Drone Inspection and Monitoring Market by Type (Fixed Wing, Multirotor, Hybrid), Applications (Constructions & Infrastructure, Agriculture), Solution (Platform, Software, Infrastructure, Service), Mode of Operations, and Region - Global Forecast to 2027

Updated on : Nov 25, 2024

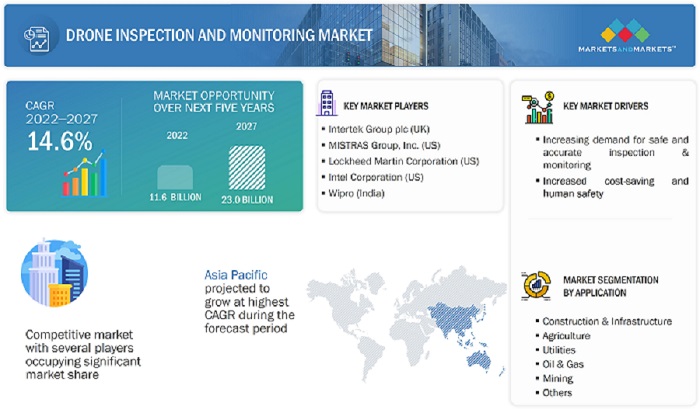

[345 Pages Report] The Drone Inspection and Monitoring Market is projected to grow from USD 11.6 Billion in 2022 to USD 23.0 Billion by 2027, at a CAGR of 14.6% from 2022 to 2027.

Drones are increasingly used for monitoring and inspection by industries as part of their maintenance practices. A visual inspection is essential to ensure the appropriate maintenance of a company’s resources. Drones are used for pipeline and infrastructure inspection, wildlife population & activity monitoring and inspection, remote infrastructure and aircraft monitoring, agricultural yield inspection, oil & gas sector inspection, and utilities inspection, among various other applications. Drone cameras usually perform the task of a human eye during inspection and monitoring applications. By employing drones to accumulate visual data, inspectors can avoid visiting hazardous areas or sites like scaffolding, chemical spills, or a tall, lean tower.

The following sections discuss the market dynamics such as drivers, restraints, opportunities, and challenges pertaining to the drone inspection and monitoring market. There is an increasing demand for AI in drones for inspection and monitoring due to their accuracy, efficiency, cost-effectiveness, and safety benefits. These factors are anticipated to fuel the growth of drone providers, namely Intertek Group plc (UK), MISTRAS Group, Inc (US), Wipro (India), Lockheed Martin Corporation (US), Intel Corporation (US), ideaForge (India) and several others.

Drone Inspection and Monitoring Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Drone Inspection and Monitoring Market Dynamics:

Driver: Rising usage of drones as remote visual inspection (RVI) tool for critical infrastructure applications

Automated and remotely piloted drones are popular in the asset management sector due to their various advantages. For instance, a compact, nimble drone can effortlessly be sent to isolated locations or into hard-to-access nooks and corners such as offshore platforms, tank tops, flare tips, windmill blades, and powerlines. By employing drones, personnel can complete inspections from a safe distance without the need for utilizing expensive ladders or scaffolding. Large areas can be included in much less time, even for more complex inspections, such as thermal imaging. Some of the critical infrastructure applications that widely use drones for Remote Visual Inspection (RVI) are solar farms, wind farms, and power lines among others.

Restraint: Issues with drone safety and security

The usage of drones by malevolent entities to conduct physical and cyber-attacks threatens society by violating its residents’ privacy and threatening the public’s safety. In reality, numerous technical and operational drone properties are being misused for potential attacks. This comprises performing critical operations based on aggressive reconnaissance, as well as surveillance aimed at tracking specific people and certain properties, causing safety and privacy issues. Hacking a drone is like hacking into one’s personal computer, and hackers can access drones from miles away. They just need to establish a connection to the drone by intercepting the signal. The radio signal is typically unencrypted, so there is a provisional step to decode it with a packet sniffer. After achieving this, the hackers block the signal and connect the drone to their device in order to manipulate the drone as per their desire. Some of the existing threats and vulnerabilities associated with drones, including susceptible to spoofing, susceptible to malware infection , susceptible to manipulation, susceptible to technical issues, prone to wi-fi jamming.

Opportunity: Advancements in LiDAR technology for commercial drones

Light detection and ranging (LiDAR) is a vital tool in the commercial drone industry. The highly accurate and precise LiDAR sensors are attached to drones to send a pulse from a laser to accumulate measurements, which are utilized to generate precise maps and 3D model of objects and surroundings. Routine photogrammetry or other survey technologies might skip the surface elevation value that is concealed by vegetation or forest cover. However, LIDAR can penetrate all through the object and identify the surface value. Hence, it finds wide applications related to inspection and monitoring like flood modeling, precision agriculture, forest planning and management, and environmental assessment.

Currently, multi-sensor payloads are popular in the commercial drone market (e.g., E/O+IR sensors). However, merging a LiDAR scanner and an optical camera in a very small and very light payload is a significant step forward. In the last quarter of 2020, DJI introduced the Zenmuse L1 sensor for its Matrice and Terra platforms. It comprises a Livox LiDAR module, a high-precision IMU, and a camera having a 1-inch CMOS on a three-axis stabilized gimbal. The L1 sensor offers 3D data in real time while securing the details of complex structures. The miniaturization of technology seems to be a budding technical innovation that will strive in the coming years.

Challenge: Regulatory hurdles and budgetary & other constraints

Drone industry is thriving at faster pace. From monitoring active fire and real-time activities to sending messages via light shows, unmanned aerial system have come to be widely used by civilians, and government agencies. However, the rising demand for drones would put huge pressure on the manufacturers to meet with customer demand and drone design regulation and also on the government authorities for procedures of permits as well as exemptions that all countries required for the drone utilization. Challenges to expanding the use of drones for public safety application include limitations on flying beyond visual line of sight (BVLOS), flying at or below 400 feet, inadequate battery life, community-based concerns over privacy, and not flying in restricted airspace, especially near airports. Moreover, Drones create challenging circumstances for insurance companies owing to the damage caused to someone’s personal or government assets and liability.

Despite these present-day challenges, drone adoption within public safety fields is likely to speed up once regulatory concerns are tackled, pilot programs gain achievement, and drone funding shifts from optional budget items to operational budget line items.

Based on Solution, the software segment witness strong growth during 2022-2027

Based on solution, the drone inspection and monitoring market has been segmented into platform, software, infrastructure, and services. The user’s flight experience and photo editing/taking experience can be enhanced using various drone-based software. The drone inspection and monitoring market by software is segmented into route planning and optimization, inventory management, live tracking, fleet management, and computer vision & object detection depending on the application area.

Route planning and optimization software offer inspection drones the capability to make their way through chaotic spaces. This software is essentially required when inspection and monitoring drones operate in clogged city environments, fly between buildings or far-off locations, as well as inspect powerlines, windmills, solar farms, etc. The software helps in deciding the most optimum route for drones to carry out operations with maximum safety.

Based on Type, multirotor registered largest share in the base year

Based on type, the drone inspection and monitoring market has been segmented into fixed-wing, multirotor, and hybrid. The multirotor drones are usually outfitted with two, three, four, six, or eight rotors and are known as bicopters, tricopters, quadcopters, hexacopters, and octocopters, respectively. Quadcopters are the most conventional design of multirotor drones. Their stabilizing process is less complicated than tricopters. They have fewer parts (implying less manufacturing costs) than hexacopters or octocopters. The larger the number of rotors in a multirotor drone, the more thrust it can produce and, thus, the heavier payload it can lift. Hexacopters or octocopters are the most commonly used multirotor drones for lifting heavy industrial cameras or delivery payloads. Drones with more than four rotors also possess a degree of dismissal, which permits them to still make a steady descent in instances wherein individual rotors malfunction or collapse. Upgrades in rotary drone performance and the integration of robust onboard sensors have opened tactical use cases for military implementation. In February 2020, the Swiss Armed Forces selected Europe’s prominent drone company, Parrot, to deliver multirotor drones for its Mini UAV program.

Based on distribution channel, offline segment to hold the largest market share during the forecast period

The intermediaries consist of distributors, wholesalers, retailers, and e-tailers or e-commerce intermediaries. The drone inspection and monitoring market has been segmented based on distribution channel into online and offline. The offline distribution channel is projected to have the largest market share in the base year, whereas the online distribution channel would have the highest CAGR during the forecast period.

The Asia Pacific region is projected to Grow at highest CAGR during the forecast period

Countries such as China, Australia, India, Japan, and South Korea contribute to the growth of the drone inspection and monitoring industry in the Asia Pacific. Political tensions in some Asia Pacific countries have led to the deployment of drones for border security in the region. This serves to be one of the most significant factors driving the growth of the drone inspection and monitoring market in the Asia Pacific.

In addition, China is one of the prime manufacturers and buyers of drones globally. There are more than 500 drone manufacturers across the globe, out of which 400 are based in China. UAV manufacturers in the country have witnessed an increased demand from various countries of Asia Pacific, Africa, and the Middle East, simultaneously positively affecting the drone inspection and monitoring market. Moreover, In 2019, the Government of China introduced new drone regulations, making it easier for applicants to obtain licenses with lowered entry conditions and convenient online applications. The regulations apply to the operation of drones weighing 250 grams and above.

Drone Inspection and Monitoring Market by Region

To know about the assumptions considered for the study, download the pdf brochure

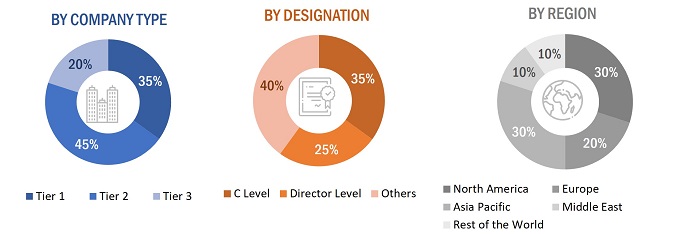

The break-up of the profiles of primary participants in the Drone inspection and monitoring market is as follows:

- By Company Type: Tier 1–35%; Tier 2–45%; and Tier 3–20%

- By Designation: C Level Executives–35%; Directors–25%; and Others–40%

- By Region: Asia Pacific–30%; North America–30%; Europe–20%; Middle East–10%; and Rest of the World–10%

Top Drone Inspection and Monitoring Companies - Key Market Players

The drone inspection and monitoring companies are dominated by globally established players such as Intertek Group plc (UK), MISTRAS Group, Inc. (UK), Wipro (India), Lockheed Martin Corporation (US), and Intel Corporation (US). These players have adopted various growth strategies such as contracts, acquisitions, agreements, expansions, investments, and new product launches to further expand their presence in the drone inspection and monitoring market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Solution, By Type, By Application, By Mode of Operation, By Distribution Channel, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East, and Rest of the World |

|

Companies covered |

Intertek Group plc (UK), MISTRAS Group, Inc. (US), Wipro (India), Intel Corporation (US), Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), SZ DJI Technology Co., Ltd. (China), Parrot SA (France) and several others |

|

Companies covered (Drone inspection and monitoring market start-ups and drone inspection and monitoring market ecosystem) |

Maverick Inspection Ltd (Canada), GarudaUAV Soft Solutions Pvt. Ltd. (India), Hemav (Spain), Raptor Maps, Inc. (US), Dronedeploy, Inc. (US) and others |

Drone Inspection and Monitoring Market Highlights

This research report categorizes the drone inspection and monitoring market based on solution, type, application, mode of operation, distribution channel, and region

|

Segment |

Subsegment |

|

By Solution |

|

|

By Type |

|

|

By Application |

|

|

By Mode of Operation |

|

|

By Distribution Channel |

|

|

By Region |

|

Recent Developments

- In December 2022, Intertek Group plc launched an innovative integrated solution, Intertek Group plc Green R&D. The new solution could ensure the safety, quality, and sustainability attributes optimized during the product lifecycle.

- In December 2022, DJI developed a compact, ultra-lightweight camera drone, DJI Mini 3, which weighs less than 249 grams. It is designed to be use by anyone anywhere.

- In June 2022, DJI launched DJI RS 3 and DJI RS 3 Pro, which incorporated a range of new features. It includes a redesigned axes-locking system which means the process is now automated. By turning on the gimbal, the automated axis locks release and unfold the gimbal, allowing the operator to get started in seconds.

Frequently Asked Questions (FAQ):

What is the current size of the drone inspection and monitoring market?

The drone inspection and monitoring market is projected to grow from USD 11.6 Billion in 2022 to USD 23.0 Billion by 2027, at a CAGR of 14.6% from 2022 to 2027.

Who are the winners in the drone inspection and monitoring market?

Intertek Group plc (UK), MISTRAS Group, Inc. (UK), Wipro (India), Lockheed Martin Corporation (US), and Intel Corporation (US) are contributing major share in the market in 2021.

What are some of the technological advancements in the market?

Speedy overview and assessment of the condition under inspection, high resolution and detailed photographs of defects, and preventive upkeep planning and optimized production are some technological advancements in the drone inspection and monitoring market.

What are the factors driving the growth of the market?

Increasing demand for safe and accurate inspection & monitoring, increased cost-saving and human safety, rising usage of drones as remote visual inspection (RVI) tool for critical infrastructure applications are some major factors that driving the growth.

What region holds the largest share of the market in 2021?

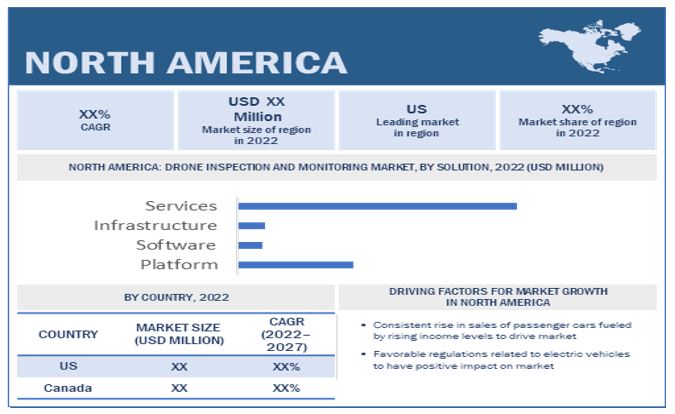

North America registered the largest share of 40.43% in global drone inspection and monitoring market in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in demand for safe and accurate inspection & monitoring- Increased cost-saving and human safety- Rise in usage of drones as remote visual inspection (RVI) tools for critical infrastructure applicationsRESTRAINTS- Lack of skilled personnel to operate drones for inspection & monitoring applications- Issues with drone safety and securityOPPORTUNITIES- Technology advancements in drones- Advancements in LiDAR technology for commercial dronesCHALLENGES- Regulatory hurdles and budgetary & other constraints- Limited flight endurance & payload capacity

- 5.3 AVERAGE SELLING PRICE

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 MARKET ECOSYSTEM MAP

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR DRONE INSPECTION AND MONITORING MARKET

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 TRADE DATA STATISTICS

- 5.9 TARIFF AND REGULATORY LANDSCAPE

-

5.10 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 KEY CONFERENCES & EVENTS IN 2022–2023

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSDRONE DATA CREATED WITH POINT CLOUDAI INSPECTIONSWARM DRONESAUTOMATED DRONES

-

6.3 TECHNOLOGY ANALYSISHYDROGEN POWERIMPROVED COMPUTER VISION AND MOTION PLANNINGNEW SCOPE FOR DRONE REST AND RECHARGE

-

6.4 USE CASE ANALYSISUSE OF DRONES FOR ROOF INSPECTIONTUV NORD USES DRONES FOR INSPECTION OF WIND TURBINESNEW YORK (US) STATE POWER USES DRONES FOR POWER LINE INSPECTION

-

6.5 IMPACT OF MEGATRENDSDRONES FOR MONITORING ENVIRONMENTAL AND ECOLOGICAL CHANGESIOT-ENABLED DRONESRAPID URBANIZATION

- 6.6 INNOVATION & PATENT REGISTRATIONS

- 7.1 INTRODUCTION

-

7.2 PLATFORMAIRFRAME- Usage of composite materials for lightweight airframes with better flight time to drive marketAVIONICS- Multi-function capabilities of avionics systems to drive marketPROPULSION- Extensive R&D on drone propulsion systems to drive marketSOFTWARE- Rapid data processing with drone software to drive marketPAYLOAD- Rising demand for drones in commercial and military sectors to drive segment- Photogrammetry- LiDAR

-

7.3 SOFTWAREROUTE PLANNING & OPTIMIZATION- Innovations in route planning software, self-learning algorithms, & auto-flight systems to boost demand for softwareINVENTORY MANAGEMENT- Use of machine learning algorithms to process resultsLIVE TRACKING- Real-time tracking enables accuracy in data analysisFLEET MANAGEMENT- Diligent monitoring of inventory, assets, and productivity requires single software platformCOMPUTER VISION & OBJECT DETECTION- Computer vision backed with machine learning and deep learning algorithms to enhance drone industry

-

7.4 INFRASTRUCTUREGROUND CONTROL STATIONS- Efficiency of GCS in controlling drones and their payloads to drive marketCHARGING STATIONS- Vital for uninterrupted drone operationsLAUNCH & RECOVERY SYSTEMS- Ability to provide extra support to drone users during takeoff and landing to drive market

-

7.5 SERVICESDRONE PLATFORM SERVICES- Rapid urbanization and industrialization to drive market- Flights (piloting & operations)- Data analysis- Data processing (deliverables)

- 8.1 INTRODUCTION

-

8.2 FIXED-WINGGROWING DEMAND IN MINING SECTOR OWING TO LONGER FLIGHT TIME TO DRIVE MARKET

-

8.3 MULTIROTORCONTRIBUTES TO LARGEST MARKET SHARE DURING FORECAST PERIOD

-

8.4 HYBRIDBETTER PAYLOAD CAPACITY AND ENDURANCE THAN NON-HYBRID DRONES TO DRIVE MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 CONSTRUCTION & INFRASTRUCTUREBRIDGES- High-quality 3D images obtained from drones to help in bridge maintenance and rehabilitationPROPERTY & REAL ESTATE- Thorough and rapid assessment with drones significantly helps save money and timeRAILWAYS- Rising demand in Asia Pacific and North America to drive market

-

9.3 AGRICULTURESOIL & CROP- High-quality drone data and photogrammetry to provide farmers with all advantages accessibleHEALTH ASSESSMENT- Usage of multispectral and infrared thermal sensors boosts tree disease inspection and prevention

-

9.4 OIL & GASUPSTREAM- Advanced drone technology leads to faster inspection and reduced downtimeMIDSTREAM- Cost-effective and accurate inspection possible with drones

-

9.5 UTILITIESTOWER INSPECTION- Drones outfitted with thermal and UV cameras to drive marketPOWER TRANSMISSION- Close-up photography/videography using drone-based inspection & monitoring to drive segmentWIND TURBINE- Timeliness, cost-effectiveness, and accuracy of drones in inspecting and monitoring wind turbines to boost market

-

9.6 MININGSTOCKPILE- Accurate and rapid inspection possible with dronesTAILING DAMS & QUARRY INSPECTION- Cost-effective, quick, and high-quality orthoimages captured with drones to drive this segment

-

9.7 OTHERSAVIATION- Use of high-level technologies for inspection and monitoring aircraft to boost market growthWILDLIFE & FORESTRY- Cost-effective and rapid inspection & monitoring with drones to drive this segmentINSURANCE- Increasing demand for drones in commercial sector to boost market growthLOGISTICS- Easy approval for indoor drones compared with outdoor ones and rising demand in warehouse and logistics industries

- 10.1 INTRODUCTION

-

10.2 REMOTELY PILOTEDDEMAND FOR REMOTELY PILOTED DRONES IN CONSTRUCTION SECTOR TO DRIVE GROWTH

-

10.3 OPTIONALLY PILOTEDOPTIONALLY PILOTED DRONES WIDELY USED IN AGRICULTURAL SECTOR

-

10.4 FULLY AUTONOMOUSFULLY AUTONOMOUS DRONES EXPECTED TO WITNESS HIGH DEMAND

- 11.1 INTRODUCTION

-

11.2 ONLINEONLINE DISTRIBUTION CHANNELS TO DRIVE SALE OF DRONES

-

11.3 OFFLINEOFFLINE DISTRIBUTION CHANNELS TO NULLIFY WAITING TIME FOR DELIVERY OF PRODUCTS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Increase in investment in development of inspection drones to drive market in USCANADA- Increase in demand for inspection services for commercial and defense applications to boost market in Canada

-

12.3 EUROPEPESTLE ANALYSIS: EUROPEUK- Technological advancements and changing regulatory policies to drive market in UKFRANCE- Rising adoption of drones for inspection and monitoring to boost market growth in FranceGERMANY- Drone Innovation Hub to promote drone industry in GermanyITALY- Rising instances of PV monitoring and oil & gas inspection to drive demandRUSSIA- Increased use of monitoring and inspection services to drive demandSWEDEN- Growing procurement of UAVs for military applications in SwedenREST OF EUROPE

-

12.4 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFIC- EnvironmentalCHINA- Presence of major drone manufacturers to drive market in ChinaJAPAN- Increasing use of agricultural drones for monitoring, spraying, and surveying applications in JapanINDIA- Increasing demand for drone monitoring services leading to indigenous development of drones in IndiaAUSTRALIA- Growing use of UAVs for inspection and monitoring of mines and oilfields in AustraliaSOUTH KOREA- Growing use of drones for monitoring assets and remote inspection in South KoreaREST OF ASIA PACIFIC

-

12.5 MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTISRAEL- Drone inspection services to focus on oil & gas industryTURKEY- Focus on indigenization of UAVs and subsystems expected to boost market in TurkeyUAE- Increased demand for remote monitoring of assets from oil & gas industry to drive marketREST OF MIDDLE EAST

-

12.6 REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDLATIN AMERICA- Use of UAVs in agriculture and for data collection to contribute to market growthAFRICA- Adoption of drones for dense forest and mining monitoring to drive market growth

- 13.1 INTRODUCTION

-

13.2 COMPANY OVERVIEWKEY DEVELOPMENTS OF LEADING PLAYERS IN DRONE INSPECTION AND MONITORING MARKET (2018–2021)

- 13.3 RANKING ANALYSIS OF KEY PLAYERS IN DRONE INSPECTION AND MONITORING MARKET, 2021

- 13.4 REVENUE ANALYSIS, 2021

- 13.5 MARKET SHARE ANALYSIS, 2021

-

13.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

13.8 COMPETITIVE BENCHMARKINGPRODUCT LAUNCHES/DEVELOPMENTSOTHER DEVELOPMENTS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSINSITU- Business overview- Products/Solutions/Services offeredDJI- Business overview- Products/Solutions/Services offered- Recent developmentsNORTHROP GRUMMAN CORPORATION- Business overview- Products/Solutions/Services offeredTELEDYNE FLIR LLC- Business overview- Products/Solutions/Services offered- Recent developmentsPARROT DRONE SAS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEHANG HOLDINGS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTEL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsYUNEEC HOLDING LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsECA GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsPRECISIONHAWK- Business overview- Products/Services/Solutions offered- Recent developmentsMICRODRONES- Business overview- Products/Solutions/Services offered- Recent developmentsSKYDIO- Business overview- Products/Solutions/Services offered- Recent developmentsAERIALTRONICS- Business overview- Products/Services offered- Recent developmentsIDEAFORGE- Business overview- Products/Services offered- Recent developmentsLOCKHEED MARTIN CORPORATION- Business overview- Products/Services offered- Recent developmentsVIPER DRONES- Business overview- Products/Services offeredAGEAGLE AERIAL SYSTEMS INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTERRA DRONE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHYSSENKRUPP INDUSTRIAL SOLUTIONS AG- Business overview- Products/Services offered- Recent developmentsDRONEGENUITY- Business overview- Products/Services offered- Recent developmentsFORCE TECHNOLOGY- Business overview- Products/Services offered- Recent developmentsWIPRO- Business overview- Products/Services offered- Recent developmentsMISTRAS GROUP, INC.- Business overview- Products/Services offered- Recent developmentsINTERTEK GROUP PLC- Business overview- Products/Services offered- Recent developmentsAERODYNE GROUP- Business overview- Products/Services offered- Recent developments

-

14.3 OTHER PLAYERSDRONEDEPLOY, INC.DRONEFLIGHT LTD.RELIABILITY MAINTENANCE SOLUTIONS LTD.DJM AERIAL SOLUTIONS LIMITEDCANADIAN UAVSMAVERICK INSPECTION LTD.GARUDAUAV SOFT SOLUTIONS PVT. LTD.HEMAVRAPTOR MAPS, INC.AIRPIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 DRONE INSPECTION AND MONITORING MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 COST COMPARISON: DRONE VS. UNDER-BRIDGE INSPECTION VEHICLES

- TABLE 4 AVERAGE SELLING PRICE OF DRONES, BY APPLICATION

- TABLE 5 LIST OF IMPORTERS FOR PRODUCT: 880211 HELICOPTERS OF AN UNLADEN WEIGHT <= 2,000 KG

- TABLE 6 LIST OF EXPORTERS FOR PRODUCT: 880211 HELICOPTERS OF AN UNLADEN WEIGHT <= 2,000 KG

- TABLE 7 HSN CODE AND GST RATE FOR AIRCRAFT AND UAV DRONES—HSN CHAPTER 88

- TABLE 8 2019 DUTY RATES FOR DRONES AND THEIR ACCESSORIES IN NORTH AMERICA

- TABLE 9 US: RULES AND GUIDELINES BY FAA FOR OPERATION OF DRONES

- TABLE 10 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE SOLUTIONS (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE SOLUTIONS

- TABLE 12 CONFERENCES & EVENTS: 2022–2024

- TABLE 13 IMPORTANT INNOVATIONS & PATENT REGISTRATIONS, 2015–2022

- TABLE 14 DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 15 DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 16 DRONE INSPECTION AND MONITORING MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 17 DRONE INSPECTION AND MONITORING MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 18 DRONE INSPECTION AND MONITORING MARKET, BY PAYLOAD, 2019–2021 (USD MILLION)

- TABLE 19 DRONE INSPECTION AND MONITORING MARKET, BY PAYLOAD, 2022–2027 (USD MILLION)

- TABLE 20 DRONE INSPECTION AND MONITORING MARKET, BY INFRASTRUCTURE, 2019–2021 (USD MILLION)

- TABLE 21 DRONE INSPECTION AND MONITORING MARKET, BY INFRASTRUCTURE, 2022–2027 (USD MILLION)

- TABLE 22 DRONE INSPECTION AND MONITORING MARKET, BY DRONE PLATFORM SERVICES, 2019–2021 (USD MILLION)

- TABLE 23 DRONE INSPECTION AND MONITORING MARKET, BY DRONE PLATFORM SERVICES, 2022–2027 (USD MILLION)

- TABLE 24 DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 25 DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 26 DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 27 DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 28 CONSTRUCTION & INFRASTRUCTURE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 29 CONSTRUCTION & INFRASTRUCTURE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 30 DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE, 2019–2021 (USD MILLION)

- TABLE 31 DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE, 2022–2027 (USD MILLION)

- TABLE 32 DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS, 2019–2021 (USD MILLION)

- TABLE 33 DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS, 2022–2027 (USD MILLION)

- TABLE 34 DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES, 2019–2021 (USD MILLION)

- TABLE 35 DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES, 2022–2027 (USD MILLION)

- TABLE 36 DRONE INSPECTION AND MONITORING MARKET, BY MINING, 2019–2021 (USD MILLION)

- TABLE 37 DRONE INSPECTION AND MONITORING MARKET, BY MINING, 2022–2027 (USD MILLION)

- TABLE 38 DRONE INSPECTION AND MONITORING MARKET, BY OTHERS, 2019–2021 (USD MILLION)

- TABLE 39 DRONE INSPECTION AND MONITORING MARKET, BY OTHERS, 2022–2027 (USD MILLION)

- TABLE 40 DRONE INSPECTION AND MONITORING MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

- TABLE 41 DRONE INSPECTION AND MONITORING MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

- TABLE 42 DRONE INSPECTION AND MONITORING MARKET, BY DISTRIBUTION CHANNEL, 2019–2021 (USD MILLION)

- TABLE 43 DRONE INSPECTION AND MONITORING MARKET, BY DISTRIBUTION CHANNEL, 2022–2027 (USD MILLION)

- TABLE 44 REVENUE IMPACT ANALYSIS

- TABLE 45 DRONE INSPECTION AND MONITORING MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 46 DRONE INSPECTION AND MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 48 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 50 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2019–2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2022–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICE, 2019–2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY CONSTRUCTION & INFRASTRUCTURE APPLICATION, 2019–2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY CONSTRUCTION & INFRASTRUCTURE APPLICATION, 2022–2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE APPLICATION, 2019–2021 (USD MILLION)

- TABLE 64 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE APPLICATION, 2022–2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES APPLICATION, 2019–2021 (USD MILLION)

- TABLE 66 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES APPLICATION, 2022–2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS APPLICATION, 2019–2021 (USD MILLION)

- TABLE 68 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS APPLICATION, 2022–2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY MINING APPLICATION, 2019–2021 (USD MILLION)

- TABLE 70 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY MINING APPLICATION, 2022–2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY OTHER APPLICATIONS, 2019–2021 (USD MILLION)

- TABLE 72 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY OTHER APPLICATIONS, 2022–2027 (USD MILLION)

- TABLE 73 US: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 74 US: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 75 US: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 76 US: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 77 CANADA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 78 CANADA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 79 CANADA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 80 CANADA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 81 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 82 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 83 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 84 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 85 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 86 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 87 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2019–2021 (USD MILLION)

- TABLE 88 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2022–2027 (USD MILLION)

- TABLE 89 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2019–2021 (USD MILLION)

- TABLE 90 EUROPE: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 91 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 92 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 93 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 94 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 95 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY CONSTRUCTION & INFRASTRUCTURE APPLICATION, 2019–2021 (USD MILLION)

- TABLE 96 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY CONSTRUCTION & INFRASTRUCTURE APPLICATION, 2022–2027 (USD MILLION)

- TABLE 97 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE APPLICATION, 2019–2021 (USD MILLION)

- TABLE 98 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY AGRICULTURE APPLICATION, 2022–2027 (USD MILLION)

- TABLE 99 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES APPLICATION, 2019–2021 (USD MILLION)

- TABLE 100 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY UTILITIES APPLICATION, 2022–2027 (USD MILLION)

- TABLE 101 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS APPLICATION, 2019–2021 (USD MILLION)

- TABLE 102 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY OIL & GAS APPLICATION, 2022–2027 (USD MILLION)

- TABLE 103 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY MINING APPLICATION, 2019–2021 (USD MILLION)

- TABLE 104 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY MINING APPLICATION, 2022–2027 (USD MILLION)

- TABLE 105 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY OTHER APPLICATIONS, 2019–2021 (USD MILLION)

- TABLE 106 EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY OTHER APPLICATIONS, 2022–2027 (USD MILLION)

- TABLE 107 UK: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 108 UK: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 109 UK: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 110 UK: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 111 FRANCE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 112 FRANCE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 113 FRANCE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 114 FRANCE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 115 GERMANY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 116 GERMANY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 117 GERMANY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 118 GERMANY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 119 ITALY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 120 ITALY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 121 ITALY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 122 ITALY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 123 RUSSIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 124 RUSSIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 125 RUSSIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 126 RUSSIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 127 SWEDEN: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 128 SWEDEN: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 129 SWEDEN: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 130 SWEDEN: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 131 REST OF EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 132 REST OF EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 133 REST OF EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 134 REST OF EUROPE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 137 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 140 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 141 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2019–2021 (USD MILLION)

- TABLE 142 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2022–2027 (USD MILLION)

- TABLE 143 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2019–2021 (USD MILLION)

- TABLE 144 ASIA PACIFIC: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 145 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR AGRICULTURE, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 152 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR AGRICULTURE, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 153 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR UTILITIES, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 154 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR UTILITIES, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 155 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR OIL & GAS, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 156 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR OIL & GAS, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 157 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR MINING, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 158 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR MINING, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 159 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR OTHERS, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 160 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET FOR OTHERS, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 161 CHINA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 162 CHINA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 163 CHINA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 164 CHINA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 165 JAPAN: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 166 JAPAN: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 167 JAPAN: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 168 JAPAN: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 169 INDIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 170 INDIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 171 INDIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 172 INDIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 173 AUSTRALIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 174 AUSTRALIA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 175 AUSTRALIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 176 AUSTRALIA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 177 SOUTH KOREA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 178 SOUTH KOREA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 179 SOUTH KOREA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 180 SOUTH KOREA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 185 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 186 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 187 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 188 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 189 MIDDLE EAST: DRONE INSPECTION AND MONITORING FOR SOLUTIONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 190 MIDDLE EAST: DRONE INSPECTION AND MONITORING FOR SOLUTIONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 191 MIDDLE EAST: DRONE INSPECTION AND MONITORING FOR SOLUTIONS MARKET, BY INFRASTRUCTURE, 2019–2021 (USD MILLION)

- TABLE 192 MIDDLE EAST: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2022–2027 (USD MILLION)

- TABLE 193 MIDDLE EAST: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2019–2021 (USD MILLION)

- TABLE 194 MIDDLE EAST: DRONE INSPECTION AND MONITORING FOR SOLUTIONS MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 195 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 196 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 197 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 198 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 199 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY CONSTRUCTION & INFRASTRUCTURE, 2019–2021 (USD MILLION)

- TABLE 200 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY CONSTRUCTION & INFRASTRUCTURE, 2022–2027 (USD MILLION)

- TABLE 201 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY AGRICULTURE, 2019–2021 (USD MILLION)

- TABLE 202 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY AGRICULTURE, 2022–2027 (USD MILLION)

- TABLE 203 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY UTILITIES, 2019–2021 (USD MILLION)

- TABLE 204 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY UTILITIES, 2022–2027 (USD MILLION)

- TABLE 205 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY OIL & GAS, 2019–2021 (USD MILLION)

- TABLE 206 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY OIL & GAS, 2022–2027 (USD MILLION)

- TABLE 207 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY MINING, 2019–2021 (USD MILLION)

- TABLE 208 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, MINING, 2022–2027 (USD MILLION)

- TABLE 209 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, BY OTHERS, 2019–2021 (USD MILLION)

- TABLE 210 MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET FOR APPLICATION, OTHERS, 2022–2027 (USD MILLION)

- TABLE 211 ISRAEL: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 212 ISRAEL: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 213 ISRAEL: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 214 ISRAEL: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 215 TURKEY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 216 TURKEY: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 217 TURKEY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 218 TURKEY: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 219 UAE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 220 UAE: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 221 UAE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 222 UAE: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 223 REST OF MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 224 REST OF MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 225 REST OF MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 226 REST OF MIDDLE EAST: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 227 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 228 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 229 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 230 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 231 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 232 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 233 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2019–2021 (USD MILLION)

- TABLE 234 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY INFRASTRUCTURE, 2022–2027 (USD MILLION)

- TABLE 235 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2019–2021 (USD MILLION)

- TABLE 236 REST OF THE WORLD: DRONE INSPECTION AND MONITORING SOLUTIONS MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 237 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 238 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 239 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 240 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 241 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 242 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 243 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR AGRICULTURE, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 244 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR AGRICULTURE, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 245 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR UTILITIES, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 246 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR UTILITIES, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 247 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR OIL & GAS, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 248 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR OIL & GAS, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 249 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR MINING, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 250 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR MINING, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 251 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR OTHERS, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 252 REST OF THE WORLD: DRONE INSPECTION AND MONITORING MARKET FOR OTHERS, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 253 LATIN AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 254 LATIN AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 255 LATIN AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 256 LATIN AMERICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 257 AFRICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

- TABLE 258 AFRICA: DRONE INSPECTION AND MONITORING MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 259 AFRICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 260 AFRICA: DRONE INSPECTION AND MONITORING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 261 DRONE INSPECTION AND MONITORING MARKET: DEGREE OF COMPETITION

- TABLE 262 COMPANY PRODUCT FOOTPRINT

- TABLE 263 COMPANY SOLUTION FOOTPRINT

- TABLE 264 COMPANY APPLICATION FOOTPRINT

- TABLE 265 COMPANY REGIONAL FOOTPRINT

- TABLE 266 DRONE INSPECTION AND MONITORING MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, FEBRUARY 2018–DECEMBER 2022

- TABLE 267 DRONE INSPECTION AND MONITORING MARKET: DEALS, AUGUST 2018–JUNE 2022

- TABLE 268 DRONE INSPECTION AND MONITORING MARKET: OTHER DEVELOPMENTS, OCTOBER 2018–JUNE 2022

- TABLE 269 INSITU: BUSINESS OVERVIEW

- TABLE 270 INSITU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 DJI: BUSINESS OVERVIEW

- TABLE 272 DJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 DJI: PRODUCT/SERVICE LAUNCHES

- TABLE 274 DJI: DEALS

- TABLE 275 DJI: OTHERS

- TABLE 276 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 277 NORTHROP GRUMMAN CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 278 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 279 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 280 NORTHROP GRUMMAN CORPORATION: OTHERS

- TABLE 281 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

- TABLE 282 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 284 TELEDYNE FLIR LLC: DEALS

- TABLE 285 TELEDYNE FLIR LLC: OTHERS

- TABLE 286 PARROT DRONE SAS: BUSINESS OVERVIEW

- TABLE 287 PARROT DRONE SAS: PRODUCTS/SERVICES OFFERED

- TABLE 288 PARROT DRONE SAS: PRODUCT LAUNCHES

- TABLE 289 PARROT DRONE SAS: DEALS

- TABLE 290 EHANG HOLDINGS LIMITED: BUSINESS OVERVIEW

- TABLE 291 EHANG HOLDINGS LIMITED: PRODUCTS/SERVICES OFFERED

- TABLE 292 EHANG HOLDINGS LIMITED: PRODUCT LAUNCHES

- TABLE 293 EHANG HOLDINGS LIMITED: DEALS

- TABLE 294 EHANG HOLDINGS LIMITED: OTHERS

- TABLE 295 INTEL CORPORATION: BUSINESS OVERVIEW

- TABLE 296 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 INTEL CORPORATION: DEAL

- TABLE 298 YUNEEC HOLDING LTD.: BUSINESS OVERVIEW

- TABLE 299 YUNEEC HOLDING LTD.: PRODUCTS/SERVICES OFFERED

- TABLE 300 YUNEEC HOLDING LTD.: PRODUCT LAUNCHES

- TABLE 301 YUNEEC HOLDING LTD.: DEALS

- TABLE 302 ECA GROUP: BUSINESS OVERVIEW

- TABLE 303 ECA GROUP: PRODUCTS/SERVICES OFFERED

- TABLE 304 ECA GROUP: DEALS

- TABLE 305 PRECISIONHAWK: BUSINESS OVERVIEW

- TABLE 306 PRECISIONHAWK: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 307 PRECISIONHAWK: DEALS

- TABLE 308 PRECISIONHAWK: OTHERS

- TABLE 309 MICRODRONES: BUSINESS OVERVIEW

- TABLE 310 MICRODRONES: PRODUCTS/SERVICES OFFERED

- TABLE 311 MICRODRONES: DEALS

- TABLE 312 MICRODRONES: OTHERS

- TABLE 313 SKYDIO: BUSINESS OVERVIEW

- TABLE 314 SKYDIO: PRODUCTS/SERVICES OFFERED

- TABLE 315 SKYDIO: DEALS

- TABLE 316 SKYDIO: OTHERS

- TABLE 317 AERIALTRONICS: BUSINESS OVERVIEW

- TABLE 318 AERIALTRONICS: PRODUCTS/SERVICES OFFERED

- TABLE 319 IDEAFORGE: BUSINESS OVERVIEW

- TABLE 320 IDEAFORGE: PRODUCTS/SERVICES OFFERED

- TABLE 321 IDEAFORGE: DEALS

- TABLE 322 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- TABLE 323 LOCKHEED MARTIN CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 324 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 325 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 326 LOCKHEED MARTIN CORPORATION: OTHERS

- TABLE 327 VIPER DRONES: BUSINESS OVERVIEW

- TABLE 328 VIPER DRONES: PRODUCTS/SERVICES OFFERED

- TABLE 329 AGEAGLE AERIAL SYSTEMS INC: BUSINESS OVERVIEW

- TABLE 330 AGEAGLE AERIAL SYSTEMS INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 331 AGEAGLE AERIAL SYSTEMS INC.: DEALS

- TABLE 332 TERRA DRONE CORPORATION: BUSINESS OVERVIEW

- TABLE 333 TERRA DRONE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 TERRA DRONE CORPORATION: DEALS

- TABLE 335 TERRA DRONE CORPORATION: OTHERS

- TABLE 336 THYSSENKRUPP INDUSTRIAL SOLUTIONS AG: BUSINESS OVERVIEW

- TABLE 337 THYSSENKRUPP INDUSTRIAL SOLUTIONS AG: PRODUCTS/SERVICES OFFERED

- TABLE 338 DRONEGENUITY: BUSINESS OVERVIEW

- TABLE 339 DRONEGENUITY: PRODUCTS/SERVICES OFFERED

- TABLE 340 FORCE TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 341 FORCE TECHNOLOGY: PRODUCTS/SERVICES OFFERED

- TABLE 342 WIPRO: BUSINESS OVERVIEW

- TABLE 343 WIPRO: PRODUCTS/SERVICES OFFERED

- TABLE 344 MISTRAS GROUP, INC.: BUSINESS OVERVIEW

- TABLE 345 MISTRAS GROUP, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 346 MISTRAS GROUP, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 347 INTERTEK GROUP PLC: BUSINESS OVERVIEW

- TABLE 348 INTERTEK GROUP PLC: PRODUCTS/SERVICES OFFERED

- TABLE 349 INTERTEK GROUP PLC: PRODUCT/SERVICE LAUNCH

- TABLE 350 AERODYNE GROUP: BUSINESS OVERVIEW

- TABLE 351 AERODYNE GROUP: PRODUCTS/SERVICES OFFERED

- TABLE 352 AERODYNE GROUP: DEALS

- TABLE 353 AERODYNE GROUP: OTHERS

- TABLE 354 DRONEDEPLOY, INC.: COMPANY OVERVIEW

- TABLE 355 DRONEFLIGHT LTD.: COMPANY OVERVIEW

- TABLE 356 RELIABILITY MAINTENANCE SOLUTIONS LTD.: COMPANY OVERVIEW

- TABLE 357 DJM AERIAL SOLUTIONS LIMITED: COMPANY OVERVIEW

- TABLE 358 CANADIAN UAVS: COMPANY OVERVIEW

- TABLE 359 MAVERICK INSPECTION LTD.: COMPANY OVERVIEW

- TABLE 360 GARUDAUAV SOFT SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 361 HEMAV: COMPANY OVERVIEW

- TABLE 362 RAPTOR MAPS, INC.: COMPANY OVERVIEW

- TABLE 363 AIRPIX: COMPANY OVERVIEW

- FIGURE 1 DRONE INSPECTION AND MONITORING MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 DRONE INSPECTION AND MONITORING MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 GLOBAL DRONE INVESTMENT VALUE (USD MILLION), 2015–2021

- FIGURE 6 HALF-YEAR RESULT OF TOP FIVE PLAYERS, 2019–2022

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

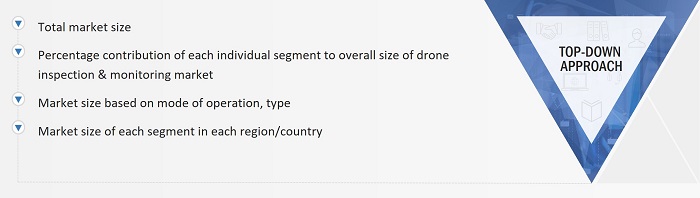

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 11 BY TYPE, HYBRID SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 BY MODE OF OPERATION, OPTIONALLY PILOTED SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 13 BY APPLICATION, AGRICULTURE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE BY 2027

- FIGURE 14 DRONE INSPECTION AND MONITORING MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 15 IMPROVEMENT IN REGULATORY FRAMEWORK TO DRIVE MARKET GROWTH FROM 2022 TO 2027

- FIGURE 16 BY TYPE, MULTIROTOR SEGMENT EXPECTED TO LEAD DRONE INSPECTION AND MONITORING MARKET FROM 2022 TO 2027

- FIGURE 17 BY APPLICATION, CONSTRUCTION & INFRASTRUCTURE SEGMENT PROJECTED TO DRIVE MARKET FROM 2022 TO 2027

- FIGURE 18 BY MODE OF OPERATION, OPTIONALLY PILOTED DRONE SEGMENT FORECASTED TO ACCOUNT FOR MOST SIGNIFICANT MARKET SHARE FROM 2022 TO 2027

- FIGURE 19 BY SOLUTION, SERVICES SEGMENT FORECASTED TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 20 BY DISTRIBUTION CHANNEL, OFFLINE SEGMENT ESTIMATED TO BOOST MARKET FROM 2022 TO 2027

- FIGURE 21 NORTH AMERICA ESTIMATED TO LEAD MARKET IN 2022

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DRONE INSPECTION AND MONITORING MARKET

- FIGURE 23 VALUE CHAIN: DRONE INSPECTION AND MONITORING MARKET

- FIGURE 24 DRONE INSPECTION AND MONITORING MARKET ECOSYSTEM MAP

- FIGURE 25 REVENUE SHIFT CURVE FOR DRONE INSPECTION AND MONITORING MARKET

- FIGURE 26 PORTER’S FIVE FORCES ANALYSIS FOR DRONE INSPECTION AND MONITORING MARKET

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOLUTIONS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE SOLUTIONS

- FIGURE 29 NDT-UAV APPLICATIONS IN BRIDGE CONDITION MONITORING

- FIGURE 30 SERVICES SEGMENT TO LEAD MARKET SHARE DURING FORECAST PERIOD

- FIGURE 31 HYBRID TYPE TO RECORD HIGHEST GROWTH DURING 2022–2027

- FIGURE 32 CONSTRUCTION & INFRASTRUCTURE TO WITNESS HIGH GROWTH DURING 2022–2027

- FIGURE 33 OPTIONALLY PILOTED SEGMENT PROJECTED TO HOLD LEADING SHARE DURING FORECAST PERIOD

- FIGURE 34 OFFLINE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 35 DRONE INSPECTION AND MONITORING MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: DRONE INSPECTION AND MONITORING MARKET SNAPSHOT

- FIGURE 37 EUROPE: DRONE INSPECTION AND MONITORING MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: DRONE INSPECTION AND MONITORING MARKET SNAPSHOT

- FIGURE 39 RANKING OF KEY PLAYERS IN DRONE INSPECTION AND MONITORING MARKET, 2021

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES IN DRONE INSPECTION AND MONITORING MARKET, 2021

- FIGURE 41 DRONE INSPECTION AND MONITORING MARKET SHARE ANALYSIS OF KEY COMPANIES, 2021

- FIGURE 42 DRONE INSPECTION AND MONITORING MARKET: COMPANY EVALUATION MATRIX, 2021

- FIGURE 43 DRONE INSPECTION AND MONITORING MARKET (START-UP/SME): COMPANY EVALUATION MATRIX, 2021

- FIGURE 44 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- FIGURE 46 PARROT DRONE SAS: COMPANY SNAPSHOT

- FIGURE 47 EHANG HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 48 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 ECA GROUP: COMPANY SNAPSHOT

- FIGURE 50 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 WIPRO: COMPANY SNAPSHOT

- FIGURE 52 MISTRAS GROUP, INC.: COMPANY SNAPSHOT

- FIGURE 53 INTERTEK GROUP PLC: COMPANY SNAPSHOT

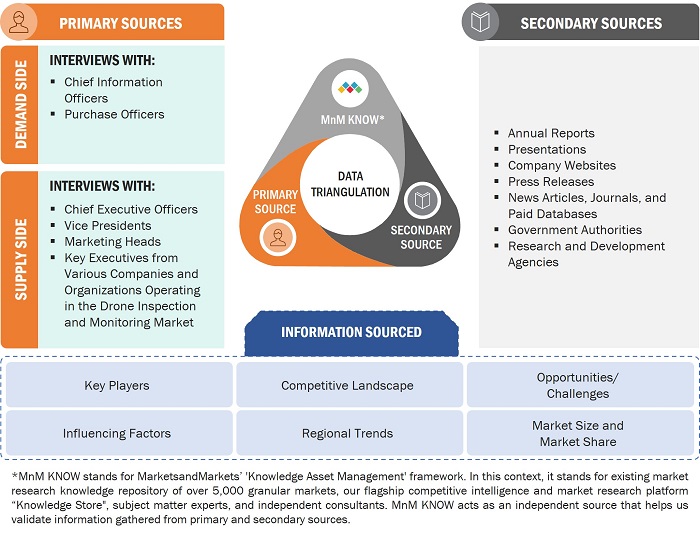

This research study on the drone inspection and monitoring market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the drone inspection and monitoring market as well as assess its growth prospects.

Secondary Research

Secondary sources referred for this research study included financial statements of companies offering drone inspection and monitoring for all types of solutions such as platform, software, infrastructure, and service, along with information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market that was validated by primary respondents.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as chief X officers (CXOs), vice presidents (VPs), and directors from business development, marketing, and product development/innovation teams; related key executives from the market participants, such as Skydio (US), Microdrones (Germany), Aarav Unmanned Systems (AUS) (India), and Detect Technologies (India); independent aviation consultants; importers; distributors of drone inspection and monitoring systems; and the key opinion leaders.

Extensive primary research was conducted after obtaining information about the current scenario of the drone inspection and monitoring market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across five regions: North America, Europe, Asia Pacific, the Middle East, and the Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. Primary research also helped analyze the solution, type, application, mode of operation, and distribution channel segments of the market for five key regions. Stakeholders from the demand side, such as CXOs, production managers, and maintenance engineers, were interviewed to understand the perspective of buyers on product suppliers and service providers, along with their current usage. It also helped in understanding the future outlook of their businesses that will affect the overall drone inspection and monitoring market.

To know about the assumptions considered for the study, download the pdf brochure

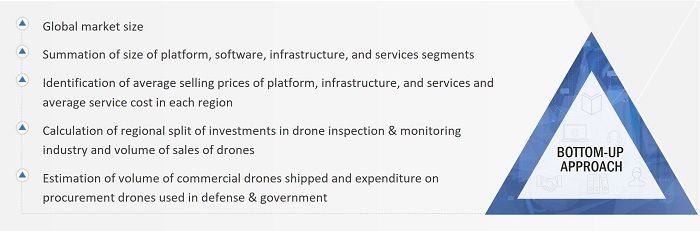

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the drone inspection and monitoring market. The figure in the section below is a representation of the overall market size estimation process employed for the purpose of this study. The research methodology used to estimate the market size also includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

This data was compiled, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market Size Estimation Methodology: Bottom-up Approach

Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall size of the drone inspection and monitoring market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and data triangulation procedure implemented in the market engineering process for developing this report.

Report Objectives

- To define, describe, segment, and forecast the size of the drone inspection and monitoring (DIM) market based on solution, type, application, mode of operation, and distribution channel

- To forecast the size of different segments of the market with respect to five key regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, along with their key countries

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify technology trends currently prevailing in the market

- To provide an overview of the tariff and regulatory landscape with respect to drone inspection and monitoring across different regions

- To analyze micro-markets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for the stakeholders by identifying key market trends

- To analyze the impact of the recession on the market and its stakeholders

- To profile the leading market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as new product launches, collaborations & expansions, contracts, partnerships, and agreements, adopted by the leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the drone inspection and monitoring market, along with a ranking analysis, market share analysis, and revenue analysis of the key players

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Drone Inspection and Monitoring Market