Automotive HMI Market by Product (Voice & Gesture Recognition, Touch Screen & Instrument Cluster Display, Steering Mounted Control, Multifunction Switch), Access, Technology, Display Size (<5,5-10,>10”), Vehicle Type & Region - Global Forecast to 2028

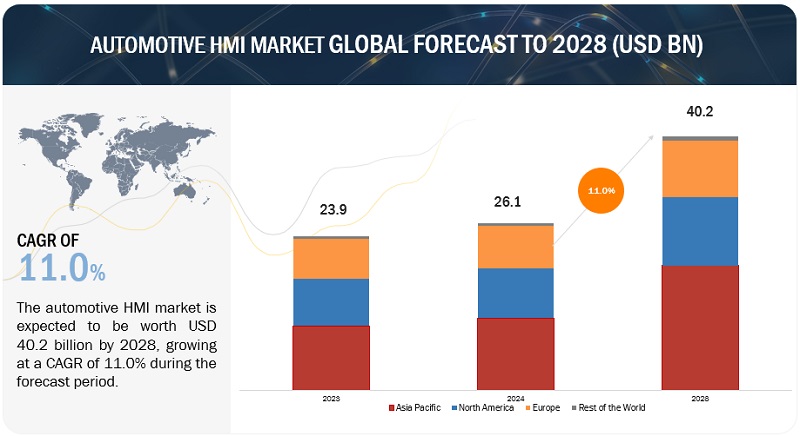

[270 Pages Report] The automotive HMI market is projected to grow from USD 23.9 billion in 2023 to USD 40.2 billion by 2028, at a CAGR of 11.0%. The automotive HMI market is being propelled by a range of factors driving widespread adoption at the global level. Vehicle and passenger safety is a primary area of focus for regional regulatory authorities. HMI design aims to minimize distraction and provide easily accessible controls and information without diverting attention from the road. User experience (UX) is another important factor, with automakers striving to create intuitive and user-friendly interfaces that enhance convenience and overall satisfaction. Connectivity and infotainment features are accommodated in HMI systems, while customization and personalization options cater to diverse driver preferences. Effective communication of Advanced Driver Assistance Systems (ADAS) information is crucial, and design trends, aesthetics, regulatory requirements, integration with autonomous driving, feedback and user research, and technological advancements also shape HMI development. These factors collectively ensure automotive HMIs meet evolving driver needs while prioritizing safety and user experience.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Advancements in artificial intelligence and machine learning

Advancements in Artificial Intelligence (AI) and Machine Learning (ML) are fueling the demand for Human-Machine Interfaces (HMIs) in the automotive industry. These cutting-edge technologies offer numerous advantages, such as enhancing driver safety, delivering personalized driving experiences, and mitigating the risk of unexpected failures. One significant application of AI driving the demand for automotive HMI is the integration of Natural Language Processing (NLP) technology. By enhancing the accuracy and interpretation of voice recognition systems, drivers can interact with the HMI more intuitively, resulting in safer and more convenient driving experiences. Another compelling example is the utilization of ML algorithms in gesture control systems. AI and ML technologies are instrumental in improving driver safety and convenience by analyzing driver behavior, predicting their preferences, and customizing the HMI accordingly. These advancements are revolutionizing the automotive HMI landscape, responding to the evolving needs of drivers, and propelling the demand for more sophisticated and user-friendly HMIs in the industry.

RESTRAINT: High cost of advanced HMI technologies

The automotive industry is experiencing a rapid evolution driven by the introduction of advanced Human-Machine Interface (HMI) technologies that provide superior safety, convenience, and customization. These cutting-edge HMI technologies necessitate specialized manufacturing processes, advanced hardware, and upgraded software, which can result in higher costs. Tier 1 companies and component suppliers make substantial investments in developing and implementing advanced HMI technologies, leading to elevated prices for end-users. Furthermore, the requirement for specialized hardware and software components further contributes to the overall cost of these advanced HMI technologies. Additionally, the regular software updates and maintenance required for these systems add to their operational expenses. While these technologies offer numerous benefits, cost remains a significant consideration for automakers and consumers. Consequently, these advanced HMI systems are primarily offered in high-end luxury cars, with limited adoption in low- and mid-end vehicles. However, as the automotive industry continues to evolve, it is anticipated that the cost of these technologies will decrease, making them more affordable and accessible to a wider range of consumers.

OPPORTUNITY: Growing innovations in autonomous mobility solution

The rise of autonomous vehicles is reshaping the role of drivers from active control to passive monitoring. This shift necessitates the development of advanced HMIs that effectively communicate information to drivers while keeping them engaged. HMI must evolve to support new scenarios like driver-vehicle handover and emergency responses. For example, Waymo, an Alphabet Inc. subsidiary, has created HMI technology that provides real-time route information and allows passengers to request changes through voice commands. This interface ensures passengers feel safe and at ease in autonomous vehicles.

Similarly, Cruise, a self-driving car company, utilizes sensors and cameras to present real-time surroundings to drivers, enabling informed decision-making. Intellias (US), Star (US), and Boréas Technologies (Canada) are also notable HMI developers. The continuous developments in autonomous vehicle technology offer an opportunity for automotive HMI providers to create innovative interfaces that effectively communicate with drivers and passengers, leading to revenue growth and addressing emerging challenges in this market segment.

CHALLENGE: Complexity in designing

The automotive HMI is an essential component of modern vehicles because it provides access to many features and functions, such as advanced driver assistance systems, climate control, and infotainment systems, for drivers and passengers. However, one of the major problems faced in the automotive human machine interface market, as experienced by numerous product manufacturers and component suppliers, is its complexity. Modern vehicles have an increasing number of features and functions, which increases the complexity of the HMI, making it challenging for users to navigate and use the system effectively.

Various initiatives are being taken to address this issue by automotive manufacturers and suppliers. HMls are becoming more complex as more features and functions are added to them as technology develops. However, if too many features are added, the risk of creating cluttered and perplexing interfaces increases, which could be dangerous for drivers, leading to distractions or perplexity. It's critical to balance adding new features and preserving a user-friendly, simple interface that improves driver safety.

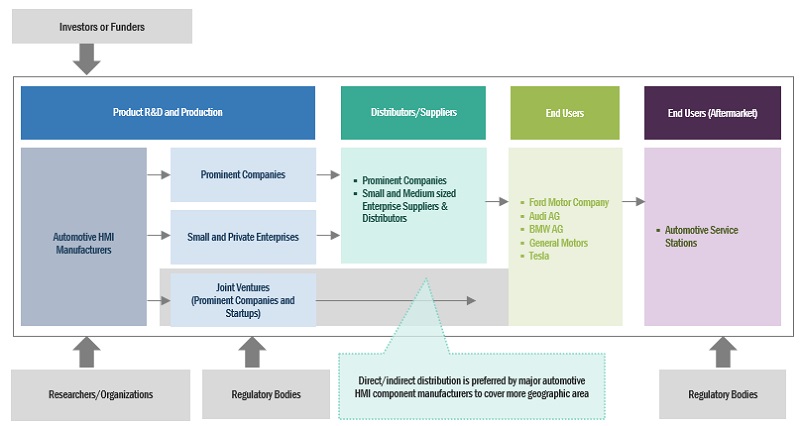

Automotive HMI Market Ecosystem.

The major players of the automotive HMI market have the latest technologies, diversified portfolios, and strong distribution networks globally. The major players in the market are Continental AG (Germany), Luxoft (Switzerland), Aptiv (Ireland), HARMAN International (US), Synaptics Incorporated (US), and Visteon Corporation (US).

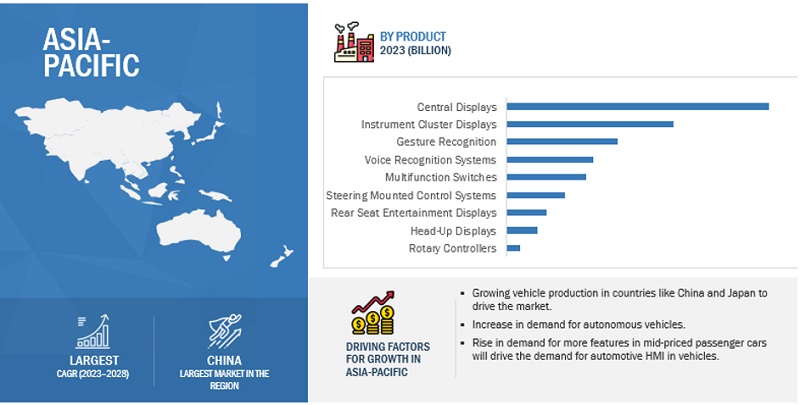

The Central Display segment by product type will lead the automotive HMI market.

The central touchscreen display is anticipated to lead the automotive HMI Market during the forecast period. Drivers and passengers can access and manage various vehicle functions and settings using central touch screens, which offer a user-friendly interface. The overall user experience is improved by these touch screens' convenience, interactivity, and intuitive navigation. Central touch screens have grown in popularity as a desired feature in cars thanks to technological advancements and the incorporation of cutting-edge features like navigation, media playback, and smartphone integration. Automakers are poised to expand the market to meet the growing demand for central touchscreen displays, which is spurring innovation and new developments in the industry.

Mid-Priced passenger cars to be the fastest growing automotive HMI market.

The mid-priced passenger car segment, expected to grow fastest, will be the primary driver of the automotive HMI market's expansion. This market segment comprises cars that balance price and features, making them appealing to many buyers. Some HMI products, like central display screens, steering mounted controls, multifunction switches, and instrument cluster displays, which already existed in the mid-priced passenger cars segment, have grown and have become strong. Further, some top trims of mid-range cars have adopted cost-effective HMI products like gesture recognition, HUD, rotary control, and high-end voice control in premium segment cars to distinguish them from the competition. Thus, the previously coming HMI features with the latest innovations and rising adoption of high-end HMI solutions would fuel the leading position of the mid-priced passenger cars hmi segment for the market during the forecast period.

Asia Pacific is the largest market for automotive HMIs.

Asia Pacific is the largest market for automotive HMIs, where China, Japan, South Korea, and India lead the market demand, with China and Japan together contributing nearly 78% in 2023. The leading market position of these countries in the Asia Pacific is mainly due to higher demand from a rise in the production and sales of automobiles. Furthermore, Asia Pacific is witnessing a surge in demand for connected and electric vehicles (EVs). These vehicles require sophisticated HMIs to enable seamless connectivity, intuitive controls, and efficient management of EV-specific features. As a result, the adoption of automotive HMIs in Asia is driven by the increasing popularity of connected and electric vehicles. The region is also witnessing a growing demand for electric vehicles, driving the demand for automotive HMIs. Also, many leading automotive technology companies and manufacturers are based in the Asia Pacific, which enables the development and production of innovative HMIs.

Some of the major players are Continental AG (Germany), Luxoft (Switzerland), Aptiv (Ireland), HARMAN International (US), Synaptics Incorporated (US), and Visteon Corporation (US)

Key Market Players

The automotive HMI market is moderately fragmented. Continental AG (Germany), Luxoft (Switzerland), Aptiv (Ireland), HARMAN International (US), Synaptics Incorporated (US), and Visteon Corporation (US) are the key companies operating in the market.

These companies adopted new product launches, partnerships, and joint ventures to gain traction in the automotive HMI market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Volume (Thousand Units) and Value (USD Million/Billion) |

|

Segments Covered |

By Product, Access Type, Technology, Display Size, Vehicle Type, and Region. |

|

Geographies covered |

Asia Pacific, North America, Europe, and the Rest of the World |

|

Companies covered |

Continental AG (Germany), Luxoft (Switzerland), Aptiv (Ireland), HARMAN International (US), Synaptics Incorporated (US), and Visteon Corporation (US) |

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs.

The study segments the automotive HMI market:

By Product

- Voice Recognition System

- Rotary Controllers

- Gesture Recognition

- Touch Screen Display

- Instrument Cluster Display

- Steering Mounted Control System

- Head-Up Display

- Multifunction Switches

By Access Type

- Standard HMI System

- Multimodal HMI System

By Technology

- Visual Interface

- Acoustic Interface

- Other Interface Technologies

By Display Size

- <5”

- 5–10”

- >10”

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

By Region

- Asia Pacific

- North America

- Europe

- Rest of the World

Recent Developments

- In October 2022, Luxoft (Switzerland) and Hyundai MOBIS (South Korea) announced a collaboration to jointly develop the next-generation in-vehicle infotainment (IVI) platform for future mobility. The collaboration aims to provide drivers and passengers with advanced digital experiences by incorporating cutting-edge technologies such as artificial intelligence and augmented reality.

- In June 2022, Valeo (France) collaborated with BMW AG (Germany) to provide the ADAS domain controller, sensor, and software for parking and maneuvering of BMW’s upcoming platform generation, “Neue Klasse,” due to launch in 2025.

- In January 2022, Visteon Corporation (US) and Steradian Semiconductors Pvt. Ltd. (India) joined forces to develop an ADAS offering superior safety features for the global automotive market. Under a joint development agreement, Steradian will grant Visteon access to its cutting-edge 4D image radar sensor hardware and perception software technology. Imaging radars play a vital role in Level 2+ autonomous driving technology by facilitating the development of safety applications, AI-powered perception algorithms, and sensor fusion.

- In December 2021, Synaptics Incorporated (US) acquired DSP Group (US), a prominent provider of wireless chipset solutions and voice processing. The acquisition combines two leading companies with cutting-edge AI, voice processing, and wireless technologies to develop a diverse range of smart connected devices.

- In September 2021, Continental AG (Germany) developed a virtual travel assistant to enhance the driving experience in passenger cars. The system offers recommendations on available free parking spots, affordable gas stations, and alerts about impending severe weather or tire pressure loss.

- In December 2020, Continental AG (Germany) entered into a partnership with Hyundai Motor Company (South Korea), wherein the partnership focused on developing a high-performance cockpit solution that offers advanced features such as augmented reality head-up displays and innovative driver assistance systems.

Frequently Asked Questions (FAQ):

What is the current size of the global automotive HMI market?

The automotive HMI market is projected to grow from USD 23.9 billion in 2023 to USD 40.2 billion by 2028, at a CAGR of 11.0%.

Which access type would be leading the automotive HMI market?

Multimodal automotive HMI type would lead the automotive HMI market due to.

Many companies are operating in the automotive HMI market space across the globe. Do you know who the front leaders are and what strategies they have adopted?

The automotive HMI market is moderately fragmented. Continental AG (Germany), Luxoft (Switzerland), Aptiv (Ireland), HARMAN International (US), Synaptics Incorporated (US), and Visteon Corporation (US) are the key companies operating in the automotive HMI market.

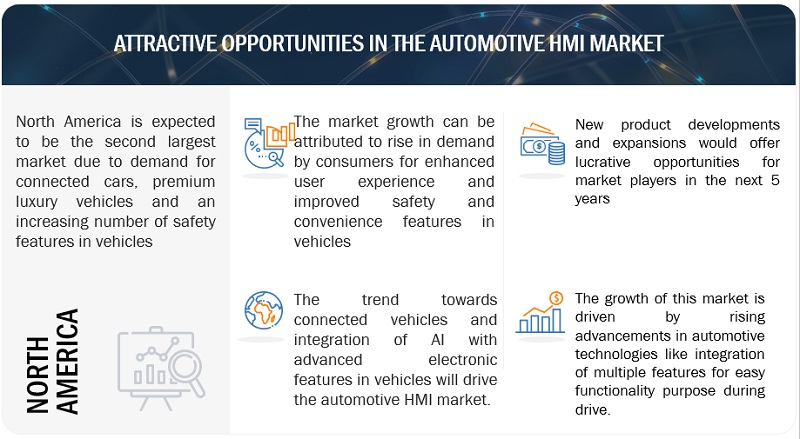

How the demand for automotive HMI varies by region?

Asia Pacific is estimated to be the largest market for the automotive HMI during the forecast period, followed by North America. The growth of the automotive HMI market in Asia Pacific is mainly attributed to the higher demand from China, Japan, South Korea and India.

What are the growth opportunities for the automotive HMI supplier?

Increased vehicle production globally especially due to rise in demand for passenger cars and light commercial vehicles with advanced HMI features would create growth opportunity for automotive HMI market. Also, upsurge in demand for fetaures like display screens, instrument clusters and steering mounted controls even in economy priced vehicles would create growth opportunities for the automotive HMI market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for vehicles enabled with connectivity elements- Rising production of luxury vehicles- Demand for driver safety and government initiatives for automotive HMIs- Advancements in artificial intelligence and machine learningRESTRAINTS- High cost of advanced HMI technologies- Limited HMI technology standardization and difficulties in integrating various componentsOPPORTUNITIES- Rising electric and hybrid vehicle sales with advanced HMI features- Growing innovation in autonomous mobility solutionsCHALLENGES- Complexity in design

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 TRADE ANALYSISIMPORT DATA- US- Canada- China- Japan- India- Germany- FranceEXPORT DATA- US- Canada- China- Japan- India- Germany- France

- 5.6 AVERAGE SELLING PRICE ANALYSIS

-

5.7 TECHNOLOGY ANALYSIS3D VISUALIZATION FOR ENHANCED USER EXPERIENCEADOPTION OF ARTIFICIAL INTELLIGENCEGROWING TREND FOR HEAD-UP DISPLAYSINNOVATIONS IN AUDIO SYSTEMSINTERNET OF THINGS IN AUTOMOTIVE HMI SYSTEMS

-

5.8 OEM STRATEGIESSTELLANTISBMW AGTESLAMERCEDES-BENZVOLKSWAGEN AGPORSCHEAUDI AGHYUNDAI MOTOR COMPANYKIA CORPORATIONRIVIANLUCID MOTORSGENERAL MOTORSFORD MOTOR COMPANY

-

6.1 INTRODUCTIONPRIMARY INSIGHTS

-

6.2 VOICE RECOGNITION SYSTEMSRISING DEMAND FOR VOICE ASSISTANCE TO CONTROL MULTIPLE OPERATIONS- Non-connected voice recognition- Virtual personal assistant/AI-enabled natural language assistant

-

6.3 GESTURE RECOGNITIONENHANCES DRIVING EXPERIENCE AND USABILITY

-

6.4 TOUCHSCREEN DISPLAYSCENTRAL DISPLAYS- Increased demand for connectivity and infotainment featuresREAR SEAT ENTERTAINMENT (RSE) DISPLAYS- Provides entertainment without driver interference

-

6.5 INSTRUMENT CLUSTER DISPLAYSPROVIDES EASY ACCESSIBILITY TO INFORMATION ON SINGLE SCREEN

-

6.6 HEAD-UP DISPLAYS (HUD)LOWERS POSSIBILITY OF DISTRACTIONS AND ACCIDENTS

-

6.7 ROTARY CONTROLLERSALLOWS USERS TO NAVIGATE MENUS AND SETTINGS

-

6.8 STEERING MOUNTED CONTROL SYSTEMSEASES DRIVING AND CONTROL FEATURES

-

6.9 MULTI-FUNCTION SWITCHESPROVIDES SAFER AND MORE CONVENIENT WAY TO OPERATE CAR FUNCTIONS

-

7.1 INTRODUCTIONPRIMARY INSIGHTS

-

7.2 VISUAL INTERFACEENHANCES DRIVING EXPERIENCE

-

7.3 ACOUSTIC INTERFACEENABLES HANDS-FREE AND EYES-FREE INTERACTION

-

7.4 OTHER INTERFACE TECHNOLOGIESREDUCES DRIVER DISTRACTION TO ENABLE SAFER EXPERIENCE

-

8.1 INTRODUCTIONPRIMARY INSIGHTS

-

8.2 STANDARD HMI SYSTEMSINCREASED USAGE DUE TO RELIABILITY AND EASE OF OPERATION

-

8.3 MULTIMODAL HMI SYSTEMSCOMBINES INPUT AND OUTPUT MODALITIES

-

9.1 INTRODUCTIONPRIMARY INSIGHTS

-

9.2 <5” DISPLAYSENABLES SPACE AND COST MANAGEMENT

-

9.3 5–10” DISPLAYSINTEGRATION OF MORE FEATURES

-

9.4 >10” DISPLAYSINCREASED APPLICATION IN PREMIUM CARS

-

10.1 INTRODUCTIONPRIMARY INSIGHTS

-

10.2 PASSENGER CARSECONOMIC PASSENGER CARS- Increasing demand for advanced featuresMID-PRICED PASSENGER CARS- Rising demand for enhanced user experience and convenience featuresLUXURY PASSENGER CARS- Demand for advanced luxury features

-

10.3 LIGHT COMMERCIAL VEHICLESINCREASING DEMAND FOR ADVANCED FEATURES AND CONNECTIVITY SOLUTIONS IN COMMERCIAL VEHICLES

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICRECESSION IMPACTCHINA- Emphasis on safety and convenienceJAPAN- Increased preference for simplicity, minimalism, and elegance in designINDIA- Increased demand for central displaysSOUTH KOREA- Increased preference for voice recognition system in vehiclesTHAILAND- Rising demand for multiple features to enhance driving experienceREST OF ASIA PACIFIC

-

11.3 EUROPERECESSION IMPACTGERMANY- Preference for premium passenger carsFRANCE- Rise in focus on road safety to drive demand for heads-up displaysUK- Consumer preference for luxury vehiclesSPAIN- Increasing popularity of connected carsITALY- Demand for advanced traffic information systemsRUSSIA- Upsurge in demand for digital instrument clustersREST OF EUROPE- Preference to limit driver distraction

-

11.4 NORTH AMERICARECESSION IMPACTUS- Growing demand for multimodal HMI systemsCANADA- Upsurge in preference for voice command feature in vehiclesMEXICO- Rising demand for large-screen central displays

-

11.5 REST OF THE WORLDRECESSION IMPACTBRAZIL- Rising consumer demand for central display screensSOUTH AFRICA- Rising demand for features in mid-priced passenger carsOTHER COUNTRIES- Increased demand for enhanced driver safety

- 12.1 ASIA PACIFIC TO BE MAJOR MARKET FOR AUTOMOTIVE HMI

- 12.2 GROWING DEMAND FOR DRIVER SAFETY AND DRIVING COMFORT TO BOOST AUTOMOTIVE HMI MARKET

- 12.3 CONCLUSION

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS, 2022

- 13.3 REVENUE ANALYSIS, 2022

-

13.4 COMPANY EVALUATION QUADRANTTERMINOLOGYSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 13.5 COMPETITIVE BENCHMARKING

-

13.6 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 13.7 NEW TECHNOLOGY STARTUPS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSCONTINENTAL AG- Business overview- Products offered- Recent developments- MnM viewLUXOFT- Business overview- Products offered- Recent developments- MnM viewAPTIV- Business overview- Products offered- Recent developments- MnM viewSYNAPTICS INCORPORATED- Business overview- Products offered- Recent developments- MnM viewVISTEON CORPORATION- Business overview- Products offered- Recent developments- MnM viewVALEO- Business overview- Products offered- Recent developmentsROBERT BOSCH GMBH- Business overview- Products offered- Recent developmentsHARMAN INTERNATIONAL- Business overview- Products offered- Recent developmentsMARELLI HOLDINGS CO., LTD.- Business overview- Products offered- Recent developmentsALPINE ELECTRONICS, INC- Business overview- Products offered- Recent developmentsDENSO CORPORATION- Business overview- Products offered- Recent developmentsPANASONIC HOLDINGS CORPORATION- Business overview- Products offered- Recent developmentsFAURECIA CLARION ELECTRONICS- Business overview- Products offered- Recent developments

- 15.1 KEY INDUSTRY INSIGHTS

-

15.2 OTHER DEVELOPMENTSOTHER PRODUCT LAUNCHESOTHER DEALS

- 15.3 DISCUSSION GUIDE

- 15.4 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

15.5 CUSTOMIZATION OPTIONSHEAVY TRUCKS HMI MARKET, BY PRODUCT TYPE- Voice recognition systems- DisplaysBUSES HMI MARKET, BY PRODUCT TYPE- Voice recognition systems- Displays

- 15.6 RELATED REPORTS

- 15.7 AUTHOR DETAILS

- TABLE 1 CURRENCY EXCHANGE RATES

- TABLE 2 PASSENGER CAR MODELS OFFERING HMI FEATURES

- TABLE 3 GOVERNMENT INITIATIVES TO PROMOTE ADOPTION OF AUTOMOTIVE HMI

- TABLE 4 REGULATIONS FOR DRIVER ASSISTANCE SYSTEMS

- TABLE 5 AUTOMOTIVE HMI MARKET: REGIONAL STANDARDIZATION

- TABLE 6 MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 7 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 US: AUTOMOTIVE HMI IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 9 CANADA: AUTOMOTIVE HMI IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 10 CHINA: AUTOMOTIVE HMI IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 11 JAPAN: AUTOMOTIVE HMI IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 12 INDIA: AUTOMOTIVE HMI IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 13 GERMANY: AUTOMOTIVE HMI IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 14 FRANCE: AUTOMOTIVE HMI IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 15 US: AUTOMOTIVE HMI EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 16 CANADA: AUTOMOTIVE HMI EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 17 CHINA: AUTOMOTIVE HMI EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 18 JAPAN: AUTOMOTIVE HMI EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 19 INDIA: AUTOMOTIVE HMI EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 20 GERMANY: AUTOMOTIVE HMI EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 21 FRANCE: AUTOMOTIVE HMI EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 22 AVERAGE PRICE RANGE: AUTOMOTIVE HMI MARKET, BY PRODUCT (2020 VS. 2022)

- TABLE 23 MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 24 MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 25 MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 26 MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 27 VOICE RECOGNITION SYSTEMS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 28 VOICE RECOGNITION SYSTEMS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 29 VOICE RECOGNITION SYSTEMS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 VOICE RECOGNITION SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 GESTURE RECOGNITION, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 32 GESTURE RECOGNITION, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 33 GESTURE RECOGNITION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 GESTURE RECOGNITION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 CENTRAL DISPLAYS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 36 CENTRAL DISPLAYS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 37 CENTRAL DISPLAYS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 CENTRAL DISPLAYS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 REAR SEAT ENTERTAINMENT DISPLAYS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 40 REAR SEAT ENTERTAINMENT DISPLAYS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 41 REAR SEAT ENTERTAINMENT DISPLAYS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 REAR SEAT ENTERTAINMENT DISPLAYS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 INSTRUMENT CLUSTER DISPLAYS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 44 INSTRUMENT CLUSTER DISPLAYS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 45 INSTRUMENT CLUSTER DISPLAYS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 INSTRUMENT CLUSTER DISPLAYS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 HEAD-UP DISPLAYS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 48 HEAD-UP DISPLAYS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 49 HEAD-UP DISPLAYS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 HEAD-UP DISPLAYS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 ROTARY CONTROLLERS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 52 ROTARY CONTROLLERS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 53 ROTARY CONTROLLERS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 ROTARY CONTROLLERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 STEERING MOUNTED CONTROL SYSTEMS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 56 STEERING MOUNTED CONTROL SYSTEMS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 57 STEERING MOUNTED CONTROL SYSTEMS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 STEERING MOUNTED CONTROL SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 MULTI-FUNCTION SWITCHES, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 60 MULTI-FUNCTION SWITCHES, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 61 MULTI-FUNCTION SWITCHES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 MULTI-FUNCTION SWITCHES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 MARKET, BY TECHNOLOGY, 2018–2022 (THOUSAND UNITS)

- TABLE 64 MARKET, BY TECHNOLOGY, 2023–2028 (THOUSAND UNITS)

- TABLE 65 MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 66 MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 67 VISUAL INTERFACE, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 68 VISUAL INTERFACE, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 69 VISUAL INTERFACE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 VISUAL INTERFACE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 ACOUSTIC INTERFACE, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 72 ACOUSTIC INTERFACE, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 73 ACOUSTIC INTERFACE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 ACOUSTIC INTERFACE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 OTHER INTERFACE TECHNOLOGIES, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 76 OTHER INTERFACE TECHNOLOGIES, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 77 OTHER INTERFACE TECHNOLOGIES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 OTHER INTERFACE TECHNOLOGIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 MARKET, BY ACCESS TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 80 MARKET, BY ACCESS TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 81 MARKET, BY ACCESS TYPE, 2018–2022 (USD MILLION)

- TABLE 82 MARKET, BY ACCESS TYPE, 2023–2028 (USD MILLION)

- TABLE 83 STANDARD HMI SYSTEMS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 84 STANDARD HMI SYSTEMS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 85 STANDARD HMI SYSTEMS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 STANDARD HMI SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 MULTIMODAL HMI SYSTEMS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 88 MULTIMODAL HMI SYSTEMS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 89 MULTIMODAL HMI SYSTEMS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 90 MULTIMODAL HMI SYSTEMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 MARKET, BY DISPLAY SIZE, 2018–2022 (THOUSAND UNITS)

- TABLE 92 MARKET, BY DISPLAY SIZE, 2023–2028 (THOUSAND UNITS)

- TABLE 93 MARKET, BY DISPLAY SIZE, 2018–2022 (USD MILLION)

- TABLE 94 MARKET, BY DISPLAY SIZE, 2023–2028 (USD MILLION)

- TABLE 95 <5” CENTRAL DISPLAYS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 96 <5” CENTRAL DISPLAYS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 97 <5” CENTRAL DISPLAYS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 98 <5” CENTRAL DISPLAYS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 5–10” CENTRAL DISPLAYS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 100 5–10” CENTRAL DISPLAYS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 101 5–10” CENTRAL DISPLAYS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 102 5–10” CENTRAL DISPLAYS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 >10” CENTRAL DISPLAYS, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 104 >10” CENTRAL DISPLAYS, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 105 >10” CENTRAL DISPLAYS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 106 >10” CENTRAL DISPLAYS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 AUTOMOTIVE HMI MARKET, BY VEHICLE TYPE, 2018–2022 (THOUSAND UNITS)

- TABLE 108 MARKET, BY VEHICLE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 109 MARKET, BY VEHICLE TYPE, 2018–2022 (USD MILLION)

- TABLE 110 MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 111 ECONOMIC PASSENGER CARS HMI MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 112 ECONOMIC PASSENGER CARS HMI MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 113 ECONOMIC PASSENGER CARS HMI MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 114 ECONOMIC PASSENGER CARS HMI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 MID-PRICED PASSENGER CARS HMI MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 116 MID-PRICED PASSENGER CARS HMI MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 117 MID-PRICED PASSENGER CARS HMI MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 118 MID-PRICED PASSENGER CARS HMI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 119 LUXURY PASSENGER CARS HMI MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 120 LUXURY PASSENGER CARS HMI MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 121 LUXURY PASSENGER CARS HMI MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 122 LUXURY PASSENGER CARS HMI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 123 LIGHT COMMERCIAL VEHICLES HMI MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 124 LIGHT COMMERCIAL VEHICLES HMI MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 125 LIGHT COMMERCIAL VEHICLES HMI MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 126 LIGHT COMMERCIAL VEHICLES HMI MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 127 MARKET, BY REGION, 2018–2022 (THOUSAND UNITS)

- TABLE 128 MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 129 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 130 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: AUTOMOTIVE HMI MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 132 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

- TABLE 133 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 135 CHINA: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 136 CHINA: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 137 CHINA: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 138 CHINA: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 139 JAPAN: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 140 JAPAN: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 141 JAPAN: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 142 JAPAN: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 143 INDIA: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 144 INDIA: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 145 INDIA: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 146 INDIA: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 147 SOUTH KOREA: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 148 SOUTH KOREA: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 149 SOUTH KOREA: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 150 SOUTH KOREA: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 151 THAILAND: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 152 THAILAND: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 153 THAILAND: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 154 THAILAND: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 156 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 157 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 159 EUROPE: MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 160 EUROPE: MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

- TABLE 161 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 162 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 163 GERMANY: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 164 GERMANY: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 165 GERMANY: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 166 GERMANY: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 167 FRANCE: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 168 FRANCE: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 169 FRANCE: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 170 FRANCE: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 171 UK: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 172 UK: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 173 UK: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 174 UK: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 175 SPAIN: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 176 SPAIN: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 177 SPAIN: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 178 SPAIN: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 179 ITALY: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 180 ITALY: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 181 ITALY: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 182 ITALY: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 183 RUSSIA: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 184 RUSSIA: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 185 RUSSIA: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 186 RUSSIA: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 187 REST OF EUROPE: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 188 REST OF EUROPE: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 189 REST OF EUROPE: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 190 REST OF EUROPE: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 191 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 192 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

- TABLE 193 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 194 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 195 US: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 196 US: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 197 US: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 198 US: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 199 CANADA: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 200 CANADA: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 201 CANADA: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 202 CANADA: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 203 MEXICO: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 204 MEXICO: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 205 MEXICO: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 206 MEXICO: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 207 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2022 (THOUSAND UNITS)

- TABLE 208 REST OF THE WORLD: MARKET, BY COUNTRY, 2023–2028 (THOUSAND UNITS)

- TABLE 209 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 210 REST OF THE WORLD: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 211 BRAZIL: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 212 BRAZIL: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 213 BRAZIL: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 214 BRAZIL: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 215 SOUTH AFRICA: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 216 SOUTH AFRICA: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 217 SOUTH AFRICA: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 218 SOUTH AFRICA: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 219 OTHER COUNTRIES: MARKET, BY PRODUCT, 2018–2022 (THOUSAND UNITS)

- TABLE 220 OTHER COUNTRIES: MARKET, BY PRODUCT, 2023–2028 (THOUSAND UNITS)

- TABLE 221 OTHER COUNTRIES: MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 222 OTHER COUNTRIES: MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 223 MARKET: KEY PLAYERS

- TABLE 224 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [SMES]

- TABLE 225 PRODUCT LAUNCHES, 2022−2023

- TABLE 226 DEALS, 2022−2023

- TABLE 227 OTHERS, 2022−2023

- TABLE 228 STARTUPS OFFERING HMI TECHNOLOGY SOLUTIONS

- TABLE 229 CONTINENTAL AG: BUSINESS OVERVIEW

- TABLE 230 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 231 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 232 CONTINENTAL AG: DEALS

- TABLE 233 LUXOFT: BUSINESS OVERVIEW

- TABLE 234 LUXOFT: PRODUCTS OFFERED

- TABLE 235 LUXOFT: DEALS

- TABLE 236 APTIV: BUSINESS OVERVIEW

- TABLE 237 APTIV: PRODUCTS OFFERED

- TABLE 238 APTIV: PRODUCT LAUNCHES

- TABLE 239 APTIV: DEALS

- TABLE 240 SYNAPTICS INCORPORATED: BUSINESS OVERVIEW

- TABLE 241 SYNAPTICS INCORPORATED: PRODUCTS OFFERED

- TABLE 242 SYNAPTICS INCORPORATED: PRODUCT LAUNCHES

- TABLE 243 SYNAPTICS INCORPORATED: DEALS

- TABLE 244 SYNAPTICS INCORPORATED: OTHERS

- TABLE 245 VISTEON CORPORATION: BUSINESS OVERVIEW

- TABLE 246 VISTEON CORPORATION: PRODUCTS OFFERED

- TABLE 247 VISTEON CORPORATION: PRODUCT LAUNCHES

- TABLE 248 VISTEON CORPORATION: DEALS

- TABLE 249 VALEO: BUSINESS OVERVIEW

- TABLE 250 VALEO: PRODUCTS OFFERED

- TABLE 251 VALEO: PRODUCT LAUNCHES

- TABLE 252 VALEO: DEALS

- TABLE 253 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- TABLE 254 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 255 ROBERT BOSCH GMBH: NEW PRODUCT DEVELOPMENTS

- TABLE 256 ROBERT BOSCH GMBH: OTHER DEVELOPMENTS

- TABLE 257 HARMAN INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 258 HARMAN INTERNATIONAL: PRODUCTS OFFERED

- TABLE 259 HARMAN INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 260 HARMAN INTERNATIONAL: DEALS

- TABLE 261 MARELLI HOLDINGS CO., LTD.: BUSINESS OVERVIEW

- TABLE 262 MARELLI HOLDINGS CO., LTD.: PRODUCTS OFFERED

- TABLE 263 MARELLI HOLDINGS CO., LTD.: PRODUCT LAUNCHES

- TABLE 264 MARELLI HOLDINGS CO., LTD.: DEALS

- TABLE 265 MARELLI HOLDINGS CO., LTD.: OTHERS

- TABLE 266 ALPINE ELECTRONICS, INC: BUSINESS OVERVIEW

- TABLE 267 ALPINE ELECTRONICS, INC: PRODUCTS OFFERED

- TABLE 268 ALPINE ELECTRONICS, INC: PRODUCT LAUNCHES

- TABLE 269 ALPINE ELECTRONICS, INC: DEALS

- TABLE 270 DENSO CORPORATION: BUSINESS OVERVIEW

- TABLE 271 DENSO CORPORATION: PRODUCTS OFFERED

- TABLE 272 DENSO: PRODUCT DEVELOPMENTS

- TABLE 273 DENSO CORPORATION: DEALS

- TABLE 274 PANASONIC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 275 PANASONIC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 276 PANASONIC HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 277 FAURECIA CLARION ELECTRONICS: BUSINESS OVERVIEW

- TABLE 278 FAURECIA CLARION ELECTRONICS: PRODUCTS OFFERED

- TABLE 279 FAURECIA CLARION ELECTRONICS: DEALS

- TABLE 280 OTHER PRODUCT LAUNCHES, 2019−2021

- TABLE 281 OTHER DEALS, 2019−2021

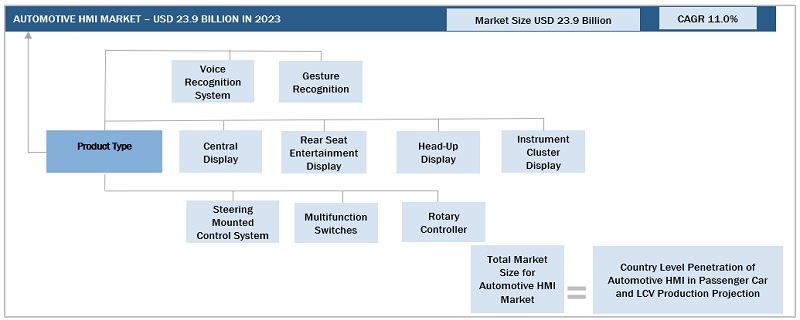

- FIGURE 1 MARKET SEGMENTATION: MARKET

- FIGURE 2 REGIONS COVERED

- FIGURE 3 AUTOMOTIVE HMI MARKET: RESEARCH DESIGN

- FIGURE 4 RESEARCH METHODOLOGY MODEL

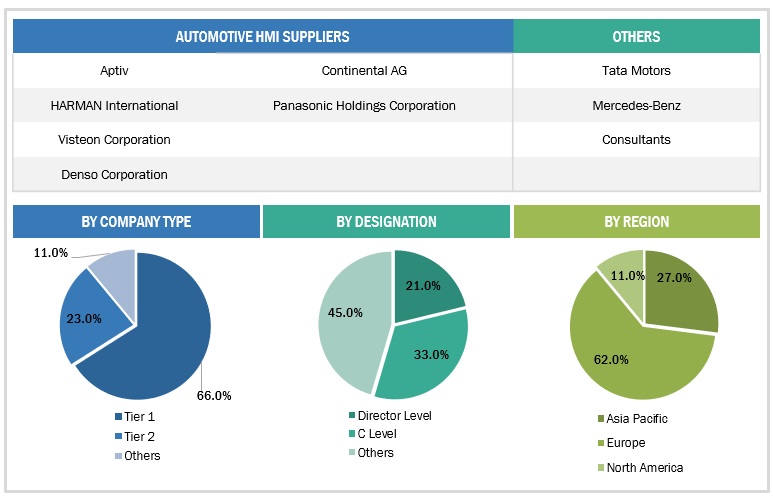

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 MARKET: BOTTOM-UP APPROACH

- FIGURE 8 MARKET: TOP-DOWN APPROACH

- FIGURE 9 MARKET: DATA TRIANGULATION

- FIGURE 10 MARKET, BY REGION, 2023 VS. 2028

- FIGURE 11 INCREASED DEMAND FOR DRIVER SAFETY AND ENHANCED COMFORT IN VEHICLES TO DRIVE MARKET

- FIGURE 12 VISUAL INTERFACE SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 13 CENTRAL DISPLAYS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 5–10” DISPLAY SIZE TO HAVE LARGEST MARKET SHARE IN MARKET IN 2023

- FIGURE 15 PASSENGER CARS TO ATTAIN LARGEST MARKET SHARE IN 2023

- FIGURE 16 MULTIMODAL HMI SYSTEMS PREDICTED TO LEAD MARKET BY 2028

- FIGURE 17 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 18 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 E AND F SEGMENT VEHICLE PRODUCTION BY KEY PLAYERS, 2017–2022 (THOUSAND UNITS)

- FIGURE 20 RISING DEMAND FOR EVS

- FIGURE 21 ELECTRIC AND HYBRID VEHICLE SALES FORECAST, 2021–2030 (THOUSAND UNITS)

- FIGURE 22 AUTOMOTIVE HMI MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 MARKET: ECOSYSTEM MAPPING BASED ON VARIOUS STAKEHOLDERS

- FIGURE 24 MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 25 MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 26 MARKET, BY ACCESS TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 27 MARKET, BY DISPLAY SIZE, 2023 VS. 2028 (USD MILLION)

- FIGURE 28 MARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 29 INDUSTRY INSIGHTS

- FIGURE 30 MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 32 EUROPE: MARKET, BY COUNTRY, 2023 VS. 2028 (USD MILLION)

- FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 34 REST OF THE WORLD: MARKET, BY COUNTRY, 2023 VS. 2028 (USD MILLION)

- FIGURE 35 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 37 MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 38 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 39 APTIV: COMPANY SNAPSHOT

- FIGURE 40 SYNAPTICS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 41 VISTEON CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 VALEO: COMPANY SNAPSHOT

- FIGURE 43 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 44 HARMAN INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 45 ALPINE ELECTRONICS, INC: COMPANY SNAPSHOT

- FIGURE 46 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 FAURECIA CLARION ELECTRONICS: COMPANY SNAPSHOT

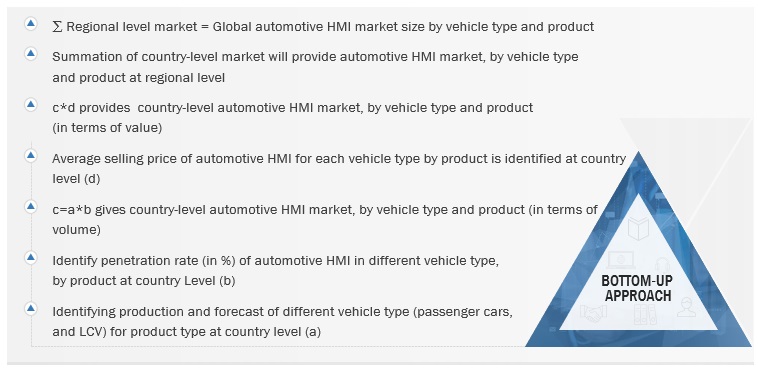

The study involved four major activities in estimating the current size of the automotive HMI market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred for this research study include financial statements of companies offering automotive HMI and information from various trade, business, and professional associations. The secondary data was collected and analyzed to determine the overall size of the automotive HMI market, which primary respondents validated.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs; vice presidents; directors from business development, marketing, and product development/innovation teams; and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as the automotive HMI market forecast, current technology trends, and upcoming technologies in the market. Data triangulation of all these points was done with the information gathered from secondary research. Stakeholders from the supply side were interviewed to understand their views on the points mentioned above.

Primary interviews were conducted with market experts from the supply side (automotive HMI manufacturers) across the major regions, namely, Asia Pacific, Europe, and North America. Primary data was collected through questionnaires, emails, and telephonic interviews.

In canvassing primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

Market Size Estimation

The research methodology used to estimate the size of the automotive HMI market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the automotive industry at a regional level. Such procurements provide information on the industry's demand aspects of automotive HMIs.

Global Automotive HMI Market Size: Bottom-Up Approach, By Product

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Automotive Human-Machine Interface, or Automotive HMI, refers to the various technologies and systems that make it easier for a driver or passenger to interact with a vehicle. It entails creating and using user interfaces, controls and displays that let users control and keep track of the features and functions of the vehicle.

Automotive HMI is defined as the collection of technologies, systems, and user interfaces that allow drivers and passengers to interact with the vehicle securely, logically, and efficiently. This covers voice recognition, gesture control, other cutting-edge interfaces, and the design of visual, auditory, and tactile displays, controls, and feedback mechanisms. Automotive HMI aims to improve the experience of the driver and passengers while ensuring safety and reducing distractions.

Key Stakeholders

- Senior Management

- End User Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the automotive HMI market in terms of value (USD million) and volume (thousand units) based on the following segments:

- Automotive Input HMI Market, By Product (Voice Recognition System, Rotary Controllers, Gesture Recognition, Touch Screen Display, Instrument Cluster Display, Steering Mounted Control System, Head-Up Display, Multifunction Switches)

- Automotive Output HMI Market, By Display Size (<5”, 5-10”, >10”)

- Automotive HMI Market, By Technology (Visual Interface, Acoustic Interface, Other Interface Technologies)

- Market, By Access Type (Standard HMI System, Multimodal HMI System)

- Market, by Vehicle Type (Passenger Cars, Light Commercial Vehicles)

- By Region (Asia Pacific, Europe, North America, and the Rest of the World)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market share of leading players and evaluate the company evaluation quadrant

- To analyze the key player strategies/right to win

- To strategically analyze the market with supply chain analysis, market ecosystem, technology trends, and trade analysis

- To analyze recent developments, including supply contracts, new product launches, expansions, and mergers & acquisitions, undertaken by key industry participants in the market

- To determine an aftermarket overview of the micromotor market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

-

Heavy Trucks HMI Market, By Product Type

- Voice Recognition System

- Display

-

Buses HMI Market, By Product Type

- Voice Recognition System

- Display

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Automotive HMI Market

Growth opportunities and latent adjacency in Automotive HMI Market

I am a Research Associate with Hanover Research, and I would like to inquire about your Automotive HMI Market report. We at Hanover are specifically interested in determining the market share of Tier 1 suppliers (e.g., Continental, Delphi) in this space, which I believe may be available in Chapter 12 or 13 of the report. Is this information available in either of those sections of the report? If so, is it possible for Hanover to purchase only the relevant section, rather than the entire document? Please feel free to contact me at my email address (thofmockel@hanoverresearch.com) with your reply and any questions you may have. Thank you for your assistance