Insurance Fraud Detection Market by Component (Solutions (Fraud Analytics, Authentication, and GRC), Service) Application Area (Claims Fraud, Identity Theft, Payment and Billing Fraud, and Money Laundering), Deployment Mode, Organization Size, and Region - Global Forecast to 2024

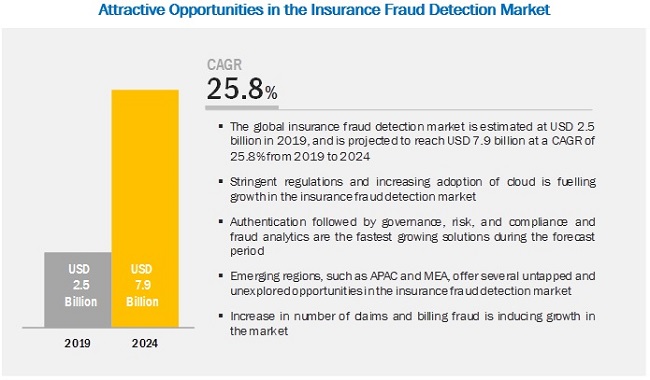

The Insurance Fraud Detection Market is projected to reach USD 7.9 billion by 2024, with a CAGR of 25.8%. The market was valued at USD 2.5 billion in 2019. Key growth drivers include effective management of identities, enhanced operational efficiency, improved customer experience, advanced analytics adoption, and regulatory compliance.

The fraud analytics segment to constitute the largest market size during the forecast period

Fraud analytics is a discipline which involves a set of analytical techniques that analyze enterprises’ systems and database to identify the vulnerabilities where fraud can happen. These solutions monitor and analyze data from several data sources; detect anomalies and suspicious & unusual behavior across all channels; and provide a control mechanism to prevent fraudulent practices, in real-time. Fraud analytics is the core of all insurance fraud detection solutions. Many vendors offer traditional rule-based fraud analytics models, whereas some prefer Artificial Intelligence and Machine Learning based techniques. Fraud analytics solutions proactively detect frauds and also help meet compliance needs.

The Small and Medium-sized Enterprises (SMEs) segment is expected to grow at a higher CAGR during the forecast period

The SMEs segment is expected to grow at a higher CAGR during the forecast period, owing to the increasing incidences of insurance frauds and cyber attacks on SMEs. The SMEs are small in terms of their size but cater to a large number of customers globally. Robust and comprehensive security solutions are not implemented in SMEs due to financial constraints. However, the large enterprise segment is estimated to hold a higher market share in 2019.

Insurance fraud detection solutions and services have been deployed over on-premises and cloud environment. Cloud deployment is expected to grow at the highest CAGR during the forecast period, while the on-premises deployment mode is estimated to hold the largest Insurance Fraud Detection Market size in 2019.

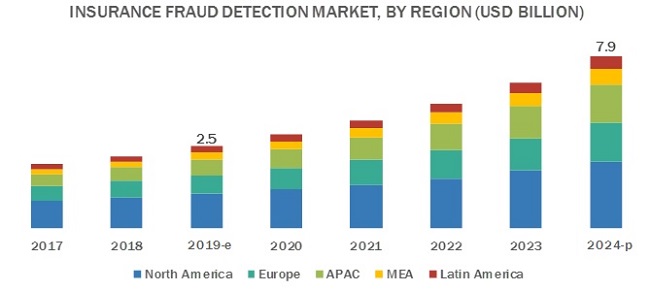

North America to account for the largest market size during the forecast period

The global insurance fraud detection market has been segmented based on regions into North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America to provide a region-specific analysis in the report. North America, followed by Europe, is estimated to become the largest revenue-generating region for insurance fraud detection solution and service vendors in 2019. Trends such as the Internet of Things (IoT), cloud adoption, and Bring Your Own Device (BYOD); and growing internal & external threats are some of the key factors expected to fuel the growth of the market in North America.

The APAC market is gaining traction, as the number of smart devices and BYOD trend are increasing in the developed and developing nations in APAC. The SMEs, as well as large enterprises in APAC, are becoming increasingly aware of the rising instances claims fraud, identity thefts, payment frauds, and have now started adopting insurance fraud detection solutions and services to combat them.

Key Market Players

Major vendors that offer insurance fraud detection services across the globe are FICO (US), IBM (US), BAE Systems (UK), SAS Institute (US), Experian (Ireland), LexisNexis (US), iovation (US), FRISS (Netherlands), SAP (Germany), Fiserv (US), ACI Worldwide (US), Simility (US), Kount (US), Software AG (Germany), BRIDGEi2i Analytics Solutions (India), and Perceptiviti (India). These vendors have adopted different types of organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and acquisitions, to expand their offerings in the market.

FRISS (Netherlands) is acknowledged as one of the leading vendors in the insurance fraud detection market. To maintain its leading position, the company focuses on understanding the fast-changing needs of its clients and has adopted effective growth strategies to enhance its offerings and increase its market reach. For expanding its footprint, FRISS partnered with EVRY, to provide Fraud Detection as a Service in the Nordics region. The company has implemented various strategies to deliver cutting-edge insurance fraud detection to global organizations. Various organic and inorganic growth strategies are helping insurance fraud detection vendors to stay ahead in the global insurance fraud detection industry.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Component, deployment type, organization size, and region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies Covered |

FICO (US), IBM (US), BAE Systems (UK), SAS Institute (US), Experian (Ireland), LexisNexis (US), iovation (US), FRISS (Netherlands), SAP (Germany), Fiserv (US), ACI Worldwide (US), Simility (US), Kount (US), Software AG (Germany), BRIDGEi2i Analytics Solutions (India), and Perceptiviti (India) |

The research report categorizes the insurance fraud detection market based on component (solution (fraud analytics, authentication, and GRC solutions), service), deployment type, organization size, vertical, and region.

By Component, the insurance fraud detection market has the following segments:

-

Solution

-

Fraud Analytics

- Predictive Analytics

- Descriptive Analytics

- Social Media Analytics

- Big Data Analytics

-

Authentication

- Single-Factor Authentication

- Multi-Factor Authentication

- Risk-Based Authentication

- Governance, Risk, and Compliance

- Others

Services

-

Professional Services

- Consulting

- Training and Education

- Support and Maintenance

- Managed Services

-

Fraud Analytics

On the basis of Deployment Type, the insurance fraud detection market has the following segments:

- On-premises

- Cloud

On the basis of Organization Size, the Insurance Fraud Detection Market has the following segments:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

On the basis of Region, the market has the following segments:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

-

Middle East and Africa (MEA)

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in the Insurance Fraud Detection Market

4.2 Market By Component, 2019–2024

4.3 Market By Solution, 2019–2024

4.4 Market Market Share of Top 3 Solutions and Regions, 2019

4.5 Market By Organization Size, 2019

4.6 Market By Deployment Mode, 2019

4.7 Market Investment Scenario

5 Insurance Fraud Detection Market Overview and Industry Trends (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need to Effectively Manage Huge Volumes of Identities By Organizations

5.2.1.2 Increasing Adoption of Advanced Analytics Techniques

5.2.1.3 Improved Operational Efficiency and Enhanced Customer Experience

5.2.1.4 Stringent Regulatory Compliances

5.2.2 Restraints

5.2.2.1 Insurance Institutions Lack Awareness Regarding the Fraud Detection Solutions

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of IoT and Byod Trends

5.2.3.2 Proliferation of Cloud-Based Insurance Fraud Detection Solutions and Services Among Global Organizations

5.2.4 Challenges

5.2.4.1 Improper Implementation and Lack of Integration of Fraud Detection Solutions Across Organization Networks

5.3 Regulatory Compliances

5.3.1 Know Your Customer (KYC)

5.3.2 Anti-Money Laundering (AML)

5.3.3 General Data Protection Regulation (GDPR)

5.3.4 Electronic Identification, Authentication, and Trust Services (EIDAS)

5.4 Innovation Spotlight

5.5 Use Cases

5.5.1 Insurance Fraud Detection By BAE Systems

5.5.2 Claims Fraud Detection in Insurance, By Aureus Analytics

5.5.3 Optimizing Investigation Process for Identifying Additional Premium Opportunities, By Prads Inc.

6 Insurance Fraud Detection Market By Component (Page No. - 47)

6.1 Introduction

6.2 Solutions

6.2.1 Increasing Fraudulent Activities to Drive the Adoption of Insurance Fraud Detection Solutions

6.3 Services

6.3.1 Growing Need for Seamless Experience and Personalized Services to Fuel the Demand for Services

7 Insurance Fraud Detection Market By Solution (Page No. - 51)

7.1 Introduction

7.2 Fraud Analytics

7.2.1 Predictive Analytics

7.2.1.1 Need to Identify Potential Threats and Claim Frauds in Insurance Processes to Drive the Adoption of Predictive Analytics Solutions

7.2.2 Descriptive Analytics

7.2.2.1 Need for Interpretation of Historical Data to Yield Useful Information to Boost the Adoption of Descriptive Analytics Solutions in the Insurance Sector

7.2.3 Social Media Analytics

7.2.3.1 Need to Identify Suspicious Patterns Through Specialized Algorithms for Effective Fraud Detection Driving the Adoption of Social Media Analytics Solutions in the Insurance Sector

7.2.4 Big Data Analytics

7.2.4.1 Need for Advanced Analytical Solution That Proactively Defends Against Fraudulent Activities to Drive the Adoption of Big Data Analytics Solutions in the Insurance Sector

7.3 Authentication

7.3.1 Single-Factor Authentication

7.3.1.1 Need for Simple and Less Complex Form of Authentication Solutions to Boost the Adoption of Sfa Solutions

7.3.2 Multi-Factor Authentication

7.3.2.1 Need to Secure Data and Information Against Frauds Driving the Adoption of Mfa Solutions

7.3.3 Risk-Based Authentication

7.3.3.1 Need to Analyze Risk Levels and Apply Stringent Authentication Processes Driving the Adoption of Rba Solutions

7.4 Governance, Risk, and Compliance

7.4.1 Need to Adhere to Various Compliances and Mitigate Risk Driving the Adoption of Grc Solutions

7.5 Others

8 Insurance Fraud Detection Market By Service (Page No. - 64)

8.1 Introduction

8.2 Professional Services

8.2.1 Consulting Services

8.2.1.1 Growing Need for Highly-Qualified Experts, Domain Experts, and Security Professionals to Fuel the Demand for Consulting Services

8.2.2 Training and Education

8.2.2.1 Increasing Need for Skilled Security Professionals to Fuel the Demand for Training and Education Services

8.2.3 Support and Maintenance

8.2.3.1 Growing Need for Installation, Maintenance, and Other Support Activities to Boost the Demand for Support and Maintenance Services

8.3 Managed Services

8.3.1 Growing Need for Technical Expertise to Maintain and Update Insurance Fraud Detection Solutions to Boost the Demand for Managed Services

9 Insurance Fraud Detection Market By Application Area (Page No. - 70)

9.1 Introduction

9.2 Claims Fraud

9.2.1 Rise in Fraudulent Claims in Healthcare, Life, and Motor Insurance Areas to Boost the Adoption of Insurance Fraud Detection Solutions

9.3 Identity Theft

9.3.1 Growing Identity-Related Frauds to Fuel the Adoption of Insurance Fraud Detection Solutions

9.4 Payment Fraud and Billing Fraud

9.4.1 Increasing Fraudulent Activities Related to Digital Transactions and Payments to Boost the Adoption of Insurance Fraud Detection Solutions

9.5 Money Laundering

9.5.1 Need to Detect and Prevent Growing Money Laundering Activities to Boost the Adoption of Insurance Fraud Detection Solutions

10 Insurance Fraud Detection Market By Deployment Mode (Page No. - 73)

10.1 Introduction

10.2 Cloud

10.2.1 Low Cost of Installation, Upgrade, and Maintenance to Boost the Adoption of Cloud-Based Insurance Fraud Detection Solutions

10.3 On-Premises

10.3.1 Need to Secure the In-House Applications, Platforms, and Systems Against Operational Frauds to Fuel the Adoption of On-Premises Insurance Fraud Detection Solutions

11 Insurance Fraud Detection Market By Organization Size (Page No. - 77)

11.1 Introduction

11.2 Small and Medium-Sized Enterprises

11.2.1 Growing Fraudulent Activities to Drive the Adoption of Insurance Fraud Detection Solutions Among Small and Medium-Sized Enterprises

11.3 Large Enterprises

11.3.1 Increasing Financial Losses and Hefty Fines for Regulatory Non-Compliance to Boost the Adoption of Insurance Fraud Detection Solutions Among Large Enterprises

12 Insurance Fraud Detection Market By Region (Page No. - 81)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.1.1 Increasing Investments By the Insurance Sector in Fraud Detection Solutions to Drive the Growth of Market in the United States

12.2.2 Canada

12.2.2.1 Government Initiatives to Safeguard Network Systems Against Frauds Driving the Growth of Market in Canada

12.3 Europe

12.3.1 United Kingdom

12.3.1.1 Growing Trend of Byod and Increased Use of Applications in Enterprises and Threat to Organizational Data Driving the Growth of Market in the United Kingdom

12.3.2 Germany

12.3.2.1 Rising Use of Online Transactions to Pay Premiums and Increasing Threat to Confidential Information Driving the Growth of Market in Germany

12.3.3 France

12.3.3.1 Growing Money Laundering and Identity Impersonation to Fuel the Growth of Market in France

12.3.4 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.1.1 Increasing Need to Secure Apis, Mobile Apps, and Websites From Fraudsters to Contribute to the Growth of Market in China

12.4.2 Japan

12.4.2.1 Increasing Number of Potential Frauds Due to High Internet Penetration to Fuel the Growth of Market in Japan

12.4.3 India

12.4.3.1 Growing Adoption of Fraud Detection Solutions in the Insurance Sector Due to Increase in Mobile Applications Use, Digitalization of Various Services, and Rise in Fraud Attacks to Drive the Adoption of Insurance Fraud Detection Solutions on A Large Scale in India

12.4.4 Rest of Asia Pacific

12.5 Middle East and Africa

12.5.1 Middle East

12.5.1.1 Increasing Frauds in the Insurance Vertical to Drive the Growth of Insurance Fraud Detection Market in the Middle East

12.5.2 Africa

12.5.2.1 Hefty Financial Losses Due to Fraudulent Attacks Across the Insurance Organizations to Contribute to the Growth of Market in Africa

12.6 Latin America

12.6.1 Brazil

12.6.1.1 Increasing Investments By SMEs and Large Enterprises Due to Growing Frauds Across Endpoints, Networks, and Applications to Drive the Growth of Market in Brazil

12.6.2 Mexico

12.6.2.1 Increasing Fraud Attacks on Insurance Verticals to Drive the Growth of Market in Mexico

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 108)

13.1 Competitive Leadership Mapping

13.1.1 Visionary Leaders

13.1.2 Innovators

13.1.3 Dynamic Differentiators

13.1.4 Emerging Companies

13.2 Strength of Product Portfolio

13.3 Business Strategy Excellence

13.4 Competitive Scenario

13.4.1 Partnerships, Agreements, and Collaborations

13.4.2 Mergers and Acquisitions

13.4.3 New Product Launches/Product Enhancements

13.4.4 Business Expansions

14 Company Profiles (Page No. - 116)

14.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.2 FICO

14.3 IBM

14.4 BAE Systems

14.5 SAS Institute

14.6 Experian

14.7 Lexisnexis

14.8 Iovation

14.9 Friss

14.10 SAP

14.11 Fiserv

14.12 ACI Worldwide

14.13 Simility

14.14 Kount

14.15 Software AG

14.16 Bridgei2i Analytics Solutions

14.17 Perceptiviti

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 148)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (84 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2018

Table 2 Factor Analysis

Table 3 Insurance Fraud Detection Market Size and Growth, 2017–2024 (USD Million, Y-O-Y %)

Table 4 Innovation Spotlight: Latest Insurance Fraud Detection Solutions

Table 5 Market Size, By Component, 2017–2024 (USD Million)

Table 6 Solutions: Market Size By Region, 2017–2024 (USD Million)

Table 7 Services: Market Size By Region, 2017–2024 (USD Million)

Table 8 Market Size, By Solution, 2017–2024 (USD Million)

Table 9 Fraud Analytics: Market Size By Type, 2017–2024 (USD Million)

Table 10 Fraud Analytics: Market Size By Region, 2017–2024 (USD Million)

Table 11 Predictive Analytics Market Size, By Region, 2017–2024 (USD Million)

Table 12 Descriptive Analytics Market Size, By Region, 2017–2024 (USD Million)

Table 13 Social Media Analytics Market Size, By Region, 2017–2024 (USD Million)

Table 14 Big Data Analytics Market Size, By Region, 2017–2024 (USD Million)

Table 15 Authentication: Market Size By Type, 2017–2024 (USD Million)

Table 16 Authentication: Insurance Fraud Detection Market Size By Region, 2017–2024 (USD Million)

Table 17 Single-Factor Authentication Market Size By Region, 2017–2024 (USD Million)

Table 18 Multi-Factor Authentication: Market Size By Region, 2017–2024 (USD Million)

Table 19 Risk-Based Authentication Market Size, By Region, 2017–2024 (USD Million)

Table 20 Governance, Risk, and Compliance: Market Size By Region, 2017–2024 (USD Million)

Table 21 Others: Market Size By Region, 2017–2024 (USD Million)

Table 22 Market Size, By Service, 2017–2024 (USD Million)

Table 23 Professional Services: Market Size By Type, 2017–2024 (USD Million)

Table 24 Professional Services: Market Size By Region, 2017–2024 (USD Million)

Table 25 Consulting Services Market Size, By Region, 2017–2024 (USD Million)

Table 26 Training and Education Market Size, By Region, 2017–2024 (USD Million)

Table 27 Support and Maintenance Market Size, By Region, 2017–2024 (USD Million)

Table 28 Managed Services: Market Size By Region, 2017–2024 (USD Million)

Table 29 Insurance Fraud Detection Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 30 Cloud: Market Size By Region, 2017–2024 (USD Million)

Table 31 On-Premises: Market Size By Region, 2017–2024 (USD Million)

Table 32 Market Size By Organization Size, 2017–2024 (USD Million)

Table 33 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 34 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 35 Market Size, By Region, 2017–2024 (USD Million)

Table 36 North America: Insurance Fraud Detection Market Size By Component, 2017–2024 (USD Million)

Table 37 North America: Market Size By Solution, 2017–2024 (USD Million)

Table 38 North America: Market Size By Fraud Analytics, 2017–2024 (USD Million)

Table 39 North America: Market Size By Authentication, 2017–2024 (USD Million)

Table 40 North America: Insurance Fraud Detection Market Size By Service, 2017–2024 (USD Million)

Table 41 North America: Market Size By Professional Service, 2017–2024 (USD Million)

Table 42 North America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 43 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 44 North America: Market Size By Country, 2017–2024 (USD Million)

Table 45 Europe: Insurance Fraud Detection Market Size, By Component, 2017–2024 (USD Million)

Table 46 Europe: Market Size By Solution, 2017–2024 (USD Million)

Table 47 Europe: Market Size By Fraud Analytics, 2017–2024 (USD Million)

Table 48 Europe: Market Size By Authentication, 2017–2024 (USD Million)

Table 49 Europe: Market Size By Service, 2017–2024 (USD Million)

Table 50 Europe: Market Size By Professional Service, 2017–2024 (USD Million)

Table 51 Europe: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 52 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 53 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 54 Asia Pacific: Insurance Fraud Detection Market Size, By Component, 2017–2024 (USD Million)

Table 55 Asia Pacific: Market Size By Solution, 2017–2024 (USD Million)

Table 56 Asia Pacific: Market Size By Fraud Analytics, 2017–2024 (USD Million)

Table 57 Asia Pacific: Market Size By Authentication, 2017–2024 (USD Million)

Table 58 Asia Pacific: Market Size By Service, 2017–2024 (USD Million)

Table 59 Asia Pacific: Market Size By Professional Service, 2017–2024 (USD Million)

Table 60 Asia Pacific: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 61 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 62 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 63 Middle East and Africa: Insurance Fraud Detection Market Size, By Component, 2017–2024 (USD Million)

Table 64 Middle East and Africa: Market Size By Solution, 2017–2024 (USD Million)

Table 65 Middle East and Africa: Market Size By Fraud Analytics, 2017–2024 (USD Million)

Table 66 Middle East and Africa: Market Size By Authentication, 2017–2024 (USD Million)

Table 67 Middle East and Africa: Market Size By Service, 2017–2024 (USD Million)

Table 68 Middle East and Africa: Market Size By Professional Service, 2017–2024 (USD Million)

Table 69 Middle East and Africa: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 70 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 71 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

Table 72 Latin America: Insurance Fraud Detection Market Size, By Component, 2017–2024 (USD Million)

Table 73 Latin America: Market Size By Solution, 2017–2024 (USD Million)

Table 74 Latin America: Market Size By Fraud Analytics, 2017–2024 (USD Million)

Table 75 Latin America: Market Size By Authentication, 2017–2024 (USD Million)

Table 76 Latin America: Market Size By Service, 2017–2024 (USD Million)

Table 77 Latin America: Market Size By Professional Service, 2017–2024 (USD Million)

Table 78 Latin America: Market Size By Deployment Mode, 2017–2024 (USD Million)

Table 79 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 80 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 81 Partnerships, Agreements, and Collaborations, 2016–2018

Table 82 Mergers and Acquisitions, 2017–2018

Table 83 New Product Launches/Product Enhancements, 2016–2018

Table 84 Business Expansions, 2017–2018

List of Figures (36 Figures)

Figure 1 Insurance Fraud Detection Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 4 North America to Hold the Highest Market Share in 2019

Figure 5 Fastest-Growing Segments of the Market

Figure 6 Increasing Claims Fraud, Stringent Regulations, and Increased Cloud Adoption to Drive the Growth of Insurance Fraud Detection Market

Figure 7 Solutions Segment to have A Higher Market Share During the Forecast Period

Figure 8 Fraud Analytics Segment to have A Higher Market Share During the Forecast Period

Figure 9 Fraud Analytics Solution and North American Region to have the Highest Market Shares in 2019

Figure 10 Large Enterprises Segment to Hold A Higher Market Share in 2019

Figure 11 On-Premises Segment to Hold A Higher Market Share in 2019

Figure 12 Asia Pacific to Emerge as the Best Market for Investment in the Next 5 Years

Figure 13 Drivers, Restraints, Opportunities, and Challenges: Insurance Fraud Detection Market

Figure 14 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 15 Authentication Solutions Segment to Record the Highest CAGR During the Forecast Period

Figure 16 Managed Services Segment to Record A Higher CAGR During the Forecast Period

Figure 17 Cloud Deployment Mode to Record A Higher CAGR During the Forecast Period

Figure 18 Small and Medium-Sized Enterprises Segment to Record A Higher CAGR During the Forecast Period

Figure 19 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Insurance Fraud Detection Market (Global) Competitive Leadership Mapping, 2019

Figure 23 Key Developments By the Leading Players in the Market for 2016–2018

Figure 24 Geographic Revenue Mix of the Top Players in the Insurance Fraud Detection Market

Figure 25 FICO: Company Snapshot

Figure 26 FICO: SWOT Analysis

Figure 27 IBM: Company Snapshot

Figure 28 IBM: SWOT Analysis

Figure 29 BAE Systems: Company Snapshot

Figure 30 BAE Systems: SWOT Analysis

Figure 31 SAS Institute: Company Snapshot

Figure 32 SAS Institute: SWOT Analysis

Figure 33 Experian: Company Snapshot

Figure 34 Experian: SWOT Analysis

Figure 35 SAP: Company Snapshot

Figure 36 Fiserv: Company Snapshot

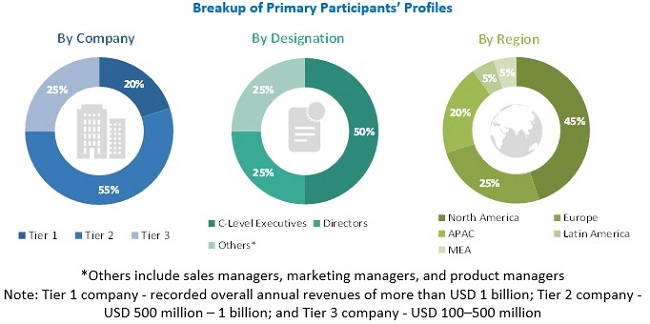

The study involved four major activities in estimating the current market size for insurance fraud detection market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The Insurance Fraud Detection Market size of companies offering insurance fraud detection solutions and services globally was derived with the help of the secondary data available through paid and unpaid sources. In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

The insurance fraud detection market comprises several stakeholders, such as insurance fraud detection solution and service vendors, insurance companies, Independent Software Vendors (ISVs), cybersecurity software vendors, cloud service providers, third-party providers, system integrators, Value-Added Resellers (VARs), Information Technology (IT) security agencies, consulting firms, Managed Security Service Providers (MSSPs), and research organizations. The primary sources included industry experts from the core and related verticals, and preferred suppliers, manufacturers, distributors, service providers, technology developers, and technologists from companies and organizations related to all the segments of the market’s value chain. In-depth interviews were conducted with various primary respondents, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology, fraud detection experts, and innovation directors, and related key executives from various key companies and organizations operating in the market, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects. The market was estimated by analyzing various driving factors, restraints, opportunities, challenges, industry trends, and key players’ strategies in the insurance fraud detection market space.

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Insurance Fraud Detection Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the insurance fraud detection market. The methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakup procedures were employed, wherever applicable. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list the key information/insights throughout the report.

Report Objectives

- To define, segment, and project the global market size for insurance fraud detection market

- To define, describe, and forecast the market by components (solutions (fraud analytics, authentication, and GRC solutions) and services), deployment type, organization size, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the micromarkets with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders by identifying the high growth segments of the market

- To forecast the market size of the segments with respect to major regions, such as North America, Europe, Asia Pacific (APAC), Middle East, and Africa (MEA), and Latin America.

- To profile the key players in the market and comprehensively analyze their market size and core competencies

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American insurance fraud detection market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the MEA market

- Further breakup of the Latin American market

Company Information

- Detailed analysis and profiling of the additional market players

Key questions addressed by the report:

- Define, describe, and forecast the insurance fraud detection market based on components (solutions and services), deployment types, organization size, and regions

- Detailed analysis of the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- Forecast revenue of the market’s segments with respect to five major regions, namely, North America, Europe, APAC, MEA, and Latin America

- Detailed analysis of the competitive developments, such as mergers and acquisitions, new product developments, and business expansion activities, in the market

Growth opportunities and latent adjacency in Insurance Fraud Detection Market