Black Start Generator Market by Type (Diesel and Others), by Power Ratings (Below 1,000 kW, 1,000 kW-2,000 kW, 2,000 kW-3,000 kW, and Above 3,000 kW), by Industry (Power, Manufacturing, Oil & Gas, and Others) and by Region - Trends & Forecasts to 2021

[154 Pages Report] Black start generators are the perfect solution to kick start power plants in case of a black out. These generators reduce starting time of primary generator in power plants by providing power for auxiliaries such as boiler feed pump, induced draft fan, forced draft fan, and circulating water pumps among others which can further run the entire power plant. Factors driving the black start generator market include growth of the power generation sector, mainly thermal and nuclear power plants and lack of power distribution infrastructure.

The global black start generator market stood at USD 1.20 Billion in 2015, and is expected to grow at a CAGR of 3.8% from 2016 to 2021.

The black start generator market is segmented based on its type, power rating, industry and region. The years considered for the study are:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

For company profiles in the report, 2015 has been considered. Where information is unavailable for the base year, the prior year has been considered.

Research Methodology

This research study involves extensive usage of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial aspect of the black start generator. The flow of the research methodology is explained below.

- Analysis of key operational and upcoming power black start generator projects across the globe along with type and capacity

- Analysis of country-wise rate of thermal, nuclear, and hydro power plant additions for the past three years

- Analysis of new oil & gas upstream operations, manufacturing of new rigs, and construction of refineries; Key manufacturing industries with captive power plants across the globe

- Estimation of installation cost of black start generator in various regions using average cost

- Analyzing market trends in various regions/ and countries supported by the on-going T&D infrastructure spending in respective regions/ countries

- Overall market size values are finalized by triangulation with the supply side data which include the product developments, supply chain and annual shipments of generators across the globe

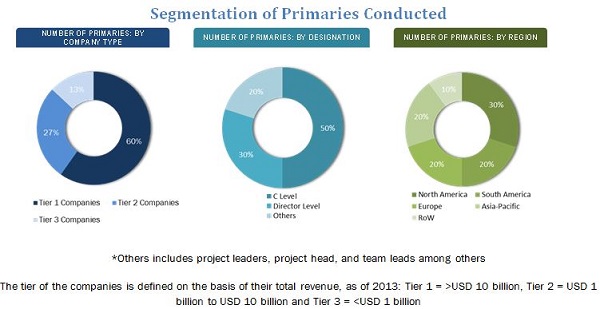

After arriving at the overall market size, the total market has been split into several segments and sub-segments. The figure below shows the break-down of the primaries on the basis of company, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

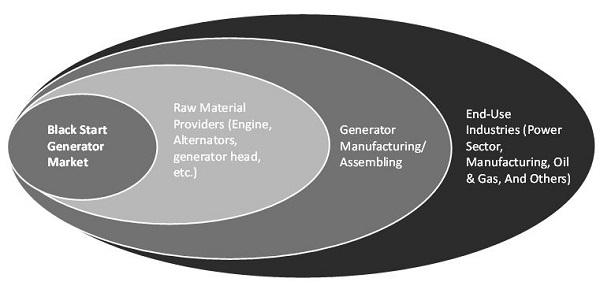

Market EcosystemThe Black start generator market starts with raw material suppliers which include engine providers, AC generator head, and DC alternator and so on. In the later stage, manufacturing of black start generator takes place where all raw materials are assembled. These devices are then sent to distributors, suppliers, and industries.

Stakeholders

The stakeholders for this report are:

- Power companies

- Black start generator manufacturing companies

- Black start generator component manufacturers

- Government and research organizations

- Consulting companies in the energy sector

- Energy associations

- Environmental associations

- Investment banks

Scope of the Report:

- This study estimates the global black start generator market, in terms of USD till 2021

- It offers a detailed qualitative and quantitative analysis of this market

- It provides a comprehensive review of major market drivers, restraints, opportunities, challenges, winning imperatives, and key issues of the market

- It covers various important aspects of the market. These include analysis of value chain, Porters Five Forces model, competitive landscape, market dynamics, market estimates in terms of value, and future trends in the black start generator market.

The market has been segmented into -

On the basis of Type

- Diesel

- Others

On the basis of Power Rating

- Below 1,000 kW

- 1,000 kW-2,000 kW

- 2,000 kW-3,000 kW

- Above 3,000 kW

On the basis of Industry

- Power

- Thermal

- Nuclear

- Hydro

- Manufacturing

- Oil & Gas

- Others

On the basis of Region

- North America

- South America

- Asia-Pacific

- Middle East & Africa

- Europe

Available Customization

With the market data provided above, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (Up to 5)

Customer Interested in this report also can view

Generator Sales Market by Type (Diesel, Gas), Application (Standby, Peak Shaving, Continuous Power), Power Rating (<100, 100350, 3511,000, >1,000 kVA), End-User (Residential, Commercial, and Industrial), and Region - Global Forecast to 2021

Diesel Generators Market by Application (Standby Power, Peak Shaving, Prime or Continuous Power), by Power Rating (0-100 kVA, 100-350 kVA, 350-1000 kVA, above 1000 kVA), by End-User (Industrial, Commercial, Residential) & by Region - Global Forecast to 2020

The global black start generator market is expected to reach USD 1.50 Billion by 2021 at a CAGR of 3.8% from 2016 to 2021. The growth is attributed to construction of thermal, nuclear, and hydro power plants and growth of manufacturing industries across the globe.

The black start generators prime application is in the power generation sector to provide the initial power for restarting the power plant during a blackout. However, over the years, black start generators witnessed tremendous demand from the oil & gas, manufacturing, and even the healthcare and IT sectors, thereby increasing its scope of application. The power sector is still the major contributor to the black start generator market. Construction of new power plants across globe to meet the increasing demand for power is the major driving factor for the black start generator market.

Diesel type generators are estimated to dominate the black start generator market based on type. The demand for diesel generators is fueled by its quick response time, easy fuel sourcing and storage, and longer running life. In spite of being lower in cost, the gas and hybrid generator market for black start is highly restricted due to difficulty is fuel sourcing and shorter running life.

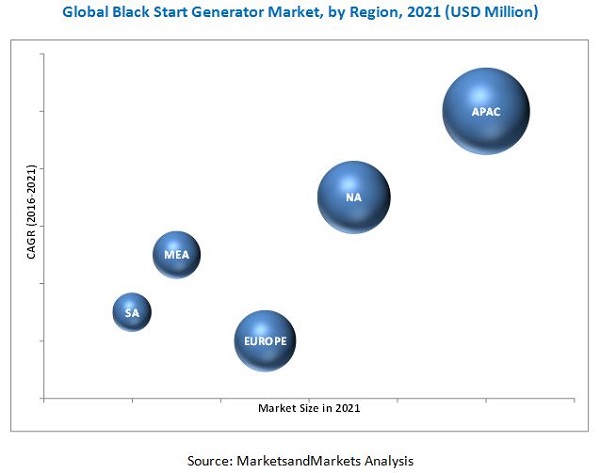

Asia-Pacific leads in terms of growth rate as well as market size from 2016 to 2021. High growth of power generation and IT & telecom sectors and new and proactive policy reforms to support growth of manufacturing sector in India and China are the major factors driving the market in this region. China is estimated to be the largest market growing at decent rate during 20162021, whereas India is likely to be the highest growing market in the region with highest growth rate from 2016 to 2021.

Black start generators require regular maintenance and testing to ensure they function during a blackout. This leads high operation and maintenance costs which are a major restraining factor for the black start generator market and motivates consumers to go for alternatives. Many power companies are providing black start service to commercial and industrial users as an alternative to installing black start generators. This service is becoming popular in developed regions and is another factor which is likely to restrain the growth of the black start generator market.

Some of the leading players in the black start generator market include GE (U.S.), Mitsubishi Heavy Industries Ltd. (Japan), Caterpillar Inc. (U.S.), MTU Onsite Energy (Germany), and Cummins Inc. (U.S.). Contracts and Agreements was the most adopted strategy followed by black start generator market players.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

3.1 Introduction

3.2 Current Scenario

3.3 Future Trends

3.4 Conclusion

4 Premium Insights (Page No. - 31)

4.1 Asia-Pacific: the Largest Market During the Forecast Period

4.2 Black Start Generator Market Size, By Industry, 2021

4.3 Black Start Generator Market, By Power Ratings, 2021

4.4 Black Start Generator Market, By Type

4.5 North America Black Start Generator Market

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Black Start Generators: Market Segmentation

5.2.1 By Industry

5.2.2 By Power Ratings

5.2.3 By Type

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Construction of New Power Plants

5.3.1.2 Growth of Manufacturing Sector

5.3.2 Restraints

5.3.2.1 High Installation and Maintenance Cost

5.3.2.2 Availability of Alternatives

5.3.3 Opportunity

5.3.3.1 Demand for Black Start in Healthcare Industry

5.3.3.2 Rise of IT & Telecom Industry

5.3.4 Challenges

5.3.4.1 Logistics & Supply

5.3.4.2 Operational Factors

5.4 Impact of Market Dynamics

6 Industry Trends (Page No. - 50)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Raw Material Suppliers

6.2.2 Manufacturers

6.2.3 Installation & Commissioning

6.2.4 Post Sales Services

6.3 Porters Five Forces Analysis

6.3.1 Threat of Substitutes

6.3.2 Threat of New Entrants

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Rivalry

7 Black Start Generator Market, By Type (Page No. - 54)

7.1 Introduction

7.2 Diesel

7.3 Other

8 Black Start Generator Market, By Power Ratings (Page No. - 60)

8.1 Introduction

8.2 Below 1,000 kW

8.3 1,000 kW- 2,000 kW

8.4 2,000 kW- 3,000 kW

8.5 Above 3,000 kW

9 Black Start Generator Market, By Industry (Page No. - 65)

9.1 Introduction

9.2 Power

9.3 Manufacturing

9.4 Oil & Gas

9.5 Other

10 Black Start Generator Market, By Region (Page No. - 71)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 By Type

10.2.2 By Power Ratings

10.2.3 By Industry

10.2.4 By Country

10.2.4.1 China

10.2.4.2 India

10.2.4.3 Japan

10.2.4.4 Thailand

10.2.4.5 Indonesia

10.2.4.6 Rest of Asia-Pacific

10.3 Europe

10.3.1 By Type

10.3.2 By Power Ratings

10.3.3 By Industry

10.3.4 By Country

10.3.4.1 Russia

10.3.4.2 Germany

10.3.4.3 U.K.

10.3.4.4 France

10.3.4.5 Rest of Europe

10.4 North America

10.4.1 By Type

10.4.2 By Power Ratings

10.4.3 By Industry

10.4.4 By Country

10.4.4.1 U.S.

10.4.4.2 Canada

10.4.4.3 Rest of North America

10.5 Middle East & Africa

10.5.1 By Type

10.5.2 By Power Ratings

10.5.3 By Industry

10.5.4 By Country

10.5.4.1 South Africa

10.5.4.2 Saudi Arabia

10.5.4.3 Uae

10.5.4.4 Rest of Middle East & Africa

10.6 South America

10.6.1 By Type

10.6.2 By Power Ratings

10.6.3 By Industry

10.6.4 By Country

10.6.4.1 Brazil

10.6.4.2 Argentina

10.6.4.3 Rest of South America

11 Competitive Landscape (Page No. - 100)

11.1 Overview

11.2 Competitive Situation & Trends

11.2.1 Contracts & Agreements

11.2.2 New Products/Services/Technologies Launch

11.2.3 Expansions

11.2.4 Mergers & Acquisitions

12 Company Profiles (Page No. - 106)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.2 Aggreko PLC

12.3 Broadcrown.

12.4 Caterpillar Inc..

12.5 Generac Holdings Inc

12.6 Gensal Energy

12.7 Himoinsa S.L.

12.8 Kohler Co.

12.9 Man Diesel & Turbo Se.

12.10 Mitsubishi Heavy Industries Ltd.

12.11 Mpower

12.12 Mtu Onsite Energy

12.13 Wartsila Corporation

12.14 Zest Weg Group

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 139)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Other Developments, 2013-2016

13.4 Knowledge Store: Marketsandmarkets Subscription Portal

13.5 Introducing Rt: Real Time Market Intelligence

13.6 Available Customizations

13.7 Related Reports

List of Tables (60 Tables)

Table 1 Black Start Generator Market Size, By Type, 2014-2021 (USD Million)

Table 2 Diesel: Black Start Generator Market Size, By Region, 2014-2021 (USD Million)

Table 3 Other: Black Start Generator Market Size, By Region, 2014-2021 (USD Million)

Table 4 Black Start Generator Market Size, By Power Ratings, 2014-2021 (USD Million)

Table 5 Below 1,000 kW Black Start Generator Market Size, By Region, 2014-2021 (USD Million)

Table 6 1,000 kW 2,000 kW Black Start Generator Market Size, By Region, 2014-2021 (USD Million)

Table 7 2,000 kW 3,000 kW Black Start Generator Market Size, By Region, 2014-2021 (USD Million)

Table 8 Above 3,000 kW Black Start Generator Market Size, By Region, 2014-2021 (USD Million)

Table 9 Black Start Generator Market Size, By Industry, 2014-2021 (USD Million)

Table 10 Power Black Start Generator Market Size, By Region, 2014-2021 (USD Million)

Table 11 Oil & Gas Black Start Generator Market Size, By Region, 2014-2021 (USD Million)

Table 12 Manufacturing Black Start Generator Market Size, By Region, 2014-2021 (USD Million)

Table 13 Other Black Start Generator Market Size, By Region, 2014-2021 (USD Million)

Table 14 Black Start Generator Market Size, By Region, 20142021 (USD Million)

Table 15 Asia-Pacific: By Market Size, By Type, 20142021 (USD Million)

Table 16 Asia-Pacific: By Market Size, By Power Ratings, 20142021 (USD Million)

Table 17 Asia-Pacific: By Market Size, By Industry, 20142021 (USD Million)

Table 18 Asia-Pacific: By Market Size, By Country, 20142021 (USD Million)

Table 19 China: By Market Size, By Industry, 20142021 (USD Million)

Table 20 India: By Market Size, By Industry, 20142021 (USD Million)

Table 21 Japan: By Market Size, By Industry, 20142021 (USD Million)

Table 22 Thailand: By Market Size, By Industry, 20142021 (USD Million)

Table 23 Indonesia: By Market Size, By Industry, 20142021 (USD Million)

Table 24 Rest of Asia-Pacific: By Market Size, By Industry, 20432021 (USD Million)

Table 25 Europe: By Market Size, By Type, 20142021 (USD Million)

Table 26 Europe: By Market Size, By Power Ratings, 20142021 (USD Million)

Table 27 Europe: By Market Size, By Industry, 20142021 (USD Million)

Table 28 Europe: By Market Size, By Country, 20142021 (USD Million)

Table 29 Russia: By Market Size, By Industry, 20142021 (USD Million)

Table 30 Germany: By Market Size, By Industry, 20142021 (USD Million)

Table 31 U.K.: By Market Size, By Industry, 20142021 (USD Million)

Table 32 France: By Market Size, By Industry, 20142021 (USD Million)

Table 33 Rest of Europe: By Market Size, By Industry, 20142021 (USD Million)

Table 34 North America: By Market Size, By Type, 20142021 (USD Million)

Table 35 North America: By Market Size, By Power Ratings, 20142021 (USD Million)

Table 36 North America: By Market Size, By Industry, 20142021 (USD Million)

Table 37 North America: By Market Size, By Country, 20142021 (USD Million)

Table 38 U.S.: By Market Size, By Industry, 20142021 (USD Million)

Table 39 Canada: By Market Size, By Industry,20142021 (USD Million)

Table 40 Mexico: By Market Size, By Industry, 20142021 (USD Million)

Table 41 The Middle East & Africa: By Market Size, By Type, 20142021 (USD Million)

Table 42 Middle East & Africa: By Market Size, By Power Ratings, 20142021 (USD Million)

Table 43 Middle East & Africa: By Market Size, By Industry, 20142021 (USD Million)

Table 44 Middle East & Africa: By Market Size, By Country, 20142021 (USD Million)

Table 45 South Africa: By Market Size, By Industry, 20142021 (USD Million)

Table 46 Saudi Arabia: By Market Size, By Industry, 20142021 (USD Million)

Table 47 Uae: Black Start Generator Market Size, By Industry, 20142021 (USD Million)

Table 48 Rest of Middle East & Africa: By Market Size, By Power Ratings, 20142021 (USD Million)

Table 49 South America: By Market Size, By Type, 20142021 (USD Million)

Table 50 South America: By Market Size, By Power Ratings, 20142021 (USD Million)

Table 51 South America: By Market Size, By Industry, 20142021 (USD Million)

Table 52 South America: By Market Size, By Country, 20142021 (USD Million)

Table 53 Brazil: Black Start Generator Market Size, By Industry, 20142021 (USD Million)

Table 54 Argentina: Black Start Generator Market Size, By Industry, 20142021 (USD Million)

Table 55 Rest of South America: Black Start Generator Market Size, By Industry, 20142021 (USD Million)

Table 56 Contracts & Agreements, 2016

Table 57 New Products/Services/Technologies Launch, 20142016

Table 58 Expansions, 2013-2015

Table 59 Mergers & Acquisitions, 20142015

Table 60 Other Developments, 2014

List of Figures (51 Figures)

Figure 1 Markets Covered: Black Start Generators Market

Figure 2 Black Start Generators Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Assumptions of the Research Study

Figure 7 Limitations of the Research Study

Figure 8 North America Dominated the Black Start Generators Market in 2015

Figure 9 Black Start Generators Market Share, By Type (2015)

Figure 10 Diesel Led the Black Start Generators Market, By Type, 2015

Figure 11 Black Start Generators Market Size, By Power Ratings, 2016 2021

Figure 12 Attractive Market Opportunities in the Black Start Generators Market

Figure 13 Black Start Generators Market Share (Value), By Country, 2015

Figure 14 Power Industry Will Continue to Dominate the Black Start Generators Market By 2021

Figure 15 India is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Black Start Generators Market Share (Value), By Type, 2016-2021

Figure 17 Power Industry for Largest Share in the Asia Pacific Region

Figure 18 Asia-Pacific Market is Expected to Grow at the Fastest Rate During the Forecast Period

Figure 19 Black Start Generators Market Segmentation By Power Ratings, By Power Ratings, By Type, & By Region

Figure 20 Increasing Electricity Demand is Expected to Drive the Black Start Generators Market

Figure 21 Electricity Consumption in Major Countries, 20082014 (In TWH)

Figure 22 Investment in Renewable Energy, By Region, 2014 (USD Billion)

Figure 23 Black Start Generators Market: Supply Chain Analysis

Figure 24 Black Start Generators Market: Porters Five Force Analysis

Figure 25 Black Start Generators Market Share (Value), By Type, 2014-2021

Figure 26 Black Start Generators Market Share (Value), By Power Ratings, 2016 & 2021

Figure 27 Black Start Generators Market Share (Value), By Industry, 2016 & 2021

Figure 28 Black Start Generators Market Share (Value), By Region, 2015

Figure 29 Regional Snapshot: Growth Rate of the Black Start Generators Market in Major Countries, 20162021

Figure 30 Asia-Pacific: Black Start Generators Market Overview (2015)

Figure 31 Europe: Black Start Generator Market Overview (2014)

Figure 32 Companies Went for Contracts & Agreements to Capture Market Share (20132016)

Figure 33 Market Evaluation Framework: Top Companies on the Basis of Developments (20132016)

Figure 34 Market Evaluation Framework: Top Companies on the Basis of Market Share (Value), 2014

Figure 35 Market Evaluation Framework: Contracts & Agreements Have Fueled the Growth of Companies During 20122015

Figure 36 Regional Mix of the Top Players

Figure 37 Caterpillar Inc.: Company Snapshot

Figure 38 Caterpillar Inc.: SWOT Analysis

Figure 39 Cummins Inc.: Company Snapshot

Figure 40 Cummins Inc: SWOT Analysis

Figure 41 Mitsubishi Heavy Industries Ltd..: Company Snapshot

Figure 42 Mitsubishi Heavy Industries Ltd.: SWOT Analysis

Figure 43 General Electric Company: Company Snapshot

Figure 44 General Electric Company: SWOT Analysis

Figure 45 Wartsila Corporation: Company Snapshot

Figure 46 Wartsila Corporation: SWOT Analysis

Figure 47 Man Diesel & Turbo Se: Company Snapshot

Figure 48 Aggreko PLC: Company Snapshot

Figure 49 Broadcrown: Company Snapshot

Figure 50 Himoinsa S.L.: Company Snapshot

Figure 51 Mpower: Company Snapshot

Growth opportunities and latent adjacency in Black Start Generator Market