Biofilms Treatment Market by Products (Debridement Equipment, Gauze, Dressing, Gel, Ointment), Wound Type (Traumatic, Surgical, Open, Diabetic Foot, Venous Leg Ulcer & Burns), End User (Hospital, ASCs, Wound Care Centers, Homecare) & Region - Global Forecast to 2025

Market Growth Outlook Summary

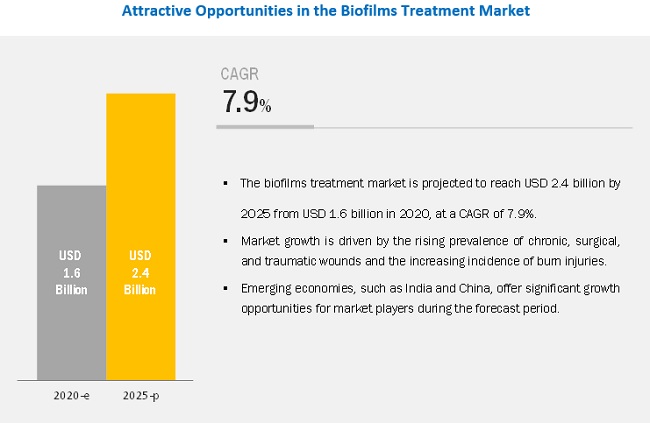

The global biofilms treatment market growth forecasted to transform from USD 1.6 billion in 2020 to USD 2.4 billion by 2025, driven by a CAGR of 7.9%. Market growth is driven by the rising prevalence of chronic, surgical, and traumatic wounds and the increasing incidence of burn injuries.

Traumatic and surgical wounds segment accounted for the largest share of the biofilms treatment industry in 2019.

Based on the wound type, the biofilms treatment market is segmented into surgical and traumatic wounds, diabetic foot ulcers, pressure ulcers, venous leg ulcers, and burns and other open wounds. The surgical and traumatic wounds segment accounted for the largest market share in 2019. The large share of this segment can be attributed to the growing prevalence of diabetes and the increasing number of surgical procedures performed.

Gauzes and dressings segment of the biofilms treatment industry to witness the highest growth rate during the forecast period

Based on product, the biofilms treatment market is segmented into debridement equipment; gauzes and dressings; gels, ointments, and sprays; wipes, pads, and lavage solutions; and grafts and matrices. The gauzes and dressings segment accounted for the largest market share in 2019. The large share of this segment is attributed to the ability of antimicrobial products to remove, prevent, and manage biofilms.

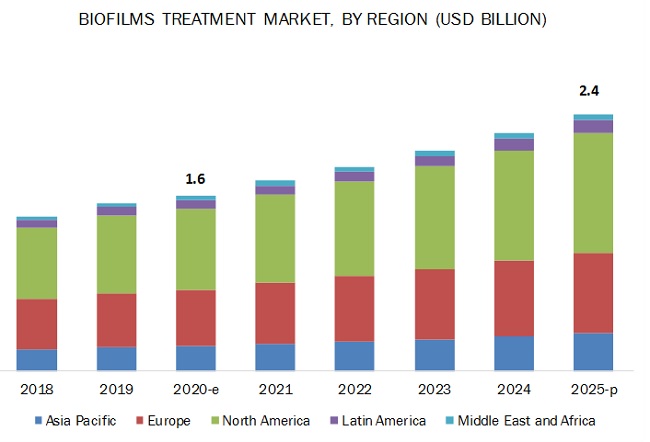

North America is the largest regional market for biofilms treatment industry

On the basis of region, the biofilms treatment market is segmented into North America, Europe, the Asia Pacific (APAC), Latin America (LATAM), and the Middle East & Africa (MEA). In 2019, North America accounted for the largest share of the market. The large share of this market can be attributed to the increasing incidence of chronic wounds, rising healthcare expenditure, the introduction of novel and specialty biofilm management products, and the presence of major market players in this region.

Prominent players in the biofilms treatment market include Smith & Nephew (UK), MiMedx Group Inc. (US), ConvaTec Group plc (UK), Coloplast A/S (Denmark), Mölnlycke Healthcare AB (Sweden), Organogenesis Holdings Inc. (US), Integra LifeSciences Holdings Corporation (US), B. Braun Melsungen AG (Germany), PAUL HARTMANN AG (Germany), Medline Industries Inc. (US), Acelity (US), Misonix (US), Zimmer Biomet Holdings Inc. (US), Kerecis (Iceland), Welcare Industries S.p.A (Italy), Medaxis AG (Switzerland), PulseCare Medical (US), Arobella Medical, LLC (UK), RLS Global AB (Sweden), Mil Laboratories Pvt. Ltd. (India).

Smith and Nephew (UK) is the leading player in the global market. The company focuses on product launches and acquisitions to increase its share in the market. Smith and Nephew is a pioneer in advanced wound care and has been in the market for more than 15 years, which provides it with a competitive edge. Also, the company is focusing on increasing its customer base and expanding its reach in untapped emerging markets.

Scope of the Biofilms Treatment Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$1.6 billion |

|

Projected Revenue Size by 2025 |

$2.4 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 7.9% |

|

Market Driver |

Increasing incidence of burn injuries |

|

Market Opportunity |

Growth potential in emerging economies |

The study categorizes the biofilms treatment market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Debridement Equipment

- Gauzes and Dressings

- Gels, Ointments, and Sprays

- Grafts and Matrices

- Wipes, Pads, and Lavage Solutions

By Wound Type

- Traumatic and Surgical Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Burns and Other Open Wounds

By End User

- Hospitals, ASCs, and Wound Care Centers

- Home Care Settings

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- RoE

-

Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments of Biofilms Treatment Industry:

- In May 2020, ConvaTec announced the launch of ConvaMax, which helps in managing highly exuding wounds, including leg ulcers, surgical wounds, and diabetic foot ulcers.

- In September 2018, ConvaTec Group received US FDA 510(k) clearance for its AQUACEL Ag Advantage antimicrobial dressings.

- In 2017, Smith and Nephew launched MolecuLight i: X, a handheld wound imaging device, in Europe. This device instantly measures wound surface area and shows the presence and distribution of potentially harmful bacteria.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global biofilms treatment market?

The global biofilms treatment market boasts a total revenue value of $2.4 billion by 2025.

What is the estimated growth rate (CAGR) of the global biofilms treatment market?

The global biofilms treatment market has an estimated compound annual growth rate (CAGR) of 7.9% and a revenue size in the region of $1.6 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET SCOPE

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 19)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 27)

4 PREMIUM INSIGHTS (Page No. - 30)

4.1 BIOFILMS TREATMENT MARKET OVERVIEW

4.2 GLOBAL BIOFILMS TREATMENT INDUSTRY, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

4.3 GLOBAL MARKET SHARE, BY END USER, 2020 VS. 2025

4.4 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW (Page No. - 33)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing prevalence of chronic, surgical, and traumatic wounds

5.2.1.1.1 High incidence of obesity

5.2.1.1.2 Growing geriatric population

5.2.1.1.3 Increasing prevalence of diabetes

5.2.1.1.4 Increase in the number of surgical wounds and SSIs

5.2.1.1.5 Increasing number of traumatic wounds

5.2.1.2 Increasing incidence of burn injuries

5.2.2 OPPORTUNITIES

5.2.2.1 Growth potential in emerging economies

5.2.3 CHALLENGES

5.2.3.1 High cost and low adoption rate of advanced wound care products

6 BIOFILMS TREATMENT MARKET, BY PRODUCT (Page No. - 37)

6.1 INTRODUCTION

6.2 DEBRIDEMENT EQUIPMENT

6.2.1 DEVELOPMENT OF NOVEL TECHNOLOGIES TO SUPPORT MARKET GROWTH

6.3 GAUZES AND DRESSINGS

6.3.1 GAUZES AND DRESSINGS ARE DESIGNED TO PREVENT THE OCCURRENCE OF INFECTIONS AFTER DEBRIDEMENT PROCEDURES

6.4 GRAFTS AND MATRICES

6.4.1 GRAFTS AND MATRICES PROMOTE HEALING AND WOUND CLOSURE

6.5 WIPES, PADS, AND LAVAGE SOLUTIONS

6.5.1 LAVAGE SOLUTIONS ARE USED FOR CLEANING WOUNDS DURING HYDRO SURGICAL AND MECHANICAL DEBRIDEMENT PROCEDURES

6.6 GELS, OINTMENTS, AND SPRAYS

6.6.1 THESE PRODUCTS ARE USED TO TREAT BURNS, DIABETIC FOOT ULCERS, AND SURGICAL & TRAUMATIC WOUNDS

7 BIOFILMS TREATMENT MARKET, BY WOUND TYPE (Page No. - 50)

7.1 INTRODUCTION

7.2 SURGICAL AND TRAUMATIC WOUNDS

7.2.1 GROWING VOLUME OF SURGICAL PROCEDURES PERFORMED TO SUPPORT MARKET GROWTH

7.3 DIABETIC FOOT ULCERS

7.3.1 RISING PREVALENCE OF DIABETES IS A KEY FACTOR DRIVING THE GROWTH OF THIS SEGMENT

7.4 PRESSURE ULCERS

7.4.1 GERIATRIC POPULATION IS MORE SUSCEPTIBLE TO DEVELOPING PRESSURE ULCERS

7.5 VENOUS LEG ULCERS

7.5.1 INCREASING PREVALENCE OF OBESITY TO SUPPORT MARKET GROWTH

7.6 BURNS & OTHER OPEN WOUNDS

7.6.1 INCIDENCE OF BURN INJURIES IS HIGH IN EMERGING COUNTRIES

8 BIOFILMS TREATMENT MARKET, BY END USER (Page No. - 57)

8.1 INTRODUCTION

8.2 HOSPITALS, ASCS, AND WOUND CARE CENTERS

8.2.1 RISING INCIDENCE OF HOSPITAL-ACQUIRED PRESSURE ULCERS AND INFECTIONS TO SUPPORT MARKET GROWTH

8.3 HOME CARE SETTINGS

8.3.1 RISING PREFERENCE FOR HOME HEALTHCARE IS CONTRIBUTING TO THE GROWTH OF THIS MARKET

8.4 OTHER END USERS

9 BIOFILMS TREATMENT MARKET, BY REGION (Page No. - 61)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 Rising prevalence of diabetes and favorable reimbursement policies in the country to boost the market growth

9.2.2 CANADA

9.2.2.1 Increasing government support to boost market growth

9.3 EUROPE

9.3.1 UK

9.3.1.1 Increase in R&D activities to propel market growth in the UK

9.3.2 GERMANY

9.3.2.1 Increasing incidence of diabetes will boost the market growth in Germany

9.3.3 RUSSIA

9.3.3.1 Government focus on increasing diabetes awareness will favor market growth in Russia

9.3.4 FRANCE

9.3.4.1 Rising geriatric population to drive the demand for advanced wound care products in the country

9.3.5 ITALY

9.3.5.1 Unfavorable reimbursement scenario for advanced wound care will hinder market growth in Italy

9.3.6 SPAIN

9.3.6.1 Rising geriatric population in the country to support market growth

9.3.7 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.1.1 Increasing incidence of DFUs to support market growth in China

9.4.2 JAPAN

9.4.2.1 Favorable regulations in Japan have boosted product launch and commercialization activity

9.4.3 INDIA

9.4.3.1 High rate of SSIs and growing investments indicate strong opportunities for market growth

9.4.4 AUSTRALIA

9.4.4.1 Increasing initiatives to spread awareness on effective wound care to support market growth

9.4.5 REST OF ASIA PACIFIC

9.5 LATIN AMERICA

9.5.1 BRAZIL

9.5.1.1 Brazil is the largest market for healthcare in the Latin American region

9.5.2 MEXICO

9.5.2.1 Diabetes is the second-highest cause of mortality in Mexico

9.5.3 REST OF LATIN AMERICA

9.6 MIDDLE EAST & AFRICA

9.6.1 GROWING PREVALENCE OF DIABETES TO SUPPORT MARKET GROWTH

10 COMPETITIVE LANDSCAPE (Page No. - 101)

10.1 INTRODUCTION

10.2 MARKET SHARE ANALYSIS, 2019

10.2.1 BIOFILMS TREATMENT MARKET, BY KEY PLAYER

10.2.2 GLOBAL MARKET FOR HOSPITALS

10.2.3 GLOBAL MARKET FOR HOME CARE SETTINGS

10.3 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

10.4 VENDOR INCLUSION CRITERIA

10.5 VENDOR DIVE

10.5.1 VISIONARY LEADERS

10.5.2 INNOVATORS

10.5.3 DYNAMIC DIFFERENTIATORS

10.5.4 EMERGING COMPANIES

10.6 COMPETITIVE SCENARIO

10.6.1 PRODUCT LAUNCHES & APPROVALS

10.6.2 ACQUISITIONS

10.6.3 COLLABORATIONS & PARTNERSHIPS

11 COMPANY PROFILES (Page No. - 108)

(Business overview, Products offered, Recent developments, SWOT analysis, MNM view)*

11.1 SMITH AND NEPHEW PLC

11.2 MIMEDX GROUP

11.3 CONVATEC GROUP PLC

11.4 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

11.5 PAUL HARTMANN AG

11.6 MÖLNLYCKE HEALTH CARE AB

11.7 COLOPLAST A/S

11.8 B. BRAUN MELSUNGEN AG

11.9 ORGANOGENESIS HOLDINGS INC.

11.10 MISONIX

11.11 ACELITY (A PART OF 3M)

11.12 ZIMMER BIOMET HOLDINGS INC.

11.13 KERECIS

11.14 MEDLINE INDUSTRIES, INC.

11.15 WELCARE INDUSTRIES S.P.A

11.16 MEDAXIS AG

11.17 PULSECARE MEDICAL

11.18 AROBELLA MEDICAL, LLC

11.19 ADVANCIS MEDICAL

11.20 RLS GLOBAL AB

11.21 MIL LABORATORIES PVT. LTD.

*Business overview, Products offered, Recent developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 144)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (109 TABLES)

TABLE 1 INCLUSIONS & EXCLUSIONS

TABLE 2 AVERAGE SELLING PRICE OF VARIOUS PRODUCTS USED IN THE BIOFILMS TREATMENT MARKET (USD)

TABLE 3 GLOBAL BIOFILMS TREATMENT INDUSTRY BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 4 DEBRIDEMENT EQUIPMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 5 NORTH AMERICA: DEBRIDEMENT EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 6 EUROPE: DEBRIDEMENT EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 7 APAC: DEBRIDEMENT EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 8 GAUZES AND DRESSINGS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 NORTH AMERICA: GAUZES AND DRESSINGS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 10 EUROPE: GAUZES AND DRESSINGS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 11 APAC: GAUZES AND DRESSINGS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 12 GRAFTS AND MATRICES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 NORTH AMERICA: GRAFTS AND MATRICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 EUROPE: GRAFTS AND MATRICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 15 APAC: GRAFTS AND MATRICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 16 WIPES, PADS, AND LAVAGE SOLUTIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 NORTH AMERICA: WIPES, PADS, AND LAVAGE SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 EUROPE: WIPES, PADS, AND LAVAGE SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 19 APAC: WIPES, PADS, AND LAVAGE SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 20 GELS, OINTMENTS, AND SPRAYS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 NORTH AMERICA: GELS, OINTMENTS, AND SPRAYS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 EUROPE: GELS, OINTMENTS, AND SPRAYS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 APAC: GELS, OINTMENTS, AND SPRAYS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 24 BIOFILMS TREATMENT MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 25 MARKET FOR SURGICAL AND TRAUMATIC WOUNDS, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 MARKET FOR DIABETIC FOOT ULCERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 MARKET FOR PRESSURE ULCERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 28 MARKET FOR VENOUS LEG ULCERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 HOSPITAL ADMISSIONS FOR THE TREATMENT OF BURN INJURIES, 2015

TABLE 30 GLOBAL BIOFILMS TREATMENT INDUSTRY FOR BURNS AND OTHER OPEN WOUNDS, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 32 MARKET FOR HOSPITALS, ASCS, AND WOUND CARE CENTERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 MARKET FOR HOME CARE SETTINGS, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 36 NUMBER OF BIOFILM WOUND CASES, BY REGION, 2018–2025 (MILLION)

TABLE 37 NORTH AMERICA: BIOFILMS TREATMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 40 NORTH AMERICA: BIOFILMS TREATMENT INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 41 US: GLOBAL MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 42 US: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 43 US: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 44 CANADA: INCIDENCE OF DIABETES, 2016 VS. 2026

TABLE 45 CANADA: BIOFILMS TREATMENT INDUSTRY, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 46 CANADA: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 47 CANADA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 48 EUROPE: PREVALENCE OF DIABETES, 2015 VS. 2040

TABLE 49 EUROPE: BIOFILMS TREATMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 EUROPE: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 52 EUROPE: BIOFILMS TREATMENT INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 53 UK: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 54 UK: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 55 UK: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 56 GERMANY: GLOBAL MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 57 GERMANY: BIOFILMS TREATMENT INDUSTRY, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 58 GERMANY: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 59 RUSSIA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 60 RUSSIA: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 61 RUSSIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 62 FRANCE: BIOFILMS TREATMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 63 FRANCE: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 64 FRANCE: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 65 ITALY: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 66 ITALY: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 67 ITALY: BIOFILMS TREATMENT INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 68 SPAIN: GLOBAL MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 69 SPAIN: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 70 SPAIN: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 71 ROE: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 72 ROE: BIOFILMS TREATMENT INDUSTRY, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 73 ROE: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 74 APAC: BIOFILMS TREATMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 APAC: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 76 APAC: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 77 APAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 78 CHINA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 79 CHINA: BIOFILMS TREATMENT INDUSTRY, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 80 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 81 JAPAN: GLOBAL MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 82 JAPAN: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 83 JAPAN: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 84 INDIA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 85 INDIA: BIOFILMS TREATMENT INDUSTRY, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 86 INDIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 87 AUSTRALIA: BIOFILMS TREATMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 88 AUSTRALIA: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 89 AUSTRALIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 90 TOTAL DIABETES-RELATED HEALTH EXPENDITURE, 2019 VS. 2030 (USD MILLION)

TABLE 91 ROAPAC: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 92 ROAPAC: BIOFILMS TREATMENT INDUSTRY, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 93 ROAPAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 94 LATAM: GLOBAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 95 LATAM: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 96 LATAM: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 97 LATAM: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 98 BRAZIL: BIOFILMS TREATMENT INDUSTRY, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 99 BRAZIL: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 100 BRAZIL: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 101 MEXICO: BIOFILMS TREATMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 102 MEXICO: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 103 MEXICO: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 104 ROLATAM: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 105 ROLATAM: BIOFILMS TREATMENT INDUSTRY, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 106 ROLATAM: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

LIST OF FIGURES (33 FIGURES)

FIGURE 1 RESEARCH DESIGN

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 3 BIOFILMS TREATMENT MARKET: BOTTOM-UP APPROACH

FIGURE 4 GLOBAL MARKET: TOP-DOWN APPROACH

FIGURE 5 DATA TRIANGULATION METHODOLOGY

FIGURE 6 GLOBAL MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 7 GLOBAL MARKET, BY WOUND TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 GLOBAL MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

FIGURE 10 INCREASING PREVALENCE OF CHRONIC, TRAUMATIC, AND SURGICAL WOUNDS WILL DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

FIGURE 11 GAUZES AND DRESSINGS WILL CONTINUE TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

FIGURE 12 HOSPITALS, ASCS, AND WOUND CARE CENTERS TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2020

FIGURE 13 ASIA PACIFIC TO WITNESS THE HIGHEST GROWTH RATE IN THE FORECAST PERIOD

FIGURE 14 GLOBAL MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

FIGURE 15 INCIDENCE OF DIABETES, BY REGION, 2015 VS. 2040 (MILLION CASES)

FIGURE 16 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 17 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 18 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE GLOBAL MARKET

FIGURE 19 GLOBAL MARKET SHARE, BY KEY PLAYER, 2019

FIGURE 20 GLOBAL MARKET SHARE FOR HOSPITALS, BY KEY PLAYER, 2019

FIGURE 21 GLOBAL MARKET SHARE FOR HOME CARE SETTINGS, BY KEY PLAYER, 2019

FIGURE 22 BIOFILMS TREATMENT MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 23 SMITH AND NEPHEW PLC: COMPANY SNAPSHOT (2019)

FIGURE 24 CONVATEC GROUP PLC: COMPANY SNAPSHOT (2019)

FIGURE 25 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT (2019)

FIGURE 26 PAUL HARTMANN AG: COMPANY SNAPSHOT (2019)

FIGURE 27 MÖLNLYCKE HEALTH CARE AB: COMPANY SNAPSHOT (2018)

FIGURE 28 COLOPLAST A/S: COMPANY SNAPSHOT (2019)

FIGURE 29 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2019)

FIGURE 30 ORGANOGENESIS HOLDINGS INC.: COMPANY SNAPSHOT (2018)

FIGURE 31 MISONIX: COMPANY SNAPSHOT (2019)

FIGURE 32 ACELITY: COMPANY SNAPSHOT (2018)

FIGURE 33 ZIMMER BIOMET: COMPANY SNAPSHOT (2019)

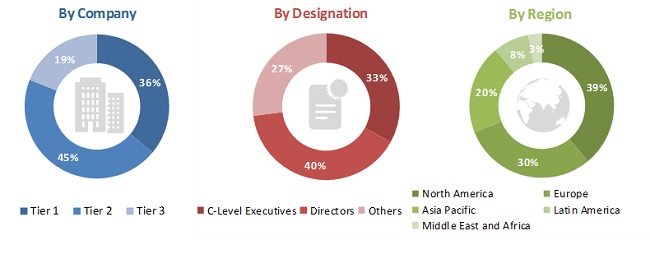

This study involved four major activities in estimating the current size of the biofilms treatment market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments.

Secondary Research

Secondary research was mainly used to identify and collect information for this study of the biofilms treatment market. The secondary sources used for this study include the World Health Organization (WHO), Food and Drug Administration (FDA), National Institutes of Health (NIH), National Center for Biotechnology Information (NCBI), Organisation for Economic Co-operation and Development (OECD), Association for the Advancement of Wound Care (AAWC), American Diabetic Association, National Pressure Ulcer Advisory Panel (NPUAP), Journal of Wound Care (JWC), American Physical Therapy Association (APTA), American Professional Wound Care Association (APWCA), National Alliance of Wound Care and Ostomy (NAWCO), European Wound Management Association (EWMA), National Institute for Health and Care Excellence (NICE), Wound Care Alliance, Wound Healing Institute Australia (WHIA), Medicare, Alliance of Wound Care Stakeholders, Annual Reports, SEC Filings, Expert Interviews, and MarketsandMarkets Analysis

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the biofilms treatment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the biofilms treatment market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the biofilms treatment market based on product, wound type, end user and region

- To provide detailed information regarding the major factors influencing market growth

- To strategically analyze micromarkets with respect to their individual growth trends, prospects, and contributions to the overall biofilms treatment market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key market players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, new product launches, expansions, agreements, partnerships, collaborations, and R&D activities in the biofilms treatment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Biofilms treatment market size and growth rate estimates for counties in the Rest of Europe and the Rest of Asia Pacific

Company Profiles

- Profiles of five additional players operating in the biofilms treatment market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biofilms Treatment Market