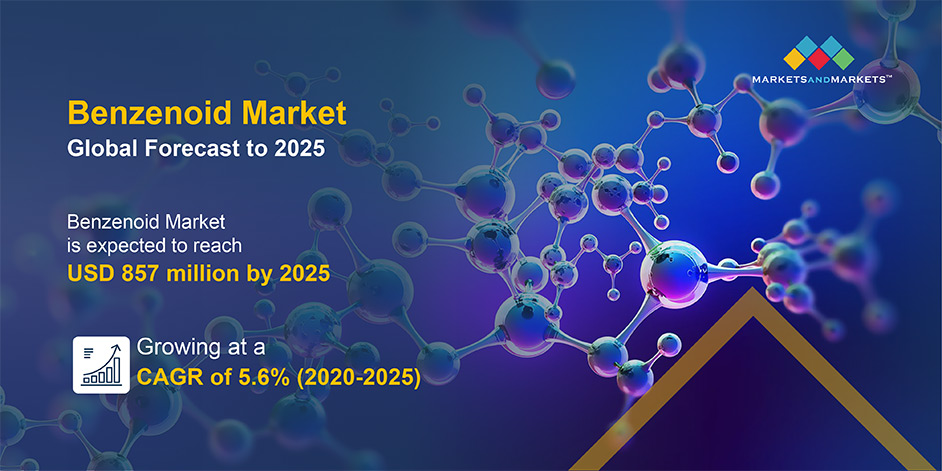

Benzenoid Market by Type (Benzyl Acetate, Benzoate, Chloride, Salicylate, Benzaldehyde, Cinnamyl, Vanillin), Application (Soaps & Detergents, Food & Beverage, Household Products), and Region – Global forecast to 2025

The benzenoids market is projected to grow at a CAGR of 5.6% to reach USD 857 million by 2025. The global industry was estimated to be valued at USD 651 million in 2020. The steady onset of factors such as rise in consumption of processed food products, shifting flavor & fragrance trends and steady growth in the personal care products in the global benzenoids markets, particularly in emerging and developing markets have triggered demand for quality benzenoid chemicals.

To know about the assumptions considered for the study, download the pdf brochure

Report Scope

|

Report Metric |

Details |

|

Market Size Forecast 2025 |

USD 857 million |

|

Market Size at 2020 |

USD 651 million |

|

Estimated CAGR |

5.6 % |

|

Recent Update Date |

NOV 2022 |

|

Market/Geography Specific Customization |

Available on Demand |

|

Currency and Unit |

USD |

|

Research Duration Considered |

2020-2025 |

|

Historical Base Year |

2020 |

|

Key Market Dynamics |

4 Types |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

Asia Pacific |

|

Government Agencies & Departments |

|

|

Regulatory Body |

|

|

Leading Manufacturers In Benzenoid Market |

|

Benzenoid Chemicals Market Dynamics

Driver: Shifting flavor & fragrance trends and preferences amongst populations globally

The global choices and preferences related to taste and aromas are changing rapidly with changing marketing trends, mindsets and increasing expenditure on lifestyle. As per the 2018 report of “Innova Market Insights” 64% of US consumers state that they “love to discover flavors from other cultures,” Dull flavors are being reinvented and more retail products and restaurants are highlighting ethnic flavors or street flavors. Unique scents and attractive designs have pushed the home fragrance market to its strongest position yet. While over the years traditionally rooted fragrances like jasmine and sandalwood have had a distinct contribution, especially for soaps, a combination of fruity-floral fragrances are now gaining traction with marketers wooing younger consumers.

Restraint: Potential health risks of synthetic chemicals affecting production growth

The genotoxicity and carcinogenicity are the key factors that are taken into consideration to determine the safety of the chemical use. Companies that manufacture perfume or cologne purchase fragrance mixtures from fragrance houses to develop their own proprietary blends. Benzenoids as food additives and fragrance ingredients are regulated as some of them pose potential risks to human health at defined concentrations. Organization such as US FDA (US Food & Drug Administration), EU Commission, IFRA (International Fragrance Association) set standards and guideline for manufacturers in order to control the possible health risks due to overuse of aroma chemicals in food and fragrance products.

Opportunity: Greater focus on R&D to develop unique and customized aroma compounds

It is estimated that fragrance manufacturers globally invest around 8% of their net sales in R&D. Consumer product manufacturers and retailers often rely on innovation from the fragrance industry to provide differentiation through technology, understanding of consumer trends, and sustainable production. A total of 139 new aroma chemicals, compounds, and formulations have been patented between January 2019 and September 2020, globally. The shifting flavor preferences of people especially after impositions of global lockdowns are estimated to drive the benzenoids market for quality benzenoid chemicals in the near future.

Challenge: COVID-19 impact on supply chains impacting the overall production of benzenoid chemicals

According to the 2019 PWC report supply chains in the chemical industry are being disrupted by outbreaks in key regions, and demand may fall due to uncertainty in the global economy and capital markets. The industry is estimated to be potentially hit hard by the COVID-19 outbreak on numerous fronts such as lowered demand and productivity, operational and supply chain disruptions, potentially tightening credit markets. The chemical sector’s supply chain has historically been strongly dependent on China, which has been heavily impacted by the COVID-19 pandemic and instituted wide-ranging countermeasures as a result.

The benzyl benzoate sub-segment is estimated to account for the fastest growth in the by type segment for Benzenoid Chemicals market.

Benzyl benzoate is naturally found in cinnamon, apricots, honey cocoa, cloves, cranberries jasmine, and mushrooms. RIFM (Research Institute for Fragrance Materials) has identified the compounds as a very weak skin sensitizer and IFRA (International Fragrance Association) has set standards for acceptable concentrations of benzyl benzoate that can be used in variety of consumer goods. It serves a supporting role, helping to dissolve and blend together all the different scent substances.

By Application , the soaps & detergents sub-segment is estimated to observe the fastest growth in Benzenoid Chemicals market.

The aroma in soaps and detergent products is bought about by the use many natural and synthetic compounds. The generally used natural compounds include oregano oil, lemon oil, coconut oil, camellia oil, and coffee essential oil amongst others. During the spread of coronavirus pandemic, the significance of soaps and detergents for hygiene purposes grew tremendously giving a boost to the sales of the industry. With organizations such as American Centers for Disease Control and Prevention (CDC), promoting hand hygiene through use of soaps and clean running water the benzenoids market grew faster in the pandemic time.

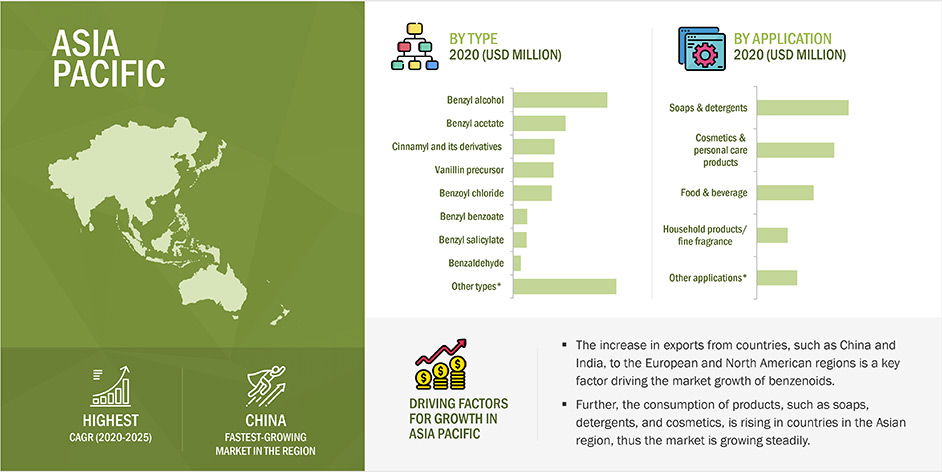

The increasing exports of the region of benzenoid chemicals to the North American and European regions, accounts for the high market share of the region.

China ranks first in terms of imports and exports of organic chemicals globally. The global chemical industry has seen a 7% annual growth rate. countries such as China, Japan, South Korea, Indonesia are doing exceedingly well in the cosmetics, beauty and personal care products market. According to Istrata reports, Southeast Asia revenue in the Beauty and Cosmetics segment amounts to USD25.449 billion in 2020 where 74% of sales contribute to mass-marketed cosmetics and 26% on luxury items. Thus the region accounts for the largest market shares in the global benzenoid market.

Key Market Players

Key players in benzenoids market include major players such as BASF (Germany), Firmenich (Switzerland), Emerald Kalama Chemical (US), International Flavors & Fragrances, Inc. (US), Eternis Fine Chemicals (India), Symrise (France), Tennants Fine Chemicals Ltd. (England), Jayshree Aromatics Pvt. Ltd. (India), and Valtris Specialty Chemicals (US. These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In June 2019, Valtris Specialty Chemicals announced a significant expansion of its benzyl derivatives production capacity in Europe. The additional production capacity will be executed at its sites in Tessenderlo, Belgium and Maastricht, Netherlands.

- In June 2019, Eternis expanded its production capacity at the Kurkumbh unit, India, for manufacturing Hamber (a pale yellow colorless liquid) that has a basic woody amber fragrance. It features a velvetlike sensation and acts as a floralizer. This company has invested USD 15 million and subsequently was able to expand its facility’s capacity from 42,000 MTPA to 60,000 MTPA.

- In February 2019, Tianjin Dongda Chemical Group Co., Ltd. company has purchased 180 acres of land in Nangang Industrial Area, Tianjin Binhai New Area, China, and invested USD 181 million (CNY 1.2 billion) in building an industrial park for food additives, which can annually yield 150,000 tons of benzoic acid with technical and pabular grades, 100,000 tons of sodium benzoate series with pabular grade, and fine chemical products with high added value.

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the Benzenoids market and how intense is the competition?

Key players in this market include competitors such as Firmenich (Switzerland), Emerald Kalama Chemical (US), International Flavors & Fragrances, Inc. (US), Eternis Fine Chemicals (India), Symrise (France), Tennants Fine Chemicals Ltd. (England) and Jayshree Aromatics Pvt. Ltd. (India). The benzenoid chemicals market includes not only established players but also strongly emerging companies. Benzenoid chemicals being a growing market, the existing players are fixated upon improving their market shares, while their newer start-ups being established rapidly in the market. The market can be classified as a fragmented market due to the presence of a large number of organized players accounting for more than 50, present at the global level as well as unorganized players present at the local level in several countries. There are numerous existing and emerging companies, especially in the North American and Asian Markets.

What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

The key stakeholders to benzenoid chemicals market would be manufacturers, suppliers, and processors of: cosmetic products, personal care products, soaps & detergent products, processed foods pharmaceutical & animal nutrition products), raw material suppliers , crude oil manufacturers, traders & retailers, wholesalers, distributors, importers, and exporters, regulatory bodies and associations . The key strategies adopted by these in the market would be new product launches, expansions, acquisitions, and joint ventures.

What are the potential challenges to the Benzenoid Chemicals market?

The industry is estimated to be potentially hit hard by the COVID-19 outbreak on numerous fronts such as lowered demand and productivity, operational and supply chain disruptions, potentially tightening credit markets. The chemical sector’s supply chain has historically been strongly dependent on China, which has been heavily impacted by the COVID-19 pandemic and instituted wide-ranging countermeasures as a result. The reduced supply of raw materials resulted into delayed deliveries of end use products in the markets. Further with price sensitivity increasing amongst consumers the demand for products such as cosmetics and perfumery also dropped sharply. Resultantly the prices of crude oil fell in the markets.

What are the key market trends in the benzenoids market?

Benzenoid chemicals are generally used for highly specific applications and are tailored to suit the end-user industry requirements and, at times even the individual customer’s requirements. Demands of new, unique fragrance and flavor chemicals in the market that are effectively used in applications, such as flavored foods, cosmetics, personal care products, and household products are rising. The demand for fragrance chemicals increased in the hygiene industry with the rise in awareness among consumers through special campaigns on digital and mainstream media about the benefits of regular hands wash as prevention for coronavirus, and the sale for hand sanitizers has also spiked.

How has the COVID-19 outbreak affected the benzenoids market?

Amidst the spread of the COVID-19 pandemic, online shopping has taken precedence over brick and mortar retail in a majority of industries. The demand for home fragrances witnessed a sharp increase, while the fine fragrances sector recorded a decline. Supermarkets, producers, marketers, and businesses have had to adapt to the changing buying behavior among consumers for food consumption. The depleting economic conditions and unemployment globally have resulted in increased price sensitivity among consumers. However the demands from the soaps and personal care market remain stable which tend to drive the demands for benzenoid chemicals. .

Can I download the PDF of market research report of Benzenoid Market?

The latest and updated Nov 2022 market research report for Benzenoid Market can be accessed on MarketsandMarkets.com. It contains Market forecast, estimated CAGR, key market dynamics and it is updated in Nov 2022. TnC apply.

How much will Benzenoid Market grow in 2023 and beyond?

The benzenoids market is projected to grow at a CAGR of 5.6% to reach USD 857 million by 2025. The global industry was estimated to be valued at USD 651 million in 2020.

Which are the upcoming trends, opportunities in the Benzenoid Market?

The steady onset of factors such as rise in consumption of processed food products, shifting flavor & fragrance trends and steady growth in the personal care products in the global benzenoids markets, particularly in emerging and developing markets have triggered demand for quality benzenoid chemicals.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.3.1 INCLUSIONS & EXCLUSIONS

TABLE 1 BENZENOIDS MARKET, BY TYPE AND APPLICATION: INCLUSIONS & EXCLUSIONS

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2017–2019

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

FIGURE 3 BENZENOID CHEMICALS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 29)

FIGURE 7 BENZENOID MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 BENZENOID MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 9 SOUTH AMERICA TO GROW AT THE HIGHEST CAGR IN THE BENZENOIDS MARKET FROM 2020 TO 2025

FIGURE 10 MARKET SHARE, BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 OPPORTUNITIES IN THE MARKET

FIGURE 11 RISE IN DEMAND FOR PREMIUM COSMETICS AND PERFUME PRODUCTS TO DRIVE THE GROWTH OF THE MARKET FOR BENZENOID

4.2 BENZENOIDS MARKET: KEY COUNTRY

FIGURE 12 NORTH AMERICA TO ACCOUNT FOR THE LARGEST SHARE IN THE COUNTRY-LEVEL MARKET FOR BENZENOIDS THROUGH 2025

4.3 BENZENOID MARKET, BY APPLICATION AND REGION

FIGURE 13 EUROPE AND ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARES IN THE MARKET FOR BENZENOIDS, GLOBALLY, IN 2020

4.4 BENZENOIDS MARKET, BY TYPE

FIGURE 14 BENZYL ALCOHOL SUBSEGMENT TO DOMINATE THE MARKET IN 2020

4.5 DEVELOPED VS. DEVELOPING MARKETS FOR BENZENOIDS

FIGURE 15 US TO RECORD THE HIGHEST GROWTH RATES DURING THE FORECAST PERIOD

4.6 ASIA PACIFIC: BENZENOIDS MARKET, BY APPLICATION AND COUNTRY

FIGURE 16 ASIA PACIFIC MARKET ACCOUNTED FOR THE LARGEST SHARE IN THE BENZENOIDS MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 37)

5.1 MACROECONOMIC INDICATORS

5.1.1 RISE IN PRODUCTION OF PETROCHEMICALS TO INCREASE THE AVAILABILITY OF CHEAPER RAW MATERIALS FOR BENZENOID CHEMICAL PRODUCTION

FIGURE 17 GLOBAL CRUDE OIL PRICE TREND (2016–2020)

5.2 MARKET DYNAMICS

FIGURE 18 BENZENOID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Shift in flavor & fragrance trends and preferences among population globally

5.2.1.2 High demand for sanitization products due to COVID-19 pandemic

5.2.1.3 Rise in consumption of personal care products

FIGURE 19 GLOBAL PERSONAL CARE INDUSTRY RETAIL SALES (2015–2019)

5.2.2 RESTRAINTS

5.2.2.1 Potential health risks of synthetic chemicals affecting the production output

5.2.2.2 Limited the conduct of social events and public outings due to COVID-19

5.2.2.3 High R&D costs for the formulation of unique formulations

5.2.2.4 Compliance with quality and regulatory standards

5.2.3 OPPORTUNITIES

5.2.3.1 High focus on R&D activities to develop unique and customized aroma compounds

5.2.3.2 Masking basic unpleasant odors in household and toiletry products to drive the use of benzenoid chemicals

5.2.4 CHALLENGES

5.2.4.1 Impact due to the COVID-19 pandemic on supply chains and the overall production of benzenoid chemicals

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS

5.4 BENZENOID CHEMICALS MARKET, PRICING ANALYSIS: BY TYPE

FIGURE 21 BENZYL ALCOHOL: AVERAGE PRICE, BY REGION

FIGURE 22 BENZALDEHYDE: AVERAGE PRICE, BY REGION

FIGURE 23 BENZYL ACETATE: AVERAGE PRICE, BY REGION

FIGURE 24 BENZOYL CHLORIDE DERIVATIVE: AVERAGE PRICE, BY REGION

FIGURE 25 BENZYL SALICYLATE: AVERAGE PRICE, BY REGION

FIGURE 26 CINNAMYL AND ITS DERIVATIVES: AVERAGE PRICE, BY REGION

FIGURE 27 BENZYL BENZOATE: AVERAGE PRICE, BY REGION

FIGURE 28 VANILLIN PRECURSOR: AVERAGE PRICE, BY REGION

5.5 BENZENOID CHEMICALS MARKET ECOSYSTEM

6 BENZENOIDS MARKET, BY APPLICATION (Page No. - 51)

6.1 INTRODUCTION

FIGURE 29 GLOBAL BENZENOIDS MARKET SIZE, BY APPLICATION, 2020 VS. 2025

TABLE 3 BENZENOID MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 4 BENZENOID MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

6.2 SOAPS & DETERGENTS

TABLE 5 BENZENOID MARKET SIZE FOR SOAPS & DETERGENTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 BENZENOID MARKET SIZE FOR SOAPS & DETERGENTS, BY REGION, 2018–2025 (KT)

6.3 COSMETICS & PERSONAL CARE PRODUCTS

TABLE 7 BENZENOID MARKET SIZE FOR COSMETICS & PERSONAL CARE PRODUCTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 BENZENOIDS MARKET SIZE FOR COSMETICS & PERSONAL CARE PRODUCTS, BY REGION, 2018–2025 (KT)

6.4 FOOD & BEVERAGE PRODUCTS

TABLE 9 BENZENOIDS MARKET SIZE FOR FOOD & BEVERAGE PRODUCTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 BENZENOID MARKET SIZE FOR FOOD & BEVERAGE PRODUCTS, BY REGION, 2018–2025 (KT)

6.5 HOUSEHOLD PRODUCTS/FINE FRAGRANCES

TABLE 11 BENZENOID MARKET SIZE FOR HOUSEHOLD PRODUCTS/FINE FRAGRANCES, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 BENZENOIDS MARKET SIZE FOR HOUSEHOLD PRODUCTS/FINE FRAGRANCES, BY REGION, 2018–2025 (KT)

6.6 OTHER APPLICATIONS

TABLE 13 BENZENOID MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 BENZENOID MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (KT)

7 BENZENOIDS MARKET, BY TYPE (Page No. - 60)

7.1 INTRODUCTION

FIGURE 30 GLOBAL BENZENOIDS MARKET SIZE, BY TYPE, 2020 VS. 2025

TABLE 16 BENZENOID MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 17 BENZENOID MARKET SIZE, BY TYPE, 2020–2025 (KT)

7.2 BENZYL ALCOHOL

FIGURE 31 TOP BENZYL ALCOHOL EXPORTERS AND IMPORTERS GLOBALLY, 2019

TABLE 18 BENZYL ALCOHOL BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 BENZYL ALCOHOL BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (KT)

7.3 BENZYL ACETATE

TABLE 20 BENZYL ACETATE BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 BENZYL ACETATE BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (KT)

7.4 BENZALDEHYDE

FIGURE 32 COUNTRIES WITH THE LARGEST TRADE VALUE FOR BENZALDEHYDE, 2018

TABLE 22 BENZALDEHYDE BENZENOID MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 BENZALDEHYDE BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (KT)

7.5 CINNAMYL AND ITS DERIVATIVES

TABLE 24 CINNAMYL AND ITS DERIVATIVES BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 CINNAMYL AND ITS DERIVATIVE BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (KT)

7.6 BENZYL SALICYLATE

TABLE 26 BENZYL SALICYLATE BENZENOID MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 BENZYL SALICYLATE BENZENOID MARKET SIZE, BY REGION, 2018–2025 (KT)

7.7 BENZYL BENZOATE

TABLE 28 BENZYL BENZOATE BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 BENZYL BENZOATE BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (KT)

7.8 BENZYL CHLORIDE

TABLE 30 BENZYL CHLORIDE BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 BENZYL CHLORIDE BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (KT)

7.9 VANILLIN/EUGENOL

TABLE 32 VANILLIN BENZENOID MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 VANILLIN BENZENOID MARKET SIZE, BY REGION, 2018–2025 (KT)

7.10 OTHER TYPES

TABLE 34 OTHER BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 OTHER BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (KT)

8 BENZENOIDS MARKET, BY REGION (Page No. - 74)

8.1 INTRODUCTION

FIGURE 33 GEOGRAPHIC SNAPSHOT OF BENZENOIDS MARKET (2020–2025)

TABLE 36 BENZENOIDS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 MARKET SIZE, BY REGION, 2018–2025 (KT)

TABLE 38 MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 39 MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 40 MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 41 BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.2 ASIA PACIFIC

FIGURE 34 COUNTRY-WISE INCREASE IN EXPORT VOLUMES FOR ESSENTIAL OILS, COSMETICS, PERFUMERY, AND TOILETRY PRODUCTS, 2015-2019

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 36 ASIA PACIFIC: BENZENOIDS MARKET SIZE, BY COUNTRY, 2020 VS. 2025 (USD MILLION)

TABLE 42 ASIA PACIFIC: BENZENOIDS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 44 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 46 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 47 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.2.1 CHINA

FIGURE 37 GLOBAL SHARES IN THE BEAUTY INDUSTRY, 2018

TABLE 48 CHINA: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 49 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.2.2 INDIA

FIGURE 38 INDIA: ORGANIC CHEMICALS EXPORTS AND IMPORTS, 2015–2019

TABLE 50 INDIA: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 51 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.2.3 JAPAN

TABLE 52 JAPAN: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 53 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.2.4 AUSTRALIA

TABLE 54 AUSTRALIA: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 55 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.2.5 REST OF ASIA PACIFIC

TABLE 56 REST OF ASIA PACIFIC: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 57 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.3 NORTH AMERICA

FIGURE 39 NORTH AMERICA: NEWLY PATENTED FLAVORS AND FRAGRANCES, JAN 2019–OCT 2020.

FIGURE 40 NORTH AMERICA: BENZENOIDS MARKET SIZE, BY COUNTRY, 2020 VS. 2025 (USD MILLION)

TABLE 58 NORTH AMERICA: BENZENOID MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: BENZENOIDS MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.3.1 US

FIGURE 41 COUNTRY-WISE IMPORTS AND EXPORTS OF ORGANIC CHEMICALS, 2019 (USD MILLION)

TABLE 64 US: BENZENOID MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 65 US: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.3.2 CANADA

TABLE 66 CANADA: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 67 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.3.3 MEXICO

TABLE 68 MEXICO: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 69 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.4 SOUTH AMERICA

FIGURE 42 SOUTH AMERICA: BENZENOIDS MARKET SIZE, BY COUNTRY, 2020 VS. 2025 (USD MILLION)

TABLE 70 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 71 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 72 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 74 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 75 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.4.1 BRAZIL

FIGURE 43 SOUTH AMERICA: COUNTRY-WISE ORGANIC CHEMICALS EXPORT SHARES, 2019

TABLE 76 BRAZIL: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 BRAZIL: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.4.2 COLOMBIA

TABLE 78 COLOMBIA: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 79 COLOMBIA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.4.3 REST OF SOUTH AMERICA

TABLE 80 REST OF SOUTH AMERICA: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 81 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.5 EUROPE

FIGURE 44 EUROPEAN CHEMICALS INDUSTRY PRODUCTION: SECTOR-WISE SHARES, 2018

FIGURE 45 EUROPE: BENZENOIDS MARKET SIZE, BY COUNTRY, 2020 VS. 2025 (USD MILLION)

TABLE 82 EUROPE: BENZENOID MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 83 EUROPE: BENZENOID MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 84 EUROPE: BENZENOID MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 EUROPE: BENZENOID MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 86 EUROPE: BENZENOID MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 EUROPE: BENZENOID MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.5.1 GERMANY

FIGURE 46 INCREASING ORGANIC CHEMICALS EXPORTS IN GERMANY, 2012–2019

TABLE 88 GERMANY: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 89 GERMANY: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.5.2 UK

TABLE 90 UK: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 91 UK: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.5.3 FRANCE

TABLE 92 FRANCE: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 93 FRANCE: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.5.4 SPAIN

TABLE 94 SPAIN: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 95 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.5.5 ITALY

TABLE 96 ITALY: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 97 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.5.6 SWITZERLAND

TABLE 98 SWITZERLAND: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 99 SWITZERLAND: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.5.7 REST OF EUROPE

TABLE 100 REST OF EUROPE: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.6 MIDDLE EAST & AFRICA

FIGURE 47 MIDDLE EAST & AFRICA: BENZENOIDS MARKET SIZE, BY COUNTRY, 2020 VS. 2025 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA: BENZENOIDS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA: BENZENOIDS MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 104 MIDDLE EAST & AFRICA: BENZENOIDS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA: BENZENOIDS MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 106 MIDDLE EAST & AFRICA:MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.6.1 MIDDLE EAST

TABLE 108 MIDDLE EAST: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 109 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.6.2 SOUTH AFRICA

FIGURE 48 GROWTH OF THE INDUSTRY SEGMENT IN SUB-SAHARAN AFRICAN FROM 2018–2023

TABLE 110 SOUTH AFRICA: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 111 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

8.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 112 REST OF MIDDLE EAST & AFRICA: BENZENOIDS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 113 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

9 COMPETITIVE LANDSCAPE (Page No. - 126)

9.1 OVERVIEW

9.2 MARKET SHARE ANALYSIS

FIGURE 49 BENZENOIDS MARKET: COMPANY MARKET SHARE OF PRODUCT MANUFACTURERS, 2020

9.3 MARKET EVALUATION FRAMEWORK

FIGURE 50 BENZENOIDS MARKET: TRENDS IN COMPANY STRATEGIES, 2016–2020

9.4 COMPETITIVE SCENARIO

9.4.1 EXPANSIONS, 2017–2019

TABLE 114 EXPANSIONS, 2017–2019

9.4.2 ACQUISITIONS, 2016–2020

TABLE 115 ACQUISITIONS, 2019

9.4.3 NEW PRODUCT LAUNCHES, 2018

TABLE 116 NEW PRODUCT LAUNCHES, 2018

9.4.4 JOINT VENTURES, 2019

TABLE 117 JOINT VENTURES, 2019

9.5 COVID-19-SPECIFIC COMPANY RESPONSE

10 COMPANY EVALUATION MATRIX & COMPANY PROFILES (Page No. - 132)

10.1 COMPANY EVALUATION MATRIX (OVERALL MARKET)

10.1.1 STARS

10.1.2 PERVASIVE PLAYERS

10.1.3 EMERGING LEADERS

10.1.4 PARTICIPANTS

FIGURE 51 COMPANY EVALUATION MATRIX, 2019

10.2 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

10.2.1 PROGRESSIVE COMPANIES

10.2.2 STARTING BLOCKS

10.2.3 RESPONSIVE COMPANIES

10.2.4 DYNAMIC COMPANIES

FIGURE 52 BENZENOIDS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

10.3 COMPANY PROFILES

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

10.3.1 JAYSHREE AROMATICS PVT. LTD.

FIGURE 53 JAYSHREE AROMATICS PVT. LTD.: SWOT ANALYSIS

10.3.2 TENNANTS FINE CHEMICALS LTD.

FIGURE 54 TENNANTS FINE CHEMICALS LTD.: SWOT ANALYSIS

10.3.3 EMERALD KALAMA CHEMICAL

FIGURE 55 EMERALD KALAMA CHEMICAL: SWOT ANALYSIS

10.3.4 LANXESS

FIGURE 56 LANXESS: COMPANY SNAPSHOT

FIGURE 57 LANXESS: SWOT ANALYSIS

10.3.5 VALTRIS SPECIALTY CHEMICALS

FIGURE 58 VALTRIS SPECIALTY CHEMICALS: SWOT ANALYSIS

10.3.6 ETERNIS FINE CHEMICALS

10.3.7 TIANJIN DACALS CHEMICAL CO., LTD.

10.3.8 TIANJIN DONGDA CHEMICAL GROUP CO., LTD.

10.3.9 FIRMENICH

FIGURE 59 FIRMENICH: SWOT ANALYSIS

10.3.10 SIGMA-ALDRICH

10.3.11 ALFA AESAR

10.3.12 PREMIER GROUP OF INDUSTRIES

10.3.13 INDUKERN F&F INGREDIENTS

10.3.14 KADILLAC CHEMICALS PVT. LTD.

10.3.15 PRAKASH CHEMICALS INTERNATIONAL PVT. LTD.

10.3.16 ELAN CHEMICAL

10.3.17 SYMRISE

FIGURE 60 SYMRISE: COMPANY SNAPSHOT

10.3.18 BASF

FIGURE 61 BASF: COMPANY SNAPSHOT

FIGURE 62 BASF: SWOT ANALYSIS

10.3.19 S.H. KELKAR & CO. PVT. LTD.

FIGURE 63 S.H. KELKAR & CO. PVT. LTD.: COMPANY SNAPSHOT

10.3.20 INTERNATIONAL FLAVORS & FRAGRANCES, INC. (IFF)

FIGURE 64 INTERNATIONAL FLAVORS & FRAGRANCES, INC. (IFF): COMPANY SNAPSHOT

FIGURE 65 INTERNATIONAL FLAVORS & FRAGRANCES, INC. (IFF): SWOT ANALYSIS

10.3.21 AXXENCE AROMATIC GMBH

10.3.22 SOLVAY

FIGURE 66 SOLVAY: COMPANY SNAPSHOT

10.3.23 UBE INDUSTRIES, LTD.

FIGURE 67 UBE INDUSTRIES, LTD.: COMPANY SNAPSHOT

10.3.24 KAO CORPORATION

FIGURE 68 KAO CORPORATION: COMPANY SNAPSHOT

10.3.25 YINGYANG (CHINA) AROMA CHEMICAL GROUP

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 178)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

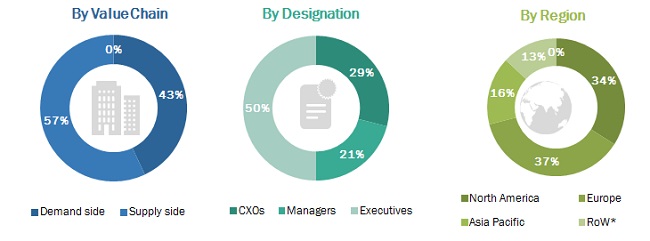

The study involved four major activities in estimating the benzenoid chemicals market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources, such as the International Fragrance Association (IFRA), United States Department of Agriculture (USDA), Food and Agriculture Organization (FAO), Fragrances and Flavours Association of India (FAFAI), European Food Safety Authority (EFSA) and Flavor and Extract Manufacturers Association of the United States (FEMA), were referred to identify and collect information for this study. The secondary sources also include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include raw material suppliers, crude oil manufacturers, traders & retailers, wholesalers, distributors, importers, and exporters of benzenoid chemicals. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply-side include chemical manufacturers. The primary sources from the demand-side include distributors, importers, exporters, and end-consumers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Market size estimation involves the determination of segmental revenue sales for benzenoid chemicals of the top 20 manufacturers operating in the global market and validating the same with the determination of volume sales through a top-down approach.

- Approach 1:

- Mapping of key benzenoid chemicals manufacturers operating in the market through taking into consideration of several key factors such as annual revenue, annual production capacity and its global presence

- Determining the segment revenue sales which is responsible for generating sales of benzenoid chemicals for each manufacturer

- Taking into on several factors such as market being fragmented comprising of more than 30 active players in the global market, ascertaining collective value share for top 20 players

- Approach 2:

- Determination of annual consumption of each benzenoid chemical in terms of volume sales (tons) at the global level

- With reference to key secondary sources, determined the consumption of each of the benzenoid chemicals at the regional level; this step not only provided share splits of market segment by type at regional level but also at the global level

- Initiated summation of benzenoid chemicals regional consumption to arrive at the global volume sales in terms of kilotons (KT)

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the benzenoid chemicals were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Benzenoid Chemicals Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into the product type segment and application segment. To estimate the overall benzenoid chemicals market and arrive at the exact statistics for all subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the benzenoid chemicals market, in terms of type, application, and region

- To describe and forecast the benzenoid chemicals market, in terms of value and volume, by region-Asia Pacific, Europe, North America, South America and Middle East & Africa-along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of benzenoid chemicals market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the benzenoid chemicals market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches, such as acquisitions, expansions, product launches, and agreements & partnerships, in the benzenoid chemicals market

- This research report categorizes the benzenoid chemicals market based on type, application, and region

Available Customizations

- With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

- The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Application analysis, which gives a detailed analysis of all applications in the benzenoid chemicals market

Regional Analysis

- Further breakdown of the Rest of Europe benzenoid chemicals market into Russia, and Poland

- Further breakdown of the Rest of Asia Pacific benzenoid chemicals market into Indonesia, Malaysia, South Korea, and Singapore

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Benzenoid Market