Mining Machinery Market by Machinery Category (Crushing, Pulverizing & Screening, Mineral Processing, Surface & Underground), Application, Power Output, Electric & Hybrid Machinery (Mining Trucks, LHD), Battery Chemistry Region - Global Forecast to 2030

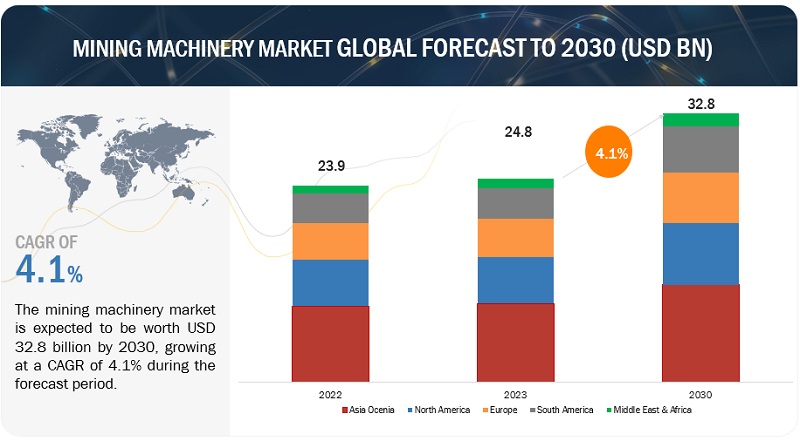

[359 Pages Report] The mining machinery market is projected to grow from USD 24.8 billion in 2023 to USD 32.8 billion by 2030 at a CAGR of 4.1%. The market is being propelled by a range of factors driving widespread adoption at the global level. The rise in the extraction of minerals, metals, and coal from mines is majorly contributing to the growth of the market. Autonomous mining trucks navigate predetermined paths precisely, reducing fuel consumption and human error while boosting safety and production volume. Electrification trends in the market in China, Japan, US and Europe are gaining traction with leading suppliers such as Komatsu, Caterpillar, Epiroc, and Sandvik.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Increasing use of electric machinery in underground mining

The electrification of mining machinery remains a crucial driver of the mining machinery market, and the demand for electric equipment is increasing due to lower operating costs, improved safety, and reduced need for ventilation. This makes it a suitable choice for use in underground mining operations. Diesel engines produce a lot of heat, fumes, and noise, making working in these regions unbearable. In addition, by 2040, the International Council on Mining and Metals is looking forward to seeing surface mining equipment that does not emit greenhouse gases, driving the need for cleaner and safer machinery. Although this type requires a high initial capital investment cost, it takes less time to pay back than if one used diesel-driven machines, making it more economical. This allows manufacturers to leverage this shift by investing more in research and development (R&D) of batteries, charging infrastructure, and autonomous operations while partnering with miners who will provide a real-world testing environment for them. Such transitions are especially important in areas like the Asia Pacific region, the Americas, and Europe, where there is an escalating requirement for emission-free equipment driven by rising cooling costs and strict emission standards. Companies including Komatsu, Caterpillar, and Hitachi are involved in developing advanced versions of electric mining machinery, speeding up the electrification trend in the sector.

RESTRAINT: Export of used mining machinery to emerging economies

Due to the increased mining activities, there is a growing demand for mining equipment in all emerging economies. These emerging economies have budget constraints and look for cost-effective options due to limited capital for initial investment purposes. Countries such as South Africa, Argentina, and Peru, to name a few, generally opt for used mining machinery since they have a reliable life cycle if appropriately maintained. Used mining equipment offers a more affordable alternative to new machinery, especially for businesses with limited capital. When looking for a cheaper option for heavy machinery and other tools, used mining equipment is more budget-friendly than new equipment for those with restricted financial resources—as such, buying a second-hand device much quicker than its brand-new substitute is possible, which implies less idleness. One can get used drills, loaders, trucks, and processing plants from the market and sell them, as they still have quite some years remaining if taken care of well. Companies offer used mining equipment for all types of mining machinery. For instance, Machinery & Equipment Co., Inc. provides a platform to buy and sell used machinery. Also, Komatsu and CAT are some of the leading companies offering used equipment for their users. The export of used mining machinery to emerging economies creates a challenge for the new mining equipment market, as many businesses in these regions choose more affordable second-hand options, reducing the demand for new machinery.

OPPORTUNITY: Use of autonomous mining machinery

Various sectors have adopted autonomous vehicles, including mining, construction, and agriculture. Autonomous vehicle technologies leverage advanced AI capabilities, GPS systems, and sensor networks to reduce the manual labor users need. The oil, gas, and mining industries operate under harsh environments with very high or low temperatures, excessive pressure levels, poisonous gases, and unruly terrains that may endanger people working there. The use of autonomous machines (which do not require on-site human presence) in these danger zones helps combat such risks and ensure uninterrupted work, even in areas that are too dangerous for workers to exist. Thus, manufacturers are developing self-driving mining machinery that wirelessly transmits its condition status reports, executes commands from a distance, and jams radio frequencies from other instruments. For instance, Hitachi's construction machinery designs autonomous technologies to make mining safer, more efficient, and more productive for large-scale hydraulic excavators and dumpers. They have also developed remote-controlled systems and an Autonomous Haulage System (AHS), which can be installed on up to 100 truck systems. Other key players in this sector include Caterpillar Inc. (USA), Volvo Construction Equipment (Sweden), and Komatsu Ltd.(Japan), which manufacture automated mining trucks for several destinations across the globe. The availability of autonomous equipment in mining is an excellent opportunity to improve safety and economic efficiency and reduce operation costs while motivating innovations within the machinery sector.

CHALLENGE: Lack of standardization in mining machinery

The lack of standardization in mining machinery presents a significant challenge for manufacturers, particularly when meeting emissions standards across various regions. Since each region has its regulatory regime, like Stage V in Europe and Tier 4 final in the US, it complicates the machines' designs, manufacture, and approval. Manufacturers are, therefore, forced to produce different versions of the same machinery to adhere to these varying standards, increasing production costs and reducing their chances of benefiting from economies of scale. The absence of common technical standards complicates the international supply chain, making it hard for manufacturers to buy assorted components for specific markets. This makes it expensive for both maker and user alike, limiting the number of products available in the market while raising prices. Inconsistencies between regulations, especially in regions like the EU, where rules vary between member states, create delays in product launches and market entry. As a result, the ability of mining machines to be exported is significantly reduced, while cross-country usage is also limited.

New after-treatment systems required to meet strict emissions standards complicate matters and make machine production much more expensive. The costs of adhering to these regulations are challenging for smaller producers since their production capacity is rarely large enough to balance compliance costs. Overall, the lack of standardization in mining machinery hampers innovation, increases costs, and reduces market growth potential, making it difficult for manufacturers to operate efficiently across multiple regions.

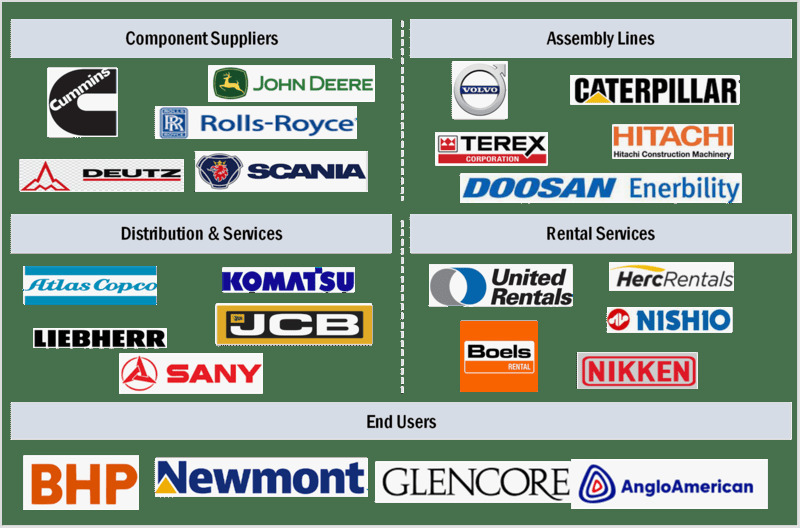

Mining Machinery Market Ecosystem.

The major players in the mining machinery market have the latest technologies, diversified portfolios, and strong distribution networks globally. The major players in the market are Caterpillar Inc (US), Komatsu Ltd (Japan), Sandvik AB (Sweden), Epiroc AB (Sweden), and Liebherr (Switzerland).

Bill of Materials in Mining Machinery (%), 2021 vs. 2030

The BOM provides a structured breakdown of the equipment's composition, including quantities, specifications, and supplier information for each item. Depending on the type of mining machinery, the percentages in the bill of materials may change, but steel is typically used most frequently in mining machinery.

“Electric and Hybrid mining trucks are estimated to hold the largest market share.”

For several reasons, the market share of electric and hybrid mining trucks, like dumpers and tipper trucks, is bigger than that of electric and hybrid LHD dumpers. In surface and underground mining operations, these trucks move massive quantities of materials, which makes them very advantageous because of their diesel engine-electric battery combination. While diesel fuel is saved and emissions are reduced during use, it is helpful in underground areas where ventilation is very important. When required, they also deliver extra power, increasing performance and productivity; furthermore, they decrease noise levels, making it easier on long shifts for operators. Conversely, electric and hybrid LHD dumpers are more efficient and save costs, but they are intended for very specialized activities underground and have low ventilation costs. Therefore, the wider use and benefits of electric and hybrid mining trucks lead to their more significant underground mining equipment market share.

Major companies that offer electric dump trucks include Komatsu Ltd. (Japan), Caterpillar Inc. (US), Epiroc AB (Sweden), and Sandvik AB (Sweden). Other than this, in August 2022, Vale (Brazil), in partnership with XCMG Mining Machinery Co., Ltd., a subsidiary of Xuzhou Construction Machinery Group Co. Ltd. (XCMG), tested its 100% electric mining truck in the mines of Agua Limpa located within Minas Gerais and Sorowako found in Indonesia. Therefore, electric and hybrid mining trucks are gaining significance due to their broader applications, including fuel savings and reduced emissions, especially in surface and underground mining. Their flexibility and enhanced performance are key factors that make them better preferred over electric and hybrid LHD dumpers.

“Lithium iron phosphate battery chemistry type is estimated to lead the electric and hybrid mining machinery market.”

Lithium iron phosphate (LFP) batteries are estimated to lead the electric mining machinery market, according to battery chemistry, during the forecast period. Unlike nickel manganese cobalt (NMC) batteries, LFP batteries use phosphate as their cathode material, which offers high electrochemical stability, better temperature resistance, and lower charge flow resistance. Consequently, some positive outcomes are higher efficiency, greater safety, and longer cycles. One reason LFP batteries are cheaper than others is that they use readily available raw materials that are less costly to manufacture. This has attracted some big names in the industry, such as Caterpillar Inc., Sandvik AB, and Sany Group, who have started using LFP batteries in their mining trucks and loaders, further expanding their market share. Even though LFP batteries possess a lower energy density, meaning they will occupy more physical space to store the same amount of power, their longevity characteristics, fast charge times, and low servicing requirements explain why they are the most preferred choice by mining firms.

“Surface Mining is speculated to hold the largest share of the autonomous mining machinery market .”

By 2030, the surface mining segment is expected to dominate the market for autonomous mining machinery. One of the driving factors is that surface mining is much safer and friendlier and, therefore, more accessible to mine than underground. Compared to conventional machines, this equipment can perform much better, with improvements between 40% and 80%. For instance, Scania AB and Rio Tinto have joined forces to create autonomous haul trucks to improve efficiency and reduce emissions at their Channar site. Hexagon has partnered with Liebherr in a similar move towards mining automation. There are various reasons why this trend must continue; enhanced efficiency (faster operations), safety (no human intervention), and reduced operational risks (since they work round-the-clock) all form the fundamental basis of why these vehicles' tractions on these terrains should pick up. Surface mines will likely expand rapidly as more businesses come on board to use such technology.

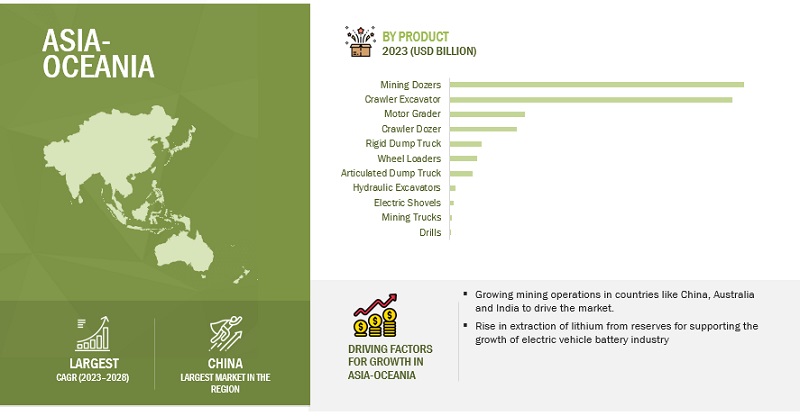

“Asia Oceania is predicted to be the largest market for mining machinery.”

Asia Oceania leads the global mining machinery market, with China, Australia, India, and Japan driving demand. In 2023, China and Australia accounted for >60% of the region's market share. This dominance is due to the high number of active mines and the increased exportation of unused mines. The area is seeing a growing need for metals and minerals, driven by industrial and infrastructure development. India, for instance, has abundant mineral reserves of bauxite, iron, chromite, and more, with the mineral processing equipment market driven by government regulations and domestic demand. The government owns about 70% of mining companies in India. As surface deposits are exhausted, the demand for underground mining equipment increases. Some major global players such as BEML, Caterpillar, and Hitachi have installed their manufacturing units and entered Joint Ventures with local counterparts in India.

With considerable lithium resources in batteries for electric vehicles (EVs), mine workings in China have raised expectations about the need for sophisticated machines. Also, there is a rising demand for minerals such as coal, copper, and gold, but a few pressurizes mining firms to modernize their extraction processes to boost efficiency. Many top mining equipment manufacturers are based in Asia Pacific, supporting the production of innovative machinery. Strict emission standards in China, India, and Japan encourage a shift toward electric equipment, offering zero-emission alternatives. The region's growth is also supported by economic factors such as decreasing battery costs and long-term savings from electric operations.

Some of the major players are Caterpillar Inc (US), Komatsu Ltd (Japan), Sandvik AB (Sweden), Epiroc AB (Sweden), and Liebherr (Switzerland)

Key Market Players

The mining machinery market needs to be more cohesive. Caterpillar Inc. (US), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Epiroc AB (Sweden), and Liebherr (Switzerland) are the key companies operating in it. These companies adopted new product launches, partnerships, and joint ventures to gain traction in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Forecast units |

Volume (Units) and Value (USD Million/Billion) |

|

Segments Covered |

By Machinery Category, Application, Propulsion, Electric & Hybrid Mining Machinery Market By Type, Electric & Hybrid Mining Machinery Market By Battery Chemistry, Autonomous Mining Machinery Market By Mining Category, and Region. |

|

Geographies covered |

Asia Oceania, North America, Europe, South America, and Middle East, and Africa |

|

Companies covered |

Caterpillar Inc (US), Komatsu Ltd (Japan), Sandvik AB (Sweden), Epiroc AB (Sweden) and Liebherr (Switzerland) |

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs.

The study segments the mining machinery market:

By Machinery Category

- Crushing, Pulverizing, Screening Machinery

- Mineral Processing Machinery

- Surface Mining Machinery

- Underground Mining Machinery

By Application

- Metal

- Mineral

- Coal

By Power Output

- < 500 HP

- 500 – 2,000 HP

- > 2,000 HP

By Propulsion

- Diesel

- CNG/LNG/RNG

By Electric & Hybrid Mining Machining Market, By Type

- Electric & Hybrid Mining Trucks

- Electric & Hybrid Load Haul Dump Loaders (LHD)

By Electric & Hybrid Mining Machining Market, By Battery Chemistry

- Lithium Iron Phosphate Battery (LFP)

- Nickel Manganese Cobalt Battery (NMC)

- Others

By Autonomous Mining Machining Market, By Mining Category

- Surface Mining

- Underground Mining

By Region

- Asia Oceania

- North America

- South America

- Europe

- Middle East & Africa

Recent Developments

- In June 2023, Caterpillar Inc. announced the launch of the new Cat 995 Wheel Loader, which increased up to 19% productivity from the previous model and a 6% increase in hydraulic force with equal hydraulic cycle time. Also, it delivers up to 13% lower hourly fuel consumption and offers an additional 8% efficiency gain.

- In May 2023, Epiroc AB launched a new flagship radio remote drill rig named SmartROC T25 R. This compact drill rig is designed for construction and quarrying and has several valuable features and technologies.

- In May 2023, Sandvik AB (Sweden) expanded its battery center of excellence in Camarillo, California, to strengthen its position as underground mining's leading battery-electric innovator. This phased expansion benefited the company by increasing battery production and testing space and adding more R&D to improve its battery and charger technology development. It also added warehouse and office space and increased the site's training and touring capabilities for customers.

- In April 2023, Epiroc AB acquired a South African mining equipment manufacturer. AARD designs and manufactures a wide range of mining equipment, specializing in low-profile underground machines for mines with low mining heights. It also provides services and support to its customers.

- In May 2022, Caterpillar Inc (US) acquired Tangent Energy Solutions (US), an energy-as-a-service (EaaS) company. Tangent Energy Solutions offers customers complete turnkey solutions for lowering energy expenses, raising energy effectiveness, reducing emissions, monetizing assistance for the electric grid, and ensuring operational resilience. With Tangent Energy, the acquisition was made to create new revenue streams. Caterpillar's extensive lineup of electric power supplies is complemented by Solution's EaaS services, providing. Caterpillar Inc. can better serve its customers with dependable, effective, sustainable, and connected power solutions that support business operations.

- In January 2022, Hitachi Construction Machinery Co., Ltd. announced the launch of ConSite Mine to the global market. It is a service solution that provides machine analytics to help resolve issues at mining sites. It uses IoT to monitor mining machinery remotely 24 hours a day and AI to analyze its operational condition

Frequently Asked Questions (FAQ):

What is the current size of the global mining machinery market?

The mining machinery market is projected to grow from USD 24.8 billion in 2023 to USD 32.8 billion by 2030, at a CAGR of 4.1%.

Which mining machinery category would be leading the mining machinery market?

The surface mining machinery category would lead the mining machinery market due to the lack of expensive ventilation and tunneling machinery as it works in an open environment, surface mining is often less expensive than underground mining. As a result, surface mining becomes a more appealing choice for mining corporations, particularly in regions with high labor costs

Many companies are operating in the mining machinery market space across the globe. Do you know who the front leaders are and what strategies they have adopted?

The mining machinery market is moderately fragmented. Caterpillar Inc (US), Komatsu Ltd (Japan), Sandvik AB (Sweden), Epiroc AB (Sweden), and Liebherr (Switzerland) are the key companies operating in the mining machinery market.

How does the demand for mining machinery vary by region?

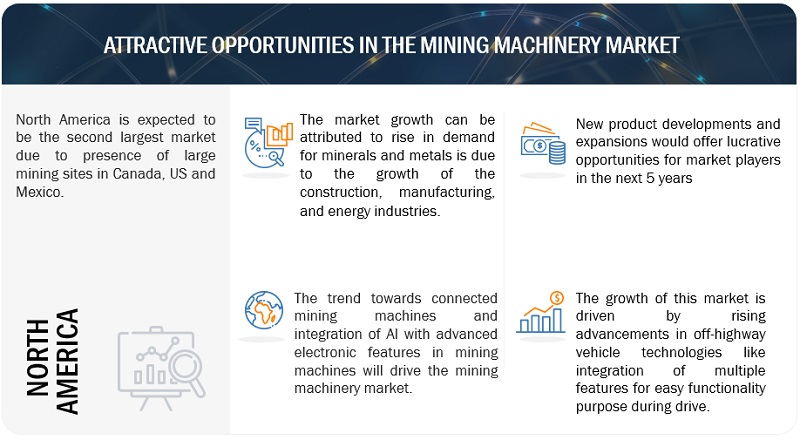

Asia Oceania is estimated to be the largest market for mining machinery during the forecast period, followed by North America. The growth of the mining machinery market in Asia Oceania is mainly attributed to the rise in mining activities in countries like China, Australia, and India.

What are the growth opportunities for the mining machinery supplier?

Increased demand for minerals and metals, rise in the extraction of lithium for the electric vehicle industry, exploration of new mines, and expansion of existing mines would create growth opportunities for the mining machinery market. Also, an upsurge in demand for advanced technologies like automation and digitization in mining operations would further influence the growth opportunities for the mining machinery market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing use of electric machinery in underground mining- Increasing demand for metals and commodities and rising count of active minesRESTRAINTS- Export of used mining machinery to emerging economies- International trade policies and relationsOPPORTUNITIES- Developments in autonomous mining machinery- Rising use of telematics services in mining machineryCHALLENGES- Lack of standardization in mining machinery- Cyberattacks

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.6 REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America: Regulatory bodies, government agencies, and other organizations- Europe: Regulatory bodies, government agencies, and other organizations- Asia Pacific: Regulatory bodies, government agencies, and other organizations- Middle East: Regulatory bodies, government agencies, and other organizations- Rest of the World: Regulatory bodies, government agencies, and other organizationsREGULATORY ANALYSIS- Non-road mobile machinery (NRMM) emission regulation outlook, 2019–2025- North America- Europe- Asia

- 5.7 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.8 TECHNOLOGY ANALYSISADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND ANALYTICSREAL-TIME LOCATION SYSTEM TECHNOLOGY (RTLS)

-

5.9 AVERAGE SELLING PRICE TREND OF MINING MACHINERYPRICE TREND, BY REGION, 2020 VS. 2022PRICE TREND, BY MACHINERY TYPE, 2020 VS. 2022

-

5.10 TRADE ANALYSISIMPORT DATA- US- Canada- China- Japan- India- Germany- FranceEXPORT DATA- US- Canada- China- Japan- India- Germany- France

-

5.11 PATENT ANALYSIS

-

5.12 CASE STUDY ANALYSISCASE STUDY 1: AUTOMATION IN MINING BY ERICSSONCASE STUDY 2: NAI HARNESSES & BOX BUILDS HELP CONTROL MINING OPERATIONS IN CHINA

- 5.13 BUYING CRITERIA

- 5.14 BILL OF MATERIALS

- 5.15 ELECTRIFICATION TREND IN MINING MACHINERY MARKET

- 5.16 RENTAL AND LEASING MODELS

- 6.1 LUCRATIVE OPPORTUNITIES IN ASIA OCEANIA AND SOUTH AMERICA FOR MINING MACHINERY MANUFACTURERS

- 6.2 ELECTRIC MINING MACHINERY TO ADD MORE VALUE TO MINING MACHINERY MARKET

- 6.3 CONCLUSION

-

7.1 INTRODUCTIONINDUSTRY INSIGHTS

-

7.2 CRUSHING, PULVERIZING, AND SCREENING MACHINERYRISE IN DEMAND FOR BETTER PROCESSED MINE MATERIALS TO DRIVE MARKET

-

7.3 MINERAL PROCESSING MACHINERYINCREASE IN DEMAND FOR SOPHISTICATED AND EFFECTIVE MINERAL PROCESSING METHODS TO DRIVE MARKET

-

7.4 SURFACE MINING MACHINERYARTICULATED DUMP TRUCKS- Better operational stability in extreme terrain conditions to drive marketCRAWLER DOZERS- Versatile operational capability to drive marketCRAWLER EXCAVATORS- High traction capability to drive marketMOTOR GRADERS- Rise in demand for precise grading of materials to drive marketRIGID DUMP TRUCKS- Easy maneuverability feature to drive market

-

7.5 UNDERGROUND MINING MACHINERYDRILLS- Rising demand for high production efficiency in drilling operations at mines to drive marketELECTRIC SHOVELS- Convenient operational ability in coal and rock loading activities in mines to drive marketHYDRAULIC EXCAVATORS- Increase in demand for versatile operational machines in mines to drive marketMINING DOZERS- Increasing mining activities to drive marketMINING TRUCKS- Growing requirement for material transport in narrow and confined underground spaces to drive marketWHEELED LOADERS- Quick cycle time in operation to drive market

-

8.1 INTRODUCTIONINDUSTRY INSIGHTS

-

8.2 COALINCREASING ENERGY DEMAND TO DRIVE MARKET

-

8.3 METALUPSURGE IN DEMAND FOR METALS FOR VARIED APPLICATIONS TO DRIVE MARKET

-

8.4 MINERALUSE OF AUTOMATION TECHNOLOGY TO DRIVE MARKET

-

9.1 INTRODUCTIONINDUSTRY INSIGHTS

-

9.2 <500 HPLIGHT-DUTY TASKS IN MINING OPERATIONS TO DRIVE MARKET

-

9.3 500-2,000 HPVERSATILE OPERATING NATURE ON MINING FIELDS TO DRIVE MARKET

-

9.4 >2,000 HPDEMAND FOR HIGH-POWER MACHINES FOR HEAVY MINING OPERATIONS TO DRIVE MARKET

-

10.1 INTRODUCTIONINDUSTRY INSIGHTS

-

10.2 DIESELDEMAND FOR HIGH TORQUE TO DRIVE MARKET

-

10.3 CNG/LNG/RNGDEMAND FOR ALTERNATE FUELS TO DRIVE MARKET

-

11.1 INTRODUCTIONINDUSTRY INSIGHTS

-

11.2 ELECTRIC & HYBRID MINING TRUCKSENVIRONMENTAL SUSTAINABILITY TO DRIVE MARKET

-

11.3 ELECTRIC & HYBRID LOAD-HAUL-DUMP (LHD) LOADERSREDUCTION IN NOISE POLLUTION IN UNDERGROUND MINES TO DRIVE MARKET

-

12.1 INTRODUCTIONINDUSTRY INSIGHTS

-

12.2 LITHIUM IRON PHOSPHATE (LFP)LOW MANUFACTURING COST TO DRIVE MARKET

-

12.3 LITHIUM NICKEL MANGANESE COBALT (NMC)HIGHER ENERGY DENSITY TO DRIVE MARKET

- 12.4 OTHERS

-

13.1 INTRODUCTIONINDUSTRY INSIGHTS

-

13.2 SURFACE MININGREPETITIVE SURFACE MINING OPERATIONS TO DRIVE MARKET

-

13.3 UNDERGROUND MININGHIGH SAFETY REQUIREMENTS IN UNDERGROUND MINING OPERATIONS TO DRIVE MARKET

-

14.1 INTRODUCTIONINDUSTRY INSIGHTS

-

14.2 ASIA OCEANIARECESSION IMPACT ANALYSISCHINA- Abundance of mineral reserves to drive marketINDIA- Underground mining machinery to drive marketJAPAN- High reserves of gold and silver to drive marketINDONESIA- Rising contribution of mining industry to GDP to drive marketAUSTRALIA- Crawler excavator segment to drive market

-

14.3 EUROPERECESSION IMPACT ANALYSISFRANCE- Large reserves of coal and uranium to drive marketGERMANY- Rise in demand for mining drills to drive marketITALY- Growing underground mining activities to drive marketSPAIN- Tedious mining process to extract tungsten to drive marketUK- Rise in demand for extraction of non-ferrous minerals to drive marketRUSSIA- Wide range of mineral reserves to drive marketREST OF EUROPE

-

14.4 NORTH AMERICARECESSION IMPACT ANALYSISCANADA- Growing demand for rare elements such as lithium to drive marketMEXICO- Rise in demand for precious metals and minerals such as silver to drive marketUS- Rise in safety requirements to drive market

-

14.5 SOUTH AMERICARECESSION IMPACT ANALYSISBRAZIL- Rise in iron ore extraction activities from mines to drive marketCHILE- Government support to mining activities to drive marketPERU- Rise in mining projects to drive marketARGENTINA- Lithium reserves in Argentina to drive marketREST OF SOUTH AMERICA

-

14.6 MIDDLE EAST & AFRICARECESSION IMPACT ANALYSISSOUTH AFRICA- Untapped mining sites to drive marketSAUDI ARABIA- Rise in demand for rare metals and minerals to drive marketREST OF MIDDLE EAST & AFRICA

- 15.1 OVERVIEW

- 15.2 MARKET SHARE ANALYSIS

- 15.3 REVENUE ANALYSIS

-

15.4 COMPANY EVALUATION MATRIXTERMINOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

15.5 COMPETITIVE SCENARIOSPRODUCT LAUNCHESDEALSEXPANSIONS

- 15.6 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN

-

16.1 KEY PLAYERSCATERPILLAR INC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKOMATSU LTD- Business overview- Products/Solutions/Services offered- MnM viewSANDVIK AB- Business overview- Products/Solutions/Services offered- MnM viewEPIROC AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLIEBHERR- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHITACHI CONSTRUCTION MACHINERY CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsDOOSAN ENERBILITY- Business overview- Products/Solutions/Services offered- Recent developmentsAB VOLVO- Business overview- Products/Solutions/Services offered- Recent developmentsSANY GROUP- Business overview- Products/Solutions/Servies offeredJCB- Business overview- Products/Solutions/Services offered- Recent developments

-

16.2 ADDITIONAL PLAYERSLIUGONG MACHINERY CO., LTD.KOBELCO CONSTRUCTION MACHINERY CO., LTDSUMITOMO HEAVY INDUSTRIES, LTD.XUZHOU CONSTRUCTION MACHINERY GROUPHYUNDAI CONSTRUCTION EQUIPMENT CO., LTD.TEREX CORPORATIONBHARAT EARTH MOVERS LIMITED (BEML)ASTEC INDUSTRIES, INC.WIRTGEN GROUPMINE MASTER LTD.FIORI GROUP S.P.AJSC “KOPEYSK MACHINE-BUILDING PLANT”BELL EQUIPMENTAARD MINING EQUIPMENTWACKER NEUSON SEBELAZ

- 17.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

17.4 CUSTOMIZATION OPTIONSAUTONOMOUS MINING MACHINERY MARKET, BY LEVEL OF AUTOMATION- Semi-autonomous- Fully-autonomousMINING MACHINERY MARKET, BY COUNTRY AND MACHINERY CATEGORY- Crushing, pulverizing, and screening- Mineral processing

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

- TABLE 1 CURRENCY EXCHANGE RATES

- TABLE 2 LIST OF SOME ELECTRIC MINING MACHINERY FROM MANUFACTURERS

- TABLE 3 LIST OF ACTIVE MINES, REGIONAL LEVEL, 2022–2023

- TABLE 4 GLOBAL TRADE POLICIES ON MINING MACHINERY

- TABLE 5 LIST OF SOME AUTONOMOUS MINING MACHINERY BY MANUFACTURERS

- TABLE 6 PROMINENT MINING MACHINERY PLAYERS OFFERING TELEMATICS SOLUTIONS

- TABLE 7 MINING MACHINERY MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 US: TIER 4 EMISSION STANDARDS

- TABLE 9 EUROPEAN UNION: STAGE V EMISSION STANDARDS

- TABLE 10 CHINA: CHINA IV EMISSION STANDARDS

- TABLE 11 INDIA: BS IV EMISSION STANDARDS

- TABLE 12 INDIA: BS V EMISSION STANDARDS

- TABLE 13 MARKET: KEY CONFERENCES AND EVENTS

- TABLE 14 PRICE TREND ANALYSIS: BY REGION

- TABLE 15 PRICE TREND ANALYSIS: BY MACHINERY TYPE

- TABLE 16 US: MINING MACHINERY IMPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 17 CANADA: MINING MACHINERY IMPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 18 CHINA: MINING MACHINERY IMPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 19 JAPAN: MINING MACHINERY IMPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 20 INDIA: MINING MACHINERY IMPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 21 GERMANY: MINING MACHINERY IMPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 22 FRANCE: MINING MACHINERY IMPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 23 US: MINING MACHINERY EXPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 24 CANADA: MINING MACHINERY EXPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 25 CHINA: MINING MACHINERY EXPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 26 JAPAN: MINING MACHINERY EXPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 27 INDIA: MINING MACHINERY EXPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 28 GERMANY: MINING MACHINERY EXPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 29 FRANCE: MINING MACHINERY EXPORT SHARE, BY COUNTRY, 2018–2022 (VALUE %)

- TABLE 30 KEY BUYING CRITERIA FOR MINING MACHINERY APPLICATIONS

- TABLE 31 LIST OF ELECTRIC & HYBRID MINING MACHINERY BY MANUFACTURERS WITH CAPACITY

- TABLE 32 LIST OF RENTAL AND LEASING SERVICE PROVIDERS AND AREA OF OPERATION

- TABLE 33 MINING MACHINERY MARKET, BY MACHINERY CATEGORY, 2018–2022 (USD MILLION)

- TABLE 34 MARKET, BY MACHINERY CATEGORY, 2023–2030 (USD MILLION)

- TABLE 35 CRUSHING, PULVERIZING, AND SCREENING MACHINERY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 CRUSHING, PULVERIZING, AND SCREENING MACHINERY MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 37 MINERAL PROCESSING MACHINERY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 MINERAL PROCESSING MACHINERY MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 39 SURFACE MINING MACHINERY MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 40 SURFACE MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 41 SURFACE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 42 SURFACE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 43 ARTICULATED DUMP TRUCKS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 44 ARTICULATED DUMP TRUCKS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 45 ARTICULATED DUMP TRUCKS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 ARTICULATED DUMP TRUCKS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 47 CRAWLER DOZERS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 48 CRAWLER DOZERS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 49 CRAWLER DOZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 CRAWLER DOZERS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 51 CRAWLER EXCAVATORS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 52 CRAWLER EXCAVATORS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 53 CRAWLER EXCAVATORS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 CRAWLER EXCAVATORS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 55 MOTOR GRADERS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 56 MOTOR GRADERS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 57 MOTOR GRADERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 MOTOR GRADERS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 59 RIGID DUMP TRUCKS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 60 RIGID DUMP TRUCKS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 61 RIGID DUMP TRUCKS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 RIGID DUMP TRUCKS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 63 UNDERGROUND MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 64 UNDERGROUND MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 65 UNDERGROUND MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 66 UNDERGROUND MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 67 DRILLS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 68 DRILLS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 69 DRILLS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 DRILLS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 71 ELECTRIC SHOVELS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 72 ELECTRIC SHOVELS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 73 ELECTRIC SHOVELS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 ELECTRIC SHOVELS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 75 HYDRAULIC EXCAVATORS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 76 HYDRAULIC EXCAVATORS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 77 HYDRAULIC EXCAVATORS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 HYDRAULIC EXCAVATORS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 79 MINING DOZERS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 80 MINING DOZERS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 81 MINING DOZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 MINING DOZERS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 83 MINING TRUCKS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 84 MINING TRUCKS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 85 MINING TRUCKS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 MINING TRUCKS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 87 WHEELED LOADERS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 88 WHEELED LOADERS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 89 WHEELED LOADERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 90 WHEELED LOADERS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 91 MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 92 MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 93 COAL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 94 COAL MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 95 METAL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 96 METAL MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 97 MINERAL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 98 MINERAL MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 99 MARKET, BY POWER OUTPUT, 2018–2022 (UNITS)

- TABLE 100 MARKET, BY POWER OUTPUT, 2023–2030 (UNITS)

- TABLE 101 MARKET, BY POWER OUTPUT, 2018–2022 (USD MILLION)

- TABLE 102 MARKET, BY POWER OUTPUT, 2023–2030 (USD MILLION)

- TABLE 103 <500 HP MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 104 <500 HP MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 105 <500 HP MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 106 <500 HP MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 107 500-2,000 HP MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 108 500-2,000 HP MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 109 500-2,000 HP MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 110 500-2,000 HP MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 111 >2,000 HP MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 112 >2,000 HP MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 113 >2,000 HP MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 114 >2,000 HP MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 115 MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 116 MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 117 MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 118 MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 119 DIESEL-PROPELLED MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 120 DIESEL-PROPELLED MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 121 DIESEL-PROPELLED MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 122 DIESEL-PROPELLED MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 123 CNG/LNG/RNG-PROPELLED MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 124 CNG/LNG/RNG-PROPELLED MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 125 CNG/LNG/RNG-PROPELLED MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 126 CNG/LNG/RNG-PROPELLED MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 127 ELECTRIC & HYBRID MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 128 ELECTRIC & HYBRID MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 129 ELECTRIC & HYBRID MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 130 ELECTRIC & HYBRID MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 131 OEM-WISE LIST OF ELECTRIC & HYBRID MINING MACHINERY WITH PROPULSION NATURE

- TABLE 132 ELECTRIC & HYBRID MINING TRUCKS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 133 ELECTRIC & HYBRID MINING TRUCKS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 134 ELECTRIC & HYBRID MINING TRUCKS MARKET, BY REGION, 2018—2022 (USD MILLION)

- TABLE 135 ELECTRIC & HYBRID MINING TRUCKS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 136 ELECTRIC & HYBRID LOAD-HAUL-DUMP (LHD) LOADERS MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 137 ELECTRIC & HYBRID LOAD-HAUL-DUMP (LHD) LOADERS MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 138 ELECTRIC & HYBRID LOAD-HAUL-DUMP (LHD) LOADERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 139 ELECTRIC & HYBRID LOAD-HAUL-DUMP (LHD) LOADERS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 140 LIST OF ELECTRIC MINING MACHINERY WITH BATTERY CHEMISTRY TYPE

- TABLE 141 ELECTRIC MARKET, BY BATTERY CHEMISTRY, 2018–2022 (UNITS)

- TABLE 142 ELECTRIC MARKET, BY BATTERY CHEMISTRY, 2023–2030 (UNITS)

- TABLE 143 ELECTRIC MARKET, BY BATTERY CHEMISTRY, 2018–2022 (USD MILLION)

- TABLE 144 ELECTRIC MARKET, BY BATTERY CHEMISTRY, 2023–2030 (USD MILLION)

- TABLE 145 LITHIUM IRON PHOSPHATE (LFP): ELECTRIC MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 146 LITHIUM IRON PHOSPHATE (LFP): ELECTRIC MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 147 LITHIUM IRON PHOSPHATE (LFP): ELECTRIC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 148 LITHIUM IRON PHOSPHATE (LFP): ELECTRIC MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 149 LITHIUM NICKEL MANGANESE COBALT (NMC): ELECTRIC MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 150 LITHIUM NICKEL MANGANESE COBALT (NMC): ELECTRIC MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 151 LITHIUM NICKEL MANGANESE COBALT (NMC): ELECTRIC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 152 LITHIUM NICKEL MANGANESE COBALT (NMC): ELECTRIC MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 153 OTHERS: ELECTRIC MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 154 OTHERS: ELECTRIC MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 155 AUTONOMOUS MARKET, BY MINING CATEGORY, 2018–2022 (UNITS)

- TABLE 156 AUTONOMOUS MARKET, BY MINING CATEGORY, 2023–2030 (UNITS)

- TABLE 157 AUTONOMOUS MARKET, BY MINING CATEGORY, 2018–2022 (USD MILLION)

- TABLE 158 AUTONOMOUS MARKET, BY MINING CATEGORY, 2023–2030 (USD MILLION)

- TABLE 159 AUTONOMOUS SURFACE MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 160 AUTONOMOUS SURFACE MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 161 AUTONOMOUS SURFACE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 162 AUTONOMOUS SURFACE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 163 AUTONOMOUS UNDERGROUND MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 164 AUTONOMOUS UNDERGROUND MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 165 AUTONOMOUS UNDERGROUND MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 166 AUTONOMOUS UNDERGROUND MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 167 MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 168 MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 169 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 170 MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 171 ASIA OCEANIA: MARKET, BY COUNTRY, 2018–2022 (UNITS)

- TABLE 172 ASIA OCEANIA: MARKET, BY COUNTRY, 2023–2030 (UNITS)

- TABLE 173 ASIA OCEANIA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 174 ASIA OCEANIA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 175 CHINA: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 176 CHINA: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 177 CHINA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 178 CHINA: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 179 INDIA: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 180 INDIA: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 181 INDIA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 182 INDIA: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 183 JAPAN: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 184 JAPAN: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 185 JAPAN: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 186 JAPAN: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 187 INDONESIA: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 188 INDONESIA: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 189 INDONESIA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 190 INDONESIA: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 191 AUSTRALIA: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 192 AUSTRALIA: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 193 AUSTRALIA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 194 AUSTRALIA: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 195 EUROPE: MARKET, BY COUNTRY, 2018–2022 (UNITS)

- TABLE 196 EUROPE: MARKET, BY COUNTRY, 2023–2030 (UNITS)

- TABLE 197 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 198 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 199 FRANCE: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 200 FRANCE: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 201 FRANCE: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 202 FRANCE: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 203 GERMANY: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 204 GERMANY: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 205 GERMANY: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 206 GERMANY: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 207 ITALY: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 208 ITALY: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 209 ITALY: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 210 ITALY: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 211 SPAIN: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 212 SPAIN: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 213 SPAIN: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 214 SPAIN: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 215 UK: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 216 UK: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 217 UK: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 218 UK: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 219 RUSSIA: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 220 RUSSIA: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 221 RUSSIA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 222 RUSSIA: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 223 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (UNITS)

- TABLE 224 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (UNITS)

- TABLE 225 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 226 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 227 CANADA: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 228 CANADA: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 229 CANADA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 230 CANADA: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 231 MEXICO: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 232 MEXICO: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 233 MEXICO: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 234 MEXICO: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 235 US: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 236 US: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 237 US: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 238 US: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 239 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (UNITS)

- TABLE 240 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (UNITS)

- TABLE 241 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 242 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 243 BRAZIL: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 244 BRAZIL: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 245 BRAZIL: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 246 BRAZIL: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 247 CHILE: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 248 CHILE: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 249 CHILE: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 250 CHILE: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 251 PERU: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 252 PERU: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 253 PERU: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 254 PERU: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 255 ARGENTINA: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 256 ARGENTINA: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 257 ARGENTINA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 258 ARGENTINA: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (UNITS)

- TABLE 260 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2030 (UNITS)

- TABLE 261 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 263 SOUTH AFRICA: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 264 SOUTH AFRICA: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 265 SOUTH AFRICA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 266 SOUTH AFRICA: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 267 SAUDI ARABIA: MARKET, BY TYPE, 2018–2022 (UNITS)

- TABLE 268 SAUDI ARABIA: MARKET, BY TYPE, 2023–2030 (UNITS)

- TABLE 269 SAUDI ARABIA: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 270 SAUDI ARABIA: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 271 MARKET: KEY PLAYERS

- TABLE 272 MARKET: KEY PLAYERS (SMES)

- TABLE 273 MARKET: PRODUCT LAUNCHES, JANUARY 2022–JUNE 2023

- TABLE 274 MARKET: DEALS, APRIL 2022–JUNE 2023

- TABLE 275 MARKET: EXPANSIONS, JANUARY 2022–MAY 2023

- TABLE 276 OTHER DEVELOPMENTS, MARCH 2023–JUNE 2023

- TABLE 277 COMPANIES ADOPTED PRODUCT LAUNCH AS KEY GROWTH STRATEGY, 2022–2023

- TABLE 278 CATERPILLAR INC: COMPANY OVERVIEW

- TABLE 279 CATERPILLAR INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 CATERPILLAR INC: PRODUCT LAUNCHES

- TABLE 281 CATERPILLAR INC: DEALS

- TABLE 282 KOMATSU LTD: COMPANY OVERVIEW

- TABLE 283 KOMATSU LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 KOMATSU LTD: PRODUCT LAUNCHES

- TABLE 285 KOMATSU LTD: DEALS

- TABLE 286 SANDVIK AB: COMPANY OVERVIEW

- TABLE 287 SANDVIK AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 SANDVIK AB: PRODUCT LAUNCHES

- TABLE 289 SANDVIK AB: DEALS

- TABLE 290 SANDVIK AB: EXPANSIONS

- TABLE 291 EPIROC AB: COMPANY OVERVIEW

- TABLE 292 EPIROC AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 EPIROC AB: PRODUCT LAUNCHES

- TABLE 294 EPIROC AB: DEALS

- TABLE 295 EPIROC AB: OTHER DEVELOPMENTS

- TABLE 296 LIEBHERR: COMPANY OVERVIEW

- TABLE 297 LIEBHERR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 LIEBHERR: PRODUCT LAUNCHES

- TABLE 299 LIEBHERR: DEALS

- TABLE 300 HITACHI CONSTRUCTION MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 301 HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCT LAUNCHES

- TABLE 303 HITACHI CONSTRUCTION MACHINERY CO., LTD.: DEALS

- TABLE 304 HITACHI CONSTRUCTION MACHINERY CO., LTD.: EXPANSIONS

- TABLE 305 DOOSAN ENERBILITY: COMPANY OVERVIEW

- TABLE 306 DOOSAN ENERBILITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 DOOSAN ENERBILITY: PRODUCT LAUNCHES

- TABLE 308 DOOSAN ENERBILITY: DEALS

- TABLE 309 AB VOLVO: COMPANY OVERVIEW

- TABLE 310 AB VOLVO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 AB VOLVO: PRODUCT LAUNCHES

- TABLE 312 AB VOLVO: DEALS

- TABLE 313 AB VOLVO: EXPANSIONS

- TABLE 314 SANY GROUP: COMPANY OVERVIEW

- TABLE 315 SANY GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 SANY GROUP: PRODUCT LAUNCHES

- TABLE 317 SANY GROUP: DEALS

- TABLE 318 SANY GROUP: EXPANSIONS

- TABLE 319 JCB: COMPANY OVERVIEW

- TABLE 320 JCB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 JCB: PRODUCT LAUNCHES

- TABLE 322 JCB: EXPANSIONS

- TABLE 323 LIUGONG MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 324 KOBELCO CONSTRUCTION MACHINERY CO., LTD: COMPANY OVERVIEW

- TABLE 325 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 326 XUZHOU CONSTRUCTION MACHINERY GROUP: COMPANY OVERVIEW

- TABLE 327 HYUNDAI CONSTRUCTION EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 328 TEREX CORPORATION: COMPANY OVERVIEW

- TABLE 329 BHARAT EARTH MOVERS LIMITED (BEML): COMPANY OVERVIEW

- TABLE 330 ASTEC INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 331 WIRTGEN GROUP: COMPANY OVERVIEW

- TABLE 332 MINE MASTER LTD.: COMPANY OVERVIEW

- TABLE 333 FIORI GROUP S.P.A: COMPANY OVERVIEW

- TABLE 334 JSC “KOPEYSK MACHINE-BUILDING PLANT”: COMPANY OVERVIEW

- TABLE 335 BELL EQUIPMENT: COMPANY OVERVIEW

- TABLE 336 AARD MINING EQUIPMENT: COMPANY OVERVIEW

- TABLE 337 WACKER NEUSON SE: COMPANY OVERVIEW

- TABLE 338 BELAZ: COMPANY OVERVIEW

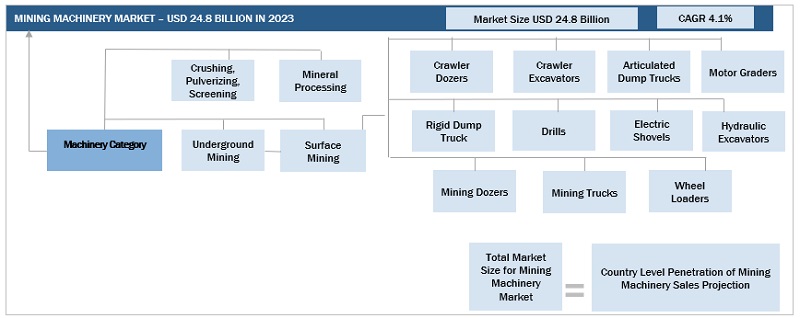

- FIGURE 1 MINING MACHINERY MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

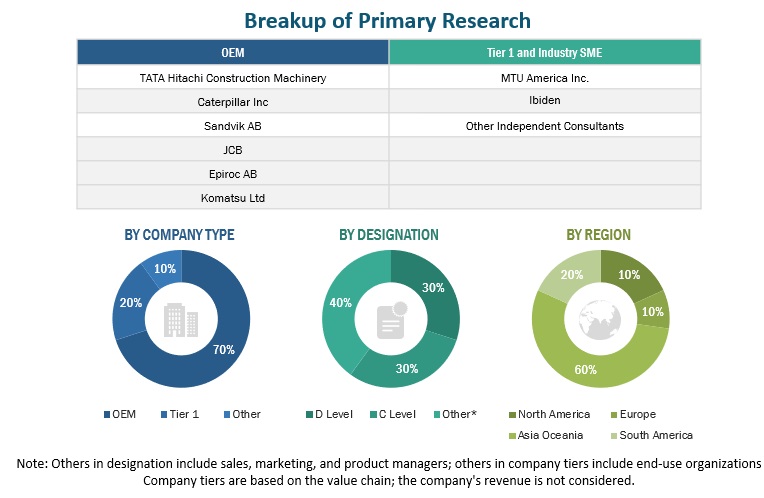

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET: BOTTOM-UP APPROACH

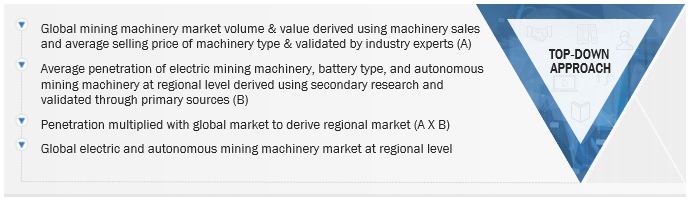

- FIGURE 7 MARKET: TOP-DOWN APPROACH (APPLICATION/PROPULSION/POWER OUTPUT)

- FIGURE 8 ELECTRIC MARKET: TOP-DOWN APPROACH (MACHINERY CATEGORY AND REGION)

- FIGURE 9 MARKET: DATA TRIANGULATION

- FIGURE 10 MARKET OUTLOOK

- FIGURE 11 MARKET, BY REGION, 2023 VS. 2030 (USD MILLION)

- FIGURE 12 GROWING DEMAND FOR METALS AND COMMODITIES TO DRIVE MARKET

- FIGURE 13 SURFACE MINING MACHINERY SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 CNG/RNG/LNG SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 15 500-2,000 HP SEGMENT TO LEAD MARKET IN 2023 (USD BILLION)

- FIGURE 16 MINERAL SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 MINING TRUCKS SEGMENT TO LEAD ELECTRIC & HYBRID MARKET DURING FORECAST PERIOD

- FIGURE 18 LITHIUM IRON PHOSPHATE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 19 SURFACE MINING TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 ASIA OCEANIA TO BE LARGEST MARKET IN 2023

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MARKET

- FIGURE 22 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 MARKET: MAPPING BASED ON VARIOUS STAKEHOLDERS IN ECOSYSTEM

- FIGURE 25 REVENUE SHIFT IN MARKET

- FIGURE 26 NRMM EMISSION REGULATION OUTLOOK, 2019–2025

- FIGURE 27 KEY BUYING CRITERIA FOR MINING MACHINERY APPLICATIONS

- FIGURE 28 BILL OF MATERIALS IN MINING MACHINERY (%), 2021 VS. 2030

- FIGURE 29 SURFACE MINING SEGMENT TO HOLD LARGEST SHARE IN MARKET DURING FORECAST PERIOD

- FIGURE 30 MARKET, BY APPLICATION, 2023 VS. 2030 (USD MILLION)

- FIGURE 31 MARKET, BY POWER OUTPUT, 2023 VS. 2030 (USD MILLION)

- FIGURE 32 MARKET, BY PROPULSION, 2023 VS. 2030 (USD MILLION)

- FIGURE 33 ELECTRIC & HYBRID MARKET, BY TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 34 ELECTRIC MARKET, BY BATTERY CHEMISTRY, 2023 VS. 2030 (USD MILLION)

- FIGURE 35 AUTONOMOUS MARKET, BY MINING CATEGORY, 2023 VS. 2030 (USD MILLION)

- FIGURE 36 MARKET, BY REGION, 2023 VS. 2030 (USD MILLION)

- FIGURE 37 ASIA OCEANIA: MARKET SNAPSHOT

- FIGURE 38 EUROPE MARKET, BY COUNTRY, 2023 VS. 2030 (USD MILLION)

- FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 40 SOUTH AMERICA: MARKET, BY COUNTRY, 2023 VS. 2030 (USD MILLION)

- FIGURE 41 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023 VS. 2030 (USD MILLION)

- FIGURE 42 MARKET SHARE ANALYSIS, 2022

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 44 MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 45 CATERPILLAR INC: COMPANY SNAPSHOT

- FIGURE 46 KOMATSU LTD: COMPANY SNAPSHOT

- FIGURE 47 SANDVIK AB: COMPANY SNAPSHOT

- FIGURE 48 EPIROC AB: COMPANY SNAPSHOT

- FIGURE 49 LIEBHERR: COMPANY SNAPSHOT

- FIGURE 50 HITACHI CONSTRUCTION MACHINERY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 51 DOOSAN ENERBILITY: COMPANY SNAPSHOT

- FIGURE 52 AB VOLVO: COMPANY SNAPSHOT

- FIGURE 53 SANY GROUP: COMPANY SNAPSHOT

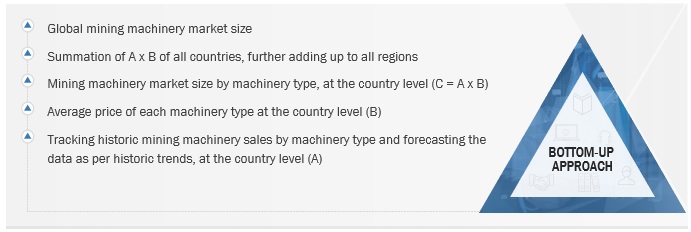

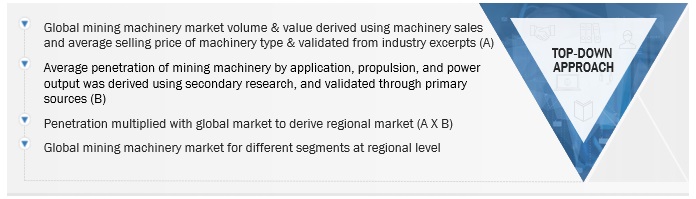

The study involved four major activities in estimating the current size of the mining machinery market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred for this research study include financial statements of companies offering mining machinery and information from various trade, business, and professional associations. The secondary data was collected and analyzed to determine the overall size of the mining machinery market, which primary respondents validated.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs; vice presidents; directors from business development, marketing, and product development/innovation teams; and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as the mining machinery market forecast, current technology trends, and upcoming technologies in the market. Data triangulation of all these points was done with the information gathered from secondary research. Stakeholders from the supply side were interviewed to understand their views on the points mentioned above.

Primary interviews were conducted with market experts from the supply side (mining machinery manufacturers) across the major regions, namely, Asia Oceania, Europe, South America, and North America. Primary data was collected through questionnaires, emails, and telephonic interviews.

In canvassing primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the mining machinery market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the automotive industry at a regional level. Such procurements provide information on the industry's demand aspects for mining machinery.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Mining Machinery Market Size: Bottom-Up Approach, By Machinery Category

Global Mining Machinery Market Size: Top-Down Approach, By Application, Propulsion, Power Output

Global Electric & Hybrid Mining Machinery Market Size: Top-Down Approach, By Mining Category

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Mining Machinery: Mining Machinery is a large machine used for the extraction of raw materials in open-cast mining environments. Mining Machinery refers to the specialized equipment and machinery used in various stages of the mining process, including exploration, extraction, processing, and transportation of minerals and ore deposits. This equipment can range from large-scale mining trucks, excavators, and drilling machines for open-pit operations to underground mining machinery.

Surface Mining Machinery: Surface mining machinery refers to a broad range of tools used mostly in open-pit or open-cast mines to remove minerals and ores from the surface of the ground. When the mineral ore reserves are close to the surface and can be economically mined utilizing sizable machinery, this sort of mining is employed.

Underground Mining Machinery: Underground mining equipment is made specifically to operate in the constrained and difficult conditions of underground mines, where access and space are constrained. Deep within the earth, these machines are essential for drilling, transporting, and processing metals and minerals. They are designed to resist challenging underground environments, which include little light, excessive humidity, and small areas.

Key Stakeholders

- Senior Management

- End User Finance/Procurement Department

- R&D Department

Report Objectives

- To analyze and forecast the market size for mining machinery from 2018 to 2030 in terms of volume (units) and value (USD million/billion)

-

To define and describe the mining machinery market by machinery category, propulsion, application, power output, autonomous mining machinery, electric & hybrid mining machinery, battery chemistry, and region.

- By machinery category [crushing, pulverizing, screening machinery; mineral processing; surface mining (crawler excavators, crawler dozers, motor graders, rigid dump trucks, and articulated dump trucks); and underground mining (electric shovels, hydraulic excavators, wheeled loaders, mining dozers, mining trucks, and drills)]

- By propulsion [diesel, and compressed natural gas (CNG)/liquified natural gas (LNG)/renewable natural gas (RNG)]

- By application (mineral, metal, and coal)

- By power output (<500 HP, 500-2,000 HP, and >2,000 HP)

- Autonomous mining machinery, by mining category (surface mining and underground mining)

- Electric & hybrid mining machinery, by type [electric & hybrid mining trucks and electric & hybrid load haul dump (LHD) trucks]

- Electric & hybrid mining machinery, by battery chemistry [lithium-iron phosphate, nickel manganese cobalt battery and others (lithium manganese oxide (LMO), lithium titanate oxide (LTO), and solid-state batteries)

- By region (Asia Oceania, Europe, North America, South America, and Middle East & Africa)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the mining machinery market

- To analyze the market share of key players operating in the market

- To strategically analyze the market with supply chain analysis, market ecosystem, technology trends, trade analysis, average price trend, regulatory analysis, case studies, and buying criteria

- To understand the dynamics of competitors and distinguish them into stars, emerging leaders, pervasive players, and participants according to the strength of their product portfolio and business strategies.

- To analyze recent developments such as agreements/partnerships/supply orders, acquisitions, geographic expansions, and new product launches of key players in the mining machinery market.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

Autonomous Mining Machinery Market, By Level of Automation

- Semi-Autonomous

- Fully Autonomous

Mining Machinery Market, By Country & Machinery Category

- Crushing, Pulverizing, Screening Machinery

- Mineral Processing Machinery

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Mining Machinery Market

Growth opportunities and latent adjacency in Mining Machinery Market

I would like to know the market share of each of the mining equipment manufacturers and what strategies they adopted to maintain their market share

I was wondering if I could get a breakout of the construction equipment market by industry - specifically I am looking for the dollar value of the equipment used in infrastructure. This is for InsideUnmannedSystems magazine.

I want to understand the market for surface and underground mining equipment, annual purchases worldwide.

In our bussiness we dissasembly mining equipmemt We have now one scoop ST1020 One Scoop ST 1030 One Simba MH 12 54 One M7 all being sold for dismantling at cery convenient prices We dsel the equipment we dismantle and send power train and elements also main tool

I am interested in gaining visibility to market trends affecting mining equipment used in surface and underground applications. More specifically, I am interested in the market for aftermarket parts and rebuilt components (transmissions, torque converters, differentials, final drives, hydraulic cylinders, drivelines) used in the repair and maintenance of mobile equipment used in surface and underground mining.

I am interested in gaining visibility to market trends affecting mining equipment used in surface and underground applications. More specifically, I am interested in the market for aftermarket parts and rebuilt components (transmissions, torque converters, differentials, final drives, hydraulic cylinders, drivelines) used in the repair and maintenance of mobile equipment used in surface and underground mining.

I am looking for mining equipment global market statistics related to equipment type and manufacturer

I am covering the broader mining sector for one of my clients and just need to study the report and find unique angles for Africa and particularly South Africa.