Automotive Rubber Seals Market

Automotive Rubber Seals Market by Component (Glass Run Channels, Roof Ditch Molding, Door, Front Windshield, Hood & Trunk Seals, Glass), Material (TPE, PVC, Silicone, EPDM Rubber), Vehicle Type (ICE, Electric), and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

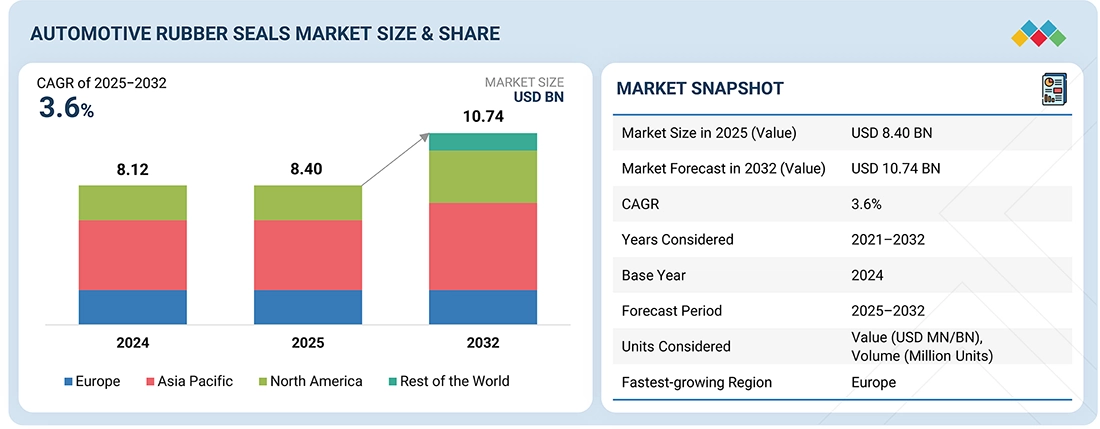

The automotive rubber seals market is projected to reach USD 10.74 billion by 2032 from USD 8.40 billion in 2025, with a CAGR of 3.6%. The automotive rubber seals market is expanding as vehicle design shifts toward electrification, aerodynamics, and acoustic comfort. EVs, in particular, demand aero-efficient and noise-insulating seals to offset the absence of engine masking noise and to maximize battery range through drag reduction. Premium models and SUVs increasingly adopt glass encapsulation, frameless door seals, and co-extruded materials that integrate lightweight thermoplastic elastomers (TPE/TPV) with EPDM rubber for durability and recyclability. In addition, the rise of panoramic roofs and frameless windows is creating demand for complex roof ditch moldings and advanced glass run channels. OEM sustainability goals and regional regulations are accelerating material transitions away from PVC toward recyclable elastomers, further reshaping product development.

KEY TAKEAWAYS

-

BY COMPONENTGlass run channels is the largest segment owing to their universal use in vehicles for sealing and smooth window operation, while glass encapsulation is the fastest-growing segment, driven by rising demand for panoramic sunroofs, frameless doors, and advanced glazing in EVs and premium cars.

-

BY VEHICLE TYPEPassenger cars dominate the sealing market due to high volumes and comfort/noise-reduction needs. LCVs maintain steady demand for durability, while HCVs focus on robust sealing for long-haul use. EVs are the fastest-growing segment, driven by aerodynamics, noise insulation, and lightweight design to enhance range.

-

BY ELECTRIC VEHICLE TYPEBEVs are the fastest-growing segment, driven by aerodynamics, noise insulation, and lightweight design to enhance range. Key applications include glass run channels and door seals for NVH reduction, as well as hood and trunk seals to optimize airflow and thermal efficiency around battery systems.

-

BY MATERIAL TYPEEPDM rubber dominates the market due to its excellent durability, weather resistance, and cost-effectiveness. TPE/TPV seals are gaining traction for their flexibility and recyclability, particularly in lightweight and EV applications. PVC-based seals maintain steady demand in cost-sensitive segments, while silicone-based seals are the fastest-growing, driven by superior thermal stability, noise insulation, and performance in premium and EV vehicles.

-

BY REGIONAsia Pacific is the largest market, driven by high vehicle production, growing EV adoption, and rising demand for comfort and noise reduction. The region shows strong demand for cost-effective sealing solutions like EPDM and TPE/TPV. Rapid urbanization and stricter emission and noise regulations are also encouraging the adoption of advanced sealing systems.

-

COMPETITIVE LANDSCAPEKey players such as Cooper Standard Automotive (US), Toyoda Gosei Co., Ltd. (Japan), Hutchinson (France), Nishikawa Rubber Co., Ltd. (Japan), and Jianxin (China) are focusing on innovations in material, aerodynamics & noise reduction, and manufacturing & process innovation. Strategies include R&D investments, strategic partnerships, product diversification, and integration of modular, scalable solutions to meet the evolving demands of EV powertrains, battery management, and advanced in-vehicle connectivity systems. These companies develop new products, adopt expansion strategies, obtain supply contracts, and establish joint ventures and agreements to gain traction in the automotive rubber seals market.

The automotive window and sealing systems market is poised for strong growth, driven by rising vehicle production, electrification, and increasing focus on comfort, noise reduction, and energy efficiency. High-performance, durable sealing solutions are critical for weatherproofing, aerodynamics, and NVH control, ensuring safer and more comfortable vehicle operation. Innovation in lightweight, multi-material, and thermally efficient seals supports advanced vehicle designs, including EVs and premium segments.

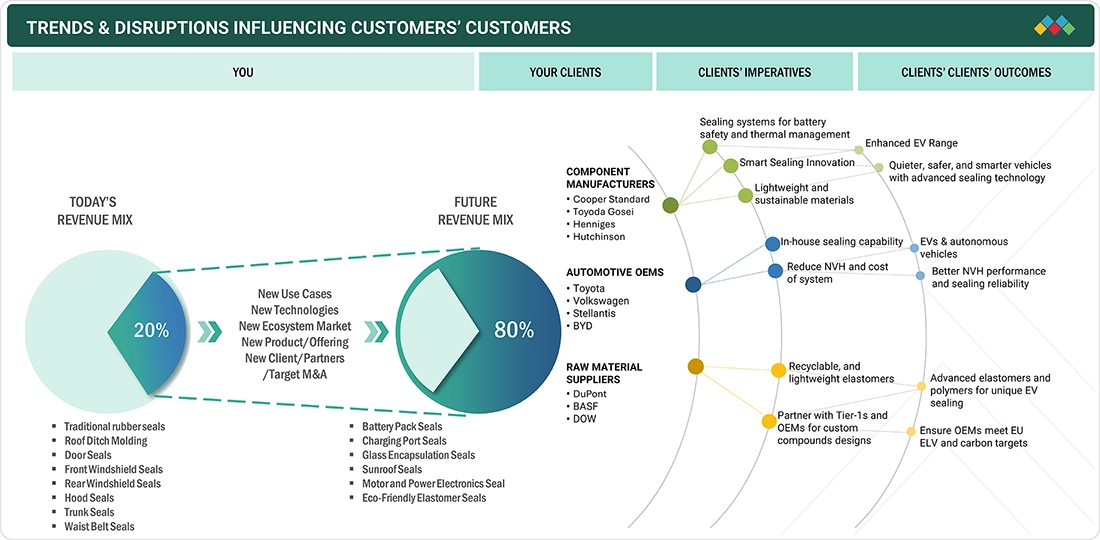

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in demand and technology trends in the automotive rubber seals market directly impact OEMs and suppliers’ businesses. Growing focus on lightweight, durable, and acoustically optimized sealing systems influences vehicle comfort, safety, and energy efficiency. These shifts cascade to raw material suppliers, Tier-I manufacturers, and OEMs, ultimately shaping revenue streams across the value chain and driving growth opportunities for innovative sealing solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Electrification & NVH Standards

-

Safety and Regulatory Pressure

Level

-

Raw Material Volatility

-

Complex assembly & fitment tolerances

Level

-

Advanced Encapsulation & Smart Glass Integration

-

EV Growth in Asia Pacific

Level

-

Balancing Performance vs. Cost

-

Integration with connected and autonomous vehicles

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Electrification & NVH Standards

Rising EV adoption highlights the need for advanced sealing solutions, as the absence of engine noise makes wind and road sounds more noticeable. OEMs are increasingly adopting double-lip glass run channels, advanced waist belt seals, and encapsulated laminated glass to enhance cabin quietness and meet stricter NVH requirements, especially in premium EVs.

Restraint: Raw Material Volatility

EPDM and TPV prices, tied to crude oil, create cost instability for sealing suppliers. Asia-Pacific players face added risk from import dependence on specialty elastomers. OEM cost-cutting pressures further squeeze margins, especially in entry-level PC and LCV segments.

Opportunity: Advanced Encapsulation & Smart Glass Integration

Rising adoption of ADAS and premium EVs is driving demand for encapsulated windshields and acoustic glass. Integrated solutions enabling sensor transparency and noise reduction create strong growth opportunities for suppliers in China, Europe, and the US.

Challenge: Balancing Performance vs. Cost

OEMs in cost-sensitive markets favor basic sealing solutions, while premium EVs demand advanced double-layer systems, widening the technology gap. In LCVs and HCVs, durability takes precedence over acoustics, making it difficult for suppliers to balance performance with affordability.

Automotive Rubber Seals Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Design and supply of automotive window and sealing systems, including weatherstrips, glass run channels, and door seals | Ensure high durability, weather resistance, NVH reduction, and integration with vehicle aerodynamics |

|

Provide advanced materials such as EPDM, TPE/TPV, silicone, and PVC for seals and window systems | Enable lightweight, flexible, and thermally/chemically resistant seals; support innovation in EVs and premium vehicles |

|

Integrate sealing systems into production vehicles, including EVs, PCs, LCVs, and HCVs | Enhance cabin comfort, noise insulation, safety, and overall vehicle quality |

|

Supply replacement windows and sealing components for maintenance and refurbishment | Maintain vehicle performance, extend lifespan, and offer cost-effective solutions for older vehicles |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem mapping highlights various players in the automotive rubber seals market, mainly including raw material suppliers, component manufacturers, automotive OEMs, and aftermarket suppliers. The leading players in the automotive rubber seals market are Cooper Standard (US), Toyoda Gosei Co., Ltd. (Japan), Hutchinson SA (France), Nishikawa Rubber Co., Ltd. (Japan), and SaarGummi Automotive (Germany), among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automotive Rubber Seals Market, By Component Type

Glass run channels are the largest component segment, accounting for the highest revenue share in the automotive rubber seals market. Their widespread use across passenger cars, LCVs, HCVs, and EVs, combined with their role in ensuring effective sealing, NVH performance, and weather resistance, makes them a core sealing solution for OEMs globally. Growing emphasis on acoustic comfort in EVs further reinforces their dominance.

Automotive Rubber Seals Market, By Vehicle Type

Passenger car demand dominates the automotive rubber seals market due to high vehicle production, consumer expectations for comfort, and a focus on water-tightness and noise reduction. Market growth is further propelled by rising adoption of advanced sealing technologies for enhanced NVH (noise, vibration, harshness) performance, the expanding popularity of SUVs and electric vehicles (necessitating more complex and durable seals), stringent environmental and emission regulations, and a shift toward lightweighting and sustainable materials.

Automotive Rubber Seals Market, By Electric Vehicle

Rapid electrification, stricter environmental regulations, and heightened consumer focus on cabin comfort require advanced weatherstripping and sealing solutions that maximize noise insulation, water-tightness, and aerodynamic efficiency. OEMs and suppliers are increasingly adopting high-performance materials such as EPDM rubber for greater durability and resistance to temperature extremes. Innovation in sustainable and bio-based materials, expansion of EV-focused R&D, and robust government incentives for EV production further fuel market expansion, with BEVs leading segment growth due to policy support and evolving consumer preferences.

Automotive Rubber Seals Market, By Material Type

EPDM remains the industry leader by market share due to its exceptional durability, flexibility, and superior resistance to extreme temperatures, ozone, and UV light. It is widely chosen for door, window, roof, and windshield seals, including engine and battery enclosures, and is especially critical for BEV/PHEV thermal and moisture management.

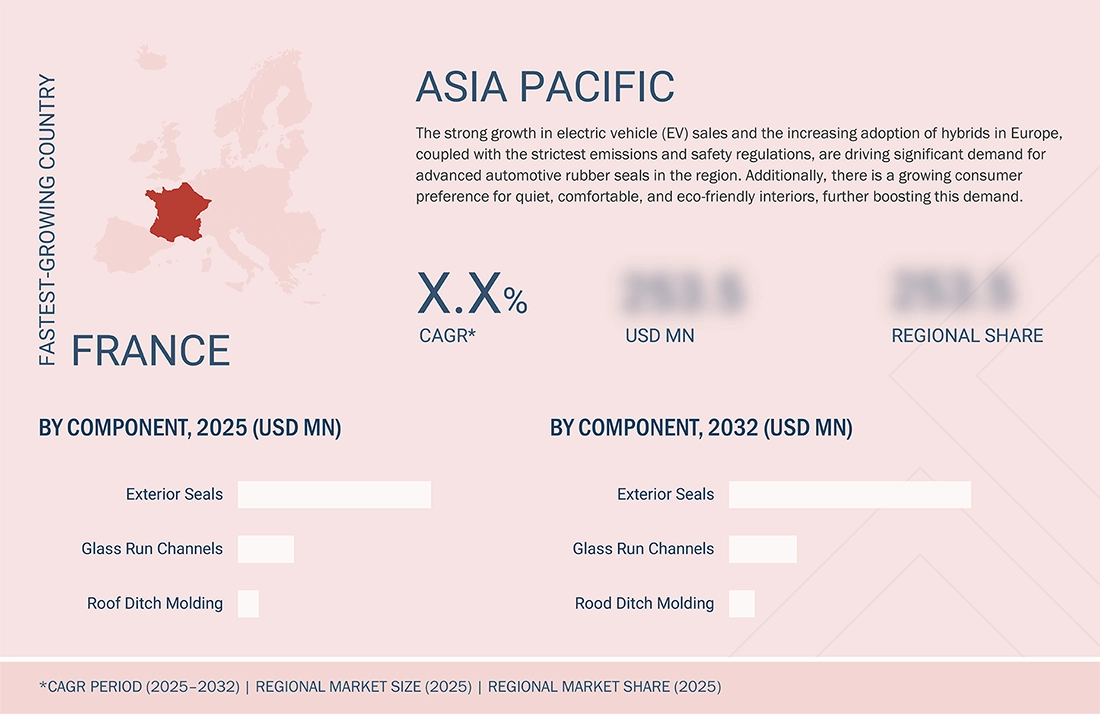

REGION

Europe is projected to be the fastest-growing region in the global automotive rubber seals market during the forecast period.

Europe is expected to be the fastest-growing market during the forecast period. The growth is driven by stringent regulations, rising demand for lightweight and noise-optimized vehicles, and rapid advancements in sealing technologies. Germany leads the region, supported by its dominance in automotive manufacturing, high R&D investment, and strategic role as a central European export hub.

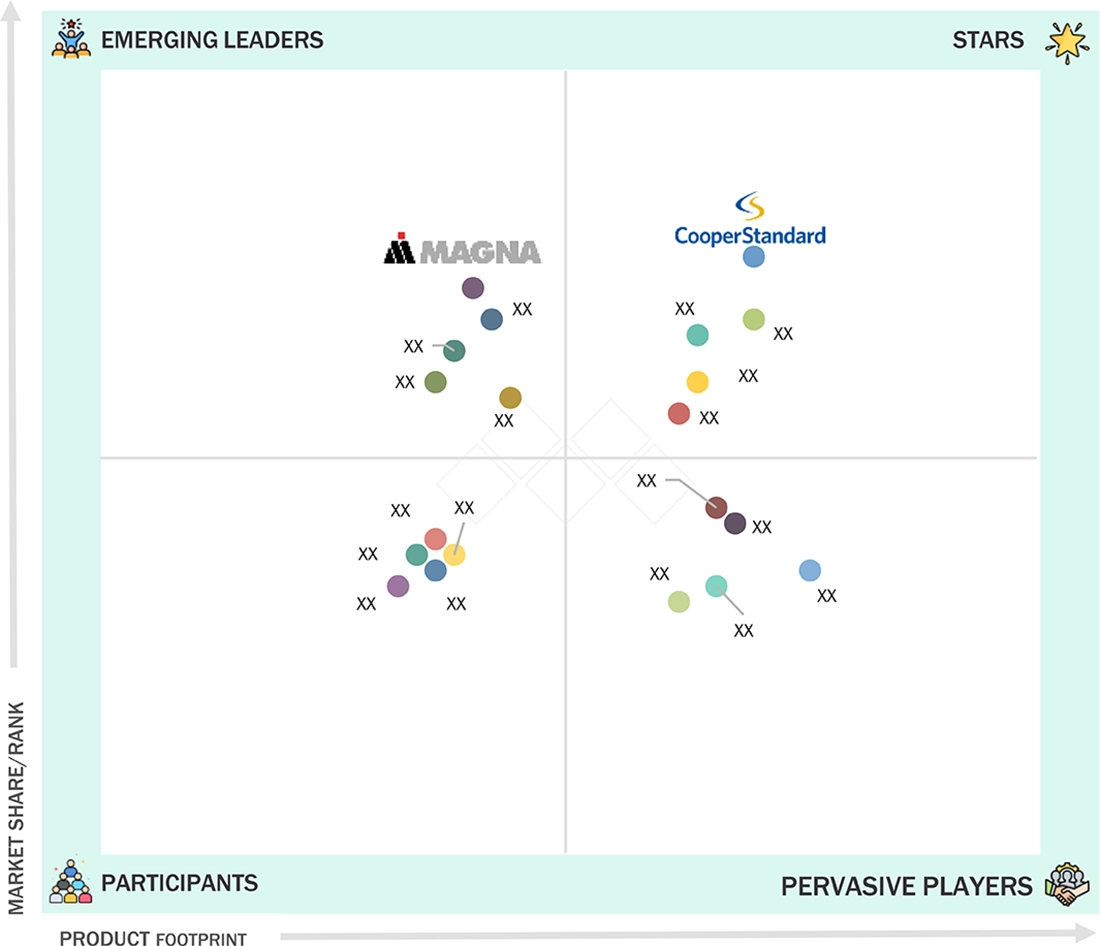

Automotive Rubber Seals Market: COMPANY EVALUATION MATRIX

In the automotive rubber seals market matrix, Cooper Standard Automotive (US) (Star) leads with a strong market presence and a wide product portfolio, with usage of sealing systems in all vehicle types. Magna International Inc. (Emerging Leader) is gaining traction with advanced automotive rubber seal solutions, supporting diverse vehicle architectures and high-reliability applications. While Cooper Standard Automotive dominates with scale, Magna shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | 8.40 BN |

| Market Forecast in 2032 (Value) | 10.74 BN |

| Growth Rate | CAGR of 3.6% from 2025 to 2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units considered | Value (USD MN/BN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, and the Rest of the World |

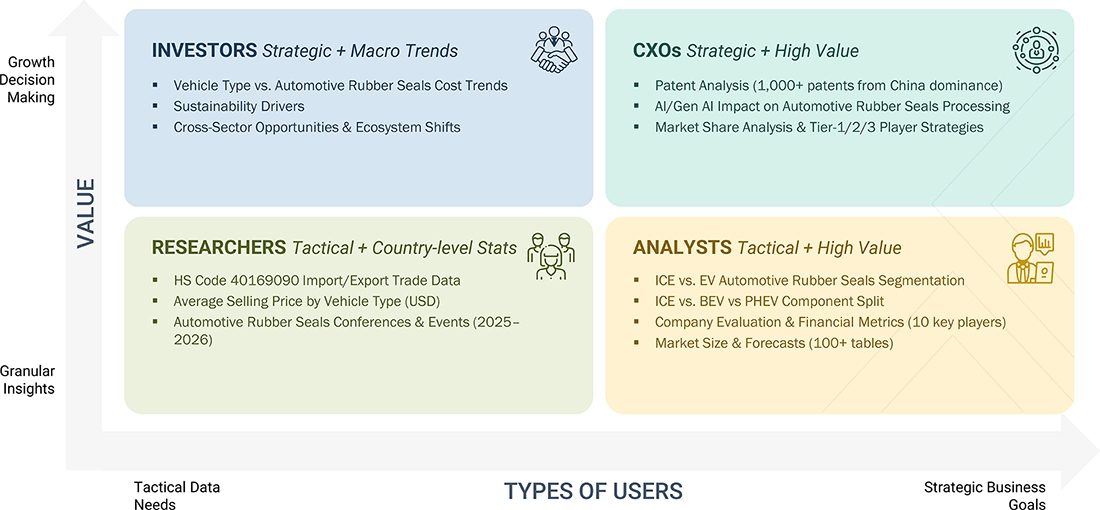

WHAT IS IN IT FOR YOU: Automotive Rubber Seals Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based EV OEMs & Tier-1 Suppliers | Competitor benchmarking for EV-specific sealing solutions, including smart glass integration and noise/vibration/harshness (NVH) performance | Identification of high-value differentiation opportunities in EV sealing solutions and smart window technologies |

| European OEMs targeting LCVs & HCVs |

|

|

| Premium Global EV Suppliers |

|

|

RECENT DEVELOPMENTS

- July 2025 : Cooper Standard announced a collaboration with Renault Group on the Renault Emblème project, an eco-conscious family demo car focused on reducing lifecycle CO2 emissions. The project integrates two key innovations: the FlexiCore thermoplastic body seal, a fully recyclable, lightweight alternative to traditional rubber-metal designs, and the FlushSeal system, offering aerodynamic efficiency and improved window guidance. This partnership highlights Cooper Standard’s role in advancing sustainable, high-performance sealing solutions aligned with OEM climate targets.

- February 2025 : Cooper Standard highlighted its Fortrex material technology at major automotive industry events in North America and Europe. Fortrex is a proprietary lightweight elastomer that blends the processability of thermoplastic materials with the durability and flexibility of traditional EPDM rubber.

- November 2024 : Cooper Standard participated in the China International Import Expo (CIIE), one of the country’s largest trade exhibitions. The company showcased its portfolio of advanced sealing technologies with a focus on EV applications. Key highlights included lightweight door and glass run channel systems designed to cut mass while improving sealing integrity, as well as new NVH solutions that minimize wind and road noise inside electric vehicles.

- September 2024 : Toyoda Gosei developed a simulation system that allows automakers to experience interior cabin sounds using different sealing parts during vehicle design. The tool helps OEMs select seals that improve NVH and create quieter cabin spaces, especially important for EVs.

- May 2024 : Toyoda Gosei doubled its rubber recycling capacity in Japan by expanding processing facilities. This move supports sustainability goals by reusing more production scrap into new automotive rubber parts, lowering waste, and reducing dependence on virgin raw materials.

Table of Contents

Methodology

The research study involved extensive use of secondary sources such as company annual reports/presentations, industry association publications, magazines, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases to identify and collect information on the automotive rubber seals market. In-depth interviews were conducted with various primary sources—experts from related industry players, rubber seal suppliers, and automotive OEMs - to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information on the automotive rubber seals for this study. The secondary sources referred to for this research study included automotive industry organizations (such as Organisation Internationale des Constructeurs d'Automobiles (OICA), CAAM, JAMA, ACEA, etc.), automotive rubber seals manufacturers, Automotive Services Association (ASA), and automotive rubber seals suppliers, regulatory bodies, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive rubber seals market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand side (automotive OEMs) and the supply side (automotive rubber seals manufacturers and distributors), and players across 4 major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 55% primary interviews from the demand side and 45% from the supply side have been conducted. Primary data has been collected through questionnaires, emails, and telephonic interviews.

In our canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our reports. After interacting with industry participants, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of in-house subject-matter experts, has led us to the findings described in the remainder of this report.

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the size of the automotive rubber seals market and other dependent submarkets, as mentioned below:

Market Size Estimation Methodology-Bottom-up approach

- Key players in the automotive rubber seals market were identified through secondary research, and their global market share was determined through primary and secondary research.

- The research methodology included the study of identifying the average number of glass run channels, roof ditch molding, and exterior sealing components installed in passenger cars, LCVs, HCVs, and EVs.

- These average numbers are multiplied by the vehicle production to arrive at the total market size, by volume.

- The average number of glass run channels, roof ditch molding, and exterior sealing components is then multiplied by the weight in gms per vehicle type (PC, LCV, HCVs, and EVs) at the country level to arrive at the total market size, by volume (million LBS)

- The market size, by value, is derived by multiplying the average selling price of automotive glass run channels, roof ditch molding, and exterior sealing components by the number of units.

- All major penetration rates, percentage shares, splits, and breakdowns for the component & vehicle type of the automotive rubber seals market were determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Automotive Rubber Seals Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact data for the market by value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply participants.

Market Definition

The automotive rubber seals market consists of different sealing systems that are used in a vehicle, which include seals of doors, windows, hood, and trunk to prevent water, dust, air, and noise from entering the vehicle.

Stakeholders

- Automotive rubber seal manufacturers

- Automotive raw material suppliers

- Automotive OEMs

- Research & development (R&D) centers

- Associations, forums, and alliances related to automobiles

- Automobile organizations/associations

- EV component manufacturers

- EV manufacturers

- Government agencies and policymakers

- Traders and distributors of automotive seals

Report Objectives

-

To segment and forecast the size of the automotive rubber seals market in terms of volume (Units & million LBS) and value (USD million) from 2021 to 2032

- To define, describe, and forecast the automotive rubber seals market in terms of volume and value

- To define, describe, and forecast the global automotive seals market based on component, vehicle type, end, and region

- To segment and forecast the market size of the automotive rubber seals market by component (Glass run channels, roof ditch molding, door seals, front windshield seals, rear windshield seals, hood seals, trunk seals, waist belt seals, and glass encapsulation)

- To segment and forecast the market size of the automotive rubber seals market by vehicle type (ICE) (Passenger car, light commercial vehicle, and heavy commercial vehicle)

- To segment and forecast the market size of the automotive rubber seals market by vehicle type (EV, BEV, PHEV)

- To forecast the market size with respect to key regions, namely Asia Pacific, Europe, North America, and the Rest of the World

- To provide detailed information regarding the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market share and core competencies

-

To study the following with respect to the market:

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- HS Code Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Conferences and Events

- Key Stakeholders and Buying Criteria

- Investment and Funding Scenario

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To track and analyze competitive developments such as product developments, deals, and others undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Automotive Rubber Seals Market, By Electric Heavy Commercial Vehicle, at the regional level

Automotive Rubber Seals Market, by Off-Highway Vehicle, at the regional level

Company Information

- Profiling of Additional Market Players (Up to 6)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Rubber Seals Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Automotive Rubber Seals Market

Amey

Nov, 2019

My specific field of interest are EPDM rubber sealing profiles used in vehicles (as I know mainly exterior like a door or side window seals), and break down of these and any detail as well as market players you can provide there. Not interested in O-rings, sealing pasts, form parts, dampeners, and so on..