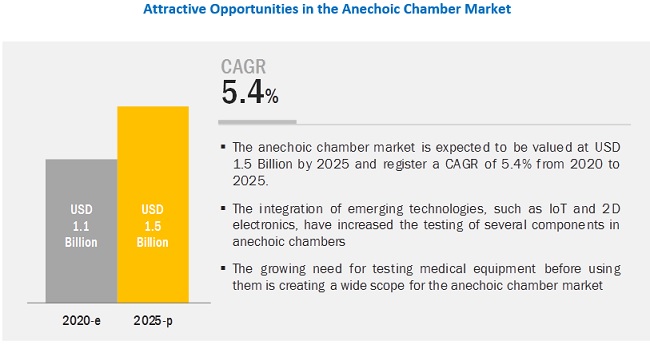

Anechoic Chamber Market by Type (Semi Anechoic chamber and Full Anechoic chamber), End-Use Application (Automotive, Military & Defense, IT & Telecom, Consumer Appliances and Electronics, Medical, and Others), and Geography - Global Forecast to 2025

The anechoic chamber market is expected to register a CAGR of 5.4% and reach USD 1.5 billion in 2025. One of the primary reasons for the growth of the market is the increasing need for testing electronics.

Impact of AI on Anechoic Chamber Market

Artificial Intelligence (AI) is making a notable impact on the anechoic chamber market by revolutionizing how electromagnetic and acoustic testing is conducted. AI-driven simulation and predictive analytics are streamlining the design and setup of testing environments, reducing time and cost while enhancing accuracy. In RF and EMC testing, AI algorithms are being used to automate data analysis, identify patterns, and detect anomalies faster than traditional methods, improving test reliability and reducing human error. Furthermore, AI integration enables real-time monitoring and adaptive control of chamber conditions, ensuring consistent test environments. As demand rises for faster and more complex testing of advanced electronics, including 5G devices, autonomous systems, and IoT products, AI is playing a pivotal role in enhancing the efficiency and scalability of anechoic chambers. This technological shift is not only boosting innovation in the chamber design and functionality but also expanding their applications across automotive, aerospace, defense, and consumer electronics industries.

Semi anechoic chamber market to grow at highest CAGR in 2020

The semi-anechoic chamber market is expected to hold the largest share of about 80% of the total market size in the year 2020 due to its unique characteristics that allow the user to constantly adjust background noise. This allows the user to test the components faster as compared to other chambers. It makes the semi-anechoic chamber perfect for immunity testing. This also allows the user to have more accurate testing and also is less risky of damages. The demand for semi-anechoic chambers is expected to grow due to the unique characteristics it possesses.

IT and Telecom application segment to grow at the highest CAGR during the forecast period

In the IT & Telecom sector servers, blade servers, Ethernet switches, routers, photocopiers, fax machines, cables, and many other information technology equipment (ITE) come under the category of electromagnetic compatibility. The growth of wireless mobile subscribers has completely outnumbered the number of wired subscribers. This unprecedented growth exponentially increases the number of equipment in the system, and the large concentration of the system over limited space further increases the chance for electromagnetic interference. Thus, the designers and manufacturers, through EMC/EMI/RF testing, assure the performance of IT & Telecom equipment, in terms of both hardware and software. Equipment testing is conducted during R&D, manufacturing, and certification stages. With EMC/EMI/RF testing, mobile device manufacturers can ensure that new products adhere to global standards.

The implementation of 5G technology will also introduce new devices that can adapt to the latest 5G technology. The testing of the 5G transmission antennas through EMC/EMI/RF testing will help to assure that the antennas are working properly. There will be many 5G devices whose components would be needed to be tested by the anechoic chambers. The anechoic chamber also helps to determine the best position for positioning the 5G radio equipment and the antennas so that they get the best possible signals.

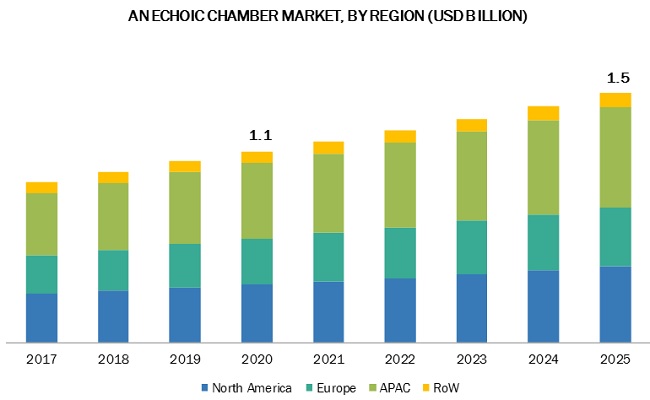

APAC to hold largest share of anechoic chamber market in 2020

The anechoic chamber market in APAC is projected to reach USD 589.7 million by 2025, it is expected to grow at a CAGR of 5.85% during the forecast period. APAC holds the largest share that is about 40% of the anechoic chamber market share.

The growing demand for modern gadgets and latest medical innovations offer a wide scope of opportunities for the anechoic chambers market in the region. Various aerospace companies are also investing in their production in APAC region due to cheap labor services and also because of ease in foreign investment norms. All these factors are expected to fuel the growth of the anechoic chamber market in APAC.

Key Market Players

Key players in the anechoic chamber market include TDK Corporation (Japan), ESCO (ETS) (US), MVG (France), Eckel Industries (USA), and Albatross Projects (Germany). TDK Corporation is an electronics company based in Tokyo, Japan. It was established in 1935 to commercialize ferrite, a key material in electronic and magnetic products. TDK's portfolio includes passive components, such as ceramic, aluminum electrolytic and film capacitors, ferrites and inductors, high-frequency products, and piezo and protection components, as well as sensors and sensor systems and power supplies. These products are marketed under brands TDK, EPCOS, InvenSense, Micronas, Tronics, and TDK-Lambda. TDK's key product groups are magnetic application products, energy devices, and flash memory application devices. TDK focuses on demanding markets in the areas of information and communication technology and automotive, industrial, and consumer electronics sectors.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Application, and Geography |

|

Regions covered |

Americas, APAC, Europe, and RoW |

This research report categorizes the Anechoic Chamber market based on type, application, and region.

ANECHOIC CHAMBER MARKET, BY TYPE

- Semi anechoic chamber

- Full anechoic chamber

ANECHOIC CHAMBER MARKET, BY END-USE APPLICATION

- Automotive

- Military and Defense

- IT and Telecommunications

- Consumer appliances and Electronics

- Medical

- Others

GEOGRAPHIC

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

-

Rest of the World (RoW)

- South America

- Brazil

- Argentina

- Peru

- Chile

-

Middle East & Africa

- Eqypt

- Israel

- Saudi Arabia

- Kuwait

- United Arab Emirates

Critical questions answered by this report:

- Where will all these developments take the industry in the mid to long term?

- What are the emerging applications of anechoic chambers?

- Which countries are expected to witness significant growth in the anechoic chamber market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 12)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 SCOPE OF THE STUDY

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 16)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.1.3.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach used to arrive at the market size via bottom-up analysis

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach used to capture the market size via top-down analysis

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 25)

4 PREMIUM INSIGHTS (Page No. - 28)

4.1 LUCRATIVE OPPORTUNITIES IN ANECHOIC CHAMBERS MARKET

4.2 ANECHOIC CHAMBERS MARKET, BY COUNTRY

4.3 ANECHOIC CHAMBERS MARKET, BY APPLICATION AND REGION

4.4 ANECHOIC CHAMBERS MARKET IN APAC, BY APPLICATION

4.5 ANECHOIC CHAMBERS MARKET SHARE, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 31)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Stringent government regulations pertaining to electromagnetic interference (EMI) across the electronics industry

5.2.1.2 Increasing trend of outsourcing testing, inspection, and certification (TIC) services that require anechoic chambers

5.2.1.3 Increased need for anechoic chambers for electromagnetic compatibility pre-compliance testing

5.2.1.4 Growing use of industry-specific customized anechoic chambers

5.2.2 RESTRAINTS

5.2.2.1 High cost involved in electromagnetic compatibility testing used in anechoic chamber

5.2.2.2 Occurrences of errors while testing in anechoic chambers

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of the hybrid and electric vehicles market

5.2.3.2 Evolution of 5G technology

5.2.3.3 Increasing application of anechoic chambers in robotics testing

5.2.3.4 Testing opportunities in 2D electronics and molecular electronics

5.2.4 CHALLENGES

5.2.4.1 Long lead time for overseas qualification assessments

5.2.4.2 Testing the flammability of the equipment that is being tested

5.3 IMPACT ANALYSIS

5.4 IMPACT OF COVID-19 ON ANECHOIC CHAMBER MARKET

6 ANECHOIC CHAMBER MARKET, BY TYPE (Page No. - 39)

6.1 INTRODUCTION

6.2 SEMI ANECHOIC CHAMBER

6.2.1 ELECTROMAGNETIC COMPATIBILITY AND RADIO FREQUENCY TESTING IN ANECHOIC CHAMBERS HELP IN ABSORBING DIFFERENT BANDS OF FREQUENCY

6.3 FULL ANECHOIC CHAMBER

6.3.1 FULL AND HEMI ANECHOIC CHAMBERS PROVIDE LOW-COST AND SIZE-EFFECTIVE TESTING

7 ANECHOIC CHAMBER MARKET, BY APPLICATION (Page No. - 43)

7.1 INTRODUCTION

7.2 AUTOMOTIVE

7.2.1 INCREASING NEED FOR MEASURING RADIO FREQUENCY EMISSIONS IN VEHICLES ON BOARD TO BOOST THE DEMAND FOR ANECHOIC CHAMBERS

7.3 MILITARY & DEFENSE

7.3.1 IMPLEMENTATION OF STANDARDS AND GOVERNMENT REGULATIONS RELATED TO ELECTROMAGNETIC COMPATIBILITY TESTING TO INCREASE DEMAND FOR ANECHOIC CHAMBERS

7.4 IT & TELECOM

7.4.1 GROWING NEED FOR TESTING 5G TRANSMISSION ANTENNAS TO FUEL THE DEMAND FOR ANECHOIC CHAMBERS

7.5 CONSUMER APPLIANCES AND ELECTRONICS

7.5.1 NEED TO ADHERE TO THE SAFETY STANDARDS OF CONSUMER ELECTRONICS RELATED TO ELECTROMAGNETIC COMPATIBILITY AND ELECTROMAGNETIC INTERFERENCE TESTING TO PROPEL THE DEMAND FOR ANECHOIC CHAMBERS

7.6 MEDICAL

7.6.1 NEED TO MAINTAIN A PROPER FUNCTIONING OF MEDICAL EQUIPMENT RELATED TO ELECTROMAGNETIC INTERFERENCE TESTING TO BOOST THE DEMAND FOR ANECHOIC CHAMBERS IN THE MEDICAL SECTOR

7.7 OTHERS

7.7.1 INCREASING DEMAND FOR ANECHOIC CHAMBERS IN DIFFERENT SECTORS

8 ANECHOIC CHAMBER MARKET, BY REGION (Page No. - 59)

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 US

8.2.1.1 Growing demand for modern gadgets and innovations in medical equipment offer growth opportunities for the anechoic chamber market

8.2.2 CANADA

8.2.2.1 Increasing demand for communication equipment testing and automotive testing to boost the market growth in Canada

8.2.3 MEXICO

8.2.3.1 Increasing demand for compact cars and electronic components are expected to fuel the growth of the Mexico market

8.3 EUROPE

8.3.1 GERMANY

8.3.1.1 Complexity of automobile electronics and increasing focus on R&D to boost the demand for anechoic chambers

8.3.2 UK

8.3.2.1 High demand for EMC/EMI testing across aerospace and military applications to boost the demand for anechoic chamber

8.3.3 FRANCE

8.3.3.1 Rise in the adoption of EMI vulnerable equipment in military & defense applications

8.3.4 ITALY

8.3.4.1 Increasing demand for medical equipment

8.3.5 REST OF EUROPE

8.4 ASIA PACIFIC

8.4.1 CHINA

8.4.1.1 Expanding telecommunication industry to drive the growth of the anechoic chamber market

8.4.2 JAPAN

8.4.2.1 Increase in FDI in the industrial sector owing to technological advancements to boost the demand for anechoic chambers

8.4.3 INDIA

8.4.3.1 Initiatives by the government to boost the aviation sector to increase the need for testing the components in anechoic chambers

8.4.4 REST OF ASIA PACIFIC

8.5 REST OF THE WORLD (ROW)

8.5.1 MIDDLE EAST & AFRICA

8.5.1.1 Growing investments in communication, infrastructure, and networking applications to increase the adoption of anechoic chambers

8.5.2 SOUTH AMERICA

8.5.2.1 Growing adoption of wireless communication and networking solutions to drive the market growth in South America

9 COMPETITIVE LANDSCAPE (Page No. - 74)

9.1 OVERVIEW

9.2 MARKET RANKING ANALYSIS: ANECHOIC CHAMBER MARKET

9.3 COMPETITIVE LEADERSHIP MAPPING, 2019

9.3.1 VISIONARY LEADERS

9.3.2 DYNAMIC DIFFERENTIATORS

9.3.3 INNOVATORS

9.3.4 EMERGING COMPANIES

9.4 STRENGTH OF SERVICE PORTFOLIO

9.5 BUSINESS STRATEGY EXCELLENCE

9.6 COMPETITIVE SITUATIONS AND TRENDS

9.6.1 PRODUCT LAUNCHES

10 COMPANY PROFILES (Page No. - 80)

(Business overview, Products offered, Recent developments, SWOT analysis, MNM view)*

10.1 INTRODUCTION

10.2 TDK CORPORATION

10.3 ESCO TECHNOLOGIES (ETS-LINDGREN)

10.4 MICROWAVE VISION GROUP (MVG)

10.5 ECKEL INDUSTRIES

10.6 ALBATROSS PROJECTS

10.7 FRANKONIA GROUP

10.8 COMTEST ENGINEERING

10.9 CUMING MICROWAVE CORPORATION

10.10 ECOTONE SYSTEM

*Business overview, Products offered, Recent developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 98)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

LIST OF TABLES (44 TABLES)

TABLE 1 COST ESTIMATES OF ELECTROMAGNETIC COMPATIBILITY TESTING

TABLE 2 ANECHOIC CHAMBER MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 3 SEMI ANECHOIC CHAMBER MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 4 FULL ANECHOIC CHAMBER MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 5 ANECHOIC CHAMBER MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 6 ANECHOIC CHAMBER MARKET FOR AUTOMOTIVE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 7 ANECHOIC CHAMBER MARKET FOR AUTOMOTIVE, BY REGION, 2017–2025 (USD MILLION)

TABLE 8 ANECHOIC CHAMBER MARKET FOR AUTOMOTIVE IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 9 ANECHOIC CHAMBER MARKET FOR AUTOMOTIVE IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 10 ANECHOIC CHAMBER MARKET FOR AUTOMOTIVE IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 11 ANECHOIC CHAMBER MARKET FOR MILITARY & DEFENSE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 12 ANECHOIC CHAMBER MARKET FOR MILITARY & DEFENSE, BY REGION, 2017–2025 (USD MILLION)

TABLE 13 ANECHOIC CHAMBER MARKET FOR MILITARY & DEFENSE IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 14 ANECHOIC CHAMBER MARKET FOR MILITARY & DEFENSE IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 15 ANECHOIC CHAMBER MARKET FOR MILITARY & DEFENSE IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 16 ANECHOIC CHAMBER MARKET FOR IT & TELECOM, BY TYPE, 2017–2025 (USD MILLION)

TABLE 17 ANECHOIC CHAMBER MARKET FOR IT & TELECOM, BY REGION, 2017–2025 (USD MILLION)

TABLE 18 ANECHOIC CHAMBER MARKET FOR IT & TELECOM IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 19 ANECHOIC CHAMBER MARKET FOR IT & TELECOM IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 20 ANECHOIC CHAMBER MARKET FOR IT & TELECOM IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 21 ANECHOIC CHAMBER MARKET FOR CONSUMER APPLIANCES AND ELECTRONICS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 22 ANECHOIC CHAMBER MARKET FOR CONSUMER APPLIANCES AND ELECTRONICS, BY REGION, 2017–2025 (USD MILLION)

TABLE 23 ANECHOIC CHAMBER MARKET FOR CONSUMER APPLIANCES AND ELECTRONICS IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 24 ANECHOIC CHAMBER MARKET FOR CONSUMER APPLIANCES AND ELECTRONICS IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 25 ANECHOIC CHAMBER MARKET FOR CONSUMER APPLIANCES AND ELECTRONICS IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 26 ANECHOIC CHAMBER MARKET FOR MEDICAL, BY TYPE, 2017–2025 (USD MILLION)

TABLE 27 ANECHOIC CHAMBER MARKET FOR MEDICAL, BY REGION, 2017–2025 (USD MILLION)

TABLE 28 ANECHOIC CHAMBER MARKET FOR MEDICAL IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 29 ANECHOIC CHAMBER MARKET FOR MEDICAL IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 30 ANECHOIC CHAMBER MARKET FOR MEDICAL IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 31 ANECHOIC CHAMBER MARKET FOR OTHERS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 32 ANECHOIC CHAMBER MARKET FOR OTHERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 33 ANECHOIC CHAMBER MARKET FOR OTHERS IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 34 ANECHOIC CHAMBER MARKET FOR OTHERS IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 35 ANECHOIC CHAMBER MARKET FOR OTHERS IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 36 ANECHOIC CHAMBER MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 37 ANECHOIC CHAMBER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 38 ANECHOIC CHAMBER MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 39 ANECHOIC CHAMBER MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 40 ANECHOIC CHAMBER MARKET IN EUROPE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 41 ANECHOIC CHAMBER MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 42 ANECHOIC CHAMBER MARKET IN APAC, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 43 ANECHOIC CHAMBER MARKET IN ROW, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 44 PRODUCT LAUNCHES, 2018–2019

LIST OF FIGURES (33 FIGURES)

FIGURE 1 ANECHOIC CHAMBER MARKET SEGMENTATION

FIGURE 2 ANECHOIC CHAMBER MARKET: RESEARCH DESIGN

FIGURE 3 PROCESS FLOW

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION

FIGURE 7 ANECHOIC CHAMBERS MARKET, BY TYPE, 2020

FIGURE 8 ANECHOIC CHAMBERS MARKET, BY APPLICATION

FIGURE 9 APAC ANECHOIC CHAMBER MARKET IN 2020

FIGURE 10 ANECHOIC CHAMBER MARKET EXPECTED TO WITNESS LUCRATIVE GROWTH OPPORTUNITIES OWING TO ITS INCREASING DEMAND IN THE IT & TELECOM AND MEDICAL APPLICATIONS

FIGURE 11 US AND CHINA ARE EXPECTED TO HOLD THE LARGEST MARKET SHARES IN 2020

FIGURE 12 APAC TO HOLD LARGEST SHARE OF ANECHOIC CHAMBERS MARKET IN 2020

FIGURE 13 AUTOMOTIVE AND IT & TELECOM SEGMENTS TO ACCOUNT FOR THE LARGEST SHARES OF ANECHOIC CHAMBER IN APAC

FIGURE 14 US IS EXPECTED TO HOLD LARGEST SHARE OF ANECHOIC CHAMBERS MARKET IN 2020

FIGURE 15 ANECHOIC CHAMBER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 16 ANECHOIC CHAMBER MARKET, BY TYPE

FIGURE 17 ANECHOIC CHAMBER MARKET, BY APPLICATION

FIGURE 18 REGIONAL SNAPSHOT (2020): ANECHOIC CHAMBER MARKET IN INDIA TO WITNESS SIGNIFICANT GROWTH FROM 2020 TO 2025

FIGURE 19 NORTH AMERICA ANECHOIC CHAMBER MARKET SNAPSHOT

FIGURE 20 REGIONAL SNAPSHOT (2020): ANECHOIC CHAMBER MARKET IN EUROPE

FIGURE 21 ASIA PACIFIC ANECHOIC CHAMBER MARKET SNAPSHOT 2020

FIGURE 22 KEY PLAYER MARKET RANKING, 2019

FIGURE 23 ANECHOIC CHAMBER MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 24 SERVICE PORTFOLIO ANALYSIS OF TOP PLAYERS IN ANECHOIC CHAMBER MARKET

FIGURE 25 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ANECHOIC CHAMBER MARKET

FIGURE 26 TDK CORPORATION: COMPANY SNAPSHOT

FIGURE 27 TDK CORPORATION: SWOT ANALYSIS

FIGURE 28 ESCO TECHNOLOGIES (ETS-LINDGREN): COMPANY SNAPSHOT

FIGURE 29 ESCO TECHNOLOGIES: SWOT ANALYSIS

FIGURE 30 MICROWAVE VISION GROUP (MVG): COMPANY SNAPSHOT

FIGURE 31 MICROWAVE VISION GROUP (MVG): SWOT ANALYSIS

FIGURE 32 ECKEL INDUSTRIES: SWOT ANALYSIS

FIGURE 33 ALBATROSS PROJECTS: SWOT ANALYSIS

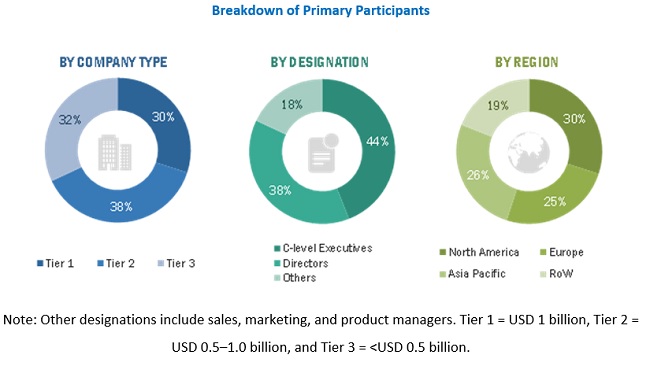

The study involved four major activities in estimating the current size of the anechoic chamber market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include biometric technologies journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the anechoic chamber market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the anechoic chamber market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides in government, consumer electronics, healthcare, banking & finance, travel & immigration, automotive, and military & defense verticals among others.

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the anechoic chamber market, by type, application, and geography

- To forecast the market size of various segments with respect to 4 main regions: North America, Europe, Asia Pacific, and the Rest of the World

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze the competitive developments such as agreements, contracts, partnerships, acquisitions, and product launches & developments carried out in the anechoic chamber market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Anechoic Chamber Market