Embedded Systems in Automobiles Market by vehicle, electric vehicle, type, component (Sensors, MCU, Transceivers, and Memory Devices), application (Infotainment & Telematics, Body Electronics, and Safety & Security) and Region - Global forecast to 2022

[161 Pages Report] The embedded systems in automobiles market, in terms of value, is projected to grow at a CAGR of 7.56% from 2017 to 2022. The market was valued at USD 4.91 Billion in 2016. In this study, 2016 has been considered the base year and 2017 to 2022 the forecast period, for estimating the size of the market. The report analyzes and forecasts the market size, in terms of volume (thousand units) and value (USD million), for the market. The report segments the market and forecasts its size, by volume and value, on the basis of region, component type, application type, electric vehicle type and vehicle type, and, in qualitative term, by industry trends. The report also provides a detailed analysis of various forces acting in the market (drivers, restraints, opportunities, and challenges). It strategically profiles the key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

The research methodology used in the report involves various secondary sources such as China Association of Automobile Manufacturers (CAAM), European Automobile Manufacturers Association (EAMA), Environmental Protection Agency (EPA), Society of Indian Automobile Manufacturers (SIAM), Japan Automobile Manufacturers Association (JAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA). Experts from related industries and suppliers have been interviewed to understand the future trends in the market. The bottom-up approach has been used to estimate and validate the size of the global market. The market size, by volume, is derived by identifying the region-wise production volumes and analyzing the demand trends. The market size, by value, is derived by multiplying the average selling price of embedded systems in automobiles by the number of embedded systems installed in the automobiles of that region.

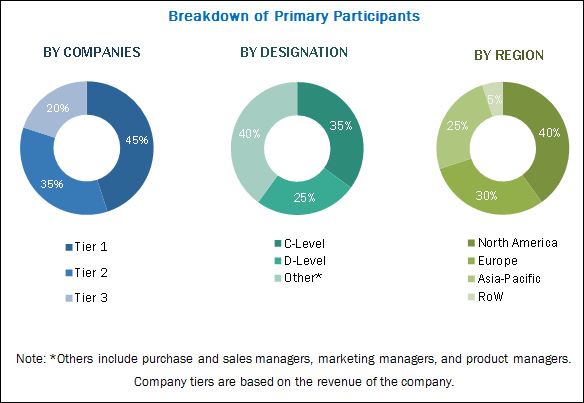

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the embedded systems in automobiles market consists of manufacturers such as Robert Bosch GmbH (Germany), Continental AG (Germany), Panasonic Corporation (Japan), Texas Instruments (U.S.), Mitsubishi Electric Corporation (Japan), and Denso Corporation (Japan), and research institutes such as the Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (EAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Target Audience

- Distributors and suppliers of automotive embedded systems

- Manufacturers of automotive embedded systems

- Semiconductor manufacturers

- Embedded software developers

- Vehicle manufacturers

- Electric vehicle manufacturers

- Raw material suppliers

- Industry associations and experts

- Tier 1, Tier 2, and Tier 3 suppliers

- Automobile organizations/associations

Scope of the Report

By Type

By Vehicle Type

By Application Type

By Electric Vehicle type

By Components

By Region

-

- Embedded Hardware

- Embedded Software

- Passenger cars

- Commercial vehicles

- Infotainment & Telematics

- Body Electronics

- Safety & Security

- Powertrain & Chassis Control

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Sensors

- Microcontrollers (MCU)

- Transceivers

- Memory Devices

- Asia-Pacific

- Europe

- North America

- Rest of the World

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional countries(up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of component types by country wise.

The market, in terms of value, is projected to grow at a CAGR of 7.56% from 2017 to 2022. The market is estimated to be USD 5.15 Billion in 2017 and is projected to reach USD 7.41 Billion by 2022. The growth of themarket is fueled by the growing trend of vehicle electrification and a rise in the number of electric vehicles across the globe.

The market has been segmented by type, component type, application type, vehicle type, electric vehicle type, and region. The market has been segmented, by component type, into sensor, microcontroller (MCU), memory device, and transceiver. The sensor is estimated to be the fastest growing segment of the market, by component type. The growing demand for electric vehicles is expected to drive the automotive embedded system sensors market.

The market has been segmented, by application, into infotainment & telematics, body electronics, safety & security, and powertrain and chassis control. The safety & security application is estimated to be the fastest growing segment of the market, by application. The increasing number of safety features and mandatory installation of features such as anti-lock braking systems (ABS) and airbags in a vehicle have driven the growth of this market. The infotainment & telematics segment is projected to grow at the highest CAGR during the forecast period.

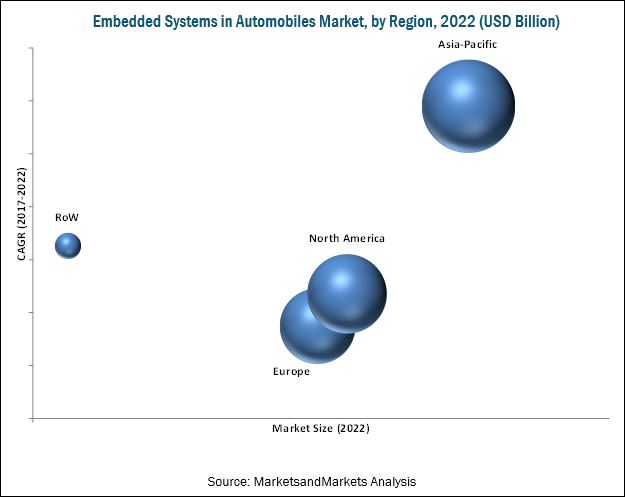

The Asia-Pacific region is estimated to dominate the market, by volume, in 2017. The rising consumer income levels, increased vehicle production in developing countries such as China, and increase in the number of electric vehicles in countries such as Japan have all added up to the growth of the market in the Asia-Pacific region.

Modern vehicles have multiple embedded systems that are connected to each other as well as the internet. A cyberattack can endanger the safety of passengers. Therefore, the possibility of a cyberattack is a restraining factor for the growth of the market.

Continental AG (Germany) is a global manufacturer of tires, automotive parts, and industrial products. The core business of the company has been segmented into the automotive group and rubber group. The automotive group consists of chassis & safety, powertrain, and interior divisions, and the rubber group comprises tires and ContiTech division. The company currently has 207,899 employees globally and the research & development of the company is carried out at 127 locations in 27 countries. The company has a presence in all major regions such as Europe, Asia-Pacific, North America, and Germany. This shows that the company is not focused on a single region to generate revenue but is trying to balance its revenue generation from all the major regions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency Exchange Rates

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Growing Demand for Battery Electric Vehicles

2.4.2.2 Growth in Luxury Vehicle Sales

2.4.3 Supply-Side Analysis

2.4.3.1 Technological Advancements in the Automotive Industry

2.4.3.2 Stringent Emission and Fuel Economy Standards

2.5 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Market

4.2 Market, By Region, 2017 & 2022

4.3 Market, By Application, 2017 & 2022

4.4 Market, By Component Market, 2017 & 2022

4.5 Market, By Vehicle Type, 2017 & 2022

4.6 Market, By Type, 2017 & 2022

4.7 Market, By Electric Vehicle Type, 2017 & 2022

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Demand for Electric Vehicles

5.3.1.2 Increasing Demand for Advanced Safety, Comfort, and Convenience Systems

5.3.1.3 Rising Trend of Vehicle Electrification

5.3.2 Restraints

5.3.2.1 High Power Consumption

5.3.2.2 Short Life Span of Electronics Systems

5.3.3 Opportunities

5.3.3.1 Advent of Autonomous Vehicles

5.3.3.2 Increasing Awareness About Vehicle Security

5.3.4 Challenges

5.3.4.1 Trade-Off Between Cost and Quality

5.3.4.2 Risk of Cyberattacks

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Role of Regulatory Authorities in Future Embedded Systems

6.3 Role of Cybersecurity

6.4 Cloud Computing for Embedded Systems in Automobiles

6.5 Embedded MRAM

7 Market, By Type (Page No. - 51)

7.1 Introduction

7.2 Embedded Hardware

7.3 Embedded Software

8 Market, By Component (Page No. - 55)

8.1 Introduction

8.2 Sensors

8.2.1 Temperature Sensors

8.2.2 Pressure Sensors

8.2.3 Image Sensors

8.2.4 Radar Sensors

8.2.5 Lidar Sensors

8.3 Microcontrollers (MCU)

8.4 Transceivers

8.5 Memory Devices

9 Market, By Vehicle Type (Page No. - 64)

9.1 Introduction

9.2 Passenger Cars

9.3 Commercial Vehicles

10 Market, By Electric Vehicle (Page No. - 69)

10.1 Introduction

10.2 Battery Electric Vehicle (BEV)

10.3 Hybrid Electric Vehicle (HEV)

10.4 Plug-In Hybrid Electric Vehicle (PHEV)

11 Market, By Application (Page No. - 75)

11.1 Introduction

11.2 Infotainment & Telematics

11.3 Body Electronics

11.4 Powertrain & Chassis Control

11.4.1 Automatic Transmission

11.4.2 Electric Power Steering

11.4.3 Active Suspension

11.5 Safety & Security

11.5.1 ADAS

11.5.2 Electronic Brake System

11.5.2.1 Antilock Brake System (ABS)

11.5.2.2 Electronic Stability Control (ESC)

11.5.2.3 Traction Control System (TCS)

11.5.3 Airbags

12 Market, By Region (Page No. - 86)

12.1 Introduction

12.2 Asia-Pacific

12.2.1 China

12.2.2 India

12.2.3 Japan

12.2.4 South Korea

12.3 Europe

12.3.1 France

12.3.2 Germany

12.3.3 Italy

12.3.4 Spain

12.3.5 U.K.

12.4 North America

12.4.1 Canada

12.4.2 Mexico

12.4.3 U.S.

12.5 Rest of the World (RoW)

12.5.1 Brazil

12.5.2 Russia

13 Competitive Landscape (Page No. - 112)

13.1 Introduction

13.2 Competitive Leadership Mapping

13.2.1 Visionary Leaders

13.2.2 Innovators

13.2.3 Dynamic Differentiators

13.2.4 Emerging Companies

13.3 Competitive Benchmarking

13.3.1 Strength of Product Portfolio (For 25 Players)

13.3.2 Business Strategy Excellence (For 25 Players)

13.4 Market Ranking Analysis: Market

Top Companies Analyzed for This Study are — Verizon, Robert Bosch, Panasonic, Toshiba, Intel, Continental AG, Denso, Mitsubishi Electric, Magna International, Valeo, Delphi Automotive, Texas Instruments, Hella KGaA Hueck & Co., Infineon Technologies, Harman International, NXP Semiconductors, Nvidia, Renesas Electronics, on Semiconductor, Analog Devices, Inc., Visteon, Rohm Semiconductor, Johnson Electric, Microchip Technology Inc., Sierra Wireless

14 Company Profiles (Page No. - 117)

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)

14.1 Robert Bosch

14.2 Panasonic

14.3 Toshiba

14.4 Continental AG

14.5 Denso

14.6 Mitsubishi Electric

14.7 Delphi Automotive

14.8 Texas Instruments

14.9 Infineon Technologies

14.10 Harman International

14.11 NXP Semiconductors

14.12 Johnson Electric

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 154)

15.1 Key Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Available Customizations

15.4.1 Detailed Analysis and Profiling of Additional Regions (Up to 3)

15.4.2 Company Information

15.4.3 Profiling of Additional Market Players (Up to 3)

15.5 Related Reports

15.6 Author Details

List of Tables (81 Tables)

Table 1 Market Size, By Type, 2015–2022 (USD Billion)

Table 2 Asia-Pacific Market Size, By Type, 2015–2022 (USD Billion)

Table 3 Europe Market Size, By Type, 2015–2022 (USD Billion)

Table 4 North America Market Size, By Type, 2015–2022 (USD Billion)

Table 5 RoW Market Size, By Type, 2015–2022 (USD Billion)

Table 6 Market Size, By Component, 2015–2022 (Million Units)

Table 7 Market Size, By Component, 2015–2022 (USD Billion)

Table 8 Embedded Systems in Automobiles Sensors Market Size, By Application, 2015–2022 (Million Units)

Table 9 Embedded Systems in Automobiles Sensors Market Size, By Application, 2015–2022 (USD Billion)

Table 10 Embedded Systems in Automobiles MCU Market Size, By Application, 2015–2022 (Million Units)

Table 11 Embedded Systems in Automobiles MCU Market Size, By Application, 2015–2022 (USD Billion)

Table 12 Embedded Systems in Automobiles Transceivers Market Size, By Application, 2015–2022 (Million Units)

Table 13 Embedded Systems in Automobiles Transceivers Market Size, By Application, 2015–2022 (USD Billion)

Table 14 Embedded Systems in Automobiles Memory Devices Market Size, By Application, 2015–2022 (Million Units)

Table 15 Embedded Systems in Automobiles Memory Devices Market Size, By Application, 2015–2022 (USD Billion)

Table 16 Market, By Vehicle Type, 2015–2022 (Million Units)

Table 17 Market, By Vehicle Type, 2015–2022 (USD Billion)

Table 18 Passenger Cars Market, By Region, 2015–2022 (Million Units)

Table 19 Passenger Cars Market, By Region, 2015–2022 (USD Billion)

Table 20 Commercial Vehicles Market, By Region, 2015–2022 (Million Units)

Table 21 Market, By Region, 2015–2022 (USD Billion)

Table 22 Market Size, By Type, 2015–2022 (Million Units)

Table 23 Market Size, By Type, 2015–2022 (USD Million)

Table 24 Market Size, By Application, 2015–2022 (Million Units)

Table 25 BEV Market Size, By Application, 2015–2022 (USD Million)

Table 26 Market Size, By Application, 2015–2022 (Million Units)

Table 27 HEV Market Size, By Application, 2015–2022 (USD Million)

Table 28 Market Size, By Application, 2015–2022 (Million Units)

Table 29 PHEV Market Size, By Application, 2015–2022 (USD Million)

Table 30 Market Size, By Application, 2015–2022 (Million Units)

Table 31 Market Size, By Application, 2015–2022 (USD Billion)

Table 32 Market Size, By Application, 2015–2022 (Million Units)

Table 33 Market Size, By Application, 2015–2022 (USD Billion)

Table 34 Market Size, By Application, 2015–2022 (Million Units)

Table 35 Market Size, By Application, 2015–2022 (USD Billion)

Table 36 Market Size, By Application, 2015–2022 (Million Units)

Table 37 Market Size, By Application, 2015–2022 (USD Billion)

Table 38 Market Size, By Application, 2015–2022 (Million Units)

Table 39 Market Size, By Application, 2015–2022 (USD Billion)

Table 40 Market Size, By Application, 2015–2022 (Million Units)

Table 41 Market Size, By Application, 2015–2022 (USD Billion)

Table 42 Market Size, By Application, 2015–2022 (Million Units)

Table 43 Market Size, By Application, 2015–2022 (USD Billion)

Table 44 Market Size, By Region, 2015–2022 (Million Units)

Table 45 Market Size, By Region, 2015–2022 (USD Billion)

Table 46 Asia-Pacific: Market Size, By Country, 2015–2022 (Million Units)

Table 47 Asia-Pacific: Market Size, By Country, 2015–2022 (USD Billion)

Table 48 China: Market, By Application, 2015–2022 (Million Units)

Table 49 China: Market, By Application, 2015–2022 (USD Billion)

Table 50 India: Market, By Application, 2015–2022 (Million Units)

Table 51 India: Market, By Application, 2015–2022 (USD Billion)

Table 52 Japan: Market, By Application, 2015–2022 (Million Units)

Table 53 Japan: Market, By Application, 2015–2022 (USD Billion)

Table 54 South Korea: Market, By Application, 2015–2022 (Million Units)

Table 55 South Korea: Market, By Application, 2015–2022 (USD Billion)

Table 56 Europe: Market, By Country, 2015–2022 (Million Units)

Table 57 Europe: Market, By Country, 2015–2022 (USD Billion)

Table 58 France: Market, By Application, 2015–2022 (Million Units)

Table 59 France: Market, By Application, 2015–2022 (USD Billion)

Table 60 Germany: Market, By Application, 2015–2022 (Million Units)

Table 61 Germany: Market, By Application, 2015–2022 (USD Billion)

Table 62 Italy: Market, By Application, 2015–2022 (Million Units)

Table 63 Italy: Market, By Application, 2015–2022 (USD Billion)

Table 64 Spain: Market, By Application, 2015–2022 (Million Units)

Table 65 Spain: Market, By Application, 2015–2022 (USD Billion)

Table 66 U.K.: Market, By Application, 2015–2022 (Million Units)

Table 67 U.K.: Market, By Application, 2015–2022 (USD Billion)

Table 68 North America: Market, By Country, 2015–2022 (Million Units)

Table 69 North America: Market, By Country, 2015–2022 (USD Billion)

Table 70 Canada: Market, By Application, 2015–2022 (Million Units)

Table 71 Canada: Market, By Application, 2015–2022 (USD Billion)

Table 72 Mexico: Market, By Application, 2015–2022 (Million Units)

Table 73 Mexico: Market, By Application, 2015–2022 (USD Million)

Table 74 U.S.: Market, By Application, 2015–2022 (Million Units)

Table 75 U.S.: Market, By Application, 2015–2022 (USD Billion)

Table 76 RoW: Market, By Country, 2015–2022 (Million Units)

Table 77 RoW: Market, By Country, 2015–2022 (USD Billion)

Table 78 Brazil: Market, By Application, 2015–2022 (Million Units)

Table 79 Brazil: Market, By Application, 2015–2022 (USD Billion)

Table 80 Russia: Market, By Application, 2015–2022 (Million Units)

Table 81 Russia: Market, By Application, 2015–2022 (USD Billion)

List of Figures (52 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 BEV Sales Data (2016 vs 2017)

Figure 6 Luxury Vehicle Sales Data (2015 vs 2016)

Figure 7 Market Size Estimation Methodology: Bottom–Up Approach

Figure 8 Key Countries in the Market: China is Expected to Be the Fastest-Growing Market During the Forecast Period

Figure 9 Market (2017 & 2022), By Component: Sensors is Estimated to Be the Largest Segment in Terms of Value

Figure 10 Market (2017 & 2022), By Region: Asia-Pacific is Projected to Witness the Highest Growth

Figure 11 Market (2017 & 2022), By Application: Safety & Security Segment to Lead the Market in Terms of Value

Figure 12 Market (2017 & 2022), By Vehicle Type: Passenger Cars Segment to Lead the Market in Terms of Value

Figure 13 Market (2017 & 2022), By Type: Embedded Hardware to Lead the Market in Terms of Value

Figure 14 Market (2017 & 2022), By Electric Vehicle Segment: Hybrid Electric Vehicle Segment to Lead the Market in Terms of Value

Figure 15 Growing Opportunities in Global Market, 2017–2022

Figure 16 Asia-Pacific is Estimated to Witness the Highest Growth in Terms of Value

Figure 17 Safety & Security Segment Expected to Be the Largest Segment of the Market in Terms of Value, 2017 & 2022

Figure 18 Sensors is Estimated to Be the Largest Segment in By Component Segment in Terms of Value, 2017 & 2022

Figure 19 Passenger Cars to Be the Largest Segment of the Market in Terms of Value, 2017 & 2022

Figure 20 Embedded Hardware Expected to Be the Largest Segment of the Market in Terms of Value, 2017 & 2022

Figure 21 Hybrid Electric Vehicle Projected to Be the Largest Segment of the Market in Terms of Value, 2017 & 2022

Figure 22 Market, Market Segmentation

Figure 23 Market, By Type

Figure 24 Market, By Component

Figure 25 Embedded Systems in Automobiles, By Vehicle Type

Figure 26 Market, By Electric Vehicle

Figure 27 Market, By Application

Figure 28 Market, By Region

Figure 29 Market Dynamics

Figure 30 Market, By Type, 2017 vs 2022 (USD Billion)

Figure 31 Market, By Component, 2017 vs 2022 (USD Billion)

Figure 32 Market, By Vehicle Type, 2017 vs 2022 (USD Billion)

Figure 33 Market, By Electric Vehicle, 2017 vs 2022 (USD Million)

Figure 34 Market, By Application, 2017 vs 2022 (USD Billion)

Figure 35 Embedded Systems in Automobiles: Regional Growth Rate, (2017–2022)

Figure 36 Asia Pacific: Automotive Embedded Market Snapshot.

Figure 37 Germany is Estimated to Be the Largest Market for Embedded Systems in Automobiles in Europe, 2017 vs 2022

Figure 38 North America: Market Snapshot

Figure 39 Competitive Leadership Mapping: Market

Figure 40 Market Ranking: 2016

Figure 41 Robert Bosch: Company Snapshot

Figure 42 Panasonic: Company Snapshot

Figure 43 Toshiba: Company Snapshot

Figure 44 Continental AG: Company Snapshot

Figure 45 Denso: Company Snapshot

Figure 46 Mitsubishi Electric: Company Snapshot

Figure 47 Delphi Automotive: Company Snapshot

Figure 48 Texas Instruments: Company Snapshot

Figure 49 Infineon Technologies: Company Snapshot

Figure 50 Harman International: Company Snapshot

Figure 51 NXP Semiconductors: Company Snapshot

Figure 52 Johnson Electric: Company Snapshot

Growth opportunities and latent adjacency in Embedded Systems in Automobiles Market