2020–2023

- TABLE 286 MARKET: DEALS, 2020–2023

- TABLE 287 AWS: BUSINESS OVERVIEW

- TABLE 288 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 AWS: DEALS

- TABLE 290 IBM: BUSINESS OVERVIEW

- TABLE 291 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 ORACLE: BUSINESS OVERVIEW

- TABLE 293 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 ORACLE: DEALS

- TABLE 295 MICROSOFT: BUSINESS OVERVIEW

- TABLE 296 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 MICROSOFT: PRODUCT LAUNCHES

- TABLE 298 BITFURY: BUSINESS OVERVIEW

- TABLE 299 BITFURY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 NEC: BUSINESS OVERVIEW

- TABLE 301 NEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 DOCK: BUSINESS OVERVIEW

- TABLE 303 DOCK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 HU-MAINTY.CO: BUSINESS OVERVIEW

- TABLE 305 HU-MAINTY.CO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 METADIUM: BUSINESS OVERVIEW

- TABLE 307 METADIUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 SERTO: BUSINESS OVERVIEW

- TABLE 309 SERTO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 ADJACENT MARKETS AND FORECASTS

- TABLE 311 BLOCKCHAIN MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 312 BLOCKCHAIN MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 313 SMALL- AND MEDIUM-SIZED ENTERPRISES: BLOCKCHAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 314 SMALL- AND MEDIUM-SIZED ENTERPRISES: BLOCKCHAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 315 LARGE ENTERPRISES: BLOCKCHAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 316 LARGE ENTERPRISES: BLOCKCHAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 317 BLOCKCHAIN MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 318 BLOCKCHAIN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 319 PLATFORMS: BLOCKCHAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 320 PLATFORMS: BLOCKCHAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 321 SERVICES: BLOCKCHAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 322 SERVICES: BLOCKCHAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 323 DECENTRALIZED IDENTITY MARKET, BY ORGANIZATION SIZE, 2019–2027 (USD MILLION)

- TABLE 324 LARGE ENTERPRISES MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 325 SMES MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 326 DECENTRALIZED IDENTITY MARKET, BY IDENTITY TYPE, 2019–2027 (USD MILLION)

- TABLE 327 NON-BIOMETRICS DECENTRALIZED IDENTITY MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 328 BIOMETRICS DECENTRALIZED IDENTITY MARKET, BY REGION, 2019–2027 (USD MILLION)

- FIGURE 1 BLOCKCHAIN IDENTITY MANAGEMENT MARKET: RESEARCH DESIGN

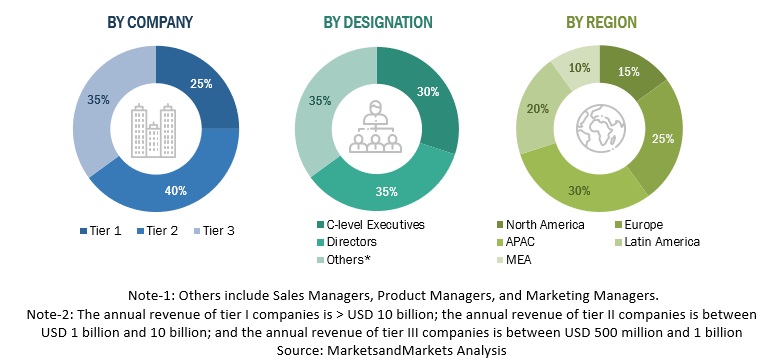

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET: DATA TRIANGULATION

- FIGURE 4 MARKET ESTIMATION: RESEARCH FLOW

- FIGURE 5 APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOFTWARE/SERVICES OF BLOCKCHAIN IDENTITY MANAGEMENT VENDORS

- FIGURE 6 APPROACH 1 (SUPPLY-SIDE) ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2—BOTTOM-UP (DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES

- FIGURE 8 STUDY LIMITATIONS

- FIGURE 9 GLOBAL MARKET SIZE AND Y-O-Y GROWTH RATE

- FIGURE 10 NORTH AMERICA TO DOMINATE MARKET IN 2023

- FIGURE 11 BLOCKCHAIN IDENTITY MANAGEMENT OFFERINGS TO ADDRESS GROWING IDENTITY THEFT ISSUES ACROSS BLOCKCHAIN PROVIDERS

- FIGURE 12 BFSI SEGMENT AND NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 13 SOFTWARE SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 APPLICATION PROVIDER SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 15 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 17 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 VALUE CHAIN ANALYSIS: MARKET

- FIGURE 19 ECOSYSTEM: MARKET

- FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: MARKET

- FIGURE 21 PATENT ANALYSIS: MARKET

- FIGURE 22 BLOCKCHAIN IDENTITY MANAGEMENT MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 24 SERVICES SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 25 MIDDLEWARE PROVIDERS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 PERMISSIONLESS NETWORK SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 27 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 29 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 32 MARKET: REVENUE ANALYSIS

- FIGURE 33 HISTORICAL FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY PUBLIC SECTOR BLOCKCHAIN IDENTITY MANAGEMENT PROVIDERS

- FIGURE 34 MARKET: RANKING OF KEY PLAYERS

- FIGURE 35 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 36 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 37 EVALUATION QUADRANT FOR SMES/STARTUPS: CRITERIA WEIGHTAGE

- FIGURE 38 EVALUATION MATRIX FOR SMES/STARTUPS, 2023

- FIGURE 39 AWS: COMPANY SNAPSHOT

- FIGURE 40 IBM: COMPANY SNAPSHOT

- FIGURE 41 ORACLE: COMPANY SNAPSHOT

- FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 43 NEC: COMPANY SNAPSHOT

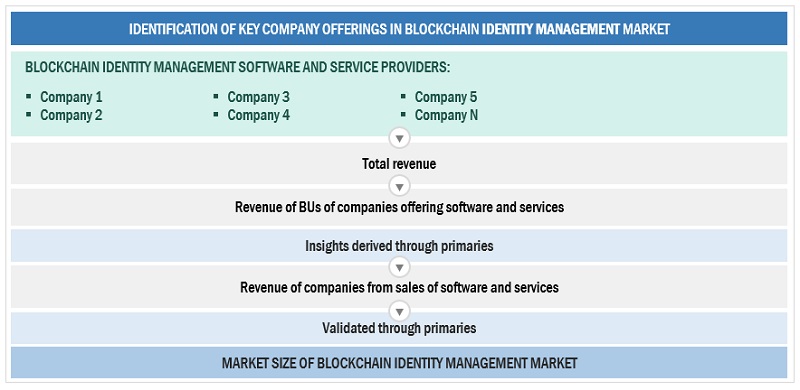

The study involved major activities in estimating the current market size for the blockchain identity management market. Exhaustive secondary research was done to collect information on the blockchain identity management industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Blockchain identity management market.

Secondary Research

The market for the companies offering blockchain identity management software and services is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of blockchain identity solution vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Blockchain identity management market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of Blockchain identity management solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global blockchain identity management market and estimate the size of various other dependent sub-segments in the overall blockchain identity management market. The research methodology used to estimate the market size includes the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Infographic Depicting Bottom-Up and Top-Down Approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Identity management involves the identification and authorization of individuals or entities to access organizational resources by providing them the necessary rights that they are entitled to. Although identity management has a lot of concerns related to the security of information, blockchain technology provides a solution through its distributed ledger technology. In this method, all transactions and information pertaining to individuals, groups, or organization entities are stored in blocks, and overriding these blocks is not possible. Blockchain technology delivers a secure solution that eliminates the need for central authorities and third parties. This makes it easier for individuals to manage and control their personal information and its access.

Key Stakeholders

- Information Technology (IT) Professionals

- Government Agencies

- Investors and Venture Capitalists

- Small and Medium-Sized Enterprises (SMEs) and Large Enterprises

- Managed and Professional Service Providers

- Blockchain Platform Vendors

- Infrastructure Providers

- Consultants/Consultancies/Advisory Firms

- System Integrators

- Third-Party Providers

- Value-added Resellers (VARs)

- Business Analysts

- Financial Services Firms

Report Objectives

- To define, describe, and forecast the blockchain identity management market based on offering, deployment mode, organization size, verticals, and regions

- To define, describe, and forecast the market by offering, deployment mode, organization size, vertical, and region

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the blockchain identity management market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile the key players of the market and comprehensively analyze their market size and core competencies in the market

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global blockchain identity management market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Blockchain Identity Management Market