Automotive Data Logger Market by End Market (OEMs, Service Stations, and Regulatory Bodies), Application, Post-Sales Application, Channels, Connection Type, and Region (Asia Pacific, Europe, North America, and RoW) - Global Forecast to 2025

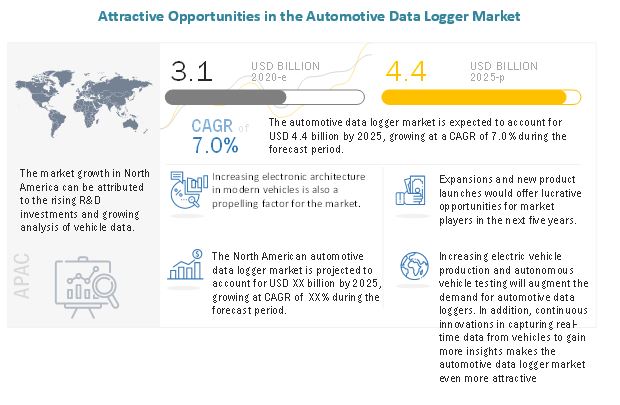

[213 Pages Report] The automotive data logger market was valued at USD 3.1 billion in 2020 and is expected to reach USD 4.4 billion by 2025, at a CAGR of 7.0 % during the forecast period 2020-2025.

The key growth drivers of this market are the higher penetration of advanced electronic components in the modern vehicle architecture and their testing that is performed prior to the vehicle’s commercialization.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Rising demand for ADAS features:

ADAS technologies consistently monitor a vehicle’s surroundings and driving patterns to detect potential problems at an early stage. This technology improves the driving experience while enhancing vehicle and pedestrian safety. It is becoming an integral part of modern automobiles and is being adopted in passenger cars as well as commercial vehicles. ADAS can be grouped into three major categories: those that aid the driver, those that warn the driver, and those that assist the driver in performing certain basic driving functions. Increasing demand for safe, efficient, and convenient driving, rising disposable income in emerging economies, and increasing stringency of safety regulations across the globe are playing a key role leading to the high demand for ADAS. Thus, ADAS testing is becoming an integral part of vehicle safety testing standards.

Several countries in Europe and North America have introduced regulations that mandate the incorporation of various types of ADAS features in passenger cars as well as commercial vehicles. For instance, the European Union announced that all new trucks and buses must be equipped with advanced emergency braking systems and lane departure warning systems from November 2015. In 2016, the National Highway Traffic Safety Administration (NHTSA) and Insurance Institute for Highway Safety (IIHS) announced making Automatic Emergency Braking (AEB) a standard feature in all new vehicles from 1 September 2022. Various automakers, which represent more than 99% of the US auto market, have accepted this mandate.

The increasing dependence on ADAS systems for improved road safety is triggering the demand for data loggers for ADAS features. The major challenge in ADAS testing is the testing and validation of massive quantities of data generated from sensors such as ultrasonic, lidar, laser, radar, and video-based systems. This challenge can be overcome by using cloud-based data loggers. Both, hardware and software approaches are used in ADAS testing-based systems. The testing can be undertaken by using Software in the Loop (SIL), Hardware in Loop (HIL), and Driver in the Loop (DIL) methods.

Restrain: High cost of data acquisition systems

The price of modern automotive data loggers is high as compared to conventional OBD-I systems. However, data loggers that support only CAN and LIN channels are relatively priced lower as compared to those that support all the major channels (CAN, LIN, FlexRay, and Ethernet). This also depends on the number of analog and digital inputs supported by data loggers. Data logger manufacturers are under constant pressure from OEMs to curtail the prices of devices while maintaining their quality. Also, OEMs are increasingly demanding data loggers that support all the channels, as their efforts towards developing autonomous and connected vehicles have increased significantly. The higher cost of data loggers is a cause for concern in emerging countries, as the automotive data logger markets are highly price-sensitive.

With the disruption of the automotive industry due to advanced vehicle electronics, automotive data loggers are expected to grow even more intelligent, as they are considered to be the most reliable data acquisition source for vehicle development, testing, and diagnosis. Modern data loggers are expected to share real-time data for analysis. This thus increases the prices of these systems, limiting their usage at the OEM as well as the service center end.

Opportunity: Monetizing vehicle data

With the number of connected and autonomous cars increasing around the globe, the data generated from vehicles is enormous. The industry that is expected to be born as a result of sharing this data with third-party companies is expected to be approximately USD 750 billion. This clearly indicates the significant power and potential that this data possesses. Such data is highly valuable for companies such as automobile insurance, fleet management, repair and maintenance workshops, city planners, and various retailers. However, all this data is not necessarily very useful. Hence, it is important for OEMs to understand how to sort the valuable information from the rest. In line with this, Delphi has acquired Control-Tec, as well as invested in an Israeli startup named Otonomo, to create a connected car marketplace that can sell the data collected by any OEM to the users of that data. Control-Tec is a developer of data acquisition systems that analyze a large amount of data and transfers the most relevant information to the cloud; while Otonomo makes this data anonymous, and prepares it for OEMs to sell it to commercial buyers, thus acting as a data broker. Otonomo is already collaborating with ten major OEMs including Daimler and 75 third-party clients. Such initiatives from suppliers are expected to significantly help OEMs in creating new revenue streams using the significant amount of data collected from their wide vehicle model range through automotive data loggers.

Challenges: Reverse engineering of vehicle CAN bus messages

The rise of car connectivity to a network means exposing the vehicle to risks. Today, even the basic functions of a car are dependent on electronics and software with 30 million to 40 million lines of codes in low-end vehicles and 100 million lines of codes in high-end vehicles; and the soul of this network is the CAN bus. However, as this bus module surfaced 30 years ago, it was not built for ensuring cybersecurity. Therefore, the safety and security of the vehicle and its passengers can be easily compromised by hackers by performing reverse engineering of the CAN bus. Reverse engineering is the process by which an authorized or unauthorized person reproduces a manufacturer’s technology.

Reverse engineering of a car’s system can be easily undertaken by using a PC/ laptop, a free software, and some accessories. This primarily happens because of the lack of message encryption in the protocol which makes it possible for the vehicle network to assume that these malicious messages are legitimate, and hence, they are processed. This is also expected to lead to incorrect vehicle data collection through data loggers, leading to erroneous analysis.

A majority of the new cars are expected to be connected to a network by 2022. Therefore, many OEMs and security solution providers are taking steps to counter the threat of reverse engineering. But every secured design is not expected to guarantee complete security over a period. There must be consistent implementation of security codes in connected vehicles. Therefore, OEMs should minimize the chances of security lags and secure the software patches.

The ADAS & safety segment is expected to be the largest market in the post-sales application segment. This is primarily because autonomous vehicles are taking the front seat in today’s automotive industry, for which advanced ADAS features such as adaptive cruise control (ACC) and automatic emergency braking (AEB) are highly important. With the advancements in ADAS features, the data loggers supporting ADAS applications will also increase at a rapid pace.

By component the automotive data logger market for software is estimated to demonstrate the highest growth rate over the forecast period.The increasing number of manufacturing plants and R&D applications in countries such as India, China, and Japan has led to a growth of the Asia Pacific data logger software market.

By Channel, Ethernet is estimated to be the fastest growing market for automotive data loggers. Ethernet data loggers have many benefits, such as built-in intelligence to negotiate with the network for seamless integration, high-speed operation, LAN connectivity, wireless capability, and direct data upload. The advantages of Ethernet over other channel types would drive the automotive data logger market for the Ethernet segment.

By end automotive data logger market Service Stations is estimated to be the largest market for automotive data loggers. The demand for data loggers is projected to increase with the launch of newer vehicle models equipped with complex electronic systems, ECUs, and ADAS features. Increased demand would give rise to more R&D activities and result in the development of newer and advanced data loggers, particularly in the US and Europe. Thus, the organized and authored service stations by established market players of the automotive industry are mainly contributing to the growth of the market.

Key Market Players

The global automotive data logger market is dominated by major players such as Aptiv (Ireland), National instruments (US), Racelogic (UK), Vector Infomatik (Germany), and Continental (Germany) These companies offer a wide variety of data logger system fulfilling all major functions and applications for various applications. The key strategies adopted by these companies to sustain their market position are new product developments, expansions, mergers &acquisitions, and partnerships & collaboration.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Application type, post-sale application, channel type, connection type, component type, end market type, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

Aptiv (Ireland), Vector Infomatik (Germany), Continental (Germany), Racelogic (UK), and National Instrument (US) |

This research report categorizes the automotive data logger market based on Application type, post-sale application, channel type, connection type, component type, end market type, and region.

Market, By End Market

- OEMs

- Service Stations

- Regulatory Bodies

Market, By Application

- Pre-Sales

- Post-Sales

Market, By Post-Sales Application

- OBD

- ADAS & Safety

- Fleet Management

- Automotive Insurance

Market, By Channels

- CAN & CAN FD

- LIN

- FlexRay

- Ethernet

Market, By Connection Type

- SD Card

- USB

- Bluetooth/Wi-Fi

Market, By Component Type

- Hardware

- Software

Market,By Region

- Asia Pacific (China, India, Japan, South Korea, Thailand, and Rest of Asia Pacific)

- Europe (France, Germany, Russia, Spain, Turkey, UK, and Rest of Europe)

- North America (US, Mexico, and Canada)

- Rest of the World (Brazil, Iran, and Others)

Recent Developments

- In June 2020 National Instruments announced its ECU Test System offering. The ECU Test System (ECUTS) is a best-of-both-worlds solution that combines standardization with the flexibility to drive efficiency in tester development, maintenance, and test time. NI integrated the first level of common components into a standardized test architecture to save customers time in the development process and simplify tester maintenance. Because of the modular PXI design, testing is flexible and can scale across a range of body, chassis, and powertrain ECUs (based on the instrumentation selected.

- In September 2019, Racelogic introduced VBOX Touch—the highly flexible, enhanced accuracy GNSS data loggers—using the latest technology available. The powerful hardware can be used in many types of diverse automotive tests such as acceleration, braking, speed verification, tire temperature monitoring, lap-timing, and durability, to name a few. The VBOX Touch comes preloaded with sophisticated performance applications that cover many common use cases, and other applications can be downloaded free of charge from Racelogic’s online library.

-

In March 2019, Vector Informatik launched Indigo 6, which features developing and testing diagnostic sequences for Microsoft Visual Studio. The advantages of this are comfortable editing, easy testing of diagnostic sequences, and best debugging support.

Frequently Asked Questions (FAQ):

How big is the automotive data logger market?

The automotive data logger market was valued at USD 3.1 billion in 2020 and is expected to reach USD 4.4 billion by 2025, at a CAGR of 7.0 % during the forecast period 2020-2025.

We are interested in the regional automotive data logger market for various application type. Does this report cover the component segment?

Yes, the automotive data logger market for application type is covered at a regional level.

Does this report include the impact of COVID-19 on the automotive data logger market ecosystem?

Yes, the market includes qualitative insights on the COVID-19 impact on the automotive data logger ecosystem.

Does this report contain the market size of different post-sale applications, especially for ADAS & Safety?

Yes, the market size of various post-sale application (ADAS & safety, fleet management, automotive insurance, and OBD) is extensively covered in terms of value.

Does this report contain the market size of different channel types, especially for CAN and Ethernet?

Yes, the market size of channel type [CAN & CAN FD, LIN, FlexRay, and Ethernet] is extensively covered in terms of volume and value. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS: AUTOMOTIVE DATA LOGGER MARKET

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 AUTOMOTIVE DATA LOGGER MARKET RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources for base numbers

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.1 Sampling techniques & data collection methods

2.1.2.2 Primary participants

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 AUTOMOTIVE DATA LOGGER MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET: TOP-DOWN APPROACH

2.2.3 DATA TRIANGULATION APPROACH

FIGURE 7 MARKET: DATA TRIANGULATION APPROACH

2.3 MARKET BREAKDOWN

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

FIGURE 9 GENERAL ASSUMPTIONS

TABLE 2 AUTOMOTIVE DATA LOGGER MARKET SPECIFIC ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 10 MARKET: MARKET OVERVIEW

FIGURE 11 MARKET: MARKET DYNAMICS

FIGURE 12 NORTH AMERICA IS ESTIMATED TO BE THE LARGEST MARKET

FIGURE 13 ETHERNET IS PROJECTED TO BE THE FASTEST GROWING SEGMENT

FIGURE 14 BLUETOOTH/WI-FI ENABLED DATA LOGGERS SYSTEMS TO HAVE THE HIGHEST GROWTH, 2020 VS 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN THE AUTOMOTIVE DATA LOGGER MARKET

FIGURE 15 INCREASING ADOPTION OF AUTOMOTIVE DATA LOGGERS FOR EVOLVEMENT OF TRADITIONAL VEHICLES TO MODERN PERCEPTIVE VEHICLES WILL DRIVE THE MARKET

4.2 NORTH AMERICA MARKET, BY COUNTRY & CONNECTION TYPE

FIGURE 16 US IS ESTIMATED TO BE THE LARGEST MARKET IN NORTH AMERICA IN 2020

4.3 MARKET, BY END MARKET

FIGURE 17 SERVICE STATIONS SEGMENT TO BE THE LARGEST FROM 2020 TO 2025 (BY VALUE)

4.4 MARKET, BY APPLICATION

FIGURE 18 PRE-SALES APPLICATION SEGMENT EXPECTED TO GROW AT THE HIGHEST RATE BETWEEN 2020 AND 2025 (BY VALUE)

4.5 AUTOMOTIVE DATA LOGGER MARKET, BY POST-SALES APPLICATION

FIGURE 19 ADAS & SAFETY APPLICATION PROJECTED TO HAVE THE LARGEST MARKET SHARE BY 2025 (BY VALUE)

4.6 MARKET, BY CHANNEL

FIGURE 20 ETHERNET CHANNEL PROJECTED TO GAIN HIGH MOMENTUM IN THE MARKET BY 2025 (BY VALUE)

4.7 MARKET, BY COMPONENT

FIGURE 21 SOFTWARE PROJECTED TO BE THE LARGEST MARKET BY 2025 IN TERMS OF VALUE

5 AUTOMOTIVE DATA LOGGER MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 AUTOMOTIVE DATA LOGGER: MARKET DYNAMICS

TABLE 3 IMPACT OF MARKET DYNAMICS OVER THE FORECAST PERIOD

5.2.1 DRIVERS

5.2.1.1 Increasing electric vehicle production and autonomous vehicle testing

5.2.1.2 Increasing electronic architecture in modern vehicles

5.2.1.3 Rise in stringent emission norms to prevent environmental impact

FIGURE 23 GLOBAL PASSENGER CAR EMISSION LEGISLATION

5.2.1.4 Rising demand for ADAS features

5.2.2 RESTRAINTS

5.2.2.1 Lack of trained workforces for the development of advanced data loggers

5.2.2.2 High cost of data acquisition systems

5.2.3 OPPORTUNITIES

5.2.3.1 Analyzing real-time vehicle data

5.2.3.2 Monetizing vehicle data

5.2.3.3 Increased demand for high-performance vehicles

5.2.4 CHALLENGES

5.2.4.1 Reverse engineering of vehicle CAN bus messages

5.2.4.2 Incorrect data capture or data loss due to physical damage in vehicles

5.3 REGULATORY OVERVIEW

5.3.1 VEHICLE TESTING REGULATION

5.3.2 ENGINE TESTING REGULATION

5.3.3 REGULATIONS/ACTIVITIES UNDERTAKEN TO REDUCE GREENHOUSE GAS EMISSIONS FROM PASSENGER CARS AND TRUCKS

5.3.4 REGULATIONS FOR SMOG, SOOT, AND OTHER AIR POLLUTION FROM PASSENGER CARS AND TRUCKS

5.3.5 REGULATIONS FOR GREENHOUSE GAS EMISSIONS FROM COMMERCIAL TRUCKS & BUSES

5.3.6 REGULATIONS FOR SMOG, SOOT, AND OTHER AIR POLLUTION FROM COMMERCIAL TRUCKS & BUSES

5.4 SCENARIO ANALYSIS

5.4.1 MOST LIKELY SCENARIO

TABLE 4 AUTOMOTIVE DATA LOGGER MARKET (MOST LIKELY), BY REGION, 2020-2025 (USD MILLION)

5.4.2 OPTIMISTIC SCENARIO

TABLE 5 MARKET (OPTIMISTIC), BY REGION, 2020–2025 (USD MILLION)

5.4.3 PESSIMISTIC SCENARIO

TABLE 6 MARKET (PESSIMISTIC), BY REGION, 2020–2025 (USD MILLION)

6 IMPACT OF COVID–19 (Page No. - 61)

6.1 INTRODUCTION TO COVID-19

6.2 COVID-19 HEALTH ASSESSMENT

FIGURE 24 COVID-19: GLOBAL PROPAGATION

FIGURE 25 COVID-19 PROPAGATION: SELECT COUNTRIES

6.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 26 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

6.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 27 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 28 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

6.3.2 COVID-19 IMPACT ANALYSIS ON THE GLOBAL AUTOMOTIVE INDUSTRY

TABLE 7 IMPACT OF COVID-19 ON THE AUTOMOTIVE INDUSTRY

TABLE 8 IMPACT OF COVID-19 ON THE AUTOMOTIVE INDUSTRY

6.3.3 IMPACT OF COVID-19 ON THE AUTOMOTIVE DATA LOGGER MARKET

7 INDUSTRY TRENDS (Page No. - 68)

7.1 TECHNOLOGY OVERVIEW

7.1.1 INTRODUCTION

7.1.2 TYPES OF AUTOMOTIVE DATA LOGGERS

7.1.2.1 Thermocouple data logger

TABLE 9 THERMOCOUPLE TYPES AND THEIR TEMPERATURE RANGES

7.1.2.2 NVH acoustic data logger

7.1.3 MODERN CHANNELS SUPPORTED BY AUTOMOTIVE DATA LOGGERS

7.1.3.1 FlexRay

7.1.3.2 Ethernet

TABLE 10 TYPES OF BUS SYSTEMS AND THEIR FEATURES

7.1.4 TECHNOLOGICAL ADVANCEMENTS IN THE AUTOMOTIVE DATA LOGGER

7.1.4.1 Global Positioning System (GPS) data loggers

FIGURE 29 REAL-TIME VEHICLE DATA LOGGING SYSTEM

7.1.4.2 Cloud-based automotive data loggers

FIGURE 30 FEATURES OF THE CLOUD-BASED DATA LOGGER

7.1.5 KEY AUTOMOTIVE COMPONENT TESTING

7.1.5.1 ECU testing

7.1.5.2 Simulation testing

7.1.5.3 Battery testing

7.2 VALUE CHAIN ANALYSIS

FIGURE 31 VALUE CHAIN ANALYSIS: AUTOMOTIVE DATA LOGGER MARKET

7.2.1 PLANNING AND REVISING FUNDS

7.2.2 AUTOMOTIVE DATA LOGGER SUPPLIERS

7.2.3 AUTOMOTIVE DATA LOGGER SOFTWARE AND DEVELOPMENT

7.2.4 OEM

7.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 HIGH BARGAINING POWER OF SUPPLIERS OWING TO MANDATES PERTAINING TO TESTING VEHICLE PARTS AND THEIR COMPONENTS DURING ASSEMBLY

7.4 DEMAND SIDE TECHNOLOGY TRENDS

FIGURE 33 BLOCK DIAGRAM OF DATA LOGGER SYSTEM

7.4.1 DATA LOGGERS FOR ELECTRIC AND HYBRID VEHICLES

FIGURE 34 ELECTRIC VEHICLE DATA LOGGING

FIGURE 35 DATA RECORDED BY ELECTRIC VEHICLE DATA LOGGER

7.4.2 ADAS AND AUTONOMOUS VEHICLE DATA LOGGER

FIGURE 36 INTELLIGENT DATA COLLECTION FOR AUTONOMOUS VEHICLES

FIGURE 37 ADAS FOR LEVEL 1-2

FIGURE 38 ADAS FOR LEVEL 1-2 FOR DIFFERENT SETUP SUPPLIER

FIGURE 39 LOGGING CONCEPT FOR ADAS LEVEL 3 FOR MULTI SETUP SUPPLIER

FIGURE 40 SENSOR FUSION TECHNOLOGY

FIGURE 41 DATA FROM AUTONOMOUS VEHICLES

FIGURE 42 THE VISION SYSTEM OF A FULLY AUTONOMOUS VEHICLE

FIGURE 43 THE EVOLUTION OF AUTOMATED SAFETY TECHNOLOGIES

7.5 SUPPLY SIDE TECHNOLOGY TRENDS

7.5.1 OBD II DATA LOGGERS

7.5.2 SMART DATA LOGGING WITH OTA DATA LOGGERS

7.5.3 DATA LOGGERS WITH SYNCHRONOUS IMAGE DATA RECORDING

7.6 PATENT ANALYSIS

TABLE 11 IMPORTANT PATENT REGISTRATIONS RELATED TO DATA LOGGER MARKET

7.7 CASE STUDY OF AUTOMOTIVE DATA LOGGER MARKET

7.7.1 CASE STUDY 1: VOLKSWAGEN GROUP OF AMERICA (LOGGING CAN & OBD2 DATA, SECURELY)

7.7.2 CASE STUDY 2: BOSCH (LOGGING CAN DATA FROM FLEET OF TEST EVS)

7.7.3 CASE STUDY 3: ZERO MOTORCYCLES (ANALYSING RIDE PROFILES OF E-MOTORCYCLES)

7.7.4 CASE STUDY 4: IDROBOTICA (RECORDING UNDERWATER ROV BATTERY DATA)

7.8 MARKET ECOSYSTEM

FIGURE 44 ECOSYSTEM: AUTOMOTIVE DATA LOGGER MARKET

7.9 PRICING ANALYSIS

FIGURE 45 PRICING ANALYSIS OF AUTOMOTIVE DATA LOGGERS

8 AUTOMOTIVE DATA LOGGER MARKET, BY APPLICATION (Page No. - 90)

8.1 INTRODUCTION

FIGURE 46 MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 12 MARKET SIZE, BY APPLICATION, 2018–2025 (‘000 UNITS)

TABLE 13 MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2 RESEARCH METHODOLOGY

8.3 PRE-SALES

8.3.1 R&D ACTIVITIES BY OEMS TO DRIVE THE SEGMENT

TABLE 14 PRE-SALES: MARKET SIZE, BY REGION, 2018–2025 (UNITS)

TABLE 15 PRE-SALES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.4 POST-SALES

8.4.1 GROWTH IN ADOPTION OF ADAS TO DRIVE THE SEGMENT

TABLE 16 POST-SALES: MARKET SIZE, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 17 POST-SALES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.5 KEY INDUSTRY INSIGHTS

9 AUTOMOTIVE DATA LOGGER MARKET, BY CONNECTION (Page No. - 96)

9.1 INTRODUCTION

FIGURE 47 MARKET, BY CONNECTION, 2020 VS. 2025 (USD MILLION)

TABLE 18 MARKET SIZE, BY CONNECTION, 2018–2025 (‘000 UNITS)

TABLE 19 MARKET SIZE, BY CONNECTION, 2018–2025 (USD MILLION)

9.2 RESEARCH METHODOLOGY

9.3 BLUETOOTH/WI-FI

9.3.1 INCREASING NUMBER OF BLUETOOTH/WI-FI BASED AUTOMOTIVE DATA LOGGER PROVIDERS TO DRIVE THE SEGMENT

TABLE 20 BLUETOOTH/ WI-FI: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 21 BLUETOOTH/WI-FI: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.4 SD CARD

9.4.1 NEED FOR INSTANT ACCESS TO DATA TO DRIVE THE SEGMENT

TABLE 22 SD CARD: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 23 SD CARD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.5 USB

9.5.1 USAGE IN COST-EFFECTIVE APPLICATIONS TO DRIVE THE SEGMENT

TABLE 24 USB: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 25 USB: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.6 KEY INDUSTRY INSIGHTS

10 AUTOMOTIVE DATA LOGGER MARKET, BY POST-SALES APPLICATION (Page No. - 103)

10.1 INTRODUCTION

FIGURE 48 MARKET, BY POST-SALES APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 26 MARKET SIZE, BY POST-SALES APPLICATION, 2018–2025 (USD MILLION)

10.2 RESEARCH METHODOLOGY

10.3 ADAS & SAFETY

10.3.1 GROWING ADOPTION OF SEMI-AUTONOMOUS VEHICLES TO DRIVE THE SEGMENT

TABLE 27 ADAS & SAFETY: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.4 AUTOMOTIVE INSURANCE

10.4.1 MANDATES RELATED TO AUTOMOTIVE INSURANCE TO DRIVE THE SEGMENT

TABLE 28 AUTOMOTIVE INSURANCE: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.5 FLEET MANAGEMENT

10.5.1 GROWING ADOPTION OF DATA LOGGERS FOR FLEET MANAGEMENT TO DRIVE THE SEGMENT

TABLE 29 FLEET MANAGEMENT: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.6 OBD

10.6.1 SHIFTING FOCUS TOWARD REMOTE DIAGNOSTICS TO DRIVE THE SEGMENT

TABLE 30 OBD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.7 KEY INDUSTRY INSIGHTS

11 AUTOMOTIVE DATA LOGGER MARKET, BY CHANNEL (Page No. - 110)

11.1 INTRODUCTION

FIGURE 49 MARKET, BY CHANNEL, 2020 VS. 2025 (USD MILLION)

TABLE 31 MARKET SIZE, BY CHANNEL, 2018–2025 (‘000 UNITS)

TABLE 32 MARKET SIZE, BY CHANNEL, 2018–2025 (USD MILLION)

11.2 RESEARCH METHODOLOGY

11.3 CAN & CAN FD

11.3.1 WIDE USAGE OF HS-CAN TO DRIVE THE SEGMENT

FIGURE 50 CAN & CAN FD DATA ACQUISITION FROM VEHICLE TO CLOUD

TABLE 33 CAN & CAN FD: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 34 CAN & CAN FD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.4 ETHERNET

11.4.1 GROWING TREND OF AUTOMOTIVE IOT TO DRIVE THE SEGMENT

FIGURE 51 DATA MANAGEMENT FROM VEHICLE TO CLOUD

FIGURE 52 DATA DIVISION TO CLOUD STORAGE

TABLE 35 ETHERNET: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 36 ETHERNET: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.5 FLEXRAY

11.5.1 APPLICATION IN SOPHISTICATED VEHICLE SYSTEMS TO DRIVE THE SEGMENT

TABLE 37 FLEXRAY: MARKET SIZE, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 38 FLEXRAY: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.6 LIN

11.6.1 COST-EFFECTIVE USAGE TO DRIVE THE SEGMENT

TABLE 39 LIN: MARKET SIZE, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 40 LIN: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.7 INDUSTRY INSIGHTS

12 AUTOMOTIVE DATA LOGGER MARKET, BY COMPONENT (Page No. - 120)

12.1 INTRODUCTION

FIGURE 53 ADAS LOGGING HARDWARE AND SOFTWARE

FIGURE 54 MARKET, BY COMPONENT, 2020 VS. 2025 (USD MILLION)

TABLE 41 MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

12.2 RESEARCH METHODOLOGY

12.3 HARDWARE

12.3.1 COST CONTRIBUTION OF HARDWARE IN DATA LOGGERS IS EXPECTED TO REDUCE IN COMING YEARS

TABLE 42 HARDWARE: AUTOMOTIVE DATA LOGGER MARKET, BY REGION, 2018–2025 (USD MILLION)

12.4 SOFTWARE

12.4.1 INCREASING COMPLEXITY AND ADOPTION ON REPROGRAMMABLE SOFTWARE TECHNOLOGY TO DRIVE THE SEGMENT

TABLE 43 SOFTWARE: AUTOMOTIVE DATA LOGGER MARKET, BY REGION, 2018–2025 (USD MILLION)

12.5 KEY INDUSTRY INSIGHTS

13 AUTOMOTIVE TEST EQUIPMENT MARKET, BY END MARKET (Page No. - 125)

13.1 INTRODUCTION

FIGURE 55 AUTOMOTIVE DATA LOGGER MARKET, BY END MARKET, 2020 VS. 2025 (USD MILLION)

13.2 RESEARCH METHODOLOGY

TABLE 44 MARKET, BY END MARKET, 2018-2025 (‘000 UNITS)

TABLE 45 MARKET, BY END MARKET, 2018-2025 (USD MILLION)

13.3 SERVICE STATIONS

13.3.1 USAGE OF AUTOMOTIVE DATA LOGGERS FOR POST-SALES ACTIVITIES TO DRIVE THE SEGMENT

TABLE 46 SERVICE STATIONS: AUTOMOTIVE DATA LOGGER MARKET, BY REGION, 2018-2025 (‘000 UNITS)

TABLE 47 SERVICE STATIONS: MARKET, BY REGION, 2018-2025 (USD MILLION)

13.3.2 RACE/RALLY CAR CLUBS

TABLE 48 RACE/RALLY CAR CLUBS: MARKET, 2018-2025 (‘000 UNITS)

TABLE 49 RACE/RALLY CAR CLUBS: MARKET, 2018-2025 (USD MILLION)

13.4 OEMS

13.4.1 GROWTH IN R&D ACTIVITIES BY OEMS TO DRIVE THE SEGMENT

TABLE 50 OEM: AUTOMOTIVE DATA LOGGER MARKET, BY END MARKET, 2018-2025 (UNITS)

TABLE 51 OEM: MARKET, BY END MARKET, 2018-2025 (USD THOUSAND)

13.5 REGULATORY BODIES

13.5.1 NEED TO CREATE AND UPDATE VEHICLE REGULATIONS AND STANDARDS TO DRIVE THE SEGMENT

TABLE 52 REGULATORY BODY: MARKET, BY REGION, 2018-2025 (UNITS)

TABLE 53 REGULATORY BODY: MARKET, BY REGION, 2018-2025 (USD THOUSAND)

13.6 KEY INDUSTRY INSIGHTS

14 AUTOMOTIVE DATA LOGGER MARKET, BY REGION (Page No. - 133)

14.1 INTRODUCTION

FIGURE 56 MARKET, BY REGION, 2020 VS. 2025

TABLE 54 MARKET SIZE, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 55 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14.2 ASIA PACIFIC

FIGURE 57 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (‘000 UNITS)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

14.2.1 IMPACT OF COVID-19 ON ASIA PACIFIC MARKET

14.2.2 CHINA

14.2.2.1 High automotive production is driving the market

TABLE 58 CHINA: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 59 CHINA: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY END MARKET, 2018–2025 (USD MILLION)

14.2.3 INDIA

14.2.3.1 Rise in foreign investments due to enhanced FDI policies expected to foster market growth

TABLE 60 INDIA: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 61 INDIA: MARKET SIZE, BY END MARKET, 2018–2025 (USD MILLION)

14.2.4 JAPAN

14.2.4.1 Increasing adoption of electric vehicles is expected to drive the market

TABLE 62 JAPAN: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 63 JAPAN: MARKET SIZE, BY END MARKET, 2018–2025 (USD MILLION)

14.2.5 SOUTH KOREA

14.2.5.1 Rapid technological advancements to drive the market

TABLE 64 SOUTH KOREA: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 65 SOUTH KOREA: MARKET SIZE, BY END MARKET, 2018–2025 (USD MILLION)

14.2.6 THAILAND

14.2.6.1 Strong growth in vehicle production to drive the market

TABLE 66 THAILAND: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 67 THAILAND: MARKET SIZE, BY END MARKET, 2018–2025 (USD MILLION)

14.2.7 REST OF THE ASIA PACIFIC

14.2.7.1 Increasing presence of established OEMs to drive the market

TABLE 68 REST OF THE ASIA PACIFIC: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 69 REST OF ASIA PACIFIC: MARKET SIZE, BY END MARKET, 2018–2025 (USD MILLION)

14.3 EUROPE

FIGURE 58 EUROPE: MARKET SNAPSHOT

TABLE 70 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (UNITS)

TABLE 71 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

14.3.1 IMPACT OF COVID-19 ON EUROPEAN MARKET

14.3.2 FRANCE

14.3.2.1 Growing motorsport industry to drive the market

TABLE 72 FRANCE: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 73 FRANCE: MARKET SIZE, BY END MARKET, 2018–2025 (USD MILLION)

14.3.3 GERMANY

14.3.3.1 Increasing R&D activities expected to drive the market

TABLE 74 GERMANY: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 75 GERMANY: MARKET SIZE, BY END MARKET, 2018–2025 (USD MILLION)

14.3.4 RUSSIA

14.3.4.1 Favorable government policies to drive the market

TABLE 76 RUSSIA: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 77 RUSSIA: MARKET SIZE, BY END MARKET, 2018–2025 (USD THOUSAND)

14.3.5 SPAIN

14.3.5.1 Increasing vehicle exports expected to drive the market

TABLE 78 SPAIN: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 79 SPAIN: MARKET SIZE, BY END MARKET, 2018–2025 (USD THOUSAND)

14.3.6 TURKEY

TABLE 80 TURKEY: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 81 TURKEY: MARKET SIZE, BY END MARKET, 2018–2025 (USD THOUSAND)

14.3.7 UK

14.3.7.1 Demand for premium cars expected to drive the market

TABLE 82 UK: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 83 UK: MARKET SIZE, BY END MARKET, 2018–2025 (USD THOUSAND)

14.3.8 REST OF EUROPE

TABLE 84 REST OF EUROPE: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 85 REST OF EUROPE: MARKET SIZE, BY END MARKET, 2018–2025 (USD THOUSAND)

14.4 NORTH AMERICA

FIGURE 59 NORTH AMERICA: MARKET SNAPSHOT

TABLE 86 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (‘000 UNITS)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

14.4.1 IMPACT OF COVID-19 ON THE NORTH AMERICA MARKET

14.4.2 CANADA

14.4.2.1 Growing LCV production expected to drive the market

TABLE 88 CANADA: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 89 CANADA: MARKET SIZE, BY END MARKET, 2018–2025 (USD THOUSAND)

14.4.3 MEXICO

14.4.3.1 Investments by leading OEMs to drive the market

TABLE 90 MEXICO: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 91 MEXICO: MARKET SIZE, BY END MARKET, 2018–2025 (USD THOUSAND)

14.4.4 US

14.4.4.1 Increasing demand for wireless data loggers to drive the market

TABLE 92 US: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 93 US: MARKET SIZE, BY END MARKET, 2018–2025 (USD MILLION)

14.5 REST OF THE WORLD

FIGURE 60 ROW: MARKET SIZE, BY COUNTRY, 2020 VS. 2025 (USD THOUSAND)

TABLE 94 ROW: MARKET SIZE, BY COUNTRY, 2018–2025 (UNITS)

TABLE 95 ROW: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

14.5.1 BRAZIL

14.5.1.1 Growing investments in automotive industry to drive the market

TABLE 96 BRAZIL: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 97 BRAZIL: AUTOMOTIVE DATA LOGGER MARKET SIZE, BY END MARKET, 2018–2025 (USD THOUSAND)

14.5.2 IRAN

14.5.2.1 Strong presence of local players to drive the market

TABLE 98 IRAN: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 99 IRAN: MARKET SIZE, BY END MARKET, 2018–2025 (USD THOUSAND)

14.5.3 REST OF ROW

14.5.3.1 Increasing vehicle parc to drive the market

TABLE 100 REST OF ROW: MARKET SIZE, BY END MARKET, 2018–2025 (UNITS)

TABLE 101 REST OF ROW: MARKET SIZE, BY END MARKET, 2018–2025 (USD THOUSAND)

15 COMPETITIVE LANDSCAPE (Page No. - 167)

15.1 OVERVIEW

FIGURE 61 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE AUTOMOTIVE DATA LOGGER MARKET FOR 2018–2020

15.2 MARKET RANKING ANALYSIS

FIGURE 62 MARKET RANKING: 2019

15.3 MARKET EVALUATION FRAMEWORK

FIGURE 63 MARKET EVALUATION FRAMEWORK

15.4 MARKET SHARE ANALYSIS, 2019

FIGURE 64 AUTOMOTIVE DATA LOGGER MARKET SHARE ANALYSIS, 2019

15.5 COMPETITIVE LEADERSHIP MAPPING

15.5.1 STAR

15.5.2 EMERGING LEADERS

15.5.3 PERVASIVE

15.5.4 PARTICIPANTS

FIGURE 65 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

15.6 COMPETITIVE LEADERSHIP MAPPING START-UP/SME PLAYERS OF MARKET

15.6.1 PROGRESSIVE COMPANY

15.6.1 RESPONSIVE COMPANIES

15.6.2 DYNAMIC COMPANIES

15.6.3 STARTING BLOCKS

FIGURE 66 AUTOMOTIVE DATA LOGGER MARKET: START-UP/SME COMPETITIVE LEADERSHIP MAPPING, 2019

15.7 WINNERS VS. TAIL-ENDERS

15.8 COMPETITIVE SITUATIONS & TRENDS

15.8.1 NEW PRODUCT DEVELOPMENTS

TABLE 102 NEW PRODUCT DEVELOPMENTS, 2018–2020

15.8.2 EXPANSIONS

TABLE 103 EXPANSIONS, 2018–2020

15.8.3 PARTNERSHIPS/SUPPLY CONTRACTS/COLLABORATIONS/ JOINT VENTURES/AGREEMENTS/MERGERS & ACQUISITIONS

TABLE 104 PARTNERSHIPS/SUPPLY CONTRACTS/COLLABORATIONS/JOINT VENTURES/ AGREEMENTS/MERGERS & ACQUISITIONS, 2018–2020

16 COMPANY PROFILES (Page No. - 179)

(Business overview, Products offered, Recent developments & SWOT analysis)*

16.1 APTIV

FIGURE 67 APTIV: COMPANY SNAPSHOT

TABLE 105 APTIV: PRODUCT OFFERINGS

TABLE 106 APTIV: NEW PRODUCT DEVELOPMENTS

TABLE 107 APTIV: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/AGREEMENTS/ MERGERS & ACQUISITIONS/SUPPLY CONTRACTS/EXPANSIONS

FIGURE 68 APTIV: SWOT ANALYSIS

16.2 VECTOR INFORMATIK

TABLE 108 VECTOR INFORMATIK: PRODUCTS OFFERED

TABLE 109 VECTOR INFORMATIK: NEW PRODUCT DEVELOPMENTS

FIGURE 69 VECTOR INFORMATIK GMBH: SWOT ANALYSIS

16.3 CONTINENTAL

FIGURE 70 CONTINENTAL: COMPANY SNAPSHOT

TABLE 110 CONTINENTAL: PRODUCTS OFFERED

TABLE 111 CONTINENTAL: NEW PRODUCT DEVELOPMENTS/EXPANSION

TABLE 112 CONTINENTAL: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/AGREEMENTS/ MERGERS & ACQUISITIONS/ SUPPLY CONTRACTS/EXPANSIONS

FIGURE 71 CONTINENTAL: SWOT ANALYSIS

16.4 HARMAN INTERNATIONAL

TABLE 113 HARMAN INTERNATIONAL: PRODUCT OFFERED

TABLE 114 HARMAN INTERNATIONAL: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 115 HARMAN INTERNATIONAL: PARTNERSHIPS/COLLABORATIONS/ JOINT VENTURES/AGREEMENTS/MERGERS & ACQUISITIONS/ SUPPLY CONTRACTS/EXPANSIONS

FIGURE 72 HARMAN INTERNATIONAL: SWOT ANALYSIS

16.5 RACELOGIC

TABLE 116 RACELOGIC: PRODUCT OFFERINGS

TABLE 117 RACELOGIC: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 118 RACELOGIC: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ AGREEMENTS/ MERGERS & ACQUISITIONS/SUPPLY CONTRACTS/ EXPANSIONS

16.6 NATIONAL INSTRUMENTS

FIGURE 73 NATIONAL INSTRUMENTS: COMPANY SNAPSHOT

TABLE 119 NATIONAL INSTRUMENTS: PRODUCTS OFFERED

TABLE 120 NATIONAL INSTRUMENTS: NEW PRODUCT DEVELOPMENTS

TABLE 121 NATIONAL INSTRUMENTS: PARTNERSHIPS/COLLABORATIONS/ JOINT VENTURES/ AGREEMENTS/MERGERS & ACQUISITIONS/ SUPPLY CONTRACTS/EXPANSIONS

16.7 TTTECH GROUP

TABLE 122 TTTECH GROUP: PRODUCTS OFFERED

TABLE 123 TTTECH GROUP: NEW PRODUCT DEVELOPMENTS

TABLE 124 TTTECH GROUP: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/ AGREEMENTS/MERGERS & ACQUISITIONS/SUPPLY CONTRACTS

16.8 HORIBA

FIGURE 74 HORIBA: COMPANY SNAPSHOT

TABLE 125 HORIBA: PRODUCTS OFFERED

TABLE 126 HORIBA: NEW PRODUCT DEVELOPMENTS/EXPANSIONS

TABLE 127 HORIBA: PARTNERSHIPS/COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS/ AGREEMENTS/MERGERS & ACQUISITIONS

16.9 XILINX

FIGURE 75 XILINX: COMPANY SNAPSHOT

TABLE 128 XILINX: PRODUCT OFFERED

16.10 INTREPID CONTROL SYSTEMS, INC.

TABLE 129 INTREPID CONTROL SYSTEMS: PRODUCTS OFFERED

TABLE 130 INTREPID CONTROL SYSTEMS: NEW PRODUCT DEVELOPMENTS

*Details on Business overview, Products offered, Recent developments & SWOT analysis might not be captured in case of unlisted companies.

16.11 ASIA OCEANIA: OTHER KEY PLAYERS

16.11.1 AUTEL

16.11.2 DANLAW TECHNOLOGIES INDIA LIMITED

16.11.3 NSM SOLUTIONS

16.11.4 TRANSTRON INC.

16.12 EUROPE: OTHER KEY PLAYERS

16.12.1 DEWESOFT D.O.O.

16.12.2 INFLUX TECHNOLOGY

16.12.3 IPETRONIK GMBH & CO. KG

16.13 NORTH AMERICA: OTHER KEY PLAYERS

16.13.1 MADGETECH, INC

16.13.2 MYCARMA

16.13.3 MOOG

17 APPENDIX (Page No. - 207)

17.1 INSIGHTS FROM INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.4.1 AUTOMOTIVE DATA LOGGER MARKET, BY CHANNELS, BY COUNTRY

17.4.2 COMPANY PROFILE OF ADDITIONAL THREE COMPANIES

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

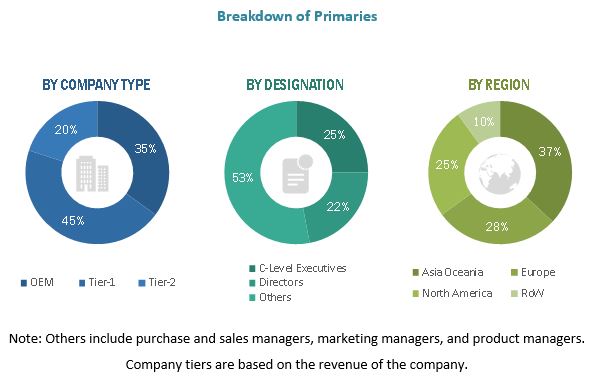

The study involved four major activities in estimating the current size of the automotive data logger market. Extensive primary research was conducted after obtaining an understanding of the market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand- [(in terms of OEMs) country-level government associations, and trade associations] and supply-side (data logger and components providers) across major regions, namely, North America, Europe, Asia Oceania and RoW.

Secondary Research

As a part of the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. Secondary sources include annual reports, press releases & investor presentations of companies, white papers, coating journals, OICA, certified publications, and articles by recognized authors, authenticated directories, and databases.

The secondary research was mainly conducted to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of players, and automotive data logger market classification & segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

As a part of the complete automotive data logger market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to estimate the market size and forecast all segments and subsegments listed in this report for the next five years (2020–2025). Extensive qualitative and quantitative data were analyzed to list key information/insights throughout the report.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the scenario of the automotive data logger market through secondary research. Several primary interviews were conducted with the market experts from both demand- (OEM) and supply-side (manufacturers and distributors of automotive data loggers and data analyzing software) across 4 major regions, namely, North America, Europe, Asia Pacific and Rest of the World including Latin America (LATAM) and Middle East & Africa (MEA). Approximately 55% of the primary interviews were conducted with experts from the demand side, and 45% of them were conducted from the supply side. Primary data was collected through questionnaires, emails, and telephonic interviews. In our canvassing of primaries, we strived to cover various departments within organizations, which included sales, operations, and administration to provide a holistic viewpoint of the data loggers for the automotive industry in our report.

After interacting with the industry participants, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings as described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate and validate the size of the global data logger market. In these approaches, manufacturing plants, service centers, and regulatory bodies statistics for each vehicle type (passenger vehicle, light commercial vehicle, truck, and bus) at a country level have been considered.

Bottom-up Approach

In the bottom-up approach, the number of manufacturing plants, service centers, and regulatory bodies at the country level is considered. The number has then been multiplied with the average number of data logger system sold in each end automotive data logger market to determine the market size of automotive data logger, in terms of volume. The country-level market size, in terms of volume, of automotive data logger, by end market type is then multiplied with the country-level average OE price (AOP) to determine the market of each vehicle type in terms of value. Summation of country-level market is done to determine the regional level market of automotive data logger and further summation of the regional markets provided the global market size

Top-down Approach

The top-down approach has been used to estimate and validate the automotive data logger market size of the automotive data logger, by application, post-sales application, connection, component, and channel type. In this approach, the market share of each application, post-sales application, connection, component, and channel type is identified for each region. The market shares are then multiplied with the volume and value of global automotive data logger, respectively. The respective regional data is added to derive the global market for application, connection, component, and channel type segments.

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that are said to affect the automotive data logger markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Report Objectives

- To define, segment, and forecast the automotive data logger market from 2018 to 2025 in terms of volume and value

- To provide a detailed analysis of various factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To segment and forecast the size of the market based on end market, application, post-sales application, channel, connection, component, and region

- To forecast the size of the market for five regions, namely, Asia Pacific, Europe, North America, and RoW

- To segment and forecast the size of the market, in terms of volume and value, based on the end market (OEMs, service stations, and regulatory bodies)

- To segment and forecast the size of the market, in terms of value, based on application (pre-sales and post-sales)

- To segment and forecast the size of the market, in terms of value, based on post-sales application (OBD, ADAS & safety, fleet management, and automotive insurance)

- To segment and forecast the size of the market, in terms of volume and value, based on channel (CAN & CAN FD, LIN, FlexRay, and Ethernet)

- To segment and forecast the size of the market, in terms of volume and value, based on connection (SD Card, USB, and Bluetooth/Wi-Fi)

- To segment and forecast the size of the automotive data logger market, in terms of volume and value, based on component (hardware and software)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key players in the market

- To understand the dynamics of competitors in the market and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze recent developments, joint ventures, mergers & acquisitions, supply contracts, new product launches, collaborations, and other activities carried out by key industry players in the fuel cell powertrain market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To analyze the impact of COVID-19 on the overall market

- To strategically profile key players and comprehensively analyze their automotive data logger market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- Automotive Data Logger Market, By Post-Sales Application, By Volume

- Automotive Data Logger Market, By Channels, By Country

- Company profile of additional three companies

Growth opportunities and latent adjacency in Automotive Data Logger Market