Transfer Case Market by Drive Type (Chain, Gear Driven), Shift Type (Electronic, Manual), Type (AWD, 4WD), Off-Highway (Construction Equipment, Farm Tractor), Ice & Hybrid Vehicle (Passenger Car, LCV, HCV, HEV, PHEV), and Region - Global Forecast to 2025

The transfer case market was valued at USD 9.01 Billion in 2016 and is estimated to reach USD 20.33 Billion by 2025, at a CAGR of 9.56% during the forecast period. The base year considered for the study is 2016 and the forecast period is 2017 to 2025. Various factors such as an increase in global demand for SUVs (with AWD systems), increased fuel efficiency with the help of advanced and smart AWD that provides 2WD or AWD according to the vehicle requirements, increased sales of hybrid segment vehicles equipped with AWD, and recent penetration of AWD in premium sedans are expected to fuel the transfer case market.

Objectives of the Study:

- To define, describe, and project the market based on vehicle type (Passenger Cars, LCV, HCV, Hybrid, and Plug-in Hybrid) from 2017 to 2025, in terms of volume and value

- To analyze and forecast the market based on four-wheel drive type (4WD, AWD) from 2017 to 2025, in terms of volume and value at country level

- To analyze and forecast the market from 2017 to 2025 based on type (Gear Driven & Chain Driven), in terms of volume and value at regional level

- To analyze and forecast the market based on off-highway vehicles (Construction equipment and Farm tractors) from 2017 to 2022, in terms of volume and value at regional level

- To analyze and forecast the market, based on shift type (Manual Shift On-the-Fly, Electronic Shift On-the-Fly) from 2017 to 2025, in terms of volume and value at regional level

- To identify the transfer case market dynamics, including drivers, restraints, opportunities, and challenges and analyze their impact on the market

- To profile key transfer case suppliers and analyze the competitive leadership map for key players based on their business strategies in the past five years

The research methodology uses secondary sources that include associations such as International Organization of Motor Vehicle Manufacturers (OICA), Emission Controls Manufacturers Association (ECMA), European Automobile Manufacturers Association (ACEA), Environmental Protection Agency (EPA), and International Council on Clean Transportation (ICCT) and paid databases and directories such as Factiva and Bloomberg. In the primary research stage, experts from related industries, manufacturers, and suppliers have been interviewed to understand the present situation and future trends in the market. The market for OE has been derived from forecasting techniques in which ICE and Hybrid vehicle production and sales data is multiplied by the penetration of transfer case in different vehicle types. The penetration is calculated by model mapping in every country considered in the study. Data sanity check has been done by considering product revenues of leading OEMs in the transfer case market.

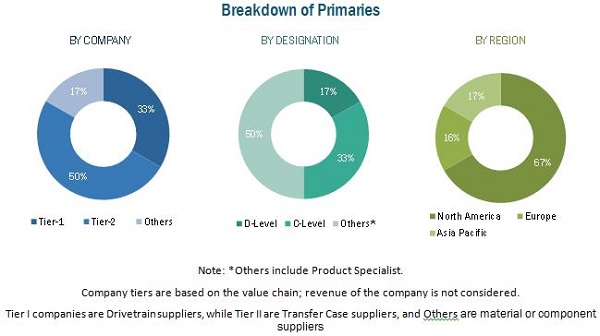

The below figure illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The transfer case market ecosystem consists of transfer case manufacturers such as Magna (Canada), BorgWarner (US), GKN (UK), Aisin Seiki (Japan), and ZF (Germany). The transfer case is supplied to major OEMs in the automotive industry including Nissan (Japan), General Motors (US), Toyota (Japan), and others.

Target Audience

- Transfer Case Component Manufacturers

- Distributors and Suppliers of Transfer Case Components

- Independent and Authorized Dealers of Drivetrain Components

- Drivetrain Manufacturers

- Vehicle Manufacturers

- Industry Associations and Experts

Scope of the Report

Market, by Region & Country

- Asia Pacific

- Europe

- North America

- RoW

Market, by Shift Type

- Manual Shift On-the-Fly

- Electronic Shift On-the-Fly

Market, by Hybrid Vehicle Type

- HEV

- PHEV

Market, by Drive Type

- Gear Driven

- Chain Driven

Market, by Four Wheel Drive Type

- AWD

- 4WD

Market, by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Off-Highway Transfer Case Market, by Vehicle Type

- Construction Equipment

- Farm Tractors

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Market, by Vehicle Type & ountry, 2015-2025

- Passenger Car

- LCV

- HCV

(The countries that will be covered will be the same as covered in this report)

- Market, by four wheel drive type and HEV & PHEV

(The four wheel drive types that will be covered will be 4WD & AWD for the HEV & PHEV vehicle segment)

- Market, by four wheel drive type & country

(The four wheel drive types that will be covered will be 4WD & AWD. The countries covered will be the same as covered in this report.)

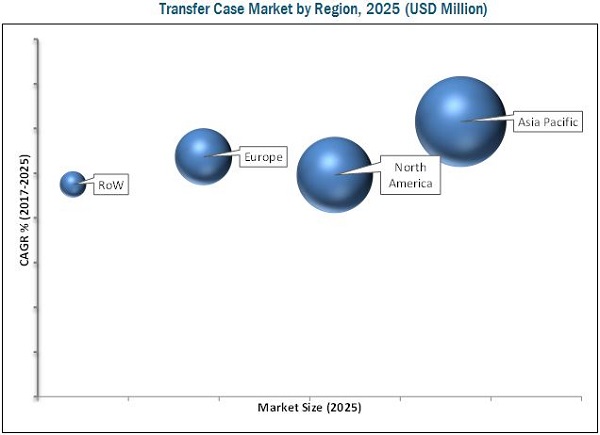

The transfer case market is estimated to grow from USD 9.79 Billion in 2017 to USD 20.33 Billion by 2025, at a CAGR of 9.56% during the forecast period. The key factors driving the market are the increasing demand for safety and traction in extreme weather or surface conditions and need for easy maneuverability. A steady increase in the use of AWD and 4WD in SUVs and premium sedans has fuelled the growth of the market. Other growth drivers include the increasing sales of hybrid electric vehicles owing to the improving infrastructure.

The PHEV segment is estimated to be the fastest growing market, by hybrid vehicle type. Asia Pacific is estimated to be the largest market for HEVs and PHEVs. Strict emission norms, rapid development of charging infrastructure, and government incentives have helped to increase the sales of HEVs and PHEVs in the region. The sales of HEVs and PHEVs in Asia Pacific increased by 19% and 36%, respectively from 2015 to 2016. Several OEMs are using a transfer case in HEV and PHEV vehicle segments to differentiate themselves from their competitors. Various governments have also taken initiatives to increase the sales of HEVs and PHEVs. For instance, the French government announced subsidies on the purchase of PHEV and HEV vehicles. Thus, the market for PHEVs and HEVs is expected to grow considerably.

The chain driven transfer case is estimated to be the fastest growing segment of the market. Chain driven transfer cases have replaced gear driven transfer cases as they are lighter in weight and offer quiet operation and smooth transmission. However, gear driven transfer cases are used in construction equipment, farm tractors, and on-road heavy commercial vehicles such as garbage truck and military trucks.

The report classifies the off-highway market into construction equipment and farm tractors. The market for construction equipment is larger as compared to farm tractors. Some of the different types of construction equipment that offer AWD or 4WD are backhoe loaders, articulated haulers, and wheel loaders, among others. Some examples of models equipped with transfer case are Caterpillar 434F2, 12 M2 AWD, Volvo A30D with D10 engine, and Komatsu WA320-7. The four-wheel drive is offered in tractors with a power output of >100 HP.

Asia Pacific is estimated to be the largest market for transfer case during the forecast period. The high share of passenger vehicles in the total vehicle production and growing demand for Sport Utility Vehicles (SUV) are driving the market in the Asia Pacific region. While the penetration of transfer case in passenger vehicles is expected to range between 15 and 18% in the region in 2017, it is expected to increase to 22–24% by 2025. The market growth can be attributed to the rapid increase in the demand for high-performance SUVs equipped with 4WD or AWD that offer better safety and comfort.

Battery electric vehicles do not have a transfer case for power distribution. The increasing demand for battery electric vehicles can thus hinder the growth of the transfer case market. The penetration of BEV is increasing year on year in various regions. The increasing popularity of these vehicles will impact the market in the near future. The market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are BorgWarner (US), Magna (Canada), GKN (UK), ZF (Germany), Aisin Seiki (Japan), Dana (US), American Axle & Manufacturing (US), JTEKT (Japan), Schaeffler (Germany), and Meritor (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Transfer Case Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.2 Factor Analysis

2.2.1 Demand-Side Analysis

2.2.1.1 Impact of GDP on Total Vehicle Sales

2.2.1.2 Urbanization vs Passenger Cars Per 1,000 People

2.2.1.3 Increase in the Demand for AWD/4WD Vehicles

2.2.2 Supply-Side Analysis

2.2.2.1 Technological Advances

2.3 Transfer Case Market Breakdown & Data Triangulation

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Transfer Case Market

4.2 Transfer Case Market By On- & Off-Highway Ice Vehicles & Hybrid Vehicles

4.3 Market, By 4WD Type

4.4 Market, By Drive Type

4.5 Market, By Shift Type

4.6 Market, By Off-Highway Vehicle Type

4.7 Market for HEV & PHEV

4.8 Market, By Vehicle Type

4.9 Market Share, By Region

4.10 Transfer Case: Supplier Analysis

4.10.1 Key Suppliers & Clients in America

4.10.2 Key Suppliers & Clients in Europe

4.10.3 Key Suppliers & Clients in Asia Pacific

5 Transfer Case Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Sales of SUV and Premium Sedans to Fuel the Market Demand for Transfer Cases

5.2.1.2 Increasing Demand for Safety, Traction in Extreme Weather/Surface Conditions, and Towing Capabilities for SUVs/Light Trucks

5.2.2 Restraints

5.2.2.1 Increasing Demand for Battery Electric Vehicles

5.2.3 Opportunities

5.2.3.1 Growing Demand for Lightweight Transfer Cases

5.2.3.2 Increasing Sales of HEVs & PHEVs

5.2.4 Challenges

5.2.4.1 High Adoption & Maintenance Cost of Vehicles Equipped With AWD

5.2.4.2 High Power Loss By the Application of Transfer Cases

5.3 Macro Indicators Analysis

5.3.1 Introduction

5.3.1.1 Sports Utility Vehicle (SUV) Sales as A Percentage of Total Vehicle Sales

5.3.1.2 GDP (USD Billion)

5.3.1.3 GNP Per Capita, Atlas Method (USD)

5.3.1.4 GDP Per Capita Ppp (USD)

5.3.2 Macro Indicators Influencing the Hybrid System Market for Top 3 Countries

5.3.2.1 Us

5.3.2.2 China

5.3.2.3 Uk

6 Transfer Case Market, By Four-Wheel Drive Type (Page No. - 53)

Note - The Chapter is Further Segmented at Regional Level and Regions Considered are Asia Pacific, Europe, North America, and RoW

6.1 Introduction

6.2 All-Wheel Drive (AWD)

6.3 Four-Wheel Drive (4WD)

7 Global Market, By Drive Type (Page No. - 58)

Note - The Chapter is Further Segmented at Regional Level and Regions Considered are Asia Pacific, Europe, North America, and RoW

7.1 Introduction

7.2 Chain Driven

7.3 Gear Driven

8 Transfer Case Market, By Shift Type (Page No. - 63)

Note - The Chapter is Further Segmented at Regional Level and Regions Considered are Asia Pacific, Europe, North America, and RoW

8.1 Introduction

8.2 Electronic Shift on the Fly

8.3 Manual Shift on the Fly

9 Global Market, By Off-Highway Vehicles (Page No. - 68)

Note - The Chapter is Further Segmented at Regional Level and Regions Considered are Asia Pacific, Europe, North America, and RoW

9.1 Introduction

9.2 Farm Tractors

9.3 Construction Equipment

10 Transfer Case Market, By HEV & PHEV (Page No. - 73)

Note - The Chapter is Further Segmented at Regional Level and Regions Considered are Asia Pacific, Europe, North America, and RoW

10.1 Introduction

10.2 Hybrid Electric Vehicle (HEV)

10.3 Plug-In Electric Vehicle (PHEV)

11 Transfer Case Market Analysis, By Vehicle Type (Page No. - 79)

Note - The Chapter is Further Segmented at Regional Level and Regions Considered are Asia Pacific, Europe, North America, and RoW

11.1 Introduction

11.2 Passenger Cars

11.3 Light Commercial Vehicles

11.4 Heavy Commercial Vehicles

12 Transfer Case Market, By Region (Page No. - 85)

Note - The Chapter is Further Segmented at Country Level and Vehicle Types Considered are Passenger Cars, Light Commercial Vehicles and Heavy Commercial Vehicles

12.1 Introduction

12.2 Asia Pacific

12.2.1 China

12.2.2 Japan

12.2.3 South Korea

12.2.4 India

12.3 Europe

12.3.1 Germany

12.3.2 UK

12.3.3 France

12.3.4 Spain

12.3.5 Italy

12.4 North America

12.4.1 US

12.4.2 Canada

12.4.3 Mexico

12.5 Rest of the World (RoW)

12.5.1 Brazil

12.5.2 Russia

12.5.3 South Africa

13 Competitive Landscape (Page No. - 107)

13.1 Overview

13.2 Transfer Case: Market Ranking Analysis

13.3 Competitive Scenario

13.3.1 Expansions

13.3.2 Supply Contracts

13.3.3 New Product Launches/Developments

13.3.4 Mergers/Joint Ventures/Acquisitions/Partnerships

14 Company Profiles (Page No. - 112)

(Overview, Products Offerings, Developments, SWOT Snalysis MnM View)*

14.1 Borgwarner

14.2 Magna

14.3 GKN

14.4 ZF

14.5 Aisin Seiki

14.6 Dana

14.7 American Axle & Manufacturing

14.8 Jtekt

14.9 Schaeffler

14.10 Meritor

*Details on Overview, Products Offerings, Developments, SWOT Snalysis MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 140)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing Rt: Real-Time Market Intelligence

15.5 Available Customization

15.5.1 Transfer Case Market, By Vehicle Type & Country

15.5.2 Market, By Four Wheel Drive Type & HEV & PHEV

15.5.3 Market, By Four Wheel Drive Type & Country

15.6 Related Reports

15.7 Author Details

List of Tables (91 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Improving Demand for Premium Vehicles, By Key Countries (2015–2016)

Table 3 Key Luxury Vehicle Manufacturers & Their Vehicle Sales in China, Us, Germany, & Uk, 2015–2016

Table 4 Government Incentives for Electric Vehicles, By Country

Table 5 US: Rising Gni Per Capita to Be the Most Crucial Indicator Given Its Excessively Strong Performance in the Recent Past

Table 6 China: SUVs Sale Expected to Play A Crucial Role Given Its Extremely Strong Performance in the Recent Past

Table 7 UK: Rising GDP Ppp to Be the Most Crucial Indicator Given Its Strong Performance in the Recent Past

Table 8 Transfer Case Market Size, By Four-Wheel Drive Type, 2015–2025 (Million Units)

Table 9 Market Size, By Four-Wheel Drive Type, 2015–2025 (USD Billion)

Table 10 AWD Transfer Case Market Size, By Region, 2015–2025 (’000 Units)

Table 11 AWD Market Size, By Region, 2015–2025 (USD Million)

Table 12 4WD Market Size, By Region, 2015–2025 (’000 Units)

Table 13 4WD Market Size, By Region, 2015–2025 (USD Million)

Table 14 Transfer Case Market Size, By Drive Type, 2015–2025 (Million Units)

Table 15 Market Size, By Drive Type, 2015–2025 (USD Million)

Table 16 Chain Driven Market Size, By Region, 2015–2025 (’000 Units)

Table 17 Chain Driven Transfer Case Market Size, By Region, 2015–2025 (USD Million)

Table 18 Gear Driven Market Size, By Region, 2015–2025 (’000 Units)

Table 19 Gear Driven Market Size, By Region, 2015–2025 (USD Million)

Table 20 Market Size, By Shift Type, 2015–2022 ('000 Units)

Table 21 Market Size, By Shift Type, 2015–2025 (USD Million)

Table 22 Electronic Shift on the Fly Transfer Case Market Size, By Region, 2015–2025 (‘000 Units)

Table 23 Electronic Shift on the Fly Market Size, By Region, 2015–2025 (USD Million)

Table 24 Manual Shift on the Fly Market Size, By Region, 2015–2022 (‘000 Units)

Table 25 Manual Shift on the Fly Market Size, By Region, 2015–2022 (USD Million)

Table 26 Market, By Off-Highway Vehicle Type, 2015–2022 (‘Ooo Units)

Table 27 Market, By Off-Highway Vehicle Type, 2015–2022 (USD Million)

Table 28 Farm Tractors: Transfer Case Market Size, By Region, 2015–2022 (‘Ooo Units)

Table 29 Farm Tractors: Market Size, By Region, 2015–2022 (USD Million)

Table 30 Construction Equipment: Market Size, By Region, 2015–2022 (‘000 Units)

Table 31 Construction Equipment: Market Size, By Region, 2015–2022 (USD Million)

Table 32 Market Size, By Hybrid Vehicle Type, 2015–2025 (’000 Units)

Table 33 Market Size, By Hybrid Vehicle Type, 2015–2025 (USD Million)

Table 34 Top Selling HEVs With Transfer Cases, By Region

Table 35 HEV: Market Size, By Region, 2015–2025 (’000 Units)

Table 36 HEV: Market Size, By Region, 2015–2025 (USD Million)

Table 37 Top Selling PHEVs With Transfer Cases, By Region

Table 38 PHEV: Transfer Case Market Size, By Region, 2015–2025 (’000 Units)

Table 39 PHEV: Market Size, By Region, 2015–2025 (USD Million)

Table 40 Market Size, By Vehicle Type, 2015–2025 (‘000 Units)

Table 41 Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 42 Passenger Cars: Market Size, By Region, 2015–2025 (’Ooo Units)

Table 43 Passenger Cars: Transfer Case Market Size, By Region, 2015–2025 (USD Million)

Table 44 LCV: Market Size, By Region, 2015–2025 (’Ooo Units)

Table 45 LCV: Market Size, By Region, 2015–2025 (USD Million)

Table 46 HCV: Market Size, By Region, 2015–2025 (’Ooo Units)

Table 47 HCV: Market Size, By Region, 2015-2025 (USD Million)

Table 48 Market Size, By Region, 2015–2025 (’000 Units)

Table 49 Market Size, By Region, 2015–2025 (USD Million)

Table 50 Asia Pacific: Market Size, By Country, 2015–2025 (’000 Units)

Table 51 Asia Pacific: Market Size, By Country, 2015–2025 (USD Million)

Table 52 China: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 53 China: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 54 Japan: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 55 Japan: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 56 South Korea: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 57 South Korea: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 58 India: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 59 India: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 60 Europe: Market Size, By Country, 2015–2025 (’000 Units)

Table 61 Europe: Market Size, By Country, 2015–2025 (USD Million)

Table 62 Germany: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 63 Germany: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 64 UK: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 65 UK: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 66 France: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 67 France: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 68 Spain: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 69 Spain: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 70 Italy: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 71 Italy: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 72 North America: Market Size, By Country, 2015–2025 (’000 Units)

Table 73 North America: Market Size, By Country, 2015–2025 (USD Million)

Table 74 US: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 75 US: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 76 Canada: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 77 Canada: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 78 Mexico: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 79 Mexico: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 80 RoW: Market Size, By Country, 2015–2025 (’000 Units)

Table 81 RoW: Market Size, By Country, 2015–2025 (USD Million)

Table 82 Brazil: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 83 Brazil: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 84 Russia: Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 85 Russia: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 86 South Africa: Transfer Case Market Size, By Vehicle Type, 2015–2025 (’000 Units)

Table 87 South Africa: Market Size, By Vehicle Type, 2015–2025 (USD Million)

Table 88 Expansions, 2016

Table 89 Supply Contracts, 2016–2017

Table 90 New Product Launches/Developments, 2016–2017

Table 91 Mergers/Acquisitions/Joint Ventures/Partnerships, 2015–2017

List of Figures (56 Figures)

Figure 1 Transfer Case Market: Research Design

Figure 2 Breakdown of Primary Interviews

Figure 3 Gross Domestic Product vs Total Vehicle Sales

Figure 4 Urbanization vs Passenger Cars Per 1,000 People

Figure 5 Comparison of Region-Wise Vehicles Produced With AWD, 2013 vs 2016

Figure 6 Data Triangulation

Figure 7 Market, By Region, 2017–2025 (USD Million)

Figure 8 Market, By 4WD Type, 2017–2025 (USD Million)

Figure 9 Market, By Drive Type, 2017–2025 (USD Million)

Figure 10 Market, By Shift Type, 2017 vs 2022 (USD Million)

Figure 11 Market, By Vehicle Type, 2017–2025 (USD Million)

Figure 12 Market, By-Off Highway Vehicle Type, 2017 vs 2022 (USD Million)

Figure 13 Market, By HEV & PHEV, 2017–2025 (USD Million)

Figure 14 Growing Demand for SUVs & Premium Sedans is Likely to Drive the Market, 2017–2025

Figure 15 On-Highway Ice Vehicle Type to Be the Largest Segment of the Market

Figure 16 AWD is Estimated to Be the Fastest Growing Market for the 4WD Type, 2017 vs 2025 (USD Million)

Figure 17 Chain Driven Transfer Case Segment is Estimated to Hold the Largest Market Share of the Market, By Drive Type, 2017 vs 2025 (USD Million)

Figure 18 Electronic Shift on the Fly is Estimated to Hold the Largest Market Share in the Market, By Shift Type, 2017 vs 2025 (USD Million)

Figure 19 Construction Equipment Segment is Estimated to Be the Fastest Growing Market for Transfer Cases, By Off-Highway Vehicle Type, 2017 vs 2025 (USD Million)

Figure 20 The PHEV Segment is Estimated to Be the Fastest Growing Segment of the Market, 2017 vs 2025 (USD Million)

Figure 21 The Passenger Car Segment is Estimated to Be the Fastest Growing Segment of the Market, By Value, 2017 vs 2025 (USD Million)

Figure 22 Asia Pacific is Expected to Hold the Largest Share of the Market, By Value, 2017–2025

Figure 23 Transfer Case: Market Dynamics

Figure 24 SUV Sales Comparison,By Country, 2015 vs 2016

Figure 25 Road Traffic Fatality Rates Per 100,000 Population, By Region, 2015

Figure 26 Battery Electric Vehicle Sales, By Region, 2017, 2019, & 2022 (Units)

Figure 27 HEV & PHEV Sales, 2017, 2022, & 2025 (Units)

Figure 28 AWD Segment is Expected to Account for the Largest Market Share, By Value, 2017–2025

Figure 29 The Chain Driven Segment is Expected to Account for the Largest Market Share, 2017–2025 (By Value)

Figure 30 Electronic Shift on the Fly to Account for the Largest Market Share, By Value, By 2022

Figure 31 Construction Equipment on the Fly to Account for the Largest Market Share, By Value, 2017–2022

Figure 32 The Transfer Case Market for HEV Segment is Expected to Be the Largest, 2017–2025 (USD Million)

Figure 33 The Passenger Car Segment is Expected to Account for the Largest Market Share, 2017–2025 (By Value)

Figure 34 Asia Pacific is Expected to Be the Fastest-Growing Market for Transfer Case During the Forecast Period

Figure 35 Asia Pacific: Market Regional Snapshot

Figure 36 Germany is Expected to Lead the European Market, By Value, 2025

Figure 37 The US is Expected to Lead the North American Market During the Forecast Period

Figure 38 North America: Market Regional Snapshot

Figure 39 Brazil is Expected to Account for the Largest Market Share, By Value, in RoW, 2017–2025

Figure 40 Companies Adopted Expansions as the Key Growth Strategy, 2013–2017

Figure 41 Transfer Case Market Ranking, 2016

Figure 42 Borgwarner: Company Snapshot

Figure 43 Borgwarner: SWOT Analysis

Figure 44 Magna: Company Snapshot

Figure 45 Magna: SWOT Analysis

Figure 46 GKN: Company Snapshot

Figure 47 GKN: SWOT Analysis

Figure 48 ZF: Company Snapshot

Figure 49 ZF: SWOT Analysis

Figure 50 Aisin Seiki: Company Snapshot

Figure 51 Aisin Seiki: SWOT Analysis

Figure 52 Dana: Company Snapshot

Figure 53 American Axle & Manufacturing: Company Snapshot

Figure 54 Jtekt: Company Snapshot

Figure 55 Schaeffler: Company Snapshot

Figure 56 Meritor: Company Snapshot

Growth opportunities and latent adjacency in Transfer Case Market

synchronized type transfer case for light commercial vehicle