Automotive TIC Market Vehicle Type (Passenger Cars, Commercial Vehicles), Service Type (Testing Services, Inspection Services, Certification Services), Sourcing Type (In-House, Outsourced), Application and Region - Global Forecast to 2028

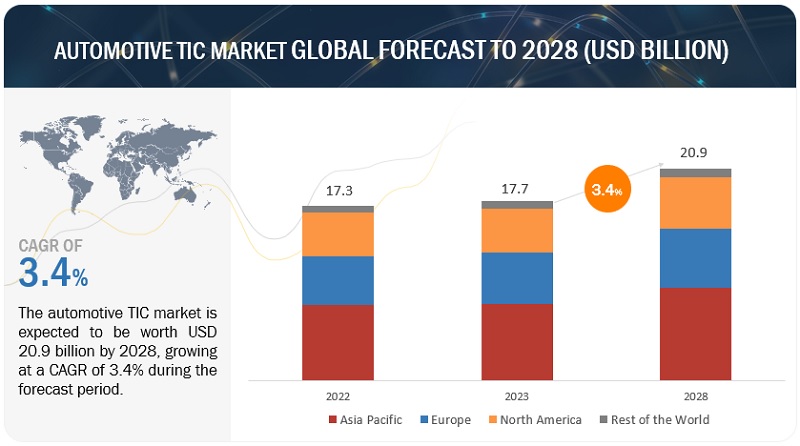

[267 Pages Report] The global automotive TIC market is projected to grow from USD 17.7 billion in 2023 to USD 20.9 billion by 2028, registering a CAGR of 3.4%. The increasing complexity of automotive technologies and the stringent regulatory landscape have created a strong demand for TIC services in the automotive sector. TIC companies are vital in conducting thorough testing and inspection processes to ensure safety standards and regulations compliance. With the rise of new automotive technologies such as electric vehicles, connected cars, and advanced driver assistance systems, the need for TIC services has intensified. As the automotive industry continues to evolve and new technologies emerge, the automotive TIC market is poised to experience sustained growth as it provides essential services to ensure safety, compliance, and quality in the automotive ecosystem.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Rapid advancements in the automotive industry

With the rise in connected vehicle technologies, there is a growing focus on cybersecurity, interoperability testing, and over-the-air (OTA) updates, among others. TIC providers are incorporating comprehensive cybersecurity testing and certification to identify vulnerabilities and mitigate risks. TIC providers also test interoperability to ensure seamless communication and compatibility between different devices, platforms, and networks. TIC providers are involved in the testing and certifying OTA update processes to ensure their reliability, security, and effectiveness. ADAS technologies are evolving towards autonomous driving. TIC providers are focusing on testing and certifying vehicles' autonomous capabilities, including sensor accuracy, object detection, decision-making algorithms, and system performance under various driving conditions. TIC providers are involved in testing and certifying the integration of AI and machine learning models in ADAS systems to ensure accuracy, reliability, and safety. With the rise of electric vehicles, there is a focus on testing and certification of batteries, charging stations and infrastructure components, and EVs' efficiency and range optimization, among others.

Restraint: Lack of harmonization in TIC standards across different regions and markets

Variations in safety, emission, and fuel efficiency standards between the US and Europe require automotive companies to meet different regulatory requirements, making TIC services complex and necessitating personalized internal standards. TIC providers face the challenge of navigating and complying with their regions' local laws and regulations, which can impact their efficiency and operational processes. The disparity in regulatory standards between regions creates challenges for international acceptance of products and hinders market growth, leading to additional costs and conflicts between local and international standards.

Opportunity: Increasing demand for hydrogen as an alternate fuel and autonomous vehicles

The rising focus on hydrogen fuel cell vehicles (FCVs) has led to a surge in the need for TIC services related to hydrogen fuel technology certification. TIC providers ensure the safety, performance, and compliance of hydrogen storage and distribution systems, fuel cell components, and refueling infrastructure. This includes testing and certifying hydrogen tanks, fuel cells, and hydrogen fueling stations. Autonomous vehicles (AVs) bring forth novel technologies, components, and systems that require rigorous testing and inspection to adhere to safety standards and regulations. TIC services are essential in assessing the dependability and safety of AV components like batteries, charging systems, sensors, and control systems. TIC providers carry out extensive testing and inspection to validate performance, detect potential hazards, and ensure compliance with safety standards, instilling consumer assurance in the safety of these vehicles.

Challenge: Highly competitive market

Various automotive TIC providers offer a broad spectrum of testing, inspection, and certification services to cater to the diverse needs of the automotive industry. Managing and delivering multiple types of TIC services require extensive expertise, resources, and infrastructure. Maintaining a reputation for high-quality and credible services becomes crucial with numerous providers in the market. Providers must consistently demonstrate competence, accuracy, and compliance with industry standards to build client trust. The presence of multiple providers offering similar services can lead to price competition. Auto tic providers may face pressure to offer competitive pricing while still ensuring profitability and sustainability.

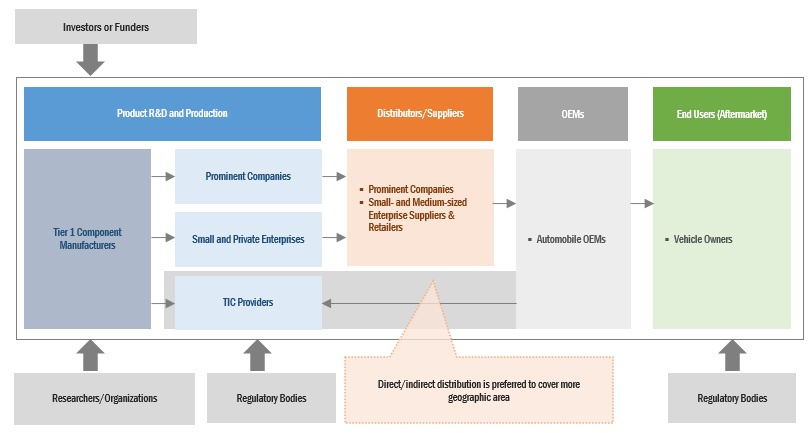

Market Ecosystem

Vehicle inspection services to be the largest market during the forecast period

TIC for vehicle inspection services (VIS) segment is estimated to hold the largest market size during the forecast period. Vehicle inspection services (VIS) are critical in assuring vehicle owners, buyers, and regulatory bodies regarding vehicle roadworthiness, quality, and compliance. They help identify potential safety hazards, mechanical issues, and regulatory violations, allowing for necessary repairs, maintenance, or remedial actions to be taken. Vehicle inspections are often required during the sale or purchase of used vehicles as part of periodic inspections for fleet management, compliance with emission standards, and vehicle registration purposes. By providing independent and unbiased assessments, vehicle inspection services contribute to maintaining road safety, protecting consumers, and ensuring regulatory compliance in the automotive industry. Remote inspections in vehicle inspection services also involve conducting inspections without requiring the vehicle to be physically present at an inspection facility. Enabled by digital technologies and communication channels, owners can provide documentation, images, and videos of the vehicle's condition, which are reviewed remotely by certified inspectors. The owner and inspector communicate through digital platforms like video calls or messaging apps. Remote inspections are particularly valuable for preliminary assessments, pre-purchase inspections, and consultation services, offering convenience and flexibility for both owners and inspectors.

TIC for EV Chargers to be the fastest-growing segment during the forecast period

As the demand for electric vehicles continues to rise, the need for a robust and reliable charging infrastructure becomes crucial. TIC providers play a significant role in ensuring EV chargers' safety, efficiency, and compatibility through thorough testing, inspection, and certification processes. With the increasing adoption of EVs globally, the automotive TIC market is witnessing a surge in demand for services specifically focused on EV charger testing and certification. TIC companies are responsible for evaluating EV chargers' performance, reliability, and compliance to ensure they meet the necessary standards and regulations. As the EV charging infrastructure expands and evolves to meet the growing demand, the automotive TIC market will experience substantial growth in EV charger testing and certification services, ensuring the safe and efficient operation of charging systems for electric vehicles.

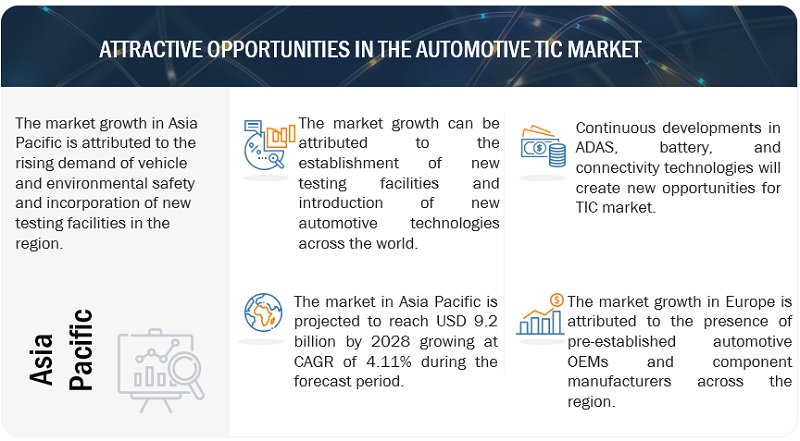

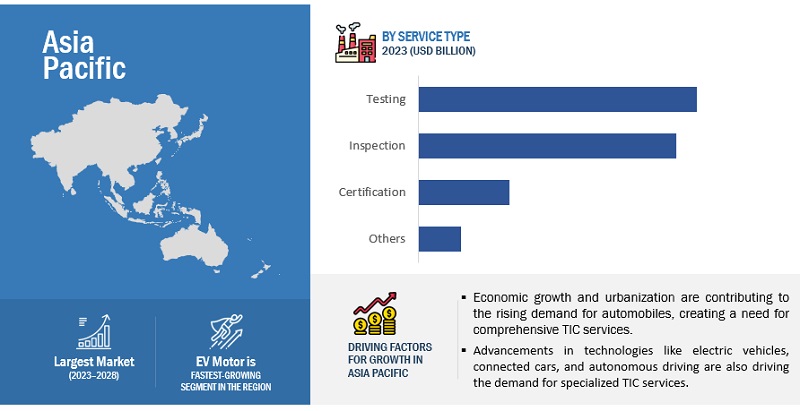

Asia Pacific to be the largest and the fastest growing market by value during the forecast period

Asia Pacific is expected to be the largest and fastest-growing region during the forecast period. In the Asia Pacific region, several TIC providers operate to address the safety, emission regulations, and other certifications set by countries such as China, Japan, and India. These countries have established stringent regulations and standards to ensure the safety, quality, and environmental performance of automotive vehicles and components. TIC providers in the region play a crucial role in conducting safety inspections, emission testing, and certification services to ensure compliance with these regulations. They help automobile manufacturers and suppliers navigate the complex regulatory landscape and obtain the necessary certifications required for their products to enter these markets. By offering comprehensive TIC services, these providers contribute to enhancing road safety, minimizing environmental impact, and fostering consumer confidence in the automotive sector across the Asia Pacific region. Consumer awareness about the importance of certification is on the rise.

Additionally, the increasing population in emerging economies in Asia Pacific has accelerated the demand for passenger cars. The recent economic meltdown in Europe catalyzed the already growing automobile industry in Asia Pacific. Several European and American automobile manufacturers, such as Mercedes Benz (Germany) and General Motors (US), shifted their production plants to Asia Pacific. Owing to all these factors, automobile manufacturing in China and India is growing, making Asia Pacific one of the largest automotive markets with increasing sales and production. Improving lifestyles and a rising number of metro cities with a steadily growing population have played vital roles in increasing the production and sales of passenger cars in the Asia Pacific region. A few Asia Pacific countries, such as Japan and South Korea, have stringent safety regulations, and the demand for passenger cars is rising. Countries such as China, India, and Japan are estimated to come up with vehicle and road safety regulations owing to the growing population and increasing vehicle demand. The increasing number of accidents will drive the implementation of safety regulations.

Key Market Players

The automotive TIC market is dominated by DEKRA SE (Germany), TÜV SÜD (Germany), Applus+ (Spain), SGS Group (Switzerland), and TÜV Rheinland AG Group (Germany), among others. These companies provide automotive TIC services to global OEMs and Tier-1 manufacturers. These companies have set up testing facilities and offer best-in-class services to their customers.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2023–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Vehicle Type, Service Type, Sourcing Type and Application |

|

Geographies Covered |

North America, Europe, Asia Pacific and Rest of the World |

|

Companies Covered |

DEKRA SE (Germany), TÜV SÜD Group (Germany), Applus+ (Spain), SGS Group (Switzerland), TÜV Rheinland Group (Germany). |

This research report categorizes the automotive TIC market based on vehicle type, service type, sourcing type, application, and region.

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Based on Service Type:

- Testing Services

- Inspection Services

- Certification Services

- Other Services

Based on Sourcing Type:

- In-House

- Outsourced

Based on Application:

- EV Batteries

- EV Chargers

- EV Motors

- Electric Systems and Components

- ADAS and Safety Systems

- Telematics and Connectivity

- Automotive Interior/Exterior Bodies

- Vehicle Inspection Services (VIS)

- Fuels, Fluids and Lubricants

- Homologation

- Others

Based on Region:

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

-

North America (NA)

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Rest of the World

- MEA

- South America

Recent Developments

- In April 2023, TUV Rheinland updated its certification program for hydrogen to ensure the safety and reliability of hydrogen technology and infrastructure. The new certification program covers various aspects of the hydrogen value chain, including production, storage, transportation, and usage. It also addresses emerging topics such as the use of hydrogen in fuel cells for mobility applications. The updated program reflects the latest technological and regulatory developments in the hydrogen industry and is designed to help companies and organizations meet the growing demand for safe and sustainable hydrogen solutions.

- In March 2023, Applus+ launched eReformas, a digital platform that provides a more efficient and flexible inspection service for users of statutory vehicle inspection in Spain. Through the eReformas platform, customers can view and manage appointments, track the inspection process in real-time, receive alerts on their mobile devices, and even make online payments. Applus+ expects the eReformas platform to improve customer satisfaction and streamline the inspection process, ultimately resulting in safer vehicles on the road.

- In March 2023, SGS announced that it has signed an agreement to sell its Automotive Asset Assessment and Retail Network Services operations to Zurich-based asset management firm, Conzzeta AG. The agreement includes selling the business, assets, and employees and transferring certain liabilities. The deal is expected to close in the second quarter of 2023, subject to customary closing conditions.

- In November 2022, DEKRA has launched a cybersecurity certification program that covers all types of electric vehicle supply equipment (EVSE). The program is the first of its kind globally. It is based on well-known cybersecurity standards, such as ETSI EN 303 645 or IEC 62443, to help EVSE manufacturers ensure their products are equipped with appropriate security solutions against significant security threats.

- In November 2022, SGS announced its membership in the Automotive Electronics Council's (AEC) Technical Committee. The AEC is a leading forum for developing reliable, high-quality automotive electronic components standards. The collaboration with AEC will enable SGS to provide its customers with testing services for automotive electronic components that comply with AEC's high-quality standards.

- In May 2022, TÜV SÜD has developed a program to evaluate the sustainability of battery production in a pilot project with Microvast Holdings. Microvast Holdings is a leading supplier of battery technology for specialized and commercial vehicles. The sustainability assessment program by TÜV SÜD aims to assist manufacturers in developing more sustainable battery production processes, focusing on ecological, social, and economic aspects.

Frequently Asked Questions (FAQ):

What is the current size of the automotive TIC market?

The current size of the automotive TIC market is estimated at USD 17.7 billion in 2023.

Who are the winners in the automotive TIC market?

The automotive TIC market is dominated by DEKRA SE (Germany), TÜV SÜD Group (Germany), Applus+ (Spain), SGS Group (Switzerland), TÜV Rheinland Group (Germany), among others. These companies provide automotive TIC services to global OEMs and Tier-1 manufacturers. These companies have set up TIC infrastructure and offer best-in-class services to their customers.

Which region will have the fastest-growing market for the automotive TIC market?

Asia Pacific will be the fastest-growing region in the automotive TIC market due to the huge volume of investments and the high demand for safer and more convenient commercial and passenger transport vehicles.

What are the key technologies affecting the automotive TIC market?

The key technologies affecting the automotive TIC market are ADAS Data Analytics & cloud computing, Virtual Testing, digital twining and Simulation, Artificial intelligence (AI) & Internet of Things (IoT), Advanced Testing techniques and Equipment, Non-Destructive Testing (NDT) Techniques, TIC solutions for EV & ADAS components.

How does TIC providers interact with the automotive industry?

TIC providers work closely with automotive manufacturers to conduct comprehensive testing and ensure compliance with regulatory standards. TIC providers assist in obtaining certifications, verifying product quality and safety, and conducting supply chain audits to ensure ethical practices. They also offer consulting services and training programs to enhance industry knowledge and assist in implementing effective processes. Through these interactions, TIC providers contribute to the overall quality, compliance, and sustainability of the automotive industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for connectivity in luxury vehicles- Global expansion of automotive market across different countries- Increasing acquisitions in TIC sector- Rapid advancements in automotive sectorRESTRAINTS- High costs associated with automotive TIC processes- Lack of harmonization in TIC standards across different regions and marketsOPPORTUNITIES- Increasing demand for hydrogen as alternate fuel and autonomous vehicles- Adoption of new technologies and methodologies like digital testing tools, automation, and data analytics to enhance efficiency and accuracy- Collaboration between OEMs and component manufacturers to offer integrated testing and certification solutionsCHALLENGES- Maintaining compliance with diverse regulatory requirements and standards across different countries- Highly competitive market

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

5.5 AUTOMOTIVE TIC MARKET ECOSYSTEMTIC PROVIDERSTIE-1 MANUFACTURERSOEMSEND USERS

- 5.6 AUTOMOTIVE TIC SERVICE PROVIDERS AND THEIR AREAS OF EXPERTISE

-

5.7 KEY STAKEHOLDERS AND BUYING CRITERIAIN-HOUSEOUTSOURCEDKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.8 TECHNOLOGY ANALYSIS

-

5.9 PATENT ANALYSIS

-

5.10 CASE STUDY ANALYSISCASE STUDY 1: KAWASAKI'S SUCCESS WITH 5-AXIS CMM INSPECTION USING RENISHAW REVO SYSTEMSCASE STUDY 2: COMMERCIAL VEHICLE TESTING – ENHANCING REAL-WORLD PERFORMANCE AND ROBUSTNESSCASE STUDY 3: ENHANCING CAR RENTAL INSPECTION WITH MOTIONCAM-3DCASE STUDY 4: ENHANCED VEHICLE INSPECTION WITH HIGH-CURRENT LED BAR LIGHTSCASE STUDY 5: INSPECTION SOFTWARE FOR AUTOMOTIVE COMPONENT TRACKING

-

5.11 REGULATORY OVERVIEWREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 TRENDS AND DISRUPTIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 AUTOMOTIVE TIC MARKET: SCENARIO ANALYSISREALISTIC SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

- 6.1 INTRODUCTION

-

6.2 TESTING SERVICESGROWING EMPHASIS ON EV AND ADAS TESTING SERVICES TO SUPPORT TRANSITION TOWARD SUSTAINABLE AND SAFE MOBILITY

-

6.3 INSPECTION SERVICESINCREASING ADOPTION OF DIGITAL TECHNOLOGIES AND REMOTE INSPECTIONS TO DRIVE MARKET

-

6.4 CERTIFICATION SERVICESCHANGING CERTIFICATION LANDSCAPE WITH SHIFT TO EVS TO CREATE NEW OPPORTUNITIES FOR AUTOMOTIVE CERTIFICATION

- 6.5 OTHER SERVICES

- 6.6 KEY PRIMARY INSIGHTS

- 7.1 INTRODUCTION

-

7.2 ELECTRICAL SYSTEMS AND COMPONENTSSHIFT TO EVS AND DEMAND FOR EMC TESTING IN ELECTRONIC COMPONENTS OF VEHICLES TO DRIVE MARKET

-

7.3 EV BATTERIESRISING DEMAND FOR BATTERIES IN EV INDUSTRY TO DRIVE MARKET

-

7.4 TELEMATICS AND CONNECTIVITYFLOURISHING CONNECTED VEHICLE ECOSYSTEM TO DRIVE MARKET

-

7.5 FUELS, FLUIDS, AND LUBRICANTSDEMAND FOR FUEL EFFICIENCY AND EMISSION CONTROL IN ICE/HYBRID VEHICLES TO DRIVE MARKET

-

7.6 AUTOMOTIVE INTERIOR/EXTERIOR BODIESINTEGRATION OF SMART AND SUSTAINABLE MATERIALS TO DRIVE MARKET

-

7.7 VEHICLE INSPECTION SERVICESCHANGING AUTOMOTIVE LANDSCAPE TO DRIVE DEMAND FOR VEHICLE INSPECTION SERVICES

-

7.8 HOMOLOGATIONINCREASING STRINGENCY OF EMISSION AND ROAD SAFETY NORMS TO DRIVE MARKET

-

7.9 EV CHARGERSDEVELOPMENT OF CHARGING INFRASTRUCTURE TO INCREASE DEMAND FOR CHARGER TESTING

-

7.10 EV MOTORSINCREASING FOCUS ON SUSTAINABLE ELECTRIC MOBILITY TO DRIVE MOTOR TESTING

-

7.11 ADAS AND SAFETY SYSTEMSRISING FOCUS ON SAFER MOBILITY TECHNOLOGIES TO INCREASE DEMAND

- 7.12 OTHERS

- 7.13 KEY PRIMARY INSIGHTS

- 8.1 INTRODUCTION

-

8.2 IN-HOUSEENHANCED QUALITY CONTROL AND COST EFFICIENCY THROUGH IN-HOUSE SOURCING

-

8.3 OUTSOURCEDNEED FOR SPECIFIC EXPERTISE, FLEXIBILITY, AND COST OPTIMIZATION TO DRIVE DEMAND FOR OUTSOURCING SERVICES

- 8.4 KEY PRIMARY INSIGHTS

- 9.1 INTRODUCTION

-

9.2 PASSENGER CARSGROWING EMPHASIS ON SUSTAINABLE AND SAFE MOBILITY TO INCREASE TIC DEMAND

-

9.3 COMMERCIAL VEHICLESINCREASING FOCUS ON TELEMATICS AND FLEET MANAGEMENT SOLUTIONS TO DRIVE MARKET

- 9.4 KEY PRIMARY INSIGHTS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Presence of major automotive OEMs to drive marketCANADA- Growing international trade, exports, and passenger safety awareness to increase demandMEXICO- Growing production of automobiles to boost market

-

10.3 EUROPEGERMANY- Presence of several established automotive and manufacturing sectors to drive marketUK- Stringent regulatory standards and certifications to drive demandFRANCE- Continuous improvements in automotive safety and environmental standards to drive demandITALY- Increasing shift toward electric mobility to drive marketSPAIN- Regular technical inspections for all vehicles to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- High production of automobiles to propel marketJAPAN- Technological advancements in automobile industry to add to market growthINDIA- Government incentives for EV adoption to drive demandSOUTH KOREA- Technological shift of major OEMs to increase demandREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)SOUTH AMERICA- Brazil to lead market in South AmericaMIDDLE EAST & AFRICA- Growing EV market to drive demand

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

-

11.3 COMPETITIVE SCENARIOPRODUCT DEVELOPMENTS/LAUNCHESDEALSOTHERS, 2020–2023

-

11.4 COMPETITIVE LEADERSHIP MAPPING FOR AUTOMOTIVE TIC MARKETSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 COMPETITIVE EVALUATION QUADRANT: SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.6 COMPETITIVE BENCHMARKING

-

12.1 KEY PLAYERSDEKRA SE- Business overview- Recent developments- MnM viewTÜV SÜD- Business overview- Recent developments- MnM viewAPPLUS+- Business overview- Recent developments- MnM viewSGS GROUP- Business overview- Recent developments- MnM viewTÜV RHEINLAND AG GROUP- Business overview- Recent developments- MnM viewTÜV NORD GROUP- Business overview- Recent developmentsBUREAU VERITAS S.A.- Business overview- Recent developmentsINTERTEK- Business overview- Recent developmentsEUROFINS- Business overviewELEMENT MATERIALS- Business overview- Recent developmentsKIWA NV- Business overview- Recent developmentsA2LA- Business overview

-

12.2 OTHER PLAYERSBRITISH STANDARDS INSTITUTION (BSI)RINA S.P.A.NORGES ELEKTRISKE MATERIELLKONTROLL (NEMKO)NSF INTERNATIONALENGINEERING QUALITY SOLUTIONS, INC. (EQS)LLOYD’S REGISTER GROUP LIMITEDMISTRASDNV GLUL LLC

- 13.1 ELECTRIFICATION OF VEHICLES TO CREATE NEW GROWTH OPPORTUNITIES

- 13.2 ASIA PACIFIC KEY FOCUS REGION FOR AUTOMOTIVE TIC MARKET

- 13.3 EMERGING AUTOMOTIVE TECHNOLOGIES TO DRIVE GROWTH

- 13.4 CONCLUSION

- 14.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 2 MARKET DEFINITION, BY SERVICE TYPE

- TABLE 3 MARKET DEFINITION, BY SOURCING TYPE

- TABLE 4 MARKET DEFINITION, BY PROPULSION

- TABLE 5 MARKET DEFINITION, BY APPLICATION

- TABLE 6 CURRENCY EXCHANGE RATES

- TABLE 7 MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 8 GDP TRENDS AND FORECASTS, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

- TABLE 9 MARKET: ECOSYSTEM

- TABLE 10 OFFERINGS OF AUTOMOTIVE TIC PROVIDERS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 SOURCING TYPES (%)

- TABLE 12 NEW DEVELOPMENTS IN AUTOMOTIVE TESTING AND INSPECTION TECHNOLOGIES

- TABLE 13 IMPORTANT PATENT REGISTRATIONS RELATED TO MARKET

- TABLE 14 CHINESE NATIONAL STANDARDS (GB STANDARDS)

- TABLE 15 US FEDERAL MOTOR VEHICLE SAFETY STANDARDS (FMVSS)

- TABLE 16 CANADA MOTOR VEHICLE SAFETY REGULATIONS (CMVSS)

- TABLE 17 BRITISH STANDARDS INSTITUTION (BSI)

- TABLE 18 AUTOMOTIVE RESEARCH ASSOCIATION OF INDIA (ARAI) STANDARDS

- TABLE 19 GERMAN ASSOCIATION OF THE AUTOMOTIVE INDUSTRY (VDA)

- TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 MARKET: CONFERENCES AND EVENTS

- TABLE 24 MARKET: REALISTIC SCENARIO, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 MARKET: OPTIMISTIC SCENARIO, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MARKET: PESSIMISTIC SCENARIO, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 28 MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 29 TESTING SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 TESTING SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 INSPECTION SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 INSPECTION SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 CERTIFICATION SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 CERTIFICATION SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 OTHER SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 OTHER SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 38 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 39 MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 40 MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 41 EV: MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 EV: MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 ICE: MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 ICE: MARKET FOR ELECTRICAL SYSTEMS AND COMPONENTS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 MARKET FOR EV BATTERIES, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 46 MARKET FOR EV BATTERIES, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 47 EV: MARKET FOR EV BATTERIES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 EV: MARKET FOR EV BATTERIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MARKET FOR TELEMATICS AND CONNECTIVITY, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 50 MARKET FOR TELEMATICS AND CONNECTIVITY, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 51 EV: MARKET FOR TELEMATICS AND CONNECTIVITY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 EV: MARKET FOR TELEMATICS AND CONNECTIVITY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 ICE: MARKET FOR TELEMATICS AND CONNECTIVITY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 ICE: MARKET FOR TELEMATICS AND CONNECTIVITY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 56 MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 57 EV: AUTOMOTIVE TIC MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 EV: MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 ICE: MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 ICE: MARKET FOR FUELS, FLUIDS, AND LUBRICANTS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 62 MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 63 EV: MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 EV: MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 ICE: MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 ICE: MARKET FOR AUTOMOTIVE INTERIOR/EXTERIOR BODIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 MARKET FOR VEHICLE INSPECTION SERVICES, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 68 MARKET FOR VEHICLE INSPECTION SERVICES, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 69 EV: MARKET FOR VEHICLE INSPECTION SERVICES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 EV: MARKET FOR VEHICLE INSPECTION SERVICES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 ICE: MARKET FOR VEHICLE INSPECTION SERVICES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 ICE: MARKET FOR VEHICLE INSPECTION SERVICES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 MARKET FOR HOMOLOGATION, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 74 MARKET FOR HOMOLOGATION, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 75 EV: MARKET FOR HOMOLOGATION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 EV: MARKET FOR HOMOLOGATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 ICE: MARKET FOR HOMOLOGATION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 ICE: MARKET FOR HOMOLOGATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 MARKET FOR EV CHARGERS, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 80 MARKET FOR EV CHARGERS, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 81 EV: MARKET FOR EV CHARGERS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 EV: MARKET FOR EV CHARGERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 MARKET FOR EV MOTORS, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 84 MARKET FOR EV MOTORS, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 85 EV: MARKET FOR EV MOTORS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 EV: MARKET FOR EV MOTORS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 MARKET FOR ADAS AND SAFETY SYSTEMS, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 88 MARKET FOR ADAS AND SAFETY SYSTEMS, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 89 EV: MARKET FOR ADAS AND SAFETY SYSTEMS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 EV: MARKET FOR ADAS AND SAFETY SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 ICE: AUTOMOTIVE TIC MARKET FOR ADAS AND SAFETY SYSTEMS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 ICE: MARKET FOR ADAS AND SAFETY SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 MARKET FOR OTHER APPLICATIONS, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 94 MARKET FOR OTHER APPLICATIONS, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 95 EV: MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 EV: MARKET FOR OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 ICE: MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 98 ICE: MARKET FOR OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 MARKET, BY SOURCING TYPE, 2019–2022 (USD MILLION)

- TABLE 100 MARKET, BY SOURCING TYPE, 2023–2028 (USD MILLION)

- TABLE 101 MARKET FOR IN-HOUSE SOURCING, BY REGION, 2019–2022 (USD MILLION)

- TABLE 102 MARKET FOR IN-HOUSE SOURCING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 MARKET FOR IN-HOUSE SOURCING, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 MARKET FOR IN-HOUSE SOURCING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 MARKET FOR OUTSOURCED SOURCING, BY REGION, 2019–2022 (USD MILLION)

- TABLE 106 MARKET FOR OUTSOURCED SOURCING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 MARKET FOR OUTSOURCED SOURCING, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 108 MARKET FOR OUTSOURCED SOURCING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 OFFERINGS BY TIC PROVIDERS, BY VEHICLE TYPE

- TABLE 110 MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 111 MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 112 MARKET FOR PASSENGER CARS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 MARKET FOR PASSENGER CARS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 115 MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 116 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 117 AUTOMOTIVE TIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: AUTOMOTIVE TIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 US: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 123 US: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 124 CANADA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 125 CANADA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 126 MEXICO: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 127 MEXICO: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 128 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 129 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 131 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 GERMANY: AUTOMOTIVE TIC MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 133 GERMANY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 UK: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 135 UK: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 136 FRANCE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 137 FRANCE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 ITALY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 139 ITALY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 SPAIN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 141 SPAIN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 143 REST OF EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 148 CHINA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 149 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 150 JAPAN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 151 JAPAN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 INDIA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 153 INDIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 154 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 155 SOUTH KOREA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 158 REST OF THE WORLD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 159 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 160 REST OF THE WORLD: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 161 REST OF THE WORLD: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 162 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 163 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 166 MARKET SHARE ANALYSIS, 2022

- TABLE 167 PRODUCT DEVELOPMENTS/LAUNCHES, 2020–2023

- TABLE 168 DEALS, 2020–2023

- TABLE 169 OTHERS, 2020–2023

- TABLE 170 MARKET: COMPANY FOOTPRINT FOR KEY AUTOMOTIVE TIC PROVIDERS, 2023

- TABLE 171 MARKET: COMPANY APPLICATION FOOTPRINT FOR KEY AUTOMOTIVE TIC PROVIDERS, 2023

- TABLE 172 MARKET: REGIONAL FOOTPRINT FOR KEY AUTOMOTIVE TIC PROVIDERS, 2023

- TABLE 173 MARKET: DETAILED LIST OF KEY STARTUPS

- TABLE 174 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 175 DEKRA SE: BUSINESS OVERVIEW

- TABLE 176 DEKRA SE: PRODUCTS AND SERVICES OFFERED

- TABLE 177 DEKRA SE: NEW PRODUCT DEVELOPMENTS

- TABLE 178 DEKRA SE: DEALS

- TABLE 179 DEKRA SE: OTHERS

- TABLE 180 TÜV SÜD: BUSINESS OVERVIEW

- TABLE 181 TÜV SÜD: PRODUCTS AND SERVICES OFFERED

- TABLE 182 TÜV SÜD: NEW PRODUCT DEVELOPMENTS

- TABLE 183 TÜV SÜD: DEALS

- TABLE 184 TÜV SÜD: OTHERS

- TABLE 185 APPLUS+: BUSINESS OVERVIEW

- TABLE 186 APPLUS+: PRODUCTS AND SERVICES OFFERED

- TABLE 187 APPLUS+: NEW PRODUCT DEVELOPMENTS

- TABLE 188 APPLUS+: DEALS

- TABLE 189 APPLUS+: OTHERS

- TABLE 190 SGS GROUP: BUSINESS OVERVIEW

- TABLE 191 SGS GROUP: PRODUCTS AND SERVICES OFFERED

- TABLE 192 SGS GROUP: DEALS

- TABLE 193 SGS GROUP: OTHERS

- TABLE 194 TÜV RHEINLAND AG GROUP: BUSINESS OVERVIEW

- TABLE 195 TÜV RHEINLAND AG GROUP: PRODUCTS AND SERVICES OFFERED

- TABLE 196 TÜV RHEINLAND AG GROUP: NEW PRODUCT DEVELOPMENTS

- TABLE 197 TÜV RHEINLAND AG GROUP: DEALS

- TABLE 198 TÜV RHEINLAND AG GROUP: OTHERS

- TABLE 199 TÜV NORD GROUP: BUSINESS OVERVIEW

- TABLE 200 TÜV NORD GROUP: PRODUCTS AND SERVICES OFFERED

- TABLE 201 TÜV NORD GROUP: DEALS

- TABLE 202 BUREAU VERITAS S.A.: BUSINESS OVERVIEW

- TABLE 203 BUREAU VERITAS S.A.: CONNECTED VEHICLE SERVICES

- TABLE 204 BUREAU VERITAS S.A.: PRODUCTS AND SERVICES OFFERED

- TABLE 205 BUREAU VERITAS S.A.: NEW PRODUCT DEVELOPMENTS

- TABLE 206 BUREAU VERITAS S.A.: DEALS

- TABLE 207 INTERTEK: BUSINESS OVERVIEW

- TABLE 208 INTERTEK: PRODUCTS AND SERVICES OFFERED

- TABLE 209 INTERTEK: NEW PRODUCT DEVELOPMENTS

- TABLE 210 INTERTEK: OTHERS

- TABLE 211 EUROFINS: BUSINESS OVERVIEW

- TABLE 212 EUROFINS: PRODUCTS AND SERVICES OFFERED

- TABLE 213 ELEMENT MATERIALS: BUSINESS OVERVIEW

- TABLE 214 ELEMENT MATERIALS: PRODUCTS AND SERVICES OFFERED

- TABLE 215 ELEMENT MATERIALS: DEALS

- TABLE 216 KIWA NV: BUSINESS OVERVIEW

- TABLE 217 KIWA NV: PRODUCTS AND SERVICES OFFERED

- TABLE 218 KIWA NV: OTHERS

- TABLE 219 A2LA: BUSINESS OVERVIEW

- TABLE 220 A2LA: PRODUCTS AND SERVICES OFFERED

- FIGURE 1 MARKETS COVERED

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 MARKET: TOP-DOWN APPROACH

- FIGURE 8 AUTOMOTIVE TIC MARKET: RESEARCH DESIGN AND METHODOLOGY

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 11 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 12 AUTOMOTIVE TIC MARKET: MARKET OVERVIEW

- FIGURE 13 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 IN-HOUSE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 NEW TECHNOLOGIES TO DRIVE MARKET

- FIGURE 16 TESTING SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 INCREASING AUTOMOTIVE PRODUCTION IN DEVELOPING COUNTRIES TO BOOST DEMAND FOR AUTOMOTIVE TIC SERVICES

- FIGURE 18 TESTING SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 PASSENGER CARS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 OUTSOURCED SEGMENT TO EXHIBIT HIGHER CAGR THAN IN-HOUSE SEGMENT FROM 2023 TO 2028

- FIGURE 21 VEHICLE INSPECTION SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 22 ASIA PACIFIC ESTIMATED TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 23 AUTOMOTIVE TIC ROADMAP

- FIGURE 24 MARKET: MARKET DYNAMICS

- FIGURE 25 VALUE CHAIN OF AUTOMOTIVE TIC SERVICES

- FIGURE 26 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 SOURCING TYPES

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 2 SOURCING TYPES

- FIGURE 29 NEW TECHNOLOGIES IN MARKET

- FIGURE 30 NUMBER OF PUBLISHED PATENTS (2012–2022)

- FIGURE 31 MARKET: TRENDS AND DISRUPTIONS

- FIGURE 32 MARKET: FUTURE TRENDS AND SCENARIOS, 2021–2028

- FIGURE 33 SERVICES OFFERED BY TIC PROVIDERS FOR AUTOMOTIVE INDUSTRY

- FIGURE 34 MARKET, BY SERVICE TYPE, 2023−2028

- FIGURE 35 TYPES OF TESTING SERVICES

- FIGURE 36 DEVELOPMENTS IN INSPECTION SERVICES

- FIGURE 37 TYPES OF INSPECTION SERVICES

- FIGURE 38 TYPES OF AUTOMOTIVE HOMOLOGATION/CERTIFICATION SERVICES

- FIGURE 39 TYPES OF OTHER SERVICES

- FIGURE 40 SEGMENTS BY APPLICATION

- FIGURE 41 MARKET, BY APPLICATION, 2023−2028

- FIGURE 42 SEGMENTS BY SOURCING TYPE

- FIGURE 43 MARKET, BY SOURCING TYPE, 2023−2028

- FIGURE 44 BENEFITS OF IN-HOUSE SOURCING TYPE

- FIGURE 45 BENEFITS OF OUTSOURCED SOURCING TYPE

- FIGURE 46 MARKET, BY VEHICLE TYPE, 2023−2028

- FIGURE 47 MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 48 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 49 EUROPE: AUTOMOTIVE TIC MARKET, 2023–2028 (USD MILLION)

- FIGURE 50 ASIA PACIFIC: AUTOMOTIVE TIC MARKET SNAPSHOT

- FIGURE 51 MARKET SHARE ANALYSIS FOR AUTOMOTIVE TIC MARKET, 2022

- FIGURE 52 TOP PUBLIC/LISTED PLAYERS DOMINATING AUTOMOTIVE TIC MARKET DURING LAST FIVE YEARS

- FIGURE 53 AUTOMOTIVE TIC MARKET: COMPANY EVALUATION MATRIX FOR TOP AUTOMOTIVE TIC PROVIDERS, 2023

- FIGURE 54 AUTOMOTIVE TIC MARKET (STARTUP/SME): COMPANY EVALUATION QUADRANT, 2023

- FIGURE 55 DEKRA SE: COMPANY SNAPSHOT

- FIGURE 56 TÜV SÜD: COMPANY SNAPSHOT

- FIGURE 57 APPLUS+: COMPANY SNAPSHOT

- FIGURE 58 APPLUS+: FUNCTIONAL SAFETY SUPPORT THROUGHOUT DEVELOPMENT CYCLES

- FIGURE 59 SGS GROUP: COMPANY SNAPSHOT

- FIGURE 60 TÜV RHEINLAND AG GROUP: COMPANY SNAPSHOT

- FIGURE 61 TÜV RHEINLAND AG GROUP: TIC SERVICES OFFERED FOR AUTOMOTIVE INDUSTRY

- FIGURE 62 TÜV NORD GROUP: COMPANY SNAPSHOT

- FIGURE 63 TÜV NORD GROUP: AUTOMOTIVE SERVICES

- FIGURE 64 BUREAU VERITAS S.A.: COMPANY SNAPSHOT

- FIGURE 65 INTERTEK: COMPANY SNAPSHOT

- FIGURE 66 EUROFINS: COMPANY SNAPSHOT

- FIGURE 67 EUROFINS: NUMBER OF EMPLOYEES AND LABORATORIES

- FIGURE 68 A2LA: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the automotive TIC market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications (for example, publications of automobile OEMs), automotive component associations, American Automobile Association (AAA), European Alternative Fuels Observatory (EAFO), International Energy Agency (IEA), country-level automotive associations, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) were used to identify and collect information for an extensive commercial study of the automotive TIC market.

Primary Research

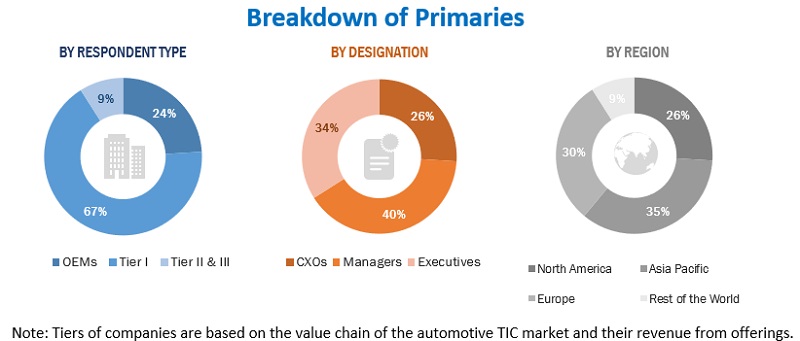

Extensive primary research was conducted after acquiring an understanding of the automotive TIC market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, trade associations, institutes, R&D centers, OEMs/vehicle manufacturers) and supply (component manufacturers, software providers) sides across four major regions, namely North America, Europe, Asia Pacific, and Rest of the World. 52% of the experts involved in primary interviews were from the demand side, while the remaining 48% were from the supply side.

Primary data was collected through questionnaires, emails, and telephonic interviews. Primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint of the report. After interacting with industry participants, brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of the automotive TIC market. In this approach, the total market size was derived by considering the TIC spending of market players. After deriving the total market size, the market at the regional level was calculated by breaking down the global market share. The country-level market was derived by using a percentage split of automotive TIC services at the regional level. All country-level data was added to derive the global market by vehicle type, service type, and sourcing type. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

Automotive testing, inspection, and certification services are carried out to check the vehicle quality. Automotive TIC service providers must ensure that automakers and suppliers comply with the national and international standards by demonstrating high safety standards, sustainable quality, and operational excellence. In the automotive sector, various assembly line components (such as seats, seatbelts, airbags, batteries, doors, tires, mirrors, lights, anti-lock braking systems (ABS), engines, and wipers), as well as final products, need to conform to certain standards and regulations. Automotive TIC services offer quality and standardization checks that help automobile manufacturers to adhere to the rules and regulations. Automobile testing requires advanced capabilities and expertise to evaluate the performance of automobiles and shorten the delivery time of vehicles.

This report takes a closer look at the automotive TIC market, providing a holistic outlook on market dynamics, industry trends, and supply and demand. It aims to provide information regarding estimates and forecasts for the market segments. The report categorizes the automotive TIC market based on service type, sourcing type, application, and geography as well as forecasts the market size and analyzes the trends in the market.

List Of Key Stakeholders

- Raw material and testing equipment suppliers

- Research organizations

- Original equipment manufacturers (OEMs)

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Analysts and strategic business planners

- Government bodies, venture capitalists, and private equity firms

- End users curious to know more about automotive TIC services and the latest standards in the automotive TIC market

Report Objectives

- To segment the market and forecast its size, by value (USD million), based on vehicle type (passenger cars and commercial vehicles)

- To segment the market and forecast its size by value (USD million), based on service type (testing services, inspection services, certification services, other services)

- To segment the market and forecast its size, by value (USD million), based on sourcing type (in-house, outsourced)

- To segment the market and forecast its size, by value (USD million), based on application (battery testing, charger testing, motor testing, electrical systems and component testing, ADAS and safety testing, telematics and connectivity testing, interior and exterior materials and component testing, vehicle inspection services (VIS), homologation testing and others)

- To segment the market and forecast its size by value (USD million) based on region (Asia Pacific, Europe, North America)

- To analyze the technological developments impacting the automotive TIC market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

- To study the following with respect to the market

- Value Chain Analysis

- Ecosystem

- Technology Analysis

- Case Study Analysis

- Patent Analysis

- Buying Criteria

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product developments, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Additional country-level breakdown by sourcing type (for specific countries not covered in the report, subject to data availability)

- Further breakdown by propulsion type (subject to data availability)

Company Information

- Profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Automotive TIC Market