Automotive Wheel Market by Rim Size (13-15,16-18,19-21,>21 inch), Material (Steel, Alloy, Carbon Fiber), Off-highway (Construction & Mining, Agriculture Tractors) Vehicle Type, Vehicle Class, End-Use, and Region - Global Forecast to 2025

[151 Pages Report] The automotive wheel market was valued at USD 31.34 Billion in 2016 and is expected to reach USD 50.54 Billion by 2025, at a CAGR of 5.52%. The base year for the report is 2016 and the forecast period is 2017 to 2025.

Objectives of the Report

- To define, segment, and forecast the market (2015–2025), in terms of volume (million units) and value (USD million)

- To segment the market and forecast the market size, by volume and value, on the basis of end-use into Original Equipment (OE) market and aftermarket

- To analyze and forecast (2015–2025) the market size, by volume, of the off-highway wheel OE market for construction equipment and agricultural tractors at regional level

- To segment the market and forecast the market size, by volume and value, on the basis of material into steel, alloy (magnesium and aluminum), and carbon fiber

- To segment the market and forecast the market size, by volume and value, on the basis of vehicle type into passenger vehicles, light commercial vehicles, and heavy commercial vehicles

- To segment the market and forecast the market size, by volume and value, on the basis of vehicle class into economy, mid-priced, and luxury

- To define, describe and project the automotive wheel OE market (country level) on the basis of rim size (13"–15", 16"–18",19"–21", and >21")

- To provide a detailed analysis of various forces acting in the global market (drivers, restraints, opportunities, and challenges)

- To analyze the regional markets for growth trends, future prospects, and their contribution to the overall market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other industry activities carried out by key industry participants

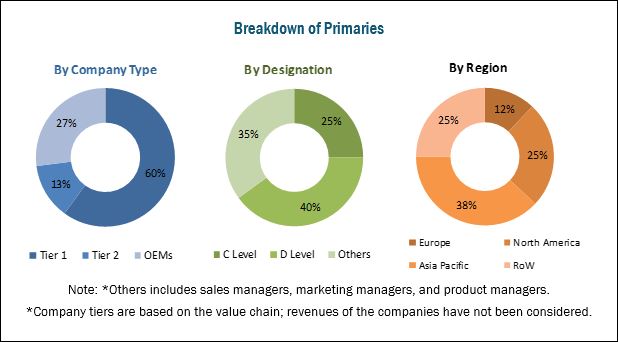

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for the purpose of data triangulation. The study involves the country-level OEM and model-wise analysis of global market. This analysis involves historical trends as well as existing market penetrations by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and adoption rate by OEMs. The analysis has been discussed and validated by primary respondents, which include experts from the automotive industry, manufacturers, and suppliers. Secondary sources include associations such as China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), European Automobile Manufacturers Association (ACEA), Environmental Protection Agency (EPA), Society of Indian Automotive Manufacturers, SAE International, and paid databases and directories such as Factiva.

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The key players in the automotive wheel market are Iochpe-Maxion (Brazil), Superior Industries International (US), Accuride Corporation (US), Steel Strips Wheels (India), Hitachi Metals (Japan), Enkei (Japan), Citic Dicastal (China), Zhejiang Wanfeng Auto Wheel (China), Borbet (Germany), Mangels Industrial (Brazil), and Mefro Wheels (Germany).

Target Audience

- Automobile manufacturers

- Automotive component manufacturers

- Automotive technology experts

- Automotive wheel manufacturers

- Distributors and suppliers of automotive systems

- Engine control system manufacturers

- Independent and authorized dealers of automotive wheels

- Industry associations and experts

- Off-Highway associations

- Raw material suppliers

- Traders, distributors, and suppliers of wheels and raw materials

Scope of the Report

Market, By Rim Size

Market, By Material

Market, By End-Use

Market, By Vehicle Type

Market, By Vehicle Class

Market, By Off-Highway

Market, By Region

-

- 13"-15"

- 16"-18"

- 19"-21"

- Above 21"

- Steel

- Alloy

- Carbon Fiber and others

- OE

- Aftermarket

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Economy

- Mid-Priced

- Luxury-Priced

- Construction & Mining

- Agriculture Tractors

- Asia Pacific (China, India, Japan, South Korea, and Rest of Asia Pacific)

- Europe (Germany, Spain, France, Italy, UK, and Rest of Europe)

- North America (US, Mexico, and Canada)

- Rest of the World (Brazil, Russia, and South Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Market, by Vehicle Type and Country

Market, by Vehicle Class and Country

-

- Passenger vehicles

- Light commercial vehicles

- Heavy commercial vehicles

- Economy

- Mid-priced

- Luxury - priced

Growing vehicle production to boost the growth of the wheel market for automotive and is expected to be close to USD 50.54 Billion by 2025.

A wheel is a circular metal frame with spokes or a solid disc mounted on a wheel hub. A vehicle tire is installed on the wheel frame, which is also called as a rim or alloy wheel. These are made from steel, aluminum, magnesium, carbon fiber, or a combination of all these metals. There are three basic components of a wheel-hub, spoke, and rim.

Market Dynamics

Drivers

- Improved vehicle dynamics and increased demand for lightweight materials

- Growing vehicle production

Restraints

- Decline in enthusiast segment – millennial effect

- Volatility in raw material prices

Opportunities

- Advanced materials and new compositions in wheels

Challenges

- Engineering barriers

- Large unorganized aftermarket for wheels

- Maintaining a balance between performance, cost, and weight

Critical Questions:

- The global market is witnessing huge growth with the growth of vehicle production. Will carbon wheels be the next frontier that OEMs are targeting?

- How the existing technology will change and what are the major trend in the wheel market for automotive?

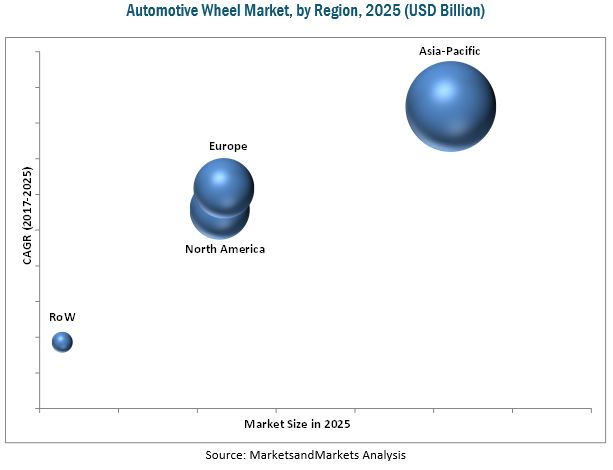

The automotive wheel market is projected to grow at a CAGR of 5.52% from 2017 to 2025. The market for automotive wheels is estimated to be USD 32.87 Billion in 2017 and is projected to reach USD 50.54 Billion by 2025. The key growth drivers of this market are the improved vehicle dynamics with an increase in the use of lightweight materials and growing vehicle production.

The alloy wheel segment is estimated to hold the largest share in the global market. The market growth in this segment can be attributed to the improved vehicle dynamics with lightweight alloy wheels and increased demand for lightweight materials to comply with stringent emission norms.

Carbon fiber and others segment is estimated to be the fastest-growing segment of this market. Rising demand for high-performance vehicle and technological innovations in the material composition are expected to drive the carbon fiber and others wheel market.

By vehicle type, the passenger vehicles segment is estimated to hold the largest share of the global market. The majority of mid and premium passenger vehicles, which provide enhanced comfort and convenience, use alloy wheels. Additionally, factors such as the sizeable number of luxury vehicles in Europe and North America and the increasing demand for luxury vehicles in the Asia Pacific region are increasing the demand for market. In the Asia Pacific region, the demand for luxury vehicles is growing due to the increasing purchasing power of consumers and the growing demand for comfort and safety features in a vehicle.

The global market for OE segment is estimated to be the largest and fastest growing market during the forecast period. Wheels are designed to last long with the vehicle life. Wheels are replaced or changed in case of accidental damage or by an enthusiast. So, the demand for the wheel is low in the aftermarket as compared to the OE market.

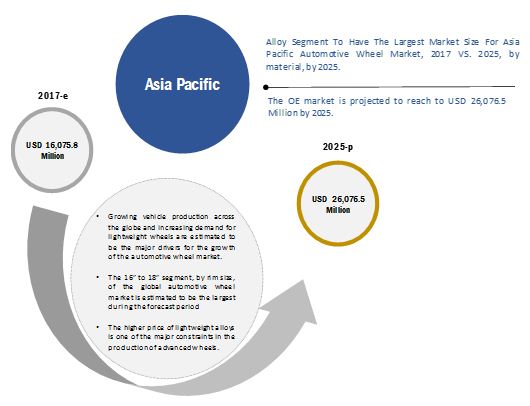

Asia Pacific is estimated to dominate the wheel market for automotive, by volume as well as value. The growth of this market can be attributed to the increased production and demand for passenger vehicles. In addition, the increasing demand for fuel economy and vehicle performance and the growing purchasing power of the consumers in the developing countries are also driving this market in the Asia Pacific region.

A key factor restraining the growth of the global market is the volatility in raw material prices. Making lightweight and regulatory compliant wheels is vital for automotive wheel manufacturers. Although the prices of wheels have decreased in the past few years, the higher wheel versions are still at a higher price range. The market is dominated by many international as well as domestic players. Some of the leading market players are Iochpe-Maxion (Brazil), Superior Industries International (US), Accuride Corporation (US), Steel Strips Wheels (India), Hitachi Metals (Japan), Enkei (Japan), Citic Dicastal (China), Zhejiang Wanfeng Auto Wheel (China), Borbet (Germany), Mangels Industrial (Brazil), and Mefro Wheels (Germany).

Automotive OEMs are in a continuous struggle to comply with the efficiency policies mandated by the governments and to cater to the consumer demand for improved fuel economy. To meet these ends, many industries nowadays are realizing the importance of using lightweight alloys and improved designs

Increase in demand for lightweight materials and improved vehicle dynamics is expected to propel the market for automotive wheel in the coming years

The global automotive wheel market is estimated to be USD 32.87 billion in 2017 and is projected to reach USD 50.54 billion by 2025, at a CAGR of 5.52% from 2017 to 2025. The market growth is primarily driven by the increasing demand for vehicle weight reduction and growing vehicle production. However, engineering barriers can restrain the growth of the global market.

Construction and mining equipment constitute the largest off-highway wheel market globally

The construction equipment constitutes various types of vehicles such as articulated dump truck, backhoe loader, motor grader, motor scraper, and others. The construction industry has witnessed a boom in the recent decades. Post the 2008 recession, there has been a significant improvement in the economy. With increase in population and improved standard of living, an increasing number of people are migrating to urban areas and spending on housing. The construction of commercial buildings, which include factories, manufacturing facilities, hospitals, schools, colleges, and others, grew by 10-12% in 2016 as compared to 2015. Hence, the demand for construction equipment is increasing, which in turn leads to the increased sales of construction and mining equipment wheels.

The passenger vehicles segment is estimated to be the largest segment, in terms of value, in the global market

The passenger vehicles segment is estimated to hold the largest market share during the forecast period. Passenger vehicles account for the largest share of the total vehicle production. Also, the increase in R&D investment by OEMs and Tier 1 players to improve the drive quality and efficiency of passenger vehicles will drive the market in this segment. Moreover, the rise in disposable income, particularly in developing countries such as China, India, Mexico, and others, will drive the automotive wheel market in the passenger vehicle segment.

Asia Pacific: Largest wheel market in Original Equipment (OE)

The Asia Pacific region leads the market, owing to increasing vehicle production in countries such as China and India. The vehicle production in these countries is projected to grow at >6.0% CAGR over the period of next five years. Increasing vehicle production has, in turn, increased the demand for wheels in this region. Many wheel manufacturers have set up their manufacturing plants in the region. These include Iochpe-Maxion (Brazil), Steel Strips Wheels (India), Hitachi Metals (Japan), Enkei (Japan), Citic Dicastal (China), and Zhejiang Wanfeng Auto Wheel (China).

Critical Questions:

- Will the carbon fiber wheels be feasible in the near or distant future?

- What will be the implications in the existing supplier chain?

- Will new companies in the automotive wheels disrupt the old matured companies?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives

1.2 Product and Market Definition

1.3 Automotive Wheel Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.3 Sampling Techniques & Data Collection Methods

2.1.4 Primary Participants

2.2 Data Triangulation

2.3 Automotive Wheel Market Size Estimation

2.4 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Automotive Wheel Market

4.2 Market Share, By Country

4.3 Market, By End Use

4.4 Market, By Vehicle Type

4.5 Market, By Vehicle Class

4.6 Market, By Off-Highway

4.7 Market, By Material

4.8 Market, By Rim Size

4.9 Market, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Automotive Wheel Market Dynamics

5.2.1 Drivers

5.2.1.1 Improved Vehicle Dynamics and Increased Demand for Lightweight Materials

5.2.1.2 Growing Vehicle Production

5.2.2 Restraints

5.2.2.1 Decline in Enthusiast Segment – Millennial Effect

5.2.2.2 Volatility in Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Advanced Materials and New Compositions in Wheels

5.2.4 Challenges

5.2.4.1 Engineering Barriers

5.2.4.2 Large Unorganized Aftermarket for Wheels

5.2.4.3 Maintaining A Balance Between Performance, Cost, and Weight

6 Technological Overview (Page No. - 46)

6.1 Introduction

6.1.1 Steel Wheels

6.1.2 Alloy Wheel

6.1.3 Carbon Fiber Wheels

6.2 Value Chain

6.3 Concept/Future Technologies

6.3.1 Goodyear “Eagle-360”

6.3.2 Michelin - X-Tweel Turf

6.3.3 Michelin - Honeycomb Airless Tires

6.3.4 Goodyear – Tires for Planetary Objects

6.3.5 Hankook – Flex-Up

6.3.6 Kumho – All Weather Tire (Maxplo)

7 Market, By Off-Highway (Page No. - 50)

7.1 Introduction

7.2 Construction and Mining Equipment

7.3 Agriculture Tractors

8 Market, By Vehicle Class (Page No. - 54)

8.1 Introduction

8.2 Economy

8.3 Mid-Priced

8.4 Luxury Priced

9 Market, By End Use (Page No. - 60)

9.1 Introduction

9.2 Aftermarket

9.3 OE Market

10 Market, By Vehicle Type (Page No. - 64)

10.1 Introduction

10.2 Passenger Vehicle

10.3 Light Commercial Vehicle (LCV)

10.4 Heavy Commercial Vehicle (HCV)

11 Market, By Material (Page No. - 71)

11.1 Introduction

11.2 Steel

11.3 Alloy

11.4 Carbon Fiber and Others

12 Market, By Rim Size

12.1 Introduction

12.2 13”-15”

12.3 16”-18”

12.4 19”-21”

12.5 >21”

13 Market, Region (Page No. - 78)

13.1 Introduction

13.2 Asia Pacific

13.2.1 China

13.2.2 India

13.2.3 Japan

13.2.4 South Korea

13.2.5 Rest of Asia Pacific

13.3 Europe

13.3.1 France

13.3.2 Germany

13.3.3 Italy

13.3.4 UK

13.3.5 Spain

13.3.6 Rest of Europe

13.4 North America

13.4.1 Canada

13.4.2 Mexico

13.4.3 US

13.5 Rest of the World (RoW)

13.5.1 Brazil

13.5.2 Russia

13.5.3 South Africa

14 Competitive Landscape (Page No. - 109)

14.1 Overview

14.2 Market Ranking Analysis

14.3 Competitive Situation & Trends

14.3.1 Expansion

14.3.2 Partnerships/Supply Contracts/Joint Ventures/ Agreement

14.3.3 Mergers & Acquisitions

14.3.4 New Product Developments

15 Company Profiles (Page No. - 116)

(Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

15.1 Iochpe-Maxion

15.2 Superior Industries International

15.3 Accuride

15.4 Steel Strips Wheels

15.5 Hitachi Metals

15.6 Enkei

15.7 Citic Dicastal

15.8 Zhejiang Wanfeng Auto Wheel

15.9 Borbet

15.1 Mangels Industrial

15.11 Mefro Wheels

15.12 Alcar

15.13 Kalink

15.14 Ronal

15.15 Thyssenkrupp

15.16 Vossen Wheels

15.17 HRE Wheels

15.18 Rays

15.19 Weds

15.20 Topy Industries

*Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 141)

16.1 Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.5 Introducing RT: Real Time Market Intelligence

16.6 Available Customizations

16.6.1 Market, By Vehicle Type and Country

16.6.1.1 Passenger Vehicles

16.6.1.2 Light Commercial Vehicles

16.6.1.3 Heavy Commercial Vehicles

16.6.2 Market, By Vehicle Class and Country

16.6.2.1 Economy

16.6.2.2 Mid-Priced

16.6.2.3 Luxury-Priced

16.7 Related Reports

16.8 Author Details

List of Tables (93 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Vehicle Production Data, By Region, 2016–2022 (‘000 Units)

Table 3 Global Market, By Off-Highway, 2015–2025 ('000 Units)

Table 4 Construction and Mining Equipment: Market, By Region, 2015–2025 (‘000 Units)

Table 5 Agriculture Tractors: Market, By Region, 2015–2025 (‘000 Units)

Table 6 Automotive Wheel Market, By Vehicle Class, 2015–2025 (Million Units)

Table 7 Market, By Vehicle Class, 2015–2025 (USD Million)

Table 8 Economy: Market, By Region, 2015–2025 (Million Units)

Table 9 Economy: Market Size, By Region, 2015–2025 (USD Million)

Table 10 Mid-Priced: Market, By Region, 2015–2025 (Million Units)

Table 11 Mid-Priced: Market, By Region, 2015–2025 (USD Million)

Table 12 Luxury Priced: Market, By Region, 2015–2025 (Million Units)

Table 13 Luxury Priced: Market, By Region, 2015–2025 (USD Million)

Table 14 Global Market, By End Use, 2017–2025 (Million Units)

Table 15 Global Market, By End Use, 2017–2025 (USD Million)

Table 16 Aftermarket: Market, By Region, 2017–2025 (Million Units)

Table 17 Aftermarket: Automotive Wheel Market, By Region, 2017–2025 (USD Million)

Table 18 OE Market: Market, By Region, 2017–2025 (Million Units)

Table 19 OE Market: Market, By Region, 2017–2025 (USD Million)

Table 20 Market, By Vehicle Type, 2015—2025 (Million Units)

Table 21 Market, By Vehicle Type, 2016—2025 (USD Million)

Table 22 Passenger Vehicle: Market, By Region, 2015–2025 (Million Units)

Table 23 Passenger Vehicle: Market, By Region, 2015–2025 (USD Million)

Table 24 LCV: Market, By Region, 2015–2025 (Million Units)

Table 25 LCV: Market, By Region, 2015–2025 (USD Million)

Table 26 HCV: Market, By Region, 2015–2025 (Million Units)

Table 27 HCV: Market, By Region, 2015–2025 (USD Million)

Table 28 Global Market Size, By Material, 2015–2025 (Million Units)

Table 29 Global Market Size, By Material, 2015–2025 (USD Million)

Table 30 Steel: Market Size, By Region, 2015–2025 (Million Units)

Table 31 Steel: Market Size, By Region, 2015–2025 (USD Million)

Table 32 Alloy: Automotive Wheel Market Size, By Region, 2015–2025 (Million Units)

Table 33 Alloy: Market Size, By Region, 2015–2025 (USD Million)

Table 34 Carbon Fiber and Others: Market Size, By Region, 2015–2025 (Million Units)

Table 35 Carbon Fiber and Others: Market Size, By Region, 2015–2025 (USD Million)

Table 36 Global Market, By Region, 2015–2025 (Million Units)

Table 37 Global Market, By Region, 2015–2025 (USD Million)

Table 38 Automotive Wheel Market, By Rim Size, 2015–2025 (Million Units)

Table 39 Market, By Rim Size, 2015–2025(USD Million)

Table 40 Asia Pacific: Market, By Country, 2015–2025 (Million Units)

Table 41 Asia Pacific: Market, By Country, 2015–2025 (USD Million)

Table 42 Asia Pacific: Market, By Rim Size, 2015–2025 (Million Units)

Table 43 Asia Pacific: Market, By Rim Size, 2015–2025 (USD Million)

Table 44 China: Market, By Rim Size, 2015–2025 (Million Units)

Table 45 China: Market, By Rim Size, 2015–2025 (USD Million)

Table 46 India: Market, By Rim Size, 2015–2025 (Million Units)

Table 47 India: Market, By Rim Size, 2015–2025 (USD Million)

Table 48 Japan: Market, By Rim Size, 2015–2025 (Million Units)

Table 49 Japan: Market, By Rim Size, 2015–2025 (USD Million)

Table 50 South Korea: Market, By Rim Size, 2015–2025 (Million Units)

Table 51 South Korea: Market, By Rim Size, 2015–2025 (USD Million)

Table 52 Rest of Asia Pacific: Market, By Rim Size, 2015–2025 (Million Units)

Table 53 Rest of Asia Pacific: Market, By Rim Size, 2015–2025 (USD Million)

Table 54 Europe: Market, By Country, 2015–2025 (Million Units)

Table 55 Europe: Market, By Country, 2015–2025 (USD Million)

Table 56 Europe: Market, By Rim Size, 2015–2025 (Million Units)

Table 57 Europe: Market, By Rim Size, 2015–2025 (USD Million)

Table 58 France: Market, By Rim Size, 2015–2025 (Million Units)

Table 59 France: Market, By Rim Size, 2015–2025 (USD Million)

Table 60 Germany: Market, By Rim Size, 2015–2025 (Million Units)

Table 61 Germany: Market, By Rim Size, 2015–2025 (USD Million)

Table 62 Italy: Market, By Rim Size, 2015–2025 (Million Units)

Table 63 Italy: Market, By Rim Size, 2015–2025 (USD Million)

Table 64 UK: Market, By Rim Size, 2015–2025 (Million Units)

Table 65 UK: Market, By Rim Size, 2015–2025 (USD Million)

Table 66 Spain: Market, By Rim Size, 2015–2025 (Million Units)

Table 67 Spain: Market, By Rim Size, 2015–2025 (USD Million)

Table 68 Rest of Europe: Market, By Rim Size, 2015–2025 (Million Units)

Table 69 Rest of Europe: Market, By Rim Size, 2015–2025 (USD Million)

Table 70 North America: Market, By Country, 2015–2025 (Million Units)

Table 71 North America: Market, By Country, 2015–2025 (USD Million)

Table 72 North America: Market, By Rim Size, 2015–2025 (Million Units)

Table 73 North America: Market, By Rim Size, 2015–2025 (USD Million)

Table 74 Canada: Market, By Rim Size, 2015–2025 (Million Units)

Table 75 Canada: Market, By Rim Size, 2015–2025 (USD Million)

Table 76 Mexico: Market, By Rim Size, 2015–2025 (Million Units)

Table 77 Mexico: Market, By Rim Size, 2015–2025 (USD Million)

Table 78 US: Market, By Rim Size, 2015–2025 (Million Units)

Table 79 US: Market, By Rim Size, 2015–2025 (USD Million)

Table 80 RoW: Market, By Country, 2015–2025 (Million Units)

Table 81 RoW: Market, By Country, 2015–2025 (USD Million)

Table 82 RoW: Market, By Rim Size, 2015–2025 (Million Units)

Table 83 RoW: Market, By Rim Size, 2015–2025 (USD Million)

Table 84 Brazil: Market, By Rim Size, 2015–2025 (Million Units)

Table 85 Brazil: Market, By Rim Size, 2015–2025 (USD Million)

Table 86 Russia: Market, By Rim Size, 2015–2025 (Million Units)

Table 87 Russia: Market, By Rim Size, 2015–2025 (USD Million)

Table 88 South Africa: Market, By Rim Size, 2015–2025 (Million Units)

Table 89 South Africa: Market, By Rim Size, 2015–2025 (USD Million)

Table 90 Expansion, 2017–2018

Table 91 Partnerships/Supply Contracts/Joint Ventures/Agreement, 2014–2018

Table 92 Mergers & Acquisitions, 2017

Table 93 New Product Development, 2016–2017

List of Figures (51 Figures)

Figure 1 Automotive Wheel Market: Segmentations Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Market, By Rim Size: Bottom-Up Approach

Figure 6 Market, By End Use: Top-Down Approach

Figure 7 Market, By Material, 2017 vs 2025

Figure 8 Market, By Vehicle Class, 2017 vs 2025

Figure 9 Market, By End Use, 2017 vs 2025

Figure 10 Market, By Vehicle Type, 2017 vs 2025

Figure 11 Market, By Off-Highway, 2017 vs 2025 (Volume)

Figure 12 Market, By Rim Size, 2017 vs 2025

Figure 13 Market, By Region, 2017 vs 2025

Figure 14 Market, By Region, Snapshot

Figure 15 Growing Vehicle Production to Boost the Growth of this Market From 2017 to 2025

Figure 16 China to Be the Fastest-Growing Market for Automotive Wheel, By Value, From 2017 to 2025

Figure 17 OE Market to Have the Largest Market Size During the Forecast Period

Figure 18 Passenger Vehicle Segment to Have the Largest Market Size for Automotive Wheel, 2017 vs 2025

Figure 19 Luxury Priced Vehicle to Have the Largest Market Size for Market, 2017 vs 2025

Figure 20 Agriculture Tractor to Hold the Largest Market Share for Automotive Wheels in Off-Highway Market, 2017 vs 2025 (‘000 Units)

Figure 21 Alloy Segment to Have the Largest Market Size for Automotive Wheel, 2017 vs 2025

Figure 22 16”–18” Segment to Have the Largest Market Size in Market, 2017 vs 2025

Figure 23 Asia Pacific to Be the Largest Market for Automotive Wheel, 2017 vs 2025

Figure 24 Automotive Wheel Market Dynamics

Figure 25 Value Chain: Market

Figure 26 Market, By Vehicle Class, 2017 vs 2025 (USD Million)

Figure 27 Market, By End Use, 2017–2025

Figure 28 Market, By Vehicle Type, 2017–2025 (USD Million)

Figure 29 Market, By Material, 2017 vs 2025 (USD Million)

Figure 30 Market, By Region, 2017 vs 2025

Figure 31 Asia Pacific: Market Snapshot

Figure 32 Europe: Market, By Country, 2017 vs 2025 (USD Million)

Figure 33 North America Market Snapshot

Figure 34 RoW: Market, By Country, 2017 vs 2025 (Million Units)

Figure 35 Key Development By Leading Players in Market for 2012-2017

Figure 36 Market Ranking: 2017

Figure 37 Iochpe-Maxion: Company Snapshot

Figure 38 Iochpe-Maxion: SWOT Analysis

Figure 39 Superior Industries International: Company Snapshot

Figure 40 Superior Industries International: SWOT Analysis

Figure 41 Accuride : Company Snapshot

Figure 42 Accuride: SWOT Analysis

Figure 43 Steel Strips Wheels: Company Snapshot

Figure 44 Steel Strips Wheels: SWOT Analysis

Figure 45 Hitachi Metals: Company Snapshot

Figure 46 Hitachi Metals: SWOT Analysis

Figure 47 Enkei: Company Snapshot

Figure 48 Citic Dicastal: Company Snapshot

Figure 49 Zhejiang Wanfeng Auto Wheel: Company Snapshot

Figure 50 Mangels Industrial: Company Snapshot

Figure 51 Mefro Wheels: Company Snapshot

Growth opportunities and latent adjacency in Automotive Wheel Market