Cognitive Media Market by Technology (Deep Learning & Machine Learning, NLP), Application (Content Management, Network Optimization, Predictive Analysis), Component (Solutions, Services), Deployment, Enterprise Size, and Region - Global Forecast to 2023

[165 Pages Report] MarketsandMarkets expects the global cognitive media market size to reach USD 1,839.1 million by 2023 from USD 396.7 million in 2017, growing at a Compound Annual Growth Rate (CAGR) of 27.2% during the forecast period. The base year for the study is 2017 and the forecast period is 20182023.

The increasing adoption of the cognitive computing technology for various applications in the media industry and demand for automated workflows in content creation and distribution are major growth drivers for the global cognitive media market.

The objective of the report is to define, describe, and forecast the size of the cognitive media market by technology, application, component, enterprise size, deployment mode, and region. The report also aims at providing detailed information about the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market.

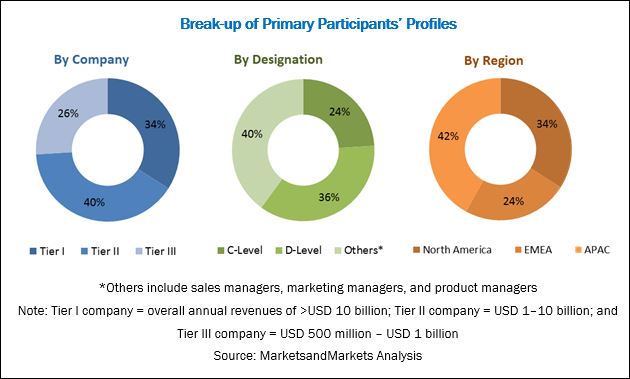

The research methodology used to estimate and forecast the global cognitive media market size began with capturing data from key vendors revenue through secondary research, annual reports, government, publishing sources, the Institute of Electrical and Electronics Engineers (IEEE), Factiva, Bloomberg, and press releases. The vendor offerings were also considered to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall global market size from the revenues of key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The figure below depicts the break-up of the primary participants profiles:

To know about the assumptions considered for the Cognitive Media Market study, download the pdf brochure

Major vendors in the global cognitive media market include Microsoft (US), Google (US), AWS (US), Adobe (US), IBM (US), nVIDIA (US), Salesforce (US), Baidu (China), Crimson Hexagon (US), Veritone (US), Bytedance (China), Acrolinx (Germany), Zeta Global (US), Kitewheel (US), Clarifai (US), Axle.ai (US), Albert (US), Kenshoo (Israel), Spotad (Israel), Valossa (Finland), Emarsys (Austria), Soundhound Inc. (US), Video Intelligence (Switzerland), MiQ (UK), Phrasee (UK), NewsRx (US), and TrendKite (US).

Target Audience for Cognitive Media Market:

- Media software tools, platforms, and service providers

- Device manufacturers

- System integrators

- Small and Medium-sized Enterprises (SMEs) in the media industry

- Advertising agencies

- Marketing agencies

- Media publishers

- Bloggers

The study answers several questions for stakeholders; primarily, which market segments to focus on in the next 2 to 5 years for prioritizing their efforts and investments.

Scope of the Cognitive Media Market Report

The report segments the global cognitive media market by technology, application, component, enterprise size, deployment mode, and region:

By Technology

- Deep Learning and Machine Learning

- Natural Language Processing

By Application

- Content Management

- Network Optimization

- Recommendation and Personalization

- Customer Retention

- Predictive Analysis

- Security Management

- Others (Campaign Analysis, Digital Publishing, and Online Gaming)

By Component

- Solutions

- Software Tools

- Platforms

- Services

- Support and Maintenance

- Deployment and Integration

- Training and Consulting

By Enterprise Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Deployment Mode

- Cloud

- On-premises

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Drivers

Automation of workflow in the media sector with the help of cognitive computing

In the media sector, it has been difficult to classify unstructured audio and video data, thus compelling media buyers to integrate the AI technology with the content supply chain. In addition, the manual process of tagging content is very time-consuming and expensive, and therefore, to improve the efficiency of the content, media professionals are adopting AI-based solutions.

Increasing demand for improved content creation drives the adoption of cognitive computing

The increasing demand for developing engaging content to reduce customer churn is driving the adoption of the AI technology in the media sector. Machine learning can automate content creation workflows, which will help content writers create more customer-engaging content. Machine learning enables content writers to be more efficient in writing content and helps them drive new revenue streams. Content creation uses 2 technologies, namely, NLP and Natural Language Generation (NLG) to produce fact-driven content that helps in content marketing.

Restraints

Slow digitalization rate affects the adoption of the cognitive computing technology in emerging economies

Due to the lack of funds for the basic requirements of IT infrastructures in the developing countries, deploying cognitive computing tools is completely dependent on the available IT infrastructures, data, and the Internet of Things (IoT) devices, which help capture instances to generate accurate results. Technological developments, cloud infrastructures, big data, and organized data filing play a vital role in the successful utilization of the cognitive computing technology in the media sector.

Opportunities

Increasing investments in the media sector

There is a need to invest in the media sector as the sector faces problems, such as shortage of skilled AI professionals and automation of workflows to improve the content creation and distribution processes. Additionally, the media industry is facing a lack of skilled AI experts and manual workflows, which distracts the marketing teams from focusing on their content strategy. Media companies are investing in the AI technology to understand their audience preferences and deliver content according to their taste. Private enterprises are also contributing to the media sector by opening new startups and innovating new applications to enrich the content metadata.

Cognitive computing can generate new revenue streams for media companies

The AI technology is transforming the traditional process of content creation and distribution by automating workflows and minimizing the time consumed for these processes. It is also helping improve the efficiency and cost-effectiveness of the content distribution process. The cognitive computing technology eliminates human intervention and automates processes, and this helps media companies in improving their revenues and profitability.

Challenges

Lack of skilled AI experts

The evolution of technology is leading to a lack of skilled professionals for AI predictive modeling, programmatic marketing, Augmented Reality/Virtual Reality (AR/VR), data privacy, and adblocking. There are a limited number of skilled AI professionals, and this lack is hindering the adoption of cognitive computing in the media sector. The adoption of the cognitive computing technology is in its nascent phase in the media industry, and thus there is a huge demand for AI scientists in a variety of domains, such as machine learning, image recognition, and NLP.

Lack of regulations and standards to manage the increasing unstructured data

The growth in the use of content in the media industry has increased the amount of unstructured data, and organizations are unable to directly analyze the growing content, such as images, videos, and audios. The increasing amount of unstructured data may create data privacy issues. Several solutions may provide useful information from metadata and comments associated with the content in the media industry.

New Product/Service Launches and Product/Service Enhancements, 20152018

|

Date |

Company Name |

Development |

|

May 2018 |

Google (US) |

Google enhanced its AI-powered Google News app, designed using the machine learning technology. It helps find relevant news based on readers reading habits. |

|

May 2018 |

Google (US) |

Google enhanced its AI-powered voice assistant, called Google Assistant, which is available across all Google products, such as Google Maps, Google News, and Gmail. The conversational assistant helps understand multiple questions and provides relevant answers in response. |

Agreements and Partnerships, 20162018

|

Date |

Type of Strategy |

Company Name |

Development |

|

March 2018 |

Collaboration |

Baidu (China) and Skyworth (China) |

Baidu announced a strategic partnership with Skyworth, a leading Chinese electrical household appliance maker. This partnership would enable the companys AI capabilities. |

|

December 2017 |

Partnership |

Baidu (China) and Xiaomi (China) |

Baidu partnered with Xiaomi, Chinas biggest smartphone maker, to invest in AI-driven technologies. This partnership would enable the company to expand its ecosystem in AI. |

Acquisitions, 20152018

|

Date |

Company Name |

Development |

|

July 2017 |

Google (US) |

Google acquired Halli Labs, an India-based AI startup, focused on machine learning and deep learning systems. Halli Labs would join the Next Billion Users team of Google to make technology and information available to the maximum number of people around the world. |

|

July 2017 |

Baidu (China) |

Baidu acquired Kitt.ai, an NLP company, to make its AI operating DuerOS fully compatible with the IoT. |

Business Expansions, 20162018

|

Date |

Company Name |

Development |

|

November 2017 |

AWS (US) |

AWS opened a cloud-based innovation center for California Polytechnic State University (Cal Poly). The innovation center accelerates digital transformation in the government and non-profit sectors using the cloud technology. |

|

December 2016 |

AWS (US) |

AWS announced its expansion in the European region. This expansion would help AWS run its mission-critical workloads and store sensitive data on AWS infrastructures, locally. |

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American cognitive media market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets expects the global cognitive media market size to grow from USD 551.4 million in 2018 to USD 1,839.1 million by 2023, at a Compound Annual Growth Rate (CAGR) of 27.2% during the forecast period. Major growth drivers for the market include automation of workflow in the media sector, an increasing demand for improved content creation, utilization of cognitive computing to combat the increasing pressure for detecting illegal content, and an increasing number of AI startups in the media industry.

The cognitive media market by technology has been segments of deep learning and machine learning, and natural language processing. The media enterprises utilize machine learning and deep learning technology for content management and providing immersive customer experience.

Major cognitive media applications are content management, network optimization, recommendation and personalization, customer retention, predictive analysis, security management, and others (campaign analysis, online gaming, and digital publishing). The content management application is expected to hold the largest market size in the global cognitive media market by application during the forecast period. Many media firms are adopting AI technology for the content management application for enhanced customization and personalization leading to customer engagement.

The cognitive media market by deployment type has 2 segments: the cloud and on-premises. The cloud deployment mode is projected to hold the larger market size by growing at a faster rate during the forecast period. Due to high infrastructure costs, most of the media companies prefer cloud-based solutions for enhanced security.

In the cognitive media by enterprise size, the Small and Medium-sized Enterprises (SMEs) segment is expected to grow at a higher CAGR during the forecast period. An increasing demand among media SMEs for the AI-based technology powered solutions could accelerate the market growth.

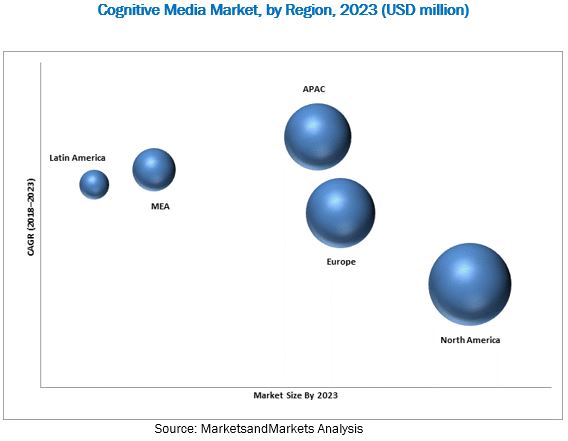

North America is expected to hold the largest market size in the global market, while APAC to grow at the highest CAGR during the forecast period. As North America has witnessed increased investments in the market, the cognitive media market in the region will record a considerable growth during the forecast period. The North American media enterprises effectively use AI technologies for various applications, such as content management, personalization and recommendation, network optimization, customer retention, predictive analysis, security management, and others (campaign analysis, online gaming, and digital publishing).

The global cognitive media market faces many challenges including the lack of regulations and standards to manage the increasing unstructured data and lack of AI skilled experts to assist in integration of cognitive solutions.

Major vendors in the global cognitive media market include Microsoft (US), Google (US), AWS (US), Adobe (US), IBM (US), nVIDIA (US), Salesforce (US), Baidu(China), Crimson Hexagon (US), Veritone (US), Bytedance (China), Acrolinx (Germany), Zeta Global (US), Kitewheel (US), Clarifai (US), Axle.ai (US), Albert (US), Kenshoo (Israel), Spotad (Israel), Valossa (Finland), Emarsys (Austria), Soundhound Inc. (US), Video Intelligence (Switzerland), MiQ (UK), Phrasee (UK), NewsRx (US), and TrendKite (US). These vendors have adopted different types of organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the global cognitive media market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Cognitive Media Market

4.2 Market Top 3 Applications

4.3 Market Top 3 Services and Regions

4.4 Market Potential, By Region

4.5 Market By Deployment Mode

4.6 Market By Region

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Automation of Workflow in the Media Sector With the Help of Cognitive Computing

5.2.1.2 Increasing Demand for Improved Content Creation Drives the Adoption of Cognitive Computing

5.2.1.3 Utilization of Cognitive Computing to Combat the Increasing Pressure for Detecting Illegal Content

5.2.1.4 Increasing Number of AI Startups in the Media Industry is Paving the Way for Intense Competition

5.2.2 Restraints

5.2.2.1 Slow Digitalization Rate Affects the Adoption of the Cognitive Computing Technology in Emerging Economies

5.2.3 Opportunities

5.2.3.1 Increasing Investments in the Media Sector

5.2.3.2 Cognitive Computing Can Generate New Revenue Streams for Media Companies

5.2.4 Challenges

5.2.4.1 Lack of Skilled AI Experts

5.2.4.2 Lack of Regulations and Standards to Manage the Increasing Unstructured Data

5.3 Use Cases

5.3.1 Introduction

5.3.1.1 Use Case: Scenario 1

5.3.1.2 Use Case: Scenario 2

5.3.1.3 Use Case: Scenario 3

5.3.1.4 Use Case: Scenario 4

5.3.1.5 Use Case: Scenario 5

5.3.1.6 Use Case: Scenario 6

5.4 Regulatory Implications

5.4.1 Introduction

5.4.2 Sarbanes-Oxley Act 2002

5.4.3 General Data Protection Regulation

5.4.4 Basel

6 Cognitive Media Market, By Technology (Page No. - 44)

6.1 Introduction

6.2 Deep Learning and Machine Learning

6.3 Natural Language Processing

7 Market By Application (Page No. - 48)

7.1 Introduction

7.2 Content Management

7.3 Network Optimization

7.4 Recommendation and Personalization

7.5 Customer Retention

7.6 Predictive Analysis

7.7 Security Management

7.8 Others

8 Cognitive Media Market, By Component (Page No. - 56)

8.1 Introduction

8.2 Solutions

8.2.1 Software Tools

8.2.2 Platforms

8.3 Services

8.3.1 Support and Maintenance

8.3.2 Deployment and Integration

8.3.3 Training and Consulting

9 Cognitive Media Market, By Deployment Mode (Page No. - 64)

9.1 Introduction

9.2 Cloud

9.3 On-Premises

10 Market By Enterprise Size (Page No. - 68)

10.1 Introduction

10.2 Small and Medium-Sized Enterprises

10.3 Large Enterprises

11 Cognitive Media Market, By Region (Page No. - 72)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.2 Canada

11.3 Europe

11.3.1 United Kingdom

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 United Arab Emirates

11.5.2 South Africa

11.5.3 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Brazil

11.6.2 Mexico

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 102)

12.1 Overview

12.2 Top Players Operating in the Cognitive Media Market

12.3 Competitive Scenario

12.3.1 New Product/Service Launches and Product/Service Enhancements

12.3.2 Agreements and Partnerships

12.3.3 Acquisitions

12.3.4 Business Expansions

13 Company Profiles (Page No. - 108)

(Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, and MnM View)

13.1 Introduction

13.2 IBM

13.3 Google

13.4 AWS

13.5 Microsoft

13.6 Salesforce

13.7 Adobe

13.8 Baidu

13.9 Nvidia

13.10 Veritone

13.11 Albert

13.12 Crimson Hexagon

13.13 Newsrx

13.14 Bytedance

13.15 Valossa

13.16 Soundhound Inc.

13.17 Kenshoo

13.18 Zeta Global

13.19 Kitewheel

13.20 Clarifai

13.21 Spotad

13.22 Video Intelligence AG

13.23 Trendkite

13.24 Emarsys

13.25 Axle.AI

13.26 Miq

13.27 Acrolinx

13.28 Phrasee

*Details on (Business Overview, Products and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 157)

14.1 Industry Excerpts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (79 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 Global Cognitive Media Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y%)

Table 3 Total Amount Invested in Artificial Intelligence Startups During 20102015 Worldwide

Table 4 Cognitive Media Market Size, By Technology, 20162023 (USD Million)

Table 5 Deep Learning and Machine Learning: Market Size By Region, 20162023 (USD Million)

Table 6 Natural Language Processing: Market Size By Region, 20162023 (USD Million)

Table 7 Cognitive Media Market Size, By Application, 20162023 (USD Million)

Table 8 Content Management: Market Size By Region, 20162023 (USD Million)

Table 9 Network Optimization: Market Size By Region, 20162023 (USD Million)

Table 10 Recommendation and Personalization: Market Size By Region, 20162023 (USD Million)

Table 11 Customer Retention: Market Size By Region, 20162023 (USD Million)

Table 12 Predictive Analysis: Market Size By Region, 20162023 (USD Million)

Table 13 Security Management: Market Size By Region, 20162023 (USD Million)

Table 14 Others: Market Size By Region, 20162023 (USD Million)

Table 15 Cognitive Media Market Size, By Component, 20162023 (USD Million)

Table 16 Solutions: Market Size By Type, 20162023 (USD Million)

Table 17 Software Tools Market Size, By Region, 20162023 (USD Million)

Table 18 Platforms Market Size, By Region, 20162023 (USD Million)

Table 19 Services: Market Size By Type, 20162023 (USD Million)

Table 20 Support and Maintenance Market Size, By Region, 20162023 (USD Million)

Table 21 Deployment and Integration Market Size, By Region, 20162023 (USD Million)

Table 22 Training and Consulting Market Size, By Region, 20162023 (USD Million)

Table 23 Cognitive Media Market Size, By Deployment Mode, 20162023 (USD Million)

Table 24 Cloud: Market Size By Region, 20162023 (USD Million)

Table 25 On-Premises: Market Size By Region, 20162023 (USD Million)

Table 26 Cognitive Media Market Size, By Enterprise Size, 20162023 (USD Million)

Table 27 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 28 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 29 Global Cognitive Media Market Size, By Region, 20162023 (USD Million)

Table 30 Major Media Agencies in North America, Till January 2018

Table 31 North America: Market Size By Country, 20162023 (USD Million)

Table 32 North America: Market Size By Technology, 20162023 (USD Million)

Table 33 North America: Market Size By Application, 20162023 (USD Million)

Table 34 North America: Market Size By Component, 20162023 (USD Million)

Table 35 North America: Market Size By Solution, 20162023 (USD Million)

Table 36 North America: Market Size By Service, 20162023 (USD Million)

Table 37 North America: Market Size By Deployment Mode, 20162023 (USD Million)

Table 38 North America: Market Size By Enterprise Size, 20162023 (USD Million)

Table 39 Major Media Agencies in Europe, Till January 2018

Table 40 Europe: Cognitive Media Market Size, By Country, 20162023 (USD Million)

Table 41 Europe: Market Size By Technology, 20162023 (USD Million)

Table 42 Europe: Market Size By Application, 20162023 (USD Million)

Table 43 Europe: Market Size By Component, 20162023 (USD Million)

Table 44 Europe: Market Size By Solution, 20162023 (USD Million)

Table 45 Europe: Market Size By Service, 20162023 (USD Million)

Table 46 Europe: Market Size By Deployment Mode, 20162023 (USD Million)

Table 47 Europe: Market Size By Enterprise Size, 20162023 (USD Million)

Table 48 Major Media Agencies in Asia Pacific, Till January 2018

Table 49 Asia Pacific: Cognitive Media Market Size, By Country, 20162023 (USD Million)

Table 50 Asia Pacific: Market Size By Technology, 20162023 (USD Million)

Table 51 Asia Pacific: Market Size By Application, 20162023 (USD Million)

Table 52 Asia Pacific: Market Size By Component, 20162023 (USD Million)

Table 53 Asia Pacific: Market Size By Solution, 20162023 (USD Million)

Table 54 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 55 Asia Pacific: Market Size By Deployment Mode, 20162023 (USD Million)

Table 56 Asia Pacific: Market Size By Enterprise Size, 20162023 (USD Million)

Table 57 Major Media Agencies in Middle East and Africa, Till January 2018

Table 58 Middle East and Africa: Cognitive Media Market Size, By Country, 20162023 (USD Million)

Table 59 Middle East and Africa: Market Size By Technology, 20162023 (USD Million)

Table 60 Middle East and Africa: Market Size By Application, 20162023 (USD Million)

Table 61 Middle East and Africa: Market Size By Component, 20162023 (USD Million)

Table 62 Middle East and Africa: Market Size By Solution, 20162023 (USD Million)

Table 63 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 64 Middle East and Africa: Market Size By Deployment Mode, 20162023 (USD Million)

Table 65 Middle East and Africa: Market Size By Enterprise Size, 20162023 (USD Million)

Table 66 Major Media Agencies in Latin America, Till January 2018

Table 67 Latin America: Cognitive Media Market Size, By Country, 20162023 (USD Million)

Table 68 Latin America: Market Size By Technology, 20162023 (USD Million)

Table 69 Latin America: Market Size By Application, 20162023 (USD Million)

Table 70 Latin America: Market Size By Component, 20162023 (USD Million)

Table 71 Latin America: Market Size By Solution, 20162023 (USD Million)

Table 72 Latin America: Market Size By Service, 20162023 (USD Million)

Table 73 Latin America: Market Size By Deployment Mode, 20162023 (USD Million)

Table 74 Latin America: Market Size By Enterprise Size, 20162023 (USD Million)

Table 75 Market Ranking for Cognitive Media Market, 2018

Table 76 New Product/Service Launches and Product/Service Enhancements, 20152018

Table 77 Agreements and Partnerships, 20162018

Table 78 Acquisitions, 20152018

Table 79 Business Expansions, 20162018

List of Figures (59 Figures)

Figure 1 Global Cognitive Media Market Segmentation

Figure 2 Global Market Regional Scope

Figure 3 Cognitive Media Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 North America is Estimated to Have the Highest Market Share in 2018

Figure 9 Cognitive Media Market Snapshot, By Technology, 2017

Figure 10 Market Snapshot By Application, 2017

Figure 11 Market Snapshot By Component, 2017

Figure 12 Market Snapshot By Solution, 2017

Figure 13 Market Snapshot By Service, 2017

Figure 14 Market Snapshot By Deployment Mode, 2017

Figure 15 Market Snapshot By Enterprise Size, 2017

Figure 16 The Global Cognitive Media Market is Expected to Witness Significant Growth During the Forecast Period

Figure 17 Predictive Analysis Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Support and Maintenance, and North America are Estimated to Hold the Highest Market Shares in the Cognitive Media Market in 2018

Figure 19 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Cloud Deployment Mode is Expected to Hold the Larger Market Size During the Forecast Period

Figure 21 North America is Estimated to Have the Highest Market Share in 2018

Figure 22 Market Investment Scenario: Asia Pacific is Expected to Be the Best Region for Investment During the Forecast Period

Figure 23 Cognitive Media Market: Drivers, Restraints, Opportunities, and Challenges

Figure 24 Cognitive Computing Capabilities By Number of Transactions (2012-2015)

Figure 25 Natural Language Processing Technology is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 26 Predictive Analysis Application is Expected to Witness the Highest CAGR During the Forecast Period

Figure 27 Services Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 28 Platforms Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 29 Support and Maintenance Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Cloud Deployment Mode is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 31 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 32 North America is Estimated to Account for the Largest Market Size in 2018

Figure 33 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 34 Worldwide Media Spending, By Region, 2018

Figure 35 North America: Market Snapshot

Figure 36 North America: Cognitive Media Market, By Application

Figure 37 Europe: Market By Application

Figure 38 Asia Pacific: Market Snapshot

Figure 39 Asia Pacific: Market By Application

Figure 40 Middle East and Africa: Market By Application

Figure 41 Latin America: Cognitive Media Market, By Application

Figure 42 Key Developments By Leading Players in the Cognitive Media Market During 20152018

Figure 43 IBM: Company Snapshot

Figure 44 IBM: SWOT Analysis

Figure 45 Google: Company Snapshot

Figure 46 Google: SWOT Analysis

Figure 47 AWS: Company Snapshot

Figure 48 AWS: SWOT Analysis

Figure 49 Microsoft: Company Snapshot

Figure 50 Microsoft: SWOT Analysis

Figure 51 Salesforce: Company Snapshot

Figure 52 Salesforce: SWOT Analysis

Figure 53 Adobe: Company Snapshot

Figure 54 Adobe: SWOT Analysis

Figure 55 Baidu: Company Snapshot

Figure 56 Baidu: SWOT Analysis

Figure 57 Nvidia: Company Snapshot

Figure 58 Veritone: Company Snapshot

Figure 59 Albert: Company Snapshot

Growth opportunities and latent adjacency in Cognitive Media Market