Automotive Lightweight Materials Market by Material (Metal, Composite, Plastic, Elastomer), Application & Component (Frame, Engine, Exhaust, Transmission, Closure, Interior), Vehicle (ICE, Electric, Micro-mobility & UAV) and Region - Global Forecast to 2027

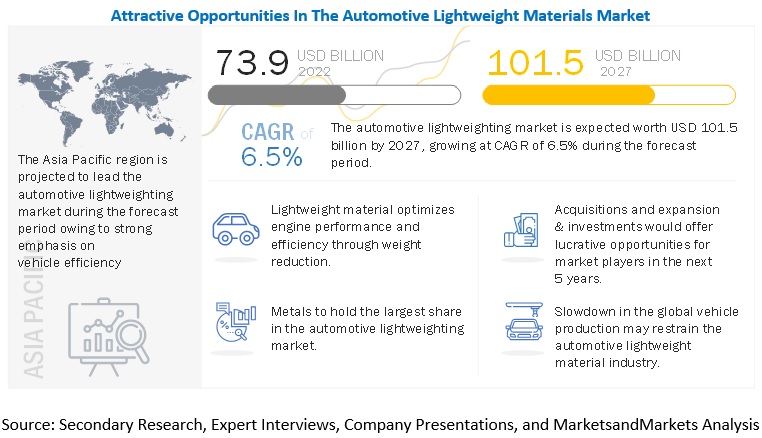

[352 Pages Report] The global automotive lightweight materials market size was valued at USD 73.9 billion in 2022 and is expected to reach USD 101.5 billion by 2027, at a CAGR of 6.5%, during the forecast period 2022-2027. The base year for the report is 2021, and the forecast period is from 2022 to 2027. The market would witness growth owing to driving factors such as the increased weight due to the addition of comfort, safety features, and emission control devices to comply with the stringent emission, safety, and fuel consumption regulations globally.

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Lightweight Materials Market Dynamics

DRIVER: Advancing manufacturing methods and technologies to drive the demand for lightweight materials

The automotive industry has traditionally used several manufacturing methods to produce various components and parts. Generally, hot-forming and cold-forming manufacturing technologies have been used for panel and body part productions. These manufacturing methods were limited to conventional materials such as some grades of steel, aluminum, and other similar metals. Furthermore, some manufacturing technologies were unsuitable for producing complicated panel shapes and designs.

Advanced manufacturing technologies are replacing conventional manufacturing methods with the increasing need for vehicles with new-age designs and features. These technologies include additive manufacturing, resin transfer, and micro-injection molding. The key advantage of incorporating such advanced manufacturing methods was the ability to manufacture new materials that are relatively light in weight and stronger.

Furthermore, these advanced manufacturing technologies are designed to operate with minimal or no material wastage. For instance, additive manufacturing technology involves relatively least material wastage. It is a subtractive process in most conventional manufacturing methods, resulting in higher material wastage. This manufacturing technology has greatly driven the growth of carbon fiber material, which has one of the highest weight-to-strength ratios. The technology is also compatible with other lightweight materials, including various grades of plastics, composites, and metals. For instance, BMW (Germany) has demonstrated its additive manufacturing capabilities in the 2020 model i8 Roadster sports car.

Such new processes and technologies greatly aid the automotive industry in meeting the increasing demand for lightweight materials. With the help of these advanced manufacturing systems, many leading OEMs are developing vehicles that are relatively more fuel-efficient and perform better. In some cases, these advanced manufacturing technologies have aided the substitution of materials, resulting in weight and cost reduction.

RESTRAINT: Difficulty in joining dissimilar materials

Mixed Material Design (MMD) has greatly enabled automotive lightweighting by designing components and parts with two different materials. However, because of the difficulty in the welding or joining process of two dissimilar materials, it isn’t easy to fully utilize the MMD’s advantages. This is mainly because of different materials’ physical properties, densities, and welding temperatures. The proper joining of these two materials is essential for the structural integrity and strength of the parts. It is a major safety concern if joining any critical components fails. For instance, there is a high difference in most of the properties between aluminum and steel, which can have adverse aftereffects, including corrosion, thermal expansion, etc. Many OEMs use special adhesives and rivets to overcome this to join two dissimilar metals. However, proper welding or other stronger joining methods are in development.

The complete incorporation of MMD can greatly aid in many automotive applications. For instance, the inner shell of the vehicle, such as the door and other panel skins, can be made using the lightest materials, and a relatively stronger material can be used to reinforce them. This can greatly reduce the weight without compromising the structural strength of the application. This can also aid in the new design of the crumble zones with MMD in the same structure and reduce the number of cross members in the monocoque chassis. This MMD can also be incorporated to control the NVH levels in the vehicle by using selective materials with higher noise absorption properties.

OPPORTUNITY: The development of advanced and affordable electric and autonomous vehicles

The increasing trend of electrification in the automotive industry is mainly due to the global demand for sustainable mobility and the growing stringency in emission regulations. Many leading automotive players, such as Volkswagen (Germany), Tesla Motors (US), Ford (US), General Motors (US), Toyota (Japan), and others, have ventured into the electric vehicle segment. Electric vehicles are relatively more efficient than conventional ICE vehicles. Along with the increase in the sales of electric vehicles, the battery range has become one of the primary buying criteria for customers. However, the battery cost is one of the major costs associated with the manufacturing of an EV. The batteries are also one the heaviest components in an EV, with around 30-40% of the vehicle’s curb weight. With such a demand for vehicles with longer ranges, incorporating larger batteries is not a feasible option as it increases the cost and weight of the vehicles and reduces the usable space. This increase in the vehicle weight further compensates for the vehicle’s performance and battery range. For these reasons, the OEMs prefer automotive lightweight electric vehicles, resulting in a relatively more extended battery range with the same battery capacity.

Furthermore, the autonomous vehicles market is also gradually developing. A few surveys suggest that around 90 percent of these autonomous vehicles will be shared, and only around 10% of them will be personal vehicles. This sharing of the vehicle demands good space for occupying more passengers comfortably. Smaller batteries can be used when such shared autonomous vehicles are incorporated with lightweight materials, resulting in more space for increased passenger occupancy. For all these reasons, the OEMs widely contain lightweight materials in developing their electric and autonomous vehicles. For instance, in 2022, Tesla Motors (US) had lightweight materials in their Tesla Model Y Long Range (LR) and Performance variants. Earlier, both variants weighed around 2003 kg. However, there was a significant weight reduction in the LR variant, with a decrease of 24 Kg. Furthermore, with the rapidly growing electric vehicle market, such as the OEMs’ incorporation of automotive lightweight materials, more affordable electric vehicles with increased driving range can be expected.

CHALLENGE: Supply chain difficulties and the high cost of lightweight materials challenge the incorporation in mid-range cars and commercial vehicles

Incorporating advanced lightweight materials to reduce the vehicle’s overall weight is a relatively more viable option. However, some of these materials are not widely available around the world. This involves various supply chain difficulties and the costs that are associated with it. For instance, magnesium is one of the key materials used in the automotive industry for multiple applications. Some automotive components generally made using magnesium include steering column bracket, steering wheel frame, cylinder head cover, gearbox body, intake housings and manifolds, wheels, etc.

Globally, China is the largest producer of magnesium, and it satisfies around 90-95% of the magnesium needed for various European industries. For instance, the lightweight wheels of the Porsche 911 GT2 RS (Germany) and Lamborghini Huracán STO (Italy) were made using magnesium alloys. A slight disruption in the supply chain, such as COVID-19 and the Suez Canal blockage, dramatically impacts the price and automotive production. In such situations, incorporating lightweight materials becomes difficult in different parts of the world. These challenges are not only limited to procurement but also the recycling of these materials or components. With the increasing demand for sustainable mobility, a part made of advanced or composite lightweight materials such as carbon fiber or mixed materials is relatively more challenging to recycle.

The manufacturing cost of automotive components made of advanced lightweight materials is higher than conventional materials. For instance, aluminum is about three times more expensive than steel, and according to World AutoSteel, the automotive production cost is 60% more when materials such as aluminum are used. Similarly, component manufacturing with materials such as titanium and magnesium costs more than that with aluminum. For these reasons, the automakers limit incorporating lightweight materials in entry and mid-range passenger and commercial vehicles.

Frames will dominate the automotive lightweight materials market during the forecast period.

During the forecast period, the frames segment will dominate the automotive lightweight materials market. The frame is one of the most significant components of an automobile that gives strength and stability to a vehicle under different conditions, with the body of an engine and axle assemblies fixed to it. The frame of a vehicle is conventionally made of steel and contributes to a significant share of the weight of a vehicle. The OEMs incorporate advanced lightweight materials, including high-strength steel, aluminum, and composites. For instance, the 2018 Audi A8 was introduced with a lightweight frame using high-strength steel, magnesium, and carbon fiber composites. Reducing the weight of the structure in heavy vehicles is not feasible since it will reduce the load-bearing capacity of the vehicle. Composites are used to construct frames for high-performance sports cars and electric vehicles like the BMW i3 and i8. Such incorporation of lightweight materials in frames to reduce the weight and increase the structural strength of the vehicles is expected to drive the automotive material market growth further.

The metals segment will dominate the electric & hybrid vehicle lightweight materials market during the forecast period.

The metals segment is expected to dominate the electric & hybrid vehicle lightweight market during the forecast period. This is mainly because of the incorporation of lightweight metals in the body structures and chassis of electric vehicles. Three materials are extensively used in the electric & hybrid vehicle lightweight market—high strength steel (HSS), aluminum, and magnesium & titanium. These materials are relatively lighter and stronger than steel. These metals are generally incorporated in the body structures, powertrain, suspension, and other vehicle components. Furthermore, since the battery contributes to most of the overall weight of the electric vehicle, it is essential to incorporate advanced lightweight materials in the body structure to ensure safety and reduce weight effectively. This incorporation of automotive lightweight materials by the EV OEMs, such as Tesla (US) using lightweight aluminum in its Model Y, X, and S, is expected to drive the lightweight materials market growth.

To know about the assumptions considered for the study, download the pdf brochure

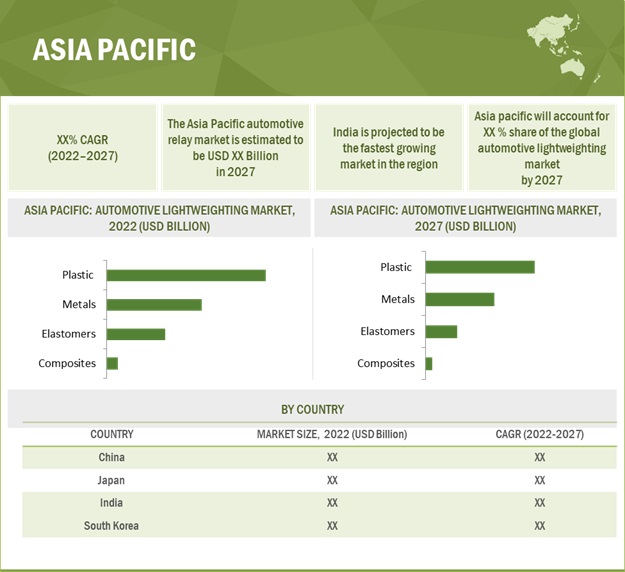

Asia Pacific is projected to dominate the Automotive lightweight materials market by 2027.

According to MarketsandMarkets analysis and validations from primary respondents, Asia Pacific is estimated to be the largest market for small passenger cars, backed by solid demand in the automotive industry. The growth of the passenger car segment will positively influence the automotive lightweight material market in the region. The region also has the presence of many of the major global automotive manufacturers. For instance, Volkswagen Group (Germany), Mercedes (Germany), Ford (US), Renault (France), and others have already set up manufacturing units in these countries. Furthermore, the increasing demand for fuel-efficient vehicles to comply with stringent emission norms will drive the market. By region, the market is expected to increase in the Asia Pacific region. This is mainly because of the strong demand in the automotive industry in countries including China, India, and others. Another key driving factor is the increasing demand for fuel-efficient and less-emitting vehicles in this region. Furthermore, the availability and affordability of raw materials in countries such as China is a key driving factor for the market’s rapid growth in this region.

Key Market Players & Start-ups

The automotive lightweight materials market is led by globally established players such as BASF SE (Germany), Covestro AG (Germany), LyondellBasell Industries Holdings B.V. (Netherlands), Toray Industries, Inc. (Japan), ArcelorMittal (Germany), ThyssenKrupp AG (Germany), Novelis, Inc. (US), Alcoa Corporation (US), Owens Corning (US), and Stratasys Ltd. (US). These companies adopted expansion strategies and undertook collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth market.

Scope of the Report

|

Report Attribute |

Details |

|

Base year for estimation |

2021 |

|

Forecast period |

2022 - 2027 |

|

Market Growth and Revenue Forecast |

USD 101.5 billion by 2027 and CAGR of 6.5% |

|

Top Players |

BASF SE (Germany), COVESTRO AG (Germany), LyondellBasell Industries Holdings B.V. (Netherlands), Toray Industries, Inc. (Japan), and ArcelorMittal (Germany). |

|

Fastest Growing Market |

Asia Pacific |

|

Largest Market |

Asia Pacific |

|

Segments Covered |

|

|

By Material |

Metal (HSS, aluminum, magnesium & titanium), Composite (CFRP, GFRP, NFRP, Others), Plastic (PC, ABS, PA, PP, PU, and others), and Elastomer (EPDM, NR, SBR & Other) |

|

By Application |

Body in White, Chassis and Suspension, Powertrains, Closures, Interiors, Others |

|

By Components |

Frames, Wheels, Bumpers & Fenders, Engines & Exhausts, Transmission, Doors, Hood & Trunk Lids, Seats, Instrument Panels, Fuel Tanks |

|

By Vehicle Type |

Passenger Vehicles, Light Commercial Vehicles, Trucks, Buses |

|

Electric & Hybrid Vehicle Type |

BEV, PHEV, FCEV, Truck, Bus |

|

Electric Vehicle, by Material Type |

Metal, Aluminum, Composites (CFRP, GFRP, NFRP & Others), Plastic, Elastomer |

|

UAV, By Material Type |

Aluminum, Composites (CFRP, GFRP), Plastics, Others |

|

Micro-mobility By Material Type |

Aluminium, Composites (Carbon Fiber), Plastics and Others |

|

By Region |

Asia Pacific, Europe, North America, And Rest of The World |

|

Additional Customization to be offered |

Automotive lightweight materials market, By Application And Vehicle Type |

The study categorizes the automotive lightweight materials market based on material, application, components, vehicle type, electric & hybrid vehicle type, electric vehicle by material type, UAV by material type, micro-mobility by material type, and region at regional and global levels.

By Material

- Metal

- Composite

- Plastic

- Elastomer

- Others

By Application

- Body in White

- Chassis and Suspension

- Powertrains

- Closures

- Interiors

- Others

By Components

- Frames

- Wheels

- Bumpers & Fenders

- Engines & Exhausts

- Transmission

- Doors

- Hood & Trunk Lids

- Seats

- Instrument Panels

- Fuel Tanks

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Trucks

- Buses

Electric & Hybrid Vehicle Type

- BEV

- PHEV

- FCEV

- Truck

- Bus

Electric Vehicle, by Material Type

- Metal

- Aluminum

- Composites

- Plastic

- Elastomer

UAV, By Material Type

- Aluminum

- Composites

- Plastics

- Others

Micro mobility By Material Type

- Aluminium

- Composites

- Plastics

- Others

By Region

- Asia Pacific,

- Europe,

- North America, and

- Rest of The World

Recent Developments

- In October 2022, LyondellBasell Industries Holdings B.V. developed a PP compound made up of PP compound material, which has reduced the vehicle’s weight by 10kg. It will help in foaming parts, reducing the density of the material, thin walling of components, can become a substitute for metal, and eliminate the paint for cars.

- In August 2022, Toray Industries, Inc. launched its 3D printer to produce automotive parts, power tools, and other heat-resistant equipment with high strength and sound design precision.

- In May 2022, BASF SE developed the Ultradur® B4335G3 HR to protect sensitive electronic devices exposed to highly challenging surroundings. For example, protecting sensors when exposed to different climatic conditions and surface contact to water and salt.

- In June 2021, Covestro developed a new composite technology named “Continuous Fiber-Reinforced Thermoplastic Polymers” (CFRTP), which is light in weight and robust in structure, reducing fuel consumption of cars, emission gas, and obeys UN goals for developing sustainable material.

- In April 2020, ArcelorMittal introduced a new S-in solution for battery electric vehicles, providing advanced high strength steel for BIW and battery packs that are lightweight, safe, cost, and sustainable.

Frequently Asked Questions (FAQ):

What is the role of EVs in the automotive lightweight materials market?

The growing trend for vehicle electrification demands electric vehicles with increased battery range. However, increasing the battery capacity to achieve a higher battery range is expensive and reduces usage space in the car. For these reasons, the OEMs incorporate lightweight for a relatively increased battery range with the existing battery capacity.

Who are the winners in the global automotive lightweight materials market?

The key market players in the automotive lightweight materials market are BASF SE (Germany), Covestro AG (Germany), LyondellBasell Industries Holdings B.V. (Netherlands), Toray Industries, Inc. (Japan), ArcelorMittal (Germany), ThyssenKrupp AG (Germany), Novelis, Inc. (US), Alcoa Corporation (US), Owens Corning (US), and Stratasys Ltd. (US). These companies adopted expansion strategies and undertook collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth automotive lightweight materials market.

How is the revenue shift in the automotive lightweight materials market?

The automotive lightweight was conventionally used in the engine components of an ICE vehicle. This involved the incorporation of various lightweight metals and composites. However, because of the emerging electrification of cars, there is a revenue shift in the automotive lightweight materials market from IC engine components to battery and EV components.

What are the new market opportunities in the automotive lightweight materials market?

The development of advanced and affordable electric and autonomous vehicles.

Performance package offerings in premium and sports cars.

What are the new advancements in the automotive lightweight materials market?

The development of advanced lightweight plastics and composites are some of the recent advancements in the automotive lightweight materials market. These lightweight composites, including CFRP, are one of the most robust materials which significantly reduce the vehicle’s weight. Other lightweight plastics are used as a preferred choice for replacing their heavy metal counterparts. These are relatively less in weight and inexpensive.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Advanced manufacturing methods and technologies- Demand for fuel-efficient and low-emission vehiclesRESTRAINTS- Difficulty in joining dissimilar materialsOPPORTUNITIES- Development of advanced and affordable electric and autonomous vehicles- Performance package offerings in premium and sports carsCHALLENGES- Maintenance difficulties and replacement costs- Supply chain difficulties and high cost of lightweight materials

-

5.3 TRADE ANALYSISIMPORT DATA, BY REGION- Iron or Steel- Aluminum- Magnesium- Elastomer- PlasticsEXPORT DATA, BY REGION- Iron or Steel- Aluminum- Magnesium- Elastomer- Plastics

-

5.4 IMPACT OF RECESSION ON ECONOMYINTRODUCTIONREGIONAL MACROECONOMIC OVERVIEWANALYSIS OF KEY ECONOMIC INDICATORSECONOMIC STAGFLATION (SLOWDOWN) VS. ECONOMIC RECESSION- Europe- Asia Pacific- AmericasECONOMIC OUTLOOK/PROJECTIONS

-

5.5 IMPACT OF RECESSION ON AUTOMOTIVE SECTORANALYSIS OF AUTOMOTIVE VEHICLE SALES- Europe- Asia Pacific- AmericasAUTOMOTIVE SALES OUTLOOK

- 5.6 TRENDS/DISRUPTION IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 PATENT ANALYSIS

- 5.8 SUPPLY CHAIN ANALYSIS

-

5.9 AVERAGE SELLING PRICING (ASP) ANALYSIS FOR AUTOMOTIVE LIGHTWEIGHTING MARKET, BY MATERIAL AND REGION, 2019–2021NORTH AMERICAEUROPEASIA PACIFICREST OF THE WORLD

-

5.10 CASE STUDIESUSE CASE 1: BUGATTI BOLIDE- LIGHTWEIGHT HYPERCAR CAN REACH TOP SPEED OF ABOVE 500 KMPHUSE CASE 2: MCLAREN’S NEW SUPERCAR ARTURA HYBRID USED LIGHTWEGHTING TO IMPROVE ITS PERFORMANCEUSE CASE 3: FORD LEVERAGED AUTOMOTIVE LIGHTWEIGHTING TO DEVELOP FUEL-EFFICIENT SEDANUSE CASE 4: PORSCHE USED LIGHTWEIGHT MATERIALS TO ENHANCE PERFORMANCE AND INCREASE STRUCTURAL STRENGTHUSE CASE 5: HYUNDAI AND KIA USED LIGHTWEIGHT MATERIALS TO ENHANCE PERFORMANCE AND REDUCE WEIGHT

-

5.11 TECHNOLOGY ANALYSISOVERVIEW- Light-duty vehicles impact lightweight material industry

-

5.12 AUTOMOTIVE LIGHTWEIGHTING MARKET ECOSYSTEM

-

5.13 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.14 REGULATORY FRAMEWORKEMISSION REGULATIONS- On-road vehicles- Non-road mobile machinery (NRMM) emission regulation outlook

-

5.15 FUEL ECONOMY NORMSUSEUROPECHINAINDIA

- 5.16 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.17 KEY CONFERENCES AND EVENTS IN 2023–2024BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

-

6.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS/LIMITATIONSINDUSTRY INSIGHTS

-

6.2 METALSHIGH STRENGTH STEEL (HSS)- Lightweight and resistant to contract tensionALUMINUM- Led by EV sales owing to lightweighting propertiesMAGNESIUM AND TITANIUM- Magnesium considered alternative to carbon fiber material

-

6.3 COMPOSITESCARBON FIBER REINFORCED POLYMERS (CFRP)- Save 0.3–0.6 liters of fuel on every 100 km of driveGLASS FIBER REINFORCED POLYMER (GFRP)- Good strength to weight ratioNATURAL FIBER REINFORCED POLYMER (NFRP)- Makes parts lighter and sustainableOTHER COMPOSITES- Europe to have highest market share

- 6.4 PLASTICS

- 6.5 ELASTOMERS

-

7.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS/LIMITATIONSINDUSTRY INSIGHTS

-

7.2 BODY IN WHITECONTRIBUTES 30% OF CURB WEIGHT WITH LARGE SCOPE FOR WEIGHT REDUCTION

-

7.3 CHASSIS AND SUSPENSIONSUSE OF ALUMINUM TO REDUCE WEIGHT

-

7.4 POWERTRAINSALUMINUM HOUSING TO REPLACE CONVENTIONAL STEEL

-

7.5 CLOSURESALUMINUM AND MAGNESIUM USED TO REDUCE OVERALL VEHICLE WEIGHT

-

7.6 INTERIORSINFOTAINMENT SYSTEMS TO REPLACE CONVENTIONAL FEATURES AND PUSH BUTTONS

-

7.7 OTHERSEUROPE TO BE FASTEST-GROWING MARKET

-

8.1 INTRODUCTIONRESEARCH METHODOLOGYINDUSTRY INSIGHTS

-

8.2 FRAMESMADE USING HSS, ALUMINUM, AND COMPOSITES

-

8.3 WHEELSINCORPORATION OF LIGHTWEIGHT WHEELS IN SPORTS AND HYPERCARS

-

8.4 BUMPERS AND FENDERSDESIGNED TO REDUCE DAMAGES

-

8.5 ENGINES AND EXHAUSTSTREND SHIFT TOWARD ALL-ALUMINUM ENGINES

-

8.6 TRANSMISSIONSLIGHTWEIGHTING IN TRANSMISSION IN EUROPE TO GROW MORE

-

8.7 DOORSASIA PACIFIC TO DOMINATE MARKET

-

8.8 HOODS AND TRUNKSINCREASING DEMAND DUE TO FUEL-EFFICIENT VEHICLES

-

8.9 SEATSGROWING NEED FOR BETTER COMFORT AND ERGONOMICALLY DESIGNED SEATS

-

8.10 INSTRUMENT PANELSDEMAND DRIVEN BY ADOPTION OF ELECTRIC VEHICLES

-

8.11 FUEL TANKSUSE OF PLASTIC TO AID WEIGHT REDUCTION

-

9.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS/LIMITATIONSINDUSTRY INSIGHTS

-

9.2 PASSENGER CARSDEMAND FOR LIGHTWEIGHT MATERIALS TO BE HIGHEST IN EVS AND IC ENGINES PASSENGER CARS

-

9.3 LIGHT COMMERCIAL VEHICLES (LCVS)NORTH AMERICA TO BE FASTEST-GROWING MARKET FOR LIGHTWEIGHT MATERIAL IN LCV SEGMENT

-

9.4 TRUCKSLIMITED USAGE OF LIGHTWEIGHT MATERIALS DUE TO HIGH COST

-

9.5 BUSESUSAGE OF LIGHTWEIGHT MATERIALS IN BUSES MORE THAN TRUCKS AND LCVS

-

10.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS/LIMITATIONSINDUSTRY INSIGHTS

-

10.2 BATTERY ELECTRIC VEHICLESLIGHTWEIGHTING TO IMPROVE FUEL EFFICIENCY OF BEVS

-

10.3 HYBRID ELECTRIC VEHICLESLIMITED AVAILABILITY OF CHARGING INFRASTRUCTURE MAKES HEVS PREFERRED OPTION OVER BEVS

-

10.4 PLUG-IN HYBRID ELECTRIC VEHICLESASIA PACIFIC TO BE FASTEST-GROWING MARKET

-

10.5 ELECTRIC TRUCKSNORTH AMERICA TO BE LARGEST MARKET

-

10.6 ELECTRIC BUSESUSED BY COUNTRIES SUCH AS CHINA AND INDIA AS MODE OF TRANSPORT

-

11.1 INTRODUCTIONRESEARCH METHODOLOGYINDUSTRY INSIGHTS

-

11.2 METALSINCORPORATED IN BODY STRUCTURES, POWERTRAINS, AND SUSPENSIONS

-

11.3 COMPOSITESADVANCED AND COSTLIER MATERIAL

-

11.4 PLASTICSBEV TO BE LARGEST LIGHTWEIGHTING MARKET FOR PLASTICS

-

11.5 ELASTOMERSUSED IN ANTI-VIBRATION RUBBER MOUNTS IN ELECTRIC TRUCKS

-

12.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS/LIMITATIONS

-

12.2 HIGH STRENGTH STEELVARIABLE THICKNESS REDUCES VEHICLE WEIGHT

-

12.3 ALUMINUMLIGHTWEIGHT AND LOW DENSITY

-

12.4 PLASTICSUSED TO WELD DISSIMILAR METALS TO FORM FIRM JOINTS AND RETAIN STRENGTH

-

12.5 ELASTOMERSLED BY EUROPEAN MARKET

- 12.6 OTHER MATERIALS

-

13.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS/LIMITATIONS

-

13.2 ALUMINUMMOSTLY PREFERRED OVER CARBON FIBER TO DESIGN FRAMES OF UAVS

-

13.3 COMPOSITESCARBON FIBER REINFORCED POLYMERS (CFRP)- WEIGHS 5 TIMES LESS THAN CONVENTIONAL STEEL DRONESGLASS FIBER REINFORCED POLYMERS (CFRP)- WEIGHS 30% LESS THAN ALUMINUM-BASED DRONES

-

13.4 PLASTICSUSED IN DEVELOPING ENCLOSURES OF COMPONENTS USED IN UAVS

-

13.5 ELASTOMERSUSED TO ABSORB IMPACT STRESS AND NVH FROM COMPONENTS

-

13.6 OTHERSEXCELLENT HEAT RESISTANCE IN HARSH AND TOUGH CONDITIONS

-

14.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS/LIMITATIONSINDUSTRY INSIGHTS

-

14.2 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Abundant availability of lightweight materialsJAPAN- Increased demand for luxury cars and stringent emission regulationsINDIA- Growth in vehicle sales and increased demand for comfort featuresSOUTH KOREA- Demand for luxury cars with increased features, technologies, and lightweighting

-

14.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Presence of R&D centers to develop advanced lightweight vehiclesFRANCE- Increasing awareness of environmental pollution hazardsRUSSIA- Lightweight metals to comply with Euro V regulationsUK- Increasing incorporation of lightweight composites in premium vehiclesSPAIN- Adoption of fuel-efficient and emission-reduction technologiesITALY- Need for EVs with longer battery rangeTURKEY- Increasing incorporation of lightweight metals in powertrainsREST OF EUROPE- Usage of aluminum and HSS to be higher

-

14.4 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing fuel prices to lead to demand for efficient lightweight vehiclesCANADA- Growing initiatives to reduce fuel consumption in vehiclesMEXICO- Rising fuel prices and stringent emission norms

-

14.5 REST OF THE WORLD (ROW)BRAZIL- Incorporation of lightweight metals in body structures of mid-range passenger carsSOUTH AFRICA- Growing need for lightweight vehicles to reduce greenhouse gas emissionsOTHER COUNTRIES- Push toward cleaner transportation with lightweight vehicles

- 15.1 OVERVIEW

- 15.2 AUTOMOTIVE LIGHTWEIGHTING MARKET SHARE ANALYSIS, 2021

- 15.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021

-

15.4 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

15.5 COMPETITIVE SCENARIONEW PRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS, 2019–2022

- 15.6 RIGHT TO WIN

- 15.7 COMPETITIVE BENCHMARKING

-

16.1 KEY PLAYERSBASF SE- Business overview- Products offered- Recent developments- MnM viewCOVESTRO AG- Business overview- Products offered- Recent developments- MnM viewLYONDELLBASELL INDUSTRIES HOLDINGS BV- Business overview- Products offered- Recent developments- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewARCELORMITTAL- Business overview- Products offered- Recent developments- MnM viewTHYSSENKRUPP AG- Business overview- Products offeredNOVELIS, INC.- Business overview- Products offeredALCOA CORPORATION- Business overview- Products offeredOWENS CORNING- Business overview- Products offeredSTRATASYS LTD.- Business overview- Products offered- Recent developments

-

16.2 ADDITIONAL PLAYERSTATA STEELPOSCOMITSUBISHI CHEMICAL CORPORATIONTEIJINSGL CARBONLANXESSBOREALIS AGSOLVAYDOWDUPONTAK STEEL HOLDING CORPORATIONUS MAGNESIUM LLCALERIS CORPORATIONHEXCELCELANESEWHB BRASIL

- 17.1 ASIA PACIFIC EXPECTED TO DOMINATE GLOBAL AUTOMOTIVE LIGHTWEIGHTING MARKET

- 17.2 COMPOSITE MATERIAL TO BE KEY FOCUS IN AUTOMOTIVE LIGHTWEIGHTING MARKET

- 17.3 CONCLUSION

- 18.1 INSIGHTS OF INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

18.4 CUSTOMIZATION OPTIONSAUTOMOTIVE LIGHTWEIGHTING MARKET, BY MATERIAL TYPE (COUNTRY LEVEL)- Metals- Composites- Plastics- ElastomersMICROMOBILITY LIGHTWEIGHTING MARKET, BY VEHICLE TYPE- E-Bikes Lightweighting Market, By Material- E-Moped Lightweighting Market, By Material

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS

- TABLE 1 MASS REDUCTION WITH LIGHTWEIGHT MATERIALS

- TABLE 2 ALUMINUM VS. STEEL MATERIAL MECHANICAL PROPERTIES

- TABLE 3 US: IRON OR STEEL IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 4 GERMANY: IRON OR STEEL IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 5 FRANCE: IRON OR STEEL IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 6 GERMANY: ALUMINUM IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 7 FRANCE: ALUMINUM IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 8 US: ALUMINUM IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 9 US: MAGNESIUM IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 10 CANADA: MAGNESIUM IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 11 GERMANY: MAGNESIUM IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 12 CHINA: ELASTOMER IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 13 GERMANY: ELASTOMER IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 14 BELGIUM: ELASTOMER IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 15 US: PLASTICS IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 16 GERMANY: PLASTICS IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 17 MEXICO: PLASTICS IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 18 CHINA: IRON OR STEEL EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 19 GERMANY: IRON OR STEEL EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 20 ITALY: IRON OR STEEL EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 21 CHINA: ALUMINUM EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 22 GERMANY: ALUMINUM EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 23 ITALY: ALUMINUM EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 24 CHINA: MAGNESIUM EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 25 AUSTRIA: MAGNESIUM EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 26 US: MAGNESIUM EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 27 JAPAN: ELASTOMER EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 28 CHINA: ELASTOMER EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 29 US: ELASTOMER EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 30 CHINA: PLASTICS EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 31 GERMANY: PLASTICS EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 32 US: PLASTICS EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 33 KEY ECONOMIC INDICATORS FOR SELECT COUNTRIES, 2021–2022

- TABLE 34 EUROPE: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 35 EUROPE: KEY INFLATION INDICATORS, 2021–2023

- TABLE 36 ASIA PACIFIC: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 37 ASIA PACIFIC: KEY INFLATION INDICATORS, 2021–2023

- TABLE 38 AMERICAS: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 39 AMERICAS: KEY INFLATION INDICATORS, 2021–2023

- TABLE 40 GDP GROWTH PROJECTIONS FOR KEY COUNTRIES, 2024–2027 (% GROWTH)

- TABLE 41 NORTH AMERICA: AUTOMOTIVE LIGHTWEIGHTING MARKET- AVERAGE SELLING PRICE (ASP), BY MATERIAL, 2019–2021 (USD/TON)

- TABLE 42 EUROPE: AUTOMOTIVE LIGHTWEIGHTING MARKET- AVERAGE SELLING PRICE (ASP), BY MATERIAL, 2019–2021 (USD/TON)

- TABLE 43 ASIA PACIFIC: MARKET MARKET- AVERAGE SELLING PRICE (ASP), BY MATERIAL, 2019–2021 (USD/TON)

- TABLE 44 REST OF THE WORLD: MARKET MARKET- AVERAGE SELLING PRICE (ASP), BY MATERIAL, 2019–2021 (USD/TON)

- TABLE 45 WEIGHT REDUCTION GOALS FOR LIGHT-DUTY VEHICLES

- TABLE 46 FUTURE WEIGHT REDUCTION TARGETS, BY COMPONENT, 2025 VS. 2050

- TABLE 47 TECHNOLOGICAL ROUTES FOR APPLICATION OF LIGHTWEIGHT MATERIALS: US

- TABLE 48 ROLE OF COMPANIES IN MARKET MARKET ECOSYSTEM

- TABLE 49 PORTER’S FIVE FORCES ANALYSIS

- TABLE 50 EURO-5 VS. EURO-6 VEHICLE EMISSION STANDARDS ON NEW EUROPEAN DRIVING CYCLE

- TABLE 51 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR PASSENGER CARS, 2016–2021

- TABLE 52 US: CAFE STANDARDS FOR EACH MODEL YEAR IN MILES PER GALLON, 2019–2025

- TABLE 53 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 54 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 55 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 56 KEY BUYING CRITERIA FOR TOP TWO MARKET APPLICATIONS

- TABLE 57 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MARKET MARKET APPLICATIONS (%)

- TABLE 58 MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 59 MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 60 MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 61 MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 62 METALS: MARKET, BY TYPE, 2018–2021 (TMT)

- TABLE 63 METALS: MARKET, BY TYPE, 2022–2027 (TMT)

- TABLE 64 METALS: MARKET, BY TYPE, 2018–2021 (USD BILLION)

- TABLE 65 METALS: MARKET, BY TYPE, 2022–2027 (USD BILLION)

- TABLE 66 HSS MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 67 HSS MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 68 HSS MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 69 HSS MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 70 ALUMINUM MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 71 ALUMINUM MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 72 ALUMINUM MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 73 ALUMINUM MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 74 MAGNESIUM AND TITANIUM MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 75 MAGNESIUM AND TITANIUM MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 76 MAGNESIUM AND TITANIUM MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 77 MAGNESIUM AND TITANIUM MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 78 COMPOSITES MARKET, BY TYPE, 2018–2021 (TMT)

- TABLE 79 COMPOSITES MARKET, BY TYPE, 2022–2027 (TMT)

- TABLE 80 COMPOSITES MARKET, BY TYPE, 2018–2021 (USD BILLION)

- TABLE 81 COMPOSITES MARKET, BY TYPE, 2022–2027 (USD BILLION)

- TABLE 82 CFRP MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 83 CFRP MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 84 CFRP MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 85 CFRP MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 86 GFRP MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 87 GFRP MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 88 GFRP MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 89 GFRP MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 90 NFRP MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 91 NFRP MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 92 NFRP MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 93 NFRP MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 94 OTHER COMPOSITES MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 95 OTHER COMPOSITES MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 96 OTHER COMPOSITES MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 97 OTHER COMPOSITES MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 98 PLASTICS MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 99 PLASTICS MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 100 PLASTICS MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 101 PLASTICS MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 102 PLASTICS MARKET, BY TYPE, 2018–2021 (TMT)

- TABLE 103 PLASTICS MARKET, BY TYPE, 2022–2027 (TMT)

- TABLE 104 PLASTICS MARKET, BY TYPE, 2018–2021 (USD BILLION)

- TABLE 105 PLASTICS MARKET, BY TYPE, 2022–2027 (USD BILLION)

- TABLE 106 ELASTOMERS MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 107 ELASTOMERS MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 108 ELASTOMERS MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 109 ELASTOMERS MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 110 MARKET, BY APPLICATION, 2018–2021 (TMT)

- TABLE 111 MARKET, BY APPLICATION, 2022–2027 (TMT)

- TABLE 112 MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

- TABLE 113 MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

- TABLE 114 BODY IN WHITE: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 115 BODY IN WHITE: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 116 BODY IN WHITE: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 117 BODY IN WHITE: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 118 CHASSIS AND SUSPENSIONS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 119 CHASSIS AND SUSPENSIONS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 120 CHASSIS AND SUSPENSIONS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 121 CHASSIS AND SUSPENSIONS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 122 POWERTRAINS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 123 POWERTRAINS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 124 POWERTRAINS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 125 POWERTRAINS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 126 CLOSURES: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 127 CLOSURES: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 128 CLOSURES: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 129 CLOSURES: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 130 INTERIORS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 131 INTERIORS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 132 INTERIORS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 133 INTERIORS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 134 OTHERS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 135 OTHERS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 136 OTHERS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 137 OTHERS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 138 AUTOMOTIVE LIGHTWEIGHTING MARKET, BY COMPONENT, 2018–2021 (TMT)

- TABLE 139 MARKET, BY COMPONENT, 2022–2027 (TMT)

- TABLE 140 MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

- TABLE 141 MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

- TABLE 142 FRAMES: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 143 FRAMES: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 144 FRAMES: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 145 FRAMES: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 146 WHEELS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 147 WHEELS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 148 WHEELS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 149 WHEELS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 150 BUMPERS AND FENDERS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 151 BUMPERS AND FENDERS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 152 BUMPERS AND FENDERS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 153 BUMPERS AND FENDERS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 154 ENGINES AND EXHAUSTS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 155 ENGINES AND EXHAUSTS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 156 ENGINES AND EXHAUSTS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 157 ENGINES AND EXHAUSTS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 158 TRANSMISSIONS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 159 TRANSMISSIONS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 160 TRANSMISSIONS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 161 TRANSMISSIONS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 162 DOORS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 163 DOORS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 164 DOORS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 165 DOORS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 166 HOODS AND TRUNKS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 167 HOODS AND TRUNKS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 168 HOODS AND TRUNKS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 169 HOODS AND TRUNKS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 170 SEATS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 171 SEATS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 172 SEATS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 173 SEATS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 174 INSTRUMENT PANELS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 175 INSTRUMENT PANELS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 176 INSTRUMENT PANELS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 177 INSTRUMENT PANELS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 178 FUEL TANKS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 179 FUEL TANKS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 180 FUEL TANKS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 181 FUEL TANKS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 182 AUTOMOTIVE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (TMT)

- TABLE 183 MARKET, BY VEHICLE TYPE, 2022–2027 (TMT)

- TABLE 184 MARKET, BY VEHICLE TYPE, 2018–2021 (USD BILLION)

- TABLE 185 MARKET, BY VEHICLE TYPE, 2022–2027 (USD BILLION)

- TABLE 186 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 187 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 188 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 189 PASSENGER CARS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 190 LCVS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 191 LCVS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 192 LCVS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 193 LCVS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 194 TRUCKS: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 195 TRUCKS: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 196 TRUCKS: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 197 TRUCKS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 198 BUSES: MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 199 BUSES: MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 200 BUSES: MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 201 BUSES: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 202 ELECTRIC AND HYBRID LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (TMT)

- TABLE 203 ELECTRIC AND HYBRID LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (TMT)

- TABLE 204 ELECTRIC AND HYBRID LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 205 ELECTRIC AND HYBRID LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

- TABLE 206 BEV LIGHTWEIGHTING MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 207 BEV LIGHTWEIGHTING MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 208 BEV LIGHTWEIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 209 BEV LIGHTWEIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 210 HEV LIGHTWEIGHTING MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 211 HEV LIGHTWEIGHTING MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 212 HEV LIGHTWEIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 213 HEV LIGHTWEIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 214 PHEV LIGHTWEIGHTING MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 215 PHEV LIGHTWEIGHTING MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 216 PHEV LIGHTWEIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 217 PHEV LIGHTWEIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 218 ELECTRIC TRUCKS LIGHTWEIGHTING MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 219 ELECTRIC TRUCKS LIGHTWEIGHTING MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 220 ELECTRIC TRUCKS LIGHTWEIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 221 ELECTRIC TRUCKS LIGHTWEIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 222 ELECTRIC BUSES LIGHTWEIGHTING MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 223 ELECTRIC BUSES LIGHTWEIGHTING MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 224 ELECTRIC BUSES LIGHTWEIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 225 ELECTRIC BUSES LIGHTWEIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 226 ELECTRIC VEHICLE LIGHTWEIGHTING MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 227 ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 228 ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY MATERIAL TYPE, 2018–2021 (USD MILLION)

- TABLE 229 ELECTRIC VEHICLE LIGHTWEIGHTING, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

- TABLE 230 METALS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (TMT)

- TABLE 231 METALS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (TMT)

- TABLE 232 METALS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 233 METALS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

- TABLE 234 COMPOSITES: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (TMT)

- TABLE 235 COMPOSITES: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (TMT)

- TABLE 236 COMPOSITES: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 237 COMPOSITES: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

- TABLE 238 PLASTICS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (TMT)

- TABLE 239 PLASTICS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (TMT)

- TABLE 240 PLASTICS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 241 PLASTICS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

- TABLE 242 ELASTOMERS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (TMT)

- TABLE 243 ELASTOMERS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (TMT)

- TABLE 244 ELASTOMERS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 245 ELASTOMERS: ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

- TABLE 246 MICROMOBILITY LIGHTWEIGHTING MARKET, BY MATERIAL, 2018–2021 (TMT)

- TABLE 247 MICROMOBILITY LIGHTWEIGHTING MARKET, BY MATERIAL, 2022–2027 (TMT)

- TABLE 248 MICROMOBILITY LIGHTWEIGHTING MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

- TABLE 249 MICROMOBILITY LIGHTWEIGHTING MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

- TABLE 250 HSS MATERIAL MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 251 HSS MATERIAL MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 252 HSS MATERIAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 253 HSS MATERIAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 254 ALUMINUM MATERIAL MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 255 ALUMINUM MATERIAL MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 256 ALUMINUM MATERIAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 257 ALUMINUM MATERIAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 258 PLASTICS MATERIAL MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 259 PLASTICS MATERIAL MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 260 PLASTICS MATERIAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 261 PLASTICS MATERIAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 262 ELASTOMERS MATERIAL MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 263 ELASTOMERS MATERIAL MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 264 ELASTOMERS MATERIAL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 265 ELASTOMERS MATERIAL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 266 OTHER MATERIALS MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 267 OTHER MATERIALS MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 268 OTHER MATERIALS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 269 OTHER MATERIALS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 270 UAV LIGHTWEIGHTING MARKET, BY MATERIAL TYPE, 2018–2021 (MT)

- TABLE 271 UAV LIGHTWEIGHTING MARKET, BY MATERIAL TYPE, 2022–2027 (MT)

- TABLE 272 UAV LIGHTWEIGHTING MARKET, BY MATERIAL TYPE, 2018–2021 (USD MILLION)

- TABLE 273 UAV LIGHTWEIGHTING MARKET, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

- TABLE 274 MARKET, BY REGION, 2018–2021 (TMT)

- TABLE 275 MARKET, BY REGION, 2022–2027 (TMT)

- TABLE 276 MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 277 MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 278 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (TMT)

- TABLE 279 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (TMT)

- TABLE 280 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

- TABLE 281 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 282 CHINA: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 283 CHINA: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 284 CHINA: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 285 CHINA: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 286 JAPAN: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 287 JAPAN: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 288 JAPAN: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 289 JAPAN: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 290 INDIA: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 291 INDIA: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 292 INDIA: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 293 INDIA: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 294 SOUTH KOREA: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 295 SOUTH KOREA: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 296 SOUTH KOREA: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 297 SOUTH KOREA: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 298 EUROPE: MARKET, BY COUNTRY, 2018–2021 (TMT)

- TABLE 299 EUROPE LIGHTWEIGHT MATERIAL MARKET, BY COUNTRY, 2022–2027 (TMT)

- TABLE 300 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

- TABLE 301 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 302 GERMANY: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 303 GERMANY: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 304 GERMANY: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 305 GERMANY: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 306 FRANCE: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 307 FRANCE: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 308 FRANCE: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 309 FRANCE: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 310 RUSSIA: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 311 RUSSIA: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 312 RUSSIA: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 313 RUSSIA: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 314 UK: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 315 UK: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 316 UK: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 317 UK: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 318 SPAIN: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 319 SPAIN: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 320 SPAIN: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 321 SPAIN: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 322 ITALY: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 323 ITALY: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 324 ITALY: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 325 ITALY: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 326 TURKEY: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 327 TURKEY: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 328 TURKEY: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 329 TURKEY: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 330 REST OF EUROPE: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 331 REST OF EUROPE: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 332 REST OF EUROPE: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 333 REST OF EUROPE: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 334 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021(TMT)

- TABLE 335 NORTH AMERICA: LIGHTWEIGHTING MARKET, BY COUNTRY, 2022–2027 (TMT)

- TABLE 336 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

- TABLE 337 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 338 US: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 339 US: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 340 US: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 341 US: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 342 CANADA: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 343 CANADA: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 344 CANADA: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 345 CANADA: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 346 MEXICO: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 347 MEXICO: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 348 MEXICO: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 349 MEXICO: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 350 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021(TMT)

- TABLE 351 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (TMT)

- TABLE 352 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021(USD BILLION)

- TABLE 353 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 354 BRAZIL: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 355 BRAZIL: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 356 BRAZIL: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 357 BRAZIL: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 358 SOUTH AFRICA: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 359 SOUTH AFRICA: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 360 SOUTH AFRICA: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 361 SOUTH AFRICA: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 362 OTHER COUNTRIES: MARKET, BY MATERIAL TYPE, 2018–2021 (TMT)

- TABLE 363 OTHER COUNTRIES: MARKET, BY MATERIAL TYPE, 2022–2027 (TMT)

- TABLE 364 OTHER COUNTRIES: MARKET, BY MATERIAL TYPE, 2018–2021 (USD BILLION)

- TABLE 365 OTHER COUNTRIES: MARKET, BY MATERIAL TYPE, 2022–2027 (USD BILLION)

- TABLE 366 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2019–2022

- TABLE 367 MARKET: PRODUCT LAUNCHES, 2019–2022

- TABLE 368 MARKET: DEALS, 2019–2022

- TABLE 369 AUTOMOTIVE LIGHTWEIGHTING MARKET: OTHER DEVELOPMENTS, 2019–2022

- TABLE 370 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS, PARTNERSHIPS, AND SUPPLY CONTRACTS AS KEY GROWTH STRATEGIES FROM 2019–2022

- TABLE 371 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 372 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 373 BASF SE: BUSINESS OVERVIEW

- TABLE 374 BASF SE: PRODUCTS OFFERED

- TABLE 375 BASF SE: NEW PRODUCT DEVELOPMENTS

- TABLE 376 BASF SE: DEALS

- TABLE 377 BASF SE: OTHER DEVELOPMENT

- TABLE 378 COVESTRO AG: BUSINESS OVERVIEW

- TABLE 379 COVESTRO AG: PRODUCTS OFFERED

- TABLE 380 COVESTRO AG: NEW PRODUCT DEVELOPMENTS

- TABLE 381 COVESTRO AG: DEALS

- TABLE 382 COVESTRO AG: OTHER DEVELOPMENTS

- TABLE 383 LYONDELLBASELL INDUSTRIES HOLDINGS BV: BUSINESS OVERVIEW

- TABLE 384 LYONDELLBASELL INDUSTRIES HOLDINGS BV: NEW PRODUCT DEVELOPMENTS

- TABLE 385 LYONDELLBASELL INDUSTRIES HOLDINGS BV: DEALS

- TABLE 386 LYONDELLBASELL INDUSTRIES HOLDINGS BV: OTHER DEVELOPMENTS

- TABLE 387 TORAY INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 388 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 389 TORAY INDUSTRIES, INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 390 TORAY INDUSTRIES, INC.: DEALS

- TABLE 391 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 392 ARCELORMITTAL: BUSINESS OVERVIEW

- TABLE 393 ARCELORMITTAL: PRODUCTS OFFERED

- TABLE 394 ARCELORMITTAL: NEW PRODUCT DEVELOPMENTS

- TABLE 395 ARCELORMITTAL: DEALS

- TABLE 396 ARCELORMITTAL: OTHER DEVELOPMENTS

- TABLE 397 THYSSENKRUPP AG: BUSINESS OVERVIEW

- TABLE 398 THYSSENKRUPP AG: PRODUCTS OFFERED

- TABLE 399 THYSSENKRUPP AG: DEALS

- TABLE 400 THYSSENKRUPP AG: OTHER DEVELOPMENTS

- TABLE 401 NOVELIS, INC.: BUSINESS OVERVIEW

- TABLE 402 NOVELIS, INC.: PRODUCTS OFFERED

- TABLE 403 NOVELIS, INC.: DEALS

- TABLE 404 NOVELIS, INC.: OTHER DEVELOPMENTS

- TABLE 405 ALCOA CORPORATION: BUSINESS OVERVIEW

- TABLE 406 ALCOA CORPORATION: PRODUCTS OFFERED

- TABLE 407 ALCOA CORPORATION: DEALS

- TABLE 408 OWENS CORNING: BUSINESS OVERVIEW

- TABLE 409 OWENS CORNING: PRODUCTS OFFERED

- TABLE 410 STRATASYS LTD.: BUSINESS OVERVIEW

- TABLE 411 STRATASYS LTD.: PRODUCTS OFFERED

- TABLE 412 STRATASYS LTD.: NEW PRODUCT DEVELOPMENTS

- TABLE 413 STRATASYS LTD.: DEALS

- TABLE 414 STRATASYS LTD.: OTHER DEVELOPMENTS

- TABLE 415 TATA STEEL: COMPANY OVERVIEW

- TABLE 416 POSCO: COMPANY OVERVIEW

- TABLE 417 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 418 TEIJIN: COMPANY OVERVIEW

- TABLE 419 SGL CARBON: COMPANY OVERVIEW

- TABLE 420 LANXESS: COMPANY OVERVIEW

- TABLE 421 BOREALIS AG: COMPANY OVERVIEW

- TABLE 422 SOLVAY: COMPANY OVERVIEW

- TABLE 423 DOWDUPONT: COMPANY OVERVIEW

- TABLE 424 AK STEEL HOLDING CORPORATION: COMPANY OVERVIEW

- TABLE 425 US MAGNESIUM LLC: COMPANY OVERVIEW

- TABLE 426 ALERIS CORPORATION: COMPANY OVERVIEW

- TABLE 427 HEXCEL: COMPANY OVERVIEW

- TABLE 428 CELANESE: COMPANY OVERVIEW

- TABLE 429 WHB BRASIL: COMPANY OVERVIEW

- FIGURE 1 MARKET: MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET: BOTTOM-UP APPROACH

- FIGURE 7 MARKET: TOP-DOWN APPROACH

- FIGURE 8 AUTOMOTIVE LIGHTWEIGHTING MARKET: RESEARCH DESIGN AND METHODOLOGY

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 PRE- AND POST-RECESSION SCENARIO: AUTOMOTIVE LIGHTWEIGHTING MARKET, 2018–2027 (USD BILLION)

- FIGURE 11 MARKET: MARKET OUTLOOK

- FIGURE 12 MARKET, BY REGION, 2022 VS. 2027 (USD BILLION)

- FIGURE 13 RISING TREND OF VEHICLE ELECTRIFICATION OFFERS ATTRACTIVE OPPORTUNITIES

- FIGURE 14 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 METALS TO HOLD LARGEST GLOBAL SHARE DURING FORECAST PERIOD

- FIGURE 16 BODY IN WHITE APPLICATION TO HAVE LARGEST SHARE IN MARKET

- FIGURE 17 FRAMES SUBSEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 18 PASSENGER CARS TO BE DOMINANT SUBSEGMENT DURING FORECAST PERIOD

- FIGURE 19 METALS PROJECTED TO BE LARGEST MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 20 BEV SEGMENT PROJECTED TO HAVE HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 ALUMINUM TO HAVE LARGEST SHARE IN MICROMOBILITY LIGHTWEIGHTING MARKET

- FIGURE 22 COMPOSITES PROJECTED TO BE LARGEST SUBSEGMENT IN UAV LIGHTWEIGHTING MARKET

- FIGURE 23 ASIA PACIFIC TO BE DOMINANT REGION IN MARKET

- FIGURE 24 MARKET DYNAMICS

- FIGURE 25 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR HEAVY-DUTY VEHICLES, 2014–2030

- FIGURE 26 GLOBAL ELECTRIC VEHICLES SALES, 2021–2030 (THOUSAND UNITS)

- FIGURE 27 EUROPE: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022 (UNITS)

- FIGURE 28 ASIA PACIFIC: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022 (UNITS)

- FIGURE 29 AMERICAS: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022 (UNITS)

- FIGURE 30 EUROPE: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 (‘000 UNITS)

- FIGURE 31 ASIA PACIFIC: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 (‘000 UNITS)

- FIGURE 32 NORTH AMERICA: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 (‘000 UNITS)

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES – MARKET

- FIGURE 34 SUPPLY CHAIN ANALYSIS: MARKET

- FIGURE 35 MARKET: ECOSYSTEM

- FIGURE 36 PORTER’S FIVE FORCES FOR MARKET

- FIGURE 37 NRMM EMISSION REGULATION OUTLOOK, 2019–2025

- FIGURE 38 KEY BUYING CRITERIA FOR AUTOMOTIVE LIGHTWEIGHTING APPLICATIONS

- FIGURE 39 MARKET, BY MATERIAL TYPE, 2022 VS. 2027 (USD BILLION)

- FIGURE 40 AUTOMOTIVE LIGHTWEIGHTING MATERIAL MARKET, BY APPLICATION, 2022 VS. 2027 (USD BILLION)

- FIGURE 41 MARKET, BY COMPONENT, 2022 VS. 2027 (USD BILLION)

- FIGURE 42 MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD BILLION)

- FIGURE 43 ELECTRIC AND HYBRID LIGHTWEIGHTING MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 44 ELECTRIC AND HYBRID VEHICLE LIGHTWEIGHTING MARKET, BY MATERIAL TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 45 MICROMOBILITY LIGHTWEIGHTING MARKET, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

- FIGURE 46 UAV LIGHTWEIGHTING MARKET, BY MATERIAL TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 47 MARKET, BY REGION, 2022 VS. 2027 (USD BILLION)

- FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 49 EUROPE: MARKET SNAPSHOT

- FIGURE 50 NORTH AMERICA: MARKET, BY COUNTRY, 2022 VS. 2027 (USD BILLION)

- FIGURE 51 REST OF THE WORLD: MARKET, BY COUNTRY, 2022 VS. 2027 (USD BILLION)

- FIGURE 52 MARKET SHARE ANALYSIS, 2021

- FIGURE 53 COMPETITIVE EVALUATION MATRIX (LIGHTWEIGHTING MATERIAL SUPPLIERS), 2021

- FIGURE 54 COMPETITIVE EVALUATION MATRIX (LIGHTWEIGHTING COMPONENT SUPPLIERS), 2021

- FIGURE 55 BASF SE: COMPANY SNAPSHOT

- FIGURE 56 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 57 LYONDELLBASELL INDUSTRIES HOLDINGS BV: COMPANY SNAPSHOT

- FIGURE 58 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 59 ARCELORMITTAL: COMPANY SNAPSHOT

- FIGURE 60 THYSSENKRUPP AG: COMPANY SNAPSHOT

- FIGURE 61 NOVELIS, INC.: COMPANY SNAPSHOT

- FIGURE 62 ALCOA CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 OWENS CORNING: COMPANY SNAPSHOT

- FIGURE 64 STRATASYS LTD.: COMPANY SNAPSHOT

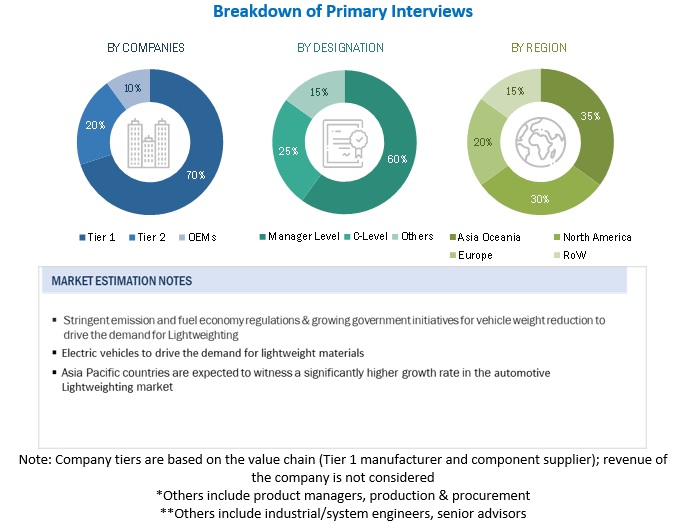

The research study involved extensive use of secondary sources such as company annual reports/presentations, industry association publications, automotive materials magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases to identify and collect information on the automotive lightweight materials market. Primary sources—experts from related industries and lightweight material suppliers—were interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors of business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as lightweight vehicle pinformation gathered from secondary research and company revenues. Stakeholders from the demand and supply sides were interviewed to understand their views on the abovementioned points.

Primary interviews were conducted with market experts from demand (OEM) and supply-side players across four major regions: North America, Europe, the Asia Pacific, and the Rest of the World. Approximately 10% of interviews were conducted from the demand side, while 90% of primary interviews were conducted from the supply side. The primary data was collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales and operations, were covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from the primaries. This, along with the opinions of the in-house subject matter experts, has led to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

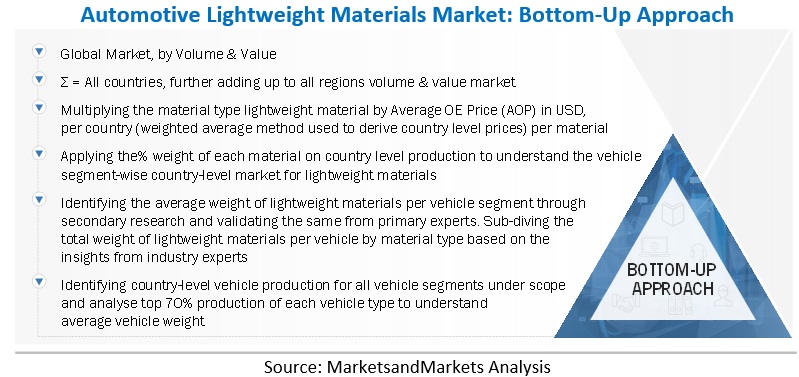

Bottom-Up Approach: Automotive Lightweight Materials Market

The bottom-up approach has been used to estimate and validate the size of the automotive lightweight materials market. The market size, by volume, of the market by material type – Metals, Composites, Plastics, and elastomers has been derived by identifying the penetration of material in each vehicle type of each key country. To determine the market size of lightweight materials in terms of volume, the average vehicle weight has been multiplied by the country-level shares of each lightweight material type considered in the study and then multiplied by the vehicle production numbers to arrive at the country-level lightweight material volume. In terms of volume, this country-level market size of lightweight materials for each vehicle type is then multiplied with the country level average OE price (AOP) (weighted average method used to derive country level prices) of each material type. This results in the country-level market size in terms of value. The summation of the country-level market gives the regional market, and further summation of the regional market provides the global market.

While estimating the regional segmentation of the automotive lightweight materials market by material type, the regional shares of automotive lightweight materials have been identified and applied to the regional market size of lightweight materials in terms of volume. The average weight of various vehicle segments at a regional level is found to calculate the demand for automotive lightweight materials. This weight is multiplied by the regional lightweight market size in volume. The lightweight materials demand is identified in thousand metric tons. With the addition of this regional market size, the market has been identified in terms of volume (thousand metric tons).

To know about the assumptions considered for the study, Request for Free Sample Report

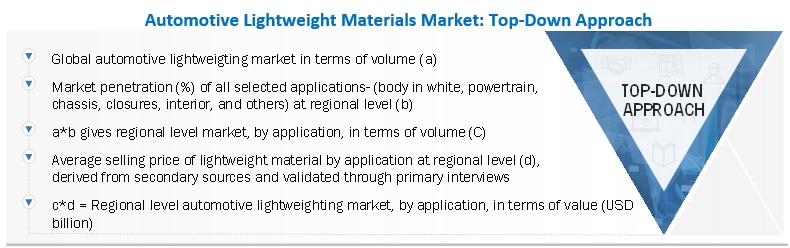

Top-Down Approach: Automotive Lightweight Materials Market

The top-down approach has been used to derive the automotive lightweight materials market based on application. The average use of lightweight materials in an application is found for each vehicle type in the region. These market shares of each application are then multiplied with the regional lightweight market to find out the volume by application in terms of thousand metric tons. All percentage shares, splits, and breakdowns have been determined using secondary paid and unpaid sources and verified through primary research. All parameters that affect the markets covered in this research study have been accounted for, reviewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

-

To define, describe, and forecast the automotive lightweight materials market in terms of value (USD million) and volume (thousand metric tons) based on the following segments:

- By Material (Metal (HSS, aluminum, magnesium & titanium), Composite (CFRP, GFRP, NFRP, Others), Plastic (PC, ABS, PA, PP, PU, and others) and Elastomer (EPDM, NR, SBR & Other))

- By Application (Body in White, Chassis and Suspension, Powertrains, Closures, Interiors, Others)

- By Components (Frames, Wheels, Bumpers & Fenders, Engines & Exhausts, Transmission, Doors, Hood & Trunk Lids, Seats, Instrument Panels, Fuel Tanks)

- By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, Trucks, Buses)

- Electric & Hybrid Vehicle Type (BEV, PHEV, FCEV, Truck, Bus)

- Electric Vehicle, by Material Type (Metal, Aluminum, Composites (CFRP, GFRP, NFRP & Others), Plastic, Elastomer)

- UAV, By Material Type (Aluminum, Composites, Plastics, Others)

- Micro-mobility By Material Type (Aluminium, Composites, Plastics and Others)

- By Region (Asia Pacific, Europe, North America, And Rest of The World)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market with Porter’s Five Forces analysis, trade analysis, trends/disruptions impacting buyers, case studies, patent analysis, supply chain analysis, market ecosystem, regulatory analysis, and technology trend

- To analyze the market share of leading players in the automotive lightweight materials market and evaluate the competitive leadership mapping

- To strategically analyze the key player strategies/right to win and company revenue

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To provide an analysis of recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Automotive Lightweight Materials Market, By Material Type (Country Level)

-

Metals

- HSS

- Aluminum

- Magnesium & Titanium

-

Composites

- CFRP

- GFRP

- NFRP

- Other Composites

-

Plastics

- PC

- ABS

- PA

- PP

- PU

- Others

-

Elastomer

- EPDM

- NR

- SBR

- Others

Micromobility Lightweight Market, By Vehicle Type

-

E-Bikes Lightweight Materials Market, By Material

- HSS

- Aluminium

- Plastics

- Elastomers

- Others

-

E-Moped Lightweight Materials Market, By Material

- HSS

- Aluminium

- Plastics

- Elastomers

- Others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Lightweight Materials Market

Interested in automotive lightweight materials based on Al and Mg alloys and MMCs, particularly where high temperature benefits are important to lightweighting.

If I purchase single license, can I print the material or copy the graph to a ppt file? And, can I share the pdf file to my colleagues? If not, is it OK to share a ppt file to quote your report?

As a part of my master of technology research I must carry out a literature survey on ongoing applications of Composite materials to Automotive sector. Therefore, this important text will prove very beneficial.

Requesting for literature for information as material input to the formation of a new transport cooperative.

we are manufacturers of all types Rubber Molded Components for Automotive, engineering industries. We want the exports orders for the same. I request you to kindly refer the good customers.

I seek a complete material about material light weight for automotive industry to apply on my business cases of automotive consulting.

I want to know about the consumption trend of insoluble sulphur in non-tyre production segment in India.